Or, old fogey downloads data, finds a negative relationship, a.k.a. the Phillips Curve…

Much was made of the meeting of minds of AOC and Larry Kudlow regarding the Phillips Curve, to wit (from Bloomberg):

… Ocasio-Cortez said many economists are concerned that the formula “is no longer describing what is happening in today’s economy” — and Powell largely agreed.

“She got it right,” Kudlow told reporters at the White House later on Thursday. “He confirmed that the Phillips Curve is dead. The Fed is going to lower interest rates.”

Well, since I’ve been teaching the Phillips Curve for lo these thirty odd years, I thought I’d check to see if I’d missed something. First, it’s important to remember that while we talk about the negative relationship between inflation and unemployment, or the positive relationship between inflation and output, the actual model we use is the expectations augmented Phillips curve including input price shocks. My preferred specification is:

πt = πet + f(ut-4 – un,t-4) + θzt

Where π is 4 quarter inflation, πe is expected inflation, u is official unemployment rate, un is natural rate of unemployment [ so (u-un) is the unemployment gap], and z is an input price shock, in this case the 4 quarter inflation rate in import prices. Each of these series is available from FRED; using the FRED acronyms, PCEPI for the personal consumption expenditure deflator, MICH for University of Michigan’s 1 year inflation expectations, UNRATE for unemployment rate, NROU for natural rate of unemployment, and IR for import prices.

Estimate this relationship using OLS over the 1987-2019Q2 period (first two months of 2019Q2 used to proxy for Q2). This sample period, after accounting for lags, spans the “Great Moderation”.

One obtains:

πt = -0.19 + 0.74πet – 0.18(ut-4 – un,t-4) + 0.15zt

Adj-R2 = 0.68, SER = 0.608, N = 130, DW = 0.40. bold numbers denote significance at 5% msl, using HAC robust standard errors.

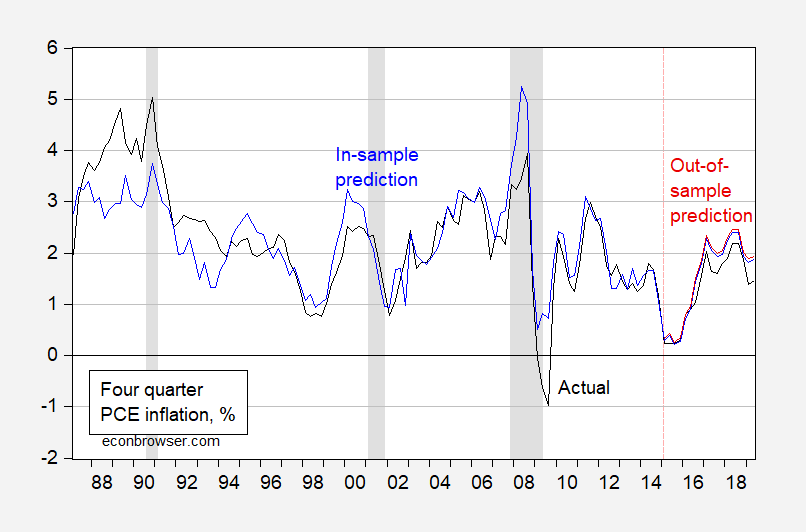

In other words, it’s not too hard to find the posited negative relationship between inflation and unemployment. That doesn’t mean that we explain inflation very well, however. In figure 1, I plot the actual, and the in-sample fit from the estimated regression.

Figure 1: Four quarter PCE inflation (black), in-sample fit from reported regression (blue), and out-of-sample fit from regression estimated 1987-2014 (red). Source: BEA, BLS via FRED, NBER and author’s calculations.

While the equation fits relatively well, clearly it’s not perfect. As of 2019Q2 (first two months), year-on-year PCE inflation is underpredicted by 40 bps. I estimated the equation on a restricted sample ending in 2014; this imparts only a marginal difference — so it’s not that something has changed substantially over the last 4 and a half years. Rather the specification could be improved.

In other words, perhaps a different measure of NAIRU, or a nonlinearity might improve the fit. However, these specification or measurement errors do not invalidate the concept of the Phillips curve. More graphs (from my undergrad course), using the output gap, here.

For more on a cross country basis, see a recent working paper by Blanchard, Cerutti, and Summers (2015). They show that the slope of the Phillips curve has dropped around the early 1990’s; those who rely upon very old stylized facts might be excused for thinking the Phillips curve had gone AWOL.

Somehow, I feel I should breathe a sigh of relief I didn’t make it as a name drop in Menzie’s latest post (or is that narcissistic and self-presumptuous?? Probably) I mentioned Phillips Curve in a prior comment recently. I hope Menzie didn’t take it to mean I don’t believe in the Phillips Curve. I think I lean pretty strongly towards believing in it. Only mentioned it as something that had nearly consensus belief in prior years (when I went to college) and something people had expressed more doubts about recently. And although I like AOC very much, agree with her on many things, and the vision of her makes my heart go pitter-patter a little bit faster and causes certain physiological reactions in me—it does NOT mean I agree with AOC on everything. And I think I side with Menzie on this one. I suppose since this is recently in the news people will doubt me, but it is pure coincidence I mentioned it in a recent thread. In fact if anything I feel I should be embarrassed that I was unaware of AOC’s recent comments on this, as one who tries to follow the news cycle on these type things.

But I’m still glad Menzie posted this, with equations etc as I think my study of it were less sophisticated and nuanced than Menzie outlines above. I went to Uni roughly mid-90s, so….. anything after that would be most likely new to me (unless I read it in Bloomberg and had forgotten it, rather unlikely)

I do think Menzie has been slightly “rough on” MMT, have gone on record on that, and still basically hold that ground. It’s pretty rare for me to go against Menzie on things, so you can bet I have some strong feeling there, or what I feel is very good reasons to go crossways on Menzie on anything economics based. That and the reason I know Menzie could perform Master economics Jiujitsu on me before I had even known the fight bell had rung.

*studies of it were

I’ve always been a fan of political cartoons, especially the ones I agree with. Now, people can take away whatever they wish reading this. I am not dictating to anyone what your impression or thoughts should be. But since the cartoon states the sources are both Forbes and the New York Times, I am presuming the numbers to be pretty damned close to accurate.

https://i.redd.it/y1t8p1toaq931.jpg

The morality/ethics of it, are more subjective (though I am not implying lack of importance or validity of view, based on the subjectivity of the morality of it).

A free stress-reliever for the kiddies:

https://www.youtube.com/watch?v=NI0_mEMaTyE

“She got it right,” Kudlow told reporters at the White House …. Worse thing ever done to AOC’s political career – praise from the partisan goofball Kudlow.

Greg Mankiw put forth a version of the Phillips curve on his blog which got John Cochrane all grumpy again. Cochrane thinks the Phillips curve is dead and has another one of his long winded rants to make his ‘point’.

@ pgl

You might have noticed I enjoy fawning over and defending AOC. Please make notation my silence here.

Why did I torture myself by reading the rest of this Bloomberg article. Kudlow is going to “educate” AOC on how to integrate supply-side silliness into MMT. Our IQs are indeed falling:

http://www.bbc.com/future/story/20190709-has-humanity-reached-peak-intelligence

There really is a lot of papers and blog posts that display a flat Phillips curve – an insignificant effect of the unemployment gap on inflation (or wage inflation).

Personally, I do not believe that the Phillips curve is dead. It is just hard to identify it, sometimes. The relationship tends to be unstable in sub-samples and across countries (of course, it all depends on the assumed model…). Perhaps the following two posts might suggest why:

Andolfato’s post – Phillips curve is alive and well, but more so in recessions.

http://andolfatto.blogspot.com/2019/06/the-phillips-curve-in-recession-and.html

McLeay & Tenreyro – Philipps curve is hard to identify because the CB trageting rule imparts the negative correlation between the output gap and inflation, which consequently blurs the identification of positively sloped Philipps curve.

https://www.nber.org/chapters/c14245

Thank you for a great post!

You knew it was coming:

https://www.youtube.com/watch?v=Iyr74Rs6BWU

You may wish to consider whether the Phillips curve works in some countries and not in others. Given the market orientation of the US I think it is only of the more likely countries for the Philips curve to work. Chapters in the OECD Employment Outlook do suggest wage determination varies a lot across the OECD and US does appear to be more at the market orientated end. See, for example, http://www.oecd.org/els/emp/34846881.pdf Chapter 4 from the 2004 edition.

By contrast, the Chapter identifies UK (and Spain) as outliers. And in UK it seems the Phillips Curve really doesn’t work. See https://www.slideserve.com/caesar-cervantes/the-employment-productivity-puzzle-supply-ing-the-answer-powerpoint-ppt-presentation by me. My view of outcomes in UK is that nominal pay growth gets shocked into a range (since 1980) and then only gets shocked out of that range is when a recession occurs and market forces increase in intensity. Then the range is shocked down. There does not seem to be a sufficiently large labour market effect to shock nominal pay growth out of the range upwards. So, the effect has been asymmetric. With 3 decreasing ranges – 7 1/2 – 8 1/2% in 1980s; 3-5% in 1990s to 2008 – the great recession – and 1-3% from 2010 to now.

Finally, UK experience suggests that you might want to consider the link between pay and price inflation in the NAIRU context. When the NAIRU regime was first strted in UK (research by CLE for the Employment Department) the last link – that price inflation was a fixed mark-up on pay growth had to be assumed. And ever since it has continued to be assumed. Price inflation has been much more variable than nominal pay growth which is very sticky. So, real pay changes tend to be determined by changes in price inflation. Not nominal pay growth.

Menzie,

I accept that one is more likely to find a significant negative relationship for the expectations-augmented PC than for just a striaght-out current inflation versus current unemployment rate one, which over the last ten years for the US looks simply just flat, falling unemployment rates with only a slight increase in the inflation rate, although yours is pretty flat with that significant -0.18 coefficient.

I would also note that, somewhat hinted at by Bill Wells, the original Phillips Curve estimated by Phillips himself was about a negative relationship between wage rate changes and the unemployment rate, with Samuelson and Solow making that leap from wage rate changes to price level changes, which is obviously an imperfect connection (I note that most of the later criticisms of the PC were recognized in that 1960 paper as caveats, although most people at that time ignored them). There is certainly a much stronger argument for the original formulation by Phillips to hold than the later more conventional variety.

For the record, showing my Post Keynesian tendencies here, I have never accepted NAIRU as a useful concept, and to the extent that it exists there is zero reason for it to equal the natural rate of unemployment, to the extent that exists, which I think there is more reason to accept. But both the textbooks and the policymakers (and probably Menzie also) accept that both exist and also equal each other.

Barkley Rosser: As Akerlof, Dickens and Perry (2000) noted, the accelerationist model is a first approximation. Getting closer to low inflation, who knows….

DW = 0.40

The Phillips Curve is a mathematical relationship. Ya compare one data series to another. The claim that a mathematical relationship is “dead” looks awfully glib.

So, there are two possible states of the world: 1) A relationship that existed in the data and that fit theory no longer exists. So “dead”. The interesting thing in this state of the world is the death. What would it look like? Well, you chart the data and you get…a panda? Pinking shears? What exactly does a mathematical relationship that “no longer exists” look like?

2) The relation ship has changed over time. So “not dead”. What would that look like? Well, you chart the data and the curve changes. No panda. No pinking shears. An actual chart with actual data points, with more recent data points showing up in a different part of the chart than the earlier ones did. A mathematical relationship still exists, but the coefficients have changed. The interesting thing is that the coefficients, which represent structural relationships, have changed. So structure has changed. That’s a hell of a lot more interesting than “dead”. “Dead” is “move along, there’s nothing more to see here.” There is plenty to see, and “dead” is dumb.

When did the Phillips Curve relationship change? Was it around the time that productivity growth diverged from wage growth? Was it around the time that inflation expectations fell precipitously? Was it around the time that the trade deficit as a share of GDP increased markedly?

Way more interesting that “dead”. Dead is for deadheads.

macroduck: Starting point: Blanchard, Cerutti and Summers (2015) cited at end of the paper.

Exactly.

Looks like a relationship between real oil prices and inflation.

Watching this film now titled “To Dust” with Matthew Broderick. It is dark mood and slow paced, but has some funny moments. Worth a try if you can access it under $5

https://www.youtube.com/watch?v=tWnO8oivMJg

Menzie,

This is off-topic somewhat, but I have just read your entry on Fiscal Multipliers in the 3rd edition of The New Palgrave Dictionary of Economics and want to congratulate you on a job well done. I think it takes a broader view than one finds in this recent Ramey paper that Vasja thinks is so great. I note that some of the points in this entry you have made from time to time in posts here.

I came upon it because as one of the three coeditors of the fourth edition of the Dictionary I am reading the whole third edition, if skimming in some parts, all 15,000 pages in 20 volumes with over 3800 entries. It is proving to be a highly educational as well as idiosyncratic experience. Anyway, congrats on a well done entry. Will be curious to see if you have any others.

You know, this world has become so crazy now, it’s getting where you can’t even backslap a pedophile rapist and wish him godspeed in life and keep your job. Anyone have a Kleenex?? I’m getting misty eyed for this poor victim Alex Acosta. Does anyone know of an employer who gropes at women’s genitals randomly that would be interested in hiring this man???

https://www.theguardian.com/us-news/2019/jul/12/alex-acosta-resigns-trump-jeffrey-epstein-plea-deal-latest-news

Any Evangelical Christians of the south USA looking for a friend of pedophile rapists for your August 2019 Employee of the Month??

https://www.youtube.com/watch?v=Zo_mpwmashg

Clearly Alex Acosta deserved to go, but the Washington rumors not much in the MSM are that Trump wanted him out because he was resisting undoing pro-labor regulations. He will almost certainly be replaced by somebody worse than him in terms of DOL policies. This is not to defend Acosta, but simply to note what seems now to be a well-established trend: that Trump replaces people with even worse people.

https://www.politico.com/story/2019/07/12/trumps-acting-labor-secretary-pick-feared-by-unions-1589621

From our good friends at website “Trading Economics” I verbatim copy/pasted the following:

“China’s trade surplus with the US rose 11 percent to USD 29.92 billion in June from USD 26.9 billion in May. For January-June combined, the country’s trade surplus with the US widened 5 percent to USD 140.48 billion from USD 133.76 billion in the same period in 2018.

Considering the first half of the year, the trade surplus widened to USD 181.15 billion from USD 135.27 billion in the same period last year. ”

How does MAGA keeping “winning” like this?? What an American icon.

Hello Professor Chinn,

I got pretty much the same answer as you did on the P Curve post:

My work:

Download as those datasets from FRED, just like Professor Chinn referenced.

Use libreoffice to get quarterly averages.

Calculate the 4 quarter inflation.

Calculate the 4 quarter shock.

Calculate the (U – naturalU).

Using my R, I got pretty much the same results.

mymodel = lm(pi ~ michplus + yearudiff + shock, data=train)

summary(mymodel)

lm(formula = pi ~ michplus + yearudiff + shock, data = train)

Residuals:

Min 1Q Median 3Q Max

-1.80004 -0.35552 -0.06667 0.25940 1.85574

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.189779 0.333419 -0.569 0.57

michplus 0.736509 0.106651 6.906 2.19e-10 ***

yearudiff -0.184529 0.036123 -5.108 1.17e-06 ***

shock 0.152645 0.009409 16.224 < 2e-16 ***

—

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.6087 on 126 degrees of freedom

Multiple R-squared: 0.6893, Adjusted R-squared: 0.6819

F-statistic: 93.19 on 3 and 126 DF, p-value: < 2.2e-16

Ooooh, my R-squared is the same as Professor Chinn's.

Cheers,

Frank

@ Frank

I’m curious, it’s not crucially important right now, but curious. Is there a specific statistical “package” you use in “R” for most of these?? For example you have “MASS” and “ggplot2” that are in the “R” library. Now those may not be directly tied to statistics, but they are packages you can install from the library, yes?? Is there a statistical “package” in “R” that you find yourself using more?? Or even just tell me the one you used for Menzie’s related post.

Hello Moses,

= = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = =

= = = = = = = = = = = Frank at Home = = = = = = = = = = = = = =

= = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = =

I learned R from that MIT Data Analytics course on edX. That R Data Analytics course is also available on the MIT OpenCourseWare site:

https://ocw.mit.edu/courses/sloan-school-of-management/15-071-the-analytics-edge-spring-2017/

For the Phillips Curve problem on this page, Professor Chinn wrote “Estimate this relationship using OLS”. The OLS tells me to use a linear regression model. In R, that’s the lm function and looks something like: mymodel = lm(pi ~ michplus + yearudiff + shock, data=train)

In the Data Analytics course, see Unit 2, Linear Regression:

https://ocw.mit.edu/courses/sloan-school-of-management/15-071-the-analytics-edge-spring-2017/linear-regression/

For the “Plain-Vanilla Term Spread Model: Recession Probability for 2020M06=42%” article on Econbrowser, Professor Chinn writes “Prob(recessiont+12=1) = -0.323 – 0.869Spreadt”. The Prob(x=1) tells me to use a binary regression model.

In the Data Analytics course, see unit 3, Logistic Regression:

https://ocw.mit.edu/courses/sloan-school-of-management/15-071-the-analytics-edge-spring-2017/logistic-regression/

The ggplot package is in unit 7, Visualization:

https://ocw.mit.edu/courses/sloan-school-of-management/15-071-the-analytics-edge-spring-2017/visualization/

Most of the time, I can tell, either from the problem description or from the Professor telling me, which regression model to use.

= = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = =

= = = = = = = = = = = Frank at Work = = = = = = = = = = = = = =

= = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = =

At work, I do mostly simple statistics: average, standard deviation, min, max, etc.

From the MIT Data Analytics course, I learned how to do a correlation matrix.

Several of the Ph.D. scientists at work collect nitrogen, phosphorus, chlorine, oxygen, etc data on various samples. I used R to create a correlation matrix. The scientists were impressed with my correlation matrix, because they could easily see positive and negative correlations.

In the classroom, the professor pretty much gives you the equation/model.

In the real world, the professor has to work very hard to develop those equations/models.

Cheers,

Frank

@ Frank

Frank, I mean this in a semi-humorous, but also in a very earnest way. That is to say, I hope it makes you slightly chuckle, but also know there is genuine regard/intent in the following statement: You are my new hero in life.

I greatly appreciate the reply, the thoroughness of breaking up the answer into segments, and the resource links provided. I am going to do my best not to lean on you as a crutch, but I have the feeling somewhere in the future in Econbrowser posts I will be querying you again, and I hope you keep an eye out for “R” related questions. I will try to keep them sparse.

Very warm regards to you and your family, loved ones—“Moses Herzog”

@ Frank

OMG, I just realized one of the two people teaching this course is a HOT chick. I might actually be able to learn “R” much faster than I originally thought:

https://youtu.be/7xWjbJOYKz0?t=22

Hello Moses,

I am happy to assist.

Yes, I thought the way the instructors step through the problem is very helpful.

I really liked the variety of problems the MIT instructors solve using R.

Anyway, I did not want to present myself as an R expert. At work, I do routine, basic statistics. But, at home, I like stretching my brain on the economic models that Professor Chinn gives on the econbrowser page.

Cheers,

Frank

@ Frank

Again, I think you are being modest and humble about yourself as it relates to “R” and your broader life knowledge. But in a world jam-packed full of CoRevs, Stephen Moores, Larry Kudrows, and donald trumps—your humbleness is a nice breath of fresh air on a Autumn day—please don’t ever change that facet of yourself

Signed, Degenerate Moses.

Professor Chinn,

If you are inclined, a little more explanation on the model would be helpful in order to obtain the same coefficients as your solution.

100*[pcepi/pcepi(-4) 1] = c + B1 (Mich) + B2 [(unrate/unrate(-4)-1) * 100 – NROU(-4)] + ( B3 (IR/IR(-4)-1)*100

C = -0.70

B1 = 0.94

B2 = -0.19

B3 = 0.09

R-squared = 0.70

N=130, Period: 1987Q1 to 2019Q2

SER = 0.58

DW = 0.44

It would be nice to tie-out to your solution, since this model would be great to update periodically.

AS: Don’t need to convert unemployment to growth rate.

My mistake in transcription. In my model, I used (UNRATE(-4) – NROU(-4)), not growth rate in UNRATE, sorry for the error in transcription.

wonder if that should be Mich(-4)?

Cheers,

Frank

Frank: Yes!

Professor Chinn and Frank,

Thanks for the correction! I saw the subscript of “t” on MICH and did not realize it should be MICH(-4).

Every statistic and coefficient now agrees with Professor Chinn.

Thanks again! I really appreciate your help on this model.

Are you the middle aged gentleman who was taking that MIT prof’s course at some southern school or something that commented in prior threads?? It’s super good to see you are still chugging along nicely on your stats and econometrics progress. It appears you have long since passed my level, you damned so and so.

@ Frank

If you are the same gentleman I am remembering from prior threads, I’m curious what you’re using to crunch your numbers??? I like to use the free ones, so most recently I am interested in Python and “R”Studio. I have a book on “R” and I have enough books on Intermediate economics and econometrics to make the other connections. Though when you are a lazy-bones like me self-taught is not always the best way. I know I can do it, it’s just getting the personal drive, and finding texts that lean towards more user friendly. I have a book I am read on “R” now and am basically still in the first two chapters. There’s tons of stuff on “R” online but they Yammer on to eternity on some things when all you really need most of the times is problem sets to see specific examples. It’s as if they think if they make it long-winded enough about stuff that is not related to core usage of the software they can keep it to “their exclusive club”. That’s probably mostly paranoia on my part, but I think there’s a segment of truth in there somewhere.

I must say I was borderline shocked to read Prof Hamilton uses MatLab. I have read so many horror stories on that (as far as user friendliness) I am not touching that one with a 100 foot pole.

Hello Moses,

No, I think you (and everyone on econbrowser) have much more econ knowledge than I do. I’m just a Ag Science Technician, in rural South Georgia, and a life-long learner. I’m still taking those AP High School and intro MIT econ classes on edX.

I have been fortunate to have Ph.D.s in a physical science as my immediate supervisor for the past 35 years. When I see some of those easier econ equations, I’m comfortable building a model.

In my personal time, I use LibreOffice and RStudio. Both are free. I donate to LibreOffice whenever I download a new update. I think LibreOffice and RStudio are fine general purpose programs. I do not know enough economics to justify a specialized economics software tool — I’m just learning economics for fun.

For R, I *highly* recommend the Data Analytics course by MIT on edX:

https://www.edx.org/course/the-analytics-edge-2

It is free, but I always pay for the certificate to help with the costs. Several tens of thousands of students have taken this course. It is one of the most popular MOOC courses. You can tell by my data names “train” and “test” that I took the MIT R course. My problem write-ups on econbrowser have the structure of those MIT R problem sets, where they break the problem into small, manageable pieces.

Harvard has an intro R course and other R-based data wrangling courses on edX:

https://www.edx.org/course/data-science-r-basics-2

Cheers,

Frank

@ Frank

I think you are modest and humble about your learning, as I have no doubt you have exceeded my current ability on economic modeling.

What you have stated is highly highly helpful to me. I don’t know how regular you are here, but I may be attempting to pick your brain on modeling and proper “R” etiquette as I go along. I hope you will keep a peripheral view on my comments especially when Menzie is doing posts related to modeling and these type things, such as the post above. Menzie uses E-Views program and other than possibly commenter “2slugbaits” no one here uses “R” regular, and there’s always minor differences in these programs, so—-you could be a great and singular kind of help to me as it related to “R” and snags I hit on the learning curve. I will try to get my knowledge base stronger before pestering you, but I hope if you’re reading here anyway you skim me for any “R” related questions.

BTW, I already have the 2 big downloads. My “R” version maybe older though, it is version 3.3.3 labeled “Another Canoe”. But I’m thinking if it isn’t older than 5 years it’s not going to make a huge difference on most of this. I am also going to obviously be going the “Rstudio” route for the “IDE” (an acronym I learned just this late afternoon)

Thank you very much for the reply to my query.

Warm regards to you Frank : )

Moses Herzog I don’t always use “R”. Before I retired I would use EViews or LIMDEP or SAS, depending on the project. The thing I liked about “R” was that it was relatively easy to simultaneously run Box-Jenkins analyses, unit root tests, forecasts, etc. on thousands of time series. But I was one of the few in the office that used “R” regularly. Another nice thing about “R” is that it has a lot of narrowly focused packages dedicated to solving specific problems. For example, it ran the same Support Vector Machine routine found in MATLAB without having to suffer through MATLAB. And for small discrete event simulations the “simmer” package was a lot easier to set up and run than the industrial sized Arena software used for big projects. I still use “R” for some things, but if it’s just routine stuff I prefer GRETL, which has the Econometrica seal of approval and has lately added a lot of new packages.

@ 2slugbaits

Yeah I remember you had talked about Gretl, and it has many characteristics I find likable. I still sometimes think of giving it a go. I was grateful for your thoughts on it at the time and am still grateful for your thoughts on it now. Very appreciative. But something made me shy away from Gretl and I can’t remember what it was now. There wasn’t enough users of it to have long-term staying power?? They weren’t updating it?? Some thing had given me pause, and honestly I can’t remember what it was now. I still haven’t completely shut the door on Gretl, but there was some issue. Honest to God I wish I could remember now. But I did give it a very serious look.

I’m actually kind of amazed as much modeling and number crunching as Menzie does that software is not a bigger topic on this blog than it is. As busy as Menzie is he tosses out some bones to people attempting the models sometimes, so maybe this will become a hotter topic over time. I’m reading up on the “R” now, and hopeful I can have a go at some of these. I’m just at the babysteps on the software though, and it goes in fits and steps.

Professor Chinn,

I notice that the residuals on the Phillip’s curve model are correlated. In practice would you add AR and MA factors to the model to improve the forecasting accuracy of the model? It seems like AR(1) AR(2) AR(3) and MA(1) MA(2) MA(3) are needed to account for the correlated residuals. However, if one computes the model from 1987Q1 to 2014Q4 in order to make an out of sample forecast, the AR and MA factors seem to be not significant.

BTW, maybe my favorite paper on the Phillips Curve is one by Alan Blinder quite some years ago in the JPE entitled, “The Phillips Curve of Japan Looks Like Japan.” Really.

Menzie: From 1987 to present, a scatter plot of the 4-quarter lagged unemployment rate against contemporaneous inflation shows zero correlation.

Moreover, if the Phillips curve is to have any meaning, there must be causality there somewhere. Presumably the causality flows from u to p, as the thousands of papers in the literature have p as the dependent variable in their models. Unemployment, then, purportedly inversely affects inflation. But does unemployment really do any such thing? Exactly how does unemployment affect inflation? That is a question that must be answered.

About that you and other advocates of the Phillips curve are likely to say something like, well, high u creates slack. But of course high u does no such thing. High u is a result of slack. Something else causes slack, and it’s sure not the unemployment rate.

Recessions are what cause slack. So the sensible thing would be to have the output gap in your equation. However if you do that the unemployment rate altogether disappears from the equation, and your model is no longer about the Phillips curve relationship. So the u minus un variable must be in the equation.

Yet when pressed to interpret it, I believe you’ll claim it’s a proxy for the output gap. Cutting through all this, I claim that your term is indeed nothing other than a placeholder for the output gap, and that over the course of the cycle the majority of the movement in the output gap takes place during recession quarters (and the couple quarters after). And that virtually alone, the recession observations determine the bulk of the statistical significance in your model. Which model would fall apart completely if not for recessions. Because as you must know, during expansions, which are the bulk of the cycle, u and p are positively correlated!

Do you get what I am driving at here?

Moreover. Contemporaneous MICH, which is of course affected by recessions, entered first and by itself already then explains 46% of the 1987 and on variation in inflation. Hardly a surprise. Leaving a total of just 22% of your 68% R-squared explained by the addition of not just one but two more variables! Roughly plus or minus 12% of which can attributed to the unemployment variable.

And this is the latest and greatest in Phillips curves? A curve where unemployment – not really unemployment of course but really output – contributes a mere 12% to the explanation of overall inflation?

JBH: So, in your world, multiple variables can’t be involved? Just because a scatterplot shows no obvious correlation doesn’t mean no relationship occurs. If exogneous shocks to supply and demand are random, you could very well get a no-relation scatterplot; would you then dismiss the supply and demand framework.

Menzie: I wouldn’t say multiple variables cannot be involved. In fact, in general I would say the opposite. But this does not exactly resolve anything.

What I do know is that there is virtually no correlation between lagged u and p at the outset. So my question is this. Can one make a silk purse out of the sow’s ear of a variable which at the outset has zero correlation with the dependent variable in question? I lean on the side that it can. But one can always learn something new. So your knowledge, is this subject in its own right addressed anywhere in the literature or textbooks?

JBH the sensible thing would be to have the output gap in your equation. However if you do that the unemployment rate altogether disappears from the equation, and your model is no longer about the Phillips curve relationship.

I’m not following you. Are you claiming that there is no relationship between the unemployment gap and the output gap?

There are quite a few different versions of the Phillips curve, and some of them are based on a positive relationship between output and inflation. But in those models the Phillips curve plays a slightly different role. For example, in Romer’s model or the Oxford 3-Equation model, the short-run Phillips curve is upward sloping and moves along the monetary policy (MP) rule curve. So what is directly observed in inflation/output space are different equilibrium points and not the Phillips curve itself. The slope of the Phillips curve is buried in the Taylor rule. For example, if the absolute value of the slopes of the IS curve, the Phillips curve and the MR curve all equal 1.0, then you get the original symmetrical coefficients of 0.5 for both the output gap and the inflation gap.

output – contributes a mere 12% to the explanation of overall inflation?

I’m not sure where you got the 12% figure. I suspect you might have been referring to the 0.18 coefficient in front of the unemployment deviation. You also seem to be missing the point that the expected inflation rate itself is an anticipation of the Fed’s reaction to an unemployment shock. Isn’t that why they call it an augmented Phillips curve?

the recession observations determine the bulk of the statistical significance in your model. Which model would fall apart completely if not for recessions. Because as you must know, during expansions, which are the bulk of the cycle, u and p are positively correlated!

There is no dummy variable for recessions in the equation, so I don’t understand your comment. The equation simply looks for a gap between the observed unemployment rate and the NAIRU. The gap can be positive or negative. And you can have a negative gap even if the economy is not in recession.

2slugbaits Lost a rather lengthy comment here when I hit the post button. Am not going through all the work to reconstruct it. Too busy. Let me say that I did a fair amount of data work and must retract what I said above regarding the recession stuff. As for unemployment gap and output gap, hardly any correlation. The other point was one I made earlier. The unemployment variable has less than 1/5th of the explanatory power in Menzie’s model. That’s a slender hook on which to hang the name — Phillips curve. As you recall, his original model was wage and price inflation only, dependent and one independent variable.

2slugbaits: From an analytic standpoint, what I wrote about recessions was wrong. I’ve spent considerable time with the data using Menzie’s model as the platform. Given the constraint of using his model, knocking out recession quarters and/or the couple quarters following and reestimating the equation does not produce the results I had believed it would. I must say, then, that I can see how you are figuratively scratching your head about the recession observations stuff that I penned.

As for the unemployment rate gap and output gap, I was also surprised that there is virtually no correlation between them. The point about the one proxying the other in my original comment is wrong to. I certainly learned something working through all this.

This said, I still have objection to this being a well structured Phillips Curve model. Phillips, as you know, in his original model related the unemployment rate with wage inflation. This later morphed in the literature to price inflation. Later still, an auxiliary price expectation term became vogue. Now in Menzie’s equation we have two auxiliary terms.

Since all variables are in the same units, their estimated coefficients are additive. We can correctly say that there are 107 units of impact on the rhs. Of these, the 18 unemployment gap units represent just 17% of the explanatory power of the model. I get it that other things equal, unemployment and inflation are inversely related. But weakly so. So weakly that to me the notion of there being a viable Phillips curve is a stretch. A 1 percentage point movement in the unemployment rate (more correctly the gap) causes (if causes is the correct verb) not even one-fifth of a percentage point movement in inflation. And how much of this fifth is truly causal or just mere correlation?