Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. This is an extended version of a column that appeared at Project Syndicate.

Inequality has been on the rise within the United States and other advanced countries since the 1980s and especially since the turn of the century. The possibility that trade is responsible for the widening gap between the rich and the rest of the population has of course become a major political preoccupation.

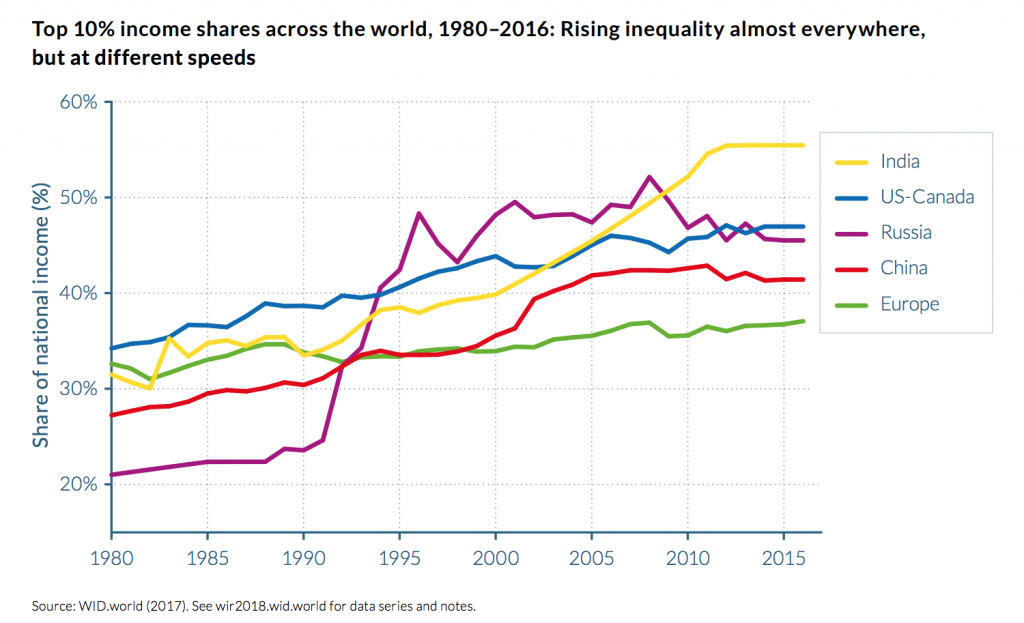

This long-standing debate can be illuminated by the latest international statistics on income distribution brought to us by the World Inequality Report 2018, released recently as the first annual installment of an effort coordinated by renowned researchers Thomas Piketty and Emmanuel Saez. The numbers from the World Inequality Database (WID) reinforce a number of important points.

Inequality within Rich Countries

First, the increase in inequality in the United States — which began in the 1980s and accelerated after the turn of the century – continues, by any measure. Most of GDP gains have gone to the rich. For example, although the share of national income going to the top 1% of the American population was only 11 % in 1980, having declined strongly since the “Roaring ‘20s”, that share had risen back to 20% by 2014. It is far above the slice of the national pie going to the entire bottom half of the population (which is only 13%).

Second, there are qualitatively similar post-1980 trends in such other major countries as Canada, UK, France, and Germany, though not as pronounced as in the US.

Measures of globalization such as the ratio of trade to GDP also began rising rapidly in the 1980s, fueling widespread suspicions that there is a causal connection between the two trends. More on this theory below. But there are reasons to doubt it. One is that the global ratio of trade to GDP, after climbing for 35 years, peaked in 2008 [at 61%] and then fell [to 56% in 2016]. In other words, political fears of globalization have risen to a fever pitch during precisely the same period when the trend has halted.

Many economists have argued that other factors are more important than trade in explaining the fate of the left-behind worker. High on the list of likely explanations for the observed widening gap between skilled and unskilled workers is technological progress that raises the demand for skilled workers relative to unskilled workers, together with a lagging supply of skilled workers coming through the education pipeline. Another possible explanation is the increasingly winner-take-all nature of many professions.

Four Waves of Trade Theory, over 2 Centuries

When I first started studying economics in the 1970s, the reigning theory of international trade was the neoclassical Heckscher-Ohlin-Stolper-Samuelson model (HO-SS). It emphasized the distinction between workers and those who possess physical or financial capital and/or human capital (e.g., a college education, or “skills”, for short). The HO-SS theory contained the prediction that international trade would benefit the abundant factor of production, which in rich countries meant the owners of capital, and would hurt the scarce factor of production, which in rich countries meant unskilled labor. This was a surprise if one was accustomed to the classical Smith-Ricardo model, Trade Theory #1. But, then, the classical theory couldn’t address the question of income distribution because it treated all of a country’s citizens as if they were the same, making no distinction between workers and capitalists. The intuition behind Trade Theory #2, HO-SS, was not hard to grasp: workers could command a higher wage if they did not have to compete against the abundant supply of unskilled labor in other countries.

Then came the post-1980 revolutions in trade theory. Paul Krugman (1980) and Elhanan Helpman (1985) made the trade models much more realistic by introducing the previously neglected elements of imperfect competition and increasing returns to scale (Model #3, called the “new trade theory”). Later, Marc Melitz (2003) focused on how trade could shift resources from low-productivity firms to high-productivity firms (in what was called the “new-new trade theory,” Model #4).

The little-noticed irony is that the HO-SS theory was eclipsed just at the start of the period during which its prediction seemed to come true, that trade between rich and poor countries might hurt unskilled workers in the former. Anti-globalization thinkers and the journalists who reported on them were eager to claim that the newest economic theories required a rethinking of the traditional case for free trade. (Remember “strategic trade policy”?) They missed the point that the HO-SS or neoclassical theory predicted that global free trade would be bad for workers in rich countries while the new theory did not.

Perhaps it is not too late. Does neoclassical trade theory explain widening inequality in the US and other rich countries? Or are factors like technological change and education more important?

Inequality Within Developing Countries

Just as the HO-SS theory implies that trade will widen the gap between unskilled workers and those with human and other capital in rich countries, it also predicts that trade will narrow the gap in countries that have the most unskilled workers. Their services will be in greater demand in an integrated world market. Pinelopi Goldberg and Nina Pavcnik (2007) found that this prediction of the HO-SS theory was not borne out: “while globalization was expected to help the less skilled who are presumed to be the locally relatively abundant factor in developing counties, there is overwhelming evidence that those are generally not better off, at least not relative to workers with higher skill or education levels.” Milanovic and Squire (2007) also found that tariff reduction is associated with higher inequality in poor countries.

The latest numbers suggest that this continues to be the case. In fast-growing emerging market countries, the greatest gains have gone to those at the top. Consider the five BRICs, for which WID data are available. In China the share of income going to the upper one percent of the population reached 14% in 2015, up from 6% in 1978. In South Africa the share has reached 19% [in 2012], up from 9% in 1987. Russia, shows an even bigger increase, to 20% [in 2015], up from 4% in 1980. India shows 22% [in 2013], up steadily from 6% in 1982. In Brazil the upper one percent receives 25% of national income the biggest share of all five (though the Mideast is worse, and Brazil’s rate of change is low). Similar trends appear in each country for the share of the upper 10%.

Other Forces Drive Inequality

This does not mean that HO-SS forces are irrelevant. (There is evidence for them in the incomes of rural versus urban areas within Chinese districts. Another study found that when Mexico opened up to trade, the fraction of workers in poverty fell in those states most exposed to trade.) But other forces seem to be dominating the trend in income distribution. Technological progress in favor of skilled workers, such as automation, seems to be a major factor everywhere. The trend toward winner-take-all labor markets may play a role as well. Naturally government distribution policy is also a major factor: the after-tax income distribution is smoother in Europe than the pre-tax income distribution, to a much greater extent than in the US.

Whatever it is that continues to increase inequality in so many parts of the world, trade does not seem to be the major explanation.

This post written by Jeffrey Frankel.

Although, globalization created more jobs, it also likely created more exploitation of low skilled workers, since they’re so abundant. In the U.S., rather than pay American workers to produce goods, U.S. corporations hire foreigners for much less. So, how can low skilled Americans afford those goods? A hundred years ago, Henry Ford raised wages. So, workers can afford to buy the cars they produced. Krugman’s article is relevant:

Profits Without Production

June 20, 2013

“Economies do change over time, and sometimes in fundamental ways.

“…the growing importance of monopoly rents: profits that don’t represent returns on investment, but instead reflect the value of market dominance.

…consider the differences between the iconic companies of two different eras: General Motors in the 1950s and 1960s, and Apple today.

G.M. in its heyday had a lot of market power. Nonetheless, the company’s value came largely from its productive capacity: it owned hundreds of factories and employed around 1 percent of the total nonfarm work force.

Apple, by contrast…employs less than 0.05 percent of our workers. To some extent, that’s because it has outsourced almost all its production overseas. But the truth is that the Chinese aren’t making that much money from Apple sales either. To a large extent, the price you pay for an iWhatever is disconnected from the cost of producing the gadget. Apple simply charges what the traffic will bear, and given the strength of its market position, the traffic will bear a lot.

…the economy is affected…when profits increasingly reflect market power rather than production.

Since around 2000, the big story has been one of a sharp shift in the distribution of income away from wages in general, and toward profits. But here’s the puzzle: Since profits are high while borrowing costs are low, why aren’t we seeing a boom in business investment?

Well, there’s no puzzle here if rising profits reflect rents, not returns on investment. A monopolist can, after all, be highly profitable yet see no good reason to expand its productive capacity.

And Apple again provides a case in point: It is hugely profitable, yet it’s sitting on a giant pile of cash, which it evidently sees no need to reinvest in its business.

Or to put it differently, rising monopoly rents can and arguably have had the effect of simultaneously depressing both wages and the perceived return on investment.

If household income and hence household spending is held down because labor gets an ever-smaller share of national income, while corporations, despite soaring profits, have little incentive to invest, you have a recipe for persistently depressed demand. I don’t think this is the only reason our recovery has been so weak — but it’s probably a contributory factor.”

Of course, the main reason Ford raised wages was to increase productivity – however, he also raised goodwill and income.

Without actually crunching the data, the graphic seems to show a flattening or decline of the top 10% share of income since 2010 (in some cases even earlier). The end of the rapid growth in the top 10% share (with the exception of India) appears to have occurred when China became the major trade player in the world.

Could it be that this disruption of income distribution has begun to stabilize? That’s hard to prove with only the recent flattening in India and what appears to be a much flatter growth for U.S./Canada and Europe. Perhaps Peak Trader’s speculation that because the bottom 90% share has been reduced, there is a smaller market for producing wealth for the top 10% and that concentration cannot continue to increase indefinitely.

I’m also wondering how much of the U.S. top 10% growth can be attributed to the Obama bailouts of the financial sector (while the rest languished) and the artificially low interest rates that harmed savers while propelling the stock market for the wealthy.

artificially low interest rates

Huh? The reason the ZLB was a problem was because the absolute value of the Wicksellian market clearing interest rate was quite high even at the ZLB. The nominal value of the interest rate was quite low globally (see JDH’s graph), but that does not mean the gap between the nominal and Wicksellian rate was small. Also, keep in mind that Prof. Frankel’s chart shows the top 10 percent income shares. That’s not quite the same thing as wealth shares and it’s not the same as the top 0.01 percent income shares. The rise in inequality isn’t just between the top 10 percent and the bottom 90 percent, it’s also between the top 10 percent and the top 1 percent, and the 1 percent and the top 0.01 percent.

Also, PeakTrader completely misunderstands the actual reason why Henry Ford raised worker wages. PeakTrader is parroting the fairy tale version that Henry Ford himself liked to tell. If PeakTrader had ever taken a course in labor economics he would have known that what Ford was actually doing was finding something known as the efficient wage. In a nutshell, there are surveillance and transaction costs associated with paying workers only their marginal product. If a worker can get a job anywhere at anytime for the market clearing rate, then there is no reason why workers should not shirk. If they get fired, then they can just go across the street and get another job for the same wage. That’s costly for businesses, so management offers wages that are slightly higher than the value of their marginal product. That makes it more costly for workers to shirk. That’s what’s called the efficient wage. But since the efficient wage is always higher than the marginal product wage, there will always be some involuntary unemployment. Raising the minimum wage makes it more costly for workers to shirk; i.e., it has the effect of raising the efficient wage. The effect on business is ambiguous; it increases the direct labor cost but decreases the indirect (i.e., surveillance and transaction) costs associated with supervising and hiring workers.

2slugbaits, that’s the limited textbook version in lower level labor economics. It should be noted, Ford’s competitors also raised wages to retain productive workers.

An increase in the minimum wage may not reduce employment much correcting for a market failure – it may be stimulative, because the (positive) wage effect may be greater than the (negative) employment effect, particularly with unemployment benefits.

It may attract more people into the workforce and expand the economy. Real income will rise for minimum wage workers, because prices will rise less than wages. However, high income workers will pay more relative to wages, to reduce real income inequality.

Also, I was involved in real world experience when the starting wage rose from $11 to $13 an hour:

Turnover rates dropped like a rock, overtime was almost completely eliminated, including six day weeks, injuries fell dramatically, hardly anyone called in sick, damage to equipment and products almost disappeared, including steep declines in reject rates, quality rocketed, morale was lifted, management no longer had to spend enormous time interviewing workers, with related paperwork and training, supervisors no longer had to cover for sick workers, to do their jobs, and had time to actually do their work, and profits increased substantially.

Experienced workers who rejected the job when they learned it was $1 or $2 an hour less than they were willing to work for took the jobs at the higher rate. Management had much more time to manage and supervisors had much more time to supervise. So, operations became much more organized and efficient.

care to explain how you know we had artificially low interest rates? what should they have been, since you KNOW they were low?

2slug and baffling,

http://www.macrotrends.net/2015/fed-funds-rate-historical-chart . Find another period with rates kept this low while the economy was growing.

Bruce Hall I think you missed the point. Just because nominal rates were low does not mean that they were artificially low. Again, the Wicksellian rate to clear the market was well into negative territory, but nominal rates were stuck at or near the ZLB. Are you suggesting that the Fed should have increased interest rates in order to satisfy “savers”??? And why should the government adopt pro-saver policies when there already was a global savings glut, to use Ben Bernanke’s term?

2slug,

The primary beneficiaries of the rates set by the Fed are the financial institutions while the lower and middle classes have been shut out of value for the use of their saved money. https://nyti.ms/2veDwlW

In essence, the Fed has underwritten the highest earners through locking in low-cost money for business expansion and a burgeoning stock market on the backs of the poorer and middle class savers during a period where the inflation in healthcare, food, and housing costs have been aggressive… all areas important to the poorer and middle classes. The only major area where the poorer and middle classes have benefitted is the energy sector. And while employment has recovered as measured by the BLS, most incomes have remained outside of the growth zone.

This is an artificially constructed situation that began with the Obama administration financial institution bailouts and then maintained despite economic growth. Obviously, the government benefits as well by having much lower interest rates to pay on the debt so more money can be spent on social justice programs which is another way of saying “siphoning money off to special interests.”

Bruce Hall Did you even read your link??? It doesn’t sound like it. No serious person doubts that inequality has been getting worse. And not just in this country. It’s a global phenomenon. But blaming the growth in income inequality on “artificially” low interest rates “that began with the Obama administration financial bailouts” is just crackpot economics. Ersatz economics. The kind of crap we used to hear from Tea Party types whose interest in political economy exceeded their abilities. And your link does not even hint at blaming inequality on Fed FOMC policies.

during a period where the inflation in healthcare, food, and housing costs have been aggressive…

What world are you living in? This isn’t 1979. Today’s problem is that inflation is too low, not too high. Just yesterday there was a Brookings conference on the problem of low inflation. The conference had all of the usual mandarins in monetary policy; viz., Ben Bernanke, Olivier Blanchard, Larry Summers, Rick Mishkin and even Prof. Jeffrey Frankel, who authored the contribution posted by Menzie.

https://www.brookings.edu/events/should-the-fed-stick-with-the-2-percent-inflation-target-or-rethink-it/

Over the last few years there have been quite a few very interesting papers on inequality. There are lots of theories about the cause or causes for growing inequality, but most of them come around to blaming inequality on the proliferation of economic rents of some form or another. Strangely, you have a history here of being one of the biggest proponents of policies that encourage rent-seeking. And voting for Trump is hardly the kind of thing anyone would do if you’re all that concerned about inequality.

“This is an artificially constructed situation that began with the Obama administration financial institution bailouts and then maintained despite economic growth. ”

bruce, again, if you know this was artificial, what should the interest rate have been? i would assume you have evidence of this? you could use the 10year-corporate bond spread, and there is a slight elevation to some of the historical data. nevertheless, it is comparable to the spread during the bush recession of the 2000’s. i just want to know what the true rate should have been during the recovery from a financial crisis which had negative outlook on the future?

2slug,

Of course this isn’t 1979 and interest rates are not over 15%. On the other hand, with virtually no income on cash savings, consumers are still faced with the fact that they are subsidizing financial institutions. Credit cards, for example, are approximately 14% higher interest than savings interest. That’s a big deal for lower/middle class people and is an area that banks are clearly taking advantage of the virtually no-cost money that is being lent.

Cost of healthcare: https://www.thebalance.com/causes-of-rising-healthcare-costs-4064878 . That’s a big deal for lower/middle class people.

You’ve always been one to express concern over these inequities, yet you criticize me for doing the same thing. Okay. Let’s remember that in future discussions. But for this discussion let’s stick with the whole thought: I’m also wondering how much of the U.S. top 10% growth can be attributed to the Obama bailouts of the financial sector (while the rest languished) and the artificially low interest rates that harmed savers while propelling the stock market for the wealthy.

You may consider the interest rates to be appropriately zero, but you missed my point that the effect of such policy is that instruments such as bonds that are normally used by risk averse investors or money market funds that are often used by older people as a means to protect their assets have been gutted and the only recourse is a wild west stock market that, while certainly can make anyone money, may be too frightening for someone with limited funds or fixed incomes… so it favors the higher income earners with more wiggle room in their investing.

One can only hope that in the light of this financial box the lower income groups find themselves that the changes in the tax laws will bring some financial relief and that corporations will loosen their purse strings on wages while adding employees. That remains to be seen.

Meanwhile, in the Democratic-controlled states, governors are looking for fraudulent ways to bring relief to high income earners by declaring taxes to be donations. I thought the Dems were looking out for the little guys. Looks like they’re only looking out for the big donors.

Bruce,

The low interest rates today have, I think, negligible direct effect on the recent distribution of income as you seem to be claiming:

1. Today’s low to zero interest rates have very little effect on average incomes of low to middle class Americans for the very reason that they don’t have much savings. If we agree we are talking about the bottom 60 percent, then the average cash savings (excluding, for example, home equity) is about $1,000.

https://www.cnbc.com/2017/09/13/how-much-americans-at-have-in-their-savings-accounts.html

2. This is likely the same group that is paying up to 15 percent on credit card balances. Anyone who has enough cash savings to pay off their credit card can blame stupidity, not low interest rates on savings or high interest rates on credit card balances, for their predicament.

3. Regarding credit card balances, there has always been a very high difference between those rates and the rates charged for credit card balances. This has to do with the losses incurred on defaults and fraud, not interest rates per se. It is a situation in which the poor and the ignorant are subsidizing others of their own kind.

4. Low interest rates might help explain the stock market boom that has recently directly helped those with equity savings. But, this is not at the cost of the poor or middle class. For the latter, most have, directly or indirectly, some stake in the market.

I think you have to look elsewhere to explain “inequality”. International trade and globalization would be at or near the top of my list.

https://www.kiplinger.com/article/saving/T037-C021-S002-savers-feel-the-pain-of-low-interest-rates.html

https://money.usnews.com/investing/articles/2016-10-19/death-of-the-saver-how-low-interest-rates-are-punishing-the-risk-averse

https://www.bankrate.com/finance/federal-reserve/federal-reserve-policy-hurts-retirees-1.aspx#slide=1

I’m not arguing that low rates don’t have benefits… they obviously do for borrowers… as long as they are in line with real inflation. But there are large segments of the population that are hurt by low rates as well. While the absolute level of a lower income person’s income related to interest payments may be small in comparison with the savings by corporations or large borrowers, the loss of such payments may be significant on a percentage and asset preservation basis for those people.

Bruce,

Gotta disagree with you here, on a number of (additional) levels:

1. You stated above “The primary beneficiaries of the rates set by the Fed are the financial institutions while the lower and middle classes have been shut out of value for the use of their saved money.” First, and very fundamentally, the Fed does not “set” market interest rates, i.e., the rates savers earn on their deposits or pay on their loans. I think you know that. They may have had a slight *influence* on mid- to long-term rates through QI, but even that is debatable. I think this may essentially be what 2slugbaits is trying to say in an unnecessarily complicated way.

2. To the extent that the Fed may have had some slight effect on producing lower market interest rates, I doubt seriously whether this has been, net on net, to the benefit of financial institutions (even if that were so, much less to the detriment of the little guy). Low interest rates do not, per se, correlate with higher bank profits. Perhaps even the opposite is true. https://www.ft.com/content/f84dbae4-e713-11e6-967b-c88452263daf

3. QI may have had the effect of lowering (temporarily) US Treasury borrowing costs. It has, to some extent, temporarily reduced the fiscal deficit (“profits” remitted to the Treasury reduce the reported deficit). This may have had the effect of delaying spending cuts and/or tax increases. I suspect the group you claim was harmed actually benefit the most from this.

4. As I pointed out above, as a general rule, “savers”, almost by definition, are not the poor or even the “middle class”. The greatest group of “savers” are the “rich”! Believe it or not, many of those “rich” were and are invested in US Treasuries and other near-cash equivalents.

5. You are correct that a small (and I believe *very* small group of savers may have been hurt by lower interest rates (please note that we should be referring here to lower *real* rates, such that the effect is immediately discounted). Discount again by those “savers” who were invested in mid- to long-term bonds or Treasuries when rates went down. They made out very well in this low interest rate environment. As did those middle class retirees holding fixed annuities or retirees with defined benefit pensions not protected by COLA provisions. So, what we are primarily talking about are people in passbook savings or money market accounts who failed to re-allocate those savings and who failed to benefit in any other way. Some of that small group may have been “risk averse”, but others among that group simply made bad or unfortunate investment decisions. Discount again that sub-sub group by those who did not capitalize on the chance to refinance their mortgages. And, none of those “savers” have benefitted from the higher house prices that low interest rates have helped produce? Etc. Etc. You need to take all this into account and then document your “large segment of the population has unjustly suffered” claim with a bit more empirical proof and quantification (something those sites you linked to sorely lack).

I will remind you to send me a note of condolence and post a comment or two here about my unfair treatment when the equity markets take a tumble… I’m a “retiree” and I can testify that I have not been hurt at all by low interest rates. Quite the contrary.

It is simply not possible for the Fed (or any other government agency), despite the best attempts otherwise, to ensure that policies they enact treat every last citizen in exactly the same way via the markets or to protect everyone from bad financial planning.

Bruce Hall Hold on fella. There’s a lot to unpack here. Take a deep breath.

(1) Healthcare costs have certainly risen and they’ve risen faster than the overall rate of inflation. That’s not a huge surprise. But (at least up until this year) the rate of increase had slowed dramatically. For example, according to JAMA insurance premiums increased about 11% per year from 1999 to 2005, but then the rate of increase slowed to about 5% per year after that. Some of that might be due to efficiencies from Obamacare, although that slowdown happened across most developed countries, so perhaps Obamacare didn’t have much to do with it. But the Fed’s interest rate policies don’t have a direct bearing on healthcare costs.

https://jamanetwork.com/journals/jama/fullarticle/2480470

(2) I agree that credit card interest rates are obscenely high. Worse yet, banks have been cheating consumers. According to the Booth School at the Univ of Chicago the large banks paid $132B (that’s billion with a B) in fines between 2012 and 2014. Virtually all of that was paid by the top half dozen banks…you know who they are. The Fed’s role here is pretty much at the margin. But if you’re concerned about corrupt bankers cheating poor folks with weak safety nets, then why would you vote for Donald Trump??? Or why would you vote for any politician who wanted to dismantle what little financial protection consumers already have?

(3) As Vivian Darkbloom correctly notes, the gap between the Federal Funds Rate and what high risk consumers face has always been high.

(4) Of course this isn’t 1979 and interest rates are not over 15%.

Real interest rates have never been at 15%, not even in 1979. I think you’re guilty of “money illusion” here and confusing nominal and real rates.

https://data.worldbank.org/indicator/FR.INR.RINR?locations=US

(5) instruments such as bonds that are normally used by risk averse investors or money market funds that are often used by older people as a means to protect their assets have been gutted and the only recourse is a wild west stock market

While it’s true that risk averse investors gravitate towards safe bonds, it’s not true that only risk averse investors use bonds. This isn’t the time or place to go into CAPM investment approaches (or even whether or not CAPM works in the real world!!!), but the fact is that risk tolerant investors hold plenty of bonds. The bottom line is that there’s a big difference between portfolio risk and individual asset risk. Don’t confuse the two.

(6) Meanwhile, in the Democratic-controlled states, governors are looking for fraudulent ways to bring relief to high income earners by declaring taxes to be donations.

I doubt if those tactics will work, but there’s little doubt that the GOP tax bill was fraudulently motivated, so I guess it kind of even things out. In any event, eliminating SALT deductions is the kind of thing that should be phased in over several years and not slipped in a week before the change goes into effect.

(7) I thought the Dems were looking out for the little guys. Looks like they’re only looking out for the big donors.

The effect of eliminating SALT will be for states to cut back on the very things that help the little guys the most; e.g., public education and healthcare. Again, there’s an old rule in public finance that the best tax policy is a longstanding tax policy because there’s been enough time for economic agents to adjust. The Trump tax deform package violates almost every element of Responsible Public Finance 101.

(8) You’ve always been one to express concern over these inequities, yet you criticize me for doing the same thing.

I’m not criticizing you for expressing concern over income inequality. Welcome to the cause, Comrade Bruce! I’m criticizing you for blaming the Fed’s interest rate policy as the reason for greater income inequality.

“I agree that credit card interest rates are obscenely high. Worse yet, banks have been cheating consumers. According to the Booth School at the Univ of Chicago the large banks paid $132B (that’s billion with a B) in fines between 2012 and 2014.”

Do you have a link for that? Specifically, were those fines (whatever the amount) for charging “excess” interest rates on credit card balances?

Sure. http://www.nber.org/papers/w20894

Table 1 shows the fines paid to US enforcement agencies. It lists government agency, the financial institution, the amount of the fine and a narrative. It’s a long list.

Thanks for that.

Having reviewed the document, I failed to find one fine that was levied on banks for charging too high interest rates on credit card balances (or anything else).

vivian, there are a number of violations for libor rigging. less for credit cards, but certainly for many mortgages, auto loans and other consumer loans. i would assume the violation is for rigging rates too high rather than too low, although as i recall some of the fraud was for rigging rates up or down-simply knowing what the rate would be was the arbitrage goal. at any rate it impacted interest rates.

“Meanwhile, in the Democratic-controlled states, governors are looking for fraudulent ways to bring relief to high income earners by declaring taxes to be donations.”

i would have thought all the conservatives and libertarians on this sight would be up in arms about the double taxation which is imposed in the republican tax bill. conservatives are vociferously advocating for a major tax on a tax! that is a curious position you seem to be embracing bruce, peaktrader, rick stryker, …

While I agree with your last paragraph, I’d like to point this out regarding your point “2. To the extent that the Fed may have had some slight effect on producing lower market interest rates…”

“While most variable-rate bank loans aren’t directly tied to the federal funds rate, they usually move in the same direction. That’s because the prime and LIBOR rate, two important benchmark rates to which these loans are often pegged, have a close relationship to federal funds.

In the case of the prime rate, the link is particularly close. Prime is usually considered the rate that a commercial bank offers to its least-risky customers. The Wall Street Journal asks 10 major banks in the U.S. what they charge their most creditworthy corporate customers. It publishes the average on a daily basis, although it only changes the rate when 70% of the respondents adjust their rate.

While each bank sets its own prime rate, the average consistently hovers at three percentage points above the funds rate. Consequently, the two figures move in virtual lock-step with one another.

If you’re an individual with average credit, your credit card may charge prime plus, say, six percentage points. If the funds rate is at 1.5%, that means prime is probably at 4.5%. So our hypothetical customer is paying 10.5% on his/her revolving credit line. If the Federal Open Market Committee lowers the rate, he/she will enjoy lower borrowing costs almost immediately.”

Read more: What Is The Relationship Between The Federal Funds, Prime And LIBOR Rates? | Investopedia https://www.investopedia.com/articles/investing/060214/what-relationship-between-federal-funds-prime-and-libor-rates.asp#ixzz53oTmSLWI

Historically, the rates that money markets and banks pay to savers moves directionally with the Fed funds rates. The relationship is not “slight”.

Bruce,

Let’s try to quantify this in real terms. I’d like to see a real example and extrapolate that to a reasonable number of people who would meet that general profile. We can limit the analysis to any “negative effects” for now.

What is the profile of the person (as part of the “large percentage”) you are talking about. Someone with $100K of savings? $500K? $1 million? Etc.

With that in mind, and having specifically identified your example, what, in your view, has been the actual effect of Fed policy on that person’s *real return* on his “savings”? That is, what would have been the net effect due solely to the Fed and not other forces? For example, some literature suggests that on a 10 year Treasury, the effect of QI may have been 50 basis points. You may choose a different example, e.g., money market funds..

Would the effect of the Fed be to lower or increase the credit card interest charged to borrowers (to the extent there was any effect)? If it was to lower rates, please explain how would this have hurt your group of “savers”? In particular, would those “savers”, by virtue of their status as “savers”, be immune from that effect if there was any?

Thanks,

Viv

bruce, i would imagine the crooked bankers in the libor scandal had a greater influence on “artificial” interest rates than the fed?

Excellent piece. Nice historical summary of some trade theory highlights.

Menzie: thanks for inviting Jeffrey Frankel.

I would just add that as a casual observer of the western Canadian resource sector, the pace of technological change astounds me. The trend to capital intensification continues and seems to show no end in sight.

Employment maximization appears to be still an important public policy goal in certain sectors. That aside, curiously enough Canadian workers appear to have come to better know benefits and costs of freer trades and overall seem rather favourable these days. Decades ago, freer trade was a highly polarized, divisive issue.

Freer trade is not under threat and enjoys broad popular support in contemporary Canada.

Does the real or perceived generosity of the Canadian welfare state play a role in that support for freer trade?

Vivian Darkbloom I failed to find one fine that was levied on banks for charging too high interest rates on credit card balances (or anything else).

Most of the fines involved fraud in the handling and packaging of mortgages. My point was not specifically about credit card interest rates, but about corrupt banking practices in general. That said, Table 1 does identify $389M in fines against J.P. Morgan for deceiving customers about credit card expenses.

“MasterCard, Visa and major banks, including JPMorgan Chase and Bank of America, agreed to pay more than $6 billion to settle accusations that they engaged in anticompetitive practices in payment processing.”

When banks and credit card companies aren’t gouging customers with high interest rates, they do it surreptitiously by price fixing transaction fees.

And a lot of the Bad Boy Banks try to create fake overdrafts by delaying when deposits are credited to an account or by processing payments before deposits.

I’m old enough to remember the days before ATMs. Back then banks encouraged people to use ATMs because it allowed them to hire fewer tellers. Then after folks got used to the convenience of ATMs, banks started finding ways to charge customers for using the same ATM services that used to be free. I get my quiet revenge by making a point of going to a human teller window as often as possible. It’s more inconvenient, but I enjoy the spite.

The way banks now use ATMs as transaction generators reminds me of what oil companies used to do with leaded gas. A long, long time ago gasoline refineries used to charge extra for leaded gas. Then in the late 60s gasoline refineries started charging more to not add the very same lead that they were previously charging for adding in! First they charged customers for putting it in and then they charged customers a premium for not putting it in.