Remember when critics wailed about the high cost/per job saved and low multipliers likely under the American Recovery and Reinvestment Act? The same set of people do not seem very bothered at all by the relatively small implied output impact of the TCJA produced by any of the reasonable modelers.

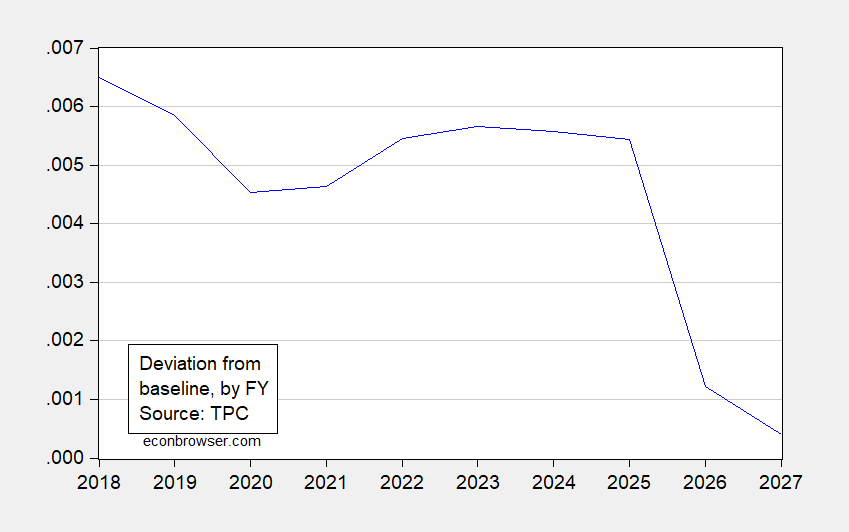

First consider the implied deviation from baseline, using the Penn Wharton Budget Model as implemented by the Tax Policy Center:

Figure 1: Deviation from baseline for House version Tax Cuts and Jobs Act. Source: TPC.

Note that by 2027, the impact is essentially zero.

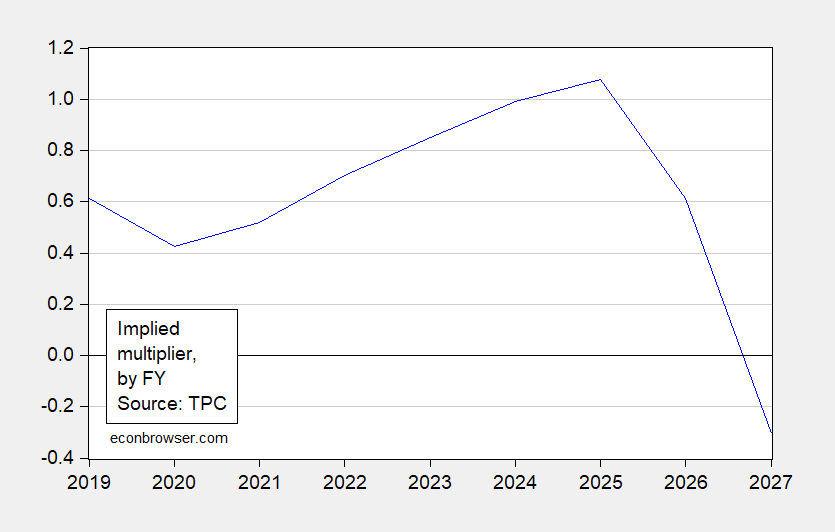

One can calculate the year-by-year implied multiplier — that is the output increase associated with tax cuts by fiscal year. This is shown in Figure 2.

Figure 2: Output deviation by FY year divided by tax revenue reduction by FY year accounting for dynamic effects but not interest costs. Source: TPC.

This calculation doesn’t take into account leads and lags in output impact (after all, in a dynamic model, output changes at time t+k in response to measures at time t should occur). Assuming most of the effects take place within the ten year period under study, then one can calculate an average multiplier – in this case 0.6. Each dollar in tax cuts (taking into account feedback effects) increases output by 0.6 dollars. (One can compare against ranges of standard estimates of multipliers used by CBO here).

Goldman-Sachs (Hatzius, December 10) estimates that the impact of the tax bill is a 0.25 ppt acceleration of GDP growth relative to baseline in 2018 and 2019, then tailing off to zero. News accounts suggest the Fed does not perceive a rapid acceleration in growth in response to the implementation of the tax package either.

The relatively small effect estimated by GS is due in part to the belief that the Fed will offset the stimulative effect given we are near full-employment. An alternative perspective is that there are asymmetries in the supply curve. In any case, the empirical evidence for big effects at or above full employment is limited.

Even if the economy falls into recession (the ten year-three month Treasury spread has fallen by 30 bps in the last seven weeks), this package will be a lousy stimulus package, given its construction (giving big tax breaks to high income households that have low marginal propensity to consume is unlikely to boost consumption and hence aggregate demand substantially.)

By the way, using Tax Foundation’s exuberantly optimistic projections, the cost per job-year created will be about $169,000, if I’ve done my math correctly (as opposed to the example here). Of course, if a more plausible employment effect is 1/10 or so of this (as is the growth rate projected by TPC vs. Tax Foundation), then the cost is about $1.7 million per job.

I’m so old I can remember when our host JDH had his hair on fire warning about the dire effects of a trillion dollar deficit and the cost of the ARRA at the depths of the Great Recession during the Obama administration.

Funny, today when Republicans are passing a dubious $1.5 trillion deficit financed tax cut for the rich when the economy is at its peak, there is radio silence from JDH. That’s pro-cyclical fiscal policy at its worst.

I find it interesting that because states can’t print money whenever they feel the need, they have to have some level of fiscal responsibility. Of course, not all states have the same attitude toward taxes and reserves. Some states are like the ant; other states are like the grasshopper. http://www.pewtrusts.org/en/multimedia/data-visualizations/2014/fiscal-50#ind5

The federal government, however, goes well beyond the grasshopper. It’s more like the drunken sailor at a bar with beautiful women. Let the booze and cash flow now and not a worry about tomorrow. We’re going to borrow ourselves into prosperity… perpetually. Unlike state governments that find themselves restricted by fiscal reality, the federal government figures as long as everyone accepts the newly printed dollars and the ever-increasing debt… well, no harm; no foul. It doesn’t seem to matter if tax revenues increase or decrease because it’s the dollar, after all. Hey we’re not the Greeks. We’ve got dollars.

Yes, this tax cut looks to be no more effective at stimulating the economy as a tax increase would be… because the federal government is going to spend whatever it wants whenever it wants and no one anywhere is going to complain. After all, it’s the federal government, not some state government or corporation where revenues and debt mean something. Besides, the numbers are too large for most people to comprehend.

“I find it interesting that because states can’t print money whenever they feel the need, they have to have some level of fiscal responsibility.”

i take it by your comment, you believe the state and federal governments should have a balanced budget requirement, and may not use debt to fund the government? or do you mean only issue debt to fund spending of your choice? please clear up what you mean by fiscal responsibility.

It’s fairly obvious… or should be… that the Federal government runs without fiscal accountability. Need money? “Make it so, Number One.”

States have debt obligations which they have to pay on a scheduled basis or all hell breaks loose. Well-run states maintain surpluses in good economic times to smooth out the financial dips in bad economic times. Should there be a “balanced budget amendment”? Should there be “pay as you go”? Well, we don’t have the first, but we do have the second. And… it doesn’t make any difference because the Federal government does whatever it wants regardless.

Sure debt can be authorized and there are plenty of valid reasons for that. However, if debt is authorized to, in effect, simply pay back part of debt already owed, then that’s a shell game. Can you run your business that way indefinitely? Can you run your household that way indefinitely?

“Can you run your household that way indefinitely?”

the economics of a household and a nations economy do not operate on the same set of rules. you fail to acknowledge, or understand, this distinction. a nation that tightens its belt during a recession only exacerbates the recession and produces further contraction. your approach is flawed.

baffling, of course I understand the differences between households and countries… but a country that fails to reduce its debt during economic expansions and then increases its debt during recessions is in a constant state of expanding its debt. Your argument for increasing debt during recessions is valid; your failure to acknowledge that maintaining or expanding debt during expansions is not. Apparently, your philosophy is debt to get us through recessions and more debt to expand programs during growth periods.

bruce hall, i am not advocating growing the debt during a recovery to fuel tax cuts, especially tax cuts for the wealthy. i think we can both agree, if such policy were to be implemented, we should seriously question the motives of such government officials? it does not appear to be warranted by sound economic understanding, do you agree?

From the Tax Policy Center, this section on savings and investment:

‘Largely because the plan would reduce the corporate income tax rate and temporarily allow businesses to expense investment, the legislation would increase the after-tax returns to saving and investment significantly. That would

encourage saving, foreign capital inflows, and investment. Although the legislation would increase incentives to save and invest, it would also substantially increase budget deficits unless offset by spending cuts. Higher deficits would push up interest rates, which would tend to discourage investment. Thus, while the plan would initially increase investment, we estimate that rising interest rates would eventually negate the incentive effects of lower tax rates on capital income and decrease investment below baseline levels in later years.’

So the long-run effect on the capital stock will be to reduce the capital to labor ratio. So how does this increase long-term growth or real wages?

pgl It’s even worse than that. The provision in the GOP bill allows an insane first year write-off for investment. That’s the kind of thing that might make sense if there’s a large output gap and the objective is to stimulate current year aggregate demand. But it makes no sense if the output gap is closed or very small. It’s not just that the resulting deficit will crowd out investment (or appreciate the exchange rate), it’s that it doesn’t increase total investment; it only pulls planned investment forward. Investment in year one might spike, but investment in years two, three, four, etc. will fall.

In principle, an investment write-off is neutral over a five year cycle or so, ie, more expenses up front, correspondingly fewer expenses later.

The problem, however, is that your corporate tax receipts in years 1-3 could entirely collapse, let’s say, from 1.6% of GDP to perhaps 0.6% of GDP. And that goes right to the deficit.

In addition, the pass-through tax rate could reduce personal income taxes as well. So if the tax law is written poorly, it could conceivably put a short term hole of cc 2% of GDP into the budget.

That would bring about the Kansas scenario, of which I have already warned.

The political lesson is increasingly clear, I think. In Alabama, as in NJ and Virginia, the Republicans have lost the suburban, Republican-leaning middle to upper middle class. This tax bill only reinforces the impression of the Republicans as unfit to govern, much the mantel the Democrats wore before Bill Clinton.

I am under the impression that Hill Republicans still believe this plan is a winner, as tax cuts usually are for Republicans. Not this time, though. This bill is chaotic with too many moving pieces and unpredictable outcomes.

I do not support it.

It’s amazing some people believe we closed the output gap, not by raising actual output, but by destroying potential output.

We need to rebuild the economy. Some deregulation, and corporate and income tax cuts, particularly for businesses, is just a start. We also need to reduce the costs of health care and education, along with reducing student loan debt, to raise discretionary income (it’s sad when Ph.Ds work as waiters). Moreover, we need to put people, who are able to work back to work and work full-time, or make work more attractive.

The federal government borrowing from the future not only raises the size of the debt, and therefore interest payments, it raises interest rates, to raise interest payments further and slow economic growth. One good thing about the depression is it keeps interest rates very low.

I guess, some people believe we can tax the rich even more to make up for the borrowing. However, the rich may have other ideas, like tax avoidance through less investment, or moving to Singapore, where tax rates are either very low or non-existent (ex-pats are a large proportion of Singapore’s population and over half of them earn at least $200,000 a year).

You sound like someone who did a mind meld between Bernie Sanders and Paul Ryan. Good luck with the inevitable confusion and headaches.

BTW – a lot of liberal economists have argued that we still have a modest output gap. If we do – transferring income from the poor to the rich is dumb as that would likely reduce consumption demand. A better idea would be a massive public infrastructure investment program.

PeakTrader pgl is right. You do sound like a Bernie Sanders/Paul Ryan mind meld. Hopelessly confused.

One good thing about the depression is it keeps interest rates very low.

Ummm…no. Nominal interest rates might be low, but real interest rates were high during the Great Recession. That’s what the ZLB issue was all about. Try to keep up.

I guess, some people believe we can tax the rich even more to make up for the borrowing.

That would be nice, but we’re not talking about taxing the rich more. The Trump plan taxes the rich less and the poor get taxed more. How about just not changing anyone’s tax rates? There’s an old rule in public finance that those with the least elastic labor supply curve always enjoy an income windfall whenever there’s a change in the tax code. But your comment is especially bizarre given that the reason we’ll have to borrow another $1.5T is precisely to subsidize the rich.

However, the rich may have other ideas,

That’s why God created prisons.

moving to Singapore

Good riddance. Better yet, suggest that they volunteer for Trump’s return to the moon project. But if they leave the country I see no reason why taxpayers should pay to protect their property.

You don’t really respond to the interrelationships and interactions of economic variables in the context of economic models, it’s just value judgments and entirely different subjects. No wonder you find it all “hopelessly confusing.” The depression (weak growth) began when the recession (contraction) ended, resulting in lower real interest rates than otherwise. Taxing and regulating “the rich” or businesses too much has consequences. What’s “bizarre” is your hatred or envy of “the rich,” and you want to lock them up or drive them out of the country. Maybe, you believe poor people should pay the taxes or take the risks starting and expanding businesses – good luck.

“You don’t really respond to the interrelationships and interactions of economic variables in the context of economic models.”

And you do? I have read enough of your right wing spin to realize that you cherry pick in the worst sort of way. Even Lawrence Kudlow is more honest.

Obviously, economics is too right wing for you – try sociology.

Bernie is more honest and you make him look like a capitalist.

hey pgl, don’t you know peak trader is not required to have a coherent economic model to support his ideology? the power of the free market will fix everything-that is the only model (ideology) you need. you think a failed banker who contributed to the financial crisis and then denies his responsibility to the outcome is really worried about accurate economic models?

After a few weeks sitting in the Macro 101 class, Baffling interrupts the instructor:

“What is this? I thought this was economics?”

The instructor says: “What is it you don’t understand?”

Baffling says: “I don’t understand any of it.”

The instructor says: “Come to my office after class to discuss your future (it’s been determined Baffling would do much better as a government bureaucrat enforcing bathroom regulations at restaurants).

Baffling goes to his Money & Central Banking 101 class to take a test. After the test, he’s in the hallway crying, not so much for failing the test than being required to think during the test for a whole hour.

and yet, peak trader, i am still not a failed banker as yourself. do you even have a phd in economics? or did you simply complete your qualifiers and quit-calling it close enough. following your thought processes, i would be surprised if you could actually complete a legitimate dissertation that could actually be defended against experts. at least not from a quality institution.

I helped more individuals and families than you’ll ever know. And, I graduated from a terminal MA program, in economics, that was rated higher and had more classes than the regular MA. Moreover, I passed the comp exams in my two fields of specialty.

And, at the University of Colorado, many of my professors had Ph.Ds from top universities.

peaktrader, just to clarify. you do not have a phd in economics. the masters degree provides you with statements. the doctorate helps you think. this explains a lot in your commentary.

“I helped more individuals and families than you’ll ever know. ”

not a surprising perspective, given your failure to acknowledge your own contribution to the financial crisis.

Baffling, you support my statements on your ignorance of economics. An MA in economics is considered a junior doctorate, unlike an MBA, which is considered an advanced bachelor’s degree. Anyway, you wouldn’t last one semester.

I’ve shown it was government failure, which you’re too much of a rigid ideologue to accept.

PeakTrader: Sorry, who considers a Master’s (especially a terminal master’s) a “junior doctorate”? I don’t think I ever heard that characterization, so I am curious.

Menzie Chinn, can’t recall who said that in school – Isn’t much of a MBA similar to third and fourth year classes, including for Liberal Arts majors?

PeakTrader: Terminal masters are often different than MA associated with PhD progress. Often the level of analysis in a terminal MA program is much lower, from my experience the two places I have taught at (University of California, University of Wisconsin). An MBA class might or might not be like a non-quantitative version of intermediate micro (typically a second year class for an undergrad major in econ) – depends very much on the school.

“An MA in economics is considered a junior doctorate”

ahhh, that is soooo cute peak trader, phd jr. i almost hate to ruin your christmas with this explanation, but here goes. that “junior doctorate” was simply your professors polite way of saying you do not have what it takes to complete a phd program, sorry for taking all your tuition money, so let me give you a little confidence as i push you out the door.

you know enough to be dangerous, but not enough to be competent in your field. that is what your “junior doctorate” achieved for you. but that was a cute story nonetheless, poor thing.

Typically, you get a Ph.D when you want to work in academia, which I didn’t. And, I didn’t want to work in government either. Not all grad econ programs are the same. I completed the program, unlike many of my classmates, some who had extensive undergrad econ. You wouldn’t even be admitted to the program.

Peaktrader, you “completed” the requirements for a masters degree, not a junior doctorate. And the results? You became a failed banker! Further evidence of why you were not invited to continue on with the phd degree. Which explains why your economic understanding on this blog is often questioned by many readers. Just to clarify, completing your “comps” for a masters degree has nothing to do with a phd, even a junior doctorate.

PeakTrader When you’re at the ZLB and inflation is not much higher than zero, the real interest rate facing businesses can be very high. During the depths of the Great Recession most estimates had the market clearing interest rate at ~ negative 5%. That’s a very high effective interest rate. That’s why many economists were arguing for a higher inflation rate.

No one is saying that the rich should be locked up simply because they’re rich; but they should be locked up if they’re lying about their sources of income. And I didn’t say they should be kicked out of the country against their will; I said that if they wanted to leave we should say “good riddance.” And the rich surely shouldn’t expect the rest of us to defend their property rights if the rich aren’t willing to assume the responsibilities of citizenship. I find it amusing that some of the unpatriotic rich who moved their money offshore in order to avoid taxes were the same clowns that criticized football players for kneeling during the anthem. Apparently it’s part of a citizen’s duty to stand rather than kneel, but it’s not part of a citizen’s duty to pay taxes.

Too much taxing and regulation isn’t good; no one disputes that. But too little taxing and regulation isn’t good either. And it’s better to tax monopoly rents at a high rate than it is to tax earned income, just as it’s better to tax the dead rather than the living. The Trump/GOP tax plan is a windfall for unearned and unproductive rents, but heavily taxes earned income. The Trump/GOP tax plan gives a big tax break for the dead and increases taxes on the living.

Brad DeLong takes the Gerald Friedman paper seriously:

http://www.bradford-delong.com/2017/12/notes-on-gerald-friedman.html

He alludes to his new paper which is one way of thinking about what the output gap may be as well as the policy implications.

It is very easy to understand.

Republicans are budget hawks in opposition and don’t worry about deficits in government.

In others they are what we Aussies call complete hypocrites.

Not Trampis: Hard to disagree with that assessment.

Hypocrisy is, of course, a principal-agent problem.

Hypocrisy occurs when an individual shows agent but acts principal. This can occur when

1) the agent is allowed to choose from one than one objective function

2) the individual is neither punished nor rewarded for faithfully fulfilling the role of agent (or not)

3) when there arise other stresses between principal and agent role. For example:

a. when a principal has multiple agency commitments (ie, to country, to party, to constituents)

b. when objective circumstances prevent the agent from fulfilling his role

(i) ie, a big pre-existing deficit,

(ii) other agents have a stake in his failure

A bonus-based system, to beat this dead horse a bit longer:

1) reduces to scope to pick from various objective functions, thereby addressing 1 above

2) rewards a specific behavior, addressing item 2.

3a. Focuses on motivating the principal to drive reconciliation of multiple agency commitments

3b1. Not really addressed. The performance bonus will reduce the deficit, but it does not necessarily govern the pace, save that it gives preference to growth over debt reduction

3b2. Because the bonus is paid to every member of Congress, all members of Congress have a stake in the success of the endeavor (ie, we are splitting the setting of strategy, as embodied in the bonus, from the execution of policy, which is embodied in voting on bills.)

To put it another way, a bonus plan is not just a nice wrinkle on current governance. It fundamentally changes the way the country’s democratic institutions operate,

Re: Ricardian Equivalence, the Trump/GOP Tax Cuts and a Few Inconvenient Questions

Why would forward looking agents permanently increase consumption if the tax bill specifically says that taxes will increase in eight years? Why would forward looking agents permanently increase consumption if they believe GOP promises to “reform” Social Security and Medicare in 2018? Doesn’t that imply that most economic agents will have to increase savings in order to offset future benefit cuts? If you believe in the strong version of Ricardian Equivalence, which so many conservative economists preached in 2009, why would you not expect Ricardian Equivalence to hold in 2018 when the impact on the deficit would be twice as large as the 2009 ARRA?

Ricardian Equivalence may indeed hold for tax cuts for the rich. But then lower income households are liquidity constrained. So it more strongly holds for this new tax cut did it would for ARRA.

Of course the rich might consume these tax cuts if they thought this was more of a permanent change if they thought Republicans will win this Class Warfare.

For those with employed children: good to know they’ll be getting big salary boosts as the tax cuts trickle down through the economy.

And….ok, I’ll stop now.