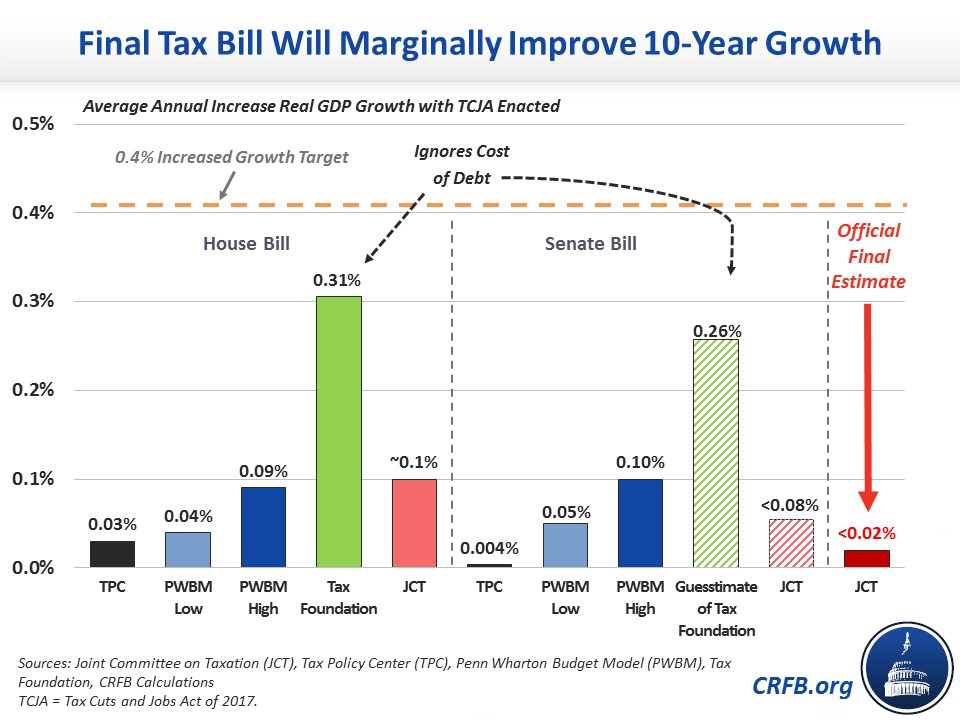

In response to my quote of CRFB’s assertion that average growth acceleration under the Tax Cuts and Jobs Act relative to baseline will be only between 0.01-0.02 percent (shown below),

Source: Committee for a Responsible Federal Budget (Jan. 3, 2018).

Reader Vivian Darkbloom writes:

I’m asking myself how an average increase of only 0.01 percent to 0.02 percent in GDP growth over a decade could result in an average of increase in the level of GDP output of 0.7 percent of that same ten-year period as reported by the CFRB and Menzie.

and continues:

Either you need to justify it (and the related text regarding the assertion that it is 1/20th to 1/40th of the McConnell estimate), or retract it.

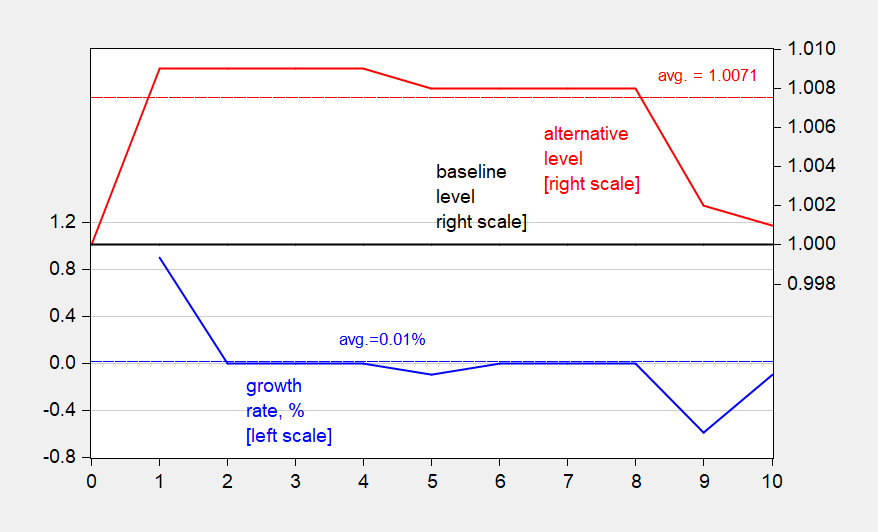

The key to understanding how the 0.01-0.02 percent growth rate is consistent with 0.8 percent higher than baseline GDP for most of the 10 year window is to recall that GDP drops to 0.1-0.2 percent above baseline at the end of the window. You can make up an example, like I did, and get for instance average GDP is 0.71 percent higher over the entire ten year period, but there is only 0.01 percent acceleration in average growth.

Figure 1: Growth rates deviation from baseline, percentage points (blue line, left scale) and level under baseline (black, right scale), and under alternative (red, right scale). Dashed lines are averages. Source: Author’s calculations. [updated 1/18]

The example can be downloaded as a small spreadsheet here. The relevant JCT document is here.

Reader Leper Messiah, who wrote:

Having now read the original CFRB blog entry, their estimate of .01 to .02 annual percent growth should have been .1 to .2. That would put the JCT estimate as 1/2 to 1/4 of the McConnell entry. Kudos to Vivian Darkbloom for spotting a major error in the calculation. It appears Maya et al are the ones who are math-challenged.

will also be disappointed to know he/she is not going to get satisfaction either.

In other words… we gave up a $1 trillion of tax revenue, and got a measly average acceleration of growth of 0.01-0.02 percent!?!?

Because of potential misinterpretations, the JCT chose not to report average growth rates, but rather reported that GDP will average 0.7 percent higher compared to the baseline. If one had assumed the benefits of TCJA occurred towards the end of the 10-year period, one could even arrive at the magical 0.4% average growth rate and be consistent with a 0.7% average increase in GDP over the period.

However, there are clear welfare advantages of having higher growth rates early in the period, which shows that the dangers of misusing the simple average growth rate.

A less normative study would not even focus on a path-dependent growth rate. If necessary for easier comparison, it would compare all alternatives using a constant geometric average growth rate. For the JCT analysis, that rate is 0.07%. (1.007 = 1.0007^10)

Actually I should have integrated, so the constant growth rate would be 0.14%. The math for finding the rate is to solve:

0.007= \int_{0}^{10} exp(r*t) dt

for r.

all good fun and nice play with stats but we will only know the truth in hindsight – bear in mind the dismal forecasting record of academic economists – and not just Prof. Chinn

chilton thomas: This is not playing with statistics (since I’m not re-estimating any parameters or doing inference). It’s math (averages, integrals, derivatives).

it’s still a projection into the future – which is unknown – can’t duck the old ceteris paribus

I watched the weather forecast this morning. Was it entirely accurate? No. But I will watch the weather forecast tomorrow morning.

BTW – the old joke is “why do economists forecast? To make the weather man look good”.

Of course Team Trump probably would have told its audience that New York City would enjoy a sunny and warm day today.

So he is saying that Republican economic estimates don’t have a dismal record of accuracy?

Kidding right?

No retraction and still no plain answers.

Repetition from previous post:

Menzie wrote “Pretty sure they all used the June 2017 CBO baseline.”

So i posted this to show the CBO baseline.

Fig. 5: CBO’s Economic Projections – Real GDP Growth

Calendar Year 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027

CBO (June 2017) 2.1% 2.2% 1.7% 1.4% 1.7% 1.9% 1.9% 1.9% 1.9% 1.9% 1.9% 1.8%

Then Menzie commented ” I don’t know for sure, but CBO does post all vintages of recent forecasts on its website so you don’t have to refer to CRFB. The baselines vary as new information comes in; it would be surprising if the baseline remained constant over time.”

This is what I mean by no plain answers.

So I will make it as plain as i can.

CBO GDP projection are already wrong, very wrong. So is any baseline that was used to project GDP due to the tax bill.

The CBO projections should not be, as a matter of law, have any influence for determining what the Congress can do on fiscal matters with projections of deficits or government income. The responsibility should be solely on Congress for the results of legislation. Although the tax bill was surprisingly good, it would have been better without the rules forcing the Congress to accept the CBO projections.

The think tanks which determined low GDP growth using CBO baseline are both politically bias against smaller government solutions and hopelessly Keynesian in economic theory. They simply cannot distinguish ordinary tax cut with those that are strongly supply-side.

if the above does not lead a reader to ignore the CBO GDP projections. the CBO baseline, and all low GDP growth predictions from the various entities. then I remind them again what Menzie explained.

“The baselines vary as new information comes in; it would be surprising if the baseline remained constant over time.”

In other words projections and predictions based on CBO baseline cannot be tested, can not be relied on, and will, without uncertainty, be wrong.

Ed

Ed Hanson

The CBO projections should not be, as a matter of law, have any influence for determining what the Congress can do on fiscal matters

Just so you know, the acronym CBO means Congressional Budget Office. The CBO is a creature of Congress. And the CBO does not limit what Congress can or cannot do…the CBO simply crunches the numbers because our politicians are as stupid and uninformed about economics as the voters they represent.

CBO GDP projection are already wrong, very wrong.

How do you know? We don’t have the 4th qtr number yet and we haven’t seen the revised numbers yet. Even if 4th qtr GDP growth comes in at 3.2%, that still leaves the 2017 growth rate at around 2.7%. The CBO was predicting 2.1%. The June CBO projection seems a lot closer to what is likely to be the actual number than the nonsense we were hearing from Team “4%” Trump.

The think tanks which determined low GDP growth using CBO baseline are both politically bias against smaller government solutions

So are you saying that the CBO projections are politically biased and therefore any think tank that uses those projections must also be politically biased? And if you’re not saying the CBO projections are politically biased, then wouldn’t it be evidence of think tank political bias if those think tanks didn’t use CBO projections as the baseline. Your comment just seem hopelessly confused. You might want to rethink what you’re trying to say.

and hopelessly Keynesian in economic theory.

The models used by those think tanks and CBO are vanilla textbook macro. And your comment seems especially bizarre given that the usual criticism of Keynesian economics is that it overstates the growth effects of fiscal policy. You know…fiscal multiplier less than 1.0 and all that. So here again you seem confused.

They simply cannot distinguish ordinary tax cut with those that are strongly supply-side.

In other words, they simply can’t rely upon unicorns, fairy dust and magic asterisks. Have I got that right? If you knew the first thing about growth accounting, then you’d know that:

(a) There is a difference between permanent changes in economic growth rates and level shifts in GDP.

(b) Supply side effects take a very long time to affect growth rates because of something known as a convergence rate.

(c) The history of “supply side” tax cuts is not a happy one.

(d) If you’ve got an aggregate demand curve and an aggregate supply curve, then you need an instrumental variable to identify the equations. I’m quite sure you have no idea what I’m talking about, but you’re the one who brought up the issue of distinguishing “ordinary tax cuts with those that are strongly supply-side.”

CBO baseline cannot be tested, can not be relied on, and will, without uncertainty, be wrong.

And therefore you’re completely justified in believing anything you want. My, how very nihilistic of you. Frankly, your “arguments” sound like the kind of stuff I’d expect to find over at zerohedge.com. Or better yet, the kind of thing one might overhear from a couple of blowhards down at the local VFW hall after they’ve had a few too many.

It’s still early in the spring semester. You still might be able to register for a basic macro class at your local community college.

This is an outstanding post, an outstanding explanation, and a generous response to the blog readership that most blog hosts don’t make the effort at. Hats off to Menzie.

I might make a FRIENDLY suggestion to Menzie as well. When the “Vivian Darkbloom”s of the world pop up out of the woodworks—and they inevitably do—You should yank out the Reagan numbers on government revenue receipts as they relate directly to the growth rate during Reagan’s 8 years (and maybe 2 years after Reagan’s term ended to account for “lag effects” of the tax policy). Relating to the “lower tax rate equates to higher government revenues due to growth” PERENNIAL LIE, It showed/shows what a huge pack of LIES guys like Micheal Deaver, Milton Friedman, Martin Feldstein were telling at the time. These numbers are POWERFUL, over a decade long, and CANNOT be denied.

We’re having a repeat performance under Trump of a TRUTH relating to the two major parties—If one buys the premise that Democrats are “tax and spend”, then Republicans are UNDENIABLY “borrow and spend”. Which is worse for our nations debt?? The record shows “borrow and spend” is much more destructive.

‘If one buys the premise that Democrats are “tax and spend”, then Republicans are UNDENIABLY “borrow and spend”.’

Absolutely. Students of Robert Barro would argue that Reagan’s deficits were simply deferred taxation. After all – there is a long-run government budget constraint. Of course Barro-Ricardian equivalence predicted that this would have zero effect on national savings. Alas it did depressing national savings which is why we had a rise in real interest rates crowding-out investment and a dollar appreciation leading to current account deficits.

For Viv: The potential GDP conundrum, from WaPo

https://www.washingtonpost.com/news/wonk/wp/2017/11/29/tax-cut-proponents-promise-3-4-percent-growth-this-economic-milestone-shows-thats-nearly-impossible/?utm_term=.794d14eaedc7

Menzie, your spreadsheet does not match Figure 1.

Hahahahahahahahhaahahaha

rtd: You are right. Thanks! Graph corrected. Conclusions regarding growth rate remains unchanged.

Menzie, why did you ignore the importance of the sign for that growth. Many on the left would have us think it is/will be negative. Moreover, using a 10 year average ignores the peaks and/or valleys in that period. Anyone notice that (Krugman – not going to happen) peak at the beginning of the period?