This is the title of a newly released VoxEU ebook, edited by Bernard Hoekman.

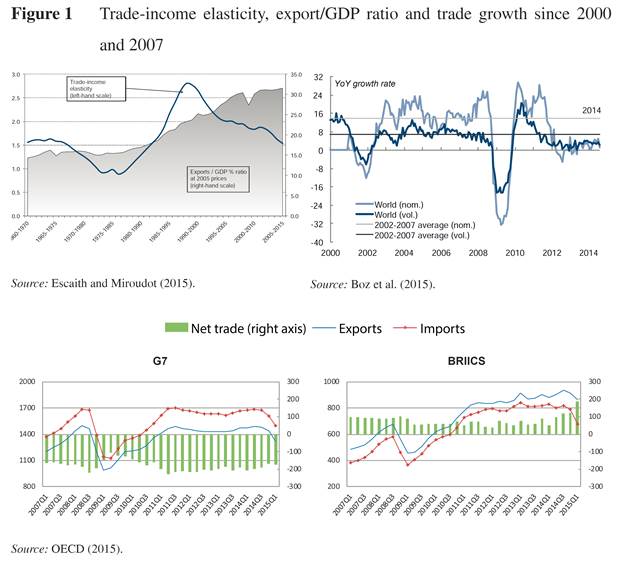

The post-Crisis decline in the growth rate of the ratio of global trade to GDP has been cause for some concern that global trade has peaked, and that we are now reaching a new normal in which trade levels will be weak in comparison to about a decade ago. Whether such a peak in trade was a defining moment in global trade or whether it is a cyclical phenomenon is one of the questions this eBook addresses.

Here’s the Table of Contents.

Part One: Introduction

Trade and growth – end of an era?

Bernard Hoekman

1 World trade and production: A long-run view

Douglas A Irwin

Part Two: Determinants of the slowdown

2 The global trade slowdown

Cristina Constantinescu, Aaditya Mattoo and Michele Ruta

3 Recent slowdown in global trade: Cyclical or structural?

Emine Boz, Matthieu Bussière and Clément Marsilli

4 Does the post-Crisis weakness of global trade solely reflect weak demand?

Patrice Ollivaud and Cyrille Schwellnus

5 The power of the few in determining trade accelerations and slowdowns

Guillaume Gaulier, Gianluca Santoni, Daria Taglioni and Soledad Zignago

Part Three: GVCs, gravity and peak trade

6 Global value chains and the trade-income relationship: Implications for the recent trade slowdown

Byron Gangnes, Alyson C Ma and Ari Van Assche

7 World trade and income remain exposed to gravity

Hubert Escaith and Sébastien Miroudot

8 A value-added trade perspective on recent patterns in world trade

Paul Veenendaal, Hugo Rojas-Romagosa, Arjan Lejour and Henk Kox

9 On the gravity of world trade’s slowdown

Matthieu Crozet, Charlotte Emlinger, Sébastien Jean

Part Four: East Asian perspectives and the China factor

10 The relationship between trade and economic growth and a slowdown of exports in Korea

Taeho Bark

11 Growth and structural change in trade: Evidence from Japan

Koji Ito and Ryuhei Wakasugi

12 The global trade slowdown: Lessons from the East Asian electronics industry

Willem Thorbecke

13 China’s trade flows: Some conjectures

Menzie D Chinn

14 Trade impact of China’s transition to the ‘new normal’

Jiansuo Pei, Cuihong Yang and Shunli Yao

Part Five: Policy perspectives

15 Crisis-era trade distortions cut LDC export growth by 5.5% per annum

Simon J. Evenett and Johannes Fritz

16 Trade growth prospects: An African perspective

Ottavia Pesce, Stephen Karingi and Isabelle Gebretensaye

17 ‘Peak trade’ in the steel sector

Simon J. Evenett and Johannes Fritz

18 Supporting the micro-multinationals to help achieve peak trade

Usman Ahmed, Brian Bieron and Hanne Melin

19 Bold political leadership and vision can unlock global trade growth

Amgad Shehata

The entire ebook can be downloaded here.

It was inevitable international trade would slow.

For example, since the U.S. became an open economy, around 1980, and over the “long-boom,” from 1982-07, U.S. export growth increased much faster than U.S. GDP growth, which was unsustainable.

However, the top priority of the U.S. government should’ve been closing the output gap, which would’ve facilitated international trade, because the U.S. has been the main engine of global growth, pulling the rest of the world’s economies.

Peak wrote:

“…over the “long-boom,” from 1982-07, U.S. export growth increased much faster than U.S. GDP growth…”

Consider that both before and after this period government growth was stronger than private sector growth. When the government grows faster than the private sector production is hindered and wealth is destroyed. That brings economic decline.

GDP is primarily a measure of government spending while exports are a sign of excess domestic production. Rather than being unsustainable, this indicator actually shows the robust nature of the economy during this time. Rather than the government attempting to close the output gap, it should have stayed out of the way and allowed the economy to produce at optimum efficiency. That is definitely not the case today. As a matter of fact it appears that the government has not only closed the output gap but it has seriously injured output and what is lost is lost forever.

“Consider that both before and after this period government growth was stronger than private sector growth.”

Evidence, please?

Jacques,

Check out the graphs in government spending and compare that to the growth in the private sector in gdp. Note that government spending exploded in the 1930 and continued through the 1970s. The increase in government spending then began to slow peaking in the early 1980s, falling until around 2000, when it returned to its previous growth trend and then exploded around 2008.

Currently we are seeing a decline in government spending and we are feeling some rumblings of recovery, but many government interventions (Obamacare expansion to business healthcare plans) have been passed into law but have not been implemented. They are hanging over the economy like the Sword of Damocles preventing private sector growth down.

” They are hanging over the economy like the Sword of Damocles preventing private sector growth down.”

funny how folks like yourself argued about obamacare and the stimulus act in your previous lives as well. obamacare was enacted, and wow, the world actually did not come to an end. stryker jr failed to obtain health insurance based on his dad’s advice, which was silly, but i guess you cannot help everybody. but obamacare was enacted, millions of people obtained affordable health insurance, and the economy continued to grow. the world did not end. perhaps you should reconsider your dire predictions in light of past miscalculations? why anybody would think the country was better off when we locked out millions of people from affordable health care is really a baffling thought. and if you don’t like obamacare, remember you had a couple of decades where you could have enacted a “free market” solution under your own name to help cover health care-but you punted.