Today we are fortunate to have a guest contribution written by Zidong An (American University) and Prakash Loungani (IMF).

In August 2010, an article in Slate noted there were “two gangs of economists warring over the cause of high unemployment” in the United States. Paul Krugman, the ringleader of the “cycs” said the cause was cyclical—specifically, inadequate aggregate demand; the “strucs” blamed a host of structural factors for the increase and predicted that unemployment would not decline unless these were addressed. Six years later, which side won the battle?

The evidence shows the “cycs” have been proved largely right. U.S. unemployment has fallen pretty much in line with the recovery in output. U.S. states where growth was stronger than the national average had declines in unemployment greater than the national average. And looking across the globe, countries which experienced more rapid growth than the global average — a group which includes the United States and the United Kingdom — had declines in unemployment greater than the global average.

Round up the only suspect

Paul Krugman wrote in 2011 that unemployment was high “because growth is weak — period, full stop, end of story.” The “strucs” had a longer list of solutions: “changes in education, immigration, occupational regulation, foreign direct investment, unemployment insurance and patent law,” according to a 2012 op-ed by Diana Furchtgott-Roth of the Manhattan Institute.

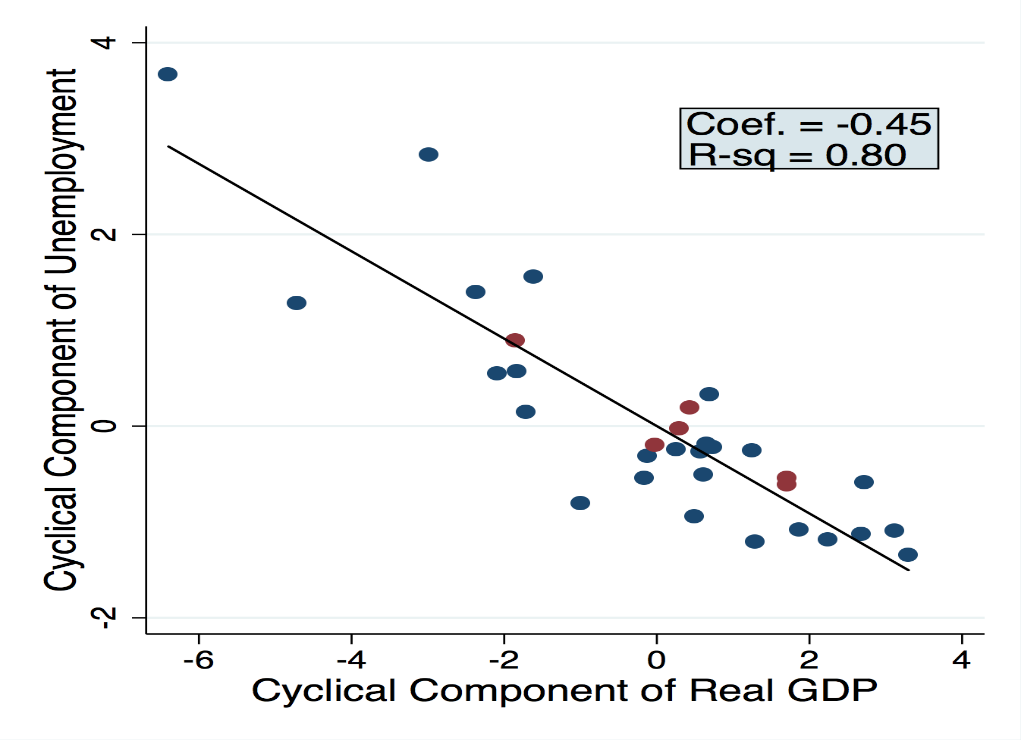

The evidence is in: growth has trumped the longer list of suspects. Figure 1 shows the relationship between the cyclical components of unemployment and real GDP using U.S. annual data. There is a very tight relationship with a R-square of 0.80 and a slope coefficient of -0.45. The recent years, shown in red in the chart, do not stand out.

In deference to the views of Jim Hamilton, these cyclical components were constructed using not the Hodrick-Prescott (HP) filter but the one that he recommends instead. In practice, using the HP filter gives similar results: a R-square of 0.78 and a slope coefficient of -0.54. The relationship between the change in the unemployment rate and the growth rate of real GDP, which does not rely on any explicit filtering, is also very strong. With quarterly data, the relationship between unemployment and output gets somewhat noisier but remains very robust (Ball, Leigh and Loungani, 2016).

Figure 1: Cyclical Components of U.S. Unemployment and Output

What Lies Beneath?

The Great Recession did not affect all U.S. states equally and the pace of the subsequent recovery also varied across states. At various times, state politicians — such as former Texas governor Rick Perry — have touted particular labor market policies they have pursued as the reason for their state’s superior employment performance. However, a sub-national look at U.S. states casts doubts on such claims and instead further bolsters the evidence that the “cycs” are right.

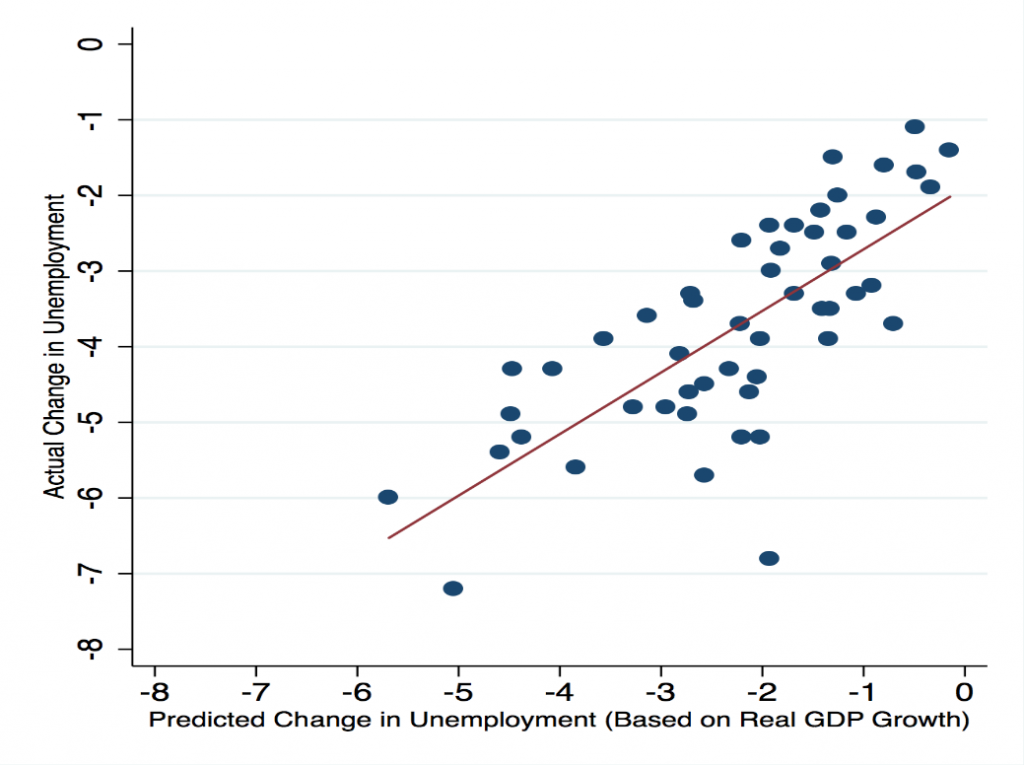

Figure 2: Actual and Predicted Unemployment Rates, U.S. States

This is illustrated in Figure 2. The vertical axis shows the decline in unemployment between 2010 and 2015 in each of the 51 U.S. states (granting DC temporary statehood). The horizontal axis shows the decline in unemployment that could have been predicted based on the growth in the state’s domestic product and the historical relationship between unemployment and output in the state. The evidence clearly shows that unemployment fell more in states where there was a stronger recovery in state output (Gonzalez-Prieto, Loungani and Mishra, 2016).

U.S. vs. Others

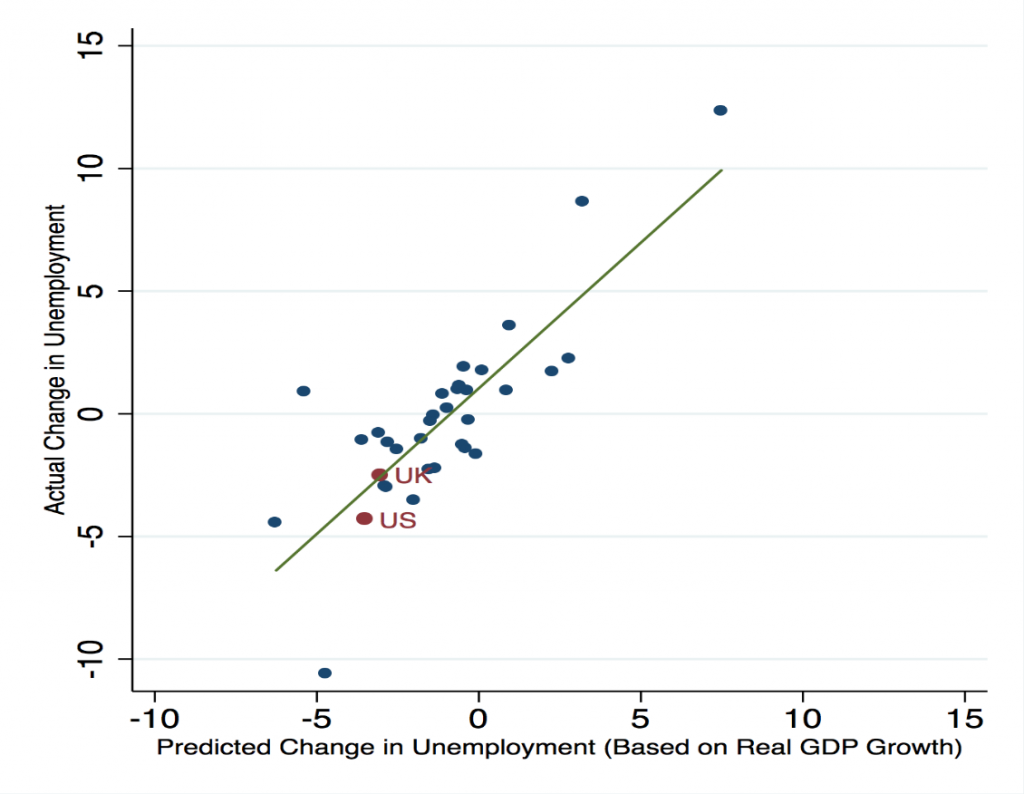

Figure 3 shows the results of a similar exercise using data on several advanced economies. This time the vertical axis shows the change in unemployment in each economy between 2010 and 2015. The horizontal axis shows what could have been predicted on the basis of the country’s real GDP growth over this period and the historical relationship between unemployment and output in the country. Once again, there is a very strong relationship between the two. In countries, such as the US and UK (highlighted in the chart), where real GDP growth has been stronger than elsewhere, the decline in unemployment rates has been sharper (Ball, Furceri, Leigh and Loungani, 2016).

Figure 3: Actual and Predicted Unemployment Rates, Advanced Economies

Battle won but war continues

The sub-national, national and international evidence thus all point to a clear victory for those who were arguing for a cyclical explanation for the cause of high unemployment in the United States and other advanced economies. By extension, the evidence vindicates the policy prescription of aggregate demand stimulus through monetary and fiscal policies that was recommended by the “cycs”. It is unlikely that the growth differences in U.S. states and advanced countries observed over this period reflected the differential effects of structural policies. Instead, they likely reflect the timing of central bank actions (e.g. Fed vs. the ECB) and differences in the fiscal stance (Kose, Loungani and Terrones, 2013).

Of course, labor market problems remain even in countries such as the United States where conditions have improved significantly over the past few years. As Kocherlakota (who went from the camp of the “strucs” over to the “cycs”) noted recently, U.S. labor force participation has declined—the reasons for this decline and how persistent it will prove remain a matter of debate. Kocherlakota argues that cyclical conditions are still weak and uncertain enough that “raising rates or signaling a December increase would be a mistake” by the Fed. Others say the U.S. economy is now at full employment and further improvements in labor market conditions should come about through structural policies rather than monetary or fiscal stimulus. So the war between the “cycs” and the “strucs” will continue; but in a field where outcomes are never clear cut, it is good to pause and declare that the “cycs” won the battle of 2010-16.

This post written by Zidong An and Prakash Loungani.

Marriner Stoddard Eccles, Chairman of the Federal Reserve under President Franklin Delano Roosevelt:

“The United States economy is like a poker game where the chips have become concentrated in fewer and fewer hands, and where the other fellows can stay in the game only by borrowing. When their credit runs out the game will stop.”

**

It is utterly impossible, as this country has demonstrated again and again, for the rich to save as much as they have been trying to save, and save anything that is worth saving. They can save idle factories and useless railroad coaches; they can save empty office buildings and closed banks; they can save paper evidences of foreign loans; but as a class they can not save anything that is worth saving, above and beyond the amount that is made profitable by the increase of consumer buying. It is for the interests of the well to do – to protect them from the results of their own folly – that we should take from them a sufficient amount of their surplus to enable consumers to consume and business to operate at a profit. This is not “soaking the rich”; it is saving the rich. Incidentally, it is the only way to assure them the serenity and security which they do not have at the present moment.

http://londonbanker.blogspot.com/2011/09/testimony-of-marriner-eccles-to.html

Where are people such as Marriner Eccles today?

Keynes Got It Right 83 Years Ago

We ignore Keynes at our peril: aggregate demand drives the economy and job creation.

Austerity – reducing the budget deficit – is folly.

The Means to Prosperity, 1933

Real growth continues to be weak, in the eighth year of the “recovery” after the severe recession, because so many Americans dropped out of the workforce, took lower paying jobs or part-time jobs, and low-skilled jobs were created (McDonald’s is the 21st century soup line). The costs in monetary policy and the national debt have been enormous.

We’re in a very weak position to fight the next recession, to boost the U.S.-centric world. The expensive and weak “recovery” is caused by structural factors. We need massive reforms in college debt, Obamacare, Dodd-Frank, regulations in general, the tax code, government spending, etc.. Otherwise, we’ll become even poorer.

The expensive and weak “recovery” is caused by structural factors.

Did you not read the post? Let me summarize: the Great Recession was a cyclical aggregate demand problem, not a structural problem. There may well be things we can and should do to improve structural factors, but they really aren’t relevant for explaining the recovery from the Great Recession.

Just a quick refresher. It can be helpful to think in terms of two curves; and aggregate demand (AD) curve and an aggregate supply (AS) curve. What we’ve been suffering from for the last 8 years is weak AD. Things to push out the AS curve take a very long time to show up in the economy. Streamlining unnecessary regulations would improve economic performance over the long run, but you’re talking about two or three generations before those kinds of structural reforms really begin to bite. You’re not going to permanently raise the near term GDP growth rate from 2% to 3% through structural reforms. Sorry, but the math doesn’t work. It’s also not clear that pushing out the AS curve is even a good idea if the Walras clearing real interest rate is negative. It’s a positive interest rate that makes the AD curve slope downward. If the short-run AD curve “flips” and slopes upward, then pushing out the AS curve actually reduces output. It’s the old “paradox of toil” problem.

Finally, I’m not sure that your idea of “reform” would match my idea. To me, reforming Obamacare means expanding Medicaid and offering a single payer option. To me, reforming Dodd-Frank means greater capital requirements for banks and vigorous prosecution of bank executives who commit or tolerate fraud. To me, right now we need more government spending, not less. The time will come when we need less government spending, but that time isn’t now. I’ll confess that I don’t have any idea what you mean by reforming college debt, but I’ll suggest lowering interest rates in exchange for higher taxes on those whose incomes are higher because of their college experience. I have a lot more sympathy for poor kids struggling through community and state colleges than I do kids from the 1% who whine about the cost of an Ivy League education.

Yes, I read the article and agree it’s partly cyclical. Sounds like you’re mixing models (AD-AS and IS-LM) and making contradictions. For example, if the price of health care insurance doubles and demand for health care falls, because the deductibles are too high, that can cause a contractionary shift in demand. We saw health care inflation slow with less demand for health care. Also, since there’s less discretionary income for other goods & services, because you’re forced to pay too much in the health care industry, you get what we’ve been having – weak growth with low inflation. I’ve explained before how other structural problems reduced income and therefore spending. It would be much cheaper to correct the structural problems than spend even more to trying offset them.

spending power in the hands of the consumers will get the wheels spinning again.. stimulus policies have been great for the trading industry and bailing out the government but real growth is based on faith and trust.. futuristic business models can not create a profitable outlook with oil potentially re-testing it’s highs ..commodity instabilities have wrecked havoc on the bottom lines..give more time for lower oil prices to create internal spending trends..and keep government security costs low..dept. of defense spending is the major beneficiary of the United States GDP…too big to fail?

Unemployment is high because economics is false: period, full stop, end of story

Comment on “Battling Unemployment: A Clear Win for the ‘Cycs’”

Walrasian, Keynesian, Marxian and Austrian economists are groping in the dark with regard to the two most important features of the market economy, that is, the profit mechanism and the price mechanism. The fault lies in the fact that economists argue from the micro level upwards to the economy as a whole. And here the fallacy of composition regularly slips in. To get out of failed economic theory requires nothing less than a full-blown paradigm shift from accustomed microfoundations to entirely new macrofoundations.

In the following a sketch* of the correct employment theory is given. The most elementary version of the objective structural employment equation is shown on Wikimedia

https://commons.wikimedia.org/wiki/File:AXEC62.png

From this equation follows inter alia:

(i) An increase of the expenditure ratio rhoE leads to higher employment (the letter rho stands for ratio). An expenditure ratio rhoE greater than 1 indicates credit expansion, a ratio rhoE less than 1 indicates credit contraction.

(ii) Increasing investment expenditures I exert a positive influence on employment, a slowdown of growth does the opposite.

(iii) An increase of the factor cost ratio rhoF=W/PR leads to higher employment.

The complete AND testable employment equation gets a bit longer and contains in addition profit distribution, public deficit spending, and import/export.

Item (i) and (ii) cover Keynes’s well-known arguments about aggregate demand. Here, though, the focus is on the factor cost ratio rhoF as defined in (iii). This variable embodies the price mechanism which, however, does not work as standard economics assumes. As a matter of fact, overall employment INCREASES if the average wage rate W INCREASES relative to average price P and productivity R. This is the opposite of what standard economics teaches.

The structural employment equation contains nothing but measurable variables and is therefore readily testable. There is no need of further discussion. As always in science, a test decides the matter.

Right policy depends on true theory: “In order to tell the politicians and practitioners something about causes and best means, the economist needs the true theory or else he has not much more to offer than educated common sense or his personal opinion.” (Stigum, 1991)

Standard economists do not have the true theory. Standard labor market theory is provable false.

Egmont Kakarot-Handtke

* See the working papers for more details

http://papers.ssrn.com/sol3/cf_dev/AbsByAuth.cfm?per_id=1210665

Excellent work… Love to see this high level of thinking.

If, say, Rick Perry engaged in a brilliant labor-market reform that reduced unemployment, it would also quite likely increase growth. Such would be the case for any structural inefficiency that was keeping potentially productive people from working.

I’m not saying that is what happened. For reasons unrelated to the evidence presented here, I mostly agree with the “cycs”. But I don’t see at all how this evidence supports us. The correlation between growth and unemployment can be predicted from either camp.

Maybe I am really missing something — I’m reading this at 5:20 a.m. with my first coffee, tense lest my country today elect an ignoramos to lead the free world — but it looks like we have just been given evidence of correlations and told they settle a debate about the direction of causality. If so, that is nonsense.