In short: Rural areas will not like what they get from a combination of expansionary fiscal/counter-cyclical monetary policy.

The Committee for a Responsible Federal Budget scored the increase in the budget deficit at about 2.5 percentage points of GDP per year (assuming no net new spending, i.e., defense increases are offset by other cuts). [1]. Deutsche Bank simulated a fiscal expansion through the FRB/US model (one of the models used by the Fed), to obtain an impact 1(3) years out of 0.5 (0.7) percentage points increase in the Fed funds rate for each 1 percentage point of GDP increase fiscal expansion, assuming the Taylor principle. That means the Fed funds rate will be about 1.7 percentage points above baseline.

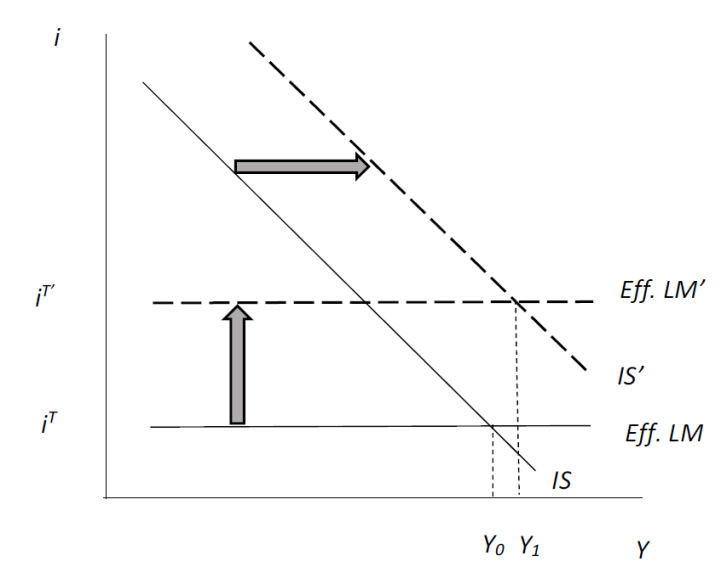

We have seen expansionary fiscal policy combined with tight monetary policy before: this is the textbook case of the Reagan/Volker macro policy combination of the early 1980’s. In this case, monetary policy is not trying to wring inflation out of the system, but it is a case where each arm of policy is likely to be moving in opposite directions. (If the aggregate supply curve is kinked, and we are close to full employment GDP, then we might get more than 1.7 ppts increase in the Fed funds rate.) This is shown in Figure 1, using an IS-LM model, where the LM is flat at iT, the target Fed funds rate.

Figure 1: Expansionary fiscal policy combined with counter-cyclical monetary policy. Tax cuts shift out IS curve to IS’; Fed follows Taylor principle, raises target Fed funds rate to iT‘.

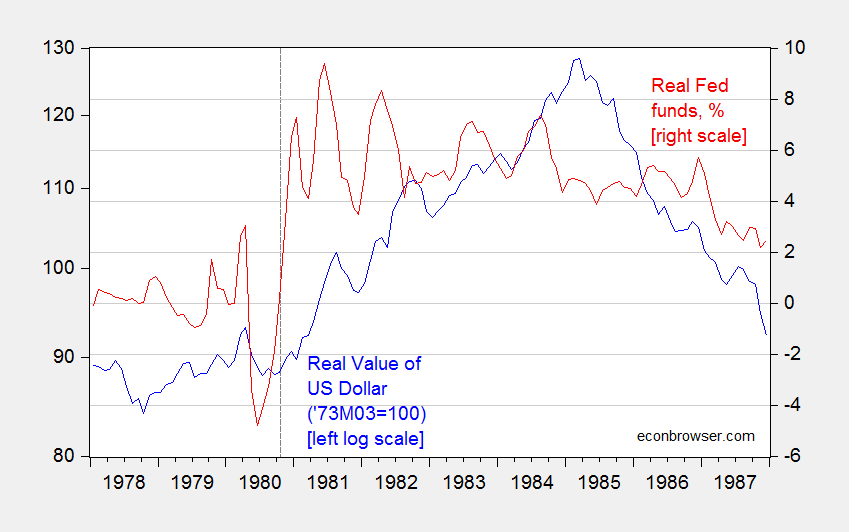

As it turned out, the increase in real rates led to a remarkable appreciation of the dollar. Figure 2 depicts the evolution of real interest rates and the real US dollar during the 1980’s. (See also lecture notes for further explication.)

Figure 2: Real value of US dollar against broad basket of currencies (blue, left log scale), and Fed funds rate minus lagged 1 year CPI inflation rate, % (red, right scale). Source: Federal Reserve Board, BLS, and author’s calculations.

Note that the peak change in the US real Fed funds rate (proxied by Fed funds minus lagged one year CPI inflation) was about 6.9 percentage points (Oct 1980 to August 1983). The real dollar appreciated by 25% (log terms) over that same period, eventually peaking in March 1985 37% (log terms) above October 1980 levels (45%). The implied semi-elasticity of real dollar value with respect to US real interest rate is about 3.5, or 5.4 including the ascent through 1985. More formally, estimating a cointegrating relationship between the US real exchange rate and real interest rate through 2007M12 yields an estimated semi-elasticity around 8. If real rates rise by 1.7 percentage points, then the dollar will rise approximately 14% (log terms).

For evidence on interest rates and the dollar exchange rate over the more recent period of unconventional monetary policy, see this post.

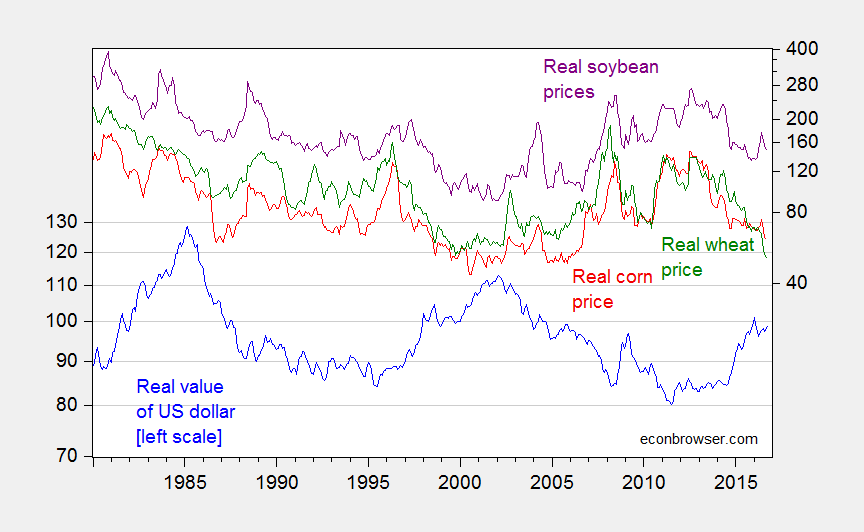

One common empirical result is that the dollar’s value and commodity prices are inversely related; see for instance Akram (Energy Journal, 2009) [ungated version], and Widmar. This is apparent if one looks at a long time series of the real rate.

Figure 3: Log real value of US dollar (broad) (blue, left log scale), CPI deflated global price of corn (red), of wheat (green), of soybeans (purple), all three on right log scale. Source: Federal Reserve Board, OECD, BLS and author’s calculations.

One explanation for the inverse correlation is that an appreciated dollar with dollar-denominated commodity prices means the relative price of commodities rises for other countries. Some part of the negative relation between dollar value and commodity prices arises because the dollar appreciates with higher real interest rates, and as documented by Frankel (2006), higher interest rates are also associated with lower commodity prices.

In any case, with real rates likely to rise and the dollar to appreciate, lower agricultural commodity prices are in store. To the extent that agricultural commodity prices are tightly linked to rural incomes, rural household incomes are likely to come under pressure in the coming years. Should higher interest in the US cause emerging market crises (e.g., [2]) that reduce demand of agricultural commodities, that conclusion applies with even more force. And I haven’t even talked about retaliation against unilateral moves by the US on trade policy (remember that jump in exports last quarter? — that was soybeans; a lot exported to China).

Next up: the return of the twin deficits?

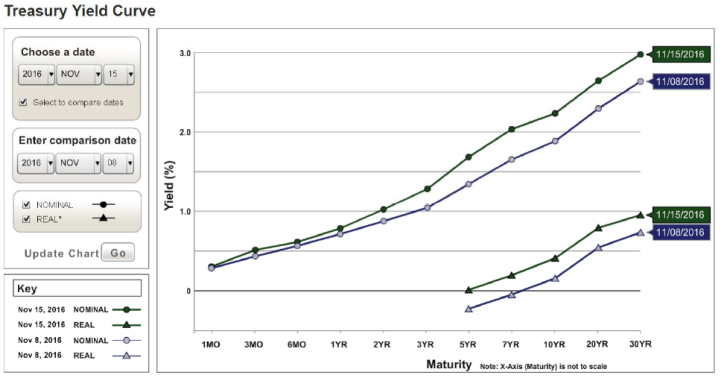

Addendum: Yield curve changes from 8 Nov to 15 Nov.

Source: US Treasury.

The ag economy is already rocking on its heels. A quick look at the Phil Fed’s log coincident index shows a lot of red in the mountain and Midwestern states. Land values are down bigtime. And over the last week there’s been a steep drop in corn, wheat, soybeans and rice. The only crop not falling is oats. And the bottom has fallen out of the lean hogs market. Just the other day I heard some Republican senators wanting to redo last year’s big ag bill because of the looming farm crisis. Throw in a lower Mexican peso, a possible trade war with China and higher interest rates and you’ve got a recipe for pitchforks and flintlocks.

2slugs says: “And over the last week there’s been a steep drop in corn, wheat, soybeans and rice. ”

without explaining why. Production is up more than demand.

” Both U.S. corn and soybean growers are expected to harvest record-high crops this year, according to the Crop Production report issued today by the U.S. Department of Agriculture’s National Agricultural Statistics Service (NASS). U.S. corn production is forecast at 15.2 billion bushels, while soybean growers are expected to harvest 4.06 billion bushels in 2016.

Aided by excellent field conditions, corn growers are expected to increase their production by 11 percent from the 2015 harvest. …

U.S. soybean growers also took advantage of the favorable weather conditions and are forecast to increase their production by 3 percent from 2015….

Wheat production is forecast at 2.32 billion bushels, up 13 percent from 2015. ”

Perhaps he forgot this is an economics blog and the rule of supply and demand?

This report gives the current picture: http://usda.mannlib.cornell.edu/usda/current/wasde/wasde-11-09-2016.txt

World Total Grains 4/

================================================================================

Total Total Ending

Commodity Output Supply Trade 2/ Use 3/ Stocks

================================================================================

2014/15 2513.07 3032.83 393.74 2455.86 576.97

2015/16 (Est.) 2456.05 3033.01 375.66 2430.34 602.67

2016/17 (Proj.)

Oct –2542.49 3144.10 397.63 2525.77 618.33

Nov –2548.16 3150.84 397.45 2529.41 621.43

Key numbers are use versus supply in a world-wide commodity. World-wide production is up this year.

CoRev I think you misunderstood my comment. I’m well aware of the several reasons why grain and livestock prices have slipped. They were declining before Trump won, although they did drop rather sharply the following day. One reason for that one day drop was because of the USDA’s report of an unexpectedly large crop. A second reason is because of the fall in the peso. A third reason is the sharp uptick in the 10 year and strong dollar. Trump is not responsible for the first reason; but he probably deserves some blame for the last two reasons. But my comment was not about the causes behind the drop in grain prices. My comment was about the already weak ag economy and why it was likely to take another hit to the gut due to Trump’s proposed policies. Trump’s proposed policies would likely tip a very rocky economic climate into something resembling the farm crisis of the 80s. Similarly, Menzie’s post was not about how the farm economy got where it is today; his post was about how Trump’s policies will affect the ag economy going forward.

https://www.philadelphiafed.org/research-and-data/regional-economy/indexes/coincident/

Are you sure you’re looking at the right map?

The Donald is a builder and he feels we need infrastructure spending. The American Society of Civil Engineers estimates we need to spend $3.6 trillion on infrastructure by 2020. The Donald also wants more defense spending, which is at a low point.

Unfortunately, we added many trillions of dollars to the national debt with little to show for it. I think, the Donald needs to raise gasoline taxes to pay for some of the infrastructure spending, while also promoting domestic production of fossil fuels. I doubt the Republicans want to add a lot to budget deficits, and will find ways not to flood the Treasury bond market.

“while also promoting domestic production of fossil fuels.”

exactly why? fossils fuel prices are already very low. increased production does not seem like an efficient allocation of capital from an economics point of view. it would only drive prices down further-very hard on the energy companies. and if it is cheaper energy you are after, then why not simply continue to promote renewables instead? cheaper renewables is probably economically more beneficial than cheaper fossil fuels.

It will probably come down to access issues, Baffs.

If you go to DC, they are always talking about ‘access’, something never mentioned in Houston.

The key ones here would be:

1. improved access on L48 Federal lands

2. revenue sharing with the states to allow offshore drilling in non-traditional areas (eg, Virginia)

3. drilling rights in ANWR

The first is incremental, and I don’t think too important.

The second is potentially important, but only after 2020. As you point out, we have plenty of oil. Not clear why anyone would do much offshore East Coast today. (And don’t forget local resistance.)

The last is actually important. Right now, Alaska is set to exit the oil business sometime after 2030. It takes a long time to do things in Alaska–call it ten years–so lead time matters there. There is a reasonable prospect of oil in a corner of ANWR, which itself is the size of Hungary. This oil could protect the TransAlaskan Pipeline after 2030, and with it, Alaska’s economy. About 90% of state revenues (last I checked, probably less now) come from oil taxes. Thus, Alaska as an populated state materially loses viability without oil. So that’s worth fighting over, to my mind, but expect stiff resistance on the left.

steven, my comment was aimed at why one would specifically promote fossils fuels. it really does not make sense, either politically, economically or environmentally. fossil fuels served a purpose, showing how electricity and energy could dramatically change the economic landscape. but they are a dead end service. we know an energy based economy is our future. but the focus should be on renewables and efficiency, and not fossil fuels.

as for alaska, not sure why you would continue to promote the socialist lifestyle of the alaskans to live off the tax of oil companies? it is ironic how so many alaskans claim to be rugged self sufficient frontiersmen, while cashing their government oil checks?

Is ‘promote’ the right word? I think it’s a matter of where you want to set the balance. Republicans will want a more liberal, pro business balance.

I leave the calls to depopulate Alaska to you.

I stated above, if gasoline taxes are raised to partially finance infrastructure spending, we should also promote domestic fossil fuels production, which may offet some of the higher gasoline taxes, along with raising national income.

Why force Americans to buy electric cars, which use fossil fuels anyway? I suspect, some of the infrastructure spending will be in transportation, e.g. light rail.

Peak –

I am not quite sure what we mean by ‘promote domestic fossil fuels production’. We have a sizeable shale resource with steadily declining marginal cost. So it really comes down to OPEC members coming to their senses rather than domestic policy per se.

As regards this, Menzie has my Yale deck from earlier this week. He’s free to publish it if he likes. Otherwise, the Yale guys will put the presentation and deck out on youtube and probably the Yale School of Management for the slides. It addresses most of these issues.

Promote: The opposite of block, hinder, impede, obstruct.

“Why force Americans to buy electric cars, which use fossil fuels anyway?”

peak, not forcing americans to buy anything. just see absolutely no need to promote the fossil fuel industry-we have better choices for the future. and an electric car does not “use fossil fuels anyway”. Alternative electricity sources are growing every day. tesla just produced a transportation/energy/house model which would take fossils out of the picture for electric cars-and much of one’s household needs. open your eyes, we can move to a fossil free (or minimized) world, which will be cleaner and cheaper, than the world you want to stubbornly hang onto.

I was a first-year grad student in 1980 and remember Jim Tobin talking about a similar situation. Based on his post-war experience, he expected the combination of lax fiscal policy (here broad based income tax cuts were the most important) plus high interest rates to be relatively ineffective, crowding out investment and causing the economy to bump along rather than recover. What he did not see was the expansion of the global economic links that had been severed in 1914. So instead of crowding out investment, the pairing of stronger currencies and qualitatively large trade deficits allowed the economy to grow based on consumption. It was not a good time for agriculture. Well, most of what’s around me (the southern tail of the Shenandoah Valley) is cattle. And some horse farms and vineyards. Maybe those will do OK…

Do not forget that a major leg of NAFTA was a big increase in ag exports to Mexico. It severely damaged the Mexican rural economy and who knows whether the benefit of lower cost food to Mexican urban residence more than offset the harm to farmers. But American farmers were a major beneficiary of NAFTA.

Apparently US farmers forgot it when they voted for Trump.

The return of the twin deficits?

The US Federal budget deficit, last I checked, was running 3.2%, this under Obama.

The trade deficit has been running around 2.5% of GDP, with a range of -2.2% to -3.2% since 2009.

The twin deficits have been with us for some time.

The question is whether these are going to get blown out even more. With a populist government (is it a populist government?), the budget deficit should rise by 1.5% on the low end, to 3.0% on the high end–to somewhere between dicey and disastrous. Unfortunately, deficit spending may be quite popular until the chickens come home to roost.

steven, you should remember that republican’s have never been against deficit spending in general. only democratic deficit spending.

Democracies have a deficit bias, due to a principal-agent problem associated with the three ideology model. But you know that.

I haven’t been here in a while and I see that little has changed.

Professor Chinn – Thanks for the electoral votes!