Today, we are fortunate to present a guest contribution written by Paweł Skrzypczyński, economist at the National Bank of Poland. The views expressed herein are those of the author and should not be attributed to the National Bank of Poland.

In January 2019 I presented on Econbrowser a couple of probit model examples that enhance the standard U.S. Treasury yield curve slope model with the U.S. Economic Policy Uncertainty Index (EPUI) as measured by Baker et al. (2016). Today, after six months, I present an update that includes the data ending in June 2019. Figures below present the obtained U.S. recession probabilities in-sample and their out-of-sample forecasts. The predicted probabilities along with the forecasts made in January 2019 are reported in the figures and table below.

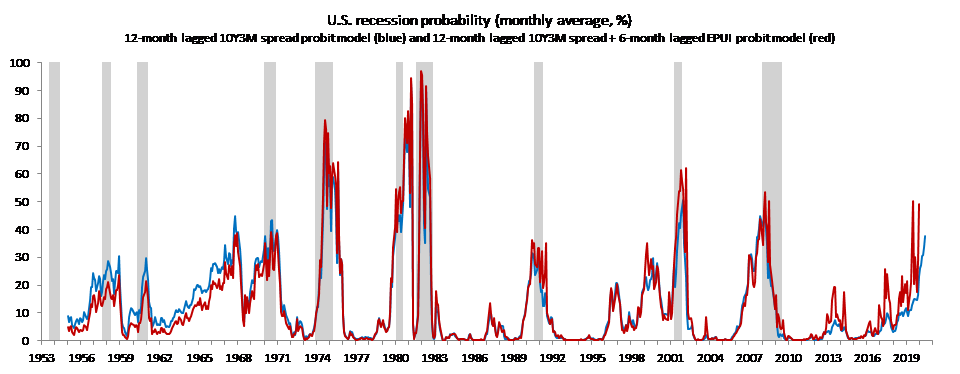

Figure 1: Recession probabilities from 10yr-3mo Treasury spread lagged 12 months (blue), and spread lagged 12 months augmented by 6 month lagged Economic Policy Uncertainty index (red). Source: author’s calculations.

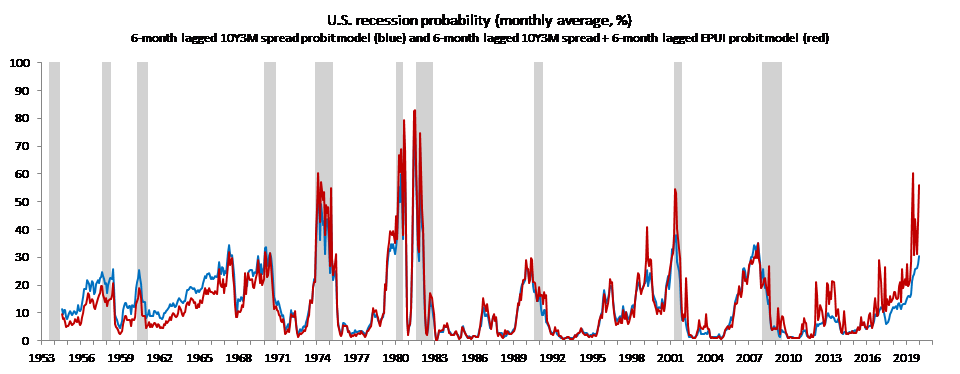

Figure 2: Recession probabilities from 10yr-3mo Treasury spread lagged 6 months (blue), and spread lagged 6 months augmented by 6 month lagged Economic Policy Uncertainty index (red). Source: author’s calculations.

Predicted U.S. recession probabilities

| Specification | January 2019 forecasts | July 2019 forecasts |

| spread_12 | 23.4% in Dec-19 | 37.8% in Jun-20 |

| spread_12_epui_6 | 39.0% in Jun-19 | 49.3% in Dec-19 |

| spread_6 | 21.5% in Jun-19 | 30.3% in Dec-19 |

| spread_6_epui_6 | 51.1% in Jun-19 | 56.0% in Dec-19 |

Notes: Specifications of probit models for the NBER dated recessions binary variable on the lefthand side of the estimation equation are the “spread_12” – model with 12-month lagged 10Y3M spread as the only regressor, the “spread_12_epui_6” – model with 12-month lagged 10Y3M spread and 6-month lagged EPUI as regressors, the “spread_6” – model with 6-month lagged 10Y3M spread as the only regressor and the “spread_6_epui_6” – model with 6-month lagged 10Y3M spread and 6-month lagged EPUI as regressors.

Overall, things have gotten worse since January 2019 as the yield curve inverted and the EPUI remained elevated, which both contributed to the rise of recession odds over the next 6 to 12 months. Current estimates are depicted in Figure 1:

I believe that among others the ongoing uncertainty related to trade and Fed independence are here the key factors keeping the EPUI high, which in case of the presented models implies elevated recession odds.

References

Scott R. Baker, Nicholas Bloom, and Steven J. Davis. 2016. “Measuring Economic Policy Uncertainty.” Quarterly Journal of Economics, vol 131(4), pages 1593-1636.

Update, 7/5/2019 10:15AM Pacific:

I did a little bit of quick calculations assuming the EPUI over 2017:01 – 2019:06 equals the average EPUI during last 2 years of Obama (spreadsheet enclosed). Specification is spread_12_epui_6, parameters are the same as in case of the actual data set used for this model. Predicted counterfactual probability for Dec-19 is 18 percentage points lower.

Figure 3: Recession probabilities from 10yr-3mo Treasury spread lagged 12 months and 6 month lagged EPUI (red), and counterfactual holding EPUI over Trump administration equal to average over preceding two years (blue).f Source: author’s calculations.

This post written by Paweł Skrzypczyński.

This will likely have our Usual Suspects all a flame:

“Overall, things have gotten worse since January 2019 as the yield curve inverted and the EPUI remained elevated, which both contributed to the rise of recession odds over the next 6 to 12 months. Current estimates are depicted in Figure 1:

I believe that among others the ongoing uncertainty related to trade and Fed independence are here the key factors keeping the EPUI high, which in case of the presented models implies elevated recession odds.”

We can only imagine their reaction. It is all fake news. Our host has manipulated the data. It was worse under Obama. And of course – we should never, ever, ever blame Donald John Trump!

I’m tempted to make some remarks here, but maybe Mr. Skrzypczyński isn’t used to my usual facetious BS nonsense. This seems like a solid post and a nice read on the holiday. Uncertainty is on ongoing concern with this White House. On both economic and national security levels.

Although I know Mr. Skrzypczyński’s post is separate from his official duties, and he has nothing to do on these type decisions, I’d like to applaud the Poland Government on their recent decisions to purchase more of their energy in the form of natural gas (or maybe it’s liquid gas when it’s shipped by ocean?? I forgot how that works now). This is a VERY wise move by the Poland government and their citizens (who I assumed at least mildly pushed gov officials on this move). It’s going to pay huge dividends for Poland’s national security longterm, and even, albeit arguably, positive dividends for their economy. It’s decisions like this that can differentiate the largely sad story of Ukraine, from the future positive storyline of Poland, vs its other East European neighbors.

And with that, I say it’s that time of year again folks. This version of the song dedicated to all southern USA white trash, who think the nation state apparatus has a mandate on the language and words people speak:

https://www.youtube.com/watch?v=GvmcjCQs6vw

You gotta turn this one up real loud so you can pick up the sounds more. It’s not helpful to the mood of the song if you think of children kidnapped from their parents in “ICE” or “CBP” cages with no life necessities or basic tools for personal hygiene, so try not to do that, in order to enhance the optimal listening experience.

https://www.youtube.com/watch?v=cM7GZXeH6-g

I always thought it was the mixture of cultures that made America great, but obviously that song (Spanish flavor music played by a Dutch immigrant born in Amsterdam Netherlands who moved to California America when he was age 7) is just crap. They obviously should have put this guitar player in a cage and withheld basic life necessities, he coulda turned out so much better.

I should have specified non-Russian sources of natural gas or liquified gas in the above comment. Hopefully that was semi-implied.

Fourth of July at Coney Island normally means eating a disgusting amount of Nathan Franks:

https://www.usatoday.com/story/sports/2019/07/04/hot-dog-contest-joey-chestnut-blasts-peter-king-criticism/1650851001/

Hot dog champion Joey Chestnut blasts sportswriter for criticizing competitive eating

Nathan’s Famous Fourth of July hot dog eating contest champion Joey Chestnut defended competitive eating after sportswriter Peter King labeled the events as “disgusting.” King, a writer for NBC Sports and longtime Sports Illustrated columnist, criticized ESPN’s recent 30 for 30 documentary focused on Chestnut and the Nathan’s hot dog eating contest. “A shame that as at least a fifth of children in America go to bed hungry nightly they’re highlighting gluttony, treating someone who overeats excessively as a ‘competitive athlete.’ Truly disgusting,” King tweeted July 3 …Chestnut won his 12th Mustard Belt on Thursday, eating 71 frankfurters in 10 minutes. He was four shy of eclipsing his own record of 74 — set last year.

HEY – that is a lot of hot dogs! The woman winner managed to down only 30 dogs. Maybe Peter King has the wrong criticism. Just think of the effect on soybean prices if these contestants gave up the hot dogs for scarfing down obscene amounts of soybeans!

Peter King knew about the research on American football concussions and serious brain damage decades ago. Peter King knew the NFL went with cheaper helmets over safer helmets years ago. Peter King knew the NFL was trying to conceal and obfuscate the scientific research of serious and terminal brain injuries to NFL and college football players. There’s no way anyone could call themselves “well read” on sports or just reading a good city newspaper every other day could say anything otherwise. Peter King spent years cozying up to general mangers of NFL teams and the big money players so he could make a career out of “leaks” about NFL player personnel decisions. But Peter King wants to lecture people about some holiday fun?? Maybe Peter King should get one of those electrical adjustable beds and blow his own hot dog. Or maybe in Peter King’s case, his Lit’l smoky.

The diaper looks good. Do you guys think it’s losing weight now??

https://www.youtube.com/watch?v=q1EQswhs6PQ

Menzie, does your Mom recommend any specific brand of pre-made pork dumplings?? Like pre-made frozen I can then boil or fry?? I know she will say homemade, but sometimes I miss that, and I gave my Chinese friends some of the biggest laughs of their lives watching me trying to fold/crease a dumpling with my hands.

What a great lady Kathleen Hall Jamieson is:

https://youtu.be/uXlYzoQf7NM?t=424

Factcheck dot org on what is happening at the border facilities

https://www.factcheck.org/2019/07/confusion-at-the-border/

‘Acting Homeland Security Secretary Kevin McAleenan claimed that children in CBP custody are receiving “appropriate meals” and showers. But the Department of Homeland Security’s inspector general’s office said it visited five facilities and found children at three of them “had no access to showers” and “two facilities had not provided children access to hot meals.”’

Are they contradicting each other? Maybe not. McAleenan may be following Trump’s policy where no showers and no food is the “appropriate” way to treat these BROWN people. Make America White Again!

Dear Paweł,

Thank you for sharing your models on your January 2019 posting to Econbrowser. I was able to compute your spread(-6) and your spread(-12) models, happily agreeing with your output. I notice that you used recession indicators that agree with the FRED series USREC. When would one use USRECM? I think I recently used USRECM incorrectly.

Below are excerpts from FRED on each method of indicators for a recession.

USREC

“A value of 1 is a recessionary period, while a value of 0 is an expansionary period. For this time series, the recession begins the first day of the period following a peak and ends on the last day of the period of the trough.”

USRECM

“A value of 1 is a recessionary period, while a value of 0 is an expansionary period. For this time series, the recession begins midpoint of the period of the peak and ends midpoint of the period of the trough. Therefore, the recession period includes the entire period of both peak and trough.”

I’m sure the folks at FRED and NBER have a good reason for having two different recession dating files, but for the life of me I have no idea what that reason could be. And FRED’s explanation is clear as mud.

Dear Folks,

Three comments on AS’s note on Pawel’s submission. Both of these are perfectly fine, by the way.

1) To see the indicators AS is talking about, you want

https://fred.stlouisfed.org/series/USRECM

I am skeptical of this, because it doesn’t seem to be based on any economic model, but I could be wrong as usual.

2) The jobs report would seem to be in contradiction to this, as in

https://www.washingtonpost.com/business/2019/07/05/hiring-rebounds-us-economy-adds-jobs-june-unemployment-rate-inched-up-percent/?utm_term=.50fca182196b

even though the unemployment rate has risen slightly. Granted that unemployment may be a lagging indicator.

3) The people who want to make the argument in favor of recession might check the following on leveraged loans

https://blocnotesdeleco.banque-france.fr/en/blog-entry/should-we-be-afraid-us-leveraged-loans

Even with the subprime loans, it took a number of years to build up to a crisis point, and Ben Bernanke was basically insisting there was no serious problem as late as 2006. Once a crisis occurs, you may have a very sharp fall, but the loan amount may not be at the crisis point for a while.

May I just close by thanking Menzie and James Hamilton for running a good weblog, where different points of view are truly encouraged and dealt with reasonably?

J.

Julian,

Thank you for your response to my post. My comment …”happily agreeing with your output” may be a bit confusing. I am not “happily” looking forward to a recession, I was happy that my output numbers agreed with Pawel’s. It is frustrating to try to replicate a posted model and not arrive at the same output.

I hope that Professor Hamilton will update his post from August 13, 2016, https://econbrowser.com/archives/2016/08/why-you-should-never-use-the-hodrick-prescott-filter, where he says, “One interesting observation is that the cyclical component of employment starts to decline significantly before the NBER business cycle peak for essentially every recession.” Updating his model, it looks to me like the cyclical component has not yet started to decline.

The unemployment rate inched up because the labor force participation rose. Employment increased enough to keep the employment to population ratio at 60.4%.

this means that the US econmy will be slowing at best in 2020 just in time for the Presidential election.

America’s offer to throw 5 football games to the Australian Men’s Nation team still holds if you take the Orange Menace from us. You can have Melania also and it’ll be like you’re syphoning off part of our illegal immigrant problem. She’s highly tolerant to sleeping right next to filth so you don’t need to give Melania any soap in her holding cage. Give her an orange colored rodent roughly the size of a hairpiece to pet on her floor mattress and she probably won’t know anything has changed.

This 4th quarter in 2019 which is the beginning of the corporate fiscal season of 2020. 4 trillion of corporate debt now will move to 8 trillion of corporate debt with interest raises. Imo, last years revalue pinged the economy and slowed it down. This one will kill the expansion. 30% drop in stocks. Consumer spending declines in 2020 as job cuts start. Much like the ARMs in the naughts

Not sure where you got this forecast or the current data. FRED claims non-financial corporate debt was $6.4 billion as of 2019QI. But it also shows the history of debt/market value of equity which was less than 34% as of 2019QI.

https://fred.stlouisfed.org/series/NCBCMDPMVCE

In other words for every $100 in the market value of assets, corporations financed with $25 in debt and $75 in equity. Not exactly that alarming.

I think Moses raised this earlier:

https://www.apnews.com/586b1e81cb684654b0cf689b9074c1cb

“Sen. Kamala Harris said Wednesday that busing students should be considered by school districts trying to desegregate their locations — not the federal mandate she appeared to support in pointedly criticizing rival Democratic presidential candidate Joe Biden last week.”

Wait a second – that is Biden’s position. You hammered Biden on this issue but it turns out your position is the same as his was?

The JBH spin machine at work again!

“Yet the stock market with the Dow having made a new all-time high, and the still robust consumer sector which is the economy’s major driving force (along with its downstream implications for the investment sector), are saying something else.”

Gee – the nominal value of the DOW is still WELL below the Glassman-Hassett 36000 mark some 18 years after they said it would be 36000. More importantly this nominal “high” needs inflation adjusted and in real terms, this is not a record high.

https://www.google.com/search?q=dow+jones+index&rlz=1C1GGRV_enSG790SG790&oq=dow+jones&aqs=chrome.3.69i57j35i39j0l4.8667j1j8&sourceid=chrome&ie=UTF-8

Note JBH shied away from talking about booming business fixed investment. I wonder why. Oh yea – its real performance is FAR below what proponents of the 2017 tax cut for the rich said would happen.

Oh yea JBH once again predicts a trade surplus even though the trade deficit has hit a record high!

Trump trolls note – JBH is outdoing the rest of you in terms of the CLOWN SHOW!

JBH wants us to believe that consumer confidence is roaring. Really?

https://www.conference-board.org/data/consumerconfidence.cfm

The Conference Board Consumer Confidence Index® declined in June, following an increase in May. The Index now stands at 121.5 (1985=100), down from 131.3 in May. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – decreased from 170.7 to 162.6. The Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – decreased from 105.0 last month to 94.1 this month.

“After two consecutive months of improvement, Consumer Confidence declined in June to its lowest level since September 2017 (Index, 120.6),” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The decrease in the Present Situation Index was driven by a less favorable assessment of business and labor market conditions. Consumers’ expectations regarding the short-term outlook also retreated. The escalation in trade and tariff tensions earlier this month appears to have shaken consumers’ confidence. Although the Index remains at a high level, continued uncertainty could result in further volatility in the Index and, at some point, could even begin to diminish consumers’ confidence in the expansion.”

Lurkers, again for the umpteenth time we see pgl in his comment tear-down mode. Something like a battery-operated 10 centimeter plastic toy feebly gnawing away at the foot of the Rock of Gibraltar. Never in years commenting on this site have I ever once said anything about Dow 36,000. Yet for the umpteenth time pgl drags it across this page like a devoted cat drags a dead mouse across the floor to its master.

In my initial comment, I did no such thing as shy away from plant and equipment. Here Pgl indulges in his habitual mode of stuffing words not spoken into others’ mouths. I simply kept my comment brief, knowing full well that business fixed investment is the real sector’s big weak spot … for the moment.

Moreover, I nowhere predicted a trade surplus. Once again we are accosted by the unprofessional misuse of the rules of logic via positing a strawman. Pgl being a master of this stupidity and perniciousness. Once the deficit starts to shrink, it can do so incrementally quarter after quarter for years and still contribute positively to real GDP growth the entire time. That’s how bloated the current (initial state of the) deficit is. That it did not shrink last month is a moot point. I myself do not think in picayune terms like pgl. What I do claim is that when the dust raised by tariff wars settles – many months from now, who can predict exactly when? – the US will come out on top with a shrinking trade deficit. As do a majority of the brightest people on the block – hedge fund managers and others running the big money.

JBH: I think pgl can be excused for confusion, given your statement:

Well, you might have said the net export component contribution to GDP growth back in the plus column” if you wanted to avoid confusion. I thought you meant NX surplus as well…

Menzie: Everything you say here is quite right and precisely well taken.

Actual data on real net exports (FRED):

https://fred.stlouisfed.org/series/NETEXC

Last quarter of 2016: negative S766 billion

First quarter of 2019: negative $905 billion

So even if JBH meant to say the trade balance has improved under Trump, he is very wrong!

Original JBH:

“The latter pivots on how soon the tariff wars redound to the US’s favor and put the net export component of GDP back in the plus column.”

Follow-up after my comment seemed to get old JBH all flustered:

“Moreover, I nowhere predicted a trade surplus.”

Seriously?!

The brightest people on the block are apparently NOT waiting for the tens of thousands of federal district court indictments (92,000 was your last count) you’ve been promising for quite some time.

Remember: the glorious night when the traitors will be whisked (“rousted!”) from their beds in their jammies and taken to Guantanamo where they will be tried by military tribunals for their deceit and trickery. And for making fun of the Trump family.

But it will happen soon, right? Oh, I know you’re bound by secrecy (and by pinkie swears with the other guys who have special Ovaltine decoder rings like yours) and that you are unable to reveal the precise moment when America will return to its Constitutional underpinnings and Christian values.

(Sure, having a President who has actually read the Constitution and whose relationship to Christianity has been verified by the likes of Falwell Jr. would help. But we can’t have everything now, can we?)