Reader Arthurian writes in the wake of the 3% growth rate (SAAR) reported for 2017Q3:

Back in January Menzie Chinn said he thought growth in the 3.5-4% range was “unlikely”. I wonder if he is having second thoughts now.

I’m going to show two pictures deploying at most undergraduate statistics to show why I — like most numerically literate people — still think sustained 3.5% growth is unlikely.

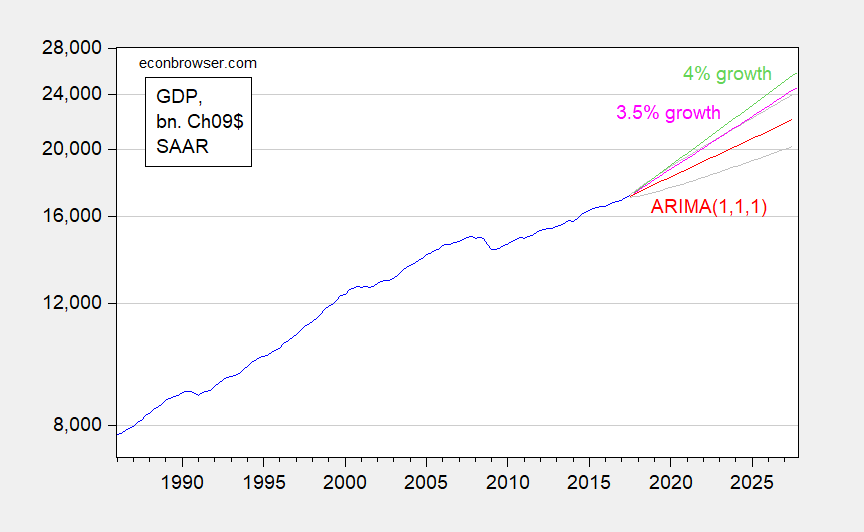

First, consider what a naive statistical model — an ARIMA(1,1,1) estimated over the 1986-2017Q3 period — says, as compared to a 3.5% or 4% growth rate.

Figure 1: Reported GDP (blue), ARIMA(1,1,1) dynamic forecast (red) and 64% prediction interval (gray lines), implied path for 3.5% sustained growth (pink) and for 4% (light green), all billions Ch.2009$ SAAR. Source: BEA 2017Q3 advance release, author’s calculations.

Note that by estimating the regression starting in 1986 when the trend growth rate was relatively high, I am slanting the results toward projecting faster growth. Even then, the 3.5% growth rate is at the uppermost edge of the 64% prediction interval. 4% growth is even more laughable.

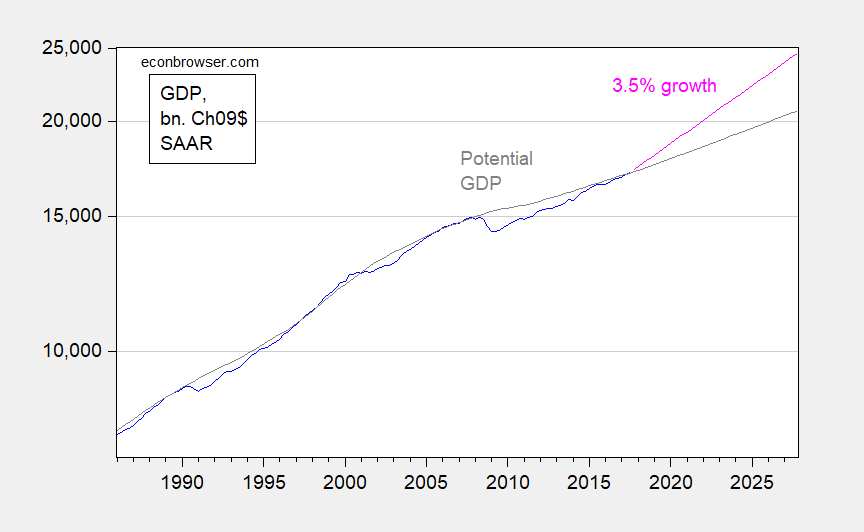

Second, now consider what sustained 3.5% growth implies for the output gap. For that calculation, one needs an estimate of potential GDP; for want of a better measure, I use CBO’s estimate. This is shown in Figure 2.

Figure 2: Reported GDP (blue), implied path for 3.5% sustained growth (pink) and potential GDP (gray), all billions Ch.2009$ SAAR. Source: BEA 2017Q3 advance release, CBO (June 2017), author’s calculations.

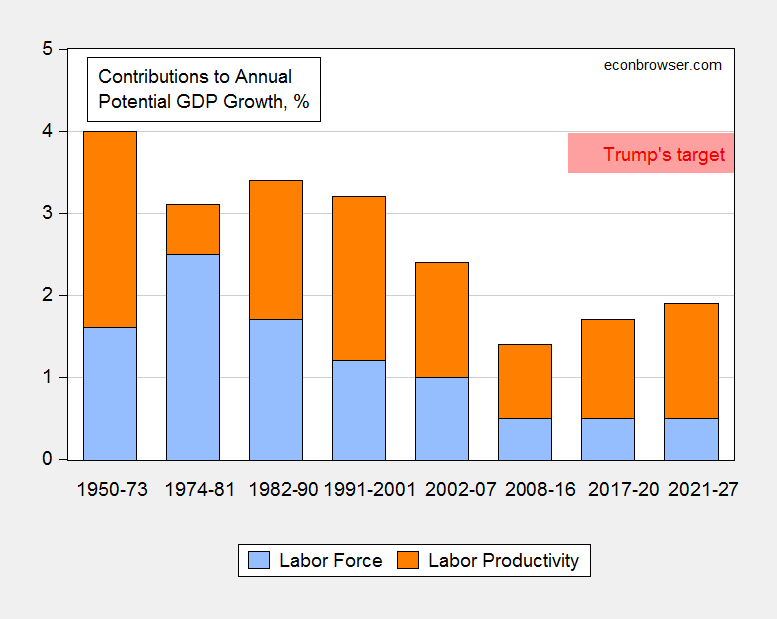

Assuming sustained 3.5% growth, the output gap by end-2019 would be 4.2%, 5.9% by end-2020. Of course, CBO could be terribly misguided about the trajectory of potential GDP. But in order to believe potential GDP can grow at 3.5%, I really do believe that it can only be done by adherence to Spaceology. Refer to Figure 3, reproduced from my January post, and look at what the orange bar — labor productivity — has to do in order to hit 3.5% potential growth.

Figure 3: Contributions to annual growth in potential GDP growth, from labor force augmentation (blue bar), and from labor productivity growth (orange bar). DJT’s target of 3.5-4% shown as pink range. Source: CBO, Budget and Economic Outlook, January 24, 2017, Table 2-3; and Trump-Pence website

Over the long boom, in 1982-07, annualized real GDP growth was 3.37%, with increasing trade deficits, reaching 6% of GDP by the mid-2000s, which subtracted from GDP.

The 1982-00 generational boom had annualized GDP growth of 3.73%.

It’s amazing, we suddenly had sustained annualized GDP growth of only 2.1% in 2009-16, after a severe recession, which implies a stronger rebound, with trade deficits cut to 3% of GDP, particularly given monetary and fiscal policies, along with TARP.

I have often asked what regime we’re in.

There is a case to be made that the comps are 1938-1947. The period starts nine years after the start of the Great Depression (1929) and with the recession after WWII, the low point of the US economy after the war ended. The Great Recession started in 2008, plus nine years is 2017.

The US economy was 80% larger in 1947 than it had been in 1938, and GDP / capita all but doubled from 1939 to 1944. Productivity was increasing by nearly 15% per year.

Now, this growth has been traditionally attributed to the pressures of WWII, and no doubt, the war played an decisive role. However, the increase in GDP stuck after the war.

As we come off a depression — and I would argue that the Great Recession was indeed a crypto depression — then we might see an unexpected catch up in trend as the depression ends, which it is apparently doing in 2017.

The Great Depression ended with a world war, and we may yet end with one here. However, barring that, we may see an echo of the 1938 – 1947 recovery in the next few years. This would argue for better-than-expected GDP growth underpinned by unexpectedly strong productivity growth. Given what we are seeing in oil markets, I am inclined to take the upside.

Unless something fundamentally changes … and I have no idea what that might be … I have to agree with Menzie on this one. After 8 years of “pump priming” and government “alternative energy” and health care programs, we ended up with a meager 2%+ growth rate.

Now, the financial markets are just fine, but that’s subject to change downward. The housing market has recovered pretty well and inflation is low (http://www.usinflationcalculator.com/inflation/current-inflation-rates/). Consumer confidence is high. Yet somehow the measures of growth seem sluggish. U.S. median income has been growing in constant dollars at a modest pace. Unemployment is low. U.S. GDP per capita has been growing, so it’s not a matter of a lot more people pushing up total GDP moderately.

Perhaps a range of 2-3% is the best our economy can do in real terms and that may not be a bad thing. Comparing the U.S. growth to China or India seems faulty. Those countries have moved from their previous third world status using Western technology and cheap labor. U.S. per capita GDP is more than 4 time that of China and 10 times that of India. The U.S. is a “mature” economy; China and India are “evolving”.

If the U.S. has a problem with its economy, it is in the distribution of the economic growth rather than the averages. As manufacturing has become a less significant part of the U.S. economy the income opportunity for the unskilled/less skilled worker has decreased accordingly. The $25/hr assembly line work is now $12/hr service industry work. Automation/productivity has further reduced opportunity in that segment of the population. Abundant supply of new workers in that segment through legal and illegal immigration has tended to suppress wages (http://www.migrationobservatory.ox.ac.uk/resources/briefings/the-labour-market-effects-of-immigration/ … and similar studies).

So, yes, the economy is actually doing fairly well under present conditions, but the devil’s in the details.

There are many millions of unemployed and underemployed able-bodied Americans who could be producing goods & services.

Folks would be well advised to look carefully at the components driving quarterly growth, expect ulterior data revisions and put less stock in hot-off-the-press GDP numbers.

Then there is the growth literature that strongly suggests slower real rates of sustainable growth for mature economies like the USA.

Frankly, there are a plethora of arguments to support Menzie’s well chosen numbers.

Figure 3 is an interesting representation of what Dan Gilbert, founder of Quicken Loans and Rock Financial, calls the “brain economy”. http://www.detroitnews.com/videos/business/2017/10/11/dan-gilbert-brain-economy/106542000/

Historically, economies have moved from the purely physical (100% labor/barter) toward predominantly virtual/intellectual. That doesn’t mean that labor is unnecessary, but that its overall contribution diminishes as technology supplants physical infrastructure. The U.S. Postal System is a good example of that. Robots on the assembly lines are another. Driverless taxis? Crewless ships? How much cash do you carry now and what percentage of your purchases do you make with cash?

The population is increasing; vehicle sales are rather steady. Why drive when you can have goods and groceries delivered. One truck on the road rather than dozens of cars. Why are shopping malls dying?

The point I get from figure 3 is that physical jobs and facilities are being replaced by the brain economy much as the agricultural economy was replaced by the manufacturing economy. The issue is that the brain economy doesn’t need uneducated/unskilled workers nearly as much as the manufacturing economy. But maybe as the transition pains are mostly in the past, we will see faster growth through the brain economy.

Menz:

I disagree with you on a lot of things (politics, micro versus macro). But I agree that 3.5%+ for a mature economy (along with all the limiters in terms of regulation and transfer payments) is extremely unlikely.

Other than that, I really don’t like the macro econ fetish for predictions and for economic cycles. Think there is really much more to learn and use from even basic micro econ (supply and demand, industry structure, behavior of firms, NPV). Which many people seem unaware of.

Can I suggest people read Justin fox’s column at bloomberg ( or go through Economist’s View blog if you are lazy like I).

you will understand Menzie’s contention much better.

This is really so obvious that I don’t understand the need to repeat it, but yet it appears plenty of folks still don’t get it; e.g., poster Arthurian. We use aggregate demand management tools (i.e., fiscal policies, monetary policies and exchange rates) to raise or lower demand relative to potential output. Too much stimulus and we get inflation. Too much austerity and we get a recession. Duh. Demand management tools are short term only, with only second order effects on long run growth. In order to have sustained real GDP growth in the 3.5% to 4.0% range that follows a balanced growth path, not only would this require nearly flawless demand management, but it would also require an change in the fundamental supply side factors that drive changes in economic growth; viz., either more workers or higher multi-factor productivity (i.e., technology, broadly interpreted). There’s no evidence that the size of the workforce will be increasing over the long run. And with Trump’s anti-immigration positions we’ll be lucky to just tread water on that front. That leaves technology. And here’s where a new paper by Charles Jones, et al., “Are Ideas Getting Harder to Find” (NBER Working paper 23782) ought to be required reading.

http://www.nber.org/papers/w23782

Their argument isn’t that the number of useful ideas is shrinking, but that coming up with new ideas and technology requires evermore intellectual resources. It’s a diminishing returns argument. The low hanging fruit has been picked. There are still plenty of apples on the tree, but those apples will be more difficult to pick. Theeir paper ought to be flashing red (or at least flashing yellow) for those who think we can achieve long run GDP growth rates like those proposed by Trump. It’s a bad bet.

It goes without saying, it’s harder to double the size of a large economy than a small economy. The U.S. economy can have 3.5% annualized real growth, for many years, by employing idle and underemployed resources and through a positive demographic shift (not necessarily more low-skilled immigrants) to raise both the labor force and productivity. Lower income and corporate taxes, along with less regulation, can facilitate growth and create a virtuous cycle.

PeakTrader It goes without saying, it’s harder to double the size of a large economy than a small economy

You might think it goes without saying, but I don’t think it’s at all obvious. China will double its economy long before the US will. And I’m pretty sure that we’ll double our economy before Sudan doubles its economy.

The U.S. economy can have 3.5% annualized real growth, for many years, by employing idle and underemployed resources

You really need to acquaint yourself with modern labor economic theory. There’s this thing called the “efficiency wage” which means that there will always be unemployed resources. Once again you have successfully solved the macroeconomic problem by assuming away the problem. Congratulations. Keep it up and you might earn a position on Trump’s economic team.

through a positive demographic shift (not necessarily more low-skilled immigrants) to raise both the labor force and productivity.

Once again, you just assume away the problem by imagining a positive demographic shift. Please note that Trump is opposed to more immigration, so good luck with that. I have no idea what you mean when you talk about a demographic shift raising the labor force and productivity. Increasing the labor force, ceteris paribus, tends to lower productivity. And Trump’s mercantilist instincts regarding copyright and patent protections is the surest way I know to hurt the spread of technology. Meanwhile, his latest budget and tax plan slams higher education, which is not exactly the preferred strategy for making workers more productive.

Lower income and corporate taxes, along with less regulation, can facilitate growth and create a virtuous cycle.

Lower income taxes that result in $1.5T in additional structural deficits is no way to facilitate growth through capital deepening. And even assuming that you can distinguish harmful regulation from helpful regulation, this doesn’t get around the “convergence” problem. It literally takes generations before those kinds of supply side changes have any significant impact. The empirical literature is pretty clear on this. The convergence rates have been studied across all developed economies and those parameter values come close to the status of a natural law. Massive deregulation today (of only bad regulations) would help the economy…but not for another 20-40 years. Yes, the convergence rates are that low.

It’s amazing how you keep pretending that Trump is someone who he clearly is not. Trump wants to deregulate much of the economy….but in just about every case he wants to deregulate the very things that are helpful all the while he wants to introduce new regulations that would be especially harmful to the economy. And yet you continue to fantasize that Trump is this economic genius. He isn’t. He’s just a senile, old moron with some impulse control issues.

2slugbaits, China has a smaller economy than the U.S., and Sudan may not be trying to double its economy or promoting growth.

When idle and underemployed labor is absorbed, wages will rise faster, and higher wages will bring more people in the labor force, etc..

There’s abundant low-skilled labor. Why import more? Many Americans 55 and older are working longer. The children of the Baby-Boomers will be entering the labor force to raise productivity.

Lower income taxes will make work more attractive. Lower corporate taxes and less regulation will promote investment, including business start-ups and expansions.

I should say the children of the Baby-Boomers will be entering prime-age – 35-54.