First, look at futures as of today (with the decline looking unabated):

Source: ino.com.

I interpreted this graph as indicating a persisten drop in soybean prices due to tariffs, separate from weather conditions impacting near term prices. Reader mp123 writes:

The fact the entire soybean curve cost moved together, doesn’t really suggest anything other than the fact that beans are at or near full carry.

I have only one comment, provided by David Reichsfeld and Shaun Roache (2011):

We arrive at four main conclusions regarding the forecasting performance of commodity futures prices in this paper. First, futures price-based forecasts are hard to beat. Futures prices perform at least as well as a random walk for most commodities and at most horizons and, in some cases, do significantly better. But the second result is that the failure of futures prices to clearly (and statistically significantly) outperform this benchmark in almost all cases is a puzzle.

The spot price reflects the cost of carry and is more influenced by current physical market conditions (and less by expectations of the future) than is the futures price. In the absence of constraints on arbitrage, this should mean that futures prices outperform the random walk, on average. Third, many other naïve time series models, including some that maximize in-sample fit, tend to do much worse than a random walk. Parameter instability renders many time-series models as useless, at best. Fourth, the relative forecasting ability of futures prices deteriorates the longer the forecast horizon, which likely reflects lower liquidity at the back end of futures curves.

We also assessed the forecasting performance of futures prices relative to a random walk during different market conditions. Theory predicts that futures prices should do much better than the random walk when the market is in backwardation because the influence of current market conditions on spot prices is particularly strong during these periods. However, we do not find a significant difference in forecasting ability between periods of backwardation and contango. This result holds even when spot prices are significantly above futures prices, in strong backwardation.

In fact for soybeans, futures prices work particularly well, so that a random walk is outperformed at the 10% msl, for horizons up to a year.

Source: Reichsfeld and Roache (2011).

So best guess of soybean prices in January 2019 is 889, down from 1040 that was futures as of beginning of March.

So that works out to a 15% drop (151 ÷ 1040, yes??). I’m wondering how that affects autumn sales (that would be lower than the 15%??) and whatever that X percent drop in prices (for Autumn harvest) is multiplied by what value in gross soybean sales for American farmers?? And then all of the American taxpayers pay that welfare check from the USDA to soybean (and corn will add up here too, yes??) farmers so Trump can take a bow and say he’s “doing it for American farmers”?? If Trump and Sonny Perdue decide the USDA pays farmers welfare checks, then this ends up being a food tax on the American people.

For all of you dumbshit Republicans who are masters at whining about luxury goods taxes and inheritance taxes, the USDA welfare checks that Trump and Sonny Perdue will pay soybean and corn farmers from the USDA doesn’t just magically fall out of the sky. That’s government money that all US taxpayers have to pay one way or the other.

Hog supplies are at their highest level ever recorded (going back to 1964) and export demand very much in doubt.

https://tradersnews.com/2018/06/28/record-high-u-s-june-hog/

So I guess we should expect Team Trump to promise a bailout for hog farmers as well as soybean farmers. Of course, that won’t be socialism.

As your typical sexist/misogynist/superficial/archaic white male, I am not sure how much I subscribe to Kanter’s theory. But for those with curious and enquiring minds, I bequeath you the following link:

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.1008.6831&rep=rep1&type=pdf

Hidden hell. Right out in the open here: https://www.nytimes.com/2018/06/28/opinion/women-dont-back-down-online.html?action=click&pgtype=Homepage&version=Moth-Visible&moduleDetail=inside-nyt-region-1&module=inside-nyt-region®ion=inside-nyt-region&WT.nav=inside-nyt-region

@ dilbert dogbert

I knew, one day, it would come to this……. /sarc

My Dad had a running joke he told for years, usually when my Mom was trying to create/manufacture a quarrel over something my Dad had no issues with. He’d say to me “See, I knew a college education would ruin her” or “I knew your mother would be ruined after she got a college education”. If you didn’t know my Dad, you would have taken his tone of voice as being his true feeling on it. But my Dad had his Master’s degree in education. And basically beat my sister and me to death with a large crescent wrench (figuratively speaking) with getting a college degree roughly from around the age of 4. And my Dad could talk about anyone who had attained to greatest successes in life (Bill Gates etc.) with the conversation ending remark “Yeah, but the dumb S-O-B never got his college degree”. And my father detested celebrities who would go to get “honorary” degrees and saw it as a joke and demeaning to any institution that handed them out. Anyone who knew my parents over an extended period of years knew who my Mom’s biggest enemy was to getting her degree—-HERSELF until my Dad started kicking her butt (over YEARS) to go out and get it.

Women spend much more time insulting each other and deriding each other then men do. But it’s not as fun to “retweet” when women take a verbal street knife to each other. Lets imagine the number of retweets this would have gotten, if any male had said this on Twitter or Facebook, instead of a sad and shallow white woman insulting an Asian female with her PhD from one of the best Universities in Canada.

https://twitter.com/jonkay/status/1007098131832455170

Because it’s said by the sad and shallow white woman to an Asian female, it doesn’t qualify as “red meat” for the feminists, so a few fans of https://twitter.com/DrDebraSoh?lang=en look at it, and we all move on. It’s too much for a white female with a large metal splinter up her A-hole towards society to do her homework before she insults someone who disagrees with her.

People aren’t allowed to say things that are generally true anymore. To make observations that hold true to reality. These are not “absolutes” they are things that are generally or predominantly true. In my opinion when you start making absolute style statements, is when you start sliding over into racism or sexism.

https://twitter.com/DrDebraSoh/status/1009105218741686272

https://quillette.com/2018/06/19/why-women-dont-code/

Here we see one woman (again a white woman) putting down an Asian woman’s degrees—->> https://twitter.com/DrDebraSoh/status/1003336953260015616

Cherry picking “news” for a SCIENCE magazine—->> https://twitter.com/CHSommers/status/1000903039002316801

Again, women attacking women, little-to-zero attention given to it (there is vulgarity in this tweet after the link jump) https://twitter.com/DrDebraSoh/status/1001141415676694531

Some women make themselves out to be laughingstocks, by asking (insisting??) to be treated like children—> https://twitter.com/DrDebraSoh/status/996073521087418369

Your race can even be changed now, based on your opinions and public stances: https://twitter.com/DrDebraSoh/status/995712517837066240

Apparently, judging from headlines, some adult women still have problems making their own clothing choices https://twitter.com/DrDebraSoh/status/991738519482757125

Women attacking women again—“snorseville” when women attack women, no red meat for claims of “the patriarchy” here https://twitter.com/DrDebraSoh/status/985574805415055361

How do some colleges prepare women for society?? SIMPLE: Just go out into the big bad world and avoid any interaction with men:

https://t.co/nHF3qOKIwL

Asian female magically becomes a white male based on her opinions. Don’t try this at home, it’s dangerous to your private parts.https://twitter.com/DrDebraSoh/status/975751370652471296

One of my biggest pet peeves with “millennial” males: (there are other nicknames for that generation of males I will skip out of respect to this blog) https://twitter.com/ireneogrizek/status/975341007687634944

Rationalizations for having ZERO INTEREST in, or being out-and-out crappy at, science and math: https://twitter.com/DrDebraSoh/status/975045668254441472

Sloughing off research because you can’t understand basic stats (“Princeton” Kopits, I’m talking to YOU) https://twitter.com/jordanbpeterson/status/965471126158696448

If you have high scholastic aptitude and excel at academics, Guess what?? It’s not even required you be white to be “racist” anymore:

https://twitter.com/RealPeerReview/status/948329231632789504

“Fourth, the relative forecasting ability of futures prices deteriorates the longer the forecast horizon, which likely reflects lower liquidity at the back end of futures curves.”

It likely reflects the potential of unexpected shocks, which are more likely to take place the longer the time horizon. Of course, that lowers liquidity at the back end, because of risk aversion.

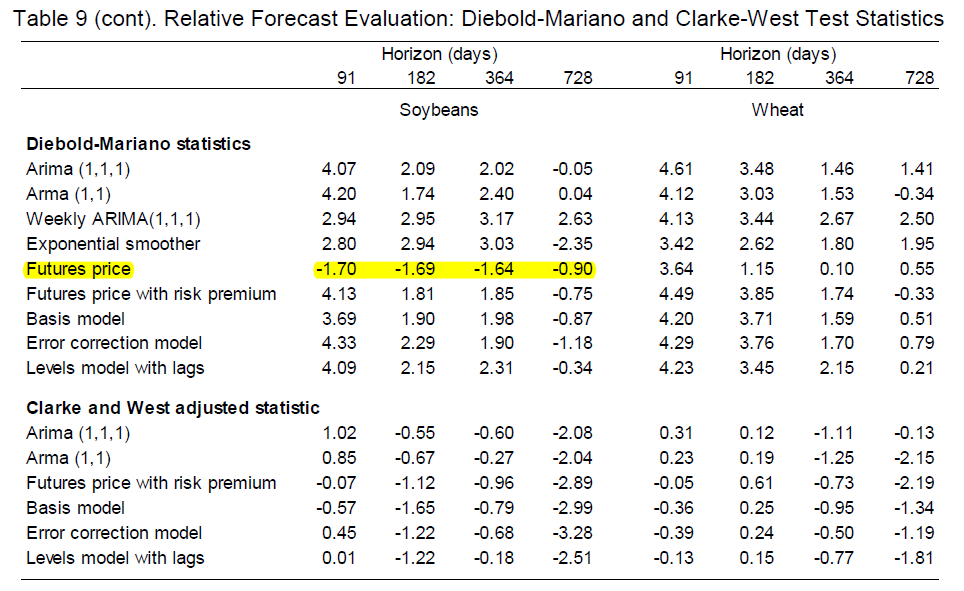

PeakTrader: Look at Diebold-Mariano stats for up to a year horizon.

This comment response by Professor Chinn, exhibits his great faith in humanity, and giving every person he interacts with “the benefit of the doubt”. And all this time I thought Chinese were the most pragmatic people on planet Earth. [ shifts into my deadpan voice ] The hell I say. The hell I say.

Some lecture notes on Diebold-Mariano:

http://www.phdeconomics.sssup.it/documents/Lesson19.pdf

“It likely reflects the potential of unexpected shocks”

Of course you and Kudlow know how to forecast unexpected shocks which is why you and he can say the deficit is lower. Snicker!

Hi ,

Where is a blog entry that explains the disaster coming from Foxconn factory in Wiskonsin?

http://thehill.com/homenews/state-watch/394618-foxconn-deal-raises-concerns-of-taxpayer-giveaways

President Trump and Wisconsin Gov. Scott Walker (R) will be on hand Thursday when the high-tech manufacturer Foxconn breaks ground at a mammoth new factory, a deal expected to bring thousands of high-paying jobs to suburban Milwaukee.

But those jobs come at a steep cost to the state, which gave massive tax breaks and incentives to the Taiwanese firm in order to lure them to Wisconsin. Some watching the deal say the state will take a generation to make back the money it gave away, and they worry that the Foxconn deal could mark the beginning of a new round of taxpayer giveaways to big corporations.

“The state is grossly overspending on a very risky deal. Even by its own math, the state says it won’t break even for 25 years. In high tech, that’s three lifetimes,” said Greg LeRoy, who heads Good Jobs First, a watchdog group that tracks lavish incentive packages states and cities give to corporations.

The incentive package passed by Wisconsin’s GOP-controlled legislature, during a special session last August, will offer the company $1.5 billion to offset payroll costs and another $1.35 billion for capital expenditures. The state will give Foxconn $150 million in sales tax exemptions on construction materials, and it plans to spend a quarter of a billion dollars on road improvements near the new factory.

The town of Mount Pleasant, where the factory will be located, will offer $763 million to help pay for the project, and Racine County gave the company $50 million to acquire the land.

In total, Wisconsin, Racine County and Mount Pleasant gave the company nearly $4.8 billion in tax breaks, incentives and taxpayer dollars for improvements. If Foxconn delivers all 13,000 jobs it has promised, that works out to about $370,000 per job.

“Foxconn is a great deal for Foxconn and an absolutely terrible deal for Wisconsin,” said Richard Florida, an urban planning expert who heads the University of Toronto’s Martin Prosperity Institute. He called the deal “a complete and total waste of taxpayer money.”

ivars: See this benefit-cost analysis.

Soybean prices down and the cost of imported steel up. GM is noting the latter will cost American jobs:

https://www.nytimes.com/2018/06/29/business/automakers-tariffs-job-cuts.html

Menzie would you please clarify this statement: “So best guess of soybean prices in January 2019 is 889, down from 1040 that was futures as of beginning of March.” Where is 8.89 from? Where is 10.40 from? I assume March is 2018?

How would you predict for these short term Price changes? Feb 22 2016 $8.6010 and June 06 2016 $11.7825. The actual prices 91 days after (Sept 5) June were $9.825 and prices for 120 days after were $9.907 (opening Nov 1, 2016). Do any of the models predict these values?

Or using an equivalent drop in prices ~ May 20 2014 $15.1550 until ~Sept 22 2014 $9.1025, what would you predict 90 and 120 days out? My price data is from:

http://www.macrotrends.net/2531/soybean-prices-historical-chart-data. I did not download the data, but took them from the chart.

Since you are doing event analysis, the event that drove the 2014 price drop was the late may and early June WASDE reports. This analyis provided this:

“Based on the June 30 USDA Acreage Report, U.S. soybean acreage for 2014 will reach a record level of 84.8 million acres, with 84.1 million acres being harvested. In the July 11 supply and demand report, USDA is projecting a record U.S. soybean yield of 45.2 bushels per acre in 2014, which if achieved, would lead to total U.S soybean production of 3.8 billion bushels in 2014. By comparison, total U.S. soybean production was less than 3.3 billion bushels in 2013. USDA is now estimating soybean ending stocks at the end of the 2014-15 marketing year to be at 415 million bushels, which would be among the highest levels ever. 2013-14 soybean ending stocks are estimated to be at 140 million bushels, which would very similar the level of carryover soybeans from 2012-13. USDA is estimating the average U.S. soybean price from Sept. 1, 2014 through Aug. 31, 2015 in a range of $9.50-11.50 per bushel, or an average of $10.50 per bushel.”

As a reminder, we have been saying soybean prices, especially annually, are affected by production amounts (harvest yields) and weather also affecting yields, as well as short term events such as tariffs.

In the short term what do you expect soybean prices to do if the tariffs are lifted, or China promises to buy xx% more in 2018-19? How is soybean acreage planted and weather doing in China? What twill China do if they negatively impact China’s own soybean production?

I forgot the link for the quote above: http://www.cornandsoybeandigest.com/blog/corn-soybean-prices-drop-after-july-wasde-report

Gee an event that occurred in July 2014. And it had the predicted impact on soybean prices. Something tells me that the American Economic Review is not going to be impressed with that paper you are working on after all.

BTW – we are talking about events during the spring of 2018. Update your calendar please.

CoRev: The first figure has at the top in big red numbers 888.5, which I approximated to 889. The graph pertains to January 2019 futures.

If you read the paper, and understood the table, you would understand that futures are not “a model”. Under certain assumptions, futures are best predictors, but not under others.

Menzie, I’m well aware the exchanges are not models. That’s why I asked questions, several articles ago, whether you were aware you were citing futures contract prices, and when you were discussing “patterns” in those data charts why did you expect historical data to change?

Furthermore , I gave examples where futures were not predicting UP markets, just for pgl an example of an event with its price impacts. That event also listed yield factors which had an impact on “long” contracts.

I will ask again for anyone to answer: “In the short term what do you expect soybean prices to do if the tariffs are lifted, or China promises to buy xx% more in 2018-19? How is soybean acreage planted and weather doing in China? What twill China do if they negatively impact China’s own soybean production?” These are more than reasonably valid assumptions to analyze.

CoRev: Do you at least know where I got 889 from now? Do you understand want a -1.6 Diebold-Mariano-West statistic means?

Menzie, why are you ignoring and deflection from the core questions? You have yet to do any analysis, and tell us your estimates/predictions. Any elementary school farm boy and do what you have done.

You cited your pride in the predictive vaue of your futures-based model, so what do you think will be the futures price of US soybeans for 3 and 6 months from the 4th of July?

CoRev: Well, futures expire on set days in a month, so there is no price for soybeans 3 and 6 months from the 4th of July. If there were a forward contract, there might be, but that would be OTC.

Menzie, there you go doing another deflection. “futures expire on set days in a month, so there is no price for soybeans 3 and 6 months from the 4th of July. ” So pick the next closest closing date and give us your proud estimate!

And you need to explain this statement: “If there were a forward contract, there might be, but that would be OTC.” By definition a Commodity Future Contract” is a standardized forward contract., even though futures traders are trading in the contracts and not in the product.

Just what do YOU estimate the November 2018 and January 2019 soybean prices will be? You have a predictive model. Predict for us.

CoRev: November futures (approx 4 months from July 4) expiration is November 14 according to https://www.cmegroup.com/tools-information/calendars/expiration-calendar/ . (There is no futures for October, and none for October 4th, which would be three months). The November soybean futures as of today 880. http://quotes.ino.com/charting/?s=CBOT_ZS.X18.E

Given the econometric evidence on the unbiasedness and relative out-of-sample forecasting performance in both Chinn and Coibion (2014) and Reichsfeld and Roache (2011), I think this is the best guess.

CoRev: What I meant by referring to a forward is that there might be a contract that is a predetermined/set number of days (say 3 months) from July 4th. That is what is called a “forward” (not future) contract. Forwards predominate in financial markets, e.g. currency trading.

Menzi, I’m surprised you have no independent prediction for Oct and Nov.

I agree that specific contracts called forwards are used outside of futures. Your used confused me.

Menzie, I’m surprised you have no independent prediction for Oct and Nov.

I agree that specific contracts called forwards are used outside of futures. Your used confused me.

CoRev: I don’t know what you mean. My best forecast based on the accuracy of futures is 880 for Nov. 14. There is no futures expiring in October. In a pinch, I’d interpolate between Sep and Nov.

Not only failing to get the concept of an event study as well as showing an inability to read a simple graph?

Look CoRev – no one ever said only tariffs matter. But tariffs do matter. And what changed in March 2018? Oh yea – trade policy.

Pgl, why are you always so snarky? Your reading comprehension failed again. You didn’t notice my event analysis.

CoRev: I think pgl did understand. If you look at July 2014, some of the price decline I am sure is due to the Ag report. I think a large proportion is due to the dollar appreciation, which can be taken as exogenous with respect to soybeans. Indeed, the aggregate commodity price index dropped with the dollar appreciation, a well known phenomenon.

Menzie, you’ve developed a mind reading talent? You got: “I think pgl did understand.” from this: ”

pgl

June 30, 2018 at 10:50 am

Gee an event that occurred in July 2014. And it had the predicted impact on soybean prices. Something tells me that the American Economic Review is not going to be impressed with that paper you are working on after all.

BTW – we are talking about events during the spring of 2018. Update your calendar please.” ?

Your own analysis is reasonable, but definitely outside pgl’s capabilities as shown by his commenting to date. I agree that some of the price decline I am sure is due to the dollar appreciation.

I noticed the 2014 event analysis. And your point was ???? Again – we are talking about recent developments. Right?

Pgl, did they not teach you about comparative analysis?

comparative analysis.

The item-by-item comparison of two or more comparable alternatives, processes, products, qualifications, sets of data, systems, or the like.

Or instead of actually thinking it is easier to just carp?

I know I’m starting to like using your style.

I think I found the recruiting poster that originally attracted many commenters on this site to the Republican party. I knew the RNC had to have some trick to get so many of Menzie’s regular agitators to join up and I think I finally found the gimmick:

https://goo.gl/images/4WFyWM

Do they know their target demographic, or what??

The recent drop in soya bean prices is dramatic, no doubt.

On the other hand, glancing at decade long charts of soya bean futures, one gets the impression that recent price moves are well within norms.

The decline in prices on the heels of the 2008 financial crisis is impressive. How does that exactly work? Global economy slows down so the demand for livestock declines?

If la Trumpette manages to engineer a global economic slowdown, should we expect even lower soya bean prices?

Prediction: If these tariffs are still in place in early 2019, farmers will be able to react to shifting relative prices and plan the year’s crop as a consequence. Could be positive for non-US soya bean producers. Given that life in general and economies in specific are ‘path dependent’, it is interesting to contemplate how much permanent damage the Trumpette tariffs are imposing on US soya bean farmers.

It will also be interesting to watch how the US deficits grows under increased subsidies and transfers to US farmers. American socialism in action.

Erik Poole: True, we’ve seen comparable declines. However, this one is largely self-inflicted. Moreover, it comes on the heels of previous declines, so that farms are already near breakeven (plus they leveraged up). So, this decline might be more painful than the previous.

Menzie “However, this one is largely self-inflicted.” That;s why I used the 2014 price drop example. This was too self-inflicted by farmers over-planting and causing supply excess issues. I presume some here know what that usually means.

Depending on your time frame your claim may not be true or supported: “So, this decline might be more painful than the previous.” Had you answered my early question re:possible changes in tariff and potential China promises, then you’d better understand why I question it validity.

I might also add that farmers are pragmatic and some ares more flexible than others in crop planting. I expect few here know that there is a short season soybean option for many farmers, and those have probably already changed 2nd planting crop plans from soybeans. Plans as well as estimates change.

CoRev: The harm from price declines is discussed in this post. Of course farmers have options for plantings; the question is whether the alternative crop will yield the same return as the pre-shock return on soybeans.

Menzie, you’re again only partially correct. Farmers will also consider whether the alternative crop will yield the same or better return at harvest time based upon the post-shock estimated return on soybeans at decision time.

I see a pattern here. That the Trump trade war is hurting farmers is WONDERFUL as you can find in the history of time other things that lower farm prices. All of your comments have this theme. And it is a rather weak defense of Trump’s stupid trade war.

CoRev I expect few here know that there is a short season soybean option for many farmers

But not for farmers in the big soybean producing states. In Iowa and most of Illinois you plant in late April through mid-May. The soybeans are usually take around 4 months to mature (give or take a few weeks). Then the beans have to sit in the field for at least a month in order to dry. Harvesting is done during October. More southern states probably can squeeze in a second crop, but the yield will be lower because those tend to be smaller 90 day beans.

The past history of the field is a factor as well. Corn is a “nutrient hog” so wouldn’t normally plant it more than three years in a row, unless you want to go broke paying for fertilizer. Soybeans replace a lot of those nutrients lost from corn, but you’re not supposed to plant soybeans more than three years in a row either. The point is that the past history of a farmer’s field constrains the planting options available to that farmer.

I don’t understand why you’re so fixed on the hypothetical of the soybean tariff being relaxed. If that happens, then I would imagine that the spot price would increase. So what does that prove? The futures price factors in the weighted probability of the tariffs being relaxed. It might happen or it might not happen. Based on the futures price it appears most traders expect that the tariff will still be in effect come this winter. If you truly believe the Chinese will cave and they will relax their tariff and January spot prices return to the $10/bushel range, then you shouldn’t pass up a potentially lucrative buying opportunity.

2slugs, most everything you pointed out is a truism, but you forget we are talking about changes in US yield percentages in single digits affecting prices.

Some of your concepts are wrong: “More southern states probably can squeeze in a second crop, but the yield will be lower because those tend to be smaller 90 day beans.” Actually far northern areas such Canada’s Manitoba province is shifting to short season soybeans. Manitoba’s 3 biggest drops in acreage is: “Three biggest crops in Manitoba by acreage (80 per cent of total acreage planted): canola, hard red spring wheat, soybeans;”….

“Crop rotation with the highest marginal returns: corn, canola, hard red spring wheat, soybeans ($363 per acre).”

https://www.manitobacooperator.ca/crops/manitobas-annual-crop-production-estimates-worth-a-look/

It confirms what I have said these many years that Global Warming has a significant positive side in adding potential for new crops.

Your final paragraph is enlightening in highlighting the difference in short term views of the tariffs versus a longer more realistic view. You admit: “…the soybean tariff being relaxed. If that happens, then I would imagine that the spot price would increase.” But, you are wrong that only the spot market prices are impacted. Both the futures and spot price would quickly equilibrate.

You also misunderstand the futures market. “Based on the futures price it appears most traders expect that the tariff will still be in effect come this winter. ” No, they expect the tariff to still be in effect for the short horizon that they anticipate holding a contract. Remember the futures market is gambling on price changes occurring. Futures trading is mostly short term trading not long term. Most futures contracts are settled in cash before the contract expires, with no physical delivery taking place. I doubt very many farmers are selling soybeans into this market, while many may be taking advantage of this potentially lucrative contract trading opportunity.

CoRev I believe you’re quoting Canadian dollar values, so multiply by 0.76 to get US dollar values. Soybean yields per acre along the Canadian border are about 60% of what they are in the primary US soybean producing areas.

https://www.nass.usda.gov/Charts_and_Maps/graphics/SB-YI-RGBChor.pdf

An American soybean producer would go broke with those kinds of yields and value per acre. Farmers in the heart of the soybean belt do not follow a two crop strategy.

As to trading futures, you need two parties to trade a futures contract. If a trader is buying low today in anticipation of selling high tomorrow, then there will be another trader paying slightly more today. And another trader willing to pay slightly more. And another trader willing to pay slightly more. I believe the point of futures trading is that all windfall profits get arbitraged away, so we shouldn’t be surprised if the observed futures contracts end up reflecting what traders believe the spot price is most likely going to be a few months down the road. In your discussion you are assuming that there is only one smart trader.

All indications are that there will be a lot of soybeans in the bins right before harvest time (445 million bushels carryover in September), so farmers would probably like to hold onto beans if they could. But farmers are also highly leveraged and interest rates have been going up. Soybean crops in the core production areas are not looking particularly good because of extreme rain (a bad consequence of global warming) and flooding. Prices could go up later, but if you’ve got to pay bills today because of low yields not producing enough immediate income, then you’ll have to dump stocks at low prices. A day after this broadcast discussing the wet fields the middle of Iowa had 7 additional inches of rain.

http://www.iptv.org/mtom/story/30900/market-plus-naomi-blohm

Go to the 4:30 minute point.

Soybean farmers see no upside to Trump’s tariffs and the resulting retaliatory tariffs.

2slugs, I believe you have out done yourself in gibberish with this comment.

However, we do agree that today: ‘Soybean farmers see no upside to Trump’s tariffs and the resulting retaliatory tariffs.” Iowa farmers may be instead praying that the tariffs be lifted so that prices will rise for their probably reduced yield.

As to the gibberish, you responded to a dollar price which had no real relevance to the point that soybeans are a major 2nd crop. You clearly missed the point that they were talking about marginal return, which is the estimated difference between gross receipts and all costs. You clearly missed what crop rotation meant.

What was your point describing your concept of soybean futures trading? We were in agreement with your previous description, but II added costs also change in the futures market and not only your implication the spot market.

CoRev

you responded to a dollar price which had no real relevance to the point that soybeans are a major 2nd crop.

Well, you’re the one who quoted that dollar price. If you thought it was worth quoting, the surely it was worth my pointing out that it was in Canadian dollars, not US dollars. As to soybeans being a “major 2nd crop”, they might be for Canadian farmers, but not for soybean farmers in the US soybean belt. They plant one crop per year.

they were talking about marginal return, which is the estimated difference between gross receipts and all costs.

Let’s just say that’s a non-standard definition of marginal return.

But it seems that we both agree the Chinese retaliatory tariffs are bad news for farmers. So maybe we also agree that the futures price is the market’s best estimate of where the markets will be shortly after harvest.

2slugs, “So maybe we also agree that the futures price is the market’s best estimate of where the markets will be shortly after harvest.”

Nope! After all these articles, you can still say that?

CoRev

Nope!

Okay, if you don’t think the futures market is the best predictor, please tell us what you think is the best predictor. Not only could you make us all very rich, but I’m certain the American Economic Review and Econometrica would invite you to publish your discovery. Who knows…maybe a Nobel is in your future!

2slugs, there is no best test. The futures market is gambling on price changes. What test predicts price changes?

It is the naivety of the TDS sufferers, who believe these tariffs are even semi-permanent (greater than 1 growing season), and that all things will stay the same ( farmers buyers will not adjust their crop planting plans and buyers will not adjust their sources to supply/demand issues).

CoRev: If you had read the papers I mentioned, then you would know that for soybeans, futures prices outpredict any statistical model, including a random walk, with statistical significance for horizons up to six months. Now, that is what the papers say. If you want to dispute those results, you need to find another peer reviewed paper that finds otherwise, and show why that methodology is superior to what I have cited. That is how the scientific enterprise proceeds.

Menzie, if the statistical tests are such good predictors why have you deferred using them <b or yours to provide your own prediction? Your own “Uncertainty” articles show rapid changes which can be translated to Futures Price changes, and are often transitory. Defaulting to the exchanges prices for your prediction comes across as a cop out, or worse, an admission they may be wrong in this instance.

I understand how this President has you guys confused. We are so accustomed to Presidents coming from the elite political class none of us accustomed to see a President make and keep campaign promises. Our last President was such a beta personality type, and having implemented many of your favored liberal policies, an alpha male which has reversed and found great and rapid success with opposing conservative policies is disconcerting to you.

Liberal reactions have been detrimental to their own political movement. Failure to give Trump any credit is obvious to conservative and many independent voters as irrational lies, because their own experiences are overwhelmingly positive.

Lying is why liberals lost Congress, the Presidency and will see little to no Blue Wave in November.

CoRev: This comment indicates you understand nothing about what we are talking about. You are confusing tests with predictors. Predictors can be econometric models, or prices. The test determine which ones perform best. By the way, the “uncertainty” papers are I think “surprise” papers, aka “news” and event studies.

“It will also be interesting to watch how the US deficits grows under increased subsidies and transfers to US farmers.”

Didn’t you get yesterday’s Kudlow memo. Deficits are falling. Well they rose but Larry hopes they will fall. And his forecasting record is so awesome. Oh wait!

Canada strikes back with its own tariffs on our goods:

https://www.vox.com/world/2018/6/29/17518946/canada-tariffs-steel-aluminum-trump-trade-war

Menzie Chinn wrote: ” (plus they [soya bean farmers] leveraged up)”

Interesting and not surprising as many sectors have ‘leveraged up’ in the wake of the Great Financial Crisis.

Off the top, can anybody suggest references to the evolving debt burden of American soya farmers or a larger group of farmers?

Erik Poole One problem for those Iowa soybean farmers is that land values have been declining the last few years in the wake of steadily rising land values over the previous 30 years. Sort of like home prices before the Great Recession hit.

https://www.extension.iastate.edu/agdm/wholefarm/pdf/c2-72.pdf

Not that it is unusual but slug has made an greatly over-simplified comment about Iowa farm land prices. After a few years of horrible President Obama fiscal policy, Iowa farm prices did go down for three years. The last year reported, the first President Trump year, 1917, land prices reversed and rose. One year is not a trend, and there a lot of uncertainty in farming there days. So the future remains interesting. A more interesting link with far more complete analysis, try this:

https://www.extension.iastate.edu/AGDM/wholefarm/html/c2-70.html

Ed

“After a few years of horrible President Obama fiscal policy, Iowa farm prices did go down for three years.”

Horrible Obama and his fiscal polices caused the Great Recession???? Of course Ed cannot tell us what fiscal policy should have been in response to the mess Bush left Obama. Most economists would argue the fiscal stimulus was the right course but it needed to be bigger.

But all can manage to say is that Obama was horrible. We do get a lot really stoooopid comments like this for some reason.

There are several reasons for my caution. needs to actually read Ed’s link as Ed is not representing it properly at all. We had only a slight decline in land values in 2009 with the big decrease being over the 2014 to 2016. This discussion said nothing about horrible Obama or fiscal policy. It was a good discussion of essentially the discounted cash flow model – which I guess was too sophisticated for Ed. One key line:

“I would caution any immediate hail of the turn of the Iowa farmland market given the stagnant farm income and rising interest rates. The fundamentals of the U.S. farm economy haven’t improved significantly, so this recent increase in land value to some extent is defying logic. There are several reasons for my caution.”

Stagnant farm income has to do with fundamentals not in any way to any claim of horrible Obama or fiscal policy. And yes the very low interest rates that followed the Great Recession did not last forever.

This is what any reasonable read of this link would tell one but this is not what Ed got from this. Go figure!

Menzie has been treating us to a lot of great discussions about soybean prices which is a major source of income for Iowa farmers and likely a driving force for the decline in land values over the 2014 to 2016. I guess Ed Hanson has not been paying attention so here is a chart of soybean prices:

https://fred.stlouisfed.org/series/PSOYBUSDQ

Notice how they have fallen since 2014. I guess Ed thinks the only reason for this is horrible Obama – whatever that means.

BTW – Trump’s trade wars are leading to falling US soybean prices as Menzie has demonstrated. Now if Ed thinks this will lead to higher land values, may we suggest he read his own link?

Ed tries to tell us that the great and wonderful Trump has managed to get land values back up. Again – he blatantly misrepresents what his own link actually said:

“as opposed to a result of improving farm income, this recent increase in land market is mainly driven by limited land supply. Given the rising interest rate and heightening farm financial stress across the Midwest, this recent bump could likely be just a temporary break in a continued downward adjustment in the farmland market.”

And we accuse PeakDishonesty of lying. Ed – this dishonestly of yours here really takes the cake!

Ed Hanson

The last year reported, the first President Trump year, 1917,

Well, I always thought you were a reactionary, but going back 101 years is even more reactionary than I thought.

I suspect that farm prices would have been sliding even more over the last few years had it not been for the real property tax rollbacks that Iowa farmers enjoyed. Take away those tax rollbacks and land values probably would have fallen even more.

You are right slug, I am feeling old.

As for the land prices continuing to fall without the new tax act, I suspect they would have, which is why I put the comment about President’s Obama bad fiscal policy.

I wish I could predict every rosy for the farmers, but I can not. the uncertainty is too great. But then again rosy times for farmers are few but American farmers are tough.

Ed

Ed Hanson provides a link to a great discussion on why land values fell. Everyone should read it – especially since Ed’s comment completely misrepresents what his own link said.

“One problem for those Iowa soybean farmers is that land values have been declining the last few years in the wake of steadily rising land values over the previous 30 years.”

Land values fell a lot during the 1980’s. Of course during the reign of St. Reagan, nominal soybean prices did not keep pace with inflation and real interest rates were high.

Now had Ed Hanson actually read his link (he clearly has not) he might note that the discounted cash flow model it uses would predict the fall in land values under St. Reagan.

Reminds of mom telling me her dad was the only farmer between Visailia and Tulare that owned his farm. The others had levered up. From the GD.

Going to be interesting to see how the steel tariffs effect GM.

https://www.youtube.com/watch?v=svGmvbdoXxY

Is Trump going to start threatening GM like he has threatened Harley Davidson?? Trump can walk around with his big fat belly, his ugly orange face, and make large gestures with his tiny hands all he wants—-He starts F’ing around with the Fortune 500—he’s going to find out what happens to leaders that mess with the power players.

Great discussion. Here is another:

https://www.youtube.com/watch?v=uXvcmbElwxo

Fox Business is giving time to the Canadians to discuss why they imposed tariffs on our products. Trump loves Fox and probably feels portrayed.

2slugbaits: Thanks for the Iowa historical country farmland values document. I trust that covers far more than just soybean culture.

The eyeball metrics suggest that land values grew steadily in the wake of the Sept. 11th, 2001 attacks on New York City and the Pentagaon, and even faster in the wake of the Great Financial Crisis. They peaked in 2013, long before the US Federal Reserve started raising the benchmark rate.

The land values did not decrease when the US Federal Reserve started raising rates in 2004.

From what little I know from reading elsewhere, as of 2013/14, global soybean production started to outpace slowing global consumption.

“From what little I know from reading elsewhere, as of 2013/14, global soybean production started to outpace slowing global consumption.”

True and as I show in my FRED link, soybean prices plummeted. Which lowered the cash flows from the Iowa land. Ed Hanson provided a link to an excellent discussion that explained land values with a discounted cash flow model. Of course Ed never bothered to read his own link and proceeded to lie about what really happened here.

Erik Poole Just to be clear, I wasn’t attempting to explain why land prices have fallen off in recent years relative to their strong growth prior to that. Rather, my point was that this falling and leveling off likely contributed to leveraging pressure on farmers. If you borrow while betting on ever increasing land values and then those land values quit rising, you’re probably going to find yourself in a highly leveraged and dangerous position. Very much like the housing crisis leading up to the Great Recession.

I’m not surprised that future prices aren’t a random walk in backwardation. In fact, one can make a very compelling argument that future prices should be more predictive in backwardation, despite the “THEORY” stated above. Imagine a one year crop failure where the back of the curve is able to signal to producers that they should plant beans vs. corn. Those relative economics still have a supply function, whereas the front of the curve (once the growing window has passed) only the ability to affect demand.

Now, compare that to a contango curve. Perhaps speculators think prices in the future will be higher. But that is a bet with uncertainty and risk. An opposing force is riskless aribtrage IF the soybean curve ever went beyond full carry (buy front futures, sell back, hold delivery receipts at exchange). Go back and look at a historical term structure in beans and you’ll see that it doesn’t EVER go beyond full carry, and that is because that arbitrage is a more powerful force. What that means, is that the back of the curve is capped at the front plus storage/interest.

mp123: Yes, but see Reichsfeld and Roache for empirical findings, as opposed to your intuition. Interestingly, futures outperform a random walk for soybeans at horizons of up to 6 months for their study, irrespective of contango or backwardation.

It will be interesting to see what the apologists have to say when foolish tariffs start to bite those who seem to think trade wars are a good idea. The spin is all fine and good for now, but real people are going to get really hurt. The administration will own all of it.

That’s all.