The implication of a (massive) revision to the expected path of government debt relative to baseline is an increase in the slope of the yield curve. Some portion comes from the expectations hypothesis of the term structure, some from an increase in the risk premium. [lecture notes on portfolio crowding out] [lecture notes on expectations hypothesis of term structure]

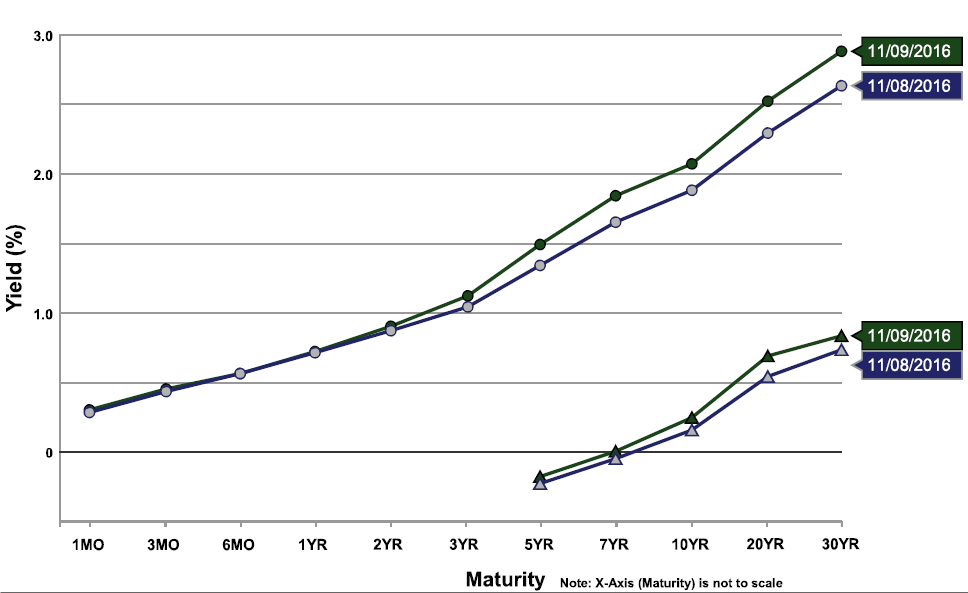

Figure 1: Yield curve as of 8 November (blue), and 9 November (green). Source: US Treasury.

That’s a remarkable jump for one day. A one-day 20 basis point change is large given the one standard deviation is 5.4 basis points (over the 2009M06-2016M11 period). A time series plot of the ten year yield is shown in Figure 2.

Figure 2: US Government ten year bond yield. Source: TradingEconomics, accessed 9 Nov 2016.

From Bloomberg:

Treasuries plunged, with 30-year bond yields climbing the most since at least 1977, amid concern that a Donald Trump administration and a Republican-led U.S. Congress will unleash a wave of spending to boost the U.S. economy, triggering a surge in inflation.

Adjusted for current yield levels, which are close to historical lows, the magnitude of the day’s rise hasn’t been exceeded in data compiled by Bloomberg going back to February 1977. Benchmark U.S. 10-year yields rose above 2 percent for the first time since January as a bond-market measure of inflation expectations climbed to the highest since July 2015. A gauge of the yield curve steepened as longer-dated debt underperformed.

However, in contrast the unrealized fears of crowding out in the past, I do not expect any anxieties to be voiced by Representative Ryan this time around.

Update, 11 Nov 1PM Pacific:

Source: Bloomberg.

Since the economy cannot afford more government spending and tax cuts, because of the huge national debt and continued budget deficits, the mix of spending and taxes need to change. Some examples: More infrastructure and defense spending with entitlement reform savings and replacing Obamacare. A higher personal tax rate for the top 20% with lower middle class tax rates. Reducing or eliminating low income tax credits, while raising the minimum wage and reducing the corporate tax rate. I think, there are ways to spur stronger growth, along with more tax revenue, without adding too much to budget deficits.

too bad we could not get the past congress to approve of a strong infrastructure spending program. we both agree with that concept. why do you think it was not implemented?

We had crowding out after the Reagan tax cut, but it worked through the strong dollar, not higher interest rates. The people forecasting crowding out were looking at the US as a closed economy. So they missed the inflow of foreign capital that forced up the dollar. The dominant reason that manufacturing has suffered since 1980 is the republican tax cuts, not the trade deals.

So what are we seeing since Trump won? Higher rates, a strong dollar and rising commodity prices.

Should you be surprised. No.

spencer: I am surprised. Please explain.

spencer I agree with you about the higher yields and stronger dollar. I don’t quite agree that commodity prices are higher…some are, but some aren’t. Corn and soybean prices plunged on Wednesday. Some of that could be attributed to a USDA report that day that came in with an unusually large crop estimate; but there was also a lot of concern over corn exports because of Trump’s positions on trade and because of the surging dollar relative to Mexico and China.

BTW, I see that the 10 year is up another 5 basis points right now; i.e., another one standard deviation move on the heels of a four standard deviation move.

Just playing around with the data & cherry-picking, I looked at treasury yields for the Friday before elections vs day after elections.

11/04/2016 vs 11/09/2016:

1.24% to 1.49% for 5-year nominal yield

1.79% to 2.07% for 10-year nominal yield

11/02/2012 vs 11/07/2012:

basically unchanged (makes sense with no change in administration)

10/31/2008 vs 11/05/2008:

2.8% to 2.5% for 5-year nominal yield

4.01% to 3.73% for 10-year nominal yield

Yields dropped after Obama defeated McCain & I don’t think you’d hear many on the right mention this. I realize there were some crazy happenings around 2008, but can anything Great Recession-related account for this yield curve shift?

Although it could be expectations of higher growth with Trump and lower with Obama? Ahhhhhh, reminds me of the following “Even in normal times, I would not wish the task of a macroeconomic time-series econometrician on a mangy dog. Especially not now.”

rtd: Could be; on the proposition that faster growth implies higher real equilibrium rates, see this post by Jim Hamilton.

can we just pause a moment and note how stunning it is that even though some of us – say president obama on down – have been calling for a larger deficit through infrastructure spending for years, the gop congress – as manifested by the kinds of suddenly oh-so-old-school peak trader comments up above – would not be moved.

and now, just like that, all their concerns go away.

yet further evidence of the deep philosophical commitment of the gop to small government!

The Donald wants infrastructure spending and the Republicans owe him a debt of gratitude (pun intended).

we both agree infrastructure spending is a good policy right now. why could we not get the republican congress to do the right thing for the past five years?

You have to give and take. I explained before, some policies are better than others and there are budget constraints.

We apparently will find out, whatever we speculate. Three questions that I have: (1) we have a congress and a pres-elect that have threatened default–why shouldn’t anyone lending to the US gov’t expect a greater risk premium on those obligations? And (2) there is less reason today than yesterday to trust the banking system, and more reason to keep savings in guns and ammo outside the financial economy, so why shouldn’t the appearance of a savings glut go down? (Big corps keep their profits overseas, don’t they?) And (3) who says that the congresspersons who “balance” the budget–we have no idea how they will keep the books and no idea what programs they will cut to appear to balance the budget when proposed– can’t make a balanced budget on paper? The banks successfully abandoned mark to market and no one looks back. There is no reason now for anyone to believe in honest bookkeeping.