From NYT:

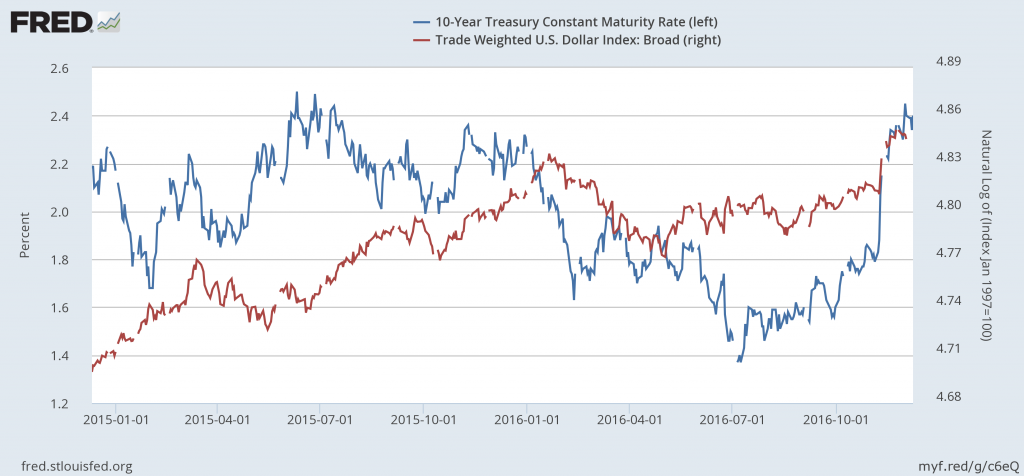

…around the globe, the surge in the dollar is provoking financial jitters.

Emerging market countries and corporations that have been binging on cheap dollar debt for more than a decade now face a spike in servicing costs and elevated debt burdens.

What can conclusions can we draw about the sensitivity of emerging markets to these developments? From Aizenman, Chinn and Ito (2016):

The results from the second step estimates that investigate the determinants of sensitivity to the (Core Economies) CE’s financial variables suggest that while the levels of direct trade linkage, financial linkage through FDI, trade competition, financial development, current account balances, and national debt are important, the arrangement of open macropolicies such as the exchange rate regime and financial openness are also found to have direct influences on the sensitivity to the CEs. As theory suggests, we find that an economy that pursues greater exchange rate stability and financial openness would face a stronger link with the CEs through policy interest rates and REER movements.

We also find that the degree of exchange rate stability and financial openness do matter for the level of sensitivity when they are interacted with other variables such as current account balances, gross national debt, trade demand, and financial development. For example, if a developing country receives higher import demand from the CEs, that would strengthen the link between the peripheral and center economies through policy interest rates when the Periphery Economy (PH) has a policy arrangement of pursuing both greater exchange rate stability and financial openness. Such a policy arrangement would also make the impact of having greater gross debt on the link between CE’s and PH’s REER. Thus, we conclude that open macro policy arrangements do have both direct and indirect impacts on the extent of sensitivity to the center economies.

We also investigate whether the exchange market pressure (EMP) of the PHs is sensitive to the movements of the CE’s policy interest rates, REER, and EMP.

Exchange market pressure is a weighed average of exchange rate depreciation and reserve decumulation, and hence one measure of financial stress on the external accounts.

…We find that the EMP of the PHs is sensitive to the movements of the center economies’ REER and the EMP during the GFC and the following period.

When we reapply the second-step estimation to the estimated sensitivity of our sample countries’ EMP to the CE’s financial variables, we find that a country with higher levels of financial development can mitigate the effect of changes in the center economies’ policy interest rates on the level of EMP it faces. While the real appreciation of the CEs could lead to higher EMP of the peripheral economies, higher levels of financial development, greater financial openness, strong trade ties with the CEs, and more stable inflation would help reduce the EMP sensitivity to center economies’ REER.

In a subsequent paper (Aizenman, Chinn and Ito (forthcoming)), we investigate the importance of which currencies are pegged to, and the currency of debt issuance.

we generally find evidence that the weights of major currencies, external debt, and currency compositions of debt affect the degree of connectivity.

… having a higher weight of the dollar or the euro in the implicit currency basket would make the response of a financial variable such as REER and EMP in the Peripheral Economies (PHs) more sensitive to a change in key variables in the Core Economies (CEs) such as policy interest rates and REER. Having more exposure to external debt would have similar impacts on the financial linkages between the CEs and the PHs. Lastly, we find that currency composition in international debt securities matter. Generally, those economies more reliant on the dollar for debt issuance tend to be more vulnerable to shocks occurring in the U.S.

Of course, the rise in US interest rates and the dollar is being propelled by the collision of fiscal and monetary policies [1] [2] that is potentially accompanied — by protectionist measures that would slow world growth. The net effect could affect emerging market economies in different ways.

From Oxford Economics, “EM investors bet Trump more ‘malign’ than ‘benign’,” (Nov. 23, 2016, not online):

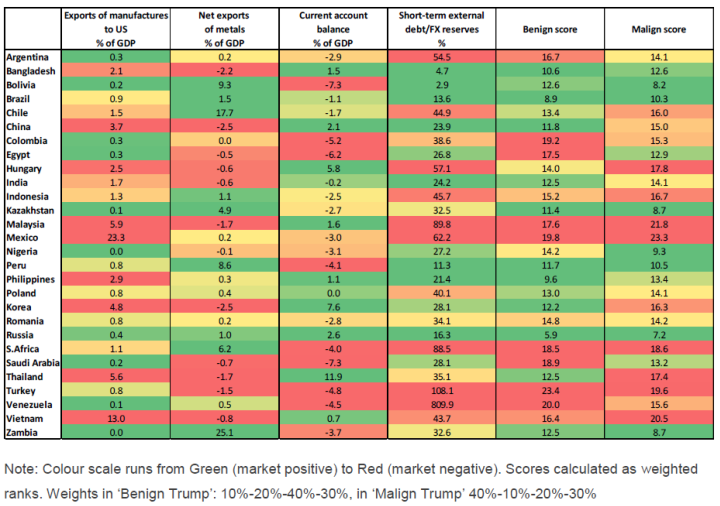

We also consider two scenarios: a ‘benign’ Trump scenario focused on fiscal stimulus and deregulation and a ‘malign’ scenario featuring sharply increased protectionism and slower world growth. These scenarios are at this point only broad sketches of the possible policy mix, rather than quantitative modelling exercises but allow us to see how the potential sensitivity rankings across countries can shift. For each scenario, each country receives a ‘sensitivity score’ based on its weighted rank position across the indicators, with indicators weighted according to different weighting schemes for the ‘benign’ and ‘malign’ scenarios.

The following conditional heat map results from their analysis:

The analysis is focused on exchange rates and sovereign spreads rather than policy rates and EMP, but the general point should remain: even in a scenario where the new administration is not heck bent on a highly protectionist regime, several emerging market economies will come under a lot of stress.

Coming soon to a Fed pushback twitter rant… Hashtag #TheRateIsTooDamnHigh

(Claim it as your own! I’m not on twitter.) “~}