Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate on May 23rd.

Donald Trump on May 5 suddenly revealed that a trade agreement with China was not imminent after all. To the contrary, the Administration on May 10 raised its earlier 10 percent tariff on $200 billion of Chinese goods to 25%, and threatened to extend 25% tariffs to the remainder of imports from China by late June (roughly $300 billion of goods). China, of course, retaliated against US exports [announcing reciprocal 25% tariffs on $60 billion of US goods, to start June 1. Surprised stock markets fell in response, with the S&P 500 down 4 per cent over the first week of the renewed trade war.

The mystery is why market investors or anyone else had up until May put faith in White House statements that a deal with China was expected any day. Why believe this Administration on such a thing? Trump, after all, is the guy who, after meeting with Kim Jong Un in Singapore, claimed that North Korea was no longer a problem because it had agreed to denuclearization. And the guy who said that Saudi officials had promised him to buy $110 billion of US arms and to lower oil prices. Did anyone really expect a proud China to agree, without meaningful reciprocal concessions, to let the US write some of its laws and to pass subsequent unilateral judgment on whether it was complying?

Contradictions in Trump trade

US trade policy is now a mass of conflicting goals.

- On the one hand, Administration officials and apologists defend the high tariffs as a regrettable but temporary expedient, a necessary means to a strategic end, a weapon whereby the consummate deal-maker will force concessions from China and other trading partners. On the other hand, Donald Trump himself looks and talks like someone who would be perfectly satisfied if the tariffs remained in place permanently. (His “love for tariffs” apparently goes back to the 1980s.) He continues to insist that China is paying the cost of the tariffs, sending money into the US Treasury. What could be better? He also appears to think it would be fine if the long-run outcome was a decoupling of the Chinese and American economies and to view with equanimity the loss of gains from trade including dismantling the value chains on which so much industry in both countries heavily depends.

- Again, on the one hand a high-priority demand is that China facilitate US companies setting up operations in China (by more conscientiously insuring that the firms aren’t required to hand over technology or other intellectual property to local partners). On the other hand, another absolutely top-priority Trump demand is to increase US net exports to China. This goal would suggest wanting US firms to produce in the US rather than in China.

- A long-standing contradiction: The US asks China to stop intervening in the foreign exchange market while also demanding that it keep the value of the renminbi high. These two admonitions have been in direct contradiction since 2014, when market forces turned in the direction of RMB depreciation.

It is worth further unpacking some of the Trump trade illogicalities.

Does one need to understand “incidence” of a tax?

The right answer to the question of costs is that the US (and the global economy too) will be worse off if we are stuck indefinitely with these higher tariffs – as now appears possible.

The President’s gleeful belief that his tariffs get China to help fund the US government is outlandish. A tariff is a tax, and US consumers and firms are the ones paying it, not China. [The estimated reduction in U.S. real income is $1.4 billion per month.]

Indeed, to the extent there may have been truth to the allegation that the Chinese government was subsidizing such products as solar panels, the tariffs imposed since January 2018 are now preventing the Chinese government from subsidizing the US.

It is true that, in theory, Chinese exporters might have experienced a sufficiently large loss in demand as a result of all these tariffs that they would have been forced to lower their prices. Students in Econ-101 learn about the “incidence” of a tax, i.e., who ultimately pays the cost. But two new studies by eminent economists examine the 2018 data and find that (1) the Chinese have not in fact lowered their prices and, as a result, (2) the full cost of the price increase has been passed through to American households. So one doesn’t even need Econ-101: simple common sense gives the right answer in this case.

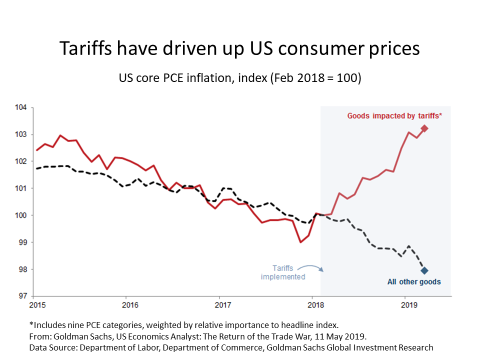

[The impact of the tariffs on consumer prices of the effected goods is evident in the graph from Goldman Sachs]

If Trump goes ahead with his threat to extend the tariff to all imports from China, the cost for a typical American household will be $300-$800 billion a year in one estimate, or as much as $2,200 in another estimate. The cost to consumers doesn’t count the cost of lost exports on the part of US firms, workers and farmers. The exports are lost through Chinese retaliation as well as other channels (including appreciation of the dollar against the renminbi).

In at least one respect, Trump’s trade policies are actually hurting the US budget. China has retaliated particularly against soybeans and other American farm products. The Trump Administration, sensitive to the electoral importance of the farm states, is attempting to compensate farmers with billions of dollars in federal subsidies, much of it going to large wealthy farmers. It’s yet another assault on the American taxpayer.

Does one need to understand comparative advantage?

Economists have long noted, whether ruefully or pridefully, that the public can’t be expected to understand the principle of the gains from trade without having been taught David Ricardo’s principle of Comparative Advantage. Paul Samuelson famously identified the principle as both universally true and yet not obvious.

But one does not in fact need to assimilate the principle of Comparative Advantage to understand the basic idea of mutual gains from trade. If both the buyer and the seller voluntarily agree to the exchange, then both gain. This assumes that they are each good judges of what they want – better, at least, than is the government. This assumption is usually correct, with a few exceptions (such as purchases of opium).

The theory of Comparative Advantage makes useful predictions as to which country will choose to export which good; but it is not really essential for understanding the basic presumption that both sides gain from voluntary trade. Again, common sense gives the right answer.

To say that both countries gain from trade overall is not to claim that every resident of each country gains. Of course an increase in trade gives rise to both “winners and losers” within each country. So does any major change. Tariffs create both winners and losers as well. But the winners tend to outnumber the losers when trade is liberalized, whereas the losers tend to outnumber the winners when tariffs are raised.

Tariffs without winners

Donald Trump appears to have engineered a spectacular example of this generalization: his trade war has hurt almost every segment of the American economy, with very few winners. The losers include not just consumers, but also firms and the workers they employ, whether they are farmers who are losing their export markets or manufacturers who are forced to pay higher input costs. Even the US auto industry, which did not ask for this “protection,” is worse off over all, having to pay more for steel and auto parts.

Trump has come close to accomplishing something that one might have thought impossible: tariffs that benefit almost noone. We may have to re-think the theory of political economy that says protectionism is usually the outcome of special interests that wield disproportionate power. It is not enough to go back 30 years to the Japan-bashers of the 1980s.We may have to go back 300 years to the mercantilists who preceded Adam Smith (1776) and the Enlightenment. The mercantilists disliked trade because it favored free individuals over the power of the state.

This post written by Jeffrey Frankel.

“The mystery is why market investors or anyone else had up until May put faith in White House statements that a deal with China was expected any day. Why believe this Administration on such a thing?”

He continues this paragraph by noting a few other Trumpian lies. Of course we have had over and over from the likes of CoRev and PeakTrader that a deal was right around the corner. Yes – you can fool some people all the time!

pgl: That is why it is useful to examine the comments of CoRev and PeakTrader. They illustrate and document the delusions and internally inconsistent thinking of a certain segment of the population. We should pity them, rather than be angry at them (unless they are being paid, which I think might be the case).

Menzie, “They illustrate and document the delusions and internally inconsistent thinking of a certain segment of the population. We should pity them, rather than be angry at them (unless they are being paid, which I think might be the case).”

Your comment exemplifies the same disconnection from reality from the real voters in this country that cost Dems the Presidency. We, the average conservative voters, know that we have been in a “Trade War” with China for decades, and that it is time to recognize it. Trump did! Why didn’t you? I can only guess it is because of your belief in global government.

“… (unless they are being paid, which I think might be the case).” epitomizes the disconnection from reality. While world- wide, election after election, we see rejection of you world view. The Chinese don’t have it!

When you party’s leaders are as flaky as AOC, and the other US hating members it has elected, it just moves you farther to the extreme. Others believe as strongly in their view points as strongly as you do, but we don’t accuse you of being paid. That’s just ludicrously silly showing your disconnection.

CoRev the real voters in this country that cost Dems the Presidency.

Excuse me, but most “real voters” voted for Clinton. And by a pretty big margin. Trump won the unreal electors in the Electoral College.

the average conservative voters, know that we have been in a “Trade War” with China for decades,

Conservatives always need some enemy. In the 1980s it was the Japanese. Oceania has always been at war with Eastasia. Most of the time conservatives whined because China was providing US consumers with cheaper goods at the expense of Chinese workers. And it’s a strange kind of war when the supposed enemy is the one buying your Treasury bonds because American voters are unwilling to tax themselves.

Others believe as strongly in their view points as strongly as you do,

That’s your problem. Your beliefs are based on pure faith and intuition. The remedy would be to make an effort at actually reading an econ textbook. If everything about economics was intuitive and common sense, then there wouldn’t be a need for anyone to pursue graduate studies along with lots of unpleasant math. There’s a reason why you shouldn’t just rely upon your gut instincts and beliefs when it comes to economics. That’s why you’re almost always wrong about the most basic things.

party’s leaders are as flaky as AOC

I’m pretty sure AOC understands economics a lot better than you do. At least she’s read the textbooks and has an econ degree. And that’s better than a degree from Glenn Beck University or Sean Hannity Community College.

You sure do manage to write a lot of utter gibberish. And we thought Trump’s twitter was out of control.

There’s a reason the current administration is trying to eliminate or at least suppress data. They could screw up an iron ball with a rubber hammer by being losers, but don’t want anybody to know. Trump has been a loser most of his life, but propped up in a way that allows him to pretend. Real data proves otherwise. As it would now. Carry on. The determined right will fail to understand reality until the economy falls apart and they starve. And even then it will be Carter/Clinton/Obama’s fault. Meh. The sun is out, and I like reality. It makes for better decisions and a clearer mind.

Most of them are not “the devil”. I’m sure many of them have good intentions. Deep inside they feel what they are saying and doing are the right things for their “homeland”. But they tend to be incredibly incredibly DUMB . Now I’ve said before when I look at Nancy Pelosi’s eyes I see a dead/vacant (sometimes confused) look in her eyes, very similar to the one Ronald Reagan had at some of his pressers. Now this first woman in this interview has a certain look, I’m NOT going to suggest to you (yet) what words come to my mind (different than my thought’s on Pelosi’s) when I look at her eyes. Any commenters would like to give their thoughts on the look in her eyes are welcomed and encouraged to give me your own thoughts. There are others as the video goes on, and you can give your thoughts on the look in their eyes and their words as well.

https://www.youtube.com/watch?v=8UjaxT468cw

Now, not to give too much away in my thoughts here, but these are the type folks I imagine our PeakTraders and CoRevs as being, in my mind’s eye—a rough approximation thereof.

“Does one need to understand “incidence” of a tax?”

Yes one does. But does Trump when he claims:

“He continues to insist that China is paying the cost of the tariffs, sending money into the US Treasury.”

Wow – the full incidence of our tariffs is borne by Chinese suppliers? Well no:

“The impact of the tariffs on consumer prices of the effected goods is evident in the graph from Goldman Sachs”

Their graph and a lot of economic evidence shows U.S. consumers are bearing the incidence of the tariff. Is Trump really so stupid that he believes what he claims? Maybe but he does have his team of “economic advisers” who might correct his idiotic views of things. Of course that would not stop the Liar in Chief from doing what he does 24/7 – LIE!

Frankel makes an important and brilliant point:

“Donald Trump appears to have engineered a spectacular example of this generalization: his trade war has hurt almost every segment of the American economy, with very few winners…Trump has come close to accomplishing something that one might have thought impossible: tariffs that benefit almost no one.”

Of course what would one expect when we have a clown as President surrounding by court jesters posing as economic advisers. Frankel’s close is even more compelling:

“We may have to go back 300 years to the mercantilists who preceded Adam Smith (1776) and the Enlightenment. The mercantilists disliked trade because it favored free individuals over the power of the state.”

Yes – we are being ruled by King Donald I – a true village idiot but one who lusts for nothing but power.

I think the real negotiating and strategy problem with President Trump is that for much of his business life, he had superior bargaining power in his business ventures when compared to suppliers and vendors. I assume he was able to say, “my way or the highway”. He currently misjudges the relative power of the USA versus China. If the Chinese have in fact expropriated USA technology and intellectual property, it seems beneficial to rectify the abuse, but as concluded by Professor Chinn, Professor Frankel and most readers of this blog, higher tariffs seem to be a losing strategy. Are there no friendly “ears” in the administration that may be subject to reasonable influence by well meaning economists and strategists?

“for much of his business life, he had superior bargaining power in his business ventures when compared to suppliers and vendors.”

That is what Trump wants us to believe. But the truth is that for most of his life, his business adventures were failures bailed out by his rich daddy. So when Trump’s incompetence costs us trillions – who will bail us out?

‘Are there no friendly “ears” in the administration that may be subject to reasonable influence by well meaning economists and strategists?’

There may have been at one point but Trump replaced them for his current class of sycophants.

AS Are there no friendly “ears” in the administration that may be subject to reasonable influence by well meaning economists and strategists?

I think the answer is no. I recently read Cliff Sims’ book Team of Vipers

https://www.amazon.com/Team-Vipers-Extraordinary-Trump-White-ebook/dp/B07KBGJKV8

It’s a horrible book, but well worth the read if you want to try and understand the Trump faithful. Cliff Sims is and remains a die hard Trump supporter. He even manages to praise Sarah Sanders as one of the bright lights on the Trump team. The “vipers” aren’t just the liberal press, but primarily the internal guard rail staffers as well as RNC folks. Sims praises the deep economic wisdom of folks like Navarro, Stephen Moore and (especially) Larry Kudlow!!! Indeed, one of the reasons Sims left was because he was unable to land a job on Kudlow’s team because he was backstabbed by those vicious vipers like Gen. Kelly. So if you think folks like Kellyanne Conway, Sarah Sanders, Peter Navarro and Larry Kudlow are the true bright lights and wise ones, it’s pretty much of a forlorn hope that Team Trump will even listen to never mind surround itself with “well meaning economists and strategists.” But I recommend reading (suffering through?) the book if for no other reason than it will give you an invaluable insight into the minds of MAGA hat wearing Trumpsters. It’s scary.

Talk about inconsistent positions. Trump claims to be frustrated with China’s “theft” of intellectual property so why one of his first acts as President this Executive Order?

https://www.politico.com/story/2019/01/23/trans-pacific-trade-pact-2017-1116638

Three days after being sworn into office as the nation’s 45th president, Donald J. Trump on this day in 2017 fulfilled a campaign promise by signing an executive order pulling the United States out of the Trans-Pacific Partnership, a 12-nation free-trade pact. The president called the TPP — which had been negotiated during Barack Obama’s term in office but had never been submitted to the Senate for ratification — “a rape of our country.”

Trump must have had sexual abuse of woman on the brain that day but how did this deal in any way hurt our nation. OK – the left complained that it protected intellectual property. I agree with this concern but then Trump wants protection of intellectual property. Go figure! The link continues:

‘As Trump’s immediate predecessor in office, Obama argued “if we don’t pass this agreement — if America doesn’t write those rules — then countries like China will.”’

China is setting the rules which I’m sure frustrates Trump. What else frustrates Trump?

‘During the campaign, Trump had hammered away at the deal as a poorly negotiated giveaway of American power. He also criticized the TPP agreement for purportedly being too verbose and too complicated, observing that it was “5,600 pages long [and] so complex that nobody’s read it.”’

Too complex for our Idiot in Chief? Gee – it was over 3 pages so Trump could not finish reading it. Go figure!

I’m not disagreeing here, just presenting a different way of looking at something. Professor Frankel states:

“The mystery is why market investors or anyone else had up until May put faith in White House statements that a deal with China was expected any day. Why believe this Administration on such a thing?”

I can definitely understand the cynicism related to the donald trump administration and all the incompetency of his international trade staff. But in fairness, I don’t think that is how the market looks at it. They aren’t placing “faith” in anyone or anything. The market participants are assuming that even very incompetent people, even if at the last minute, are going to do the things which best serve themselves. “Giving in to” China is/was probably the best idea for donald trump going into late 2016 elections, as none of his base followers ever read the details anyway, (why read a major city newspaper??—when they can slouch in their lounge chair watching FOX news with a dead look in their eyes) and some kind of a celebratory meeting at Mar-a-Lago with Xi could have been quite an easy sell to his base, and would have helped his GDP numbers (and other economic barometers) that are going to take on higher weight for him near his re-election time.

How many of donald trump’s base, if you asked them right now, know about his $16 billion in additional government welfare going to farmers that the taxpayer is now funding instead of Chinese consumers??? 3 in the entire U.S. mainland?? It’s welfare, and we should call it what it is—government welfare. It’s distributions of government money going to farmers who will end up begging at a food pantry if donald trump’s USDA staff doesn’t send them money. Now I guess Mitch McConnell thinks it’s horrible when it goes to blacks with no decent quality local public education or decent local jobs, but when it goes to mostly white farmers for having a tractor in the front yard and deciding not to plant crops at all or switch crops, or let crops rot in a silo, then government welfare on the taxpayer dime is a wonderful thing. Just like corporate welfare is a wonderful thing when it goes to Mitt Romney.

https://www.latimes.com/archives/la-xpm-2012-jan-12-la-na-bain-subsidies-20120113-story.html

https://www.salon.com/2012/01/19/romney_corporate_welfare_king/

https://www.motherjones.com/politics/2012/01/romneys-crony-capitalist/

https://www.thenation.com/article/romneys-crony-capitalism-bains-big-government-subsidies/

While I think Frankel is right that there seem to be no winners in the US at least from the trade war with China so far, it does seem that there were a few winners in the steel industry and thus probably in the metallurgical coal industry, with Trump especially obsessed with helping coal. Of course those damaged lots of steel users, with those losses certainly outweighing the fairly small gains of the winners.

Of course keeping on the steel and aluminum tariffs, just now removed after Senate GOP pressure related to the new NAFTA deal, had violated promises made to Canada and Mexico in connection with that deal. But we know that Trump’s word has never been his bond.

One would think companies like AK Steel would benefit from Trump’s protectionism. Their 10-K certainly kisses the feet of Wilbur Ross. When the tariffs were first announced, the stock price soared. Revenues have hit $6.8 billion but notice that the stock price is now back to less than $2 per share.

https://finance.yahoo.com/quote/AKS/

Page 7 of AK Steel’s 10-K filing for fiscal year ended December 31, 2017 had quite the discussion under “Competition”:

“Domestic steel producers, including us, face significant competition from foreign producers. For many reasons, these foreign producers often are able to sell products in the U.S. at prices substantially lower than domestic producers. Depending on the country of production, these reasons may include generous government subsidies; lower labor, raw material, energy and regulatory costs; less stringent environmental regulations; less stringent safety requirements; the maintenance of artificially low exchange rates against the U.S. dollar; and preferential trade practices in their home countries. In recent years, the annual level of imports of foreign steel into the United States has increased over historical levels and is affected to varying degrees by the relative level of steel production in China and other countries, the strength of demand for steel outside the U.S. and the relative strength or weakness of the U.S. dollar against various foreign currencies.

In 2015, the combination of overcapacity and slowing domestic demand in countries such as China resulted in imports of low-priced foreign steel into the U.S. at levels significantly higher than previous periods. As the supply of imported steel surged, it caused dramatic downward pressure on the price of flat-rolled steels in the American marketplace. Imports of finished steel into the United States accounted for approximately 27%, 26% and 29% of domestic steel market consumption in 2017, 2016 and 2015, levels that are higher than the historic norm. During 2016, we successfully concluded the anti-dumping (“AD”) and countervailing duty (“CVD”) cases that we and other major domestic steel producers initiated in 2015 against imports of corrosion-resistant (“Coated”), cold-rolled and hot-rolled carbon steel products from multiple foreign countries. The final duties determined by the United States Department of Commerce (“Commerce Department”), which in some cases exceed 400% for combined AD and CVD duties, will remain in effect for a minimum of five years.

Following those determinations, in September 2016, we and other domestic producers made filings with the Commerce Department asserting that Chinese steel producers are attempting to circumvent the AD and CVD duties against Coated and cold-rolled carbon steel by transshipping Chinese steel through Vietnam for minor processing before importing these final steel products into the U.S. market. On December 5, 2017, the Commerce Department announced preliminary affirmative rulings that Coated and cold-rolled carbon steel imported from Vietnam produced from steel that originated in China is circumventing existing AD and CVD orders on these products imported from China. The Commerce Department instructed the U.S. Customs and Border Protection to begin collecting cash deposits on all imports of Coated and cold-rolled carbon steel produced in Vietnam using Chinese-origin steel.

In addition, during the first quarter of 2017, pursuant to trade cases that we and other domestic producers of stainless steel initiated, the Commerce Department assessed final duties against Chinese stainless steel imports, which in some cases exceed 265% for combined AD and CVD duties. These duties will remain in effect for a minimum of five years.”

Why didn’t they just write “We Love You Wilbur Ross”!

Mmmmm???????

“This assumes that they are each good judges of what they want – better, at least, than is the government. This assumption is usually correct, with a few exceptions (such as purchases of opium).”

Might ponder that markets aggregate buyers and sellers knowledge and governments aggregate the knowledge of the people at least in a semi democracy. Governments aggregate the peoples common wisdom, ignorance, foolishness, stupidity and folly. The current example of ignorance, stupidity and folly is mr trump.

Surely the problem is Trump has no idea about international trade and neither do his advisors.

and I won’t call you shirley again. ( what you have never watched Flying high tsk tsk)

the reason that Wall Street “believed ” Trump was that Wall Street are Snake Oil Salesmen. CNBC, Bloomberg, and et all have to produce positive spin to bad news to keep people buying shares of stock. Mr. Frankel’s sounds like the French officer in Casablanca who said he was shocked that gambling was going on in Casablanca.

Thus, the corporate press are nothing more than shills for Wall Street bankers.

More evidence that it is the U.S. consumer not the Chinese producer who pays the incidence of the Trump tariffs:

http://www.econ.ucla.edu/pfajgelbaum/RTP1.pdf

The Return to Protectionism by Pablo D. Fajgelbaum, Pinelopi K. Goldberg , Patrick J. Kennedy , and Amit K. Khandelwal

March 10, 2019

Abstract

We analyze the impacts of the 2018 trade war on the U.S. economy. We estimate import demand and export supply elasticities using changes in U.S. and retaliatory tariffs over time. Imports from targeted countries declined 31.5% within products, while targeted U.S. exports fell 11.0%. We find complete pass-through of U.S. tariffs to variety-level import prices. Using a general equilibrium framework that matches these elasticities, we compute the aggregate and regional impacts. Annual consumer and producer losses from higher costs of imports were $68.8 billion (0.37% of GDP). After accounting for higher tariff revenue and gains to domestic producers from higher prices, the aggregate welfare loss was $7.8 billion (0.04% of GDP). U.S. taris favored sectors located in politically competitive counties, but retaliatory tariffs offset the benefits to these counties. We find that tradeable-sector workers in heavily Republican counties were the most negatively affected by the trade war.

Found this when reading this interesting post:

https://libertystreeteconomics.newyorkfed.org/2019/05/new-china-tariffs-increase-costs-to-us-households.html

New China Tariffs Increase Costs to U.S. Households

Mary Amiti, Stephen J. Redding, and David E. Weinstein

“One way to estimate the effect of these higher tariffs is to draw on the recent experience of the 2018 U.S. tariffs. Our recent study found that the 2018 tariffs imposed an annual cost of $419 for the typical household. This cost comprises two components: the first, an added tax burden faced by consumers, and the second, a deadweight or efficiency loss. The magnitude of these costs depends on how a tariff affects the prices charged by foreign exporters and the U.S. demand for imported goods. Studies, including our own, have found that the tariffs that the United States imposed in 2018 have had complete passthrough into domestic prices of imports, which means that Chinese exporters did not reduce their prices. Hence, U.S. domestic prices at the border have risen one for-one with the tariffs levied in that year. Our study also found that a 10 percent tariff reduced import demand by 43 percent.”

Trump’s claim that the Chinese are paying for these tariffs is refuted by a number of analyzes. Even a village idiot should know he is lying.

Trump keeps claiming that his tariffs are collecting over $100 billion per year. While it is true that tariff revenues have doubled since 2016QIV, revenues rose from only $37 billion per year to $75 billion per year as of 2019QI:

https://fred.stlouisfed.org/series/B235RC1Q027SBEA

One would think even the village idiot Lawrence Kudlow would know how to check the BEA data. Of course Kudlow is a gutless coward incapable of correcting his boss’s lies.

BIASED. Like NYTimes.

Prof Frankel please justify to which extent there is “mutual trade”.

Breakeven Inflation Rate: https://fred.stlouisfed.org/series/T10YIE

David Ricardo: “Ricardo recognized that applying his theory in situations where capital was mobile would result in offshoring, and therefore economic decline and job loss. To correct for this, he argued that (i) most men of property [will be] satisfied with a low rate of profits in their own country, rather than seek[ing] a more advantageous employment for their wealth in foreign nations, and (ii) that capital was functionally immobile.”

Ricardo quoting Ricardo? Sorry Zi Zi – but you need to properly source that alleged quote. And WTF does the expected inflation rate have to do with this? Oh wait – as usual you have no clue.

A fundamental “ideological” difference is whether today’s rate inversion, low long-term rate is a natural product of decades of offshoring production (overly sufficient liquidity, catering to Corporates’ interests, strangling of Middle Class) or higher tariffs from Trade War.

WTF? Your babbling is beyond incoherent. Please stop.

I noted that when NYTimes doesn’t like a piece of news. They’d phrase it in a way that fits their ideology and disable the comments.

BBC does the same. Furthermore, they don’t even show the author’s name for most of news articles.

Econbrowser is definitely better in that aspect!

Thank you very much for the guest post by Professor Frankel.

Professor Frankel mentions tax incidence and Econ 101. I just happened to finish the first week, the course started May 21, of Econ 14.01 (Microeconomics 101) on edX by Professor Gruber at MIT. This intro Econ course has calculus in it, so it is more challenging than an algebra-based Econ 101.

https://www.edx.org/course/microeconomics-2

In the very first week of Econ 101, Professor Gruber lectured on tax incidence.

1) if the full cost of the tariff is passed through to American consumers, then I think (just like we learned in the first week of Econ 101) that demand is downright inelastic. I do not see how Mr. Trump’s tariff war hurts the Chinese producer. And, with an inelastic demand curve, I do not think Chinese producers are in danger of getting hurt.

2) Suppose whatever market prior to the tariff war was in equilibrium. Unless the tariffs were permanent, I do not think domestic American producers would invest in new factories and equipment. When the tariffs are lifted, I think markets would slide back to the lower pre-war equilibrium.

3) Just last week, I was exploring, with Professor Chinn, the problem of real wages. I think wages are sticky downwards. For Mr. Trump’s tariff war, it seems to me that owners, and not the workers, in the domestic market would get the delta price increase. Especially if the tariffs are temporary, it seems unlikely to me that worker wages would permanently rise.

I know Mr. Trump has an undergraduate degree in economics from UPenn. If Mr. Trump wants a refresher in Econ 101, MIT is asking for a $10 donation on edX or Mr. Trump could skip the donation and audit the course for free.

I’ve been out of school for 36 years and I take refresher courses.

Cheers,

Frank

Frank: I think Mr. Trump has an undergraduate *real estate* degree from Wharton/Penn.

He does. ILSM thinks he got that from Fordham but no Fordham is off the hook for this grade inflation.

PGL, gratified you remember,across topics. my reply to Moses on Fordham.

Not so impressed (reading comprehension on par with your critical thinking) that you missed the point: that I have two 30 something nephews who are Fordham degreed alums…… neither is named Vladimir!

Trump did his first two years at Fordham, transferred to Wharton.

WTF? No one suggested your relatives were named Vladimir. Dude – the vodka has made you paranoid.

The person’s age and the person’s choice of college major mean nothing, when you’re starting off at ground zero with someone who thinks they already know ALL the answers.

This is why a President has a cabinet and staff. No one expects them to have all the answers. What they DO expect is someone with enough wisdom and judgment to plug the right people in the right specialty jobs, and listen to them when those vacancies in a President’s knowledge need filled in.

https://www.youtube.com/watch?v=ozq0zOzsMBg

When a U.S President surrounds himself with flatterers, it’s a recipe for DISASTER.

https://www.bartleby.com/36/1/23.html

We’re not there yet, but all these people wearing red hats better hope we don’t get there. They may, as the old cliche’ goes, “live to rue the day”

Fog of War was a great film. McNamara eventually (late in life) realized had they applied empathy to Ho Chi Minh – the entire Vietnam disaster could have been avoided. Too bad Bush-Cheney never learned that lesson.

“When a U.S President surrounds himself with flatterers, it’s a recipe for DISASTER.”

People like Kudlow and Moore are nothing but flatterers. Reagan during his first year made the same mistake – hire incompetents like Art Laffer as “economic advisers”. Economic chaos followed. The good news is that Reagan finally brought in Martin Feldstein and William Poole to clean up the mess.

Frank Regarding Trump’s educational achievements, you might find this short synopsis interesting:

https://www.quora.com/How-many-academic-degrees-does-Donald-Trump-have

Specifically,

Trump’s real estate mogul father, chose Wharton because at the time Wharton uniquely offered a narrowly focused vocational program in real estate.

Also, Trump claims (i.e., lies) about having graduated at the top of his class. We don’t know his GPA, but we do know from graduation ceremony brochures who graduated summa cum laude, magna cum laude and cum laude. Trump is not listed on any of those awards, so he clearly did not graduate at the top of his class.

Maybe Wharton gave Trump the class clown award!

OMG, the “I think Quora is a real news source” disease is spreading. 2slugbaits, I expect sooooooo much much much more from you. You let Barkley Junior get his dementia “ick!!!”! germs on you. If Menzie starts quoting Quora I’m officially taking this a sign of a near-term apocalypse. G*ddamn slugs, did you have a brain aneurysm this morning?? Quora for Christ’s sake?? Geeeeezuz F’ing Christ, Quora!?!?!?!?! Did you also remember to send out your chain letter this morning before the bad luck hits you??—-and also smear Vicks VaopRub all over your neck before that cold gets worse???

Come on slugs!!!!!

What part of Trump’s biography is wrong?

@ 2slugbaits

I might be able to get a 5 year old child to tell me donald trump’s bio correctly. That doesn’t exactly mean I want to quote that 5 year old or use that 5 year old as a reference. I don’t click on Quora links, so I’ll take your word the bio is correct.

Oh dear, 2Slug, you are in danger! Getting “ick” dementia germs on you from me! You might end up like I have as demented as Nancy Pelosi! Indeed, it is well known that Nancy and I are constantly quoting Quora as a news source all the time. There is a You Tube out there on this that Moses saw!

Oh, now it is even worse, further signs of my deterioration, for which I apologize to one and all. Once again I have misread a post by Moses, a lynching offense if there ever was one. It is not “”ick” dementia germs on you” but “dementia “ick!!!”! germs on you,” a profoundly important distinction, and you certainly do not want to get them on you, 2Slug, whatever the are.

And I must point out to others that this danger of Pelosi-like dementia and its germs may not wait for you to become old. After all, as Moses repeatedly points out, I am “Junior.” So all you young-uns better stay away from Quora and pay no attention to Nancy Pelosi, or you too will end up with all those dementia”ick!!!”! germs on you. Beware

@ Barkley Junior

There’s a rumor going around you’re an “editor”. An “editor”….. “whatever the are”.

Oh my, Moses, you do not now what “the” are? The are many things, including demons of dementia especially striking editors and House speakers. The are the main topic of a very famous episode of the Simpsons, I hear. Surely you have seen it.

Hello 2slugbaits,

Thank you very much for the additional info at quora.

Yes, about a year ago, I had read the graduation brochure on archive at UPenn. I was curious about Mr. Trump’s claim of “first in his class”.

The commencement program is online at UPenn archives:

https://archives.upenn.edu/digitized-resources/docs-pubs/commencement-programs/program-1968

It shows Mr. Trump’s name on page 21.

On page 66, the commencement program shows students with academic honors from the Wharton School of Finance and Commerce.

The Daily Pennsylvanian archives at UPenn show students on the Dean’s List:

https://dparchives.library.upenn.edu/cgi-bin/pennsylvania?a=d&d=tdp19681025-01.2.27&e=——-en-20–1–txt-txIN——-

The Wharton School does have a page on Mr. Trump in the Alumni Magazine:

https://www.wharton.upenn.edu/wp-content/uploads/125anniversaryissue/trump.html

Cheers,

Frank

“The Wharton School does have a page on Mr. Trump in the Alumni Magazine”

Notice this page says nothing about how Trump did when he was in college.

“On page 66, the commencement program shows students with academic honors from the Wharton School of Finance and Commerce”

15 Cum Laude, 4 Magna Cum Laude, and 2 Summa Cum Laude. Trump’s name appears nowhere.