With Judy Shelton’s nomination to be a Fed governor, it behooves us to consider her views on the world. I will point out two salient (there are many) areas of confusion about her views: (1) interest rates and monetary policy easing, and (2) currency manipulation.

- Does a Zero Interest Rate on Excess Reserves Guarantee a Zero Fed Funds Rate?

On the first point, Dr. Shelton has been known to argue for a reduction in the interest rate on excess reserves (IoER). From WaPo (June 19, 2019):

“Because I’m so against paying interest on excess reserves, in a way, I’m radically in favor of eliminating 235 basis points [on interest rates],” Shelton said. She suggested a “glide path” of “maybe one to two years” to take the interest rate the Fed pays on excess reserves from the current level of 2.35 percent back down to zero.

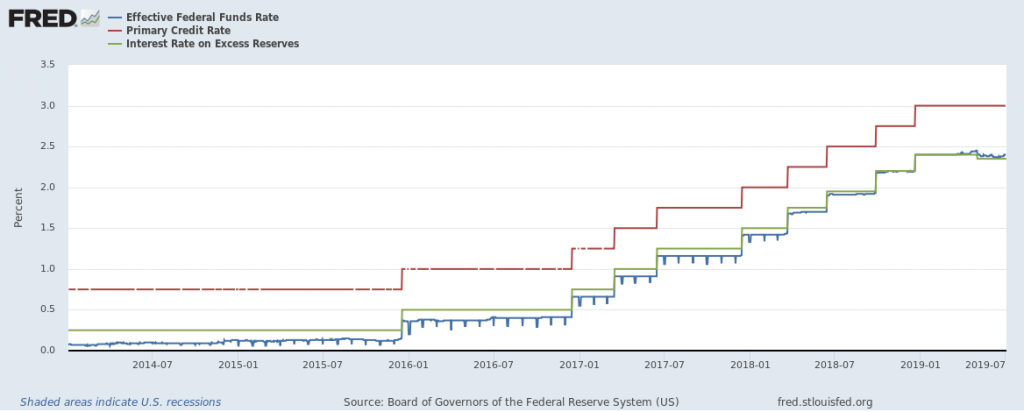

In practice the effective Fed funds rate is only been slightly above the IoER — and in the past has been below (having to do with FHFA and othre entities accessing the Fed funds market, see here).

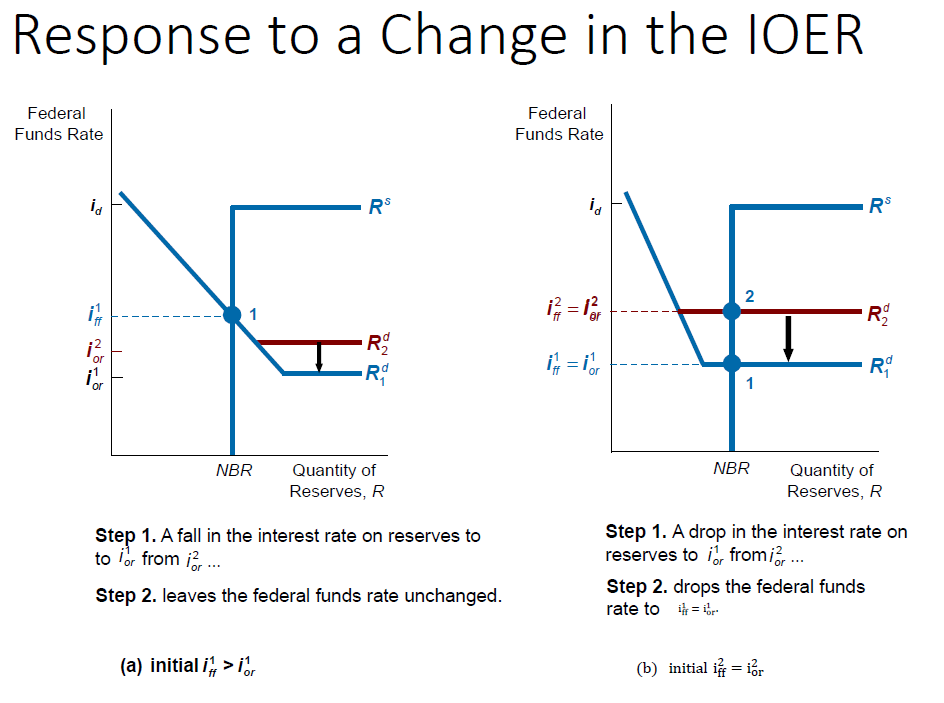

In theory, though, lowering the IoER does not lower the Fed funds rate. To see this, consider a graphic pulled from a money & banking textbook (Mishkin), and edited.

As shown here (drawn in the case no other entities besides banks can access the Fed funds market), decreases in the IoER do not necessarily impact the Fed funds rate. In order to ensure the Fed funds rate moves if the reserves demand curve intersects the supply of reserves (at NBR, nonborrowed reserves), the Fed must increase the supply of reserves.

2. Shelton Makes Absolutely No Sense in Discussing Currency Manipulation

(From this February 2017 post.) In response to my post on a possible new approach to tackling currency manipulation, reader “Judy” comments by sending me a link:

https://www.wsj.com/articles/currency-manipulation-is-a-real-problem-1487031395

This is a WSJ op-ed, which is behind a paywall. Here is an ungated version:

Certainly the rules regarding international exchange-rate arrangements are not working. Monetary integrity was the key to making Bretton Woods institutions work when they were created after World War II to prevent future breakdowns in world order due to trade. The international monetary system, devised in 1944, was based on fixed exchange rates linked to a gold-convertible dollar.

No such system exists today. And no real leader can aspire to champion both the logic and the morality of free trade without confronting the practice that undermines both: currency manipulation.

When governments manipulate exchange rates to affect currency markets, they undermine the honest efforts of countries that wish to compete fairly in the global marketplace. Supply and demand are distorted by artificial prices conveyed through contrived exchange rates. Businesses fail as legitimately earned profits become currency losses.

…central banks provide useful cover for currency manipulation. Japan’s answer to the charge that it manipulates its currency for trade purposes is that movements in the exchange rate are driven by monetary policy aimed at domestic inflation and employment objectives. But there’s no denying that one of the primary “arrows” of Japan’s economic strategy under Prime Minister Shinzo Abe , starting in late 2012, was to use radical quantitative easing to boost the “competitiveness” of Japan’s exports. Over the next three years, the yen fell against the U.S. dollar by some 40%.

…

Whether China is propping up exchange rates or holding them down, manipulation is manipulation and should not be overlooked.

So…let me get this straight. If you lower interest rates and that depreciates a currency, that’s manipulation. If you embark on quantitative easing by purchasing domestic assets and the currency depreciates, well that’s currency manipulation. And if you intervene in the foreign exchange market to keep a currency weak by purchasing foreign currency, that is manipulation, as well as if you intervene to keep it strong by selling off foreign currency.

This expansive definition of “manipulation” means that pretty much every central bank in the world is manipulating their exchange rates — except for those that have their exchange rates at the “correct” levels, as determined by somebody.

That article made me wonder what criterion would result in exchange rates being at correct levels. According to this article, Dr. Shelton believes a fix to gold would do the trick.

“We’re talking about monetary integrity. And if we really do have a some kind of a global economy, it doesn’t make sense that people are using different units of account to measure value.”

Implicitly, this means she views the world as an optimal currency area (e.g., symmetric shocks, and/or free factor mobility and fiscal union). Hmmm.

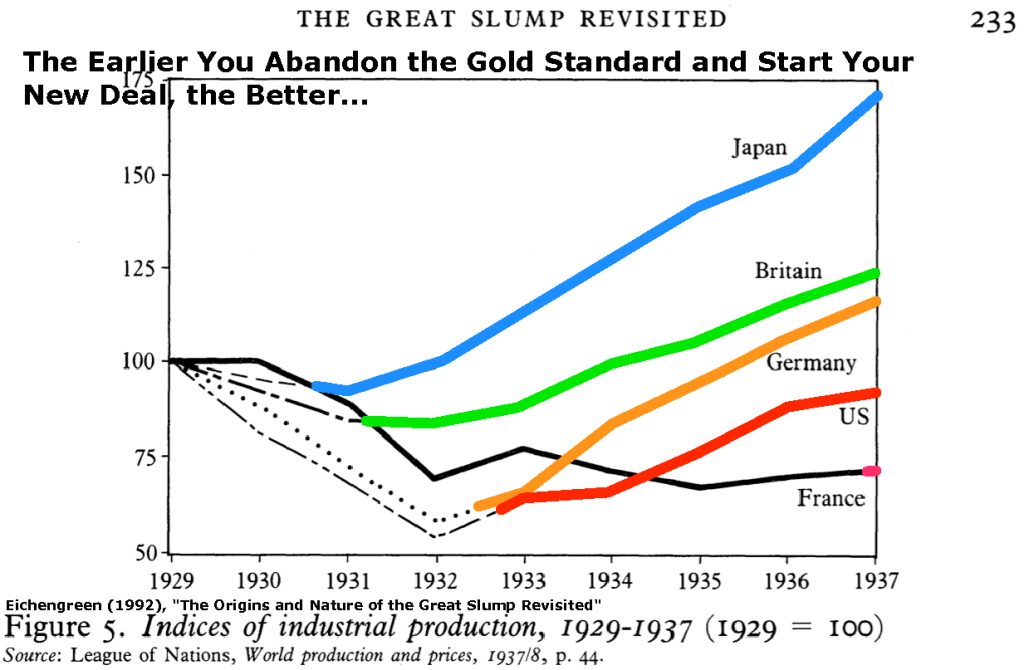

I’ll further observe that if you fix your exchange rate to gold at the “wrong” levels, you might have the real exchange rates less volatile, but still misaligned. Those who know economic history, know the consequences, summarized in this graph:

See also Jim’s post on the subject.

With currency manipulation becoming a hot topic, I fear a Fed governor who has truly confused views on the subject will only give ammunition to the “crazies”. I say this, even though the Fed has typically averred that the currency is the purview of the US Treasury — after all, so many rules and norms have been broken in the past three years, what is another.

More on Dr. Shelton’s views, in this long interview.

Reader Judy? Shelton actually reads your blog and yet is so utterly confused on basic monetary economics? OK!

Let me get this straight – letting the market determine exchange rates leads to manipulation? I guess when one allows market determined rents – that is manipulation of housing prices. And since we at least used to approximate market determined prices for food, we are manipulating the prices of tomatoes, lettuce, and yes even soybeans.

Oh wait – this reminds me of those CoRev rants where he accuses you of manipulating the data on soybean prices. But of course according to the Judy Shelton standard, soybean prices themselves were always manipulated. It is all making perfect sense now!

…or, Reader Judy has a bot looking for her name on blogs so that she can respond. If one is very concerned about one’s image in the world, blog-crawling reader-bots can be helpful.

Speaking of currency manipulation!

https://www.snopes.com/ap/2019/07/03/trump-start-manipulating-dollar/

‘Trump Says US Should Start Manipulating the Dollar

Such a move would contradict official U.S. policy not to manipulate the dollar’s value to gain trade advantages.

WASHINGTON (AP) — President Donald Trump on Wednesday accused China and Europe of playing a “big currency manipulation game.” He said the United States should match that effort, a move that directly contradicts official U.S. policy not to manipulate the dollar’s value to gain trade advantages.

In a tweet, the president said if America doesn’t act, the country will continue “being the dummies who sit back and politely watch as other countries continue to play their games — as they have for so many years.”

Trump’s own Treasury Department in May found that no country meets the criteria of being labeled a currency manipulator, although the report did put China and eight other countries on a watch list.’

Our President is an idiot so why not have fellow idiots on the Federal Reserve?

I concur,

how does one manipulate a floating currency?

Definitely a sandwich short of a picnic and his age exacerbates this

“I am pleased to announce that it is my intention to nominate Judy Shelton, Ph. D., U.S. Executive Dir, European Bank of Reconstruction & Development,” Trump wrote on Twitter. “Judy is a Founding Member of the board of directors of Empower America and has served on the board of directors of Hilton Hotels.”

She knows the hotel game. She is an expert on everything! Empower America – is that a Lafferian outfit? Ph.D.? Not in economics. I would call this quote resume padding but even on its own terms – a really weak resume!

pgl: She has a Ph.D. in business administration. Topics are (according to interview on C-SPAN) on option pricing theory/banking and on differential tax rates and Miller-Modigliani (as I understand it).

Let’s assume for the moment “Judy” has a good post-graduate education (whether that is a viable assumption or not) for argument’s sake. That implies even stronger her disingenuousness, does it not??

I’m listening to her 1989 hour long discussion and the first substantive point was a call for a proper accounting of Soviet debt. Gee – a right winger wanting to see reliable data! She will not last long with Trump if she decides to take this tact now!

https://books.google.com/books/about/The_Coming_Soviet_Crash.html?id=L8aqAAAAIAAJ&source=kp_book_description

The coming Soviet crash: Gorbachev’s desperate pursuit of credit in Western financial markets

“In this provocative and thoughtful analysis, Judy Shelton demonstrates that the Soviet financial crisis is severe, and the West’s sending money to the Soviet Union for credit results in enhanced Soviet military capability, not consumer goods.”

Well she got one thing right some 30 years ago but a lot of people thought the Gorbachev experiment was about to fail. Gorbachev was replaced by Yeltsin who used Western money to line the pockets of his buddies. Hmmm – isn’t that what is doing?

I’m always curious about the mental state, the internal metaphysical place of a woman, that she will happily dance to the tune and cavort with a man who views her own gender as “weak” and worthy of being sexually molested on a personal whim. Now, I know with Netanyahu it’s just he’s a sociopath. He’s devoid of any morals. But this Judy Shelton, what is it about her, that donald trump abuses women, takes great pride in invading the most personal spaces of a woman’s body, and she’s happy to join the donald trump freak show circus and wave her pom poms?? What is it in Shelton’s personality that she doesn’t even blink an eye at working together with a man who would molest her sister or daughter if donald trump felt a base desire needed to be satiated??? Then I read women saying how men are the cause of their glass ceiling etc. What does “NOW” have to say about KellyAnne Conway?? What does NOW have to say about Sarah Huckabee’s statements about donald trump’s sexual molestation victims?? And what has Judy Shelton have to say about those victims of donald trump’s openly confessed molestation of women??—as donald trump’s daughter goes to annoy world leaders in Osaka, jumping around like some 4 year old CEO’s daughter uninvited to a corporate board meeting. Well, ivanka is having fun in Osaka….. why would she show any empathy to the women that had their vagina groped by the Loser-In-Chief?? Why would she show any empathy to other women who were abused by her Dad?? Well….. no reason is there….. that’s all men’s fault. She surely has no accountability to address her father in a public way in the matter, she’s a girl, and she’s having fun, and therefore is cleared of all accountability on the matter. We know how these unspoken rules work—it’s “not fair” to expect ivanka to do THAT…..

ivanka is just a great lady, really a great lady. I’d say ivanka is a “strong woman” but that descriptor is reserved for Nancy Pelosi who is extremely frightened her colleagues might want to impeach trump. Oh my God, frightening to think of that. Impeachment…..I feel emotionally terrified just typing it.

Moses,

We shouldn’t be harder on the women who support Trump than the men. Yes, the women have reason to revile his treatment of their sex, but that’s not new in this world. Trump is a supreme exemplar of a problem women put up with all the time, not a new phenomenon. He belittles men, as well, and in truly odious ways.

People who work for Trump (barring several of “my generals” who seem to have done yeoman work in frustrating his worst inclinations) are revealed to be of low moral quality, but I don’t think the women can be seen as more shocking or begrimed than the men.

isn’t that what TRump is doing?

Found the paper she noted as her first publication:

Journal of Financial and Quantitative Analysis

Volume 16, Issue 4, November 1981 , pp. 603-623

Equal Access and Miller’s Equilibrium

https://www.cambridge.org/core/journals/journal-of-financial-and-quantitative-analysis/article/equal-access-and-millers-equilibrium/9BD1792F3D4CA24CFF6606383A57230F

Controversy over the implications of debt and the rationale belying capital structure has seemingly come to rest upon a plateau defined by Miller’s equilibrium analysis of aggregate corporate debt [10]. In “Debt and Taxes,” Miller reasserts his contention that whether capital is obtained through debt or equity has no bearing on the market value of the firm and is, therefore, irrelevant–a notion which has long been accepted with some reluctance by the finance academe. When the Modigliani-Miller model was first offered some 20 years ago [11], it was accompanied by a set of assumptions which portrayed the world of corporate finance in such malleable terms as to make the irrelevancy propositions palatable. Adaptation of this theoretical model (by its originators) to its secular counterpart through the imposition of corporate taxes [12] brought about a reassuring reversal of the irrelevancy doctrine, but left in its stead the disconcerting prescription to maximize firm value by financing exclusively via debt. Consideration of tax effects at the personal level by Farrar and Selwyn [7] marked the next concession to reality by capital structure theorists. Instead of alienating the original model still further from observed corporate behavior, this step provided a means of reconciling the overwhelming advantage of debt financing at the corporate level with the ultimate after-tax “consumption possibilities” afforded to individual investors. Miller’s analysis explains that corporations are forced to “gross up” nominal interest rates to attract bondholders who must be compensated for their personal tax liability [10]. Potential increases in market value due to the tax deductibility of interest payments are exhausted in the competitive drive toward equilibrium—at which point there are no gains from leverage. The sanctity of the irrelevance theorem thus appears to have been restored at the aggregate level.

*********

I bet Lawrence Kudlow has no clue what any of that means!

17 minutes into this hour long discussion she was hammering the ruble and praising how the British pound freely floating with respect to the dollar. In other words, Judy Shelton vintage 1989 contradicts Judy Shelton now!

I’m not defending Shelton’s current policy prescriptions, but maybe we can allow for the fact that after 30 years people change their views on things. Whether they are wrong currently is pretty much irrespective of that. If we flipped it, I suspect certain people would say how she’s progressed on the matter. I don’t think 30 years getting a different answer from people qualifies as “contradiction”. Although in today’s world where women can bring charges about things that happened 30 years ago when they voluntarily went to a hotel room for a job interview, maybe I’m wrong. Little Jane from Cherry Lane was shocked that hotel room interviews weren’t standard protocol, that’s how they always showed it on “Father Knows Best” on the nights she was watching. So maybe it all makes sense for Judy now. She had an epiphany one night watching a travel show spotlighting east coast Chinese. When Judy found out some coastal Chinese don’t squat in the bathroom anymore she knew this managed currency stuff was pure garbage.

Besides, if you consider from racial context, Judy is being very “consistent”. The darkies (ruble) are always in the wrong, and as the great poets in mobile home parks of South USA say “white (read British pound) is always right”.

Am I allowed a few moments of narcissism here?? (I know what you’re thinking “When the hell has it ever stopped you before?!?!?”)

Mishkin’s older text is the one I studied/used in college. This is the cover of the exact version text I used: https://images.app.goo.gl/M6fqd3umfiasardz6

I took that course under a guy, who was an outstanding professor. He was not an “all star” in terms of published work etc, but a great professor. He had a yearly scholarship he personally funded (at least one annually that I know of, maybe more) that would go to a student in the department. I took 3 courses with him and did relatively well. At the end of the final exam of the last class I took with this gentleman, which was (if I remember right) one term before I graduated, he asked me if I would be interested in a scholarship that would pay a large portion of the fees to study which I think was connected to an actuarial science degree (past my bachelor’s in finance). I hazily recall it was tied to a small “sister university” in Nebraska. He grinned at me and said, “It’s really only a matter of filling out paperwork, I am the one who approves the person”. Can you guess being the complete moron that I am what my response to him was??

I still think of him now and again in my mind. He was one of the kindest and most gracious professors I ever had (before the implied offer). One of the students asked him what he would do when he retired, he said in somewhat serious fashion, but smiling “Visit the Top 10 beaches of the world”. He may be dead now, but I like to imagine him in a long comfortable beach lounger drinking a strawberry daiquiri languidly scanning over his Merrill Lynch account.

Off-topic

Some pretty big news here related to southern border surveillance. It’s a BIG contract, and a rare severe punishment. You can wager this will get ZERO mention on FOX news, because it makes donald trump look bad, and it also shows the ineptitude of private contractors to do a job correctly:

https://www.washingtonpost.com/technology/2019/07/02/border-surveillance-subcontractor-suspended-after-cyberattack-misuse-traveler-images/?noredirect=on&utm_term=.ba360adbbcf3

ANOTHER, of a zlllion stories on donald trump’s Justice Department interfering in FBI operations:

https://www.washingtonpost.com/politics/justice-department-watchdog-to-investigate-decision-to-cancel-fbi-headquarters-plan/2019/07/03/76971d76-9d85-11e9-9ed4-c9089972ad5a_story.html?noredirect=on&utm_term=.194f6b5b8405

And here is some important news for anyone with family/friends in Seattle, especially parents with children or elderly that might need to be admitted into a Seattle hospital:

https://www.seattletimes.com/seattle-news/health/1-patient-dies-5-others-infected-by-mold-that-closed-seattle-childrens-hospital-operating-rooms/?utm_content=buffer8f880&utm_medium=social&utm_source=twitter&utm_campaign=owned_buffer_tw_m

Maybe not worth canceling an important hospital visit, but something to be aware of before entering the hospital.

Curious if Gita Gopinath could ever get the Managing Director job at IMF?? She can crunch numbers. She seems to be very even-tempered. She can do TV and social media pretty well. Doesn’t she deserve that if David Lipton moves on??

It seems you are beating around the bush with Shelton’s views on currency manipulation.

The bottom line is that she is a Gold Standard wingnut conspiracist.

https://youtu.be/VIx_nMysTUY?t=8

That is not a nut, she served the bank of de Rothschild. Follow the money.

Which branch of the Rothschild family? Different branches seem to be suing each other. I googled Judy Shelton and Rothschild and something really bizarre popped up:

https://www.pmbug.com/forum/f4/trump-reclaim-fed-reserve-rothschild-family-3834/

Trump To Reclaim Fed Reserve From Rothschild Family

“President Trump has vowed to reclaim control of the Federal Reserve from the Rothschild family, freeing it from crippling regulations that has held America back for decades. Trump says the Federal Reserve has been allowed to cause interest rates to soar, create huge dept, and slow the growth of the economy for far too long.

WTF?

Here is something even more bizarre:

http://classicalcapital.com/New_Fed_Governors_.html

‘The point has been made here previously that America’s economic system is correctly classified as mercantilism – not capitalism. This has been so since at least 1929, and mercantilists have exerted important influences here at all times, certainly including the colonial and early post-colonial periods. Thanks to the monster called Dodd-Frank enacted by the Obama Congress in 2010, all banks in the U. S. (including the Too Big To Fail Banks of Wall Street) are now regulated principally by the monster from Jekyll Island (the Fed). The Fed, in turn, is principally owned and controlled by the TBTF Wall Street banks, and thus by the Rothschild families.’

This is One Flew Over the Cuckoo’s Nest time. And we thought Trump was bringing mercantilism back!

I’m not going to click on that link, but whoever is writing that has an agenda and is stating the absolute reverse of reality. The Federal Reserve has NEVER applied its regulatory function. That’s why Yellen’s last move as she hit the exit door was so shocking. And shocking is a word I rarely use anymore.

In fact, I would say Yellen’s regulatory move on her last 2 days in her job were easily more shocking to me than finding out donald trump had won the electoral college

Oh, and back in 2010 Shelton was screaming that interest rates were too low and that a 2% inflation target was much too high and that Zimbabwe inflation was just around the corner. Today, she is saying just the opposite. I wonder what changed?

She echoes her Dear Leader’s views exactly, flip-flopping as politically necessary.

Now THAT is a good example of contradiction. Not saying you love banana pudding at age 65 and refused to eat bananas when you were 12. See, we can get this people. We can get it. With Barkley Junior’s help, we can cross that bridge.

I bet there’s a certain Puh-hud Prof in Madison Wisconsin that would agree with a large portion of this FT editorial:

https://ftalphaville.ft.com/2019/07/03/1562149846000/US-aggression-on-the-dollar-will-prove-costly/