And actually decline, in dollar terms.

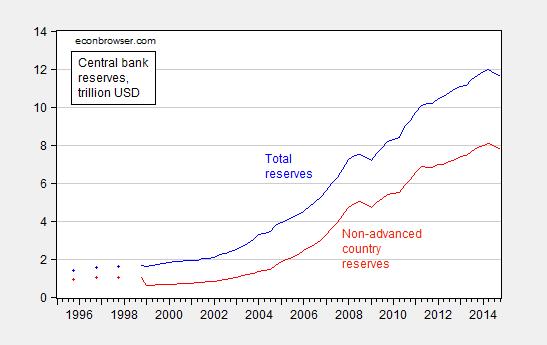

Figure 1 displays total reserves and non-advanced country reserves, denominated in US dollars.

Figure 1: Foreign exchange reserves, total (blue), and held by non-advanced countries (red), in trillions of USD. Source: IMF COFER.

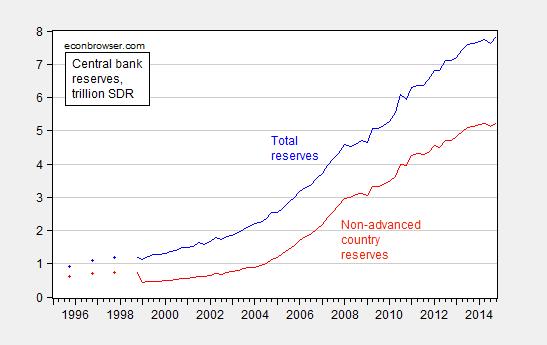

Note the drop in non-advanced country reserves in the last two quarters. The only drop of a comparable magnitude occurred during the aftermath of the global financial crisis. The rapid appreciation of the dollar makes the interpretation of dollar-valued reserves a bit more complicated than usual. In SDR terms, reserves have essentially plateaued.

Figure 2: Foreign exchange reserves, total (blue), and held by non-advanced countries (red), in trillions of SDR. Source: IMF COFER.

This is interesting because this represents a continuation of the phenomenon outlined in Section 4 of Bussiere, Chen, Chinn and Lisack (2014). We conjecture:

What drives this ‘flattening’ in foreign reserve accumulation? We come up with several possible explanations. First, it is possible that, once a country reached its pre-crisis level of reserves, it slows down the accumulation as foreign reserves are no free lunch and the opportunity cost and risks associated with valuation effects may be high. Second, the deceleration of foreign reserve accumulation may reflect a change of policy priority with regard to monetary autonomy, exchange rate stability and financial openness in the wake of the 2008-2009 financial crisis, as Aizenman et al. (2010) put forward. After all, reserve accumulation may be motivated by the need to reconcile the ‘Impossible Trinity’ (this is however an aspect of reserve accumulation that we do not consider in this paper).

Last but not least, if foreign reserve accumulation tails off, it might be because of the stabilization of the underlying macroeconomic variable that foreign reserves are used to cover. In our paper, we argue that this macroeconomic variable is short-term debt. With the ‘flattening-out’ of short-term debt after the financial crisis (the reasons why short-term debt diminishes after the GFC are multiple, e.g. Great Retrenchment), the demand for foreign reserves must fall.

In work currently underway, we are examining these hypotheses.

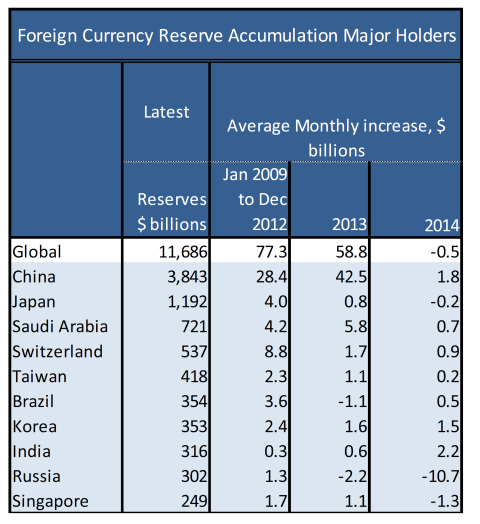

The deceleration is widespread, suggesting in part a common factor, but there is also some variation, indicating some idiosyncratic effects. Chinese accumulation has dropped in dollar terms from $28.4 billion/month over the 2009-2012 period, to $1.8 billion/month in 2014. Russian accumulation, from $1.3 billion/month to -$10.7 billion/month. Table 1 presents some statistics.

One question raised by a declining pace of reserve accumulation is whether bond prices will tend to rise faster (e.g., [1]). Kitchen and Chinn show that Treasury yields depend on foreign official sector purchases of dollar assets.

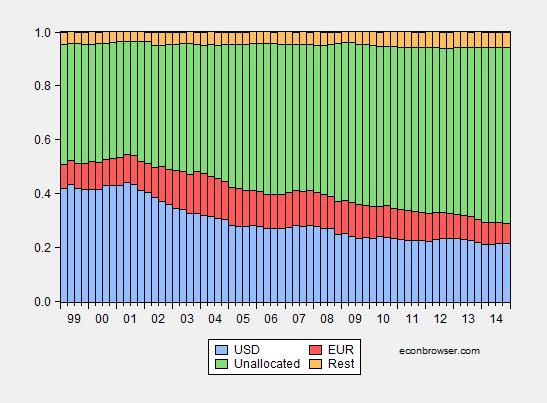

COFER data includes information on currency composition:

Figure 3: Shares of USD (blue), EUR (red), unallocated (green) and all others (orange) in total reserves. Source: IMF COFER.

Unfortunately, as shown, there is a large degree of uncertainty regarding the amount of dollar assets vs. others. Benn Steil at the CFR, in assessing Chinese reserve accumulation, concludes that China is not selling off reserves, after stripping out valuation effects, and assuming that 65% of reserves are in US dollars. Since China accounts for a third of world reserves, and three-quarters of reserve accumulation over the last two years, it would seem that lots of upward pressure on Treasury yields from this quarter is unlikely.

My impression was that official dollar reserve holdings in London accounted for a big part of the ‘unallocated.’ And I agree with the above cite that the recent decline in dollar reserves held by China is an artifact of the rise of the dollar. Most recently, Japan appears to have resumed dollar purchasing to stimulate their economy. Of course, the recent drop in oil prices accounts for rapidly diminishing reserves of the major oil exporters (most notably Russia).

You don’t show U.S. reserves, which puts these holdings in perspective and raises the question – why are reserves of the Asian economies so large relative to the size of their economies? I think the main explanation is export-led growth strategies. At one point, even Krugman was exasperated enough to say “Go, Schumer!”

Yes, there has been a steep fall in commodity prices.

Valuation effect estimate is sensitive to the assumption that 65% of China’s holdings are in U.S. dollars. Could be higher than that which would reduce the negative impact of the valuation adjustment. But who knows, other than China’s SAFE?

The bulk of the rapid growth of reserves over the last couple of decades was by the rapidly growing Asian countries so that they would not have to submit to the standard IMF cures for countries experiencing currency crises. It could be that after all this growth in reserves these countries now think they have sufficient reserves to avoid having to go going hat-in-hand to the IMF and that they can let their growth in reserves taper off. In other words, maybe a flattening of world reserve growth is not something to make a big deal of.

“The bulk of the rapid growth of reserves over the last couple of decades was by the rapidly growing Asian countries so that they would not have to submit to the standard IMF cures for countries experiencing currency crises.”

I very seriously doubt this. Look at the data on the accumulation of reserves in Japan and China. Neither country has had currency crisis. Their accumulation of reserves has clearly been the result of export-led growth strategies, not the need to avoid IMF conditions.

don: The quote refers to the past couple decades; that means back to 1995. Now recall what happened to Thailand and Korea in 1997. If one examines these two countries which experienced searing financial crises with what was perceived as onerous IMF conditionality, one will see a determined effort to rebuild and increase reserves since then.

No doubt some truth to that – it was also Ben’s story. But the statement I questioned is whether this accounted for the bulk of the growth in Asian reserves. In 1995, China had less than $100 billion in foreign reserves. Now it is almost $4 trillion…..