State level data for GDP in 2017Q3 were released yesterday. This is an opportunity to evaluate the progress of manufacturing value added (as opposed to employment) in Wisconsin after passage of the Manufacturing and Agriculture Credit (MAC).

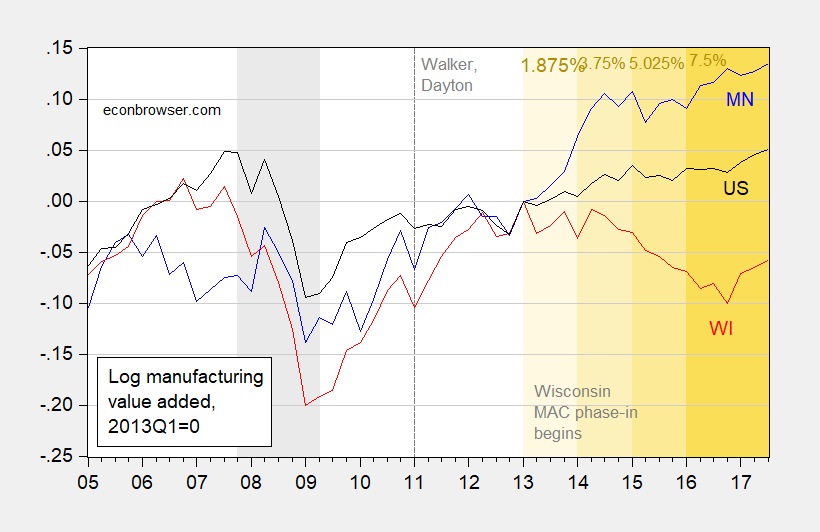

Figure 1: Log real manufacturing output in Minnesota (blue) and in Wisconsin (red), normalized to 2013Q1=0. NBER defined recession dates shaded gray. Orange shading indicates phase in of Wisconsin Manufacturing and Agriculture Credit (MAC), with darkness of color indicating size of credit, in indicated percentages. Source: BEA, accessed 1/25/2018, NBER, and author’s calculations; graph updated 1/25.

Figure 1: Log real manufacturing output in Minnesota (blue) and in Wisconsin (red), normalized to 2013Q1=0. NBER defined recession dates shaded gray. Orange shading indicates phase in of Wisconsin Manufacturing and Agriculture Credit (MAC), with darkness of color indicating size of credit, in indicated percentages. Source: BEA, accessed 1/25/2018, NBER, and author’s calculations; graph updated 1/25.

Obviously, different things are happening in 2013Q1 when MAC was implemented; however, the fact that Minnesota manufacturing surges while US manufacturing continues to grow as Wisconsin dives is suggestive. As of 2017Q3, Wisconsin manufacturing value added is 5.8% below 2013Q1 levels, 2.4% below 2012Q4, just before implementation of the MAC.

Neither employment (according to establishment data) nor value added have re-attained pre-recession peaks. In contrast, nationwide-level manufacturing value added has just exceeded pre-recession peaks.

The question occurred to me whether there are leading and trailing states in recessions, or is each recession unique?

Did the following explanation of the tax credit mean that the credit was implemented gradually, reaching its full amount in 2016.

———————————————————————————————————————–

From the referenced Manufacturing and Agriculture Credit (MAC)

‘What is the rate of credit?

The credit is a percentage of eligible qualified production activities income. The credit is calculated by multiplying eligible qualified production activities income by one of the following percentages:

For taxable years beginning after December 31, 2012, and before January 1, 2014, 1.875%

For taxable years beginning after December 31, 2013, and before January 1, 2015, 3.75%

For taxable years beginning after December 31, 2014, and before January 1, 2016, 5.025%

For taxable years beginning after December 31, 2015, 7.5%”

————————————————————————————————————————-

If so, it shows usual stupidity of gradual tax changes. All it does is incentivise the tax payer to delay changes until maximum advantage is available.

Again, if i am right about the gradual implementation, it provides a reasonable explanation of the action of the Wisconsin manufacturing value. It did not seem to have great affect until the year 2016.

Ed

Ed, Do you have an explanation for the 2 year negative effect?

DD

It is possible the very nature of the tax incentive is the cause of the negative affect. At the margin, normal investment which would have occurred earlier was put off due to the greater tax incentive.

The same thing occurred with the original Reagan tax breaks. Reagan wanted the full cuts immediate but the Congress would only pass delayed full effect. While the recession of 81-82 was probably inevitable, due to FED interest action, it would have been milder with immediate implementation of the tax cuts.

Those who design and pass legislation should be aware of and learn from delayed incentive.

Ed

Ed Hanson: See revised graph. If you are right, then I would have expected a pick-up in manufacturing in 2016Q1, instead of a year later, in 2017Q1.

Ed wrote:

it shows usual stupidity of gradual tax changes. All it does is incentivise the tax payer to delay changes until maximum advantage is available.

Again, if i am right about the gradual implementation, it provides a reasonable explanation of the action of the Wisconsin manufacturing value. It did not seem to have great affect until the year 2016.

No, what you are suggesting doesn’t make sense for this tax credit.

Taxpayers will delay for one-time benefits, such as for making a capital investment or for selling an asset with substantial capital gains. In the case of those event-based taxes, the taxpayer is penalized (pays higher taxes) by acting early.

The Wisconsin MAC provides a credit for ongoing production-based income. The taxpayer is rewarded, not penalized for acting early. If a taxpayer makes an investment to increase production or improve profitability in the initial year of the MAC and claims a tax credit at the low initial rate, the opportunity to claim the higher credit is not lost. The taxpayer instead collects increasing tax credits each year until the benefits of the investment benefit from the fully phased-in rate. If a business investment makes sense at a partial 3.75% credit, there is no incentive to wait 2 years for the full credit.

On a totally subjective/personal/semi-narcissistic note, Looking at ____ like the data in this post really annoys the hell out of me (nearly to no end). Because in my state (a red state run by an illiterate female governor and illiterate Republican legislature) all we ever do is shoot ourselves in the foot economically, then “realize” we shot ourselves in the foot, and proceed to “fix” the foot that was shot by going ahead and shooting the other corresponding foot. Then the governor and Republican legislature go on TV and say “Look we fixed, it, now BOTH feet are bleeding profusely. You’re Welcome.” And then the illiterate constituents (or 4th grade level readers AT BEST) smile and go back to playing the slot machines at the local Indian casino.

Menzie

Six months is not much time. It is near impossible to always account how long manufacturing production begins to increase due to capital investment, but as I suspect, 6 months is possible.

Again, lets remember that much of Wisconsin manufacturing types are older in nature. That could mean longer reaction times as well.

Fact is, lag it is speculation. But the fact also is that Wisconsin manufacturing is presently rebounding quite nicely.

Ed