The IMF staff has now determined the Renminbi should be included in the IMF’s unit of account, the Special Drawing Right (SDR). Reviews of the decision are covered here and here. But as the articles note, there is a long ways to go before the RMB is internationalized so as to rival the dollar or euro.

This was actually the point I made in the discussion of a paper on the RMB’s progress toward internationalization by Eswar Prasad, at the Asia Economic Policy conference at the San Francisco Fed a week and a half ago (conference agenda not yet online). The paper is not yet online (an older paper from last year is here).

The reason the road will be long is fairly simple — at least in my mind. It’s not because of technical difficulties — Chinese policy authorities have demonstrated that if the political will is there, they can implement policies forcefully and effectively. Rather it is a question of choices, and in this case the trilemma is once again relevant:

Figure 1: The Trilemma.

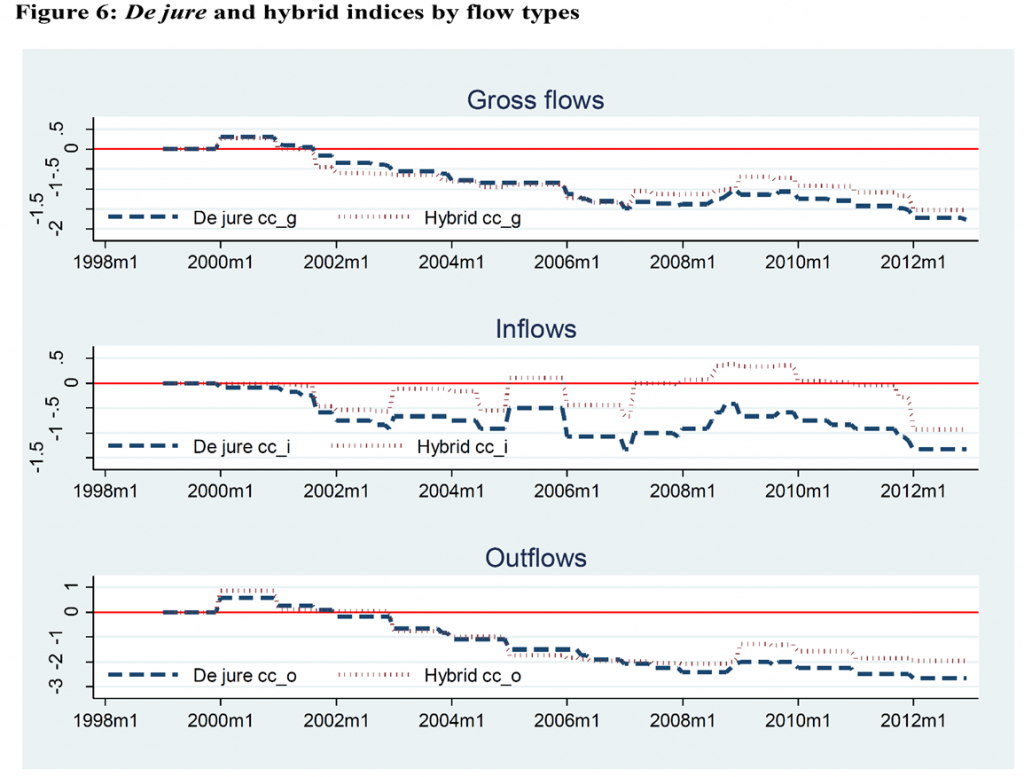

In order for China’s currency to become a key international — as opposed to a regional — currency, it will have to liberalize the capital account (and the domestic financial system as well). That process in itself requires a conscious decision to relinquish control. That process is already underway with respect to capital account openness, as shown in this figure from Chen and Qian (2015) (earlier version discussed in this guest post).

Figure 6 from Chen and Qian (2015).

However, as China moves from the top vertex of the triangle toward the base, policymakers will have to make a choice of (1) whether to continue liberalizing, and then (2) whether to move toward a combination of free float/financial openness or a combination of monetary autonomy/financial openness.

In the best of times, these would be difficult decisions. Against a backdrop of a decelerating economic growth, tentative financial conditions, and a weak global economy, it’s not clear that Chinese authorities would view the ascension of the RMB as a sufficiently high priority, so as to sacrifice policy autonomy.

These arguments are laid out in greater detail in “Emerging Market Economies and the Next Reserve Currencies,” OER (2015).

China’s net exports in US$ and euro terms as a share of US$ and PPP GDP are insignificant and becoming less so.

Moreover, China will be importing (or trying to) more oil, food, and materials hereafter as a share of GDP, reducing net exports and FDI inflows indefinitely hereafter.

The RMB will eventually be removed from the loose US$ peg and devalued, betraying the presumed good faith of the IMF and banksters adding the Chinese currency to the SDR basket, which they did as a precursor step to attempt to gain control of the Chinese banking system so they can repatriate US$’s from China via central bank and IMF reserve swaps, among other objectives.

This didn’t work in the 1930s when the Japanese removed the Yen from gold (the reserve basis of the day), devalued the Yen by 30% (and later another 30%), and left the League of Nations prior to Japan’s militarist-imperialist rampage in the early to late 1930s to secure resources.

The CCP officials are going to relinquish control of China’s economy and financial system to the western bankster oligarchs when Pat Buchanan becomes a Liberal Democrat and Hell freezes over in August (in the northern hemisphere).

China is Japan c. 1931-33 to 1937.

P.S. China will lose the “Scramble for Africa II”, as the Anglo-American empire cannot permit China to secure scarce resources in Africa and establish a African trade and RMB currency regime to compete with the US$ and euro blocs.