What the Meese-Rogoff papers do and don’t say, and the implications for empirical exchange rate modeling

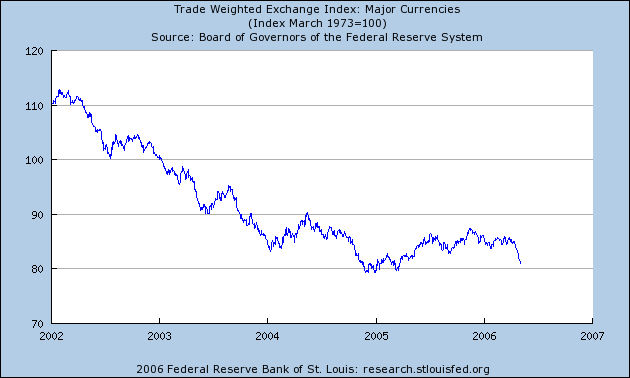

My former teacher Dick Meese recently made several presentations here at UW Madison. One of those talks was on the relationship between the results in the Meese and Rogoff paper and exchange rate prediction. As the dollar looks set to resume its decline, it might be useful to understand the meaning of this paper.

Meese and Rogoff detailed in their 1983 paper the fact that the extant models of the period (monetary, Hooper-Morton) failed to outperform a random walk in out of sample historical simulations, by either mean error, mean squared error or mean absolute error criteria. (An out of sample historical simulation is a forecast where parameter estimates from a particular sample are used out of sample, but using ex post values of the right hand side variables.) This finding has by and large stood the test of time, including sequels by Meese and Rogoff (1988 Journal of Finance), and to a lesser extent the 1995 paper by Chinn and Meese, as well as the 2005 paper by Cheung, Chinn and Garcia Pascual.

Does this mean that monetary models of exchange rates are irrelevant. Not really. The Meese-Rogoff results pertain to a combination of a theory (say a monetary model of exchange rates) and assumptions about the driving processes for the fundamentals (stable autoregressive processes, and a random walk for certain prior views regarding the expected coefficient values).

My colleagues Charles Engel and Ken West have written a paper in which the monetary model is correct but, given a low discount factor, the exchange rate actually Granger-causes (temporally precedes) the implied fundamentals (money stocks, income levels, interest and inflation rates). This does not have to happen, but usually does given the discount factor and the usual degree of autoregressivity in the fundamentals (see the paper by Jian Wang).

So the bottom line is that monetary models might be relevant, especially for thinking about what shoud happen in response to a monetary shock; but the ability of empirical versions of the model to predict future exchange rates depends as much on the other auxiliary assumptions as much as the basic theoretical framework.

Technorati Tags: Richard Meese,

Kenneth Rogoff,

monetary+model,

exchange rate

So, Menzie, has your colleague given up for good the long swing argument that he and your co-blogger, Jim Hamilton once published in the AER? I know that previously here you argued that studies that you have done have undermined it. But what of their views?

I think the point of that paper by Engel and West is the standard one about unpredictability of asset prices. Suppose everyone knew that the dollar was going to depreciate 10% against the Euro next year. Assume there’s some economic model that looks at inflation rates, trade levels, etc, and makes a solid prediction like this, and everyone believes it.

Well then, of course people would sell dollars today and move into Euros so as to benefit from their relative appreciation. The result is to move the dollar to Euro ratio in advance of the prediction, thereby eliminating the forecast shift in relative prices.

The same is true of any other asset price. If everyone knew what Microsoft’s stock price would be next year, they’d buy or sell today until the predicted price change vanished. Likewise for oil or anything else. (Of course this is modulo discount rates, it won’t work if you start looking too far out.)

Barkley Rosser: As I’ve mentioned before, the 1994 JIE paper by Charles Engel reported out-of-sample forecasting results using the Markov switching model. In general, that model could not outperform a random walk, even though, as you point out, he and James Hamilton found evidence of long swings in their 1990 AER paper. On the other hand, in the studies I mentioned (Chinn and Meese, 1995; Cheung, Chinn and Garcia Pascual, 2005), we assessed only linear models, or function nonlinearities, and not nonlinear models of the regime-switching type. So my assertions do not directly speak to the issue of regime-switching approaches, although I believe that broadly speaking the same qualitative findings are obtained.

Hal: Actually, there is nothing in the theory that says that asset prices should follow exact martingale processes. In the stock price literature, there is a predictable component, and it happens that this predictable component is small relative to actual innovations in stock prices. In the exchange literature, only the unpredictable component of the exchange rate movements should be unpredictable. For instance, uncovered interest parity is consistent with efficient markets, but uncovered interest parity implies that expected exchange rate movements should on average equal the interest differential.

My interpretation of the Engel-West paper is that asset prices are the present discounted value of the fundamentals, and that the discount factor — if very close to unity — can make the asset price less predictable than the fundamentals.

Menzie,

And uncovered interest parity rarely holds, last time I checked.

The Engel and West paper is very clever (I saw Ken present it at the AEA meetings over two years ago). It looks to be technically correct. But I fear that my feeling about it is that is “too clever by a half,” although I am not sure that I can clearly articulate why.

Glad to see that you grant that the situation with the nonlinear regime switching is unresolved. (And where is JDH on all this?)

BTW, I’ll be spending July visiting UW econ dept. Catch you then in person. Are in social science, LaFollette, or both?

Barkley Rosser: Actually, we don’t know if uncovered interest parity holds. What we do know is the joint null hypothesis of uncovered interest parity and rational expectations (sometimes called the “risk neutral efficient markets hypothesis, sometimes the unbiasedness hypothesis) is rejected at short horizons. When survey data is used instead of ex post realizations of the exchange rate change, there is more evidence of UIP for at least the major currencies.

If you are interested in Markov switching (in a different context than upswing-downswing), see the paper by Frommel, MacDonald, Menkhoff.

I am indeed in the Social Sciences building, along with the Economics Department, even though my primary affiliation is with the La Follette School of Public Affairs.

On another note, a reader has reminded me that I should give proper due to two important papers on nonlinearities, Diebold and

Nason (Journal of International Economics, 1990), and Meese and Rose (Review of Economic Studies, 1991). While I am at it, I will also gratuitously cite as well Chinn (Journal of International Money and Finance, 1991).

Thanks. Very interesting and useful. See you in July (I’ll be in Soc Sci somewhere; Ken should know where).

Am still wondering if JDH’s silence on all this means that he is bowing to your superior knowledge in dumping down on his old work with Charlie Engel??? (still trying to get a rise out of him, I am… :-))

Barkley, I certainly am not going to quarrel with Menzie’s assessment that a random walk is hard to beat out of sample. Particularly given Charles Engel’s subsequent post-sample investigations, I’m not encouraging people to take forex positions based on the apparent long swings.

I do confess to some general puzzlement as to why exchange rates do what they does, and am usually happy to defer to Menzie on this subject.

Jim,

Having just finished teaching an international finance class for the first time, I must confess some ultimately similar puzzlement (and I have even published a few papers in the area over the years, although none of them have been among those of mine that anybody has cited, so I will not make any claims for their worth).

For both of you, I don’t think I can give a source for this, but I do remember seeing a paper some time ago that said in effect, “And the random walk is not really all that good of a predictor either; it just generally does better than most other models.” Is there something to that as well, or is that really kind of a nonsensical statement?