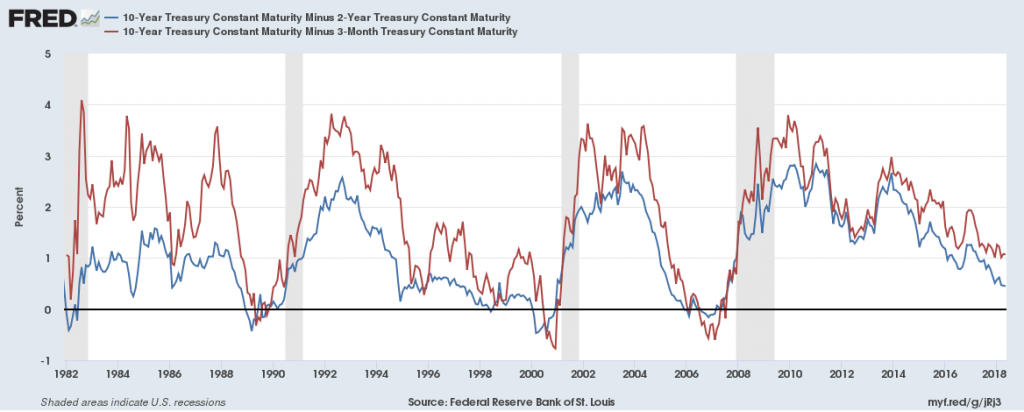

If one uses a three year window, it’s three times: February, 1986, May 1995, September 1997. Three other times, a recession follows.

The last time around — when people were saying “this time is different” — was May 2005. Inversion occurred in February 2006 (and in November 2006, skepticism of impending recession). The recession is dated by NBER as starting in December 2007.

For additional discussion of the implications of a flattening yield curve, see Michael Klein’s EconoFact article, and (for cross country empirics) Chinn and Kucko (2015).

Menzie,

As much as I complain and comment on your political post, I admire this type of economic post you provide. The insight you provide is terrific.

Question, I loaded the daily effective fed fund rate and it seemed that it crossing the it10 year constant maturity rate is also a historical recession call. Would you look at this and see if I am just kidding myself or if there is some correlation. If so, does it show more control of the FED in causing recession than some admit to?

Ed

Ed Hanson: Since the effective Fed funds rate is very close to the three month Treasury rate usually, then the Fed funds rate crossing the 10 year constant maturity rate is the same as the 10y-3mo spread going negative (i.e., inversion over the 3 mo to 10 year part of the yield curve).

@ Menzie

“a fortiori”?? “a fortiori”?!?!?!!? Really, I have tried to push the limits of “The Menzie Filter” as far as it goes. Asterisks, underscore, blanks, abbreviated F bombs. With no ill-will to the blog host, it is just my “דרך הפעלה”. Then Menzie, then, you have the unmitigated gall to drop the grotesque vulgarity of “a fortiori” in a research paper?? Wow man…..

https://www.youtube.com/watch?v=VwvkC9z-9zE

It’s fascinating how some people who seem to be missing a few points in the IQ department, will say that the Fed causes recessions, and nearly in the same sentence, insist the Fed can’t/hasn’t done anything to avoid recessions/depressions. Of course, in Ed Hanson’s world, that right-wing orthodoxy has “nothing” to do with politics, does it?? And yet the sleazy mammal currently inhabiting the White House that Ed Hanson loves so much, will sit with Fed Chair candidates and do a “litmus test” on whether he, as an economically illiterate White house inhabiter, can dictate to them, Fed policy.

This is more the topic area that I really enjoy and have fun soaking up. Not saying I 100% understand it all, but finance area is more my favorite flavor on the menu. Always enjoy these. I don’t see rates rising that fast—-with one caveat—that with all these bonds Trump’s government is going to sell to fund his huge increase in debt that because of a “bond glut” they may have to increase the rate just to sell the damn things. I’m sure Menzie has some theories for or against that happening if he hasn’t already stated it.

Faster productivity growth will slow inflation. The business tax cuts should increase capital spending, and more children of the Baby-Boomers will enter “prime-age.” Raising the minimum wage should boost productivity growth, not only by attracting better workers, outside the workforce, but also by boosting morale and performance of the large percentage of workers earning less than $15 an hour. Moreover, a higher minimum wage should increase capital spending, to replace some labor hours, along with creating higher paying jobs in producing and maintaining capital equipment. Higher paying jobs for low income workers will increase aggregate demand. However, much of that will be offset, e.g. paying down student loans (for less marketable degrees) and more saving (e.g. for a house). Moreover, less regulation reduces production costs.

Another totally off topic rant from the folks at Fox and Friends.

Kind of warms your heart, doesn’t it??

https://youtu.be/7LnZEmi6KXA?t=36s

50% chance over the next 3 years seems about correct to me. But, its not a random event: The Fed controls the outcome either by taking some additional inflation risk, or jamming the brakes because they are worried about HyperInflation of 2.3% per year. Unfortunately the Fed spends way too much time looking in the rear view mirror of the 70s. So the way I look at it, there is about a 50% chance that the FOMC screws up. Sounds about right.

I was reading Bloomberg and I had a finance question for Menzie (or kind of a hybrid finance/econ question). I read Italy’s 10year yield had jumped 13 basis points in one day. That is a pretty big jump for a single day, correct?? It’s at 2.08%. What rough number (say margin of error a quarter basis point) would that have to be to start “inciting” panic in Euro markets?? I’m not trading on this information, I’m just generally curious.

I mislabeled my question above, I meant to say a margin of error of 25 basis points, obviously a “quarter of a basis point” would be a pretty damned tiny “margin of error”.

Here’s another interesting question, related to Menzie’s paper, that I think Menzie will understand why I ask it, and those who had read even just half the Kucko paper would get. If you had a country which in past years had a “strong legal regime”, but recently had seen the rule of law being corroded from the inside (think Justice Department, Fed Reserve, EPA, nomination of District Court judges, etc) would that tend to UNLINK the inverted yield curve away from nearby recessions??

Also would there be any historical examples of this??

The high yields of Treasuries and dwindling reserve currency status of USD are two of Trump team’s major weaknesses in its trade wars against rest of the world(one could say against mainly China). Coupled with Trump team’s need to work for chances of winning elections, Trump team would most likely fold in current trade wars, especially with European’s refusal to bow to Trump team’s “You are either with us or you are against us” approach(as manifested in the handling of Iran and NK denuclearization, status of Jerusalem, trade tariffs against China, sanctions against Russia,…) to pull allies to its side to isolate and weaken US main perceived opponents, paving the ways for more winnable onslaughts in next stages.

your real feral funds rate is still negative if you take the average of the median and trimmed mean annual rates. no recession until the real rate is substantially in positive territory.