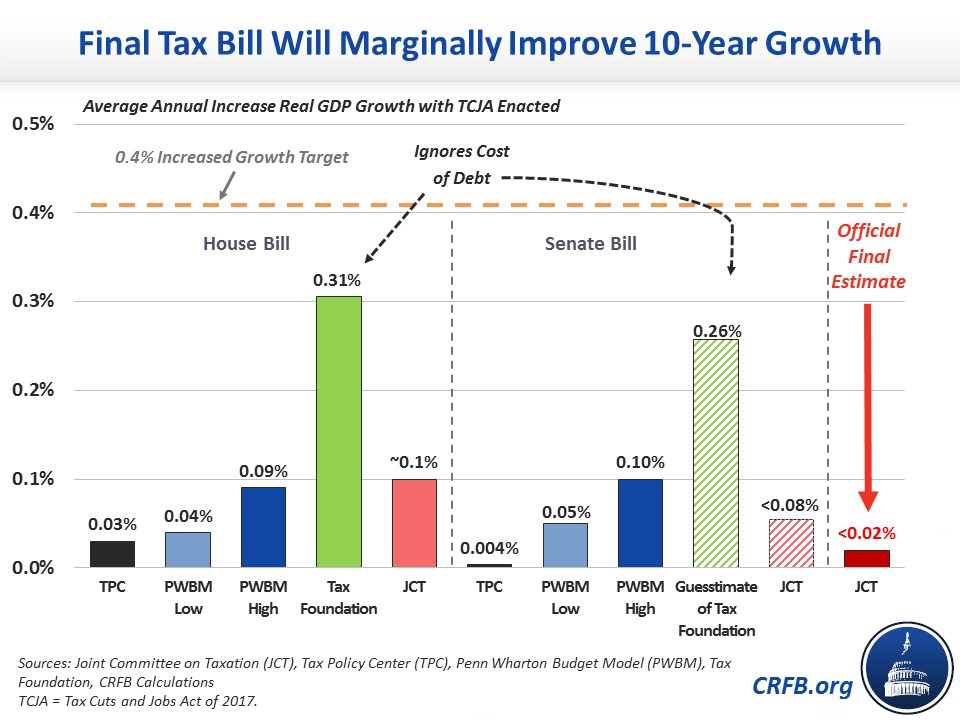

Never have so many simulations been ignored in favor of faith in tax cuts. Here’s the CRFB’s run down on growth impacts from the tax legislation as passed.

Source: Committee for a Responsible Federal Budget (Jan. 3, 20198).

Hence “the final bill [increases] average GDP growth by just 0.01 to 0.02 percentage points per year over a decade.”

I am glad to see that the unicorns and tooth fairies folks have not taken over the JCT (yet). (Here is one example of the “unicorn and fairy dust” crowd, who makes a reference to a mysterious organization called the “JTC”).

Given how this was sold as attracting foreign investment into the US, the simple fact will be that gross national income (GNI) will fall relative to GDP. So if real GDP will grow at best at only 0.02% per year, it stands to reason that this forecast should include how much real GNI will fall per year.

That Stephen Moore nonsense advocated getting rid of the honest analysts and replacing them with right wing hacks. Go figure. But he cannot even get the basic facts right:

‘Instead, this plan would set the rate at 20% for corporations (down from 35%).’

Moore is upset that the corporate profits tax rate was not slashed to 15%. But could someone tell this fool that the actual law did not cut it to 20%? Rather 21%.

DeLong used to call Luskin the Stupidest Man Alive. I think we have a new candidate.

Menzie

Could you tell me what the actual baseline GDP estimate is from which the various estimates came from?

And if possible, the past years’ estimates from before the Trump election?

Such numbers would help the evaluation of the different methods employed.

Than-you

Ed

Ed Hanson: Pretty sure they all used the June 2017 CBO baseline.

Menzie

This is what found following your lead.

Fig. 5: CBO’s Economic Projections – Real GDP Growth

Calendar Year 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027

CBO (June 2017) 2.1% 2.2% 1.7% 1.4% 1.7% 1.9% 1.9% 1.9% 1.9% 1.9% 1.9% 1.8%

Do you agree these are the numbers to use to rate the various estimates?

I ask because I found it interesting from previous CBO estimates for GDP for 2016

August 2015 GDP for 2016 —- 3.1%

Jan 2016 GDP for 2016 —- 2.3%

August 2016 GDP for 2016 —- 1.9%

(per CBO, actual real GDP for 2016 — 1.8%)

Note how different the estimates can vary over time, which is why I asked you to lock down the actual number for baseline GDP.

Credit all information above obtained from The Committee for a Responsible Federal Budget except where noted directly from CBO.

Ed

Ed Hanson: I don’t know for sure, but CBO does post all vintages of recent forecasts on its website so you don’t have to refer to CRFB. The baselines vary as new information comes in; it would be surprising if the baseline remained constant over time.

Menzie, you wrote in part:

“it would be surprising if the baseline remained constant over time.”

Agreed. But non-constancy should not affect the estimates of future performance by the different parties due to the Tax Bill. Or this whole exercise would be meaningless.

Would you mind showing your calculation of marginal GDP improvement for the following assumptions for the year 2017?

Assume annual real GDP comes in at 2.7%

CBO estimate real GDP was 2.1%

Is it as simple as 2.7% – 2.1% equals a 0.6% marginal gain over estimate?

Thank-you in advance,

Ed

Ed Hanson: The baseline is conditional — so for instance if population growth is less than assumed (I’m taking population growth as exogenous), then you’d have to do the marginal calculation you propose taking that into account.

I note the list of simulations omits the Treasury Department’s one-page analysis, supposedly penned by the Office of Tax Policy (but apparently not by the Office of Tax Analysis, which is the part of OTP composed of economists). That episode, taking research on the incidence of the corporate income tax down from the Treasury Department’s website, and “research” by the Council of Economic Advisers that cites discredited studies on the effect of a corporate income tax on wages, are all very disheartening.

Businesses may employ new technologies for higher productivity over the next decade, to raise GDP growth. Historical chart:

https://www.bls.gov/lpc/prodybar.htm

As the labor market tightens and real wages rise enough, there will be more capital spending. Also, the aging capital stock will be upgraded. Moreover, the children of the Baby-Boomers (born in 1982-00) will be entering prime-age (35 to 54, after the Generation X Baby-Bust, mostly born in the mid-‘60s to early ‘80s) and older workers will work longer, to also boost productivity. Pro-business policies, e.g. lower taxes and less regulation, also helps. Therefore, we may have accelerated growth over the next few years and settle at a higher growth rate than the past few years.

Moreover, many states and cities raised their minimum wages for 2018:

http://money.cnn.com/2017/12/29/news/economy/2018-minimum-wage-increases/index.html

Perhaps, not much of the repatriation of profits held overseas will go into share buybacks, given the high level of stock prices. Instead, it may be used mostly to pay-down domestic debt, increase dividends, and for acquisitions and capital upgrades. Also, there may be more foreign investment.

Walmart latest corporation to raise minimum wage, along with giving bonuses:

https://www.usnews.com/news/top-news/articles/2018-01-11/walmart-raises-minimum-wage-to-11-an-hour-in-wake-of-ustax-law

From your story:

“Walmart is likely to save billions of dollars from the new tax law, which slashed the corporate tax rate to 21 percent from 35 percent, and the wage hikes will cost the retailer only a fraction of those gains, analysts said.”

So when Trump’s CEA said the incidence of the corporate profits tax rate cut would go mostly to wages – the evidence says otherwise. At least in Wal Mart’s case. Good thing they got their small wages as Paul Ryan is about to slash their health care benefits to pay for this tax cut for the rich.

So, you don’t want Walmart employees to have higher wages and more bonuses. Fortunately, Walmart employees have better health care insurance than Obamacare or government insurance, which should be much cheaper.

http://www.washingtonexaminer.com/surprise-walmart-health-plan-is-cheaper-offers-more-coverage-than-obamacare/article/2541670

“Perhaps, not much of the repatriation of profits held overseas will go into share buybacks, given the high level of stock prices. Instead, it may be used mostly to pay-down domestic debt, increase dividends, and for acquisitions and capital upgrades. Also, there may be more foreign investment.”

Let’s sets aside this blah, blah, blah for a moment. Financial economics as in the Modigliani-Miller propositions predict that none of the repatriated profits will go to new capital with all of it being paid out in dividends (or stock buyouts which comes to the same macroeconomic effect). And if foreigners do increase US investment, they get the profits which means GNI falls relative to GDP. This last wrinkle has been widely discussed and yet Bottom Trader missed the point entirely.

OK – back to his usual blah, blah, blah. Pardon the interruption.

Toyota just announced it will be investing $1.6 billion in a plant in Alabama – it’s expected to create 4,000 jobs at an average of $50,000 a year, beyond the jobs created from the investment. You don’t believe that’s good, particularly with the multiplier effect?

You really don’t know what corporations will do with the repatriated profits – I can guess they won’t spend much to buy back shares with high stock prices. Obviously, the most important point of liberal/socialists arguments is the name calling.

Toyota was going to do that anyway. Lowers transportation costs and Alabama does not let the UAW anywhere near Toyota’s workers. But do keep up your day job – Trump spinning.

PeakTrader You should be a little more skeptical about this Toyota expansion. Toyota’s sales have been flat the last couple of years and it’s hard to see how demand will increase enough to justify significantly more capacity. And I’m quite familiar with the Huntsville area. Unemployment in Madison County, AL is 3.4% and the average job pays over $55K per year. So we’re being asked to believe that Toyota will be able to hire 4,000 additional folks out of a fully employed labor force and do this by paying less than average pay for the area. That doesn’t pass the smell test. What’s more likely is that Toyota will be shutting down one of their existing plants and shifting production and workers to the Huntsville plant…assuming of course that the city of Huntsville comes through with all of those sweeteners they had to hand out.

As to Walmart, I don’t think Walmart is increasing their wages because they’ve suddenly decided to be a generous employer. Have you been to a Walmart lately? They have “Help Wanted” signs posted everywhere. It takes forever to go through the checkout lanes (and I hate the self-checkout) because they can’t keep staff. I can’t tell you how many times I’ve looked at the queue and balked or reneged out of the queue after waiting. I just walk away leaving the cart with the melting ice cream dripping onto the floor. Walmart was going to raise their wages whether the tax bill went through or not. Walmart was just doing what other business people have been doing…flattering Trump’s immature ego.

2slugbaits, I’ve seen buses with Chinese writing and big groups of Chinese going into the most crowded Walmart. Amazing. And, you shouldn’t buy ice cream (for more than one reason).

“I just walk away leaving the cart with the melting ice cream dripping onto the floor. ”

i did that years ago. haven’t been to a walmart in years. at the time, there was a target across the street. prices were slightly higher, but i never had to wait to get out of the store.

had an aunt who worked at a walmart for nearly 20 years, because it was the only big retailer in town. they shut down all the small shops. treated the workers like crap-but they could because there were no competitors in town. and consumers had to wait in line because there were no competitors left in the small town either.

… and in ten years we will be able to say, “The forecast was correct; the actuals were wrong.”

Is that like DOW 36000?

Quite possibly. The certainty of consensus predictions is only outweighed by their error.

Isn’t the Administration attempting to reduce the labour force by various deportations?

This would make it problematic to say the least

Your citation to the CRFB discussion is dated January 3, 2019. CRFB, however, does not pretend they wrote this in the future as their own date is January 3, 2018.

pgl: Thanks, have fixed.

I am less sanguine about the effects of the tax bill than is the JCT. Let me point out two things that make me skeptical. One is the usual economic analysis of isoquants and isocosts. A typical example of this analysis can be found at http://wikieducator.org/ISO_QUANT_AND_ISOCOST. It is unclear whether the JCT has made detailed assumptions about the possibility of substitution between labor and capital, but it may be possible to challenge their assumptions on the negative side – the “long run” of substituting capital, which the tax bill lowers the price of, for labor, may be much shorter than is being assumed. So you may not even get the small increases in output that they are assuming, since so much labor may be removed in favor of capital, with the returns to capital going overseas, as Krugman rightly and repeatedly has stressed.

The second problem with this thing is the possibility of increasing corporate holdings of cash. You look at the corporate series on checkable deposits and holdings of cash in

https://fred.stlouisfed.org/series/NCBCDCA

and it is just skyrocketing. It’s becoming a measurable fraction vs. corporate total assets. It’s easy to say that in a low interest rate environment, the corporations aren’t giving up that much. That’s true, but it ignores the possibility that they are anticipating the future. If the tax bill widens the deficit so much that interest rates start to rise dramatically, then it will make sense for corporations to invest in financial assets and not in real ones. The more they do, the less employment will rise. As it is, it is a good question why corporations haven’t already invested in real assets, which would show up in the GDP investment series, which is not doing all that well for this supposedly great business era.

This isn’t a whole story or a model. But it makes you wonder.

Sloppy. It is the ‘Joint Committee on Taxation’, not the ‘Joint Tax Committee’. Look it up.

In this case, Moore is pure rah-rah. Nothing much to substantiate his claim.

Having said that, if we are coming out of a crypto-depression, as I have maintained, then we could see some substantial catch-up growth, and that would make the tax plan look like a winner on the GDP side (although probably not on the budget side).

I might have caveated this post a bit more, because the tax plan — and Trump — will take the credit if growth picks up, as I think it might.

Delong critiques something only marginally better from Michael Boskin:

http://www.bradford-delong.com/2018/01/should-read-the-jcts-dynamic-score-assesses-the-republican-tax-reform-bill-as-michael-j-boskin-another-look-at.html

Marginally being the key phrase here.

“The economy is doing quite well,” Dimon told Fox Business’s Maria Bartiromo Tuesday. “If we have a couple of years of good growth, that could justify the markets where they are. 4% economic growth this year is possible.”

http://dailycaller.com/2018/01/09/jamie-dimon-4-percent-economic-growth-is-possible/

I’ll be on Bloomberg’s Daybreak Americas tomorrow at 7:20 am talking about oil prices.

Honestly Menzie,

Will you write anything so as not to pinned down including deleting the reply button.

Above you replied to a simple example that i asked about as follows;

“Ed Hanson: The baseline is conditional — so for instance if population growth is less than assumed (I’m taking population growth as exogenous), then you’d have to do the marginal calculation you propose taking that into account.”

If everything is subject to change baseline, population, and whatever, what is the point of the post and the estimates of performance, if they cannot be evaluated with certainty.

I am asking you to take a stand. Assume that the CBO as well as the performance estimators all believe the have done their best given the uncertainty of the world.

Please show your calculation of my simple request. And then, if you would, tell us who of the estimators you agree with the most..

And I will ask another question, assume the CBO baseline average growth of real GDP over ten years is 1.8%. Does the final estimate of the Tax Bill effect of 0.02% mean the stake their best effort at a predicted growth rate of 1.8% + 0.02% equals 1.82%.

Not looking for that one armed economist, but one who will plainly speak.

Ed

Ed Hanson: Forecasting is hard work, systematic forecast evaluation even harder. I believe CBO publishes spreadsheets with the assumptions going into the potential GDP, which projection converges to. It’s not me that has to be pinned down — I think CBO has pinned itself down a lot more than any organization I know of. What you have to do as an informed observer is to do the hard work to take into account changes in the conditions.

For instance, I do what you propose in my paper on exchange rates, here, but you can see it’s an involved process to do for as simple a model as we examine.

On the matter of US corporations repatriating profits and investing more in the US than abroad, what I have read suggests that in fact the new law encourages just the opposite, more investment abroad, despite the propaganda claiming the opposite. I assume that most of the entities making the various forecasts are aware of this and accounting for it as reasonably as they can, although that is obviously one of those things hard to forecast specifically.

From CRFB:

“At the end of December, the Joint Committee on Taxation (JCT) released its final dynamic analysis of the Tax Cuts and Jobs Act (TCJA). JCT’s analysis concludes the bill will have a modest impact on growth in the near term but almost no effect after a decade. After accounting for this near-term growth, the $1.46 trillion bill will still cost $1.07 trillion. This is consistent with estimates of the previous iterations of the House and Senate bills and inconsistent with claims that the bill will pay for itself or substantially accelerate sustained long-term growth.

“JCT projects the final tax bill will increase ten-year Gross Domestic Product (GDP) by 0.7 percent on average – which is similar to its estimates of prior versions of the bill. Importantly, though, JCT finds most of this increase will disappear toward the end of the decade as various parts of the bill expire and debt accumulates. This results in the final bill increasing average GDP growth by just 0.01 to 0.02 percentage points per year over a decade. In other words, it will improve growth by one-fortieth to one-twentieth of the 0.4 percentage points claimed by some of the bill’s advocates.”

So, on the one hand, the JCT estimates that the bill will “cost” (cost to whom?) $1.46 trillion over 10 years but with macro dynamic effects that “cost” is reduced to $1.07 trillion, a difference of about $385 billion * On the other hand, McConnell claims a 0.4 percent increase in average GDP growith would eliminate the entire “cost” amount of $1.46 trillion.

*Actually, $451 billion due to additional growth less $66 billion estimated additional debt service.

Now, CRFB comes along and says “most of this (0.7 percent) growth will disappear toward the end of the decade”. No, the 0.7 percent is an average over the 10 year period. Averages don’t “disappear” during the period that is being averaged. Also, as CRFB then notes, the primary reasons the model shows little to no additional growth *after* the 10 year period is because of the expiring provisions, not because those enacted provisions, while in force, did not contribute to growth. What are the chances all those provisions will actually be allowed to lapse and who will be responsible for it if they do?. Is history here any guide? Notice here that the CRFB claims this growth trend will stop because many provisions will expire (yes, I’m aware that this also affects the static revenue line). . But what they fail to note is whether they are in favor of letting them expire. If they are in favor, then I guess they can accuse themselves in advance of killing the tax bill’s growth effect.. In other words, it’s bad for growth that they expire; but, in our hearts, we think that would be good! We’re just not gonna tell ya.

Also, CRFB, citing McConnell, state that his growth estimate of 0.4 percent (needed to close the entire “cost” gap) is one-twentieth to one-fortieth (!) of the JCT growth estimate. Here, I’m stumped, perhaps because I don’t understand the law of diminishing (marginal) returns—if the JCT estimates the dynamic effects of the bill would reduce the “cost” by almost one-third, how much would the bill reduce those “costs” if growth (due to the bill) were 20 to 40 times higher than the JCT’s estimate?

Growth rates and levels, macro effects, sunrises and sunsets, chained CPI, monetary offsets, political agendas, party hacks. Fascinating stuff. A lot to ponder here, but I guess these estimates are more than guesses–it’s economic science!. And, even more useful, political talking points!

For what it’s worth, my guess is we have already seen some of the effects of the tax bill during the past several months leading up to its passage. This is not included in any estimate of net “costs” after the date of entry into force. GDP growth rate of nearly 4 percent? Didn’t see that in any of CRFB’s prior estimates. Nor did I see it in the CBO’s June (baseline?) estimate.

Finally, referring to that headline, it does not surprise me at all that the effects of the tax bill would be “marginal” on economic growth.

Viv –

Some numbers, using the CBO June 2017 forecast as the base, CBO percets of taxes as share of GDP.

Under the CBO forecast, 2017-2027

– real GDP growth, CAGR; 1.9%, cumulative deficit: $10.2 trillion (2018-2027)

CBO Forecast, tax plan revenue cuts, no growth effects

– real GDP growth, CAGR, 1.9%; cumulative deficit: $11.6 trillion (2018-2027)

CBO Forecast, tax plan revenue cuts, growth to historical averages

– real GDP growth, CAGR, 2.5%; cumulative deficit: $10.5 trillion (2018-2027)

You need an average GDP growth rate of about 2.6% real to breakeven from a fiscal perspective. The tax plan cannot deliver that in any explicit fashion.

If you’re going to get there, you need strong productivity growth, which none of us understand very well. I’d add that population is not necessary exogenous. If you look back historically, it can almost look endogenous, ie, if there is work, people show up to do it, odd as that may seem.

Steve,

Where did I write that this tax bill will be deficit neutral? The whole thing is a black box, including the static estimates. When you start with black boxes, you can rest assured the discussion is merely political (on both sides). I’m just pointing out some of the more obvious absurdities and partisan hackery (that’s why I come here–it is in abundance). Just look at Barkley’s comment—he’s read a few articles “suggesting” the bill will encourage foreign, not US investment. Those “suggestions” seem to bear the imprimatur of truth. Anything contrary to that is labelled “propaganda”. This is the quality of the discussion from our academic/political “elite” (I hestitate today to use the conjunction “and”). For example, can you explain the logic of the “20x to 40x difference in GDP growth between the JCT and McConnell” (as claimed by CFRB) and the 3x difference in additional revenue from dynamic effects? When we talk about “cost”, are we talking about the increase in the deficit minus the increase in household income? This is not a cost/benefit discussion. It’s a cost discussion.

While your back of the envelope method is deceptively appealing, there is a lot more going on here, even in the static estimate. We need more, not less, transparency here. The track record in the past on this sort of thing hasn’t been very good. The effect on the deficit, one way or the other, is dependent on a lot more than real GDP growth times Hauser’s law of 19.5 percent. How much additional revenue will the deemed repatriation of those corporate earnings bring? How much will the scale back in deductions? The new limits on corporate interest deductions? Etc. Etc. Etc. That’s *before* one even starts to think about macro effects. Don’t ever forget that.

I’ve spent my entire professional career in international tax (in additional to having “read more than a few articles”). I know how CFO’s and CEO’s of our top companies think about and react to our tax code. I’m also very aware of the major distortions the Code has had not only to businesses, but also individual behaviors. This law isn’t perfect, that’s for sure. I’m as concerned about the debt as much as you are. But, the changes, by and large, were long-needed and move in the right direction. Most of those essential changes, to include the corporate tax changes, the international provisions and the scale-back of deductions will remain. Don’t worry, when the Blue Team takes over, they’ll increase the marginal rates on the top 5-10 percent of taxpayers or whatever percent populist politics will allow. Most of the rest will remain. History repeats.

And if we’re lucky, spending will be reduced. I’m not holding my breath on the latter. Again, history has a tendency to repeat itself in familiar patterns.

Good luck on your oil talk. I only own two individual stocks (the rest in ETF’s). One is ST, so I’ll check out what you have to say. The purpose of those two positions is to remind me why one shouldn’t pick stocks and also to divert me from the blackjack tables.

Steve,

I meant STO; not ST.

“Hence “the final bill [increases] average GDP growth by just 0.01 to 0.02 percentage points per year over a decade.”

I’m having a hard time reconciling this statement with the actual JCT report. Here’s what the JCT actually wrote under “Effects on Output”:

“The Joint Committee staff estimates that the proposal would increase the *level* of GDP relative to the baseline forecast, by 0.7 percent on average throughout the ten-year budget window.”

I’m asking myself how an average increase of only 0.01 percent to 0.02 percent in GDP growth over a decade could result in an average of increase in the level of GDP output of 0.7 percent of that same ten-year period as reported by the CFRB and Menzie.

Perhaps the answer lies in the following passage by the JCT:

“Because of the expiration of individual income tax rate cuts and other provisions affecting wage taxation after 2025, the increase in labor supply is expected to decline, and possibly reverse, after 2025. Similarly, the phasing out of bonus depreciation and the special deduction for pass-through income are expected to slow the rate of new investment toward the end of the budget window. As a result, the increase in output reported above is expected to be in the range of 0.8 to 0.9 percent over most of the ten-year budget window, and fall to 0.1 to 0.2 percent by the end of the budget window.”

So, this seems to confirm that the average over the ten-year period is indeed 0.7 percent and not 0.1 to 0.2 percent as reported by CFRB and Menzie. It appears the the 0.1 to 0.2 percent is not the average over the ten-year period but is already included in the average of 0.7 percent. It applies only at the end of the period, for the reasons JCT puts forth.

Also, despite the drop-off in the latter years (due to expiring provisions), the JCT estimates the macro effects on *revenues* to be surprisingly stable.. The drop-off in revenues is not due to the lower effects of the macro economic growth model, but to the conventional estimate. See the actual numbers per year under Table 1.

https://www.jct.gov/publications.html?func=startdown&id=5055

Menzie, perhaps you can explain why that 0.01 to 0.02 is claimed to be the estimate over the ten-year period?

Viv –

I am personally unsure that I put a whole lot of stock in any of the growth estimates.

We have an economy essentially at full employment with an aging and slow-growing workforce, coupled with protectionist and anti-immigrant pressures. In effect, that means we have to grow at high rates above potential GDP (we are above CBO potential GDP now). It doesn’t leap off the page, tax plans here or there.

Now, here’s the thing. If you take a log graph of per capita GDP and run it from 2007 back to 1947, it’s pretty much a straight line. During WWII, the numbers run above the line, and during the Great Depression, below the line. But if you get back to 1929, you’re once again right on the log line. Put another way, by 1947, neither the Great Depression nor World War II were visible in US per capita GDP statistics.

Right now, we’re well off that per capita line. Do we revert, or are we off it forever? If we revert, then you can expect a number of years of surprisingly high GDP growth. That has nothing to do with tax plans, and everything to do with some underlying pace of development of the economy. I can assure you though, the tax plan will get the credit — that’s why I would have soft-pedaled the criticism, had I been Menzie.

At some level, though, it comes down to productivity growth, and the economics profession is largely clueless about what drives it.

As for the effect on the deficit, that’s relatively straight-forward. GDP x tax share of GDP = tax revenues. The CBO’s assumptions about this share, and in particular the income tax share of revenues, are wildly optimistic on the high side based on the historical record back to the 1960s. Therefore, the tax revenue share of GDP is likely overstated, that is, the deficit is likely worse than projected on the revenue side, certeris paribus.

I have looked only on a cursory level at the spending side, and that looks like it could be alright. But I would not even remotely be surprised if in fact the numbers came in materially worse than projections. (If you know analysts, this wouldn’t surprise you.) The key driver is the 25 million Americans reaching retirement age between now and 2030. That’s three New Jersey equivalents (bad enough having one!). Now, it’s clear that there will be whopping increases in payroll taxes in the middle of the 2020s. If I were a Democrat, that’s what I’d talk about. The deficit won’t be as bad as it looks, because it can’t be. At some point, our fine politicians will capitulate to bloated entitlement promises.

In any event, I can’t claim great enthusiasm for the tax plan. This is not the early 1980s, when taxes so visibly needed to be reformed. Perhaps the plan will help. I am more inclined to think it represents a change of regime, the end of the Great Repression, and it is this end, not the tax reform, that will bring more rapid growth.

There is some risk. Per the CBO with JCT effects, borrowing goes to about $800 bn this year, and on to $1 trillion in 2019 and 2020. The US debt I think has an average tenor of seven years, ie, 11% of GDP is re-priced every year. Thus, a 1 pp rise in interest rates can put us in a bit of a bind in relatively short order. In addition, I think you have to budget a recession in the 2018-2020 time frame, so we’ll need to borrow to cover that, too.

I wish I could find some enthusiasm for the tax plan (not here in New Jersey!). I am frankly appalled, however, that we should be running a trillion dollar deficit at the top of the business cycle while carrying a 77% debt-to-GDP ratio.

Recession. I just feels like the Great Repression.

Steven, Viv

As I have been discussing with Menzie, the CBO hires lots of educated and I assume hard working people. They make produce many well organized reports from the immense volume of data it has access to. The mathematics used is extensive, complicated sand sophisticated.

And they are consistently wrong with their GDP projection. and lately grossly wrong.

The August, 2015 report projected 2016 real GDP growth at 3.1% -It came in at 1,8%

The June 2017 report projected 2017 real GDP growth at 2.1% -It will be substantially higher (note last 2 quarters at 3.15 and 3.2%)

That same 2017 report projected 2018 real GDP growth at 2.2% – it will be above 3%

History has shown that after solid supply-side tax rate cuts, the corporate and small business reductions are exactly that, the economy responds With terrific growth. It will be so for several years this time, assuming Congress does not screw it up later.

Ed

Credit goes to 2slugbaits for noting the real reason WalMart is raising wages. On top of a shortage of workers – due to the Obama boom – we now see WalMart closing many of its Sams Club stores. Wonder why Bottom Trader failed to mention that.

Of course, the regressive liberal/socialist gives no credit to the Trump tax cuts and deregulation for higher wages, more bonuses, and greater benefits, along with more disposable income, for workers with the highest marginal propensities to consume.

It’s all due to “the Obama boom” – the multi-trillion dollar L-shaped “recovery” from the severe recession that put the country in a weak and limited position for a future president to deal with – sure, a liberal/socialist would’ve solved the problem with open borders and micromanaging the economy, since they know best.

We certainly give Bottom Trader full credit for parroting Trump’s spin.

PT: Thank God for those fiscal conservative/free market savants who’ve been near apoplectic over deficit and debt increases unless those doing the increasing are named Reagan, Bush, and Bush.

And what would we do without information that proves conclusively the 185% increase in the national debt under Reagan was just what the economics doctors ordered while the 70% increase under Obama had (almost) ruined the economy?

Looking at both the Reagan and Bush II tax cuts, it’s now fairly obvious that free markets captained by wily free traders cannot survive unless the government finances tax cuts by borrowing huge amounts while always claiming the cuts will eventually pay for themselves

That was certainly clarified during the period from 2002-2007 when the national debt increased by only 55% under the watchful eye of a Republican congress and administration. Who, it must be added, were prudent enough to cut taxes–twice–while sending 140,000 American troops to fight on two Asian fronts.

So, please, continue your vigilance and continue to inform us when those liberal/socialist progressive evildoers try to borrow more and more money we don’t have and while we all sit back and watch the bonanza sure to come while free marketers show us how to run up the national debt painlessly. Until, of course, the next recession, which I’m positive you’ll blame on those darned liberal/socialist progressive evildoers.

Personally, I call that conservative economics at its very best.

Ed wrote:

“History has shown that after solid supply-side tax rate cuts, the corporate and small business reductions are exactly that, the economy responds With terrific growth.”

Indeed. Who can forget the endless boom after George W. Bush’s tax cuts. What a contrast from the deep recession triggered by the Clinton tax increases.

Our country owes its firm financial footing to the Bush tax cuts. A Heritage Foundation research paper (D.Wilson and William Beach) foretold the story:

Under President Bush’s plan, an average family of four’s inflation-adjusted disposable income would increase by $4,544 in fiscal year (FY) 2011, and the national debt would effectively be paid off by FY 2010

Luckily for our country, Trump recently appointed one of the authors of the paper to head the Bureau of Labor Statistics. Hopefully, Mr. Beach will finally produce an honest unemployment figure, and we will see that there was a giant step change down from the 20% level of the Obama administration to the low 4% level today. The current BLS figures absurdly show a pretty steady decline from the end of the recession until present: https://data.bls.gov/pdq/SurveyOutputServlet?request_action=wh&graph_name=LN_cpsbref3

“Hence “the final bill [increases] average GDP growth by just 0.01 to 0.02 percentage points per year over a decade.”

Menzie,

As I indicated above, unless you have a reasonable explanation, that statement that you put in bold print is wrong. Either you need to justify it (and the related text regarding the assertion that it is 1/20th to 1/40th of the McConnell estimate), or retract it.

Vivian Darkbloom: I didn’t answer before because I thought you were joking. You’re seriously that math-challenged? JCT indicates 0.8 percentage point increase in level of output on average over 10 years; if you think about it, 0.15 percentage point acceleration in growth is consistent with about 0.8 percentage point increase in level of GDP. As far as I know, 0.15 percent is between 0.1 percent and 0.2 percent…

If you don’t believe me, plug the numbers into a spreadsheet, and calculate for yourself. Geez.

I think the issue is that the article said 0.01 to 0.02 percentage points in the growth rate. This is 0.0001, not the 0.001 as you wrote. Dividing by 10, this leaves about a 0.08 pp increase in the level of GDP.

Having now read the original CFRB blog entry, their estimate of .01 to .02 annual percent growth should have been .1 to .2. That would put the JCT estimate as 1/2 to 1/4 of the McConnell entry. Kudos to Vivian Darkbloom for spotting a major error in the calculation. It appears Maya et al are the ones who are math-challenged.

Leper Messiah: I’m not so sure. I took the numbers from the TPC assessment of House plan. It shows 0.45% average higher GDP over 10 year window, but average of growth rates is 0.0047%. I think this is a function of the implied contour of the growth relative to baseline. So in the absence year-by-year numbers from JCT, I’d say it’s possible that the CRFB numbers are right.

Menzie,

So, you’ve gone from accusing me of being “math challenged” and now you are diluting your assertion to “it’s possible the CFRB are right”?

Geez.

Leper Messiah: see this post.

Vivian Darkbloom: see this post.

Dudley:

“The legislation will increase the nation’s longer-term fiscal burden, which is already facing other pressures, such as higher debt service costs and entitlement spending as the baby-boom generation retires. While this does not seem to be a great concern to market participants today, the current fiscal path is unsustainable. In the long run, ignoring the budget math risks driving up longer-term interest rates, crowding out private sector investment and diminishing the country’s creditworthiness. These dynamics could counteract any favorable direct effects the tax package might have on capital spending and potential output. ”

https://www.newyorkfed.org/newsevents/speeches/2018/dud180111

Okay, I admit that I’m confused here. Vivian Darkbloom suggests that the JCT is actually predicting many years of average increases of 0.8% to 0.9% in GDP followed by a couple of 0.1% to 0.2% values towards the end of the 10 year horizon, eventually averaging out to 0.7%. Unfortunately the JCT does not provide us with a year-by-year analysis. It’s also not clear if JCT is suggesting an average annual increase of 0.7% in the growth rate, or if they are suggesting that the level of GDP will be 0.7% higher after 10 years. I found the wording of the JCT paper quite confusing. At one point they clearly say that they are talking about a 0.7% level shift across the 10 year window; but other wording suggests they mean an average change in the growth rate. But here again, should we interpret this as meaning an additional 0.7 percentage points to each year’s growth rate (that seems implausible on the face of it), or do they mean an additional 0.7% of the growth rate itself; e.g., baseline growth of 2.5% + (2.5% * 0.7%) = 2.5175%, which is awfully close to the 0.1% to 0.2% change in the growth rate found by other analyses and shown in Menzie’s chart. On the face of it, interpreting the JCT analysis as saying that the tax cuts will add an average of 0.7 percentage points to the GDP growth rate just doesn’t pass the smell test. It’s ridiculous to assume that the growth rate would increase from (say) 2.5% to 3.2% just because of the tax cuts. Not even the Tax Foundation makes that claim and it’s way out of bounds with other reputable studies.

A few other quibbles with the JCT analysis. First, their paper refers to “average” changes in output. I assume they mean they are taking the average change across the several different models they used to simulate the output effects of the tax cut. They needed to be more clear as to what they were averaging.

Second, the Frisch elasticity of labor supply parameter (0.20) used in their DSGE simulation is a little hard to swallow. A value like 0.20 would have been plausible 30 years ago at certain points in the business cycle, but the more recent estimates I’ve seen for when the economy is already at full employment is more in the neighborhood of 0.04. Third, in their OLG model the technological growth rate of 0.019 seems wildly optimistic. Lastly, there’s something very odd about a tax plan that is supposed to be all about increasing growth through capital deepening, but yet the bottom falls out in the predicted growth rates when the labor supply factors are phased out. That’s either a problem with the JCT model or it’s a problem with the GOP’s rationale for cutting corporate tax rates. If the JCT model is correct, then it’s the corporate tax rate reduction that should be temporary and the labor supply income tax cuts should be permanent.

The JCT document states:

“The Joint Committee staff estimates that the proposal would increase the level of GDP

relative to the baseline forecast, by 0.7 percent on average throughout the ten-year budget

window.”

Over the horizon, 0.7% of nominal forecast GDP is $1.7 trillion, of which the JCT estimates that $407 bn will end up as tax revenue, if I am reading the table correctly. Total nominal GDP over that period is $244 trillion.

Download the document here: https://www.jct.gov/publications.html?func=startdown&id=5055