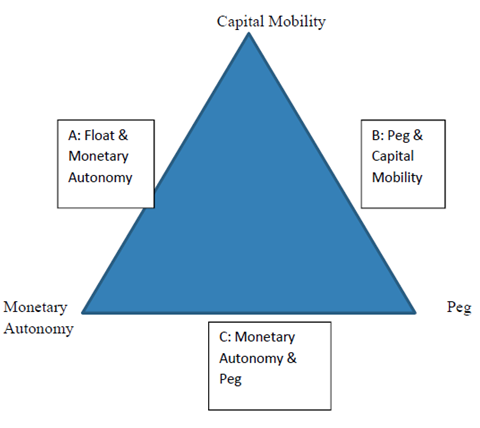

I’ve just finished up the Mundell-Fleming model in my int’l finance course, and ended the section with a discussion of the “International Trilemma”, also known as “the Impossible Trinity”, which states that a given country can at any given time fully achieve only two out of three objectives of exchange rate stability, monetary autonomy, and financial integration (full capital mobility) at a time.

This is characterization is derived from the implications of the Mundell-Fleming model, and ignores a lot of nuances, such as whether the implied linkages depend upon the amount of trade between pegger and pegged, currency composition of external debt, and so forth.

Here is the abstract of a paper coauthored with Joshua Aizenman and Hiro Ito, released as NBER Working Paper No. 22737.

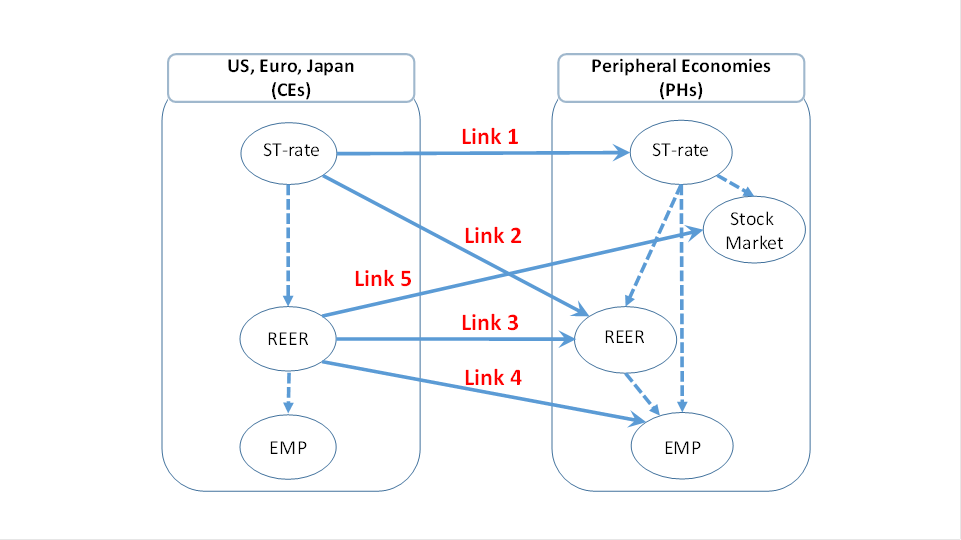

We study how the financial conditions in the Center Economies [the U.S., Japan, and the Euro area] impact other countries over the period 1986 through 2015. Our methodology relies upon a two-step approach. We focus on five possible linkages between the center economies (CEs) and the non-Center economics, or peripheral economies (PHs), and investigate the strength of these linkages. For each of the five linkages, we first regress a financial variable of the PHs on financial variables of the CEs while controlling for global factors. Next, we examine the determinants of sensitivity to the CEs as a function of country-specific macroeconomic conditions and policies, including the exchange rate regime, currency weights, monetary, trade and financial linkages with the CEs, the levels of institutional development, and international reserves. Extending our previous work (Aizenman et al. (2016)), we devote special attention to the impact of currency weights in the implicit currency basket, balance sheet exposure, and currency composition of external debt. We find that for both policy interest rates and the real exchange rate (REER), the link with the CEs has been pervasive for developing and emerging market economies in the last two decades, although the movements of policy interest rates are found to be more sensitive to global financial shocks around the time of the emerging markets’ crises in the late 1990s and early 2000s, and since 2008. When we estimate the determinants of the extent of connectivity, we find evidence that the weights of major currencies, external debt, and currency compositions of debt are significant factors. More specifically, having a higher weight on the dollar (or the euro) makes the response of a financial variable such as the REER and exchange market pressure in the PHs more sensitive to a change in key variables in the U.S. (or the euro area) such as policy interest rates and the REER. While having more exposure to external debt would have similar impacts on the financial linkages between the CEs and the PHs, the currency composition of international debt securities does matter. Economies more reliant on dollar-denominated debt issuance tend to be more vulnerable to shocks emanating from the U.S.

Menzie, I’ve never been particularly well-versed in it’l econ. As such, I’m wondering if this even a “problem”? I believe that I understand the logic behind the impossibility itself, but what I can’t see why B) or C) would ever be desired in any advanced, modern economy. In the linked prior blog post, there’s mention of “three macroeconomic objectives” and “three goals” but aren’t (serious) economies aware of the problems stemming from fixed rate regimes and thus pursue other macro goals/objectives than this trifecta?

rtd: If one’s country is highly integrated via trade with another, the gains from pegging one’s exchange rate to that other one can be great. That was part of the (economic) impetus for Economic and Monetary Union (aka the euro). If EMU had only encompassed the countries identified by Bayoumi and Eichengreen as constituting an optimal currency area (OCA) (see here), the benefits of hard pegging might be more obvious.

I suppose I’ll defer to Milton Friedman as it relates to fixed exchange regimes in general and the EU in particular.

rtd: Just remember, Milton Friedman thought that nominal exchange rates would be relatively smooth, under a floating exchange rate system. Most international finance economists would concur he was wrong on this count (to say the least).

Menzie,

I was surprised not to see you on the list of Democratic economists who urge a vote for Clinton. Jeff Frankel stood up and was counted but you are curiously absent.

I began to hope that some of the arguments of your commenters have gotten through to you and you are wavering. Probably a quixotic dream, but we can hope.

Rick Stryker: I was not asked, so I did not sign. Had the petition made it to me, I would’ve signed in a heartbeat.

As you might guess, I am not going to vote for the guy the KKK has just endorsed (and has two trial dates in the next two months). My guess is you are going to vote for that guy.

NYU’s Mario Rizzo was the only one I’ve seen who gets it – he signed both petitions.

I don’t understand citing the KKK’s endorsement as a reason not to support a candidate. If I were to vote (which I am not), I wouldn’t vote for Trump. However, it certainly wouldn’t be based on the support of others. Seems naive.

rtd: I apologize if I gave the impression those are the only reasons I’m voting for Clinton; in addition, she has the most reasonable, pro-growth economic policy platform (see here), and a belief in expertise. I also have the sneaking suspicion that Donald J. Trump does not consider people like me “American”.

Sorry, but you already clearly stated the KKK endorsement and two trial dates as your reasons. As such, I will hold you to the same standard that you often hold the commenters of this blog – the Menzie China rule of selectively ignoring additional explanation one’s position/comments has been invoked, or, I think the kids would say “no backsies”

rtd: Menzie China? Freudian slip there? Very interesting.

actually, the kkk endorsement of donald trump is sufficient grounds for not voting for him. it would be naive to not question a candidate who received the support of bigots and racists.

“I also have the sneaking suspicion that Donald J. Trump does not consider people like me “American”.” -MC

I share that sneaking suspicion. Interesting how all threads lead to the presidential election, eh?

Menzie: I am going to throw this out there for your consideration please. I like to think I have reasonably good understanding of the benefits and costs of various exchange regimes, in particular why a pegged rate makes good sense in certain specific contexts.

What I do not understand is why Saudia Arabia — highly dependent on oil exports — continues to peg the Riyal to the US dollar, where the US is a net importer of oil and enjoys a highly diversified economy with a strong financial sector.

It makes no sense whatsoever whether viewed from the perspective of decisions made to rapidly increase oil exports as of mid-2014 or the perspective of attempting to diversify the Saudi economy.

Perhaps consumption of foreign goods and services is more important to Saudis than the long-run strength of their economy?

Stumped.

Only interesting if you’re seeking to be interested in nothing. Typo….. that’s all.

rtd: Oh, okay, thanks.

rick, we still have not heard. are you going to vote for the republican candidate, trump?

Another way to look at this.

In an open economy with a current account deficit, the equilibrium or market clearing interest rate is the one that attracts sufficient foreign capital to finance the deficit with a stable currency. If the currency is rising the interest rate is too high, unless you goal is to raise the value of the currency. Conversely, if the currency is falling interest rates are probably too low.