That’s the title of a new EconoFact memo written by me:

Nearly 70 percent of rural votes cast in the 2016 election went to Donald Trump. This phenomenon has been attributed in part to the declining fortunes of farmers. But rather than helping reverse this trend, several of the Trump administration’s policy proposals would negatively affect the fortunes of the agricultural sector by depressing the prices received by farmers, reducing the demand for American agricultural exports, and raising production costs. Moreover, that portion of the agriculture budget aimed at supporting farm prices and incomes is likely to be squeezed to accommodate the increase in defense spending.

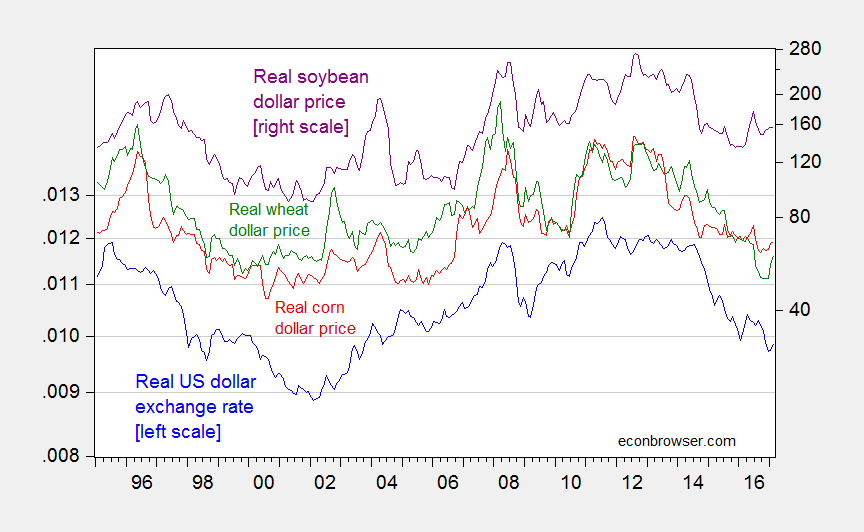

Why do I arrive at this conclusion? The EconoFact memo lays out the points in detail, but first and foremost is a macro point — aggressive (albeit regressive) fiscal policy at near full employment will push up interest rates, push up the dollar’s value, and hence push down dollar prices of ag commodities.

Figure 1: Real trade weighted US dollar exchange rate (blue, left scale, down is appreciation), and dollar global price of wheat (green), corn (red), and soybeans (purple ), all deflated by CPI. Source: Federal Reserve Board, IMF, BLS, and author’s calculations.

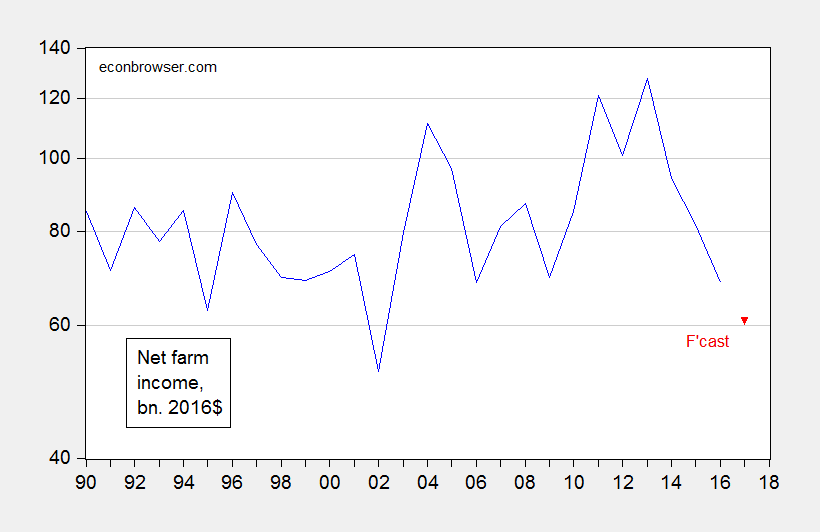

The likely pressure on ag commodity prices is likely to take place against a backdrop of already declining real net farm income.

Figure 2: Net farm income, in billions of 2016$, deflated by CPI. 2017 estimate from USDA, deflated by CBO estimate of CPI. Source: USDA , BLS, CBO, Budget and Economic Outlook, January 2017, and author’s calculations.

Given the Administration’s budget outline, I can only guess that there will be a lot of cutting in the discretionary aspects of the agriculture budget. Over the longer term, price supports and conservation efforts could be reduced if the President is intent on boosting defense, cutting taxes, and holding the line on budget deficits.

The Administration’s New Trade Strategy (discussed here) also casts a pall over the ag economy’s prospects. From Nafta to possible WTO sanctioned retaliation over the border adjustment tax and other trade initiatives, there’s plenty for those in the ag economy to worry about.

More stuff to worry about, laid out in the EconoFact memo.

Would love to see some analysis on what’s going on with GDPNOW vis a vis the NY Fed’s Nowcast. Are we headed towards recession?

The soybean, corn, wheat, and cotton farmers are all heavily subsidized via crop insurance and other government programs. Also, ethanol policy has supported demand, though the 10% blend wall is tough to break thru. Still many farmers get a better price because their corn basis is better now that they have a local ethanol plant versus when they often had to sell to feed yards farther away. Don’t shed a tear for them. They are more big business than traditional farmer. That isn’t true for other crops that don’t have the same political lobby.

Actually, most Fed forecasts still moderate GDP growth in 2017. The FED’s Atlanta GDPNow predicts lower growth in 1st Quarter 2017 then the others, but that others have had slightly higher growth. Right now, except for tourism and business travel, I don’t think Trump’s sound and fury have had much effect on the economy. If they get their bill blowing up Medicaid and the private insurance market through, pass their no-butter, all guns, budget with a big fat tax cut for the 1%, and if they put hard money/high interest guys in charge of the FED, 2018 may be a different story. The personal income, estate, capital gains, and corporate tax cuts, and replacing some of that loss revenue with a “border adjustment tax” which will function to some extent as VAT and flat consumption tax will shift the burden of paying for Government from 1% to the lower 90%. That will depress consumption. Higher interest rates also function as tax on the debtor class (again much of the 90% borrow for mortgages, HELOCs, student loans, car loans, and credit cards). This will also depress consumption. Foreign trade and the high dollar will increase negative net exports, which will depress consumption. Less welfare and transfer payments will depress consumption. Somehow, the 1% will be so excited that their efforts will be rewarded and their taxes will be reduced, that they will engage in a investment boom to fulfill a demand in ?????? , rather sock their money into bonds, art, and bigger homes and yachts.

For 37 years we have been implementing policies of shifting income and wealth from the 90% to the 1% (or really, the .01%). https://www.theguardian.com/business/2014/nov/13/us-wealth-inequality-top-01-worth-as-much-as-the-bottom-90 and http://www.ips-dc.org/billionaire-bonanza/

What I also find strange to the point of crazy is that people like the Kochs and Mercers and Trump believe that the economic policies of the last 37 years, including the last 8 under Obama, that have allowed them to accumulate this wealth and income is somehow “socialist” and “destroying America” if they are asked to pay 3% more in taxes then allow Government to help the poor and working poor get financial assistance in getting health care.

Although the dollar had a strong run-up prior to the election (in anticipation of a Clinton victory?), there has been a slow decline since December despite the Fed rate hike and promise of future hikes. http://www.x-rates.com/graph/?from=USD&to=EUR&amount=1

I agree with mp123’s assessment of government subsidies and programs (especially the ethanol program). If there is one sector that could be in danger because of Trump’s general views, it’s probably ethanol. That program is a loser for everyone except the farmers. The biggest losers from the program are 1) the taxpayers who subsidize the program, 2) vehicle owners who get reduced fuel economy and more expensive engines to fight ethanol corrosion, and 3) cities… http://www.latimes.com/science/sciencenow/la-sci-sn-ethanol-ozone-levels-brazil-20140501-story.html

http://reason.com/blog/2016/08/19/epa-says-it-needs-eight-more-years-to-de

Heaven’s to Betsy! The End Times must be upon us…Bruce Hall and I completely agree on something! The ethanol program is a loser for everyone except farmers and Sen. Grassley.

Even a blind squirrel finds the occasional acorn. 😉

I can remember agriculture taking a big hit in the mid-1980s (I went to one of the early Farm Aid concerts). We were just coming out of the stagflation and Fed Chair Paul Volker’s bitter pill of very high interest rates. Was there also an adverse affect on farm income at the time? Your chart doesn’t go back far enough. Many of the crop support programs that mp123 mentions in his reply were around then but didn’t do much to prevent a lot of bankruptcies.

US Women’s Hockey Team boycotting Championship over ‘Equal Pay’.

To simplify it, their product does not generate enough demand to finance the salaries they are demanding. They see the men’s compensation, but fail to see that men’s hockey is what the market watches.

Menzie has gone on record saying he is all-in for ‘feminism’, and that it can do no wrong.

Yet, we see yet another example of how ‘feminism’ is the most economically unsound of ideologies, and cannot be attractive to anyone who grasps even Econ 101, let alone a supposed Professor of Economics.

Darren: You are definitely obsessed. I challenge you to find a single Econbrowser post I have written that uses the word “feminism”. The only times the word has shown up in a comment of mine is when I am quoting you, or quoting GK.

So, who the hell pays any attention to hockey of any stripe? Pro soccer dwarfs it, even baseball, just Baseball, doubles it. Get a grip. Talk to your bookie.

Darren: “US Women’s Hockey Team boycotting Championship over ‘Equal Pay’.”

Once again Darren demonstrates that he is nothing less than a lying sack. Nowhere do the women’s hockey players demand “equal pay.” They are simply demanding a raise from their current $1,500 a year stipend from USA Hockey for a year round job.

Sorry but the time for politeness has ended. Trump has normalized lying to such an extent that it seems routine. Time to simply call liars the lying sacks they are. And Darren is a lying sack. Go and hide from your embarrassment.

You’re really out of touch with rural people. Rural decay was a part of it but Trump won them over with his America First message. They are patriotic people who don’t always just vote for whoever promises them the most handouts. I know that is a foreign concept to a liberal.

Patriotic people who voted for the Russian candidate.

Is that the same as Obama was the Muslim Mole?

obama was a muslim was absolutely false. trump and the russians? the fbi began that investigation three months before the election-not that comey would comment on that in public. conservatives in bed with the kgb. this could be quite damaging.

Farm income seems highly correlated with commodities more broadly.

Having said that, any number of Trump proposals could adversely affect the farming community.

the price of farmland tends to be what created problems for farmers in past crisis. the commodity prices themselves then make the farmers insolvent over a period of time. but it’s the debt of land that cannot be serviced which is the issue. farmers buy land expensive when they have cash from high commodities. when that cycle drops, the debt is still there. small farmers usually cannot buy land when it is cheap, due to low commodity prices and less income.

Farming accounts for about 2% of U.S. employment versus about 50% in the late 19th century. The quaint view of “small” farms as small plots of land with a few chickens, pigs, and cows is a fantasy.

Half a century ago, if you were to go to the Dakotas, you would see that many “small” farm consisted of a “section”… a square mile or 640 acres. At harvest time, you would see a dozen combines side-by-side clearing a whole field in one pass. The “small” farmers would co-operate so that all of the harvesting for all of the farms were completed within a week or so. The harvesting went on all day and all night.

The farmer who were in trouble were poor businessmen and planners. They were like any poorly run business; they failed. They sold out and other farmers or corporations would take over the land. Here in Michigan, it is not uncommon for better run farms to lease the land from farmers who, for one reason or another, could no longer operate their land. Dairy farmers will lease land to grow soybeans and corn as feedstock.

Farmers are used to the ups and downs of the markets and adjust accordingly if they are good businessmen. The smart farmers take on debt judiciously.

But you are correct that some farmers get caught up in the “never will fall” market view and make bad debt decisions. But that’s not unique to farmers: http://fortune.com/2016/05/20/corporate-america-debt/