As are all import prices.

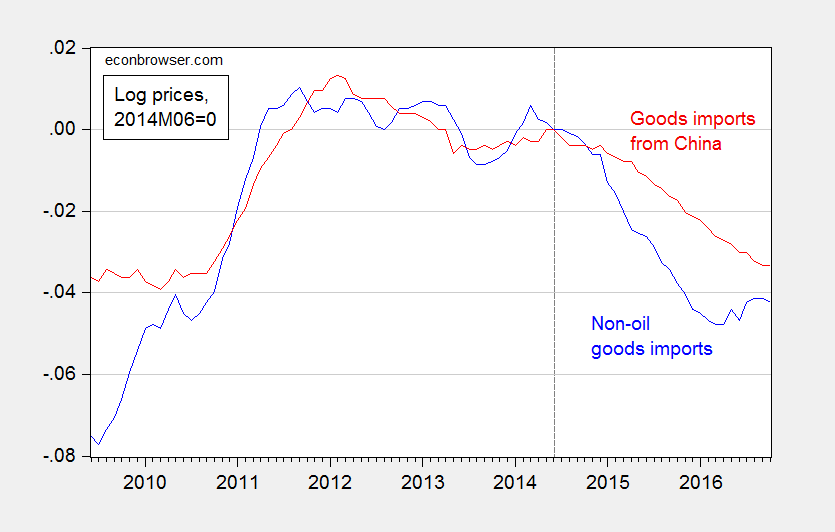

Figure 1: Log import prices of non-petroleum goods (blue), and of goods imports from China (red), all normalized to 2014M06=0. Source: BLS via FRED, author’s calculations.

Chinese import prices have fallen 3.3% (log terms) since mid-2014; overall non-petroleum by 4.2%. While the USD has appreciated less against the CNY than against a broad basket, the implied exchange pass through is not substantially different.

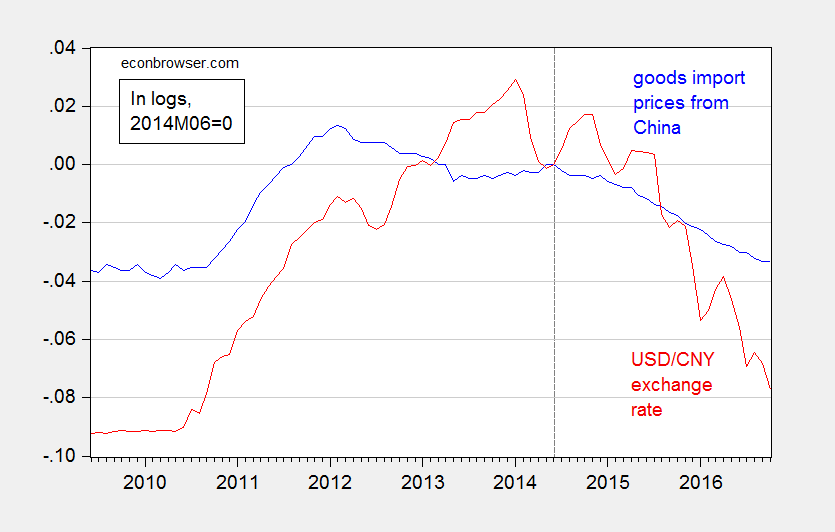

Figure 2: Log goods import prices from China (blue), and USD/CNY exchange rate (red), both normalized to 2014M06=0. Exchange rate normalized so down is dollar appreciation. Source: BLS and Federal Reserve Board and via FRED, and author’s calculations.

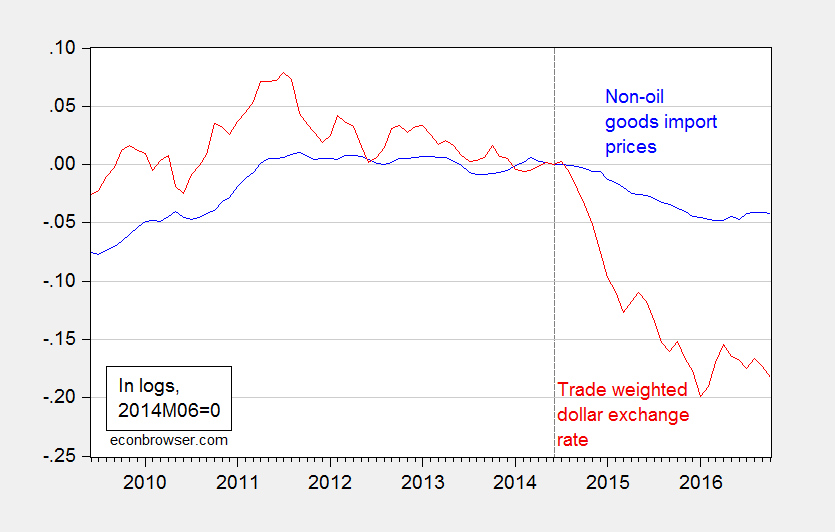

Figure 3: Log goods import prices ex.-petroleum (blue), and USD exchange rate against broad basket (red), both normalized to 2014M06=0. Exchange rate normalized so down is dollar appreciation. Source: BLS and Federal Reserve Board via FRED, and author’s calculations.

The implied exchange rate pass-through for imports of Chinese goods is about 42.9%, for imports of nonpetroleum goods about 23%. The former is consistent with my previous back-of-the-envelope estimates, discussed in this post.

If the USD rises another 10% (as discussed in this post), then nonpetroleum goods prices could be expected to decline an additional 2%.

To determine the drop in prices of imported Chinese goods, one would need at a minimum the further drop in the CNY relative to USD. All I can say is that President-Elect Trump’s pronouncements on US-China relations can only serve to accelerate financial capital net outflows, thereby putting further downward pressure on the CNY’s value. I don’t know if that is what the President-Elect intends, but that’s what he’s going to get…

Update, 12/12 9PM Pacific: Paul Mathis observes:

Trump is also doing a great job of lowering the value of the Mexican peso against the dollar. Since he is not likely to terminate NAFTA as he promised or negotiate a better deal, Mexico will be the final destination for even more American jobs.

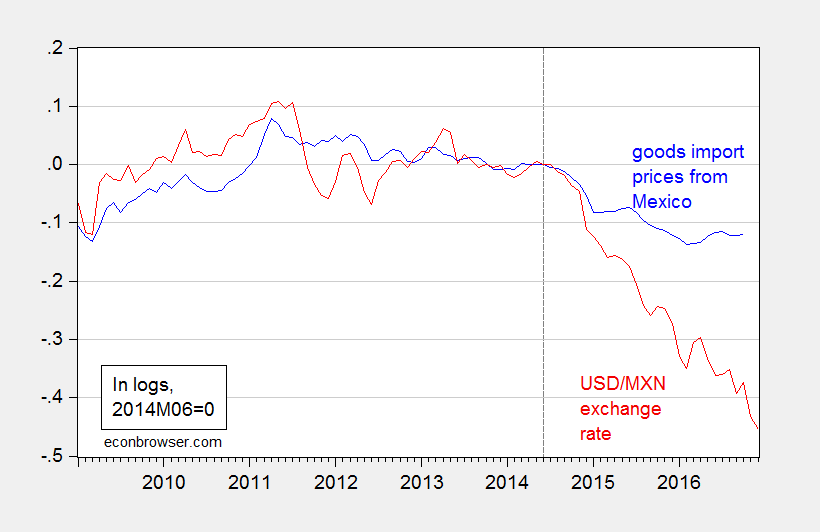

This is an excellent observation, as shown in Figure 4:

Figure 4: Log goods import prices from Mexico (blue), and USD/MXN exchange rate (red), both normalized to 2014M06=0. Exchange rate normalized so down is dollar appreciation. December observation for exchange rates is through 12/9/2016. Source: BLS and Federal Reserve Board and via FRED, and author’s calculations.

With the recent depreciation of the Mexican peso, one should expect further decline in import prices of goods originating in Mexico.

Trump is also doing a great job of lowering the value of the Mexican peso against the dollar. Since he is not likely to terminate NAFTA as he promised or negotiate a better deal, Mexico will be the final destination for even more American jobs. Looks like the WWC will be screwed again by the con man.

At least we can save money by not building the Great Mexican Border Wall since there will be many jobs in Mexico and no need to go to El Norte. In fact, many Americans might head south of the border to find work!

many Americans might head south of the border to find work!

And just as many Americans might head north of the border to find sane government. Also, Sarah Palin’s backyard might actually be in Russia.

Paul,

Donald Trump must be a truly magical politician who can make the dollar rally against all currencies… before he actually does anything or even takes office.

or… http://www.investing.com/analysis/us-dollar-softens-as-fed-begins-final-policy-meeting-of-the-year-200169557

Bruce Hall: You do know that asset prices are the present value of the expected fundamentals into the future…

Menzie, you know Bruce is like a dog and doesn’t have the imagination for a concept such as ‘future’ or ‘expectations’. He is what we in the biz like to call ‘expectationless’.

So, Menzie, what are the future expectations that make the dollar so strong?

– Because of expectations that there will be future interest rate increases? … because the economy is strong now and expected to stay strong under Donald Trump?

Or because everyone sees the U.S. economy failing and inflation running amok? Oh, wait….

And Gridlock, think about what you are saying.

Bruce Hall: You should read Feldstein (1986). I’ve tried to explain it numerous times on this blog apparently with no luck, so maybe a conservative macroeconomist (Feldstein was CEA Chair under Reagan) will have more luck.

Menzie,

So the argument is that the doubling of the national debt under Obama had nothing to do with the expectation of higher interest rates… it’s only the expectation of the national debt increasing under Trump? Surely you jest.

But the authors conclude that although expanding budget deficits in this period “may also have raised the level of U.S. real interest rates and helped to strengthen the dollar. . . the extent of upward pressure on real interest rates and on the dollar through this channel is uncertain, and numerous studies have failed to uncover significant effects”

So, it’s the strong economy … and expectations of it getting stronger?

“other factors have continued to push up the demand for dollar assets” and suggest that the dollar’s strength since 1982 has been due to “the combination of increased after-tax profitability of U.S. corporations, demonstrated strength of the U.S. recovery, reversal of international lending outflow from U.S. banks, and generally more favorable longer run prospects for the U.S. economy. . . .”

It certainly can’t be “tight money” or even the expectation of that, can it?

“There is also the view, identified most strongly with Ronald McKinnon (e.g., 1984), that the strong dollar does not reflect any “real” phenomena (budget deficits, increased profitability, alternative tax rules) but is solely an indication that monetary policy in the United States is too tight.”

It’s actually how other countries perform (their deficits) versus the U.S. (our deficits) as indicated by the dollar strengthening against the DM when the German economy faltered.

Concluding Comments

The findings of the current research can be summarized briefly. The estimated reduced-form equations for the dollar-DM real exchange rate imply that the rise in the expected future deficits in the budget of the U.S. government had a powerful effect on the exchange rate between the dollar and the German mark. Each one percentage point increase in

the ratio of future budget deficits to GNP increases the Exchange rate by about thirty percentage points.

…

“As I have emphasized elsewhere in a different context (Feldstein 1982), all models are “false” in the sense that they involve substantial simplifications that can lead to incorrect inferences. It is impossible to relax all of the specification constraints or include all of the plausible variables in any single model.”

…

Yeah, I guess that about clears it up.

Bruce Hall So the argument is that the doubling of the national debt under Obama had nothing to do with the expectation of higher interest rates…

Again, please ask Santa for a macro book. Also note the difference between debt (a stock variable) and deficit (a flow variable).

Increasing the deficit through spending when the labor clearing interest rate is negative does not crowd out investment; it crowds in investment. Increasing the deficit through tax cuts for the top 0.1% does next to nothing in terms of increasing aggregate demand when the labor clearing rate is above zero and the top 0.1% behaves in accordance with Ricardian Equivalence. What you get are higher interest rates and a stronger dollar, which makes imports cheaper, which hurts the very voters Predator-elect Trump claimed to represent.

This really isn’t that difficult as long as you remember that Trump is as dumb as a bag of hammers and doesn’t have a clue. Trump is an idiot in the original (ancient Greek) sense of the word.

https://en.wikipedia.org/wiki/Idiot

2slug,

In simple terms, a budget deficit is the difference between what the federal government spends (called outlays) and what it takes in (called revenue or receipts). The national debt, also known as the public debt, is the result of the federal government borrowing money to cover years and years of budget deficits.

But then you knew that….

The good news is the expectation the U.S. economy will perform relatively better than the rest of the world leading to higher interest rates and a stronger dollar. Certainly, most of that is priced in U.S. financial markets. Let’s not ignore the elephant in the room (pun intended).

China’s GDP has accelerated to 7% growth which is relatively waaay better than our 2%.

I’d rather have 2% of $50,000 (U.S. per capita GDP) than 7% of $5,000. The E.U. is a closer comparison (of developed countries). And, the expectation is more than 2% growth.

The price index for GAFO sales ( department store type goods) has fallen from 100 in 2009

to 89.3 last month.