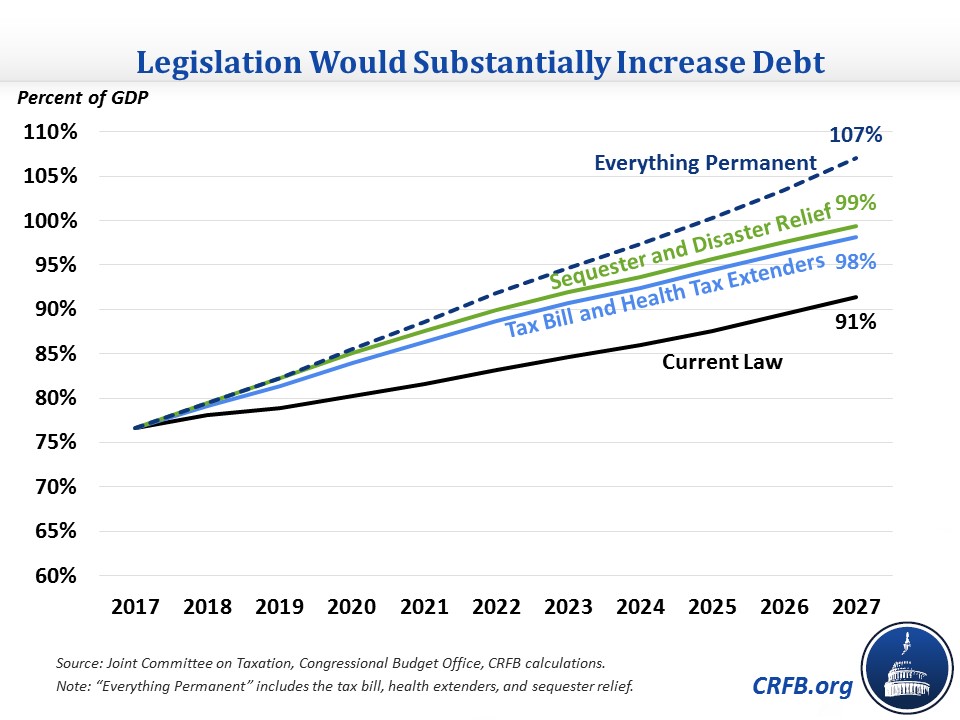

(Some) defenders of the Tax Cuts and Jobs Act as passed argue that tax cuts for households will be extended, rather than disappearing by 2027. What does that mean for debt?

Source: CRFB. Note: Differs from gross debt by netting out intra-Federal government holdings.

CRFB estimates FY2019 deficits will be $1.1 trillion.

Fortunately, the President has stated he will not sign a tax bill that he believes will increase the budget deficit.

Menzie. Tut, tut.

Did not the Treasury secretary say these tax cuts would be self financing. How could debt increase if this is the case?

Of course evidence for this must surely come from the tax cuts instigated by Messrs Reagan and Bush. no increase there surely

Reagan tripled the debt. What were the consequences?

By 2016, federal spending was 483% higher and the national debt was 20 times greater than when Pres. Reagan took office in 1981. The debt-to-GDP ratio, which had been 31% in 1981, increased to 105% in 2016. https://fred.stlouisfed.org/series/GFDEGDQ188S#0

The result: Real GDP gained 159% and jobs increased by more than 54 million since 1981.

We had our worst inflation of the past 60 years during the decade 1973-1982 when the debt-to-GDP ratio was always less than 35%. Today, it has been over 100% for the past 5 years, but inflation is less than 2%.

“By 2016, federal spending was 483% higher and the national debt was 20 times greater than when Pres. Reagan took office in 1981. ”

This again? Nominal GDP was over 6 times what it was in 1981. A lot of your 483% has to do with a higher price level. Population in 2016 was higher than it was in 1981. Mean real income per capita was higher.

You know all of this and yet you still make this comparisons? C’mon man.

The point is the stimulative effect of deficit spending and the absence of negative effects therefrom. The fact is that the debt increased 20 fold but that increase had no adverse effect on inflation which fell from 10.4% in 1981 to 1.3% in 2016.

https://fred.stlouisfed.org/graph/?g=gJ4#0

Likewise, interest on the debt as a percent of GDP fell from 2.1% in 1981 to 1.3% in 2016. Most important, 54 million more jobs is exactly what Keynes would have regarded as successful policy.

In the absence of a counterfactual, there is not much evidence to support your claim of an absence of negative effects. You cannot know what would have happened in a lower debt environment. A bit too absolute to be credible, in any case.

There is also reason to think that debt dynamics will be different in the future than they have been until now. Demographics and slower growth both create risks that debt will be a bigger problem in the future in the U.S. than the in the past.

@Macroduck

“Demographics and slower growth both create risks that debt will be a bigger problem in the future in the U.S. than the in the past.”

Good points. Trump’s anti-immigration policies are definitely going to impede the economy which, combined with lower productivity, could result in slower growth. As usual, the government’s incentives are wrong and that could produce adverse results.

But the debt itself is not the problem. Rather, the problem is adverse policies that economists have not addressed in a meaningful way. We are being guided and governed by fools.

If this increase in the debt/GDP ratio were driven by a progressive agenda, we would hear Republicans talking about that Reinhart and Rogoff paper. But of course since this is being driven by tax cuts for the rich, the R&R paper will not be mentioned.

ha! I was going to post something like this. In D.C., debt spent on My Projects is good, debt spent on Your Projects is bad. In reality, I think that the R&R was being used to promote austerity. I think that the R&R “debt bad” bloodline have some serious methodological flaws.

Hypocrisy thy name is “Politics.”

The path to 90% debt to GDP is unacceptable. We need faster economic growth and less government spending – not an impossible attainment.

Faster economic growth might be nice but reducing the national savings rate to let the rich consume more will reduce growth. Oh wait – you have the solution – less government spending. But no mention of where it would be cut. I guess you did not notice – Trump wants more defense spending as well as infrastructure spending. The former is a bad idea but hey. The latter is pro-growth.

Of course you might say “entitlement reform” which is nothing but code for slashing Social Security benefits and letting people die from inadequate health care. The true Republican agenda.

The explosion in entitlement spending not only crowds-out other government spending, it will crowd-out economic growth. Yet, some people want it to go on, or spend even more! We need to reduce or take away entitlement benefits to force people to work. Thereby, adding to GDP and raising tax revenue. And, more people will be earning pensions or 401(k)s and employer health care benefits. Then, there will be more government money to help the truly needy.

“The explosion in entitlement spending not only crowds-out other government spending”.

Give us all a break. I would think even Sean Hannity would not be so honest to write such a line. OK – you want granny not to get her Social Security benefits and you’d cut poor kids off from food and health care. We get it.

PeakTrader Since it’s the holiday season I suppose we should tolerate a little magical thinking; but Rudolph, Santa, Frosty and Heat Miser are more real than your comment. You willed the tax cuts while the economy was at or near the top of the business cycle. That means budget deficits will increase. But notice that Menzie and the CRFB didn’t say the tax cuts would push debt to 91% of GDP. The tax cuts and planned extenders add another 16 percentage points to the 91% already baked in the cake. You argued for it. You voted for it. You own it.

not an impossible attainment

Glad you think so. Now, please go to the CRFB website and play with their budget deficit simulator tool. Then get back to us with how you think it’s possible to keep the debt-to-GDP ratio under 90% given the mess that Trump just handed us. And do it without magic asterisks and unicorns. Good luck.

Yes. I think it is hard to argue that a debt ratio of 107% is ‘bad’, but 91% is ‘good’. They are both bad.

Here are a few scenarios of how the numbers could come out:

Scenario 1

– Assumptions: CBO Projected Real GDP Growth Rates 2018-2027, JCT Tax Plan Impacts, No spending cuts

– Budget deficit averages 4.8% of GDP 2018-2027 (6.0% in 2027)

Scenario 2

4% Real GDP Growth 2018-2027, JCT Tax Plan Impacts, No spending cuts

– Budget deficit averages 3.8% of GDP 2018-2027 (3.5% in 2027)

Scenario 3

4% Real GDP Growth 2018-2027, JCT Tax Impacts, -15% cuts to Medicare, Medicaid, other mandatory in 2018

– Budget balance achieved in 2022; Budget surplus of 0.3% of GDP on average 2018-2027

Scenario 5

2.5% Real GDP Growth 2018-2027 (historical average, with a middling recession budgeted for 2021), JCT Tax Impacts, -15% cuts to Medicare, Medicaid, other mandatory in 2018

– Budget balance never achieved; average deficit 2018-2027, -1.5% of GDP on average (-0.8% in 2027)

Of these scenarios, No. 5 is a kind of fiscally optimistic scenario:

– Reasonable growth, much better than since the Great Recession, but not off the charts. A largely predictable recession is included.

– Federal revenues are a bit, but not egregiously, on the high side historical average as percent of GDP

– Massive (-15%), prompt cuts to Medicaid, Medicare, and Other Mandatory, with decent fiscal discipline thereafter

Put all these rosy assumptions together, and you don’t balance the budget for another ten years,

You can add my statement above as scenario 4 to reduce debt to GDP towards 50% by the mid-2020s.

There’s nothing like hard work to build character 🙂

are you wiling to take a CUT in YOUR entitlements (medicare and social security) over the next couple of decades to build your own character and contribute to economic growth? please explain your skin in the game.

Of course Peak would say he is entitled to his entitlements whereas the rest of us should just eat cake.

Given many trillions of dollars have been wasted for an economic depression, since 2009, what choice do you have?

You’ve had your fun. Now, let’s get to work 🙂

I was, of course, reserving Scenario 4 for you.

Scenario 4

– 4% Growth 2018-2027

– -15% Cuts to Medicare, Medicaid, Other Mandatory from 2018

– Tax Plan Impacts

Leads to

– Budget balance 2022

– Public debt-to-GDP at 50% in 2025

You need some serious optimism to get there.

I think the entitlement cuts will stumble exactly as Reagan’s did. OK, you can find Republican votes for tax cuts. Can you get Collins, Murkowski and a few other on board for steep entitlement cuts? History says no.

That’s exactly why you want to align the incentives first.

In 1929, the debt-to-GDP ratio was 16%.

Over the past 60 years, whenever we have started paying off the federal debt, the result has always been a recession shortly thereafter because demand and money are both being drained from the economy and therefore profit margins of companies must fall if consumption does not increase to replace the lost government spending. The U.S. economy has never been harmed by increasing the federal debt, but it has been harmed by paying it off many times.

During the 1920s, there was a budget surplus every year and 4 separate recessions during that decade with the last one resulting in the Great Depression. Everyone understood at the time that those surpluses were a major cause of the Great Depression, but we have forgotten their wisdom.

For the past 5 years, our debt-to-GDP ratio has been over 100% with no recessions, but with steadily rising employment, falling unemployment, rising wages and the lowest inflation of the past 50 years. We should have learned the lessons Keynes taught us 80 years ago, but we are not willing to learn and so budget deficits have become a political obsession.

https://fred.stlouisfed.org/series/LES1252881600Q

Are you arguing Menzie is advocating Herbert Hoover fiscal policy? If so – I would say that is unfair. If not – then you comment has no point.

I am arguing that we should think rationally about the debt and deficits instead of politicizing them for our own agendas. We are not on the gold standard anymore and acting like we are serves no purpose. Bitcoin makes more sense than obsessing about deficits. R & R were wrong in their conclusions and we should start from that truth.

“I am arguing that we should think rationally about the debt and deficits instead of politicizing them for our own agendas.”

I agree 100%. Focusing on the government deficit is the wrong metric for many discussions. I would, however, argue that one cannot argue that a tax cut increases investment and long-term growth while at the same time touting how rich people can consume more of our income. Well – I guess Republicans argue this all the time but then when have they ever been honest about the effects of fiscal policy?

The Real Problem of the Trump Tax Cuts

“THE outstanding faults of the economic society in which we live are its failure to provide for full employment and its arbitrary and inequitable distribution of wealth and incomes.” The General Theory, p. 372.

True 80 years ago and just as true today. Economists need to emphasize what Keynes said instead of obsessing about the debt which makes no more sense than obsessing about the gold standard.

Paul Mathis For the past 5 years, our debt-to-GDP ratio has been over 100% with no recessions

You’re referring to the gross public debt, which isn’t particularly relevant here. It’s the debt held by the public (not gross public debt) that matters. The difference between the two represents the contribution to national savings in the form of accrued FICA tax surpluses. It’s a little counter-intuitive because the FICA surplus increases national saving, but it also increases the gross debt.

There’s a time and place for government deficits. Running a deficit to fund capital infrastructure spending can be a good thing if the return from the capital project exceeds the interest rate. Running a cyclical deficit during a deep recession when the economy is at the ZLB also makes sense. But increasing the structural deficit when the economy is well into recovery and near the top of the business cycle makes absolutely no sense. If the deficits are financed with lending from the wealthy, the long run effect will be to transfer income from labor to the rentier class. If the deficits are financed through lending from abroad (as the Trump plan seems to assume), then the long run effect will be an income transfer from labor to foreign capital owners. It’s quite possible that the long run deficits will not affect unemployment, but those deficits will surely affect domestic labor income and GNP (as opposed to GDP). In other words, even if labor’s marginal product increases, labor’s effective purchasing power will fall.

That said, future Presidents will be saddled with the problem of climbing down from Trump’s huge structural deficits (assuming no future recessions!!!). And the path to stabilizing the debt-to-GDP ratio is something that can’t be done quickly, precisely because of the austerity shocks that you mentioned. It’s going to take a couple of generations of responsible governance to undo Trump’s recklessness. But Trump’s base is largely older white guys (like himself) who probably won’t be around when those tough decisions have to be confronted. For the moment they just see the tax cuts as free money.

Lots of assumptions and predictions 2slug, but where are your facts to support your theses?

It is easy to imagine dire consequences from an increase of our debt, but when has our debt ever hurt us? Name the time or admit you are wrong.

Paul Mathis

Plenty of times, beginning right after the Revolutionary War. And again with the War of 1812. And the Civil War. And inflation spiked immediately after the First World War. And inflation was a problem in the 1960s and 1970s when the Fed failed to take away the punch bowl. Remember LBJ’s “guns and butter” or Nixon’s wage and price controls? Or how about the real trade weighted exchange rates as a result of Reagan’s deficits in the early 1980s? Those were all bad things due in large part to overly expansionary fiscal policy. And shouldn’t we look at the histories of other countries, or do you think the US is exceptional? I could go back to the Emperor Diocletian and what happened when he decided debt didn’t matter.

The US is not on the gold standard and we have our own central bank, so there is no risk of outright default…or at least there is no reason why there should be a risk of outright default. But there are other kinds of risks besides outright default risk. If taxpayers are unwilling to vote for taxes, then sooner or later bond holders are going to recognize that deficits must be funded either by foreigners or the central bank. If funded by foreigners, then workers will be poorer. If funded by the central bank, then we risk inflation.

I’ve never been a fan of the R&R paper and its magical 90% threshold. I don’t think debt levels as a percent of GDP are in-and-of-themselves cause for excessive alarm. But rising debt-to-GDP ratios with no expectation of ever getting that ratio under control is a completely different matter. There’s a big difference between a stable 90% debt-to-GDP ratio and an explosive and unstable 70% debt-to-GDP ratio. The latter is a far bigger problem than the former. The Trump tax bill is giving us the latter.

Japan’s debt-to-GDP ratio is more than twice as big as ours, yet Japan’s inflation is 1% and its unemployment is under 3%. Its real interest rates are zero and this has continued for a considerable time.

Nobody really knows what China’s equivalent debt-to-GDP ratio is, but certainly it is huge. China’s growth over the past two decades has been triple ours and China is rapidly overtaking us as the world’s largest economy.

Japan and China are not stupid.

Paul, budget deficits will not be a political obsession for the next few years, since the debt is growing due to republican policies. The obsession will only return once democrats regain some control of government again. Corker is a prime example.

Hopefully, both sides will stop the debt nonsense just as previous generations finally stopped obsessing about the gold standard nonsense.

“The U.S. economy has never been harmed by increasing the federal debt”.

Oh yea that Bush43 boom. He cut taxes for the rich and increased Federal spending as a share of GDP. And we NEVER had a recession under his watch. Oh wait!

Wait, What?

Are you saying that the massive mortgage fraud by Wall Street fraudsters which collapsed the housing market and brought on the financial crisis of 2008-09 was caused by the debt increase under Bush43?

I have never heard that claim made by anyone anywhere and I don’t see the connection or causation, so please explain. And BTW, Bush’s spending as a share of GDP averaged 19.0% while Clinton’s averaged 19.2%.

Wait, What?

Are you saying that the massive mortgage fraud by Wall Street fraudsters which collapsed the housing market and brought on the financial crisis of 2008-09 was caused by the debt increase under Bush43?

I have never heard that claim made by anyone anywhere and I don’t see the connection or causation, so please explain. And BTW, Bush’s spending as a share of GDP averaged 19.0% while Clinton’s averaged 19.2%.

(ceteris paribus)

For those so concerned with the rich not taxed enough, they should be happy with the SALT deduction limit. There are many affluent areas in the country with high income households and they’ll be paying more in taxes. So, that should be good for the income equality crowd.

peak, you make a dishonest argument. most folks are not advocating for a tax increase. most folks are arguing that a tax decrease is not warranted at this time. and that is what the current economic policy is doing. interestingly, the salt tax increase is simply a conservative assault on a particular segment of the wealthy. most likely those that do not donate to the republican party. talk about government picking winners and losers.

Soak the upper middle class so we can reward the 1%. Got it!

The top 1% tend to itemize state, sales, and/or property taxes to reduce federal taxes.

However, I heard 80% of them end up paying the (higher) Alternative Minimum Tax.

And, does Baffling believe the rich are only democrats?

Paul Mathis Japan has been at the ZLB for a long time with no real prospect of relief. That means the cost of running up debt is not a problem…at least as long as Japanese households are willing to buy sovereign bonds at zero interest. And since Japan is at the ZLB and the various QE experiments have been a disappointment, they really don’t have much choice. Fiscal policy is the only tool available. The US is not at the ZLB and interest rates are rising and the economy is near the top of the business cycle. We’re not looking at an immediate problem, but there is a high risk of the Fed having to raise interest rates in order to cool down the economy due to unhinged fiscal stimulus. We could luck out with a spike in productivity, in which case the large deficits might not be as much of a problem; but counting on productivity to spike is not a bet I would want to take.

“the economy is near the top of the business cycle.” Really?

Prime Age Labor Force Participation Rate is well below its pre-recession peak and has increased less than one percentage point over the past 2 years. https://fred.stlouisfed.org/series/LNS11300060

Core PCE Inflation is well under the Fed’s 2% target. https://fred.stlouisfed.org/series/BPCCRO1Q156NBEA#0

Real average hourly wages have decreased for the past 4 months and are up a whopping 0.2% over November 2016. https://www.bls.gov/news.release/pdf/realer.pdf

So the economy is over-heating and needs to cool down, huh?

Paul Mathis So the economy is over-heating and needs to cool down, huh?

We’re not talking about what the economy is doing right now. The concern is what the economy will be doing 10 years out when the debt-to-GDP ratio will be at 107%. Or do you believe that interest rates will always be less than the growth rate? Do you think it will be easier to make interest payments after Trump and the GOP pushed through a large tax cut? Do you understand that in terms of how the debt affects workers it’s really the ratio of interest payments to Net National Product. “Net” because that’s what is available for consumption and new investment. “National” rather than “Domestic” because it accounts for the outflow of payments to foreigners, which will be a major problem if the Trump deficits are financed from overseas. And the debt-to-GDP ratio is a good harbinger of what to expect in terms of interest payments to NNP.

“Prime Age Labor Force Participation Rate is well below its pre-recession peak” . Maybe it’s because “Real average hourly wages have decreased”. See my point? If you want to increase labor force participation rates, then you’ll have to increase wages. But if you increase wages, then you probably shouldn’t pretend that core PCE will stay under 2%. Push on one variable and you affect other variables.

Perhaps one reason is because

Lots of conjecture 2slug, but no facts and no proof to back it up. The economy is not overheating and you have no crystal ball to see out 10 years from now.

Real hourly wages have decreased because there is no labor shortage vis-a-vis the available skill set. If you really want to change the economy in a positive direction, you would be talking about the need for skills training and education instead of hypothesizing about the debt increase implications.

Your debt obsession is just like the gold standard obsession of previous generations. Get over it just as they did.

Japan’s problem is collapsing population. You can’t solve that with either fiscal stimuls or monetary policy.

Japan’s productivity growth per worker has not been bad. The problem is that the number of workers is dropping fast. As a result, productivity gains are being offset by a declining workforce, with the net effect that Japan’s economy is likely to be no bigger in 2050 than it was in 2010.

On the other hand, if the economy is not growing and the demand for real estate is falling year after year, how exactly does one maintain meaningfully positive interest rates? If the house I buy today will be worth less every following year, what interest rate would I need to actually buy a piece of property? Thus, a collapse of population appears to correlate with a collapse of the interest rate.

However, many economists have advised the Japanese to use fiscal policy to jump start the economy, and the Japanese have run sizeable deficits for years, without effect. The country was able to do this because interest rates have converged with zero. This then puts us into Paul’s world, where interest expense doesn’t matter and the government can borrow until people simply won’t lend them anymore money.

And that’s fine, as long as there is no refinancing risk and interest rates stay at zero forever. If either of those conditions prove untrue, then the government is really cooked. With a declining workforce, it cannot grow its way out of debt. And the same declining workforce has to face rising tax rates year after year just to hold government revenues steady, so it’s hard to solve a problem with a tax increase.

Therefore, any bump in the road will have to be solved with either 1) one-for-one spending cuts, or 2) a round of hyper-inflation. Any country which has allowed itself to be trapped in such a situation rightly deserves to be called a banana republic.

Was the “government really cooked” when Reagan tripled the debt?

There was a huge refinancing risk with interest rates on long term bonds in double digits from 1979 to 1985. Interest on the debt as a percent of GDP was more than double what it is today from 1984 through 1998. The worst thing that happened was a minor recession in 1991.

Meanwhile, inflation fell from 13.5% in 1980 to 1.9% in 1986, even as real GDP growth accelerated from 0.1% in 1980 to 3% in 1986.

You’ve got no facts to back up your speculations Steve.

Historically, Paul, the constraint on government borrowing was interest expense. This was true in the Reagan years as well, when 3 mo T-bill rates never fell below 5%, and were as high as 13%. More recently, rates have hovered near 0%. In this latter case, interest expense is materially meaningless: investors are willing to give you their money for free, in terms of interest.

In the case of Japan, low interest rates encouraged the government to vastly increase borrowing to levels not feasible at, say, 4% interest. At a 200% debt to GDP ratio, almost 8% of GDP would have to go to interest payments alone. That’s really not feasible. However, at zero interest rates, the government could in theory borrow 1000% of GDP without any fiscal consequence at all. Thus, at or near a zero interest rate level, there is a huge incentive — a huge political incentive — to address policy problems with vastly increased borrowing. This is exactly what the Republicans are doing on a hefty structural deficit inherited from the Democrats. (This argues against Ricardian equivalence, by the way.)

This latter strategy is bounded by interest rates or refinancing risk only on a contingent basis. If interest rates never rise materially and investors are forever willing to extend increasing amounts of credit to the government, then in principle, the government could run cost-free deficits forever. Do you think that is likely? I don’t.

As for Reagan: Debt held by the public increased from 30% to 38% of GDP under his administration. Neither level is particularly high. The current level, 77%, is already high by traditional measures of prudence. Raising it to 107% of GDP makes matters that much worse. Thus, not only the increase, but the amount of debt as a share of GDP makes a big difference.

I think the Reagan administrations can be rightly blamed for the whole ‘deficits don’t matter’ mentality which has infected US political thinking since then (excepting the Clinton administration). During the Clinton administration, spending was cut, revenues were increased, and the federal budget was in surplus. The country saw its best few years for economic growth in the last 50 during Clinton’s second term. This leaves in me the impression that deficits do, in fact, matter.

The Clinton surpluses produced the recession of 2001. Money and demand was being drained from the economy which, as any Keynesian would tell you, results in recession.

We have been running large deficits for the past 9 years — far above previous years — and the result has been no recession or inflation with low unemployment. Clinton’s second term ended in a stock market collapse in 2000 and recession in 2001. Not exactly good times.

Steven Kopits

We agree. Japan’s underlying problem is depopulation. As I told Paul Mathis, Japan is a special case. In fact, there’s nice VoxEu article on this:

http://voxeu.org/article/why-japan-s-debt-hasn-t-wreaked-havoc-yet

As long as interest rates remain low, Japan’s high debt-to-GDP ratio isn’t an immediate concern. But eventually Japanese households will tire of saving at a zero interest rates. Japan’s problems will hit when they have to roll over existing debt at a high rate of interest and a small workforce paying taxes. One way to think of it is that as long as Japanese households are willing to lend to the government at zero interest, it’s not really any different than paying a direct tax. It’s the difference between telling someone they must hand over so many yen and asking them if they wouldn’t mind please handing over so many yen.

Is China a “special case” too?

China supposedly has massive debt problems but it has been growing at more than triple our rate for the past 20 years. China has no problem financing its debt and neither do we.

Debt phobia is nonsense.

China is your example of a nation with a debt problem? I guess you are unaware how much their national savings has exceeded their investment. Their debt problem I presume is that they hold so much of our government bonds.

@pgl

China’s debt problem is centered on its state-owned enterprises, as I a sure you know. To assert that China does not have a debt problem is disingenuous.

China has pursued strong Keynesian infrastructure policy while we have let our nation fall to ruin thanks to the debt paranoiacs

PeakTrader Yesterday morning you said: The path to 90% debt to GDP is unacceptable. We need faster economic growth and less government spending – not an impossible attainment.

If it was so easy to find a path to faster economic growth and less government spending I challenged you to put up or shut up using the CRFB deficit tool. You’ve had plenty of time to come up with an answer. Based on your non-response I can only conclude that perhaps it is an improbably attainment. Remember, magic asterisks and unicorns don’t count.

2slugbaits, I’ve explained before, we need to limit federal spending to 18% of GDP, except in recessions, which matches the historical average of federal tax revenue. The spending is unsustainable and builds-up interest on the national debt, to create a vicious cycle (actually, there should be budget surpluses to make up for deficit spending in recessions). We need pro economic growth and wiser spending policies within budget constraints. You want more spending and regulation? Then, we need to grow the economy.

The CBO states:

“The large amount of federal borrowing would draw money away from private investment in productive capital in the long term, because the portion of people’s savings used to buy government securities would not be available to finance private investment. The result would be a smaller stock of capital and lower output and income than would otherwise be the case, all else being equal,” the report said.”

So this tax cut for the rich will crowd out investment. What most of us said from the start.

Obviously, you missed the “all else being equal” part.

PeakTrader You still haven’t answered the challenge. All we get is more magic asterisks and unicorns. Tell us EXACTLY which programs you think should be cut and by how much. The CRFB tool will let you do that. As to the rest of your post…

(1) The Trump tax cuts lower revenues, so even if you want to keep spending at 18% the Trump tax cuts make the deficit problem worse, not better.

(2) As a percent of GDP, less than half of the total federal revenue comes from income taxes. And the corporate tax rate contribution is small and has been drifting down for quite awhile.

(3) Social insurance revenues account for about a third of total federal revenues. That’s been pretty steady, but will drift down in the future as boomers retire.

(4) As boomers retire and FICA revenues fall off (as a percentage of GDP), then income and corporate taxes will have to increase in order to pay the interest that the FICA trust bonds have been accumulating. Or are you suggesting that the government should default on those bond payments???

This comment is a howler: there should be budget surpluses

And somehow the Trump tax cuts will lead to budget surpluses??? Are you nuts? Are you one of Greg Mankiw’s “cranks and charlatans”?

We need pro economic growth and wiser spending policies

So subsidies to Alaska cruise lines is your idea wise spending? Do you think a “conservation easement” provision designed as a tax break for Trump’s golf courses is an example of wise tax policy? Did you read the garbage that the K-Street lobbyists hung on the thousand page tax bill? Sheesh.

So I guess we’re still waiting for you specific plans (as opposed to bumper sticker slogans).

He has been asked this many times. And never a real reply.

2slugbaits, I would promote work through less entitlement spending. For example, Social Security benefits starting at 68 with a minimum $1,500 a month and freezing any cost of living increases for several years, if individuals are expected to receive over $2,000 a month. Require only catastrophic employer health care insurance and allow savings accounts for all other health care needs. So, consumers can shop around to reduce costs. Tighten eligibility for food stamps or limit it for two months (children living in parent’s basement are no longer eligible). Now, tell me, how much will that add to GDP and tax revenue, and reduce government spending?

And, your calculator makes no sense. The changes in Social Security (although limited in you calculator) reduce the debt little. Yet, Social Security is the biggest spending item. Providing Social Security at 68 will remove the disincentive to work at 62, and Medicare eligibility will be 68 instead of 65 (employer health care and savings accounts will offset much of Medicare, along with reducing healthcare costs).

I personally would do away with the retirement age entirely. You can retire anytime, and your social security will be adjusted accordingly on a contribution basis paying in and an actuarial basis paying out.

I think I would also vest SS beyond a certain age, for example, 72 years old. After that point, for example, you would receive a pay-out whether you work or not. I haven’t worked through the numbers, but there is a number that makes sense. The intent would be to mitigate the use-it-or-lose-it nature of SS.

This is again conservative policy to my mind, ie, actively opposing age discrimination, actively seeking to adjust the workplace to the needs of seniors, and actively encouraging those who can work, to work.

The way I see the numbers, Social Security can be managed without requiring cuts.

There is a huge amount of constructive, conservative policy to be done–but it’s not necessarily the tried dogma we hear day after day.

Let me take a crack on Peak’s behalf:

(1) The Trump tax cuts lower revenues, so even if you want to keep spending at 18% the Trump tax cuts make the deficit problem worse, not better.

The tax cuts, coupled with mooted Republican spending increases, based on the latest JCT numbers, suggests deficits in the trillion dollar range for 2019-2020. I think the Kansas Scenario is entirely possible in that time frame.

(2) As a percent of GDP, less than half of the total federal revenue comes from income taxes. And the corporate tax rate contribution is small and has been drifting down for quite awhile.

Corporate income taxes have ranged from 1.4% to 2.2% of GDP since 1983. They are currently around 1.6% of GDP.

Personal income taxes are around 47% of total tax revenues. CBO sees this consistently above 50% (as high as 53%). CBO’s projections are entirely unrealistic based on the historical record.

(3) Social insurance revenues account for about a third of total federal revenues. That’s been pretty steady, but will drift down in the future as boomers retire.

Actually, CBO sees the various payroll taxes rising at 3.5% / year to 2027. This contrasts with an NGDP growth rate of 3.9%. As a share of GDP, payroll taxes move in a tight range of 5.9-6.1% of GDP, and this does not materially change over the outlook.

The payroll tax revenue forecast must be understood as principally political. The yawning gap between payroll taxes and mandatory spending makes it reasonably clear that a massive increase in payroll taxes, specifically the health insurance component, is in the works. Based on what I see, health related payroll taxes are currently 2.9% of an individual’s income; this is likely to rise to around 10% of income, ie, largely equivalent of social security contributions which I see at 10.6% of income.

The CBO, of course, doesn’t want to show this (instead, it puts the pressure unrealistically on income taxes), because it would freak out the voters, and neither the Republicans nor Democrats want to talk about what is likely in store.

Republicans are forcing CBO and JCT to provide “dynamic scoring” on their growth forecasts. Traditionally they only do static analysis because dynamic scoring is subject to all sorts of gaming.

But from what I can tell, they have not done “dynamic tax avoidance” calculations. They compute the projected deficits assuming the mix of corporations and pass-throughs in the present economy. But as we have seen in Kansas, distortionary tax laws cause radical shifts as individuals and businesses restructure to take advantage of tax avoidance schemes. The radical tax distinctions between different types of income provides huge incentives to restructure income to more favorable low tax rates.

Neglecting these dynamic tax avoidance shifts means that the revenue shortfalls could be significantly greater than projected and deficit costs significantly higher than $1 trillion. But even if the aggregate difference is not that significant, for the motivated wealthy few, the resulting increased inequality should be dramatic.

Good point since this tax “reform” make the tax code more complicated not less. The “base erosion” provisions are a joke. Tax attorneys are already gaming this for their client.

Once again Steven Kopits opines on a subject he knows nothing about.

First: “I personally would do away with the retirement age entirely. You can retire anytime, and your social security will be adjusted accordingly on a contribution basis paying in and an actuarial basis paying out.”

Social Security already does this. You can retire at any age between 62 and 70.5 and receive an actuarially adjusted benefit. There is nothing special about retiring at the so-called “full retirement age” of 66.

Second: “I think I would also vest SS beyond a certain age, for example, 72 years old. After that point, for example, you would receive a pay-out whether you work or not.”

Social Security already does this except the maximum age is 70.5.

Note that when you stop working has nothing to do with when you collect Social Security benefits. You can collect benefits anywhere between 62 and 70.5 whether you are working or not. However, working and collecting benefits at the same time can have disadvantageous tax implications.

It is astounding the occasions that Steven thinks himself the smartest person in the world who has just bestowed on us his great wisdom, when it turns out that almost everyone else knew these things decades ago.

I stand by what I said.

Social Security still refers to a ‘Full Retirement Age’, which is currently 66. I said do away with a retirement age entirely. Furthermore, the penalties for early retirement, even by a couple of years, is stiff, so one is largely driven to the FRA.

Second, Social Security states that “a person can receive his or her largest benefit by retiring at age 70.” The max benefit for retiring at 70 for my age cohort is a premium of 24% over ordinary benefits, that is, a maximum of an incremental $7,600 / year at the current scale.

If you live in California and earn $80,000, then your taxes (state and fed) are about $24,000. If your work the four years from 66 to 70, that’s about $100,000 in taxes that a retired person would not have paid. You may received full social security benefits, but there may be withholding, and that social security income will be taxed at your highest marginal rate, so that’s another $30,000 or so.

And then, you may work past 70. My grandfather retired from full time work at 84. In the current system, you get no credit for time worked above 70.

And, finally, there is no vesting beyond survivor benefits. If you retire at 70 and die at 72, your estate won’t receive any incremental benefit for those four years you worked between 66 and 70.

So I stand by what I said.

1. Do away with the retirement age entirely. Employers still tend to treat 65 as a retirement age, and that still is a result of the picture that Social Security creates. Even if you slide that number up, Social Security still thinks you’re old at 70 and should be retired.

2. You should receive credit for working past 70, and some of that should be owed to your estate if you die early.

3. We need to be clear that the issue is not just Social Security, but the entire GDP an older worker creates. The opportunity cost to society of retirement is not just tax revenues, but the entire economic activity of the older worker.

Kopits: “Furthermore, the penalties for early retirement, even by a couple of years, is stiff, so one is largely driven to the FRA.”

No it isn’t. It is an actuarial adjustment, exactly as you called for in your original statement. Acuarially, the person collecting at 62 receives the same benefit as the person collecting at 66. That’s what actuarial adjustment means.

Kopits: “The max benefit for retiring at 70 for my age cohort is a premium of 24% over ordinary benefits.”

It’s an actuarial adjustment. Exactly as you called for in your original statement.

Kopits: “And, finally, there is no vesting beyond survivor benefits. If you retire at 70 and die at 72, your estate won’t receive any incremental benefit for those four years you worked between 66 and 70.”

Surviving spouses (and children under 18) receive 100% of the worker’s benefits for life. Do you have any idea how annuities work? It’s not like a 401(k) plan. An annuity has a higher payout than a 401(k) when you are alive because benefits cease when you and your eligible survivors die. This is the reason that most economists recommend converting at least some of your 401(k) to an annuity at retirement. Where are you going to get the trillions of dollars for you “vested” inheritances?

Apparently Kopits is opposed to people making rational choices based on their own circumstances. 37% of workers choose to retire at the earliest Social Security benefit age of 62. Only 1% work past 70. Apparently the nominal “full retirement age” is irrelevant to that decision. Presumably they are tired of working crappy jobs at crappy wages for crappy bosses. Their bodies are broken.

Sure privileged folks like Kopits can “work” past 70 because they do nothing all day but sit at their keyboards typing out a few words of inane comments a day. One could even make an argument that the world would be a better place if they would just retire and spare us their worthless pontifications.

I understand the actuarial adjustments from 62-70; however, there are no adjustments outside either boundary. The penalty for early retirement is still pretty stiff, even if actuarially correct.

The central challenge on the federal spending side in the next 13 years will be the retirement of 25 million baby boomers, and their impact on fiscal balance and taxation. That’s what we have been discussing here, with differing views on the policies associated with growth, taxation, and entitlements.

I believe our society is going to struggle to finance a large cadre of people who are retired for 20-25 years of their lives. Moreover, the economic difference between someone who is of retirement age but working, and another who is out of the workforce, is substantial. As a fiscal conservative, I want to encourage those who can or want to work, to do so.

To that end:

1. Social Security should stop being the primary proponent of age discrimination. If Social Security puts out a ‘Full Retirement Age’ or an age of any sort, private employers take their cues accordingly. It creates an expectation. It suggests that companies should not hire people from the mid-50s, because they will retire in just a few years. If you get rid of the retirement age, this factor is lessened.

2. Older employees are not entirely like younger ones. They are more reliable, but they are also less interested in working 100 hour weeks. They want more flexibility in time and place, and I think we need to be re-orienting our hiring and work practices accordingly.

3. I personally think the President should be leading on this. He should be saying something like this:

“If you’re thinking of retirement, our congratulations. But if you like to work and want to continue working, we want to encourage you. Twenty-five years is a long time to be retired. You might want to spend some of that time constructively employed.

“And employers, you will soon be facing an environment when retiring employees are increasingly difficult to replace. Hold on to your people, but understand that older workers may well value time and flexibility more than money. So you’re going to have to adapt and change the way you work. The good news is that you’ll be able to get high quality employees at a quite reasonable price. But you’re going to have to make room for a more mature culture. You need to adapt.

“For our part, Social Security is going to stop using the concept of ‘retirement age’ completely. Retire whenever you want, keeping in mind that your payouts will change accordingly. And if you work past 68, we want you to vest your benefits. The longer you work, the greater the benefits. Extra benefits. We know that your working is more than just saving us social security payouts. It means in addition your taxes, and the entire benefit of your labors to our economy and society. And if you work, that gives the government the ability to provide better support to retirees who are unable work or want to spend their late years enjoying life free of the cares of the workplace.

“The US will see 25 million baby boomers hit 65 from now to 2030. We need to find a way to use the experience and talents of this group to our greatest ability. If you are inclined to work, work. But the biggest lesson is for employers: You’re going to have to change your thinking, your culture, and your expectations. Two generations ago, we made room for women in the workplace. Over the next decade, business needs to make room for seniors. That’s both your opportunity and your obligation. Get to it. We will be there to support you.”

That’s what I’d like to hear.

Sheesh, Kopits still doesn’t understand how Social Security works. He thinks that working longer and paying higher benefits somehow saves money. But if you work longer and delay collecting benefits, you later collect bigger benefits that are actuarially the same as if you collected benefits earlier. You still don’t seem to get it. It doesn’t cost the government any more in benefits if you retire at 62 or 70. In aggregate the government pays the same the same amount. How many times does this have to be explained to you?

And he says that employers will want to keep older employees because they will be cheaper. Perhaps Kopits doesn’t realize how labor markets work. If you want to keep people from quitting, you pay them more not less.

And this silly obsession with the “full retirement age.” Kopits must think employers and employees are quite stupid if they are so heavily influenced by this arbitrary age. In fact, they aren’t stupid and we know this because the majority of workers retire before the “full retirement age”. And employers stop promoting and giving raises to employees well before the “full retirement age.”

And this idea of “vested benefits”. You don’t seem to understand how annuities work. If you are going to give “vested benefits” to heirs, you are going to have to come up with trillions of extra dollars. Funny that so-called “fiscal conservatives” just wave their hands about spending and revenues.

Instead of focusing on seniors you should be focusing on the declining participation of prime age workers 25 to 54. Why isn’t the Trump MAGA economy creating better jobs at higher wages to attract prime age workers into the workforce?

Sheesh, Kopits still doesn’t understand how Social Security works. He thinks that working longer and paying higher benefits somehow saves money.

Yes, I do. First, best I can tell, the actuarial equivalence does not include Social Security taxes paid during years in which the individual is eligible for payouts. The total payouts are actuarially equivalent, but exclude additional social security taxes paid during the post-retirement period.

Second, from the government’s perspective, social security is not the only source of tax revenue, and further, the contribution of the individual to GDP also matters.

But if you work longer and delay collecting benefits, you later collect bigger benefits that are actuarially the same as if you collected benefits earlier.

You max out benefits at 70.

And he says that employers will want to keep older employees because they will be cheaper.

I am saying that the labor-leisure trade-off is different for older workers in many cases. Older workers may therefore be willing to take a lower hourly rate for greater flexibility in hours. Absolutely. This is essentially the same argument as for women with young children. Many will take a lower wage for regular hours and limited travel requirements. Same deal with older folks, but a different motivation.

And this silly obsession with the “full retirement age.” Kopits must think employers and employees are quite stupid if they are so heavily influenced by this arbitrary age.

In my experience, many employers are heavily influenced by public policy. You bet. If the government says you should be retired at 65, many employers will take their cues accordingly.

To wit: Employment to population ratios for 65+ year old workers vary enormously across the OECD. In France, it’s 2.8%; Germany, 6.6%; the US, 18.6%; Japan, 22.3%; Korea, 31%; and Iceland, 41%. Government policy is utterly decisive in the labor force participation of 65+ year olds.

And this idea of “vested benefits”. You don’t seem to understand how annuities work.

I understand how annuities work. As it stands, if you work to 80, you get no greater SS benefits than if you retire at 70. Further if you work until 70 and die at 72 without a spouse, then the extra social security taxes you paid are lost to your estate. Right now, if you work past 70, you incur the cost of working (SS taxes) and none of the related benefit.

I think that’s wrong.

At a minimum, older workers should be considered in the totality of their taxes as sources of benefit to the government. Further, I think policy should really considered older workers entire contribution to GDP, not only their taxes paid. If an older worker makes $80,000 (to choose an arbitrary number) or is retired and consumes, say, $40,000 in SS and health spending, that’s a big difference.

https://stats.oecd.org/Index.aspx?DataSetCode=LFS_SEXAGE_I_R