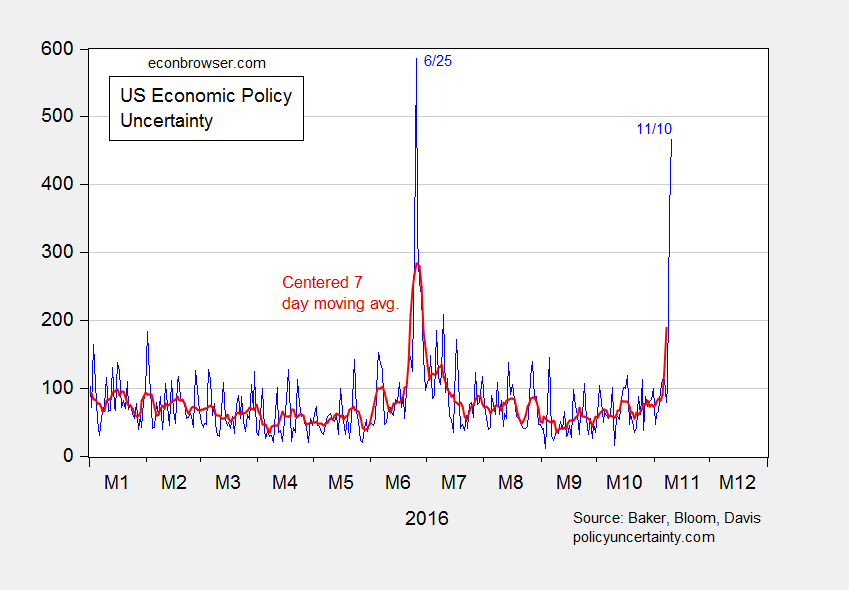

As of today, measured economic policy uncertainty hit 468.

Figure 1: Daily economic policy uncertainty index (blue), and centered 7 day moving average (red). Source: PolicyUncertainty, and author’s calculations.

At the peak post-Lehman, the index hit 626 on September 30, 2008. While the index has not yet matched the post-Brexit value (587) recorded on 6/25, it’s still early days. My guess is that policy uncertainty will remain elevated for an extended period. In my mind, the question is whether the stimulative effects of aggressively expansionary fiscal policy will be offset by the depressing effects of heightened economic policy uncertainty (let alone political and security uncertainty).

See Baker, Bloom and Davis (2012) for a discussion of quantitative assessment of the impact of uncertainty on output and economic activity more generally.

There is a lot of uncertainty, much the chatter with the clients today. Trump essentially ran without a platform, so we don’t know what to expect. Populist governments often explode the deficit, and it would not be hard to move it up to 6.5% of GDP (at 3.2% now) with needed defense spending increases and corporate tax cuts, et al. One version of events is that the national budget begins to look like that of Kansas. Not the only possible outcome, but perhaps the most probable of those likely to be implemented.

Steven Kopits Why do you think Trump believes we need more defense spending? Trump has said that he and his buddy Vladimir would like to see the US pull away from NATO. And he said that he opposed the APS-2 build-up in the Baltics, Romania and Bulgaria. Do we need a bigger army to fight Mexico???

We will not be chummy with the Russians. The differences are substantive, not stylist.

Trump has stated plans to increase defense spending. These may be no more serious than his other plans, but I think Republican leadership thinks we need to spend more in this area.

More here.

http://warontherocks.com/2016/11/how-much-will-donald-trump-really-spend-on-defense/

stylistic.

No doubt that defense contractors would like to see a big increase in defense spending. But the services are less keen because of the type of spending that the GOP Congress wants. The services learned the lesson of the Reagan boom/bust cycle. For example, the Navy ended up with over 600 ships, which turned into 300 white elephants by the time there were delivered. The Army and Air Force faced similar problems. Big capital investments quickly turn into long term drains on budgets. What DoD really needs is more money for the less glamorous stuff covered by operations & maintenance and R&D accounts. Besides, monies for procurement appropriation accounts take a long time to work through the procurement cycle. Monies for ships have an obligation life of 5 years (i.e., funds appropriated in FY2017 don’t have to be put on contract until FY2021) and the money has until FY2026 before it is actually disbursed from the Treasury. You get almost no fiscal bang for the buck with procurement appropriation dollars. But the O&M and R&D monies must be spent within the fiscal year. OTOH, buying a ship today will likely see physical delivery to the Navy just when Congress begins the DoD cutback cycle. Those of us in the business a long time have seen this movie before…several times.

You also forget the coming “Bomb the Hell out of ISIS and take the Oil War” we have been promised. Also, tough with the Chinese. Newt Gingrich will be Secretary of State and Michael Flynn Secretary of Defense (I really wish they would go back to the old name and call it the “War Department”)i. There are also the 10 to 12 million illegals to apprehend, put in detention camps, and the perhas utilize as slave labor while they await deportation . Then there will the national stop and frisk and show me my papers law. This will need a couple hundred thousand special contractor employed ICE agents.

We are going to get the full Christianist & Ayn Rand Government across the country. Everywhere will be Kansas and Louisiana (I expect “States Rights” and State Sovereignty not to a Conservative Republican hell hole will be superseded ). The 58% of white folks who voted are going to get what they wanted, good and hard as old H. L. Mencken put it.

Trump is a smart, numerate guy who cares about people’s well-being, so he will introduce value-added sales taxes and triple federal taxes on gasoline and diesel.

But “needed” defence spending increases? Huh?

OK, I finally figured it out. Steven Kopits is a Neo-Marxist in the Baran and Sweezy tradition.

You made me laugh, Eric! I’ve been called lots of things. Never a Neo-Marxist.

Erik Sage observation about defense spending. The neocons and global elite – many of whom are dual passport holders – drive an unrelenting war propaganda machine to deceive the American public that the US should spend more on defense. This latest thrust started after the Berlin Wall went down, and went full blossom well before Bush II took office. Sowing chaos in the Mideast 16 years now. Shredding America’s reputation around the globe. Toppling legitimate governments including that of the Ukraine. Tightening the noose around Russia with sanctions, unilateral threats, and unwarranted massing of NATO forces along the Baltic-Turkey fault line. War mongers, all. For those who want to know the truth, turn off television and go to any honest geopolitical website – like that of F William Engdahl. Let us pray Trump will end this insanity.

I suspect that one element of the uncertainty index is what the Fed does next month. The Fed has been signaling a rate hike, and the latest employment numbers published before the election probably moved a few Fed minds in that direction. With our new Trumpster Fire Predator-elect things aren’t quite so clear. The market is signaling inflation expectations under Duke Donald of Orange. Does the Fed try to raise rates to head off inflation? I dunno.

now that trump is in office, will he continue to chastise the fed for low rates. or will he welcome the slowdown the higher rates which he has promoted during the recession? i can easily see him criticizing the fed for raising rates as a move to try and make him look bad. the fed loses either way with trump.

2SLUGS

You might be interestd in this link

https://www.youtube.com/watch?v=qASazE4RkCo&feature=youtu.be&t=29m9s

I don’t worry about the effects on markets and the budget so much as the seeming openness to nuclear proliferation. I worked on a lot of delivery systems from College to middle adulthood. Scares the shit out of me that we are giving comfort to those who want more nukes rattling round unstable parts of the world. More NK’s Wheeeeeee!!!

Speaking at Yale.

I’ll be speaking at Yale on Monday, the 14th.

Yale School of Management

Evans Hall, 165 Whitney Ave, New Haven

November 14th, 11:45 am – 1:00 pm. Open to the public.

“Oil Markets Forecasting 2016: Analyzing the Oil Sector after the Price Crash of 2014”

The sequel to my Columbia University lecture of 2014, this talk examines market developments since the oil price crash of two years ago. The presentation will cover

•the causes of the oil price collapse

•the role of the shale revolution

•the struggles of the oil majors like Shell to maintain relevance–and their dividend

•consumers’ rekindled love of flying and driving

•OPEC’s switch to a volume-led strategy, evolving against the backdrop war and rivalry in the Middle East, and

•the destabilizing effect of a belligerent-but-broke Russia, and a post-peak oil China at a historical inflection point in the country’s development

The presentation will touch on the daily challenges analysts and investors face in trying to make sense of a dislocated oil market lacking reliable data, including

•the inability of market watchers to agree on fundamentals of supply, demand and inventory build

•the impacts of time lags and cost reductions on the output of the oil majors like Shell and Exxon

•uncertainty about the extent and pace of shale technology development

•unexpected twists from new gaming behaviors by shale operators

•the convoluted politics of OPEC supply

•the extraordinary level and the potential variability in production outages

•the role of China’s statistics ‘massaging’ in distorting global oil demand growth expectations

•the collapse of marginal cost as a price anchor in summer 2015, and

•improvisation by analysts to derive market balances from the futures curve

This presentation is intended not only as an oil markets overview, but also as a case study examining the analyst’s predicament in forecasting a market without adequate data during a period of fundamental change. Students and faculty should both find it of interest.

Can you refresh this chart to include November 12th? And then also refresh it on Tuesday the 15th, one week after the election?

I have a feeling the uncertainty measurement is going to go down quite a bit.

Anonymous: Following up on this. The 358 on the 9th and 468 on the 10th have been drastically revised down to 254 and 292. And the print today the 13th is 459! What is this all about?

It’s like Brexit. Half the people know and the other half don’t know.

Some of the smartest economists in North America strongly believe that people need to be fooled into better economic outcomes through higher inflation.

Inflation is noise, uncertainty is also noise in a manner of speaking. In that respect, the Trump presidency may be a huge boom to the American economy.

I see happy days ahead.

Canada might want to bring back the Third Option.

The economy could use a little more inflation. And the economy could use some infrastructure spending. But Donald Duke of Orange is proposing infrastructure spending that makes the economy less productive (i.e., building a wall with Mexico). When some of us argue for more infrastructure spending we usually have in mind things that would also make the economy more productive, not less productive; e.g., roads, bridges, airports, power grid, sewer systems, flood control, etc. Building a wall and building useless weapons platforms is not the kind of infrastructure spending we need. All buck and no bang. We’d be better off if he just spent big bucks digging a ditch and filling it up again.

2slugsbait: Utter nonsense. Inflation should be pegged at zero. Ongoing. This is the very definition of sound money. Any inflation above zero on a sustained basis is deleterious to saving which is at the heart of all civilizations. For those who do not comprehend the paramount importance of savings, read Carroll Quigley’s brilliant Evolution of Civilizations. This is the crux of why Keynesian theory is flat wrong. Moreover, targeted inflation above zero is a dishonest taking from all those who hold any purchasing power in the form of fiat money.

JBH More clueless Austrian crapola. The second derivative should be pegged at zero over the long run, but not the first derivative. A zero inflation rate is not symmetrical with respect to its consequences. Deflation is more destructive than inflation. You want an inflation target that is safely above the zero lower bound, but not so high that it risks accelerating.

Any inflation above zero on a sustained basis is deleterious to saving which is at the heart of all civilizations.</I.

This statement is wrong on many levels, but here are two. First, stable inflation can be anticipated and incorporated into the nominal rate. Stable inflation above zero is neutral with respect to savings. Second, if you knew anything at all about modern growth theory you would know higher savings rates do not increase the long run growth rate. The two main factors that influence long run growth are population growth and technology, broadly understood.

And just why do you think savers should be preferred above borrowers? Methinks your inner Max Weber is showing.

“Inflation should be pegged at zero. Ongoing. This is the very definition of sound money.”

a small amount of positive inflation is a means of provoking savers and capital hoarders to do something positive and active with their wealth. that is probably a good thing. zero, or negative inflation, does not promote risk taking and growth. if you are a proponent of growth, then zero interest rates are not a desirable outcome. zero rates tend to preserve the status quo.

Is there uncertainty or is there the narrative of uncertainty. Were not the prognosticators saying the stock market would crash if Trump was elected? Didn’t the hysteria cause futures to be down 800 points for the Dow the morning before the markets opened on the 9th? And wasn’t the crash going to destroy the economy?

http://finance.yahoo.com/chart/%5EGSPC#eyJtdWx0aUNvbG9yTGluZSI6ZmFsc2UsImJvbGxpbmdlclVwcGVyQ29sb3IiOiIjZTIwMDgxIiwiYm9sbGluZ2VyTG93ZXJDb2xvciI6IiM5NTUyZmYiLCJtZmlMaW5lQ29sb3IiOiIjNDVlM2ZmIiwibWFjZERpdmVyZ2VuY2VDb2xvciI6IiNmZjdiMTIiLCJtYWNkTWFjZENvbG9yIjoiIzc4N2Q4MiIsIm1hY2RTaWduYWxDb2xvciI6IiMwMDAwMDAiLCJyc2lMaW5lQ29sb3IiOiIjZmZiNzAwIiwic3RvY2hLTGluZUNvbG9yIjoiI2ZmYjcwMCIsInN0b2NoRExpbmVDb2xvciI6IiM0NWUzZmYiLCJyYW5nZSI6IjVkIn0%3D

http://www.marketwatch.com/story/trump-critic-warren-buffett-says-stocks-will-continue-to-rise-2016-11-11

It all makes for fun reading, but perhaps we have to see what happens. We just experienced the slowest, drawn-out recovery in more than half a century. Now the Fed is making noise about slowing down the economy with rate increases since it can’t prime the pump any longer. Seems like a lot of extraneous churning that could affect the economy before Trump has an opportunity to affect it one way or the other.

Who really knows? With Marie Antoinette… er, Clinton… we knew that those who could afford to pay would be able to play. With Trump, we have “uncertainty”.

trump advocated for higher rates when he ran for office. and a slow economy would have been improved by infrastructure spending, something the left was for. why is it now a valid option to consider infrastructure spending, but not while obama is in office? i find it interesting a republican government will implement the democratic policies that we have wanted for years, after touting the evils of such policies for years. think about it. obamacare will be repealed, and replaced……………….by obamacare! it will just be renamed the trump gold class insurance policy to appease the talk show class.

Bruce: You put your finger squarely on a most interesting phenomenon. Best guess is the 800 pt plunge in the Dow in thin middle-of-the-night trading was market manipulation by big players to scalp quick profits from the gullible. What better time for such a coup given the rapidly unfolding election surprise? In the light of day, the true story emerged. The market told us economic growth will pick up next year under the pro-business policies of Donald Trump. All the more certain, since for nearly eight years growth has been suppressed like a cork below the surface by the policies of the Federal Reserve and the Obama administration.

Over the course of the recovery, Fed policy went from an instantaneous positive impact on growth in late-2008 to eventual diminishing returns and then, at some point, to outright negative returns. The most important price of the free market was grossly distorted for a very long time. All along ZIRP and QE were generating unintended consequences – many and cumulative. The first visible negative consequence was the crash in oil prices that followed on the heels of the 2013 Bernanke announcement that ZIRP and QE had reached their apogee. The renormalization of interest rates going forward, if done gradually without bursting the stock market bubble, will boost growth not damage it. Nonetheless, the debt that was enabled by ZIRP and QE both public and private will put a cap on potential growth for years to come.

It seems, the biggest cities overwhelmingly vote for Democrats:

http://www.nytimes.com/interactive/2016/11/11/upshot/100000004762129.mobile.html

Of course, the graphic doesn’t reflect Republican dominance in state legislatures, governors, the U.S. House, and smaller city governments.

And, it looks like Democrats will defend 25 of 33 U.S. Senate seats in 2018, lose the Supreme Court, challenge an incumbent President in 2020, etc..

They have an uphill battle (pun intended).

Trump’s economic policy? Well, it’s hard to be optimistic – or as Lewis Black says,” “Now, you might say he’d make a terrible president. I mean, the guy bankrupted his own casino. A casino! Where the House always wins! Unless it’s Donald Trump’s house!”

A pretty good overview of Trump’s tax policies at ZH: http://www.zerohedge.com/news/2016-11-11/what-donald-trumps-proposed-tax-cut-means-you

The question is really how strong the Republican firewall in the Senate is against massively increased deficits. If it’s weak, expect a deficit well north of 6% of GDP. If it’s strong, figure 4.5% of GDP, compared to 3.2% currently.

Menzie,

This is a bit off topic, but I’ve been thinking of the many lessons of 11-9, The Trumpening. One lesson that may interest the econbrowser audience concerns the failure of the election prediction models. These models were constructed by and large by Clinton’s supporters, and they all failed massively on election day. These failures I think were not anticipated because of the confirmation bias of the model creators, who thought that a Trump victory was as inconceivable as Brexit.

Perhaps the best example is the election prediction model of the Princeton University neuroscientist Sam Wang.. Wang was absolutely convinced of his model’s accuracy, giving Hillary Clinton a 99% chance of winning the election. Wang was celebrated in a Wired magazine article as the “new king of the presidential election data mountain.” Wang seems to have the credentials that give him massive credibility: an undergraduate degree in physics from Caltech and a PhD in neuroscience from Stanford. Wang was so convinced of his models accuracy that he promised to eat a bug if Trump got more than 240 electoral votes. To his credit, Wang ate bugs on CNN recently.

I looked at Wang’s model code before the election and saw the problem with the model: he was not accounting for the fact that errors in polls are highly correlated. Why didn’t he see that? I think confirmation bias had to be part of it. I’ve looked into Silver’s model too, as much as is possible, because he doesn’t post his code as far as I know. Nate Silver, even though a Clinton supporter, did try to adjust his model for correlated error. But ultimately, in any polling aggregation model, the probability of a correlated poll error in either direction is unknowable and you have to take the predictions of these models with more than a grain of salt. Silver tried to adjust but how can you really do that? Even in Silver’s case, I would think that unconscious bias was probably at play.

I voted for Trump on election day. To me, it was entirely conceivable that Trump could win. The polls were close enough that the historically observed polling error could have put either candidate in the winners circle. It’s easier for me to see that fact because I don’t view a Trump victory as the end of modern civilization.

Another good example was the votecastr real time prediction model that so many of Clinton’s supporters were so excited about. I took a look at the votecastr methodology before the election and thought it was ridiculous. Basically, they use machine learning techniques such as random forests to calibrate a micro-targeting model. Then they get a list of early voters and predicted how they voted based on the model. On election day, they had teams in swing states doing surveys and updating the predicted results real time. The guy behind this, a Clinton supporter, honestly believed that he could accurately predict the vote real time. On election day, the model was showing a Clinton blowout in every state. As I watched that, I imagined how the model developers must have slapped themselves on the back, because the model was showing exactly what they expected to happen.

This sort of academic attitude is widespread in the Left. Instead of focusing on trying to measure directly how voters will actually vote, these machine learning gurus thought they could predict that from their model. Predict the facts from the theory!

Trump of course was dismissed as an idiot when he said that microtargeting and big data modeling was overated. Trump said he didn’t have to spend so much money on ads. Trump said that GOTV efforts were not worth as much as people think. Trump was right and the experts were wrong.

As you know, Trump was also widely ridiculed for saying that climate change is a hoax. Hoax is an inelegant way to put it, but he’s essentially correct again. As I’ve pointed out many times over the last few years, whether climate change will be ultimately harmful depends on how much stock you put in climate models. These models are much more complicated than these election prediction models and if you look into their details and code, you realize that there are huge assumptions in them that can’t be verified. Predicting what will happen to the climate in 50-100 years is much harder than predicting the outcome of a election. These climate models are constructed by scientists who believe in their output just as much as Wang believed in his election model. Many people believe the scientists because they have good credentials and they seem pretty sure about what they are saying. It’s not technically speaking a hoax, since the climate scientists believe what they are saying, which helps the public believe it too. But I interpret Trump’s statement to mean that the most effective cons are fully believed by their promoters.

No one is thinking about the problem of confirmation bias, least of all the climate model developers. These models lead to policy prescriptions they all support: higher taxes, more regulation, and more influence and authority for academic experts. But, as I’ve argued before, these climate models are fundamentally unscientific, since they make predictions too far into the future to check. We can see how well polling models work because the election will happen pretty soon after the predictions are made. But we can’t tell if these climate models are right for at least 50-100 years. They don’t even look correct now, since they can’t explain the environment even in sample. But the climate scientists find a way to dismiss that objection. The climate models of 2016 are the baldness-curing elixirs of 1916. Your hair isn’t actually growing but the salesman has a good explanation for why you need to wait a bit longer to look like Tom Cruise.

I would be willing to bet some good money that these climate scientists will be eating bugs in 75 years, a bet that Rick Stryker Jr. will not be around to collect on. One of the many encouraging signs in the Trump transition is that he has put climate alarmism skeptic Myron Ebell in charge of the EPA transition.

Rick: Five venerable models unanimously predicted a Trump victory, one well over a year in advance. Already in mid-2015, Alan Lichtman’s 13 Keys to the Presidency model predicted the vote would go against the incumbent partly no matter who the Republican candidate would be. I’ve used Lichtman’s model to correctly predict every election since 1984. In July 2015, knock on wood I concluded through a lot of analysis including the country’s mood that Trump would get the Republican nomination. His charisma was a part of my thinking. Then, shifting over to the 13 Keys methodology, predicted that being the Republican candidate he would win the election. The scurrilous mainstream media, and the traitors in his own party, nearly managed to upset this. Imagine the popular vote outcome if the press had done its job without bias and with honesty? Then Ray Fair’s election model (Yale) with its long excellent record, Helmut Norpoth’s relatively recent model based on primary results that correctly predicted the last three elections, an Artificial Intelligence model (how interesting!) that also has a perfect record, and the 90-days-before-the-election stock market model which has been 86% accurate in the postwar period. None of these models relied on the polls. The polls did not take cognizance of Trump’s brilliant Rust Belt strategy of speaking to disgruntled, angry blue collar workers. Nor was polling methodology nuanced enough to adjust its demographic base and voter turnout percentages to the changed environment since 2012. Hence Nate Silver’s 538 website got choked by garbage in garbage out. The tip-off to the inadequacy of the polls was the off-the-charts turnouts at all Trump rallies.

JBH,

Yes, those alternative methodologies did get it right. I took the Fair model fairly seriously in my own thinking although I wasn’t really sure about the other methodologies. In my view, the polling models were exaggerating Hillary’s chances. But I did and do think we have to look at polling evidence.

I thought it would be a very close election–maybe 55-60% probability of a Hillary victory and 40-45% for a Trump win, so that it would be a little more likely that Hillary would squeak across the finish line but the Senate would most likely stay red. But I wasn’t willing to call it for Trump.

Congrats to you for getting this one right.

Rick Stryker

First, let me agree with you about prediction markets. I’ve never had a lot of faith in them even though many of my old classmates developed some of the earliest ones. I also agree that elections across state boundaries tend to be correlated. This is something that Wang did not take sufficient account of and something that Nate Silver did worry about, although he didn’t know what to do about it. A few days before the election I heard him express concern that many of the polls were converging because no pollster wanted to be seen as an outlier. I also believe there’s a kind of Heisenberg uncertainty principle with poll aggregation. As poll aggregation outperforms individual polling, it makes more sense to do less individual polling, but that affects the validity of the aggregation itself.

Unless you’re someone in the top 1% it’s hard to see any good coming out of a Predator Trump administration…at least over the short run. His policies will hurt the very people he claimed to represent. Those folks are nitwits and frequently conned by preachers and politicians.

But over the longer run I’m optimistic on most fronts, with the exception of the environment. Politically Trump is likely to be a one-termer, as was Clinton if she had won. The economy will probably go into recession during the next four years….my prediction is next September. The Democrats may not retake the Senate in 2018, but the House is probably within striking distance given historical gains for out of power parties. The one exception was 2002, and that was a special case unlikely to be repeated. So the Democrats could flip 25 seats or so. Also, this is the 6th election out of the last 7 in which a Democrat has won the popular vote. And it now appears that Clinton’s margin will probably be around 2 million. Trump is the constitutionally legitimate winner, but that’s mainly because the Constitution is a deeply flawed document meant to protect the interests of 18th century conservative slavocrats. Erich Honecker was also the constitutionally legitimate ruler of the old German Democratic Republic, but I don’t think anyone would consider him a democratically legitimate ruler. It’s awfully hard to ignore a 2 million vote difference and still think Predator Trump is anything other than the product of a banana republic election. Coincidently, Trump declared victory on the 217th anniversary of the Eighteenth Brumaire. Longer term the Trump coalition will be difficult to replicate. In order to win he had to crank the anger meter up to 11, and even then he only won blue states by razor thin margins. After he betrays those voters they will be unlikely to vote for him again. And of course many of them will be dead in 2020….downscale white males are the only demographic experiencing shorter life expectancies.

2slugs,

I’m also optimistic about the future, so I guess that means that one of us is going to be sadly disappointed.

I agree with you on the recession timing. Trump may well get unlucky on that and be a one-term President. The current expansion has already gone on a long time.

rick, you probably should acknowledge the election models did get the popular vote correct. they did capture the general trend. the electoral college would be the equivalent of trying to capture the derivative terms as well-that is a difficult task. same thing with climate models. they have captured the general trend, but can struggle with the derivative terms.

As Yogi reportedly said, “It ain’t over till it’s over.”

Just a reminder that no one has yet been elected President; that happens on December 19th.

For the sake of argument, let’s assume that truly disqualifying information emerges between now and 12/19 regarding Trump, e.g., it turns out that he was on the payroll of the Russian government (remember, we have not seen his tax returns).

If approximately 10% of Trump’s Electors vote for Hillary, or if about one of Trump’s Electors per state changes from how they pledged to vote, Hillary Clinton would be President. While there are some penalties for being a “Faithless Elector” in some states, it’s my understanding, based on a Supreme Court ruling, that Electors have the unconditional right to vote for whomever they wish.

The game has rules. It’s over.

Rather than conservative electors changing their stripes and elevating a democrat, with Pence waiting in the wings, any Trump missteps might lead to an opportunely more conservative administration. The Donald made short work of his republican rivals which won’t soon be forgotten, even if they forgive him for winning in less than a sportsmanlike way. Imagine the jubilation of the party elite to see their victory consolidated.

Yes, that’s a good point. The Democrats trying to cheat Trump out of the election would end up with a conservative. However, the Donald also ran against the Republican establishment, and the rigged system.

You don’t play a game of winning swing states trying to get more votes in California.

The Democrats can cheat Bernie out of the nomination, but they can’t cheat Trump out of the election, although they’re trying.

Trying? Care to elaborate? ‘Cause I think you just misspoke, in a lying kind of way. I could be wrong, but I think “Democrats are trying to cheat Trump” amount to a flat out lie. Prove me wrong.

Kalvin,

Peak is right. Over 4 million Hillary supporters have signed a petition asking the Trump electors to violate their pledges and change their vote to Hillary Clinton in the electoral college. Amazingly, they are asking Trump electors to violate the law in states in which being a “faithless elector” is illegal, saying that they will pay their fines for them.

rick, you advocated that your son violate the law and not buy healthcare. in that case, is appeared to by ok for him to simply pay a fine for violating the law. why the double standard?

The Supreme Court said the penalty is a tax.

Baffles,

To quote Chief Justice Roberts:

“Neither the Affordable Care Act nor any other law attaches negative legal consequences to not buying health insurance, beyond requiring a payment to the IRS.”

“Congress’s choice of language … does not require reading 5000A as punishing unlawful conduct.”

Besides being wrong on the facts (Again!!!!), you also missed the point of Rick Stryker Jr. I was using Rick Stryker Jr. to illustrate how a typical young person would reason about what actions to take, given the incentives the law provided. I was using him as a device to illustrate my prediction that young people (and more generally people) would not sign up for the plan at the rate the Administration expected, putting eventual actuarial pressure on the system.

Given what eventually happened to Obamacare, I was completely right of course. I also predicted in 2014 that if the Democrats did not fix Obamacare after the midterms, it would come back to haunt Hillary’s presidential run in 2016. That happened too.

Baffles, I’m not sure why you follow this blog, but if you are here to learn, you should listen to me more and argue less.

“The Supreme Court said the penalty is a tax.”

peak,are there any ramifications for not paying ones taxes? still the law.

“Baffles, I’m not sure why you follow this blog, but if you are here to learn, you should listen to me more and argue less.”

rick, here is what i have learned from you on this site. if you are obama, lying is a crime. if you are donald trump, it is ok to lie.

if you are a “faithless elector” you are acting illegally. if you are rick jr., it is ok to not follow the law.

yes rick, i can really learn a lot from a guy like yourself. especially the giddy jubilance at the thought of making millions of people lose access to affordable health insurance. you are a real hero to me rick. people will be singing your praises for generations to come.

I guess, it’s ok for Trump to lie, because he doesn’t know he’s lying.

Obama and Hillary know.

Here’s an interesting article 🙂

“Cleveland Indians fans have rioted across the country in protest of the 2016 World Series. Despite knowing the rules of the game prior to playing, they were unhappy they lost and demanded the outcome to be changed.

They could be heard chanting #NotOurWorldSeriesChampion all across America. Even though the Cubs won 4 games and the Indians only won 3, since both teams scored 27 total runs throughout all 7 games, they are being declared co-world champions.

When questioned, Commissioner Manfred stated, “We felt as though it was the right thing to do for the nation. What kind of example would Major League Baseball be setting if we expected the adults who play this game, and their fans, to gracefully accept defeat? Instead of creating a bigger divide between the Cubs and Indians, MLB is confident that the Cubs will gladly share their victory with the Indians.””

http://m.imgur.com/j0ttf7b?r

Many dems enjoyed vicarious schadenfreude when witnessing Trump confront and criticize past Bush policies during the primaries. Trump served cold comeuppance to a legacy of malfeasance, rekindling dem’s burning enmity, lingering long and dissonant after the pervasive damage to our national psyche and economy under a republican administration credited with not only the tech meltdown, the Bush Crusades, but the Great Recession to boot.

Perhaps the disappointment with establishment dems was that they never properly condemned the Bush administration with commensurate disdain for misleading America into perpetual conflict and insolvency. The lack of retribution for these misadventures may have helped suture the open wounds, but was not cathartic in the same way as witnessing Jeb! be dismissed as “low energy”.

Now, dem’s vicarious admiration has morphed into shock at the prospect of an even more brutal administration taking shape under the banner of conservative hegemony accompanied by a full scale loss of power for the unorganized party.

Even worse, double jeopardy awaits should the Donald become the target of an insidious conspiracy to consolidate power for the republican establishment. Could the Donald once again receive dem approbation if he becomes the lone firewall to a Rovian coup? With Christy kicked to the curb, Karl is likely fuming that his key insider is toast — and excited at the prospect of exacting revenge beyond the reach of the electorate — fomenting internecine retribution with impunity, compounding the horror to powerless dems. It almost seems inevitable that Trump will be vilified as a lifelong dem, undeserving the high station of a conservative president. And all they have to do is impeach him. What a coup!

Ask Machiavelli…

“In all men’s acts, and in those of princes especially, it is the result that renders the verdict when there is no court of appeal”

On the other hand, republican miserliness could reduce the global carbon output due to deflationary economic collapse. So, we wait to see what happens. A lot can happen in the next four years. The likelihood is that “uncertainty” will lead to chaos due to entanglements impinged upon in every dimension. This political entropy will unleash forces and agencies with the potential to disrupt social coherence. Speculating on the economic consequences of what would potentially be two new republican administrations within four years boggles the mind. The yield curve may soon experience a pneu crevé, as the seas of discontent rise above previous records.

While loathe to admit it, dems should consider the benefits of watching the Donald’s back while there is still time. The unimaginably horrific scene of fiscal penuriousness, social and economic decay and unbridled military adventurism under an ad-hoc reactionary right wing alt-regime foisted on a powerless public is a specter to be feared.

There’s the real world and a world of politics.

When you can’t tell the difference, you’re in a world of nonsense and foolishness.

Rick Stryker I was using Rick Stryker Jr. to illustrate how a typical young person would reason about what actions to take, given the incentives the law provided.

I don’t recall too many folks disagreeing with you about the incentives as written into the law. Hey, that’s why some of us were arguing for much stiffer penalties. Young people are stupid and don’t always realize that if they’re lucky someday they’ll be old. And when they’re old the won’t be able to buy insurance at anything like an affordable rate. The young have to subsidize the old with the implicit social contract that tomorrow’s young will return the favor. A rational, farsighted economic agent would recognize that; but of course, young people are not rational and anything but farsighted. So it’s up to the government to provide the adult supervision they need.

BTW, what does Jr. plan to do when he’s in his mid-50s with a chronic cough from smoking all those e-cigs? Oh wait…let me guess. He’ll want Uncle Sugar to bail out his sorry ass. It’s the Red State way.