The quasi-nomination of Stephen Moore and Herman Cain to the Federal Reserve Board has resurrected the issue of the gold standard. Jim Hamilton has repeatedly — and convincingly — critiqued the idea of a return to the classical gold standard, here, here, here, and here. But here I talk about what a gold standard for the 21st century would entail.

In “A Gold Standard Does Not Require Interest-Rate Targeting“, Lawrence White critiques an article by Matt O’Brien, noting the operation of the classical gold standard did not involve interest targeting, and hence would not require large variations in interest rates. Rather:

Under the regime of the classical gold standard, a newly minted US $10 dollar coin contained .48375 troy ounces of gold. Alternatively put, the gold definition of the dollar equated 1 troy oz. of gold to $20.67. The dollar price of gold in the US did not vary from that par value (except within the narrow band around parity set by the cost of shipping gold in or out, estimated at less than ±0.33% of par value) despite the absence of offsetting central bank policy. Matt O’Brien’s view is inconsistent with the historical record of the classical gold standard.

That point is true. In point of fact, the classical gold standard did not rely on explicit interest rate manipulation; nor did adjustment work through the Humean price-specie-flow mechanism wherein excess provision of money leads to an outflow of gold. In fact, there was some variation in gold prices within the gold point bands determined by the cost of transporting gold.

The point is that — irrespective of the existence or not of a central bank — a nominal anchor like a gold price limits the autonomy of monetary policy. The more mobile capital is (i.e., the lower the barriers to financial capital movements, and the less insulated the banking sector), the less autonomy.

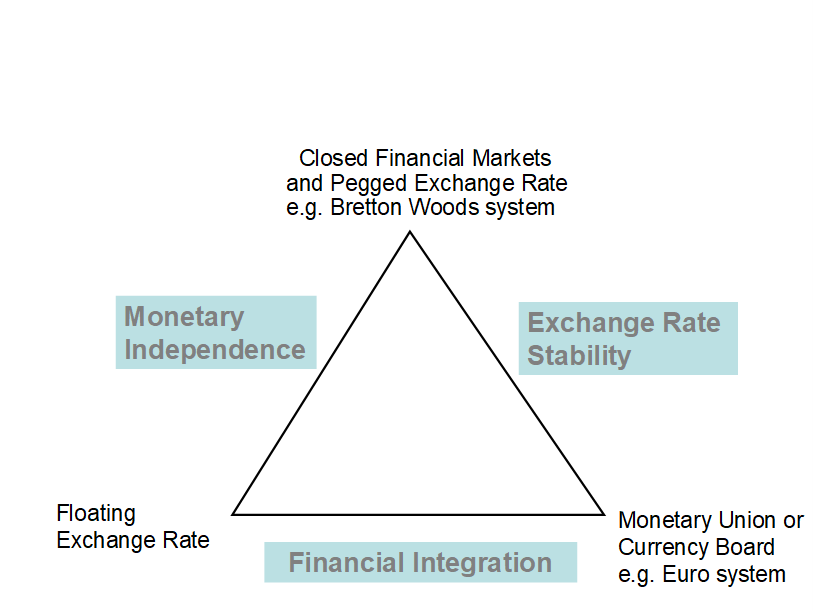

This is just an application of the “international trilemma” or “impossible trilemma”. Mundell-Fleming…

Figure 1: The Impossible Trinity.

The gold standard is merely a specific form of a very hard fix. During the classical gold standard, capital mobility was not perfect, so (even with near perfect credibility) monetary authorities had some latitude. Even then, as Obstfeld, Shambaugh and Taylor pointed out, the gold standard had higher interest rate correlations (less monetary autonomy) than under other regimes.

In 2019, capital mobility is much, much higher. FX trading, according to the 2016 BIS survey, is around $5 trillion per day. Uncovered interest parity seems to hold. Even countries with $4 trillion in foreign exchange reserves have to fear financial capital outflows.

In other words, in the modern high capital mobility world, adjustment via sterilized depletion of foreign exchange reserves (or gold, in the case of a return of the gold standard) is not feasible. The money supply will endogenously shrink, or countries will have to resort to an interest rate defense.

And that was my point: A fixed exchange rate regime, credibly and irrevocably linked to gold, will eliminate monetary policy autonomy. Demand, supply, liquidity, all sorts of shocks will manifest in adjustments in interest rates.

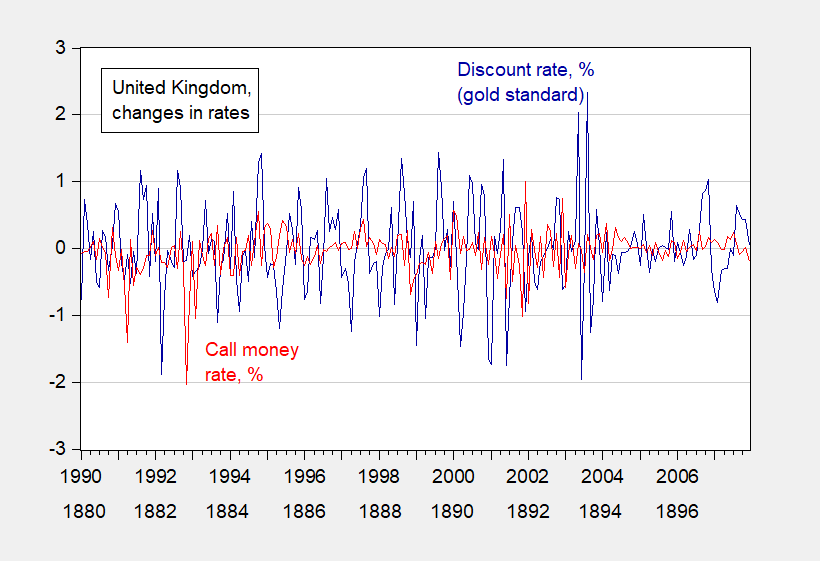

While the level of interest rates have exhibited greater variability in the past 35 years, due to variations in inflation, the volatility of interest rates — as measured by changes in interest rates — was higher during the classical gold standard (for Great Britain/UK as shown in Figure 2).

Figure 2: Month on month change in UK call money rate (red), and in Great Britain open market discount rate (dark blue), both in %. Source: FRED.

Over the 1880M01-1913M12 period, the standard deviation of monthly changes in the call discount rate was 0.62 percentage points; over the 1990M01-2007M12, the standard deviation was 0.32 percentage points, even including the drop in the level from 15% to 6% 1990-92…

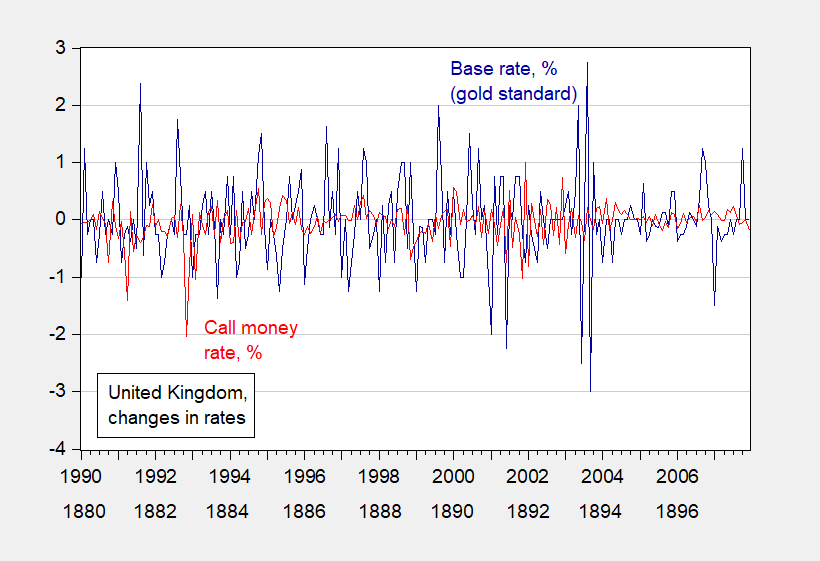

This finding is robust to the use of other series; substitute in the base rate for the discount rate.

Figure 3: Month on month change in UK call money rate (red), and in Great Britain open market base rate (dark blue), both in %. Source: FRED, and Neal-Weidenmier via Alan Taylor.

The standard deviation of changes in the base rate over the gold standard is 0.69 percentage points.

I think the gold standard could be sustained from some time, just like Argentina sustained its currency board. But that experience shows that more is needed than merely enshrining the hard fix in the constitution; the concomitants of giving up monetary autonomy are also necessary. (So, see Barry Eichengreen’s Golden Fetters for the authoritative work.)

Postscript: I’ve skipped the point about calculating the necessary interest rate changes to target the exchange rate (in this case, the price of gold). The estimate obtained in this post was based upon the Dornbusch-Frankel sticky price monetary model. Use of this number is validated if one thinks price stickiness is invariant to the exchange rate regime, i.e., the Lucas econometric policy evaluation critique does not apply. This is dubious in theoretical terms, but it is an open question whether the change in regime would effect a quantitatively important change. For the empirical relevance of this issue in macroeconomics, see Ericsson and Irons.

Update, 4/20:

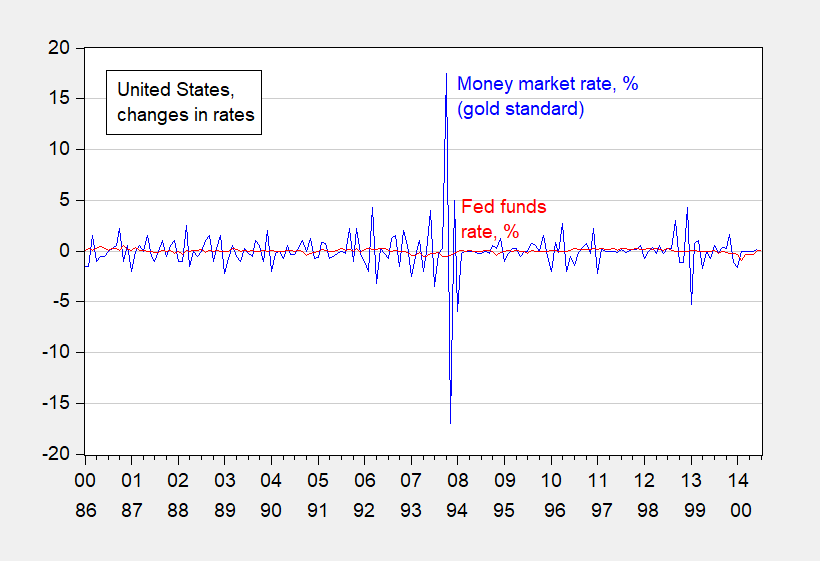

Figure 4: Month on month change in US Fed funds rate (red), and in money market rate (blue), both in %. Source: FRED, and Neal-Weidenmier via Alan Taylor.

I actually have Eichengreen’s Golden Fetters book (paperback) in my house somewhere—finding it may prove an even larger challenge than reading it.

https://www.youtube.com/watch?v=J-1cTPVFxGo

Good analysis. I’ll bet the ranch that Stephen Moore will not get past the 1st paragraph as actual evidence and economic theory is just TOO hard for his small brain.

https://www.youtube.com/watch?v=NB7ZMczCXEM

Schoolhouse Rock – Mueller Report Redactions

“I don’t know what’s up with this Bill Barr, he looks as if Elton John had conversion therapy…..” Oh man, that was funny. Some people on that link were suggesting John Goodman to play Bill Barr on SNL. I mean I can see it, but it would be a stretch for me as I find Goodman to be a very likable person IRL. But I guess the facial features it makes sense. I think I’ll keep reading the report while that’s on. It’s too upsetting to get much of a laugh out of me anymore. I’m just not much up for punchlines when democracy is being destroyed right in front of my eyes. Maybe some dark humor but not the yuk yuk jokes or sophomoric high school humor.

This is very off topic. Please forgive me.

20 April 1999

Please remember that date and all the others that have followed since.

Lest We Forget

They shall grow not old, as we that are left grow old:

Age shall not weary them, nor the years condemn;

At the going down of the sun, and in the morning,

We will remember them.

We always remember April 19, 1995 around here. But the thing that I always want to know about Columbine is how many people were thinking of the social outcasts of the grade schools and high schools before the tragedy at the school?? About as much as they do in any white suburban social enclave on the outskirts of large metro areas in America where they’ve “taken flight” away from the inner city and play all their “I’m better than thou” games. We search out those that are a little different and we make certain they are aware they are different, even if we have to work at it (including the parents of the snobs). Violence is ALWAYS wrong but I’ve reached a point that I’m tired of pretending we don’t know this shit happens all over America that creates fertile soil for such people as the perpetrators. Sorry for saying that, not sorry for saying that.

But those suburban area snobs (mostly white, but but others as well) will continue on playing “their reindeer games” without the unwashed in schools all across America. And that is something Columbine or anything else will not ever change.

To boil it down to simple terms, the gold standard would, if internationally adopted, be essentially the same as adopting a universal global currency. Isn’t that exactly the kind of thing the gold bugs don’t like? What am I missing here?

Willie: I think mostly the proposals are for country by country adoption. If the world went on a gold standard, that would eliminate exchange rates *and* maintain a generally deflationary environment.

Of course Moore decries the Nixon shock where the fixed exchange rate regime ended. Like we have had hyperinflation ever since!

Let’s see what Keynes had to say:

“Never in history was there a method devised of such efficacy for setting each country’s advantage at variance with its neighbours’ as the international gold (or, formerly, silver) standard. For it made domestic prosperity directly dependent on a competitive pursuit of markets and a competitive appetite for the precious metals. When by happy accident the new supplies of gold and silver were comparatively abundant, the struggle might be somewhat abated. But with the growth of wealth and the diminishing marginal propensity to consume, it has tended to become increasingly internecine.

“The part played by orthodox economists, whose common sense has been insufficient to check their faulty logic, has been disastrous to the latest act. For when in their blind struggle for an escape, some countries have thrown off the obligations which had previously rendered impossible an autonomous rate of interest, these economists have taught that a restoration of the former shackles is a necessary first step to a general recovery.”

The General Theory, p. 349.

True then, true now. Some people never learn the lessons of history.

The rightwing considers The General Theory to be one of the top 10 books of evil!

I have stated before on this blog, that I don’t think Timothy McVeigh was alone in the OKC bombing. I strongly believe Timothy McVeigh was not alone. And that the federal government, some judges etc, were overly eager to prosecute to protect the federal government’s reputation and the professional (read career) standing of many involved in the prosecution of the case. McVeigh was guilty–that is not something anyone of sane mind would argue. But being guilty and acting alone in the plotting and planning of a crime are two different things.

Now let me strongly stress, I am not one who buys into conspiracy theories easily or often. Example: Marilyn Monroe. I don’t buy any of the theories. I think Monroe was an emotionally unstable woman, with self-esteem issues going back to childhood. She took some pills–end of story. The JFK assassination. “Fool” that I am I believe Lee Harvey Oswald did this “alone” in the sense it was his bullet and he was the only shooter. Was he “encouraged” or was a “seed planted” in Oswald’s mind by someone?? Possibly….. but in the end analysis he acted alone—-

Not so with Timothy McVeigh. There were body parts after the bombing–never identified or linked back to any person’s body. There were other individuals seen near the rental truck, but never explained or accounted for. But there was also the planning of the targeting of the Murrah building, shown in court documents, as regards the layout of a particular federal building (very similar if not exact replica to Murrah) related to, shall we say “a farmer in Michigan”. And if you read Stephen Jones book you will know what (who) I am referencing—it’s clear as day. I believe that man was JUST as guilty as McVeigh, but was never prosecuted (certainly not fully prosecuted) that I am aware of.

You wanna know what REALLYhappened in OKC?? You have the Federal government’s story which is an incomplete story that aids quick resolution and the legal prosecution of a single baddy, and you have a wider lens, more thorough, and more genuine story told by Stephen Jones. I recommend the Stephen Jones version—which can be found at these two links. The federal government does no one any favors by telling a half story for the history books.

https://legacy.lib.utexas.edu/taro/utcah/03493/cah-03493.html

https://www.amazon.com/Others-Timothy-McVeigh-Oklahoma-Conspiracy/dp/1586480987/ref=sr_1_fkmr0_2?keywords=stephen+jones+okc+bombing&qid=1555709086&s=gateway&sr=8-2-fkmr0

I wanna stress I’m not viewing this as a “conspiracy theory” in the purest sense of “evil players” in the federal government. I am NOT making the federal government out to be the boogeyman. I am talking about people in a pressure cooker situation that got overly eager to have a result declared, a prosecution of a criminal finalized, and not having any ruffles in the sheets observable to those with only surface level perception.