From Furman, Russ and Shambaugh:

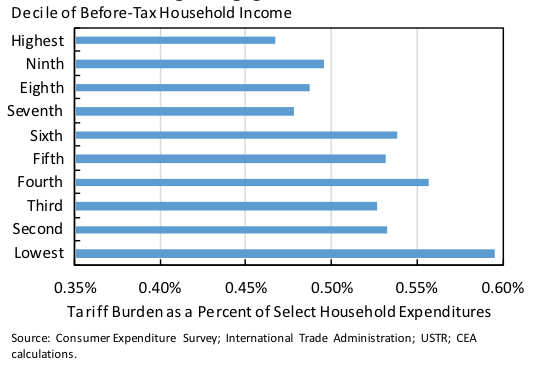

[t]ariffs are imposed in a regressive manner – in part because expenditures on traded goods are a higher share of income and non-housing consumption among lower income households, but also due to explicit regressivity within categories.

Figure 3 depicts the relative burden of tariffs, by income decile:

That’s for the current system of tariffs. What would imposing higher tariffs on Chinese imports do? The analysis does not provide the answer to that question. My guess is that, given the preponderance of inexpensive consumer goods sourced from China, the regressiveness would increase. Trade expert Caroline Freund notes:

Even if the welfare of the rest of the globe is excepted, such a tax on goods imported from China would “tremendously” hurt the poor by jacking up the prices on many of the products they most frequently use, said Caroline Freund, a senior fellow at the Peterson Institute for International Economics.

Things to consider, as we hurtle toward day one.

I think that the correct answer is hard to say. People generally forget about the third law of demand: When you impose a fixed cost, demand shifts to higher quality goods. Who (consumers, manufacturers, importers, retailers) bears the burden of the cost depends a lot on price elasticity at each step. Hard to say whether consumer prices or total spending actually increase, and who bears the cost. Maybe consumers will just substitute higher quality goods, and spend the same total dollars. Maybe the cost will fall on importers.

I also find people’s assumptions about this “regressive” effect wholly inconsistent with their assumptions about minimum wage increases. Many economists pushing the minimum wage figured that the higher labor cost would not be passed on to consumers in the form of higher prices. Is Wal-Mart going to pass on higher import prices? Why would I believe that they would pass on higher import prices, yet would not pass on higher labor costs? I am using Wal-Mart as the prototypical firm, I do not mean them literally of course.

It seems as though people are choosing their price elasticity assumption to suit their political worldview. This is yet another example of why economists are on the outs these days: They pretty transparently choose their assumptions to fit their desired conclusions.

I doubt the costs will be passed on. Wal-Mart will absorb the higher costs and adjust, by selling a different basket of goods and improving costs elsewhere (i.e. improving productivity).

Whether people are truly “better off” or not depends a lot on one’s assumptions about the adjustment costs of trade shocks. If the border tax adjustment has net positive employment effects, people will likely see themselves as better off. In laymans’ terms: people would rather have a job and pay a bit more at the store, than be unemployed yet able to spend their government check on cheap foreign imports.

Michigan just passed a regressive tax on gasoline. The gasoline tax of 19 cents a gallon will increase by 7.3 cents and the diesel tax of 15 cents a gallon will go up 11.3 cents [as of 1/1/17], with automatic annual inflationary adjustments in 2022 and after. Vehicle registration fees will rise 20 percent.

Why has there been no harsh condemnation by economists. Oh, because the government gets to spend the money. Wait, isn’t that what happens with a tariff?

Michigan just passed a regressive tax on gasoline. The gasoline tax of 19 cents a gallon will increase by 7.3 cents and the diesel tax of 15 cents a gallon will go up 11.3 cents [as of 1/1/17], with automatic annual inflationary adjustments in 2022 and after. Vehicle registration fees will rise 20 percent.

Why has there been no harsh condemnation by economists? Oh, because the government gets to spend the money. Wait, isn’t that what happens with a tariff?

As a general rule, economists support higher excise taxes on polluting fuels. It is supposed to discourage use, encourage enhanced efficiency, incentivize substitutes.

Economists don’t support tariffs because they are viewed as distortionary and wealth decreasing as opposed to wealth enhancing.

But you know that already, didn’t you? Is there a joke here I am missing?

Unfortunately, you are correct. Theoretical concerns outweigh practical, everyday burdens. But a regressive tax is still a regressive tax… and as the price of gasoline increases it becomes more regressive.

https://www.washingtonpost.com/news/energy-environment/wp/2016/02/08/why-many-economists-support-obamas-idea-of-a-tax-on-oil/

What seems to be forgotten by economists is that people are already paying another regressive “tax”… the additional cost to purchase vehicles that are mandated to meet pollution and mileage standards. Justifying higher gasoline taxes as a means to save the environment or fight global warming is basically … wait for it … a tax on a tax.

So, let’s be honest and say that some, not all economists don’t mind being intellectually inconsistent by saying that if a regressive tax fits their bias it is okay, otherwise it is a catastrophe.

Bruce Hall: I’m happy to say the gasoline tax is regressive, although since expenditures on roads and highways are tied to the tax, the net effect is unclear to me (somebody has probably written on this, but I don’t know the reference offhand). In Wisconsin, we are embarked upon rapid disinvestment in road maintenance; everybody will suffer, but proportionately, I guess people who drive cars for a living or to get to and from work will be hit hardest.

The point is that arguing whether a tax is regressive or not is somewhat superfluous. A tax is a tax. It takes money out of consumers’ pockets and puts it into the government’s treasury. Yes, some taxes hit the lower income more than others and applying some moralistic apology to some of these is like saying this beating “is for your own good.”

As for tariffs, same thing. The money goes to the government where it will be spent “for your own good”.

Erik Poole But you know that already, didn’t you?

No, Bruce Hall did not know that. He also did not know that externality taxes not only increase welfare and economic efficiency, but if they are well designed they need not be regressive. For example, one of the carbon taxes proposed by the WH and evaluated by CBO found that the carbon tax would actually increase income for the bottom quintile. The WH carbon tax was progressive, not regressive. Of course, the Michigan tax hike was designed by a bunch of braindead, clueless and economically illiterate GOP politicians, so my guess is that it was not well designed and could very well be regressive. But that’s because stupid voters tend to vote for stupid politicians.

Yes, I understand the concept of a lump-sum income redistribution scheme for carbon taxes… about 3-1/3% for lowest 20% incomes. But it has to be paid first. Nice way to increase d̶e̶p̶e̶n̶d̶e̶n̶c̶y̶ income o̶n̶ from government. Has nothing to do with the environment.

Keep trying to milk the golden calf.

But it won’t happen.

The very liberal Justin Trudeau has been pushing his “environmental carbon tax” in Canada. The reaction: http://www.torontosun.com/2017/01/14/trudeaus-cheap-talk-on-climate-change

Yes, right.

But:

– Trump will not understand this. And in case he would, he would not change his mind as he is suffering from narcissistic personality disorder.

– While happening on the main front line, and even more important for him: the dream of keeping poor people from seeing a doctor is within reach.

There’s a profit incentive in having a sick population, Trump. Well done America.

John –

Obamacare has already achieved the goal of preventing middle class people from seeing a doctor. Many people now have deductibles of $5,000+ on annual premiums of $6,000+, and this for people of modest income. As a result, many of these people effectively have no insurance coverage at all for routine illness or injury. That’s why Obamacare is so unpopular.

The key, of course, is to peel people with pre-existing or chronic conditions off of Obamacare. With that, the mandate could stand and the economics could work. But then you have to find a revenue source for chronic care patients. I’ll have an article on that.

Steven Kopits: “Many people” is an elastic term. Please document; I’ve read many, many anecdotes about the ACA. And many, many have turned out to be just that – anecdotes. Please, give me data.

Here:

https://www.nytimes.com/2015/11/15/us/politics/many-say-high-deductibles-make-their-health-law-insurance-all-but-useless.html

This is crazy. Have you even looked at the exchanges? Yes, you can select a plan with a high deductible. But there are other plans with lower deductibles. Obamacare offers people a menu of choices. And if you’re low income and live in a civilized state, there is a subsidy to help out. What people are finding out is that a healthcare system that consumes 17% of GDP must also consume something like 17% of GDI. That isn’t always obvious to middle class voters with good employer provided health insurance. In that regard Obamacare has been an exercise in consciousness raising.

many of these people effectively have no insurance coverage at all for routine illness or injury

Is that a problem if people choose to select a plan that doesn’t cover routine illnesses or minor injuries? At least they have a plan that will cover major illnesses. At least they have the option of buying a plan. That may not be all of what people want, but it’s better than having no options, which is what they had prior to Obamacare.

The key, of course, is to peel people with pre-existing or chronic conditions off of Obamacare.

And do what with those people? Just let them die quietly and without complaint?

But then you have to find a revenue source for chronic care patients.

Yes, you do. And good luck with that. In the end you have to socialize those kinds of risks. If you don’t want community ratings and you want to lump people with chronic or pre-existing conditions, then you have to finance it with something like Medicare or Medicaid. But the GOP doesn’t seem to be in the mood to expand those two programs.

Obamacare was always a second best solution. But a second best solution was better than nothing, which is what tens of millions of people had prior to Obamacare. A better approach would be universal Medicare with private insurance complementing Medicare “B” and prescriptions. I think that’s ultimately where we’re headed after the GOP plan crashes and burns. But until that happens I expect the blue states to set up something like Romneycare. Sooner or later even dimwitted red state voters will catch on that they’ve been conned.

steven

“Obamacare has already achieved the goal of preventing middle class people from seeing a doctor. Many people now have deductibles of $5,000+ on annual premiums of $6,000+, and this for people of modest income. ”

when you get your information from the echo chamber, it is not suprising your view is inaccurate. you statements would only apply to a very small fraction of the people directly impacted by the ACA. it is very disingenuous, as has been the MO of the alt-right, to imply these are the general impacts on the middle class as a whole. it is simply not true-and you should be embarrassed to repeat such inaccuracies.

are there some people who have high deductibles and premiums? sure. people also had similar conditions prior to the ACA-assuming they could even get insurance in the first place.

so you get your insurance from your wife. the monthly premium is not only what she pays per month, but also how much the state itself kicks in for the insurance policy. in my previous position, i paid $100/month and my employer paid over $500/month for single coverage. i still worked for that additional $500/month, it was not “free”. steven, you are a smart guy. time for a reality check. the republicans have been shameful in creating a false narrative regarding the true picture of the ACA. and you fell for it. don’t be a fool and continue to repeat it.

Steven Kopits is quite ignorant about the individual insurance market because he has probably never purchased an individual insurance plan in the private market.

On the exchanges you can buy as much insurance as you want or can afford. That’s how markets work. You can have a deductible of $6500 or you can have a deductible of zero dollars. That’s a market choice. That’s not Obamacare. That is exactly as the market was before Obamacare.

85% of people purchasing Obamacare have deductibles of $1000 or less after subsidies. So his many people claim is cherry picking suspect. Guys like Kopits just like to lie about Obamacare.

As for cost, Kopits is probably ignorant of the fact that the average employer plan for an individual costs $7000 and for a family is over $17,000. So people getting insurance on the exchange for much lower prices than that are getting a bargain.

Before Obamacare, in the individual market I saw annual price increases of 10% to 15%. Since Obamacare the increases have be lower.

Kopits is totally ignorant of how bad the individual insurance market was before Obamacare and how much better it works now. When he says prices are high and deductibles are high he doesn’t answer the question “compared to what.” Like most Republicans he is either ignorant or just a liar.

Whoa there, Joseph.

I did not lie about Obamacare. I linked the NYT article above.

As for insurance, I get mine via my wife, who is a NJ state employee. I think that speaks for itself.

steven, the folks in this article want a low premium, low deductible, high coverage insurance policy. that does not even exist outside of obamacare. it was interesting, people in the article complaining about the deductible and then stating they decided to drop their insurance after receiving some large bills needing to be paid. do they really think those bills will disappear on any current and future medical treatment they receive after dropping coverage? by dropping their insurance, they removed the yearly out of pocket cap their policy actually provided-a policy point of the ACA itself. if one is trying to disparage the ACA, using these financial numbskulls to illustrate the weakness of the ACA is quite baffling. my experience with this type of anecdotal analysis indicates many of the subjects were financial failures, with or without the ACA. it if foolish to blame the ACA for such failures.

Thanks for proving my point, Steven. You have government health insurance. You know absolutely nothing at all about the individual insurance market. So your claim is that you are not trying to deceive. You are simply ignorant.

So when you say deductibles are high, compared to what? Plans in the individual market have always had a range of deductibles from low to high. They still do. Some people complained about high deductibles before Obamacare. Some people still complain about high deductibles. How is that a failure of Obamacare? Health insurance in the U.S. is inordinately expensive compared to other countries.

If you really care about high deductibles for the middle class, then you should be supporting higher taxes on the rich to fund better subsidies for middle class insurance. That isn’t a failure of Obamacare. That’s a failure of Republicans.

Anecdotes are not data. The NYT can cherry pick some people who are unhappy about their insurance. They could also interview the millions of people that are happy with their insurance but that isn’t quite as interesting.

The data says that the average deductible is less than $900. Only 20% have deductibles over $6000. Most of those are probably healthy young people who want cheap insurance with high deductibles. Anyone with higher deductibles have it because they chose higher deductibles or their income is too high for subsidies. That isn’t a failure of Obamacare.

So really, stop making a fool of yourself by opining on a topic you know nothing about.

Steven said:

“Many people now have deductibles of $5,000+ on annual premiums of $6,000+, and this for people of modest income. As a result, many of these people effectively have no insurance coverage at all for routine illness or injury. That’s why Obamacare is so unpopular.”

Steven is absolutely right. If you don’t qualify for a subsidy, Obamacare is a raw deal, which is the reason many fewer people have signed up for Obamacare than was originally predicted. The problem is particularly acute for older people. As this analysis shows, for 2017 the average monthly Bronze plan premium for a 50 year old is $489.54 per month, a 21% increase over last year. The average deductible is $6,092. For a Silver plan, the numbers are $574.10 per month and a deductible of $3,572 and for a gold they are $730.28 per month and a deductible of $1,197.

What a mess Obama and the Democrats have made. Buying health insurance is hugely expensive for people with middle incomes who don’t qualify for a subsidy. You pay large premiums and can’t use the plans for routine health care costs.

To make matters worse, fixing this mess will be very difficult without making things even worse in the short run. Job one for Trump and the Republicans as they work to undo the damage will be to keep the blame focused on the authors of this catastrophe as they attempt to shift the blame.

of course, rick, those prices are unsubsidized. many in obamacare are subsidized. and for those who were not, what do you think their costs were prior to obamacare. do you have any idea what the premium cost is for a typical employer sponsored worker?

you are making very fallacious arguments. you complain that premiums are rising. hint, they are rising for people not on obamacare as well. prior to obamacare, these unsubsidized workers could not get reasonable insurance at an affordable price-even if they could even get coverage at all. insurance companies could charge 5 times the price for older consumers, rather than the 3 times the price under the ACA.

i really do like how rick stryker enjoys his own insurance, probably medicare with a booster, but finds it in his heart to deny that possibility to anybody else deemed less worthy. rick got his, and if possible, he wants to take away yours too.

rick, you guys have been crying about obamacare and its repeal for years. in all that time, why haven’t you come up with a plan that you could pass immediately? why are we waiting for this “tremendous” plan in which nobody has any idea of its contents? why must we repeal obamacare before we get any information on this great new plan? what have you been doing the past eight years? bunch of hacks.

Rick Stryker More nonsense. Where to begin?

All non-fraudulent health insurance is expensive. That’s just a fact. If you have employer provided health insurance, then the cost is hidden from most workers, but it is still part of the wage bill. And it is deductible, which further hides the cost and shifts it onto others. As I said before, something that consumes 17% of GDP must also consume 17% of GDI.

As to deductibles, the fact that high deductible plans are available is a choice on a menu. If people want lower deductibles, they can find them on the exchanges. Now it may be true that people are stupid and irrational…and the last election is evidence of this, but that doesn’t change the fact that lower deductible plans are available. Buyer’s remorse is true in all markets. People make bad decisions. What’s not available on the exchanges is the free lunch plan.

The costs you cited are a bargain. Here’s an exercise. Take your monthly premium and add your employer’s contribution. Then compare it to what’s on the exchanges. I think you’ll be shocked.

What a mess Obama and the Democrats have made. Buying health insurance is hugely expensive for people with middle incomes who don’t qualify for a subsidy.

I’m middle class and I’m not on Obamacare. My annual health insurance premiums are a tick under $20K. Health insurance is expensive for everyone.

And the reason insurance premiums went up this year was because the phase-in part of Obamacare expired. During the phase-in part the government provided the insurers with a cushion until the market prices could be discovered. This was pretty much of a one time adjustment, which in the end affected only around 5% of subscribers. The other 95% are seeing no change.

I’m sorry to hear that Rick Stryker, Jr didn’t survive that motorcycle crash because he decided to buy that HDTV rather than get insurance on the exchanges. He might be alive today if he hadn’t listened to you. That must be a terrible burden you’re carrying around.

Stryker: “If you don’t qualify for a subsidy, Obamacare is a raw deal.”

Answer this question. What was the deal before Obamacare?

Nobody got a subsidy. No one. Not one. Now at least 85% get a subsidy. If you want everyone to get a subsidy the answer is simple. Tax the rich and give the subsidies to the middle class. What is the Republican answer. Nothing?

Answer this question. Who could even buy health insurance before Obamacare?

Many people could not because of pre-existing conditions. Insurers would simply refuse if you had a history of cancer or heart disease or diabetes. Or some states had the high-risk pools, better known as the Dead Pools. If you had the money you could buy insurance for $20,000 or $30,000 a year. Today no one can be refused insurance because of their heath condition. Everyone pays the same regardless of pre-existing conditions.

Just like Kopits, Stryker is totally ignorant about the subject he is talking about.

It is fitting that Stryker and Kopits are teaming up again on ignorance about the individual insurance market. You might recall their embarrassing fiasco back when Obamacare was first starting.

Here is what they said: “So it costs us $140 bn per year to insure an incremental 3 million people. Only $35,000 per head. What a bargain!”

This is a blunder so big it actually took two numerically challenged conservatives working in tandem to gin up — Steven Kopits who misread a simple line graph to come up with the wrong denominator and Rick Stryker who failed elementary multiplication in coming up with the wrong numerator.

It’s embarrassing but they keep coming back for more.

Joseph –

Putting high cost, pre-existing condition or chronic care individuals into an insurance pool will tend to create an adverse selection problem, with a premium death spiral. And we’re seeing a good bit of that in Obamacare. Part of the cost of pre-ex pool members are being financed by high premiums and high deductibles, with the result that the cost of Obamacare insurance has been rising quickly and insurers have been losing money, with many withdrawing from various exchanges. Thus, having an insurance policy does not equate to having useful insurance coverage–and that’s a big reason Obamacare has been so unpopular and the Democrats electoral results so spectacularly bad.

The Tea Party arose in 2010 specifically in response to Obamacare, with Democrats being blown out in the House in 2010 and losing the Senate in 2014. In state houses and legislatures, the Democrats are near 100 year lows. Obamacare was Obama’s signature achievement. If it were popular, the Democrats would not have been decimated and it is less likely that a populist like Trump would have come to power.

If you want a functioning insurance pool, you have to put people with similar risk into the pool. That’s a business proposition predicated on an actuarial basis.

Taking care of the chronically ill is really a charitable function, to the extent they cannot pay for their own care. Charitable contributions are budget-limited. They are a function of how much you can afford, as a nation, to pay for a certain segment’s care.

Conceptually, insurance and public chronic care support are two different things, and have to be handled differently, in my opinion.

“If you want a functioning insurance pool, you have to put people with similar risk into the pool. ”

for an insurance pool to work for the consumer, you want a diversity of risk into the pool. if you want the insurance pool to work for the insurer, you want a similar, low risk pool. obamacare is enforcing the former.

“Conceptually, insurance and public chronic care support are two different things, and have to be handled differently, in my opinion.”

then you should absolutely not support any bit of medicare. as you get closer to retirement, however, my guess is you will be a supporter of medicare.

Conceptually, for an insurance pool to work, you need similar levels of risk and uncertainty. If one person knows for certain he will need $350,000 of dialysis, then putting him in a pool with a healthy 26 year old will produce a bad result, notably because the 26 year old will feel that the insurance cost is not representative of his actual risk–and he’ll by right. That’s what causes the premium death spiral that we’re seeing in Obamacare. Healthly people think Obamacare is a bad deal–and they are right!

I don’t see the connection to Medicare. In general, the elderly are unlikely to be able to cover all their own costs, particularly if we start slicing these by age cohort. Therefore, they will need societal support. But we need to be very careful how much support we give, because it is being provided by ‘makers’ — taxpayers — and consumed by ‘takers’ — principally retired people. If you are taxing a guy with school age children to pay for the elderly, you are implicitly making inter-generational transfers. You are converting investment in students into consumption for the elderly. Within limits, that’s ok, but if you let it get out of hand, you’ll gut your society.

Along these lines, I encourage you to listen to this NPR interview with Dan Malloy, Governor of Connecticut. You can see how unfunded pensions obligations are more or less eviscerating the state, leading there to a potential death spiral, just as we may see in NJ.

http://wnpr.org/post/new-year-new-goals-conversation-connecticut-governor-dannel-malloy

steven, medicare was a conscious decision to provide health care to a group of people-old-who otherwise would be unable to obtain health care, other than the wealthy. why do we limit this to only the elderly?

from your perspective, workers for a large corporation are in an even worse position. the young and the old get lumped together into one standard premium. and you are forced to buy the insurance policy. this effectively occurs because your company pays a much larger share of the monthly premium than the worker. but if you opt out of the insurance, you do not get to pocket the employer contribution. are you against how a large corporation pools the risk?

Steven Kopits: “Putting high cost, pre-existing condition or chronic care individuals into an insurance pool will tend to create an adverse selection problem, with a premium death spiral.”

Steven demonstrating once again that he doesn’t even understand the fundamentals of insurance. Adverse selection can only occur if customers can opt in and opt out at will, that is, wait until you get sick, then buy insurance. That is the purpose of the insurance mandate. Everyone is in the pool. There is no adverse selection.

This is the most fair way of operating since no one knows at birth whether they will be in the low cost of care of high cost of care group.

You want to segregate the healthy from the sick, the winners from the losers. If you have the bad luck to be in the loser group, tough for you. That is the precise system we had before Obamacare and people hated it. Out of all of the Obamacare benefits, the one that is almost unanimously favored is the elimination of discrimination based on pre-existing conditions.

If you can’t discriminate, you also must require everyone to contribute, which is what the mandate does. Everyone is in the pool and everyone is treated fairly.

Creating separate pools, low risk and high risk, as you suggest, doesn’t save a dime. It just distributes the costs of medical care non-uniformly, between the winner and losers. The winners get cheap insurance and the losers get very expensive insurance. The public has been very clear that they don’t like that.

I realize that Kopits considers himself one of the lucky ones, so should have cheap insurance. But I will bet that if calamity befalls him, he would squeal like a stuck pig begging for help.

Joseph,

As usual, you don’t know what you are talking about. Steven understands this much better than you do. Of course adverse selection is the problem. As Princeton health economist Uwe Reinhardt put it in 2015 in his discussion of the problems with Obamacare:

“However, for purely political reasons, the ACA mandate for all persons in the United States to be insured was rather weak, leading many younger or healthier individuals simply to forgo purchasing health insurance and paying the relatively low fines for doing so. Over time, this practice naturally will drive up the community-rated premiums, inducing even greater numbers of young and healthy individuals to forgo insurance coverage, leaving private insurers with ever-more expensive risk pools.

The result of this adverse risk selection (the scenario in which sicker-than-average people purchase insurance while young and healthy people do not) has been that some private health insurers underpriced their policies on the ACA exchanges, perhaps to gain market share early on or because they simply did not anticipate quite the adverse risk selection that occurred.

It is hard to see a way out of this dilemma, given the current political climate.”

Rick Stryer However, for purely political reasons, the ACA mandate for all persons in the United States to be insured was rather weak,

Well, DUH! That’s exactly why so many of us were calling for much higher penalties. For political reasons Obama & Co. decided to go easy on people the first few years and did not push the penalty. And that was probably okay as a temporary expedient. But over the long run the ACA mandate has to be strengthened. Good to see you’re now onboard with a stronger ACA mandate. We’re making progress.

http://www.modernhealthcare.com/article/20160514/MAGAZINE/305149980

http://www.forbes.com/sites/theapothecary/2017/01/02/learning-from-cbos-history-of-incorrect-obamacare-projections/#79c5dbbd75e3

steven, adverse selection was well known prior to the ACA. they do have provisions to assist with the problem. penalties were light and slowly increasing to avoid the shock-but they were meant to address the problem. i would rather have higher penalties immediately, would have helped, but understand the resistance to immediate change. but you also had political hacks, such as rick stryker on this blog, who advocated the young to avoid obamacare. not for the benefit of the young. but to promote the political ideology of one rick stryker. that has not been helpful to the success of the ACA. you do understand how hacks such as rick stryker were intentional in their attempt to sabotage the ACA without acknowledging their contribution to the problem?

steven, the ACA instituted policies such as community ratings and mandatory enrollment to avoid the problem of adverse selection. the right wing efforts to sabotage the ACA have not been helpful. the acceptance of romneycare and the pillory of obamacare should open your eyes to the integrity of some on this issue.

I guess I should not be surprised that you missed the point. I was not advocating that young people don’t sign up for Obamacare. I was using devices such as Rick Stryker Jr (and others) to illustrate the incentives that were created in the program. I was pointing out that young people are not incentivized to sign up for Obamcare and predicting that they wouldn’t in the expected numbers. That, and the fact that Obamacare is a bad deal in general if you don’t get a subsidy, was bound to create lower than expected sign ups and produce what Uwe Reinhardt called a slow death spiral. The only reason it didn’t happen sooner is that the Obama Administration diverted funds to defray insurance company losses. The Republicans put a stop to that last year and here we are.

If you could be honest about it, you’d realize that my analysis of the perverse incentives created by Obamacare, what was likely to happen with the program, and the political problems it would create for the Democrats was pretty accurate and put out years before other people realized it.

rick, you have never been a provider of a solution. every business has a jerk in the back of the room that can come up with a thousand reasons why the idea is bad. no idea is perfect, because we live in an imperfect world. there will always be flaws. but the good people in the world attempt to solve those problems, even with flawed instruments. the back benchers of the world really contribute nothing towards the solutions, just look for the flaws. usually because they do not have the courage to step up and lead. my bone with you, rick, is you do not have the courage and leadership skills required to implement a solution. that is why i consider you a back bencher.

Bruce Hall:

Menzie is correct to point to the net effect. In your calculations of regressivity, you are ignoring the negative impacts of gasoline and diesel-powered automobiles on lower-income people.

An opportunity cost approach is key. So what is the opportunity cost of low excise taxes on fuel?

A multi-billion dollar naval fleet positioned near the Gulf of Persia? The Iraq invasion, occupation and the blowback in the form of Da’esh? The semi-permanent bullseye on the backs of American citizens? A reputation for killing large numbers of innocent civilians?

Ugly, sprawling, inefficient low-density suburbs and crappy communities? Bad air that generally tends to more greatly impact folks of lower socio-economic status?

Obesity and COPD epidemics that tend to impact those of lower socio-economic status more than others? Even if victims of obesity and COPD are self-insured, the decline in economic productivity affects all citizens.

Any policy that discourages consumer use of petroleum fuels means more is available for industry and the armed forces.

Median apartment costs $2 m in NYC.

Here’s what $2 m buys you in Princeton:

http://www.zillow.com/homes/for_sale/Princeton-NJ/house,mobile,townhouse_type/39009666_zpid/395489_rid/1500000-_price/5677-_mp/40.408398,-74.563351,40.303618,-74.747887_rect/12_zm/?

And for you fans of high speed rail:

http://www.wsj.com/articles/plan-to-speed-up-amtraks-northeast-route-faces-opposition-in-small-towns-1484568000

Rick Stryker, what is this adverse selection death spiral you speak of? The ACA exchanges have signed up record numbers every year since 2014. This year will set a new record with another million sign ups. The ACA exchanges are thriving.

Any adverse selection can be easily fixed by either a stronger mandate or bigger subsidies. This would be easy to fix but Republicans are invested in failure so aren’t inclined to help.

But in in spite of Republican obstruction, the exchanges are doing fine. Premiums are lower than projected in 2014. The cost curve has bent downward. There is no death spiral.

Keep in mind that Obamacare is not responsible for selecting or regulating insurers in each state. The Feds only provide the exchange website. Local politicians, in particular the state insurance commissioner, is responsible for approving plans, approving premiums and approving provider networks.

States that have good insurance commissioners, like California, Washington, New York and Massachusetts have great insurance. States like Texas, Tennessee and Arizona have terrible insurance commissioners that are dedicated to making the ACA fail, so not surprisingly have bad insurance choices. Texas even passed a law forbidding federal Obamacare navigators to assist people in signing up. They have done no advertising to encourage people to sign. No surprise then that they have had problems with their insurance market. That isn’t a failure of Obamacare. That is the failure of Republican state politicians.

Conservatives like Rick Stryker have been predicting the doom of Obamacare since day one. Contrary to predictions, the Obamacare markets are thriving and expanding every year.