The headline number for nonfarm payroll employment was decent [1], and although there are worrisome aspects, I think the key take-away is the fact that manufacturing employment is slowing much more than overall. To the extent that manufactured goods proxies for tradables, I think caution is in order with respect to monetary tightening. And yet, I read headlines reporting that the “Fed is on track to raise rates…”[Sparshott/RTE WSJ].

My argument for deferring monetary tightening follows this sequence.

- The dollar’s surge coincides with manufacturing employment slowdown.

- The manufacturing slowdown is even more evident in other measures.

- The dollar’s movements seems well explained by monetary policy.

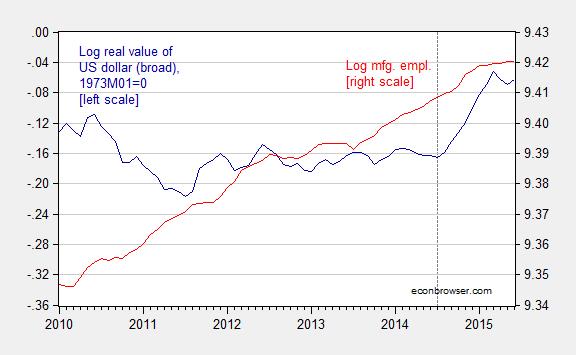

Figure 1 illustrates the remarkable surge in the real value of the dollar against a broad basket of currencies — an approximate measure of competitiveness in a macro sense.

Figure 1: Log real trade weighted value of dollar (broad, 1973M01=0) (dark blue, left scale) and log manufacturing employment, seasonally adjusted (red, right scale). Dashed line at 2014M07. Source: Federal Reserve and BLS.

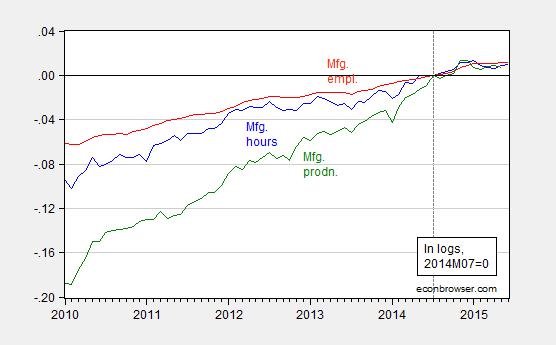

The manufacturing slowdown is marked in other aspects, as shown in Figure 2.

Figure 2: Log aggregate manufacturing hours (blue), log manufacturing employment (red), and log manufacturing production (green), all normalized to 2014M07=0. Dashed line at 2014M07. Source: BLS, Federal Reserve, and author’s calculations.

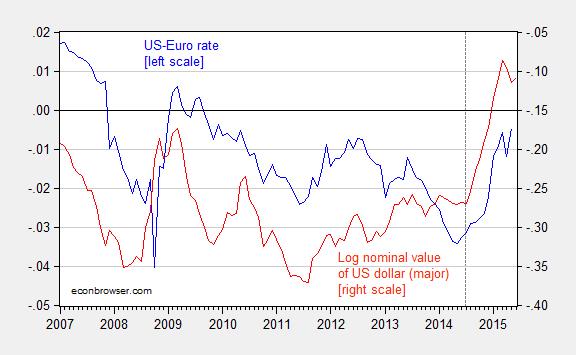

There is always the temptation to say that exchange rates move in ways mysterious (heck, I’ve contributed to that literature). But I think there is a strong case to be made — stronger than usual — that monetary policy has been driving the dollar’s value. Now, this point can’t be verified by reference to interest differentials, given the zero lower bound. But shadow rates, which summarize anticipations of future rates, do tell a tale, as shown in Figure 3.

Figure 3: Shadow Fed-ECB interest differential (blue, left scale), and log trade weighted nominal value of US dollar (major) (red, right scale). Source: Xia and Wu, Federal Reserve Board, and author’s calculations.

The correlation is consistent with the view that the extremely rapid rise in the dollar’s value was due to perceptions of rising Fed rates against a backdrop of declining ECB rates. So, if there is anything that is likely to suppress further dollar appreciation, it would be signalling from FOMC members of a slow pace of rate rises, contra what the is being reported Hilsentrath/RTE WSJ.

In the absence of such measures, current forecasts are for more dollar appreciation (For instance, as of today, Deutsche Bank forecasts dollar – euro parity be year’s end). As I noted earlier, another year of appreciation would not be surprising, given historical precedents.

More on the employment release, from [Calculated Risk], [Baker/CEPR], and [Timiraos/WSJ RTE].

Put Oil back to 100$. Manufacturing “problems” solved. Where did you think those jobs were coming from?

The U.S. shale oil boom, and its multiplier effect, which has slowed, likely has a negative effect on U.S. GDP growth.

I heard, the summer driving season starts in late May (Memorial Day), ends in early September (Labor Day), and peaks July 4th (Independence Day).

Of course, cheaper oil has a positive effect on domestic consumption.

While, substituting domestic goods for imports has a negative effect on domestic growth.

“Fed is on track to raise rates…” – eh? Why?

The CBO doesn’t forecast the economy getting back to its potential GDP before 2017; the employment:population ratio is up slightly but still around the lowest it’s been for 30 years despite the low unemployment rate; and inflation has completely given up this year. Raising rates any time soon would seem to be completely antithetical to the Fed’s purpose.

Try looking at manufacturing excluding energy and the weakness is not such a clear story.

Note also the strong relationship between the dollar and the price of oil. So again blaming the dollar on weakness may be really just another aspect of the weakness in energy.

The absurdity of the government labor figures is easy to see. We added 223,000 jobs while 432,000 dropped out of the work force. The US participation rate is 63%. At lease it is still over 50%. Almost twice as many walked out of the US workforce than enter it. Like immigration they say that people vote with their feet. That is not a very good vote of confidence.

But that is okay because the government can report that the unemployment rate dropped to 5.3%. Isn’t that great! fewer people are working but the unemployment rate went down. Huh?

Speaking of the international aspects look at the participation rates of some of the world’s newsworthy economies: Greece labor participation rate – 53% but the unemployment rate is 25.6 (obviously Greece has too many people looking for work).

But Puerto Rico, a part of the US, is the best example: labor participation rate – 43% but no problem Puerto Rico still has only 12.2% unemployment.

So obviously the answer is that we need to have fewer people looking for work.

Lost in a haze of fog and confusion of theoretical nonsense, which perforce limits visibility and misdirects public attention toward sideline trivialities, is the main event. There is too much debt. The US economy will be condemned to forever underperform until debt is brought down. Intimately related is market pricing which could hardly be more distorted given that monetary policy is still pegging the price of credit to zero. The price of credit is the most important price in the economy. For over six years now it has been held to a level which is wholly artificial. This regime is diametrically opposite the thing that should be done – lowering debt – as its very raison d’etre is to boost credit demand not taper it back. Since time immemorial, societies have known the best way resolve a problem is to start now not delay. It cannot possibly be correct to delay normalizing rates. Caution toward monetary tightening – tightening being the only thing that can restore any semblance of normalcy to debt and market pricing – is nothing more than ignorance disguised by the seductive garb of conventional economic wisdom. Is there a price to be paid? You bet. But the price will be even greater the longer things are put off. You have a front row seat watching Greece. Next, a few years down the road, Spain. At which time the eurozone unravels. In the meantime, caution on constraining credit here – which in the end must happen anyway to get the debt down – only makes the future that much less manageable when the next financial crisis does strike.

Why should the Fed overweight the significance of the manufacturing sector when the service sector appears reasonably healthy? Yes, the average hourly earnings data was weak in June. That could be the result of a calendar related quirk but importantly, hourly earnings are up 2.7% SAAR this year and rising 2.5 to 3.0% across more widely respected measures. Raising rates once or twice this year, as appears to be the baseline in the so-called “dots plot” is already consistent with the cautious approach to monetary tightening you are advocating. The core on the FOMC is signaling as much already, which is why Hilsenrath is reporting as such. Under what set of conditions would you be comfortable with an increase off the zero lower bound?