One of the arguments for acting sooner rather than later on monetary policy is that if the slack disappears, inflationary expectations will surge. That’s represented in this quote from reader Peak Trader’s comment. While I don’t rule out this possibility, it seems reasonable to me to empirically assess whether this is true for the United States over the past thirty years.

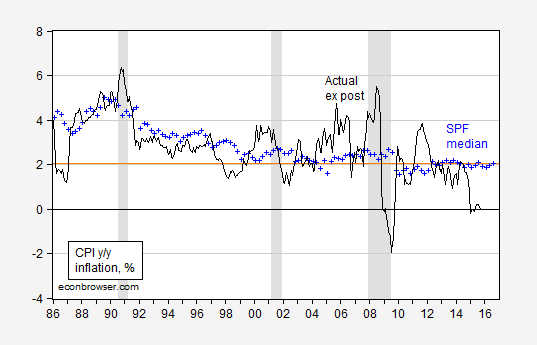

Figure 1: Ex post CPI inflation, year-on-year (black), survey median expectations of 1 year ahead inflation (blue +). NBER defined recession dates shaded gray. Source: BLS via FRED, Survey of Professional Forecasters, NBER, and author’s calculations.

I am sure if there is a drastic regime change, one could see a rapid and dramatic shift in measured expectations; the question is whether that scenario is relevant and/or plausible.

Update, 1PM Pacific: Reader Steven Kopits comments:

The relevant period would be 1960 to 1985. Inflation has been modest since the Volcker days.

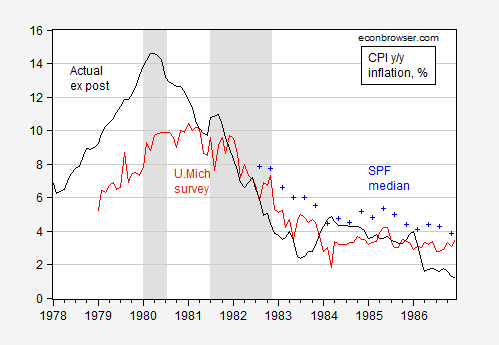

Here is a graph with the available survey data.

Figure 2: Ex post CPI inflation, year-on-year (black), survey median expectations of 1 year ahead inflation (blue +), and U.Michigan household survey of 1 year ahead inflation (red). NBER defined recession dates shaded gray. Source: BLS via FRED, U.Michigan via FRED, Survey of Professional Forecasters, NBER, and author’s calculations.

I will let readers decide whether expecations turned on a dime. They seem pretty adaptive to me.

“…inflation expectations can change quickly”

In fact expectations about economic stability, interest rates and the dollar’s value would change very quickly if a certain doctor or don somehow got to 270 EC votes.

The selloff would be huuuuge.

It’s possible, the Fed has done an excellent job preempting inflation over the past 30 years.

Once the Fed is behind the curve, more tightening is needed, than otherwise, to slow inflation.

When has it ever happened since 1933 that the U.S. economy expanded too quickly and the Fed got behind the inflation curve? The last time we had accelerating inflation was 1973-80 caused by the oil shocks – not something the Fed could have foreseen.

https://research.stlouisfed.org/fred2/series/PCETRIM12M159SFRBDAL

If there isn’t accelerating and slowing inflation, then why are there tightening and easing cycles to maintain price stability by central banks?

And, regarding your prior post, Carson may win just to move race relations forward after Obama setting them back 50 years.

Wow Peak , exactly how has Obama set back race relations to 1955. I was born in 1939 so I remember what race relations were like. I taught in a segregated school in 1963! I currently volunteer with black youth. Your statement is disturbingly ignorant of the reality then and now.

Robert, so, how many years or decades, since 1965, have Obama set back race relations?

Maybe, that’s the main reason Carson is leading in the polls – to actually help the black community.

peak

“Maybe, that’s the main reason Carson is leading in the polls – to actually help the black community.”

is carson leading in the polls, due to the african american republican vote? and if he is not getting that popular vote, what makes you think he will help the situation if the african american community does not roundly support him?

White people voting for Carson will help the black community.

So, if you really want to help black people, vote for Carson.

If you look at unit labor costs for the 1970s the assumption that the 1970s was just an oil driven shock is not such a clear case.

At the time we thought it was much more a wage driven spiral that probably started when we did not have a recession in 1967 to dampen wage gains.

Why survey? Why not use US Treasury yield spreads? Further, if using surveys, why not ask folks what they think the inflation rate was? They will overstate, for sure. Inflation is clearly not much of an issue. The Fed had a wild 6 year learning curve post Bretton Woods till Volker stepped on the breaks. Remember the days of the money supply cone? Since then not much shaking. M1 has finally started to increase after being below the monetary base for several years. Not clear if the Fed will shrink the base down to a trillion, but they could easily if the M1 and M2 to base multipliers start to get back to normal. So given treasury yields, inflation is a non factor. If M1 and M2 continue to grow, and the Fed keeps the base at 4 trillion, then inflation could be a factor and should pop up in treasury yields.

The relevant period would be 1960 to 1985. Inflation has been modest since the Volcker days.

The graph also shows that the inflation rate is more volatile than inflationary expectations. At times, substantially so.

Btw, if oil was 4.5% of GDP in the US, and fell to around 2% of GDP with the price collapse, does that imply that inflation would drop pro rata? The data certainly seems to suggest it.

Steven Kopits: Still think inflationary expectations are not particularly volatile. I will add a graph showing U.Mich survey data over part of the sample you mention.

What about this chart, which shows it can move quickly sometimes:

https://research.stlouisfed.org/fred2/series/MICH

Peak Trader: They can, particularly in the early period, but I have plotted with the ex post inflation (see Figure 2). Compare the volatility…

On that graph, I see only one case of a rapid change persisting, and many of the rest look like they are driven by oil or disasters, in addition to being short-lived: Gulf War I, 9/11, Katrina, massive run-up in oil in 2007/8, its crash in ’08/09. The only rapid change that stuck was ’80-’84, which appears to have been the result of a massive double-dip recession engineered by the Fed for exactly that purpose. Is the equivalent in reverse in the offing?

I am not particularly worried about inflation. If it went to 4%, or even 5%, I don’t know that it would be the end of the world.

Bubbles, though, those can blow up the global economy.

steven, you can help with the bubbles with finance reform programs. big banks and hedge funds can be controlled. right now you want to control their bad behavior by raising rates and ending QE? why not control them a bit more directly? bubbles are not a problem if leverage is constrained. losing money you already have is tough but survivable, but losing money you leveraged and don’t really have is a big problem. limit the leverage. that is what finance reform programs have been trying to implement.

I take it from BC’s comments that he thinks we’re already past the point of no return. I am not so pessimistic, but would really prefer to see leverage and house prices lower.

In Princeton, I think we are seeing a bigger housing boom than we did in 2005-2006. It seems every 1960s rancher coming on the market is being scraped and replaced with a $1.5 m trophy house. Indeed, the historic (old money) mansions on the western side of town are also being scraped. These are, say, $4-5 million houses being demolished and replaced with new houses of similar scale (6000+ sf), but brand new and at similar cost, ie, the purchaser is in effect buying the house twice.

These sorts of things make me nervous.

In any event, you are suggesting that credit should be allocated by quantity (ie, restrictions on borrowing), rather than price (the interest rate). I am far from convinced this is likely to work.

steven,

i don’t really think you can ever effectively eliminate bubbles. but you can have an impact on their influence when they burst. a bubble fueled by leverage is far worse than a bubble fueled without leverage. neither is good when it burst. however, when you have significant skin in the game, you tend to be more careful than when playing with other peoples money. that is why i would advocate controls on leverage. solving the problem with higher interest rates overall simply punishes both the good with the bad. that said, there is room for a combination of restrictions on borrowing as well as interest rates, because neither will be fully effective on their own. in the last real estate boom and bust, we did have restrictions on both. interest rates were higher for low down payment individuals. however, we simply allowed people to leverage an additional loan to pay the down payment. end game, we had too many people over leveraged when the asset value dropped. controlling leveraged debt is important-price does not do the job adequately.

Thanks, Menzie. You can see in the U Mich data that inflation expectations drop from around 10% in 1982 to around 2% by mid-1984. Expectations were changing at the pace of 1% (pp) per quarter. I would say that’s pretty volatile.

On the other hand, I don’t think any of these periods are reliable analogs to the current situation. I think a more reasonable precedent would be the post-1929 period. That record indicates that there was no major inflation spike until 1943, during the war.

The last time the Fed blew it badly was in the 2006-07 period when inflation wasn’t a problem, but the distinct likelihood that falling prices (I don’t want to say deflation) in specific, high-profile, big-impact sectors was roundly ignored until… oops, too late… just exacerbated system problems by keeping rates too high for too long.

There is a tendency toward inertia on the part of the Fed. I think the present conditions reasonably support the some inertia. But perhaps the Fed needs some new measuring tools so that it can act appropriately for both raising and lowering rates. Would raising the Fed Funds Rate from 0-0.25% to even 1% have significant impact on commerce? That’s probably just a hiccup in reality, but would signal that the Fed sees a reality that most do not and could be the source of great concern.

Still, it depends on where you are looking for price increases (inflation). Housing is up, but absolute prices are still below historical peaks. Oil/gasoline prices are down 50% from recent highs, but electricity rates have been increasing rapidly due to government policies. Food prices continue to escalate, in part from the western drought and in part from regulatory pressures. Wages have been going up and there is pressure from both the White House and unions to have wages go up even faster. So, would raising the Fed Funds Rate “fix” these aspects of our economy.

I think not. Perhaps relaxing governmental attempts to manipulate markets might be a better “solution.”

Demographics and the long-term historical pattern of CPI and interest rates:

https://app.box.com/s/545ufkd4x268h9uj8cuht24acksm30q0

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2wgo

https://app.box.com/s/f63455cttd4vuys0z2jiovrd0xm7mfiu

https://app.box.com/s/kb1tvgnkwx2p2dpmu2btvtuijgt9tb3q

https://app.box.com/s/xgccmf10czcugywc3ubtrf73e31xsors

https://app.box.com/s/x85ciaw5unj1fih8m8iebx63s8nlhqhx

S&P 500 revenues and earnings:

https://app.box.com/s/qpgtgjtag2exy5d9hqk7saipcltlb56k

https://app.box.com/s/ttsdbdi2phrz7fpmijmq18jccr9wvtv9

https://app.box.com/s/uu94vkwgsv5lez0nm0tij3f0f2azl9l8

Bank C&L loan delunquencies and charge-offs:

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2whA

We’re slowly sleepwalking into a deflationary recession, bear market, increasing corporate credit risk, and likelihood of banks pulling in lending for the cycle.

Yet, the Fed continues with “forward giddiness”, insisting that the funds rate is going higher.

Perfect timing.

We should be so lucky that expectations (and inflation!) jump to 4% or 5% in short order. It would get us out of this liquidity trap! The Fed could then raise rates to a level even the bond vigilantes would find acceptable, and we’d be sort of back to normal (assuming wages caught up!). Otherwise, we’re going to end up like Japan, mired in a low-growth trap for another decade.

If the Fed loses credibility targeting 2% inflation. it would be expensive regaining that credibility.

Anyway, the Fed has been trying to raise nominal growth (see Fed’s balance sheet).

There must be other factors weighing on growth.

As Bob Brinker said: “The Federal Reserve is the only operation in Washington doing its job.”

Derrell: We are indeed in a trap, though I prefer the term box canyon since it is broader than liquidity. And being so the trap is far worse than you think. We will be in it for decades, not just one. On trend, real growth will grind lower and lower. While around the edges certain actions can be taken that would stimulate growth, fiscal and monetary policy actions are not amongst these. Moreover, warring political factions will stymie other actions that would be helpful even if a growth champion were to appear. Fiscal stimulus and easy money credit creation will only worsen the debt burden which is crushing growth. The overriding constraining variable on potential growth is debt-to-GDP. Over the past 7 years, this has gone full global as China’s debt burden is now on a par with that of the EU, US, and Japan. Since the smaller EM nations are subject to global forces in a way the big four are not, their generally lower debt ratios are in the danger zone too.

For certain the consequences will be civil strife around the globe as well as in the US, potential for a calamitous financial catastrophe, and a realignment of global reserve currencies toward a gold backed yuan-ruble. The American empire is sliding precipitously. Neocons and other members of the dominant Council on Foreign Relations will spin war as the way out as they have ever since the collapse of the Soviet Union starting with Bosnia in 90s.

The proper course would be for the US to gradually over time reduce the overall debt-to-GDP ratio. This, however, by definition necessitates a negative credit impulse. The problem then being that throughout history whenever the credit impulse went negative long enough recession resulted. The kneejerk reaction to the next recession will be the same as the last, throwing more debt at the problem to revive the economy. Instead of letting the system purge itself of real sector malinvestment and financial sector excessive debt. Of course, Americans would not stand for a period of zero or negative growth that went on for very long. People have no clue about the horrific box canyon policy-makers have led us into. Nor of the protracted period of low growth it will take to get us out and back onto a sustainable growth path. Psychologically, this is because people have great difficulty connecting an event today with its inevitable consequences in the not-to-distant future. Consequences in the case of debt that have cumulated exponentially.

With civil strife, potential global war, the probability of a financial crisis far worse than the last, and shocks from China and the EMs hitting the US in a way they never before have (at least since the Great Depression where those shocks ricocheted between developed nation powers), this admixture is a chilling warning of what is to come. Demographics also align badly, as does the eventuality of peak oil arriving before renewables are sufficiently far along to plug the gap. Renewables were an insignificant 2.5% of world energy consumption last year. In addition, the world may face extreme cooling the next few decades due to the solar cycle. Also, never in modern times has there been more chaos in the Mideast, brought on by the forces of modernity and the policies of the US and NATO whose aim has been to take out one sovereign leader after another starting with Bosnia right down to the Ukraine and Syria.

The reigning economics paradigm is myopic about most outside forces, and substantially wrong in many places in its core theory of how the macro economy works. The disconnect between the monetary economy and the physical economy has never been greater. This disconnect is amplifying already extreme income and wealth inequality, and making the financial economy just that much more fragile. In long historic scope, financial and banking crises are now on an exponential upswing. This time the cracks in the financial edifice are against a backdrop of record global debt. And what about the status of work with robots rapidly taking over? What social disruptions to come here?

One day in the mid-70s in my doctoral advisor’s office, he told me global per capita growth prospects had reached their apogee. Likely never again would the US see growth like in the 50s and 60s. (Since then real US growth has fallen at the rate of 0.4 ppt per decade.) Already his voluminous mind, by superimposing the physical reality of limited energy and other resources on the process of economic growth, foresaw the future that has actually unfolded. I made note of what he said. Still it went in one ear and out the other, as in my youthful naivety I had an unrealistically optimistic view of progress based on my short life to then that just happened to coincide with the US’s heyday. I simply did not yet have the wisdom and perspective to see many mosaicked nature for what she really is.

Lastly the machinations of the New World Order, directed by the wealthiest of elites, whose documented aim is to strip sovereignty away from all nations, and with it personal liberty. The patriotic American middle class is the main obstacle in their way. Just imagine how further restricting freedom will affect growth.

JBH, what s/he said. 😀

I would add that at this point in the Long Wave progression, financial, economic, social, and political instability is the norm (“not-so-new normal”), as is elite and their ministerial intellectual and technocrats’ reaction to instability associated with excessive debt to wages and GDP, EXTREME, even OBSCENE, inequality, and proletarianization of labor, even “educated”, professional middle- and upper-income-class, and self-employed labor, including doctors, attorneys, university professors, public administrators and bureaucrats, engineers, programmers, architects, nurses, teachers, etc.

But we are now facing unprecedented, global, structural constraints from Peak Oil; population overshoot; resource depletion per capita; mass-social redundancy anxiety (see William Catton); climate change; excessive debt to wages and GDP; a record low for labor share and resulting deceleration of productivity; contracting acceleration of money velocity to private GDP (“deflation”); an equity bear market; secular trend rate for nominal GDP per capita below 2%; fiscal constraints/austerity; a liquidity trap, risk aversion, and liquidity preference; and the de facto end of the Anglo-American, rentier-socialist, militarist-imperialist trade regime, i.e., “globalization”.

Peak: Carson is leading among conservative republicans who hate Obama partly because he is a black man- hardly a cross section of Americans. You still have not explained exactly how Obama has made race relations worse than even 1965!

It could be fun for Econbrowser to offer a survey question of whether readers expect the Fed to raise rates in December (yes or no) and tally the percentage of each to see how close the readers’ expectations are to the actual outcome.

I was not impressed with last night’s debate.

Steven, you were not supposed to be impressed. Hillbillary is the presumptive CEO of the Anglo-American imperial corporate-state to follow Obama/Obummer/Obomba, who was no more or less qualified to hold the job. But that’s what the rentier-socialist Power Elite top 0.001% want, i.e., someone with no personal or institutional power to unilaterally decide anything apart from the wallpaper and color and style of curtains for the Oval Office, which the First Lady or Gentlemen can decide.

Trump is a stealth Demoncrazy whose vested business interests and wealth are much more aligned with that of Wall St., East Coast banksters, bankster-bought politicos, and the mob than the Scots-Irish and Anglo-Saxon, middle- and upper-income working-class ‘Merikans being decimated by globalization, deindustrialization, financialization, feminization, and fiscal austerity.

Trump’s candidacy is Hillbillary and Wall St.’s win, just as was that of Obummer.

So, no worries. It’s all good. The top 0.001-1% are safe.

But were I a DC/VA/MD/NJ/NY overpriced house owner, I wouldn’t be taking out any big equity loans against $1M+ houses in the region. The next unreal estate bust will hit disproportionately harder high-end, buy-up properties that peak Millennials won’t ever be able to afford to mortgage and bid for at anything close to current prices.

https://www.stlouisfed.org/on-the-economy/2015/october/predicting-impact-oil-prices-inflation

A St Louis Fed take on the impact of oil prices on inflation. If oil remains about the same as current price then they expect inflation to be 2.2 by the end of the year. This is based on a technical adjustment y-o-y. The FOMC probably find such in-house research influential although it is published with the standard disclaimer.

This analysis looks about right to me. The decline in oil price is a one time thing, so it should reset inflation for maybe a year (assuming the price has fallen by about 2% of GDP), with normal inflation resuming thereafter.

I wonder about its implications for Jim’s ICE model.

https://app.box.com/s/ys8ijadj4b57nb95ka0b3ilph38ga7fm

The breakpoint was the watershed of 1980-81 where Volcker took control and broke the back of inflation via monetary targeting. The Fed operates very differently today. In earlier years, Fed policy did not operate that way and so inflation could run away with itself. In the mid-80s, the new regime of monetary targeting morphed to something else. The something else was a de facto Taylor rule. By the time Taylor had written his seminal piece, the Taylor rule was in gear (being actively pursued by the Fed as revealed by their policy changes) though still not being followed religiously. I had figured this out at some point in the mid to late-80s. That is before the Taylor rule was ever a part of the literature. I used this knowledge to very successfully forecast the funds rate at that time. The empirically-derived neutral rate at the time was 2%. Over time it morphed modestly to 1.6%. The proof was in the pudding of extremely successful forecasts.

Let us call the era from just before Greenspan to present the Taylor rule era. The market understood during this era that the Fed would act sooner rather than later to hike (or lower) the fund rate when the real rate (as measured by nominal fed funds minus core CPI inflation) got outside the range of plus or minus a percentage point of the ostensible neutral rate. A band around the nearly constant neutral rate showed this quite dramatically. Moreover, at nearly every FOMC meeting during this Taylor rule era, the term “anchored expectations” would appear. This operated on the public’s perception to keep expectations well bounded, though of course the Fed had to follow through and start to hike when or shortly after the nominal funds rate fell below the rectangular band around the neutral rate.

One especially vivid case was 1993, during which time the real fed funds rate was almost perfectly zero each month. This was a dead giveaway that a hike was coming. (The nominal rate was being held approximately 2 ppts too low because of headwinds in the banking system extant in the wake of the 1990 recession.) In October of 1993 I got a bond market signal that the time to hike had finally arrived. In February 1994, the initial hike of that next cycle did come. It then precipitated a bond market debacle that year.

An important empirical observation evident in real time from 1980-81 on was that over the course of a calendar year it was rare for the Dec-over-Dec CPI rate to accelerate by more than a percentage point. This by itself confirms the point of this post that expectations were (had good reason to be) exceeding sticky. Even more to the point, why they were. And rightfully so. That rare handful of years follows. 1987: the Fed hiked in August which, by the way, triggered the Crash of ’87 which itself stunned inflation. 1990: yield curve had already inverted. All inversions were because of Fed tightening to make good on their promise of anchoring inflation. Inversion=tight money, and implies in short order, though with a lag, inflation will slow. 1999: yield curve inversion surrounds this episode. 2004: the longest period the funds rate was held below the neutral rate since the stagflation of the 70s. The SPF did not pick up on this, so consensus interest rate forecasts went awry. However, by 2004 the Fed had trained the market to expect 2% which is why SPF expectations remained sticky. 2007: yield curve inversion. 2009: trivial case of huge inflation rebound from deep temporary Great Recession low.

You have just learned that it is rare indeed for inflation to accelerate by more than a percentage point in a calendar year. And when it does so, the Fed is already tightening. You’ve also been introduced to a piecewise method of analysis. That is, I discount what happened in the old regime – that of the pre-watershed years – because the new regime (current Taylor rule regime) embodies a Fed commitment to anchor inflation in a way the old regime did not. My piecewise methodology is far more general than this, and is a very powerful tool for understanding what is really going on. Regime changes are constantly taking place and play havoc with regression analysis.

There’s more. There is a reason the Fed plays attention to core inflation. Bursts in crude oil prices are generally self-correcting. They make take overall inflation higher. But if the price of crude surges by 75% or more in a 12-month period, that generally helps precipitate a recession. Which then, of course, knocks the stuffing out of inflation. Turning to core inflation, since the 1980-81 watershed, core inflation accelerated by over a percentage point in calendar Dec-to-Dec only twice : the trivial case of 2011 which was an oscillating then dampening reaction off the recession trough, and in 2004. Hence in the past 35 years, there is only one anomaly. 2004 was a substantial inflation acceleration not accompanied by tight money. Yet in 2005 the rate of inflation fell back. Never having looked at the total picture quite this way before, I’ve yet to do the analysis to be able to say exactly why inflation decelerated after 2004.

We are now in yet another era. The conjunction of post-crisis and Taylor rule eras. The Fed has held the real fed funds rate negative for 8 straight years. Yet the overall CPI rate is currently 0.0%! (Or if you prefer, the core is 1.9%, up only 2/10ths of a percentage point from the prior Sep.) How can such low inflation be? Well obviously because something is different. The thing that is different is the global deflationary impulse. It is of two (and perhaps more) parts: global supply glut emanating out of China and global debt weighing down everywhere. Menzie much to his credit got this right early on. Though I suspect if we parse the general notion of deflationary impulse further, he and I will quickly come to some disagreement. For all I know, this may be because he reads too much science fiction.

This was a nice analysis, JBH.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2wgo

https://app.box.com/s/545ufkd4x268h9uj8cuht24acksm30q0

https://app.box.com/s/xgccmf10czcugywc3ubtrf73e31xsors

https://app.box.com/s/kb1tvgnkwx2p2dpmu2btvtuijgt9tb3q

https://app.box.com/s/f63455cttd4vuys0z2jiovrd0xm7mfiu

https://app.box.com/s/earfgyknu6xx8woigktnnny6dn7devt2

https://app.box.com/s/xcult10g1qfq3qi9wobow4j4l6j0pu0o

https://app.box.com/s/h0p6s4ye96k6cx7smn0r2te0giganyy1

We’ve been here several times before, gentlemen, but we’ve been “educated” (socialized, credentialed, and allocated to the occupational strata) not to know (eyes wide shut) or to ignore the fact; but it’s “capitalism” (or its evolutionary successor as militarist-imperialist, rentier-socialist, bankster central-planned, corporate-statism, i.e., “fascism with a friendly, self-superior, self-satisfied, Goldman Sachs bankster’s face”).

Thank you, Steven.

If expectations changed substantially relatively often theory says expectations would adapt to the volatility. And theory says this should not happen outside of tail events.