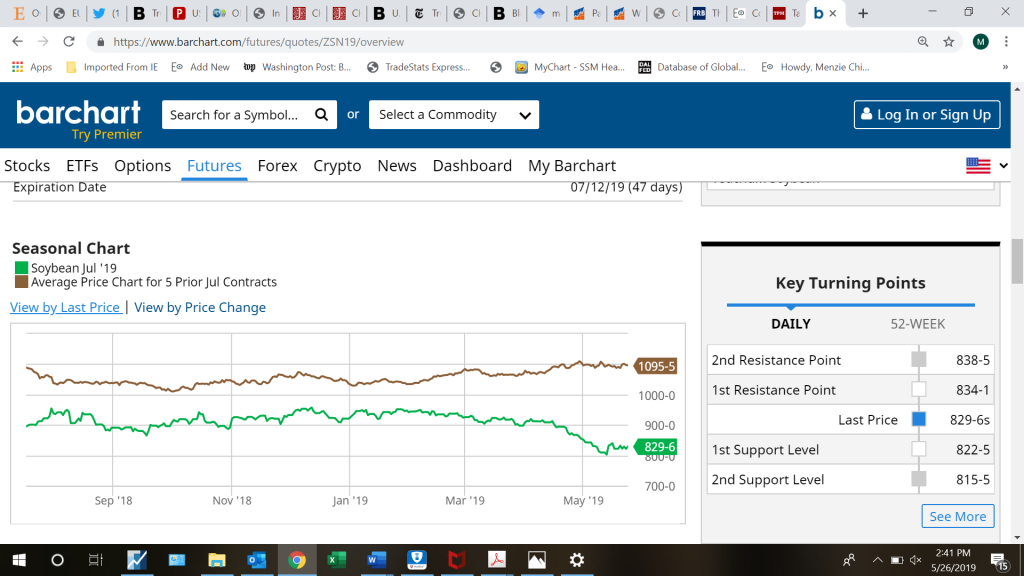

A year ago, the July 2019 futures were $10.46, compared to $8.296 today.

Reader CoRev writes on July 9th:

…no one has denied the impact of tariffs on FUTURES prices. Those of us arguing against the constant anti-tariff, anti-Trump dialogs have noted this will probably be a price blip lasting until US/Chinese negotiations end. We are on record saying the prices will be back approaching last year’s harvest season prices.

The following graph confirms not only are prices not back to last year’s harvest, but to what has been recorded for futures contracts over the past five years:

Source: barchart.com, accessed 5/26/2019.

So…much…winning. So much, we need to dole out another $16 billion to our farmers.

Thanks to CoRev for providing so much falsifiable hypotheses.

Update:

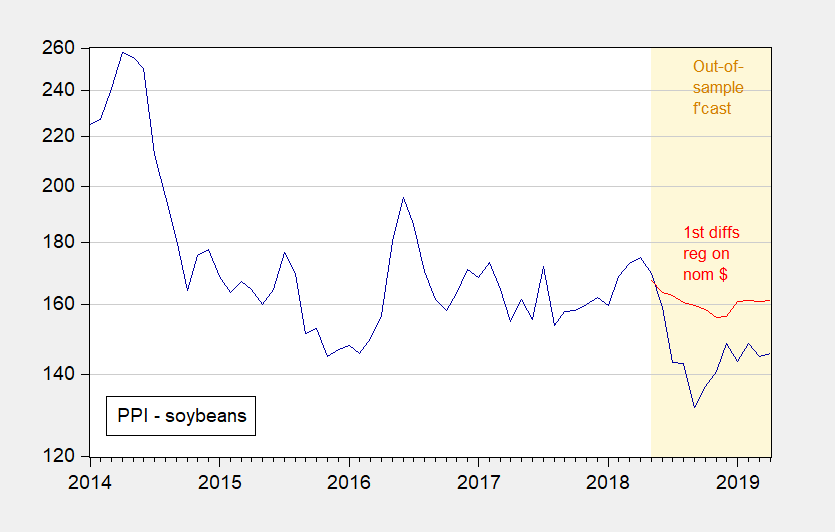

CoRev notes the multi-quarter blip is defined by period of US-China trade negotiations. He also asserts the majority of decline in soybeans was in 2014, due to dollar decline. I don’t disagree. But the decline since April 2018 (8%) is not that small relative to that in 2014 (16%). And the decline since April 2018 has only partly been explained by the dollar movement, suggesting the bulk is due to other factors including Chinese tariffs.

Figure 2: PPI for soybeans (dark blue) and dynamic (ex post historical) forecast from first differences regressions of log PPI on log dollar (Fed broad index) over 2000M01-2018M04 period. Out-of-sample period shaded orange. Source: BLS and author’s calculations.

Thanks again to CoRev for providing an easily falsifiable premise!!!!

“The package we are announcing today ensures that farmers will not bear the brunt of those trade practices by China or any other nations,” Secretary of Agriculture Sonny Perdue said. “While farmers would tell you they’d rather have trade not aid, without the trade … they’re going to need some support.”

Farmers may not bear the entire cost of this trade war but taxpayers, consumers, auto workers, etc will. As Frankel’s recent post notes – Trump has managed trade protection that has no winners, only losers. Brilliant – I guess!

“A year ago, the July 2019 futures were $10.46, compared to $8.296 today.”

The irony will be lost on CoRev so permit me to draw this in crayons for him. A year ago was BEFORE the trade war hit soybeans. The bar chart shows that when the trade war hit soybeans, future prices took an immediate nose dive.

Hey CoRev – it is what we mean by an EVENT STUDY. You said you’ve read Fama so I’m sure you saw what this means if you really did read what we asked you to do.

How can you ignore thus: “this will probably be a price blip lasting until US/Chinese negotiations end. “? Of course I just live in several liberals heads rent free on this subject alone, but in agriculture where growing/harvesting cycles take a year, a blip based upon trade negotiations can only be judged in those annual time frames. The actual short

This current price drop actually began in mid-June 2014 under Obama’s administration. The actual short term blip that Menzie prefers to compare was a few months of higher prices in 2016, just as the tariff wars started. https://markets.businessinsider.com/commodities/soybeans-price

When you just want to point fingers and make weak points, why does data or even logic need to be included? BTW, at $8.29/bu and a $2.00 subsidy raised and paid from those tariffs, many soybean farmers are being healed. Remember all those discussions/comments about the poor hurting soybean farmers. Was it ever valid or just more hate driven wishful thinking? I dunno. To actually know you have to talk to the actual farmers to see what they sold, when and at what price, and whether they took advantage of any insurance or subsidy payments.

Looking at futures prices tells you what the traders are or are not making. Farmers live a much more complex life.

CoRev: So, it’s a year-long “blip”?

NO!!!!! It’s has been several years and I thank you for admitting your premise is WRONG! “He also asserts the majority of decline in soybeans was in 2014, due to dollar decline. . I don’t disagree. ”

Thank you for repeating my original position, even again”…no one has denied the impact of tariffs on FUTURES prices. ” and accordingly farmers’ income. But beating a dead horse is all you have. I will highlight and capitalize so pgl can better read, even though he will not understand: THE CHINESE TARIFFS HAVE LOWERED SOYBEAN AND OTHER AG PRICES!

Do you remember this part of my comment? “Remember all those discussions/comments about the poor hurting soybean farmers. Was it ever valid or just more hate driven wishful thinking? I dunno. To actually know you have to talk to the actual farmers to see what they sold, when and at what price, and whether they took advantage of any insurance or subsidy payments. ” Your underlying premise is also wrong. “Was it ever valid or just more hate driven wishful thinking?” To show this reality you should have included a third line on your Fig 2, PPI Chart, soybean farmers income showing the incidence and effects of insurance and subsidy payments. To be clear, that 3rd line should have a break above the existing price line and parallel the movements of the prices shown. This is more complex to estimate, as it requires details and not averages, but like so many here I’m not sure profit/loss is an understood concept.

BTW, thank your for bringing up the effect of change in the dollars value. it might just explain why the Brazilian soybeans are still selling at a slight premium over ours. The US dollar has gone up in value when compared to the value drop in the Brazilian. The last time, about a week ago, I checked futures prices, Brazilian soybeans were selling at an enormous ~2% premium over the US. /sarc The case of US/Chinese tariffs clearly are over riding the other supply and demand variables here. /sarc I added the (/sarc) indicator just for the deep thinkers who comment here. Even more /sarc.

My belief, after living rent free, is that your series of articles, especially those specifically pointed at me, is just more TRUMP HATING and the inability to have your beliefs questioned.

Thank you for the opportunity to point out the weaknesses of your premises.

CoRev: I have to admit your comments are a “target rich” environment for examples of economic misunderstanding – I hope you’ll understand why I will continue to use your comments as a pedagogical tool. Should be good for years to come of teaching.

That’s what I call a “cackle worthy” (in the best of ways) comment.

Menzie, as are yours “target rich”. Claiming a premise, then contradicting it (at least a portion of it) in an update???? I can admit my optimism by expecting the trade negotiations to be over quicker, but you have yet to admit that farmers are not so financially hurt as you have claimed or implied.

I am also confident of the restoration of the Bourbons.

Menzie

Well, given how well European reactionary parties did over the last few days, maybe Louis XIX is only a Trump tweet away.

@2slugbaits

I have a sadistic thread running through me, tend to be up for sardonic humor, and enjoy dark humor, but your comment is a little bit too close to reality for even me to laugh at, at this particular moment.

P.S. Tell Menzie anything approaching an attack on Bourbon drink is completely unacceptable. This is a hard red line.

“I am also confident of the restoration of the Bourbons.”

Way too subtle Menzie. I am sure Co-Rev, does not comprehend the disdain.

2slugs, reactionary? How about nationalist? As you might not have noticed, but 2016 was not an extreme or ultra right reaction to the liberal views of your party, but it was voters’ REACTING and moving us back to the middle and historical views of this country and away from globalism.

Please just look at the candidates your party has elected and are presenting. Do they represent traditional American views? If you believe they do, then you are in for another surprise in 2020.

CoRev reactionary? How about nationalist?

A distinction without a difference. And if LePen isn’t a reactionary, then I don’t know who is.

but 2016 was not an extreme or ultra right reaction to the liberal views of your party,

Really? I didn’t realize that Trump won the popular vote. And I didn’t know that the GOP won big in 2018. Good thing Trump has a solid 40%!!!

CoRev in agriculture where growing/harvesting cycles take a year,

So are you trying to convince us that ag prices should only change once a year? Your “argument” is as idiotic as it is Fama-free.

at $8.29/bu and a $2.00 subsidy raised and paid from those tariffs, many soybean farmers are being healed.

So your solution to godawful economic policy is to ask the rest of the country to bail out farmers who were stupid enough to vote for Trump? Why should we continue to support a President whose policies only succeed in turning farmers into charity cases?

Since CoRev does not have the attention span to finish reading Fama’s writings on this maybe we should recommend he watch the close of Trading Places with the scene about the Orange Crop report!

https://www.youtube.com/watch?v=RLySXTIBS3c

2slugs, you are again outdoing yourself with self bloviating ignorance. “So are you trying to convince us that ag prices should only change once a year?” only someone who disbelieves Fama could say that.

But this: “So your solution to godawful economic policy…” confirms what i have said several times. The biggest problem you have with conservative policy is that it works, and the when tried by Clinton (with a Republican House push), Reagan, Bush and now Trump is clearly better than your own, Obama, godawful economic policy.

Ignoring that difference is just denial of the obvious that too many voters recognize. And that, too many voters, is your fear.

“you are again outdoing yourself with self bloviating ignorance.”

Get a mirror and repeat this line to yourself a few thousand times. It truly applies!

CoRev you are again outdoing yourself with self bloviating ignorance. “So are you trying to convince us that ag prices should only change once a year?” only someone who disbelieves Fama could say that.

You didn’t exactly answer my question.

But this: “So your solution to godawful economic policy…” confirms what i have said several times.

And here again you didn’t answer my question. Do you think Trump’s trade war is good economic policy? And if not, then why should the rest of us bail out farmers who enthusiastically voted for the guy who started the trade war?

tried by Clinton (with a Republican House push)

Funny that you want to give the GOP credit for Clinton’s economy, but you’re silent when it comes to the GOP Congress’ role during the Obama years. Obama had the misfortune of having to suffer an economically illiterate Tea Party while trying to recover from Bush’s Great Recession. And there is no mystery to standard GOP economics. The GOP cuts taxes for the rich, runs up huge deficits even when the economy is at full employment, and then leaves it to a successor administration to clean up the mess.

2slugs, not answering hypothetical and unsupported questions makes no sense.

Do I think Trump’s trade war is good economic policy? Is it an economic, political or some of both strategy? It is both and when our own economy is strong is the best time to try to change China’s and others AGGRESSIVE and unfair trading practices. Continuing to ignore these issues is not a solution.

Funny you can not see, or admit, the results difference in these economic policies. Instead of just mouthing failed Dem talking points and cherry picking a single metric, deficits, let’s talk about employment, GDP growth, gross revenue receipts, old and new and large and small business growth, etc. (there is a long list). this Politifact article https://www.politifact.com/truth-o-meter/statements/2015/jan/20/barack-obama/barack-obama-claims-deficit-has-decreased-two-thir/

includes an analysis of one of Obama’s claims, but more importantly provides estimates of future deficits https://lh6.googleusercontent.com/P28ZmpjGqC5_r6lrh0rJmdcLN2_K8YuLkWXwuVi46pW1D61KnLboqERe6Xle84nZQdsrHqHVN7680y8hxKmAIfInGdl7Mw6eaF701sKVJ8_qPhv0enitOFSIzMVTZhyACA

Already cooked into the books are spending on Dem entitlement programs that need reform, but are resisted by all elected Dems. And lest we forget the ACA, that epitome of atrociously bad legislation.

So just what accomplishments did Obama have? Were any record setting as we have seen in this administration? BTW, gross revenue receipts already in FY19 exceed FY18’s by $35,386B for the same period. https://www.fiscal.treasury.gov/files/reports-statements/mts/mts0419.pdf

“BTW, gross revenue receipts already in FY19 exceed FY18’s by $35,386B for the same period. ”

Because the country is larger. And, you know inflation does in-fact exist. Man CO-Rev, you are the silliest. It’s like you do not even know what inflation or per capita are. Did you go to college?

CoRev You were the one who kept insisting that annual harvest cycles are critical for understanding soybean prices, so it seems rather natural to ask if that means you think prices should also change annually. It’s not hypothetical. You were the one who asserted the importance of thinking in terms of annual production cycles. I’m simply asking you to clarify how that is supposed to affect prices. You keep ducking, bobbing and weaving, as you always do.

As to the Obama deficits, your article says that the claim of a two-thirds reduction was accurate. Did Obama do much to reduce the long run structural deficit? No, but then again, unlike Trump, Obama didn’t make that structural deficit any worse. We should not be running a 10 year full employment deficit of 4.4% of GDP, but yet that’s exactly what CBO is projecting thanks to Trump’s tax cuts. And those deficits would be much worse except for the fact that the tax cuts for the middle class (but not the 1%) start to phase out after a few years.

https://www.cbo.gov/system/files/2019-03/54918-Outlook-VisualSummary_0.pdf

As to economic growth, the CBO projected a temporary bump in 2018 (which we saw) followed by declining growth afterwards, with “slower growth in business fixed investment after 2018 and in consumer spending after 2019, which is what we’re seeing now.

Trump’s economic policy is essentially the same as Nixon’s; i.e., juice the economy with big deficits for political purposes and then leave it someone else to clean up the mess. Then again, you were always a big Nixon supporter.

You don’t want to answer the question whether or not Trump’s trade war is good economic policy. Instead you try to fuzz the issue by tossing out a lot of junk about it being part of some grand political strategy. If that’s the goal, then it’s hard to see how it is working. He’s alienated our allies in Europe as well as Canada, Mexico and Japan. He gave China a political gift by killing TPP. His own administration now admits that trade wars are not easy to win. And the weapon he is using (viz., tariffs) is singularly ineffective at addressing the problems he supposedly wants to fix.

when our own economy is strong is the best time to try to change China’s and others AGGRESSIVE and unfair trading practices.

This is the kind of thing that Menzie has in mind when he holds you up as an example of amateurs practicing economic analysis without a license. Your claim that it’s best to start a tariff war when your domestic economy is strong is the kind of thing that sounds intuitively true. It agrees with what you probably learned on the playground. And you then carry that analogy over to economics. But that’s just based on your gut instinct, and like almost all instinctive reactions to economic problems, it’s dead wrong. This is why people who have read econ textbooks simply roll their eyes when they read some of the economically illiterate stuff that you write. The fact is that the best (or least bad) time to get into a tariff war is when your economy is weak (which is counterintuitive); but you don’t think like an economist so you don’t see why that’s true. I don’t think Menzie has any personal animus towards you, it’s just that much of what you post reflects the kind of economic illiteracy that he’s trying to correct.

CoRev Already cooked into the books are spending on Dem entitlement programs that need reform,

…says the guy who applauds Trump’s latest $16B “leave no farmer behind” welfare program.

Dave, you did not note the distinction of citing GROSS receipts. How many causes are there other than inflation?

2slugs, You keep ducking, bobbing and weaving, as you always do. If not hypothetical then answering a just plain absurd question makes no sense. When you get serious, then ask a meaningful reality-based question . Repeat after me do not answer an absurdly hypothetical or question that isn’t serious. Are you seriously thinking harvest cycles, except in your feared warm world, are less than a year? Careful now about confusing a part of the cycle with the whole.

We don’t have to pay off the “structural deficit” but will have to pay off Obama’s record setting deficits. Please be serious. Just as you ignored my answer that Trump’s China trade policy is not just economic but also a POLITICAL policy to forestall increased aggression. “Politics is war without bloodshed while war is politics with bloodshed.” A trade war is also a form of war without bloodshed. It is you who doesn’t want to admit that the trade war war goes beyond JUST ECONOMICS, nor do you want to admit we have been is such a war far longer than the current tariff cycle.

It is this attitude of denial that makes economics comments such a target rich environment. There is a whole world outside that of economics, and those living in that world better understand reality and VOTE TOO!

CoRev

answering a just plain absurd question makes no sense.

If the question is absurd, then it’s only because your comment about harvest cycles is absurd. I’m not the one who kept insisting on the importance of harvest cycles, you are. I’m just curious as to why you are unable to explain why its important.

Are you seriously thinking harvest cycles, except in your feared warm world, are less than a year?

I didn’t ask about the length of the harvest cycle, I asked about its relationship to the price. There are well known seasonal effects as new crop overlaps with old crop, but those effects happen every year and don’t explain this year’s deviations. So it’s hard to see how harvest cycles have any relevance to soybean prices over the last year.

We don’t have to pay off the “structural deficit” but will have to pay off Obama’s record setting deficits.

You’ve got it exactly backwards. Cyclical deficits are supposed to be cancelled by cyclical surpluses. Running large (and growing larger) full employment structural deficits are what will burden future generations. But then again, like a lot of folks in your demographic you’re more interested in your short run tax cuts than what happens to the welfare of future generations.

Just as you ignored my answer that Trump’s China trade policy is not just economic but also a POLITICAL policy to forestall increased aggression.

Really? What part of “some grand political strategy. If that’s the goal, then it’s hard to see how it is working. He’s alienated our allies in Europe as well as Canada, Mexico and Japan. He gave China a political gift by killing TPP. His own administration now admits that trade wars are not easy to win. And the weapon he is using (viz., tariffs) is singularly ineffective at addressing the problems he supposedly wants to fix” did you not understand? What part of Menzie’s game theory payoff matrix did you not understand? What part of China’s thinly veiled threat about rare earth metals makes you think Trump’s playing a winning strategic hand?

It is you who doesn’t want to admit that the trade war war goes beyond JUST ECONOMICS

No, I think it’s Trump who misunderstands and thinks it’s all about making deals. Trump is a one trick pony. All he understands is the tariff tool, which is ineffective at solving the kinds of problems you seem to be worried about. OTOH, TPP is not just an economic document, but also a political agreement. In fact, TPP’s principal value was in the political alliances it created that were supported by economic integration. And TPP left China on the outside. You’ve hitched your wagon to an economic and political nitwit.

those living in that world better understand reality and VOTE TOO!

I think this gets to a lot of the anger we see in white conservatives. Because they don’t understand complicated issues that don’t lend themselves to simple gut instinct answers, they start to feel disrespected when told that everything they thought was true really isn’t. They don’t see themselves as stupid, but instead of rethinking things and going to the effort of learning what experts are saying, they end up tuning into Rush and Sean who validate their ignorance. Then they take their anger out at the polling station. That pretty well describes the Tea Party movement. The problem is that while they may vote, they are a dying demographic. Trump lost the popular vote by a wide margin, but yet Trump voters continue to believe that they are the silent majority. Sen. Lindsay Graham was right about one thing; the GOP can’t continue to rely upon ginning up angry white voters. CoRev, you are forever living in 1979.

2slugs, most of what you provided is just plain nonsense and not worth commenting.

This however, is another example of the fuzzy thinking rampant in economics. ” Cyclical deficits are supposed to be cancelled by cyclical surpluses.” We both know how the public debt works and unless we balance the budget or have surplus it just keeps increasing as the old and new debt is funded.

This article explains how Dems did in balancing a budget: https://www.washingtontimes.com/news/2015/may/5/senate-clears-way-final-passage-congress-budget/ No annual budget passed for 6 years until we had a Republican Congress? Obama/Dem congress did pass a 2010 budget with appropriations, but it appears only because it included the stimulus package.

There after all that was passed was Continuing Resolutions until we had a Republican Congress. You continuously grip about the Republican resistance to Dem spending, but the validity of that resistance is obvious in the improvements in economic indicators under Republican Policies and leadership versus those of Dems.

The rest of your comment remains in that fuzzy area of our policies are better than yours, but we are seeing just how wrong that is with Trump/Republican economic indicators.

I also see you ignored the potential shooting war threat with China we saw during the late period of Obama’s administration. Some successful policy????

The Chinese are funding the ag subsidies? Of course they are. I should have known.

“This current price drop actually began in mid-June 2014 under Obama’s administration. The actual short term blip that Menzie prefers to compare was a few months of higher prices in 2016, just as the tariff wars started.”

There was this fellow named CoRev who claimed Trump stabilized soybean prices. Of course this fellow never told us what magic wand Trump used to pull the incredible trick. Of course Menzie’s point was to use the methodology of event studies to show the effect of the tariff wars. Of course I’m using a term out of Fama’s writings which of course you do not have the attention span to even bother to read. So I provided a little movie clip that you might enjoy.

There was a fellow named Co-Rev who demonstrated rank idiocy to all observers.

CoRev, who are these people representing themselves as “farmers” on television?? Is this some California government conspiracy?? A European socialist conspiracy?? Is it a cosplay game?? Who are these people CoRev??

https://www.youtube.com/watch?v=7D4K-OfCRP0

https://www.youtube.com/watch?v=NwKaae4ilqE

https://www.youtube.com/watch?v=FB5ShaT1Jg4

Brandon Wipf of the American Soybean Association certainly understands future markets. I bet he read Fama. Hey CoRev – hire this man as your tutor. You need him.

Your last link featured Gayle King who kicked Norah O’Donnell off of her morning show. But Norah will be OK as she booted Jeff Glor off the evening news. I tell you – CBS has been high jacked by a bunch of fierce women who want to dominate their time of the day.

“This current price drop actually began in mid-June 2014 under Obama’s administration.”

Ah yes – those horrible Obama policies lowered soybean prices from $15 a bushel to $10 a bushel. Of course this is the usual disinformation campaign that we have called CoRev out on before. And yet Trump’s favorite troll repeats it?

Of course soybean prices were $10 a bushel when Obama took office. So with his usual ODS logic, might CoRev have the integrity of admitting this and praising Obama’s policies from 2009 to 2014? OK, answer that when you get off the floor from laughing so hard!

In this visual representation of Menzie’s “intellectual beatdown” on CoRev, today the part of Menzie will be played by #2 Kawhi Leonard (in white) and the part of CoRev will be played by #21 joel Embiid (in blue).

https://www.youtube.com/watch?v=VbyN9umU7K4

That’s “only” a 10% decrease. Problem?

But consider: when tens of thousands of federal district court indictments( to be delivered in the middle of the night) send traitors to Guantanamo for trial by military tribunals, soybean prices will bounce back nicely.

@ noneconomist

Only JBH, CoRev, and the Eleven Elders of trump plaza know the answers. Also the 7 trump–ets will play an important part. If you listen and focus very hard you can hear the trump—ets NOW!!!!! Sssssshhhhhh!!!! Right now the naked ladies of “GoT” are now giving the answers at the link below, quiet and listen!!!! The flat chested one of “GoT” even knows the secret of why the Earth is NOT a globe!!!! Also they will tell us why if the Earth was actually a globe going at roughly 1000 mph we would all fly off it right at this moment!!!! It is because of “perspective”!!!! The sky is actually a glass dome with lights pretending to be stars. Soon the secrets will unfold!!!! Remember to follow the misty path of the flat-chested “GoT” girl up “The Stairway With the Hedgerows” QUIIIIIET!!!

https://youtu.be/jLl4siAr9v4?t=199

*I should have said “rotating” (on its axis) at 1000mph in the above comment where I said “going at”. I know CoRev and JBH take the above type comment very seriously, so I wanted to get one of the few things I meant to be true in that comment straight.

I for one am already tired of so much winning.

I’ve heard rumors this guy, Bart Starr, used to do some incredible feats in one of the northern states, I forgot which state it was now. Coached by some 3rd generation Italian American. You know the type, one of those lazy immigrants coming to America for a free ride. Wish I could remember that coach’s name…….. Well it doesn’t matter who his coach was, or his name, those lazy immigrants are always the same, they never amount to anything and just suck off the welfare system. Probably never even graduated from university, damned slobs.

https://www.nytimes.com/2019/05/26/sports/bart-starr-packers-super-bowls.html

Can you imagine some 2nd or 3rd generation immigrant coaching America’s greatest loved sport??

https://youtu.be/QKQS1VZbquc?t=78

You can also see how, those “lazy/dirty” immigrants, take their bad habits with them, where they “suck off the system” “looking for handouts” everywhere they go. And it’s disgusting what they do to the work habits and tolerance of those around them:

https://youtu.be/7Tgu5rd-v0g?t=728

Those “lazy/dirty” immigrants, creating wreckage and a slack attitude everywhere they go…… They don’t have the “true” “built in” work habits like the true native-born Americans have:

https://www.wsj.com/articles/trump-lawyer-arranged-130-000-payment-for-adult-film-stars-silence-1515787678

Cowboys vs. Packers: The Ice Bowl aka the 1967 NFL Championship

https://www.youtube.com/watch?v=oe0XChUkWgU

Starr’s quarterback sneak to win this game is still legendary.

Coach Vince Lombardi was born in Brooklyn. He played and later coached for Fordham University before taking a job as an assistant coach for the NY Giants. He abandoned his NY routes when the Packers made him a head coach offer.

Lombardi was a very tough coach but he was also ahead of his time for respecting the rights of both black players as well as those who happened to be gay.

Fordham University!?!?!?! A dirty/lazy immigrant and a college graduate?? Now I know he was a dirty/lazy immigrant AND an elitist!!!! This guy would have no place on donald trump’s White House staff. College grad….. What a sicko. Hell, I bet Fordham is an accredited university as well, and that really makes me nauseated. I’m calling Betsy Devos to expose this liberal conspiracy right now!!!!!!

Founded 1841, Fordham is the Jesuit university of NY. No longer run by the church, however, all presidents of the university have been Jesuits.

Another famous alum: a “president of the United States, Donald Trump.”

Two of my nephews are Fordham alums as well.

‘Another famous alum: a “president of the United States, Donald Trump.”’

Gee ILSM – everyone on the planet knows Fordham is a Jesuit school. Did you just learn that from your boss – Putin? BTW – Trump spent only two years there so to call him an alum is stupid even for you. He transferred to Wharton. Fordham is glad that Trump soiled the reputation of that school in Philly!

2019 crop information

I learned some confirming information today from a large local farmer, several thousands of acres planted. As was conjectured early in the soybean discussions, the smart and experienced big farmers contracted their crops early last year. Indeed, in talking about this year, while planting a field of milo/sorghum, their crops are already contracted even before all fields are planted. Yes, that sorghum too is already contracted.

I did not ask whether he had cut down on soybean acreage, but he did mention they had ~1500 acres this year. He has even more acres in corn this year, and most of both crops are already contracted. His corn broker is in the Kansas as they are concerned with the Midwest’s crop harvests. I do not live any where near Kansas.

As I have tried to point out there is the Economists’ view of farming and there is the farmers’ view. Running a business causes emphasis on other viewpoints than macroeconomics.

He was adamant that his selection of crops had to do with crop loss from deer and birds, as much as prices. He seems to think they have achieved a happy medium of production versus loss. He does not plant soybeans nor corn on the farm on which we talked due to the deer crop loss. I guess we hunters need to do a better job. 😉

It is this difference in viewpoints, economists versus farmers, that cause many of the target rich comments.

CoRev: Good for your farmer friend. For others (from leftist pub Forbes https://www.forbes.com/sites/chuckjones/2019/05/26/trumps-handouts-wont-be-enough-to-save-american-soybean-farmers-as-prices-hit-new-lows):

Ah but this is Chuck Jones of Forbes whose bio concludes with:

“I have a B.S. in Industrial Engineering from Stanford University and a Postgraduate Diploma in Economics from the University of Sussex, England.”

Clearly some left wing socialist who knows nothing about economics! Why trust him over those unnamed but clearly reliable sources CoRev relies upon?

pgl: But CoRev’s friend is a really good guy!

That article has a lot of great information often on factors that CoRev tries to raise. Except the article’s presentation of the facts contradicts such about everything CoRev has said on these subjects!

Menzie, perhaps you’ve heard of them, but some farmers are able to claim entitlements. But, we’ll remember, how badly those farmers are doing as they continue planting. As they do nearly every year,weather permitting.

CoRev: Keep on asserting, and throwing in anecdotes. Here:

https://www.forbes.com/sites/chuckjones/2019/05/26/trumps-handouts-wont-be-enough-to-save-american-soybean-farmers-as-prices-hit-new-lows/#68d33951271b

“I learned some confirming information today from a large local farmer”.

One local farmer whose name you do not provide? Shhh – be very careful. The Deep State is trying to figure out who this fellow is. Call Bob Barr now and have those FBI agents arrested!

CoRev,

So why did you not ask your friend whether he planted more or less soybeans this yeatr? All of the rest of your discussion is completely irrelevant to this thread. Of course smart farmers contract as early as they can. Are we supposed to be astounded that this guy did so for his sorghum planting? Did he plant sorghum last year and fail to contract early?

Funny given your emphasis on the importance of weather you did not mention it. Many farmers are having problems getting things planted due to excess rain. Presumably your friend lucked out and did not have these problems.

My farmer friend also contracted early as he always does. However he has looked forward to getting money from Trump. Is your friend planning to get in on tha action?

Barkley, those are all very good questions that I just never thought to ask. Why not do your own research?

I thought that this sentence was self explanatory for those paying attention: ” His corn broker is in the Kansas as they areconcerned with the Midwest’s crop harvests. I do not live any where near Kansas. ”

Please pay attention to what happening off campus.

“Harvests” not the same as “planting.” As somebody noted. yields for some crops in some places will be higher from the rains, for what gets planted.

Actually, I was kind of wondering what the significance of the corn broker being in KS was given that not much corn is planted there. It is the top state for winter wheat.

And as for your friend, it seemed that much of his decision making was driven by animal damage. Was that worse than usual? Did that have anything to do with the weather or Brazilian currency values or Chinese planting more soybeans?

And I am curious if he is like my friend going to get any money from the Trump handouts for farmers?

Barkley, another set of good questions. Taking the obvious first, “And I am curious if he is like my friend going to get any money from the Trump handouts for farmers?” No, doesn’t want the required paper work and reviews, and if you read carefully and applied the history of this year’s prices you’d know it wasn’t necessary. As always, his harvest amounts will determine his risk for this year’s crops, even though already contracted. Weather permitting He will not know until near harvest. (That was for 2slugs and others not understanding when crop risk can be determined.)

As for your: “Actually, I was kind of wondering what the significance of the corn broker being in KS was given that not much corn is planted there. It is the top state for winter wheat.” Whether more or less Kansas corn will be harvested, the Kansas CORN broker is betting on supplying his customers, even if from a long distance less effected by the Kansas weather.

Yes, “And as for your friend, it seemed that much of his decision making was driven by animal damage. Was that worse than usual? Did that have anything to do with the weather or Brazilian currency values or Chinese planting more soybeans?” Worse than usual is not the issue, but consistent damage is. His solution is to plant crops on his high damage fields that the animals dislike. In this case buckwheat and milo/sorghum. Clearly some of his farms have less damage than on the farm which we had the conversation. Tariffs can also be considered consistent damage/loss of crop income, but like animal loss there are mitigations available. I think this farmer represent the attitude of the annual crap shoot that many others face and not just to the tariff price losses.

I have tried to explain the weather risk associated with farming. Then came this Spring’s Midwest weather. It is weather that can devastate an entire season’s crop. and even cause serious damage to the farm. (Again for 2slugs, recovery from a season’s crop loss and especially weather farm damage can take multiple crop cycles to recover.)

You might also need to understand that a large portion of his farmed land is rented and not owned. Making his starting costs possibly higher than those farmers working their own land.

CoRev

I guess we hunters need to do a better job.

Ah, so that’s why you keep saying you need large magazines for your guns. One shot isn’t enough.

His corn broker is in the Kansas as they are concerned with the Midwest’s crop harvests. I do not live any where near Kansas.

I’ll be in Kansas in a couple weeks. My relatives are concerned. And as I mentioned before, those farmers who aren’t effected by the cold and wet Midwest weather will probably see a slight uptick in prices because of supply concerns even though demand will be depressed due to the Chinese tariffs. But the goal of public policy isn’t to make a few lucky farmers winners at the expense of most being losers.

there is the Economists’ view of farming and there is the farmers’ view.

So in the case of tariffs (which is what we’re talking about), are you saying that farmers have a different view than academic economists? Do farmers think a trade war is good business?

2slugs, why all the nonsense questions? I’d be interested in your Kansas farmers view on applying for the subsidies. Please ask them if they would do so if there were any alternative? My discussion today indicated that they had not and probably would not because of all the paperwork and frequent reporting required. But, that’s the view of a successful large acreage farmer, dunno about your Kansas relatives. Farmers can be an independent breed.

I know you forgot your early comment re: farmers planting decision problems. You might ask them if they have changed their minds about what and how much to plant. Again, weather permitting.

CoRev once again makes stupid comment after stupid comment. Credit to Dave for calling out CoRev’s 2nd stupidest comment under this thread:

“DaveMay 28, 2019 at 1:14 am

“BTW, gross revenue receipts already in FY19 exceed FY18’s by $35,386B for the same period. ”

Because the country is larger. And, you know inflation does in-fact exist. Man CO-Rev, you are the silliest. It’s like you do not even know what inflation or per capita are. Did you go to college?”

Thanks Dave for noting we need to calculate tax revenues in real per capita terms but to answer your question – CoRev clearly did not go to college. But let’s note this incredibly dumb comment ala CoRev:

“it might just explain why the Brazilian soybeans are still selling at a slight premium over ours. The US dollar has gone up in value when compared to the value drop in the Brazilian.”

OK, the Brazilian Real has nominally devalued but that is no surprise given Brazil’s high inflation rate:

https://fred.stlouisfed.org/series/DEXBZUS

But I guess CoRev does not realize we are citing soybean prices in terms of US$ whether they come from the U.S. or from Brazil. So whether the nominal devaluation in the Real matched the difference between Brazilian inflation and U.S. inflation does not have any bearing on price comparisons when denominated in the same currency. Given CoRev thinks otherwise shows how utterly clueless Trump’s favorite troll is.

Menzie, did you even read the whole article? Internal to it was this: “There are multiple other factors that are effecting soybean farmers including heavy rains and floods keeping them from planting on a timely basis (helps per bushel price but could hurt total income) or a swine flu outbreak in China, which has led to the killing of millions of pigs that would consume soybeans (hurts soybean prices). However, the main contributor seems to be the dramatically decreased demand from China.”

and this:

” It does not help the long-term issues of lower prices, which peaked at $17 per bushel in 2013, or the unintended consequence of the Chinese increasing their soybean production.” These examples better support my position than yours. Not everything price is not solely related to the tariffs.

Do you remember your <less than a year blip claim? Also did you ever do the math to see what our/my prediction represented? "…We are on record saying the prices will be back approaching last year’s harvest season prices.” If you are unaware, it is well below the: “A year ago, the July 2019 futures were $10.46, …”price you’ve preferred to quote. Averaging the months starting prices for September through January it is ~$9.75. Indeed, the high price this year has been at $9.22

At 1330 today, May 28, 2019, the price was $8.55 down from the day’s $8.58 high. We’re still away from July 15, but the estimates are interesting.

CoRev: Truly, you are an idiot impervious to reason. Ask yourself why the Chinese have increased domestic planting of soybeans, and trying to develop permanent alternative sources of soybeans — could…it…be…retaliation…for…Trump…tariffs? Why is the US dollar stronger? Could…it…be…the collision of monetary and fiscal policy, augmented by higher economic policy uncertainty induced by …Trump … tariffs?

“CoRev: Truly, you are an idiot impervious to reason.”

We yea but how do we let this go?

“CoRevMay 28, 2019 at 9:32 am

Dave, you did not note the distinction of citing GROSS receipts. How many causes are there other than inflation?”

All Dave asked was for CoRev to express tax revenues in real per capita terms. The most basic concept ever and yet it went right over CoRev’s head. Even though we have asked him thousands of time the same exact issue of simply getting the data right. But nope – CoRev is impervious to even basic data.

“Dave, you did not note the distinction of citing GROSS receipts. How many causes are there other than inflation?”

I mean, does CoRev even understand that GROSS/net is entirely different from inflation-adjusted or per-capita?

Barkley, those are all very good questions that I just never thought to ask. Why not do your own research?

I thought that this sentence was self explanatory for those paying attention: ” His corn broker is in the Kansas as they areconcerned with the Midwest’s crop harvests. I do not live any where near Kansas. ”

Please pay attention to what happening off campus.

Menzie, the term is rent free! What a weak response to a valid query. Did you note my highlighted areas in your article?

I have been consistent with my position from the beginning. Tariffs have lowered prices but other things also affect them (a list was provided). Since, you have added the ASF impacts. Good for you. You even quoted me: “Reader CoRev writes on July 9th:

no one has denied the impact of tariffs on FUTURES prices. …”

Now why are we in this trade war? That is simple. Policy shifted from Obama’s, which got us perilously close to a shooting war with China to one of power politics and economic war with China (ans several others practicing unfair trade.) Which do you prefer?

Please add some objectivity to your thinking.

“Policy shifted from Obama’s, which got us perilously close to a shooting war with China”

CoRev asserted with zero evidence.

Must be a requirement: every econ blog attracts a stable genius.

FRED reports the Real Broad Effective Exchange Rate for Brazil (index = 100 for 2010). Note over the last 10 years, this real exchange rate varies but tends to be near 80 which is about where it is today.

https://fred.stlouisfed.org/series/RBBRBIS

CoRev in his usual insanity thinks some alleged devaluation of the real (it has not devalued systematically over the last decade) is why the US$ price of soybeans paid to Brazilian farmers is now 25% higher than the US$ price of soybeans paid to U.S. farmers.

Now where he got such an insane idea is beyond me. Anyone? Bueller? Bueller?

Here fishy. C’mon here fishy. But, but I, fishy AKA pgl, makes even another unsupported claim. “CoRev in his usual insanity thinks some alleged devaluation of the real (it has not devalued systematically over the last decade) is why the US$ price of soybeans paid to Brazilian farmers is now 25% higher than the US$ price of soybeans paid to U.S. farmers.” Looking up YESTERDAY’S Brazilian July price/bu we find it is $8.56/bu and the US price yesterday was: $8.56/bu. WOW! To pgl $8.56 in both countries equals a 25% premium.

Is there any wonder why I seldom read pgl’s comments. They just don’t relate to anything but his own little skewed world.

Ah CoRev – I asked you for a reliable source for your data. Yes – no one trusts your babbling to be even remotely correct. Do you even know how to provide reliable sources? Didn’t think so.

Fishy (pgl) reliable source(s)? You are the one claiming a 25% differential, and clearly have a source for that claim????? I provided Tuesday’s US & Brazilian prices. Asking for reliable sources for prices after making such a FALSE claim indicates you had NO SOURCE. I’ll show you mine if you show me yours. Otherwise, its just another pgl comment pulled from his nether regions.

BTW, looking this AM, yesterday’s US soybean price was ” $8.72 USD 0.04 (0.43%) 07:06:00 AM EDT MI Indication*” and the price in Brazil was:

“US$ per metric ton As of: Wednesday, May 29, 2019 Last: $320.4″ You do the conversion as it is your claim that there is a 25% premium for Brazilian soybeans.

Please note the quote marks, although I did edit out extraneous information and added the $ for clarity.

BTW – I think we have a clip from the one economic class CoRev signed up for!

https://www.youtube.com/watch?v=KS6f1MKpLGM

Pgl, how soon you forget your rant about Brazilian soybeans selling at such a high premium. Look it up in the comments, although I know you’re too lazy to do so.

My rant? It is basic information. OK – you can’t bother with real world data and keep your job as Trump’s favorite troll.

Pgl, how could you have missed my latest Brazilian pricing data? Obviously, you didn’t look up your rant comment and now can’t recognize real world data from prejudiced propaganda.

Sometimes calling is shooting fish in a barrel is just not descriptive enough.

“how could you have missed my latest Brazilian pricing data?”

You are considered a reliable source for soybean prices in Brazil? Excuse me for missing whatever babble you produced and I’m sure it was even funnier than the latest from The Onion! Did you quote this in terms of the REAL or the $? Skip that as I know you have no clue what an exchange rate even is!

Bueller? Bueller? Oh yea – CoRev skipped his economic classes!

CoRev Take another look at the Treasury data. Funny that you didn’t mention that outlays are also up…way up over last year’s pace. And notice that most of the increased revenue receipts are coming from off-budget accounts, with on-budget receipts almost unchanged in nominal terms and actually lower in real terms.

2slugs and there you go again with on/off budget misunderstanding. They all go tot he deficit if receipts are less than outlays

Also ” And notice that most of the increased revenue receipts are coming from off-budget accounts,…” Weren’t the “off-budget” receipts meant to pay for the entitlements they represent? And doesn’t this: “… with on-budget receipts almost unchanged in nominal terms and actually lower in real terms.” contradict the complaints about reduced receipts from Trump’s policies.

Dave seems to think its only due to inflation, but aren’t we receiving added receipts from some tariffs?

I dunno, but the logic shown in these comments seem grossly biased.

“Dave seems to think its only due to inflation, but aren’t we receiving added receipts from some tariffs?”

Mother of God. Dave’s point was SIMPLE even for a low IQ troll like you. Express revenues in real terms when comparing across time. Look CoRev – we know you are really stupid but even you get this. So you continue to lie about what Dave wrote.

But yea nominal tariff revenue has doubled since late 2016 so even in real terms, this narrow item has increased in real terms. But the figure is a mere $75 billion not the hundreds of billions your lying hero keeps claiming. And yea – it is being paid by hard working Americans not the Chinese as your lying hero keeps claiming.

So we got a massive tax cut for the Hampton Beach crowd and a increase in the cost of goods ordinary Americans buy at Wal-Mart. Take from the working dude to give to the ultra rich. Standard Republican fiscal policy.

CoRev on/off budget misunderstanding. They all go tot he deficit if receipts are less than outlays

Trivially true. What you keep forgetting is that off-budget receipts also create an exactly offsetting increase in the public debt. In other words, off-budget receipts reduce the unified deficit, but have zero effect on the public debt, whereas on-budget receipts reduce both the deficit and the public debt. The economic effects of the two kinds of receipts are very different.

almost unchanged in nominal terms and actually lower in real terms.” contradict the complaints about reduced receipts from Trump’s policies.

On-budget receipts are lower in real terms and as a percent of GDP. And receipts from income taxes are actually lower even in nominal terms. As to the tariffs, yes, those add to receipts. They are essentially a hidden tax on low income folks…the true Trump way. I hope you’re not as stupid as Trump in believing that the Chinese pay those tariffs.

2slugs misses the target again in his on/off budget matters belief. He confuses accounting terms and their operational considerations. On/off Budget are accounting constructs for tracking portions of the DEFICIT. The DEFICIT need not be wholly converted to Public Debt. He has forgotten that time have changed, and “exactly offsetting increase in public debt … have zero effect on the public debt”.

The change he forgets is: ” “…First, this year for the first time since 1982, the combined retirement and disability parts of Social Security (OASDI) is running a deficit, and it will continue to do so throughout the 75-year projection period. Its outlays now exceed its tax revenue and the interest on its trust funds….” https://taxfoundation.org/social-security-deficit/

The effect of this OASDI defict is to change his above quoted sections of his comment. They are no longer true.

If you care to read more details:

His comment: “Trivially true. What you keep forgetting is that off-budget receipts also create an exactly offsetting increase in the public debt. In other words, off-budget receipts reduce the unified deficit, but , whereas on-budget receipts reduce both the deficit and the public debt. The economic effects of the two kinds of receipts are very different..: ” Notice I never used the term “deficit”, but used terms commonly used by the US Treasury.

US Treasury uses these definitions: “What is the Debt Held by the Public?

The Debt Held by the Public is all federal debt held by individuals, corporations, state or local governments, Federal Reserve Banks, foreign governments, and other entities outside the United States Government less Federal Financing Bank securities. Types of securities held by the public include, but are not limited to, Treasury Bills, Notes, Bonds, TIPS, United States Savings Bonds, and State and Local Government Series securities. ”

Note her we do not see the terms unified nor on/off budget.

But digging deeper we find this definition: “What is the difference between the debt and the deficit?

The deficit is the fiscal year difference between what the United States Government (Government) takes in from taxes and other revenues, called receipts, and the amount of money the Government spends, called outlays. The items included in the deficit are considered either on-budget or off-budget.

You can think of the total debt as accumulated deficits plus accumulated off-budget surpluses.The on-budget deficits require the U.S. Treasury to borrow money to raise cash needed to keep the Government operating. We borrow the money by selling securities like Treasury bills, notes, bonds and savings bonds to the public.

The Treasury securities issued to the public and to the Government Trust Funds (Intragovernmental Holdings) then become part of the total debt. For information about the deficit, visit the financial management web site to view the Monthly Treasury Statement of Receipts and Outlays of the United States Government (MTS).”

2slugs confusion occurs because of his misunderstanding of the daily operational considerations of running the US finances, and his reliance on this : “You can think of the total debt as accumulated deficits plus accumulated off-budget surpluses.” For years the off-budget surpluses were increasing ON AN ANNUAL BASIS, but recently that has changed and we are drawing down on the largest off-budget fund, the Social Security Trust Fund. Drawing down on these Trust Funds is done by converting the special Trust Fund Bonds to Treasury securities issued to the public. Accordingly the off-budget surpluses have disappeared and we are drawing down on the special Intragovernmental Trust Funds.

“What are Intragovernmental Holdings?

Intragovernmental Holdings are Government Account Series securities held by Government trust funds, revolving funds, and special funds; and Federal Financing Bank securities. A small amount of marketable securities are held by government accounts. ”

Adding to 2slugs confusion is the operational need to reduce short term deficits (daily, weekly, or monthly) by temporarily drawing from these Intragovernmental account surpluses. This is done by converting them to short term debt instruments and released for public auction becoming a part of the debt held by the public.

Even on an operational basis this is not true: “… off-budget receipts also create an exactly offsetting increase”, but can also increase the Debt held by the Public. Moreover, since we are now in a deficit basis for several of the Trust Fund accounts we are increasing that Debt held by the Public.

My original statement to 2slugs included this: “We both know how the public debt works and unless we balance the budget or have surplus it just keeps increasing as the old and new debt is funded. :

This is how Treasury defines that: “Why does the debt sometimes decrease?

The Public Debt Outstanding decreases when there are more redemptions of Treasury securities than there are issues. ” Simply stated when receipts are in surplus or we stop borrowing (balanced).

Regrettably 2slugs and I have had this overly detailed discussion several times and he still fails to understand the fundamental terms, operations and more importantly the changes in Trust fund surpluses.

CoRev Regrettably 2slugs and I have had this overly detailed discussion several times

True. And you still don’t understand. BTW, you’ll note that I referred to the public debt, not the debt held by the public. Those are two very different things. In your reply you continually confused the two. And if you’ll check the link to your own Treasury statement you will see that this year FICA receipts ($531.2B) exceed FICA outlays ($519.4B), In other words, off-budget receipts are still running a surplus, which means they are reducing the unified deficit without doing anything to reduce the public debt. Still, eventually FICA outlays will exceed FICA receipts, which is all the more reason why on-budget receipts should be increasing faster than they are. I’ll make this very simple for you. Ever since the early 1980s the off-budget side has been running surpluses…sometimes very large surpluses. Those surpluses allowed Republican presidents to cut taxes on the rich, which increased the on-budget deficits but dampened the effect on the unified budget deficit. But each time the on-budget side borrowed from the off-budget surplus the Treasury wrote an IOU that increased the public debt without increasing the debt held by the public. Now those IOUs are starting to come due, and since the off-budget surpluses are fading away, that means on-budget receipts (i.e., income taxes on the rich) will have to increase in order to avoid defaulting on those IOUs. And if Trump doesn’t want to increase on-budget receipts, then he’ll have to go beg for some money from China, Russia and Japan. Then again, Trump prides himself on being the “King of Debt.”

unless we balance the budget or have surplus it just keeps increasing as the old and new debt is funded

You completely ignored the critical points about the increase in the deficit as a percent of GDP. That reflects the economic burden of each year’s deficit. Under Obama it was shrinking too fast. Under Trump it is expanding too quickly. The debt-to-GDP ratio can stabilize or fall even if a country maintains a small deficit as a percent of GDP. There’s a formula for this. Learn it.

2slugs,

When I go to the April monthly Treasury Report, Figure2. Cumulative Receipts, Outlays, and Surplus/Deficit through Fiscal Year 2019, I find a negative balance for the FY to date. Outlays for SA + Medicare $964 and receipts for Social Insurance and Retirement $722 ($242). I don’t know where you got your figures, but the latest Treasure numbers are considerably different. The official category is OASDI

you are trying too hared to spit hairs: “BTW, you’ll note that I referred to the public debt, not the debt held by the public. Those are two very different things.” No! Those are two closely related things. “Public debt, sometimes also referred to as government debt, represents the total outstanding debt (bonds and other securities) of a country’s central government. It is often expressed as a ratio of Gross Domestic Product (GDP). ” It is the sum of the components we have been discussing. BUT, it is seldom used within the government for accounting purposes.

You have consistently ignored the point that being on/off budget is just an accounting artifact used to reduce the apparent deficit, but is considered as part of the Public Debt. My point was off budget is not part of the Debt held by the Public, unless the special intragovernmental bonds are converted. and I gave examples of when and why that occurs.

The rest of your 1st answer was more of your typical TDS driven political prejudice.

Your 2nd point is just ridiculous. You still don’t want to admit we have passed the point of surpluses for OASDI receipts versus outlays. We’ve talked about this for years, and the date projections of when it would occur have passed.

Have you forgotten all the proposals by Dale and Bruce?

“And notice that most of the increased revenue receipts are coming from off-budget accounts, with on-budget receipts almost unchanged in nominal terms and actually lower in real terms.”

Just provided a FRED graph (www.bea.gov is the source) and Federal tax revenues are lower now than they were as of 2017QIII even in nominal terms. But yea – you get Dave’s point about doing this in real terms. Guess what – CoRev does too but he is deliberately misrepresenting Dave’s simple point as blatantly lying is all this troll has got.

You know with CoRev’s parade of lies, it might be nice if he once in his trolling career look at a reliable source of data like this:

https://fred.stlouisfed.org/series/W006RC1Q027SBEA

Federal government current tax receipts

In 2017QIII (just before the Trump tax cut), this reached $2080 billion per year. As of 2018QIV, it was only a $2019 billion – a nominal decrease. Cue Dave’s point – the price-level over this period increased so the real decline is even greater.

Of course CoRev will flat out lie about what Dave’s simple point was. That is what trolls do.

CoRev is also noting tariff revenues have increased. True even in real terms. Of course tariff revenues represent a mere 3.7% of total Federal revenues so touting this petty cash is truly a pathetic argument. But it is the best CoRev can come up with.

CoRev Cyclical deficits are supposed to be cancelled by cyclical surpluses.” We both know how the public debt works and unless we balance the budget or have surplus it just keeps increasing as the old and new debt is funded.

But not in terms of the debt as a percent of GDP. Hopefully you understand why that’s important. If the debt-to-GDP ratio increases, then it gets harder to roll over old debt. Under Obama the deficit as a percent of GDP was declining…in fact, it was probably declining too fast. That’s not today’s problem. You don’t start increasing the deficit as a percent of GDP when the economy is at full employment. That’s about as economically illiterate as you can get.

As to the Republicans in Congress, pretty much all I recollect are temper tantrums about raising the debt ceiling and various antics that spooked the markets from time to time. Republicans worked overtime to ensure the economy would stall…McConnell and Grassley even bragged about how they sabotaged the economy in order to hurt Obama. They weren’t even subtle about it!

There was never any serious threat of a China shooting war…at least not until yesterday.

Fishy gets it wrong again: “There was never any serious threat of a China shooting war…at least not until yesterday.” Another pglism without reference

Even this astute political and economic tome knew back in 2013: https://www.popularmechanics.com/military/a9722/heres-what-a-shooting-war-in-the-east-china-sea-might-look-like-16205950/

“Tensions are escalating as China tries to claim new turf. Here’s what to expect if the cold war involving Japan, China, the U.S., and other East Asian nations heats up.

This past weekend China escalated tensions in the East China Sea by unilaterally establishing what it calls an Air Defense Identification Zone that includes islands claimed by other nations. China released a map and coordinates of this zone, demanding that any aircraft report to China before entering the airspace, declaring that its armed forces “will adopt defensive emergency measures to respond to aircraft that do not cooperate in the identification or refuse to follow the instructions.”

This posturing got an early test on Monday when the United States flew two B-52s straight through the zone China has claimed, with no response from China. Secretary of Defense Chuck Hagel has said the flight, which took off from Guam, was part of a prescheduled exercise. But it seems clear that the U.S. is also sending a message that it won’t respect such a claim. “We view this development as a destabilizing attempt to alter the status quo in the region,” U.S. Secretary of State John Kerry said this weekend. “This unilateral action increases the risk of misunderstanding and miscalculations….”

CoRev The subject of the Popular Mechanics article was written in the subjunctive voice. We’ve always had tensions with the PRC even going back to when you probably called it Red China. Surely you’re old enough to remember these little dust-ups:

https://history.state.gov/milestones/1953-1960/taiwan-strait-crises

One difference is that Ike and Obama were smart enough to know how to send China a message (how does that agree with your claims that Obama was weak against China?) while managing to stay out of an actual hot, shooting war. I’m not at all confident that Commander Bonespurs is smart enough to avoid stumbling into a war.

“There was never any serious threat of a China shooting war…at least not until yesterday.”

these are the types of things that trump speak has allowed to occur. corev simply made up a completely false strawman argument to further his silly agenda. there was a time when people at least agreed on what a “fact” was. now that we have allowed “alternative facts” into the world, people like corev and rick stryker can simply make up statements from their own little fantasy world and inject them into our reality. this is how folks like corev and dick stryker can vote for a convicted felon for president.

A reliable source on how soybean prices in Brazil compare to U.S. soybean prices distinguishes between spot prices and future prices. Hey I get CoRev is adverse to reliable sources of data and is clueless what we are talking about when we note spot v. future prices but here goes:

http://www.soybeansandcorn.com/news/Mar4_19-Soybean-Premium-and-Prices-Move-Higher-in-Brazil

March 4, 2019

Soybean Premiums and Prices Move Higher in Brazil

“The strong demand for Brazilian soybeans continue to push premiums and interior prices higher according the consulting firm Cogo Inteligencia em Agronegocio. At the Port of Paranagua the premium for March deliveries increased from $0.40 a month ago to $0.52 per bushel above Chicago. For May deliveries, the premium increased from $0.45 a month ago to $0.58 per bushel above Chicago.”

$0.52 per bushel is the premium on the spot market. The premium for deliveries in May are a bit higher. There’s more on what Brazilians are seeing in longer-term futures markets:

“Last week at the Port of Paranagua soybean prices were R$ 78.00 per sack for immediate delivery (approximately $9.45 per bushel) and R$ 78.50 for March delivery (approximately $9.51 per bushel). At the Port of Rio Grande, the soybean price was R$ 77.30 per sack (approximately $9.36 per bushel) for immediate delivery and R$ 77.80 for March delivery (approximately $9.43 per bushel).

Premiums bottomed out between December and January at the Port of Paranagua and as each month passes, they continue to move higher. For July delivery they are $0.75 to $0.78 per bushel above Chicago. Prices in the forward months are moving higher as well with May and June in the range of R$ 84.00 to R$ 85.00 per sack (approximately $10.18 and $10.30 per bushel).

The demand for Brazilian soybeans is strong given the smaller crop and the strong demand from China. Brazil exported almost 85 million tons of soybeans last year, but given the smaller crop, shorter carryover, and increased domestic usage, exports may be down to 70 million tons in 2019.

Most analysts feel this is a clear sign for higher domestic prices going forward. Brazilian farmers hear this of course and as a result, they are reluctant to sell their 2018/19 soybean crop in the hope of higher prices going forward.”

Ah – there is the point. Brazilians are expecting their prices to rise over time while U.S. soybean prices clearly do not trust CoRev’s predictions that their prices will rise. How do we know? U.S. future prices are still depressed.

Fishy, sigh. Your article: “March 4, 2019 ” Almost 3 months ago????

At least I have a reliable source which I linked to. You on the other hand flat out lie which is why you refuse to provide links. Oh wait – maybe you simply compared apples to oranges. You have proven over and over you have no clue about the data you allegedly cite.

Fishy, BTW, do you know how to calculate the differential using this averaged data? When I calculate the prices using those dates I see a whopping ~3.4% difference. Want to calculate the difference in currency values for that period? Just wondering.

Can you tell this ole man which of your price quotes are futures and which are spot?

As Menzie stated: “A year ago, the July 2019 futures were $10.46,…” Today’s futures price for July delivery was $8.875. Can you calculate that price change %? Is the difference smaller than the subsidy payment, if the farmer chose to accept it?

I know how to do basic arithmetic. Do you? Of course when one does arithmetic using made up data – the result is the intellectual garbage you excel in.

Look CoRev. We know you serially lie. We also know you are so stupid you do not even know when you are lying. The true definition of an incompetent troll.

Fish, if I am so wrong why did I calculate a different value than your 25% for the same period using the that periods prices. Some even from your pwn reference. Blaming anyone else when your own estimates are wrong, and not verifying that your reference verifies your claim, is the epitome of ignorance, or in your preferred parlance, STOOPID.

Let me repeat my finding: ” When I calculate the prices using those dates I see a whopping ~3.4% difference.” It’s all simple if you know where and for what to look.

You’ve been out doing your normal ignorant self.

My point from the beginning has been that weather plays a BIG part in the overall thinking and income for farmers. Sometimes more so than tariffs. The past two years, 2018 and 2019, makes this painful and obvious point. This article explains the effect: https://calgaryherald.com/business/local-business/an-absolutely-brutal-year-alberta-farm-incomes-plummet-70-per-cent-in-2018

70% loss!!!!!!

It does mention the effect of tariffs on Canadian farmers, but not those we have been discussing, but those punitively or protectively implemented against Canada.

All the while we’ve been discussing the effect of China’s tariffs which have generally caused price losses in the high single digits to low teen percentages.It is weather that cause those disastrous losses to farmers, and this has been true since the origin of human farming efforts.