Despite provision of numerous references, reader CoRev writes:

… it’s a big IF that soybeans futures are LONG TERM predictors at all.

I find skepticism of forecasting capabilities usually justified. However, when that skepticism is not supported by any citations, I consider such skepticism self-serving. Hence, I am going to go step-by-step for those who are not familiar with econometric methods and assessment metrics, in the hopes of educating people about the challenges of systematic prediction. Here I use as an example soybeans.

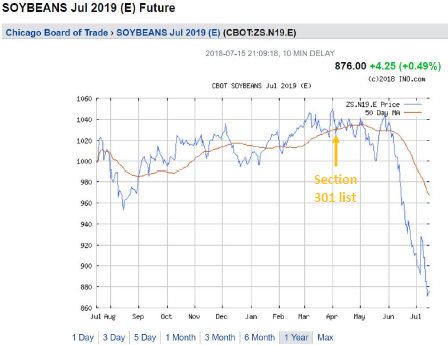

Figure 1: Soybean futures for July 2019. Source: ino.com.

Are futures unbiased predictors?

To answer this question, one can estimate the following equation, using OLS.

st+k – st = α + β(ft,k – st) + ut+k

Where st is the log spot rate at time t, ft,k is the log futures rate for a transaction k periods hence, and u is an error term that is under the efficient markets hypothesis null a random expectations error (an innovation).

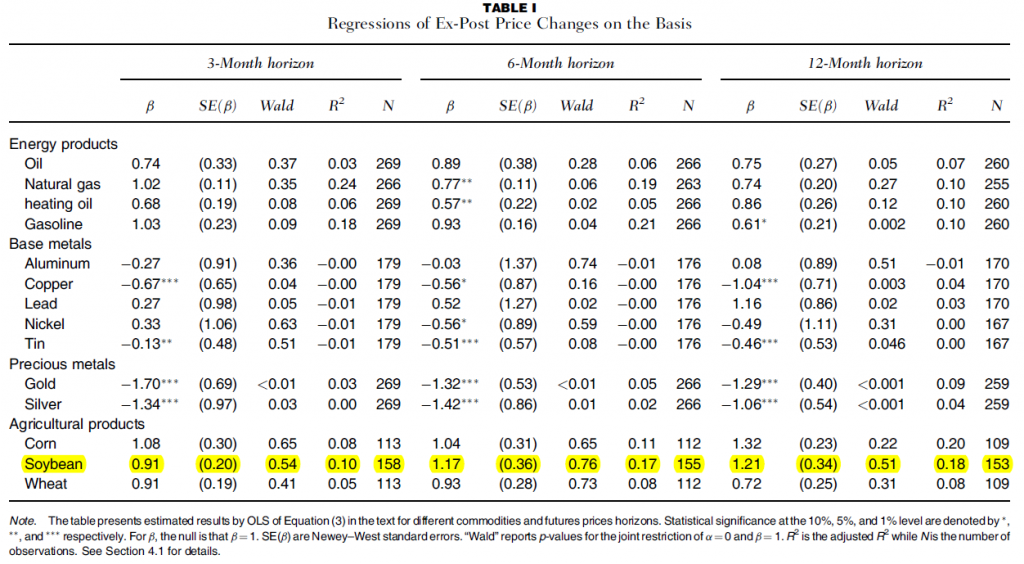

In Table I (from Chinn and Coibion, 2014), I highlight in yellow the SOYBEAN results of this regression for soybeans, at the 3, 6 and 12 month horizons.

Table I from Chinn and Coibion, 2014.

Notice the point estimates are close to one, and statistically indistinguishable from that value, using standard errors robust to serial correlation and heteroskedasticity. Hence, the testing approach is conservative. A Wald test for the joint null α=0, β=1 is not rejected at conventional levels. That null hypothesis is consistent with the futures price being an unbiased predictor. In words, the results mean when the basis is 1%, the average change in the soybean price over the corresponding period will be…1%.

Interestingly, the R2’s are high for soybeans. In contrast, similar results are not obtained for metal commodities. In particular, the estimated β’s are often negative. Hence, we can conclude that futures are unbiased predictors of future spot soybean prices for horizons of up to a year, and have measurable predictive power.

Are futures the most precise predictors?

As is well known, mean and variance are both important. One could have an unbiased predictor, with large variance; or one with small bias, but small variance. Hence, we should look at precision.

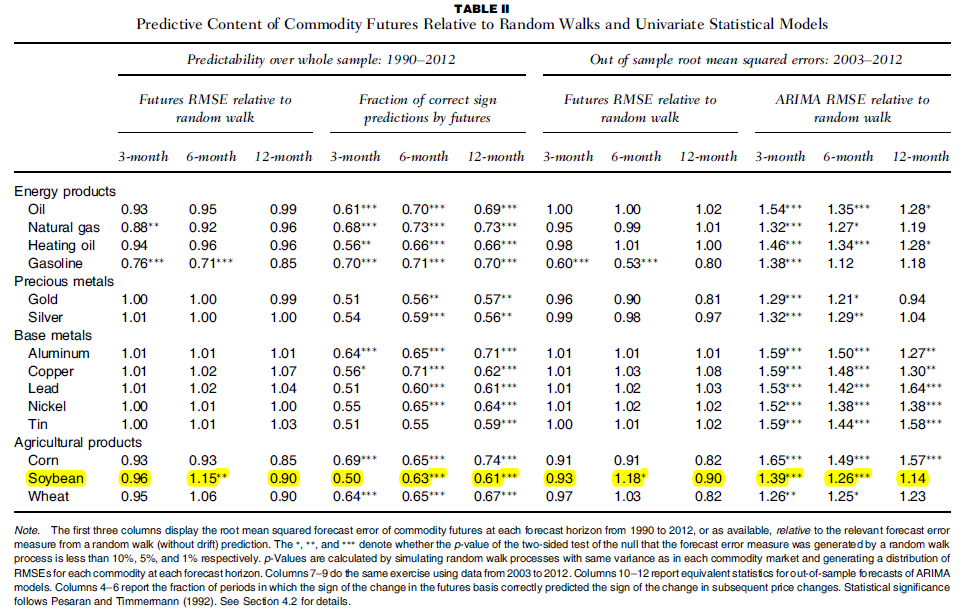

Here, one has a hard time answering the question, partly because the set of predictors is infinite. In Chinn and Coibion, we compare futures against a random walk and a ARIMA(1,1,1) model. Table II shows that at 3 and 12 month horizons, both in full sample and in a reserved out of sample (2003-12), soybean futures (highlighted yellow) had a lower root mean squared error (RMSE) than that of a random walk. At the 6 month horizon, futures are worse than a random walk, and significantly so.

Table II from Chinn and Coibion, 2014.

Even so, futures at the 6 and 12 month horizons predict correctly the sign of change in actual spot prices more than would happen by random chance (63%), and significantly so.

ARIMAs do not outperform a random walk for soybeans, and do worse by a statistically significant amount.

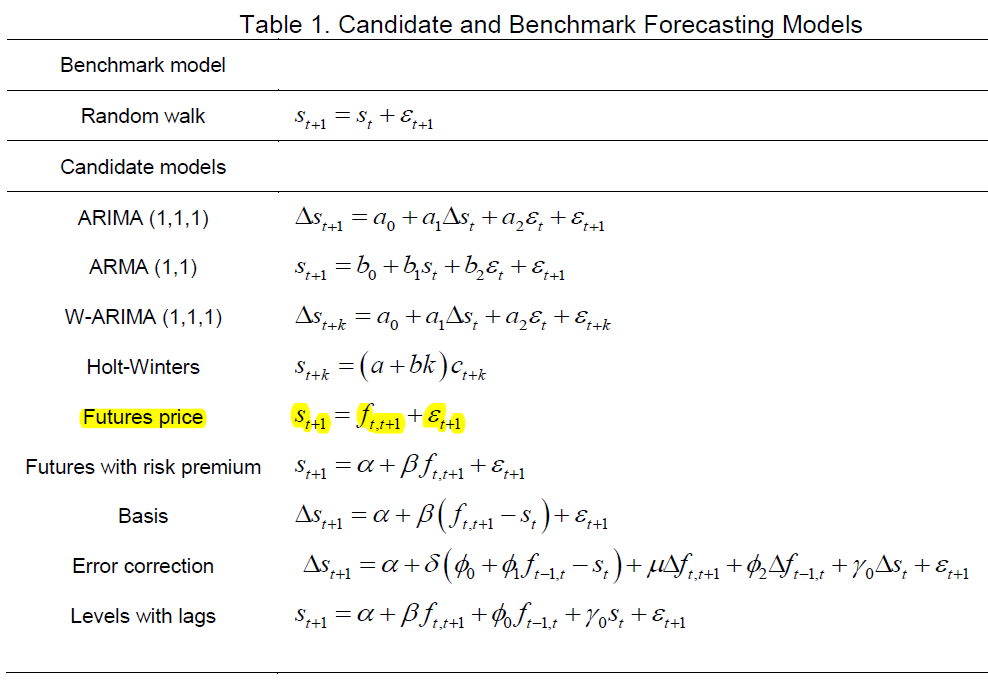

One can always argue that there’s a better model that would outperform futures. That’s hard to guard against because there are an infinite number of models to evaluate, but Reichsfeld and Roache (2011) have done a good job checking against a large set of comparators.

Table 1 from Reichsfeld and Roache, 2011.

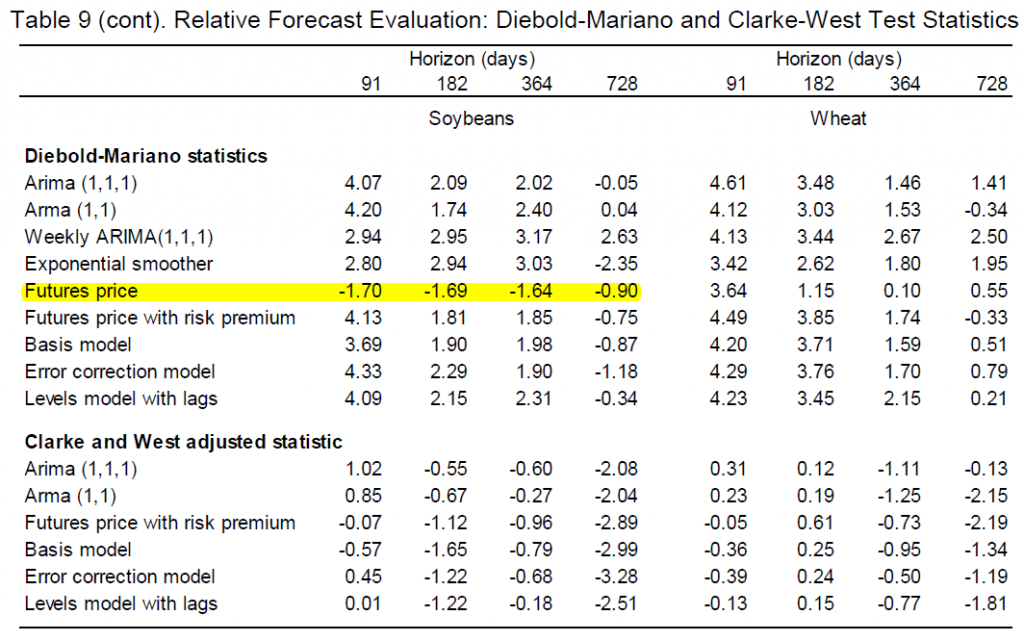

Reichsfeld and Roache, 2011 then test to see if each predictor outperforms a random walk. If the Diebold-Mariano-West statistic is less that -1.64, then a random walk is beaten with statistical significance. As shown in the excerpt from Table 9, soybean futures do, for horizons up to a year.

Table 9 (excerpt) from Reichsfeld and Roache, 2011.

Econometric models do worse than a random walk, and statistically significantly so. Even taking into account the sampling error involved in econometric models (using the Clark-West statistic), futures continue to outperform, while econometric models only outperform a random walk model at horizons of 2 years. (Even at two years, futures outperform a random walk.)

Conclusion

Soybean futures are remarkably good predictors of future spot prices of soybeans. Hence, my best guess of soybean prices one year from today is 872.

Other futures – particularly for metals and precious metals – do not share those attributes. Nor are, as Robert Hodrick showed more than 30 years ago that for currencies, futures and forwards are not good or unbiased predictors of future spot rates.

Hence, one cannot make generalizations about futures, or any predictive method. Rather, one needs to do extensive, systematic and appropriate econometric work.

Marv Albert in semi-shock to Hubie Brown: “Wow Hubie, Menzie could have gone for the vicious slam dunk on CoRev, but chose to do the highly irregular scoop shot. What’s going on there Hubie!?!?!?!?!

Hubie: “it’s really hard to tell, obviously Menzie “Air” Chinn could have gone with the vicious slam there, it’s as if he’s letting his supremely outmatched opponent know ‘Hey, look, I can take you down either way’. But Marv, only Menzie knows why he elected the kinder scoop shot there.”

https://www.youtube.com/watch?v=w7vsjOHq5E0

“THE PREDICTIVE CONTENT OF COMMODITY FUTURES” by MENZIE D. CHINN and OLIVIER COIBION should be required reading before anyone comments. Of course CoRev should be required to actually read Fama’s 1970 piece first. This would spare us the on and on and on protests.

Reading the very beginning of Ashoka Mody’s book being the night owl I am (and listening to a collection of John Carpenter’s soundtrack music, which is really awesome but probably better suited to early November mood-wise. One question arises as I’m only just barely started. One of the “underpinnings” or basic ideas of the Euro is, that with a single currency different European countries will be less apt to go to war. Probably the two big scares here are Germany getting full of itself again and throwing its weight around,, and that if the Euro area “fragments” that Putin’s Russia or his successor makes a power move for energy resources in places like Ukraine or Latvia, Lithuania etc.

But my question is this: Are we all really so dumb to believe that when Europe has one currency this is going to eliminate wars in the Euro region?? Like, exactly how stupendously and spectacularly dumb is that assumption?? Look at Russia. Look at China. Where do they rank on the “development spectrum”?? That’s an earnest question I am asking about where China And Russia lie on the “development spectrum”—but we can say at least mid range to high since….. 2010?? I’m trying to be conservative in measuring here. So with one currency Stalin murdered how many people??? With one currency Mao ZeDong murdered how many people (through mostly man-induced starvation)??? Are we really so dumb to believe that when we have bastards like Karolos Papoulias, Wolfgang Schäuble, or Andrzej Duda in a European level multi-national parliament that it’s going to turn into “the land of milk and honey”??

Europe is going through some intensely painful birthing contractions right now—to give rise to what monster that pops out when it’s finished??—because some very naive economists and pragmatic power hungry bureaucrats are telling us that if you’re all using the same paper money leaders will suddenly become altruistic?? I hate to break the bad news to some of you, but there is no demand and supply curve intersection point that explains the psyche of a bastard like Slobodan Milošević, not that some simple minded economist wouldn’t TRY it.

Gold standard stopped no wars to my knowledge. Once a country gets the bit by bug that demands mass organized murder (sometimes sanction by immoral “justice” Saddam, Qaddafi, Assad, Chiang from Mao view) there is no stopping a war, just keep reading the US press the bug stinger..

All the allusions of reincarnation of Hitler (Milosevic) are US neocon bug stinging.

You missed the league of US neocons in your list of troubling souls in the EU parliament, though few are in elected office here.

I’m sorry but your tirades in this vein have gotten really old. Start your own blog so the rest of us can ignore your tiresome rants.

I suspect this guy is Russian or East European. Menzie (rightfully) doesn’t let me know, but I’d put bank on it. Seems weird on a blog though, I thought most of these Putin weasels were in Facebook or twitter, not a freaking blog.

Keep wondering how Menzie attracts these types, and it’s hard to believe only because of Menzie’s ethnicity attracts these many weirdos and flakes, but I can’t seem to come up with an alternative reason. Or maybe it’s an American like “rtd” and he just gets off on poking people in the eye. Would make a great sociological study if you could track these flakes down and give them a survey.

Moses Herzog: You can make your own assessment by reading this article.

Menzie, thank you. I have booked mark this for 3, 6 and 12 month comparisons.

Bookmark away. You clearly misunderstand the entire point of the post. You are one of those ignorant fools who see a weather forecast that predicts an 82% chance of rain, and then when rain doesn’t happen thinks “oh the forecast was wrong.” Your bookmark is irrelevant to the discussion and I am sure you are going to reply with some snide comment about results but really the comment just digs its own grave. Good luck. Ignorant fool.

Dave, I’m sorry you reject the validity of a prediction. My bookmarking is not irrelevant to my position that the tariffs ARE one of many affect on soybean prices, but that these tariffs are short term effects. Farmers mitigate these short term effects by storing and selling at expected higher prices periods as evidenced by their own experience. These short term effects are usually mitigated by two harvests, the long term in farming.

If you’re confused what is the orange thing with it’s tiny hands in front of its crotch sitting next to Putin this early morning around 6:15am, this is an explanatory video:

https://www.youtube.com/watch?v=AHzHvNqcDjA

Some people call it “trump”, in the video they call it “Pumpkinhead”, but a name gaining steam lately is “Orange Excrement”

If its chin is swelling up and it begins to chase you, throw a McDonalds cheeseburger at it or toss it an old copy of Penthouse magazine, or disguise yourself as a thick book, and usually Orange Excrement will lose its breath and give up pursuit.

Okay, I’m anticipating some complaints from the usual suspects. I’m sure that CoRev will emphasize that he was only referring to “LONG TERM predictors” and then pretend that 3-month and 6-month predictors are not long term. Except that would imply he accepts that futures prices are good short term predictors, which would then contradict his even earlier statements that there weren’t any good predictors at all.

I also expect we’ll hear from folks that will wonder why you used logs rather than untransformed observations. Aside from the fact that logs tend to lower heteroskedasticity (oops, better explain that term: https://en.wikipedia.org/wiki/Heteroscedasticity ), there are theoretical reasons as well. It’s well known that changes in asset prices, exchange rates, and just about every economic variable are multiplicative rather than additive. One consequence is that we should then expect the distribution of the error terms to be normally distributed if the observations are transformed into logs, which then allows for conventional OLS tests.

But Menzie, I do have a question about why you examined GARCH errors. My takeaway is that you found that accounting for GARCH errors slightly weakened your case for futures prices as predictors of spot prices because doing so reduced the standard errors; however, you seem to largely discount or downplay the importance of this result. I would agree with downplaying the significance of the GARCH corrections, but I am curious as to why you bothered doing it at all. I realize that it’s pretty much standard practice when dealing with economic variables for the reasons you cited in footnote 9 referencing JDH’s paper. But in this case I’m not convinced that the usual rationales for examining GARCH effects would really apply. For one thing the time horizons seem awfully long. GARCH effects are the kinds of thing you would expect to find in high frequency data, but not monthly data separated across non-contiguous months. The other problem is that in the case of soybeans you used a rolling 5 year window, but each year only had 7 observations. That’s only 35 observations with each regression. As you noted in footnote 10, GARCH tests using small sample sizes are notoriously unreliable…as I’ve discovered from personal experience. Bottom line is that I’m reading section 5.1 as largely a mechanical exercise of going through the motions of running GARCH tests, but I really don’t think the paper loses anything if folks just skip over that section.

2slugbaits: While it does seem strange to have GARCH effects at the monthly frequency, we decided to be comprehensive. I agree the main point of the paper is gleaned from the standard regression results and the forecast evaluation.

Nov. ’20 futures up 1.6% so far today.

At 907, I’m a buyer.

Eddie Murphy and Dan Aykroyd are selling. And if you have no clue what I mean by this, watch this classic!

https://www.youtube.com/watch?v=RLySXTIBS3c

That’s a classic clip. Of course, first the price goes up, and then Akroyd and Murphy sell into the price rise. Only after the price peaks do they sell. Here, we have a price crash, and I am suggesting one could buy into the trough.

Let’s look at some economics:

The front month for soybeans is trading at 845. This is the lowest price since 2007 — even lower than during the Great Recession — and it fully reflects China’s 25% tariff, that is, the removal of tariffs would just send the price back to where it began. Therefore, in theory, there should not be much downside from here (leaving aside aggregate market conditions) and a free option on a 25% upside. Why wouldn’t I take that?

And there’s more. The longer prices stay low, the less soy American farmers will plant. Where will China make up the difference? That means higher prices later on. And we’re projecting an oil shock somewhere in the next 18-36 months, which will have a considerable impact on soy markets. So I see a limited downside, big upside option, and fundamental factors pushing soy prices up.

I like the play. From China’s perspective, their tariff strategy could prove a major own-goal come 2020.

Steven Kopits: Do you know why Brazil now produces and exports soybeans?

I presume it’s comparative advantage.

Steven Kopits: US soybean export embargo of 1973 provided strong incentive to Brazilian production, see here, page 10.

@ Menzie

Didn’t Keynes himself say something about how a surplus of inventories effects prices as well (in addition to your effective point on Brazil)??? Where would American soybean inventories be around November ’20 (I’m thinking VERY LARGE) ?? I’m asking, mostly jokingly (although it’s somewhat conceivable), are they going to burn the soybean inventories the same way dairy farmers throw out surplus supplies of milk??

I enjoy reading “Princeton” Kopits comments on investing and economics. It’s like pushing a chalk board or white board behind Glenn Beck and saying “Ok idiot, GO!!!!!”

https://www.youtube.com/watch?v=66dheQBx58I

https://www.youtube.com/watch?v=P_lgTIZ22jE

https://youtu.be/zxAqZv6TMb4?t=4m39s

The only big difference there, is, unlike Glenn Beck, if “Princeton” Kopits makes this soybean bet a large bet, and Trump gets re-elected, “Princeton” Kopits’ crying will be real.

https://www.youtube.com/watch?v=DmXjxgy6MUo

The answer to this question is clearly no. Thanks for giving us the correct answer!

Right, but if I am China, I don’t want to do that, because it will make the trade deficit all the worse, ie, it makes it all the more likely tariffs will stay on China’s exports to the US.

Brazil soybeans are planted in November, harvested in February. US crops are harvested around September.

US exports to China involve about 45,000 square miles of planted fields. You think the Brazilians can conjure up a spare 45,000 square miles of agricultural land between now and November?

Don’t get me wrong. I think the whole trade war thing is a bad idea. On the other hand, I don’t see how a commodity market can maintain a 20% price differential between suppliers.

> You think the Brazilians can conjure up a spare 45,000 square miles of agricultural land between now and November?

Yes. Well, it’s not so much conjuring up as re-prioritizing.

OK, Dave, but if you risk 45,000 sq miles and you guess wrong because the sanctions are lifted or not enforced, you’ll be wiped out. And with a fungible commodity, you have to be a massive risk taker.

Right now, if I am a physical trader, I am all over finding ships and booking storage and re-directing product to un-tariffed markets. Someone’s going to make a lot of money here. Same thing Andy Hall did in early 2009.

I don’t think you get what this was about. The inside information said one thing but what the old farts were told was just the opposite. In other words, the old farts were trading on false information which I suspect you are to.

Go rent the movie and watch it over and over again. You might learn something about markets.

I don’t have any inside information.

“Princeton” Kopits, You’re buying below 907 or above 907?? Your trade (if you have the balls to do it, I tend to doubt it) may give new meaning to the phrase “dumb retail investor”. I sadistically hope you take every last dime from your bank account on this soybean bet, because if you’re that damned dumb, it’s going to be fun to watch. Have you ever been to Nacogdoches Texas??

https://www.youtube.com/watch?v=4HQyFWcb3AY

It’s actually a binary bet—will Trump be re-elected or won’t he?? That’s still 50/50, and if he is you’re going to look pretty dumb.

Make sure you black out the personal data and then upload your brokerage slips on here, it’s probable I could squeeze 10 years of periodic laughter out of that.

Putin and Trump agree to cooperate in the coverup:

https://talkingpointsmemo.com/livewire/putin-denies-interfering-in-us-election-offers-to-analyze-together-any-evidence

Putin “offers to analyze together any evidence”??? Yea right!

BTW Trump threw U.S. law and order under the bus today. No wonder the intelligence services and the FBI see Trump as a traitor.

Russia has declared this meeting to be a big success. Of course Putin owns the U.S. White House.

“Presidents Trump and Putin respect each other and they get along well,” said Dmitry Peskov, the Kremlin spokesman. “There is no clear agenda. It will be determined by the heads of state themselves as they go along.”

That was what Dmitry said before the meeting. During the joint press conference, Dmitry was openly chuckling at what a gullible fool Trump is.

Yep. Trump’s performance was embarrassing. Even his usual backers at Fox Noise were left slack jawed by the rambling garbage coming out of Trump’s mouth. He likes to think of himself as Donald de Medici but he’s really Donald Duck. He’s really in way over his head. The really disturbing thing is that his usual defenders on this blog can’t see it even though Fox Noise reporters did!!!

2slugbaits: You’re too kind. I believe 45 thinks of himself as Don Vito Corleone.

It’s amusing how the topic has metamorphosed from whether the decline in the deferred soybean contracts were solely a result of Trump trade policies to whether futures prices are better than predicting a random walk. As if proving that it’s not a random walk somehow validates the former.

CoRev’s job at the Trump White House is to do exactly this. He tosses up incessant babble so we lose sight of the real issues with Trump’s stupid trade wars. Of course Menzie is really patient here – which only frustrates CoRev to no end.

Pgl, my has actually become finding and pointing out your horrible errors. But, even that is not challenging, nearly everyone of your comments is gahrbagge.

As a soccer fan, I applauded the Russian World Cup yesterday as the games were great. But I am insulted that Putin is buying off his poodle aka the Traitor Donald Trump with a gift of one of the balls:

https://www.si.com/soccer/2018/07/16/vladimir-putin-donald-trump-soccer-ball-gift-video

Trump knows nothing about soccer and is the worst enemy of the United States ever. To abuse such a great game for a a raw takeover of the American White House by Communist leader Putin is disgusting.

But somehow I expect PutinPoodlePeakyBoo will find someway to defend this garbage.

Corev

I have never seen Menzie make a hard number prediction before. Well done by inducing one. Menzie has put much effort in analyzing these type of economic events. It will make for excellent learning for all. Waiting to see.

Menzie, how about the idea of posting the relevant stock exchange reactions since the trading retaliations have been in the news? My contention is since US trade is the biggest prize out there, those countries who reacted with the largest retaliations have been made the most economically vulnerable and their stock markets will show this to be likely. A general measure of economies shown through major stock exchanges is better way of looking at the trade issues than by just looking at separate commodities. And I highly suspect the best performing stock exchange is in America.

Ed

Corev

I have never seen Menzie make a hard number prediction before. Well done by inducing one. Menzie has put much effort in analyzing these type of economic events. It will make for excellent learning for all. Waiting to see.

Menzie, how about the idea of posting the relevant stock exchange reactions since the trading retaliations have been in the news? My contention is since US trade is the biggest prize out there, those countries who reacted with the largest retaliations have been made the most economically vulnerable and their stock markets will show this to be likely. A general measure of economies shown through major stock exchanges is better way of looking at the trade issues than by just looking at separate commodities. And I highly suspect the best performing stock exchange is in America.

Ed

Posting as Anonymous we see. But did you really need to post twice? Especially given that last sentence. America is a nation not a stock exchange. Actually we host several exchanges. And a lot of foreign based multinationals trade there. So sure – Toyota is probably doing great.

Ed Hanson: Actually, each time I cited the futures, and mentioned Chinn/Coibion, I was stating my predictions. It’s your inability to understand the basics of forecasting that prevented you from understanding.

As I stated before in the context of the US, the stock market is the PDV of expected future dividends, discounted using the risk free rate and the equity risk premium. Hence, it is difficult to a priori state what would be the effect on the stock market of trade measure actions. I’ll let you do the post on your blog.

“it is difficult to a priori state what would be the effect on the stock market of trade measure actions. I’ll let you do the post on your blog.”

Hint for our novice forecaster Ed. Stock prices reflect the expected future cash flows of COMPANIES – not nations. So maybe you can think in terms of how steel tariffs affect companies like GM or Toyota. Of course Toyota does not pay much in the way of Trump’s tariffs as their production is largely offshore. Alas GM is not so lucky. So steel tariffs will likely help Toyota as it makes the cars of its competitors more expensive. One more hint – Yahoo/Finance is an easy to use tool. Let’s see:

https://finance.yahoo.com/quote/TM/

Oh wow – Toyota shareholders are doing GREAT! Thanks Mr. Trump!

Menzie

Do you really have a problem explaining to those who can not follow your paper? I hope you do not teach undergraduate beginning economic courses. Unless. of course, your intention is to decrease economic understanding in the world. But then again, I suspect that exactly what you want, because only the economic illiterate and the power elite could support socialism.

Ed

“Do you really have a problem explaining to those who can not follow your paper?”

If he doesn’t – I do. A well written paper and you accuse Menzie of trying to keep people “illiterate”.

Look – it is not our fault that you need to take off your shoes to count beyond 10. Try actually learning a little economics.

To accuse those of us who actually studied economics as being supportive of socialism is just pathetic. Of course your boy (Trump) proved today he is a captive of Putin – who we all know is a communist.

Ed Hanson There is nothing in the paper that is not covered in any intermediate level undergraduate course in econometrics. If an undergrad cannot understand the paper, then that undergrad should reconsider his or her major and go to something less quantitative…say business management or…God forbid, sociology.

Ed Hanson: I think my evaluations for undergrad courses are pretty good. I’ve been teaching undergrad courses for over thirty years. But especially for you, let me try again — for *soybeans*.

1. The statistical relationship between the basis and actual changes in the price is close to one-for-one (unbiasedness).

2. The futures today for a trade k periods hence is the best guess of the spot rate k periods hence (minimum root mean squared prediction error).

3. Hence, the best guess on average of what the price in July 2019 is the futures price as of today for a July 2019 delivery.

D***, you are dense. If you don’t understand the papers (or are unwilling to try), then you shouldn’t be commenting on forecasting.

Menzie

Mostly unwilling to try. Which puts me in the vast majority. And that majority should be your encouragement to learn how to communicate with them. Not that you have to, being secure in your profession, but it is a shame that you do not attempt to learn. You are an honest economist, opposite to your being a dishonest political fanatic, and if you could find your way out of your elitism, you could be of great service to more economically. True, even when you are wrong.

By the way, I suspect your soybean number will be quite wrong, but I also would not bet against you, I can remember when i was certain that inflation was imminent because of the FED actions during the great recession. You said that inflation was not in the cards and totally right. I respect your economic education and your analysis. Too bad you can not relate socialism to your knowledge of the the horrendous damage the socialist and communist did to the people who could not escape them.

Ed

Ed Hanson: For your benefit, I have provided a simplified version of my explanation. Hopefully, it will better suit you.

Ed Hanson: Socialism is Soviet Union post-New Economic Policy; it is China, in the era of Mao. The United States in 2018 is nowhere near socialism. By the way, I have enough stories from my parents to understand the implication of central command combined with authoritarianism to know.

“Socialism is Soviet Union post-New Economic Policy; it is China, in the era of Mao.”

Hang on a second. I wrote my undergraduate thesis in Lenin’s New Economic Policy (NEP) . Yes my 2nd favorite teacher specialized in Russian history. OK – he was a died hard Republican but his advise to me on pursuing a career in economics over history showed he was not only brilliant but a person who actually cared.

BTW – had the Soviet Union followed what Lenin originally intended, the experiment would have worked as NEP was supposed to be an interesting use of market principles for socialist purposes.

Menzie, ” I have enough stories from my parents to understand the implication of central command combined with authoritarianism to know.” My answer to you is you know the stories, but not the lesson.

Why do you keep promoting policies that increase the breadth and power of the Washington, rather than promoting the more diversified and less power individual state governments?

I am sure there were hundreds of millions in China who supported policies that lead to Mao taking power not realizing that those policies also led to the strong central government you are opposed to. It is not good enough to say you are opposed to a strong central command and an authoritarian government; you have to understand history that shows growth of centralized power is the norm for governments and only active support of policies that limit that growth is capable of delaying or even stopping that trend. Menzie, that means limitation in both taxation as well as the ability of the government to raise taxes. You see it quite well the danger of out of control tariffs, but only by seeing the damage they can do to the economy. You do not see the danger of government creating a new tax stream, nor did you raise the alarm when Congress gave its power to the executive to create the new tariffs. But you are such a party man, when such things occur you are speechless in response when it is the dems in power or work in a bipartisan manner to that end. You celebrated the use of executive power when President Obama was the wielder, but cry out when it is President Trump who wields. You do not seem to realize that it is not the person in power that is the problem but the power given to that person. I would be right beside you if you campaign to eliminate the way Congress gives away its Constitutional power to the executive. But you won’t because you think that a 2000 page law that creates 100’s of thousands of pages of regulation is a good thing. It is not, it is means of the historic trend of greater and dangerous centralized government. Look at ObamaCare or Dodd-Frank, because you supported the ends you did not care about the means. This is what millions of Chinese learned too late during the “Great Leap Forward” and the later Red Guard purges, but you did not. You can only say you are opposed to powerful centralized government, but never call out your own party who advances continually to that result. You should note, that the opposition of the repub establishment was the tea-party movement, calling for less and restricted central government, while the reaction to the dem establishment is rise in power of the socialist and leftist who use the means of a more powerful central government to achieve its ends. Why are you not true to your word and become a Tea-Party man?

I am asking you to self examine, and see where the policies you support lead. Then either admit you are a socialist and a strive for big central government with all its dangers, or change the means you use to create the society you want. Its starts by recognizing that those you so vocally oppose are closer to your stated desire not to let government grow in power to a dangerous level than you find in your dem party. Scott Walker policy is closer to lead to your stated desire than those in your Wisconsin dem or progressive party.

Enough for now, but I only wish you would understand that political leaders come and go, but it is the power promoted to the central government that produces the tyrant you are so vocal against. And you promote that power.

Ed

Ed Hanson You keep bringing up this socialist crap. When you talk about socialist economics, exactly which socialists do you have in mind? There’s a pretty big range. Have you ever actually read any socialist economics? Have you ever read something as foundational as Irving Howe’s “Essential Works of Socialism”? And I don’t mean the Leninist political blather, I mean the actual economics. For example, what would a typical socialist have to say about the elasticity of production isoquants? Linear? Orthogonal? Curved? Is the socialism of Marx’s 1844 Paris manuscripts the same socialism that you’d find in the Grundrisse or Capital? Is Michael Harrington the same kind of socialist as Nikolai Bukharin or Rosa Luxemburg? Can you discuss socialist economics without unknowingly wandering off into some version of Austrian economics? I ask because in my experience some of the people that bloviate the loudest about socialist economics don’t actually know the first thing about it, and all too frequently share the same labor theory of value that Karl Marx used.

Putin is not running a socialist state. More like crony capitalism. And guess what Trump’s America will be. The Putin regime in America. Trump’s family will be RICH but the rest of us will be screwed.

China to Reimburse Tariffs for State Reserve Soybeans

https://www.bloomberg.com/news/articles/2018-07-09/china-is-said-to-reimburse-tariffs-for-state-reserve-soybeans

Prosser Chinn,

Would you consider posting your Soybeans 3 month data for the EViews ARIMA model and the random walk model and also the models for same? It is always fun to follow how you construct your models and forecasts.

Thanks for the consideration.

AS: Will try to soon. Data set is not documented right now.

Timely post. The yield curve has not inverted but commodity prices are declining. Just downloaded Chinn and Coibin 2014. Thanks Menzie.

re socialism: I understand Ed Hanson’s usage. He seems to critique heavily interventionist social democracy. For this reason, I often refer to the USA as the USSA. The United Socialist States of America.

The USSA has a developed welfare state even if the priorities and methods leave some of us scratching our heads and sometimes even wondering how sectarian, ethnic or racially-motivated American generosity will blow back as measured by dead Americans.

In that respect, “We are all socialists now” and ideally we should find more precise vocabulary to describe and critique policy options.

Dr. Chinn,

Thank you for the link and the explication. I learned some new and interesting ways of looking at the price data!

Table 9 is fascinating: do you have much of an explanation or intuition why (A) other models perform worse than random walk or (B) Futures price does not outperform for wheat?

Aaron: You’re welcome. I cannot speak exactly to Table 9 from Reichsfeld and Roache, but in Chinn and Coibion, we find a small proportion of the negative betas is attributable to liquidity (open interest).