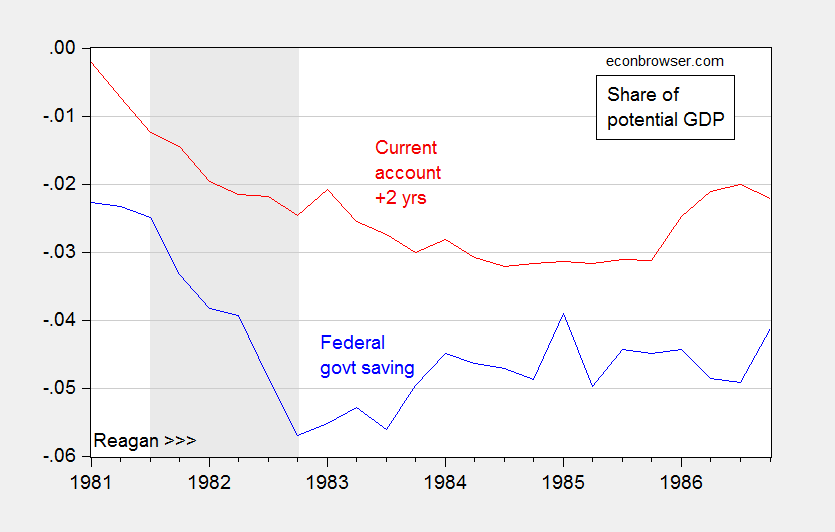

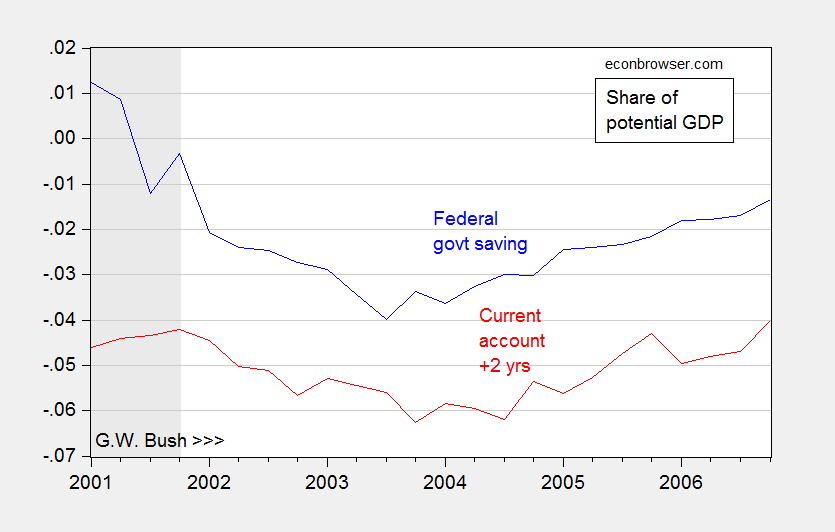

We have had previous experience with episodes of tax cuts unmatched by spending reductions, in terms of the impact on external balances. Below I plot the evolution of the Reagan twin deficits, and the evolution of the G.W. Bush twin deficits.

Figure 1: Federal government net saving (blue), and current account lead by two years (red), both as share of potential GDP. NBER recression dates shaded gray. Source: BEA, 2016Q3 3rd release, and CBO (August 2016), NBER, and author’s calculations.

Figure 2: Federal government net saving (blue), and current account lead by two years (red), both as share of potential GDP. NBER recression dates shaded gray. Source: BEA, 2016Q3 3rd release, and CBO (August 2016), NBER, and author’s calculations.

I cite empirical evidence and channels in my 2005 Council on Foreign Relations report. Greater fiscal stimulus increases absorption, pulling in imports. Deficits push up interest rates, especially combined with a Taylor rule, appreciating the dollar (see this post).

Astute readers will note that both episodes are roughly aligned with the beginning of Republican administrations: Reagan and G.W. Bush. I’m guessing the protectionist/fiscally expansionary/financial-deregulatory regime coming in with the Trump administration is likely to be in the same mold — leaving a mess for the succeeding administration to fix.

Bottom line: the way fiscal policy is likely to unfold, the current account balance (mainly accounted for by the trade balance) is likely to deteriorate, not improve. Tariffs, quotas and other restrictions — especially in an era of vertical specialization — are unlikely to offset the deterioration in the trade balance arising from absorption and dollar effects.

We don’t really know “the way fiscal policy is likely to unfold,” merely based on the past anyway. Trump spent a lot of time railing against the debt, against typical Republicans like Bush, and advocated the “penny plan” to reduce the deficit. The “Penny plan” requires reducing discretionary spending by 1 percent each year excluding defense (Social Security, Medicare and Medicaid).

I would bet that we get some version of the Penny Plan to reduce deficits. If Trump breaks promises, it will be on entitlements: In other words, both discretionary and non-discretionary spending will be reduced until the deficit is closed (excluding defense).

I would even go farther and say that there is about a 60% chance we get some version of a constitutional amendment to balance the federal budget, probably some compromise between the 1994 version that missed by one vote, and the 2009 version (you can google them if you are unfamiliar with the text that passed). Nearly enough states have ratified a constitutional convention to get a balanced budget amendment. The current most accurate math says we are 6 states short, but some claim its 34. Is a little fuzzy since some legislation was passed in the 70s. There is supposed to be a House authorized report coming out this year to sort out the official math.

The climate just is not what it was in the 80s and 90s. If a balanced budget amendment gets through the house and senate, which I think has a pretty significant chance, the GOP controls enough states to get it ratified.

If the GOP does not balance the budget on the other hand, this will only increase the pressure for GOP controlled states to force a balanced budget amendment from the state level.

The bottom line: People who are basing “what is likely to unfold” on what stereotypical republicans have done are also the same people who thought Clinton would win. They have not updated their priors in the face of new information, and they have not been paying attention to where the state-level GOP base is now.

This Balance Budget amendment will sure be interesting since Trump plans to boos military spending by a trillion over the next 10 years and pass 4 trillion dollar tax cut for individuals and corporations over the same 10 year period. That is adding 500 billion dollars a deficit each year that is bottoming out at 600 billion in a low unemployment economy. And expand Homeland Security spending as well to deport those 10 million undocumented immigrant and carry out an an intense war on Drugs and Terrorism internally, which will of course increase the prison population. So exempting about 100 billion, that leaves about 400 Billion in non-discretionary spending (no embassies, no CDC, no National Institutes of Health, etc.) to eliminate and you still have a 500 billion dollar deficit, at low unemployment. http://www.cbpp.org/research/policy-basics-non-defense-discretionary-programs Steve, please expain to me how this will work and you promise me that in the Republican Corporate Libertarian paradise that there never will be another recession, unless the lazy workers all decide to a take few months off?

Where are the 1990s?

So, a further question on the much-discussed border adjustment tax.

If it is passed, I think we might assume that major US trading partners would immediately retaliate by implementing their own border adjustment tax wrt to the US. This would imply that there would be no currency appreciation.

In principle, the status quo ante would be restored,. Or would it? Would offsetting US and, say, Canadian border adjustment taxes simply return the previous trade equilibrium? Or does it change the import/export mix?

OT:

Strength of city finances

http://www.thefiscaltimes.com/2017/01/09/How-Strong-Are-Your-Citys-Finances-116-US-Cities-Ranked