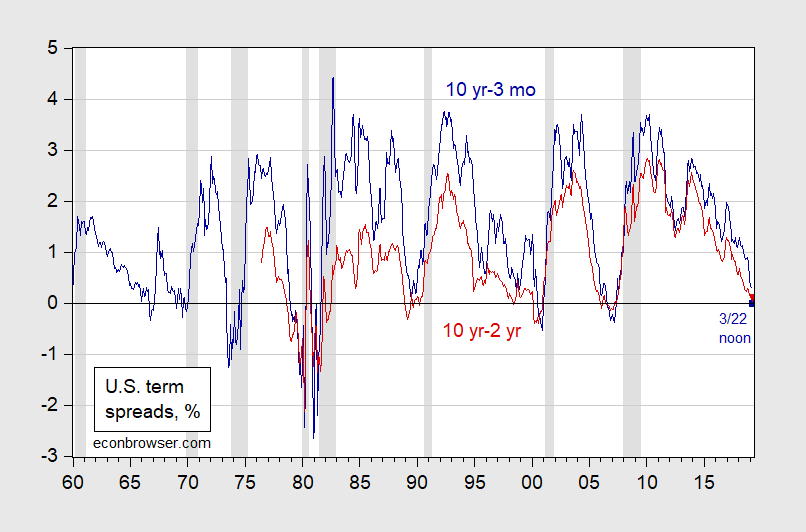

Of the 10yr-3mo spread.

Source: Bloomberg.

For context, see what has happened each time an inversion of 10yr-3mo has occurred.

Figure 1: 10 year-3 month Treasury term spread (blue), 10 year-2 year Treasury term spread (red), March 2019 observations for 3/22 noon, all in %. Three month rate is secondary market. NBER defined recession dates shaded gray. Source: Federal Reserve via FRED, Reuters, NBER and author’s calculations.

For the implications, see Chinn and Kucko (2015). See also Klein (2018).

For implications for emerging markets, see Mehl (2006).

I hear that Mr. Trump is going to nominate Stephen Moore to be Fed governor. God help us all.

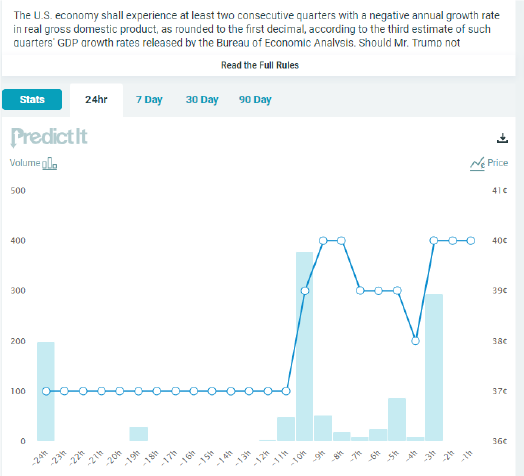

Update, 6pm Pacific: Market expectations of a Trump recession jump 0.37 to 0.40.

Source: PredictIt, accessed 22 March 2019 9PM Eastern.

As noted by several of us here, portions of the yield curve have been inverting off and on for quite some time now, even if this is the first time since 07 that this particular combo, 3 and 10 year have inverted. Again, in general, the zone from around one to three years has been lower than some shorter term yields frequently, but now we have 10 dropping below 3.

A further reminder is that in nations with negative nominal rates, the lowest rates are often for about 2 years. This has also been noted here previously a number of times.

Puts a recession 12-18 months out. Smack in the middle of the next election.

http://worldhappiness.report/ed/2019/#read

Now is this a study, or a survey?

First sentence reads:

“The World Happiness Report is a landmark survey of the state of global happiness that ranks 156 countries by how happy their citizens perceive themselves to be.”

C’mon Stephen – we have known you are stupid for a long, long time. Relax as we get it!

I think, Menzie Chinn’s worst nightmare is we have a soft landing or very mild recession in the first half of 2019, the Fed starts cutting rates and a trade deal with China is done by mid-2019, the economy reaccelerates in the second half of 2019, and Trump wins 40 states in 2020 against Beto.

The big hope is the E.U. economy continues to drag down U.S. economic growth.

@ Peakignorance

Your implication is that Menzie is “hoping” for a severe recession. Anyone who reads this blog regular knows Menzie is not that type of person and that is not the case. He still lets you say what you want to say, even when it’s borderline libelous, which also speaks to the man’s tolerance of others. You might let that sink in your thick skull from time to time when you insult Menzie for no reason.

I think Menzie has also, NOT definitively predicted, but indicated he leans to a recession happening past the year of 2019. Not that you were paying attention to anything here.

Yes, comments about those who “hope” for a recession reveal that those making such statements may well be suffering from bone spurs. In their heads.

I’m assuming I’m not alone in having children and grandchildren who WORK and who might be partly or severely affected by the economic downturns that accompany such events.

It’s pure ignorance, of course, but what else can we expect from the myopia that affect so many true Trump believers?

Here Here

It seems that PK has a problem using both sides of his brain. I doubt that anyone hopes for a recession which would impact on her, her family and community.

Would I say that a recession won’t impact the political environment at the time. Ofcourse not and if it can shown that Trump’s policies were a contributing factor it would be negligent.

And god knows that PT wouldn’t put up with that from either side of the political aisle.

Thanks Menzie! I’m curious what this says about when the next recession will likely hit? <1 year?

Noneconomist and Abe, are you trying to be Menzie Chinn’s mother?

I’m sure, Menzie Chinn can take care of himself.

You have a very poor sense of humor.

I guess, that’s expected from Big Brother and Big Mother Authoritarians.

More brilliance from the guy who didn’t know Sonny Bono has been dead for 21 years or that Clint Eastwood was last mayor of Carmel three decades ago.

You have a very poor memory , but I guess that’s to be expected from Little Brother who thinks he knows everything but who knows little worth knowing.

But please. Continue proving how little you know.

Noneconomist, you’re just full of fake news.

You deserve a job at CNN

Ah! A would be ready wit. Please let me know when you’re ready.

Well, gosh. Enjoy serfdom when the lopsided economy makes it to its logical conclusion.

I haven’t seen anything here that would indicate that anybody is hoping for a recession. It doesn’t matter, anyway. Here’s why. If the economy is improving, then the incumbent will benefit from that in the public’s view. If the economy isn’t improving, then the reverse is true. We have a decent economy in some respects, a great economy in some respects, and in a few respects, things could be better. Overall, though, times are quite good. It’s hard to get much better than we have it now. Even if we have a soft landing, we will be landing. It won’t take a recession to sour the public mood. What it will take is a falloff in growth that reduces perceived opportunities and perceived future well-being. When the current regime is as poorly regarded as the orange guppy in good times, it isn’t hard to figure out what will happen if times are less good, even if they aren’t bad.

Think about it before saying dumb things.

March 22, 2019

“… a round of dour economic data from Europe actually pushed the measure into inverted territory. The yield on the 10-year Treasury note tumbled to 2.44 percent Friday, its lowest level since January 2018. That was just below the 2.45 percent yield on three-month Treasury bills.

…research from the Federal Reserve Bank of San Francisco has cited the yield difference between three-month Treasury bills and 10-year Treasury notes — which inverted Friday — as the most reliable predictor of recession risk.

Campbell Harvey, a Duke University finance professor whose research first showed the predictive power of the yield curve in the mid-1980s, stressed that an inversion must last, on average, three months before it can credibly be said to be sending a clear signal. If that does occur, history shows that the economy will fall into a recession over the next nine to 18 months.

But even with the yield curve’s track record for predicting recessions, Professor Harvey emphasized that there was no such thing as certainty in economic forecasting.”

https://www.google.com/amp/s/www.nytimes.com/2019/03/22/business/yield-curve-inverted-recession.amp.html