From Anneken Tappe in CNNBusiness:

The Economist’s Big Mac Index — a lighthearted way to make the value of currencies more tangible — showed that nearly all currencies in the index are undervalued against the dollar.

The Big Mac Index, released Wednesday, is rooted in the theory of purchasing power parity: Exchange rates reflect the value of goods a currency can buy. If currency X can buy an item at a lower price than currency Y, then currency X may be comparatively undervalued and currency Y could be overvalued.

There are two key aspects to recall from this exposition: (1) the dollar is the benchmark, and (2) PPP is the metric. Using (1), if a particular currency is overvalued relative to the dollar, the dollar must be undervalued relative to the particular currency. That makes sense on a bilateral basis, but we live in a multilateral world.

The other concern is (2); as I highlight in my recent survey for the Oxford Research Encyclopedia of Economics Finance, strict PPP is unlikely to hold for countries of substantially different levels of per capita income. Rather, the “Penn effect” holds, so that a proper assessment of currency misalignment should consider the country’s per capita level of income.

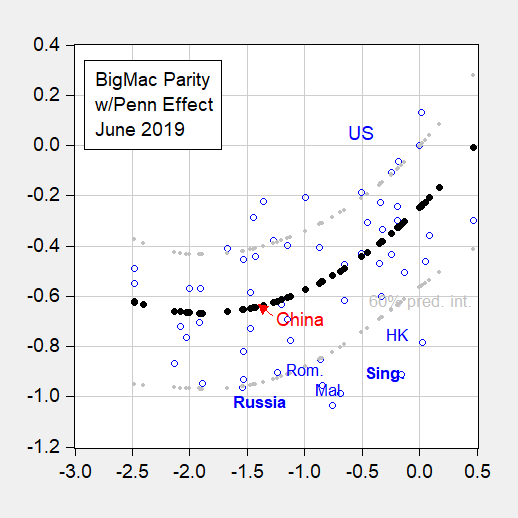

In Figure 1, I present the price of a Big Mac in US dollar terms (relative to the price in the US, logged) against the relative income levels of a country relative to that of the US [both variables in logs].

Figure 1: Log price level relative to US price level plotted against log relative per capita income, both in 2019. Penn Effect line estimated using quantile regression (black) and 60% prediction interval (gray). Source: Economist, IMF World Economic Outlook April 2019 database, author’s calculations.

The nonlinear specification is due to Hassan (2016). Note that the results incorporate the fact that lower income countries have lower prices for Big Macs, instead of using the PPP baseline which would imply a Moldovan Big Mac costs the same as a Swiss Big Mac.

The raw Big Mac data is here.

The prediction interval indicates that there is some imprecision regarding whether the US dollar is truly overvalued, whether the Chinese yuan is undervalued, relative to a multilateral assessment of the best fit estimate of the relationship. (If I’d forced the fitted curve to go through log relative price 0 at log relative per capita income 0, then I’d be assessing the Penn effect in US dollar terms).

The results suggest that if one is using Big MacParity accounting for income levels, then Trump should really be pursuing… Russia (and Singapore). Additional economic reasons to be wary of massive fx intervention on the basis of alleged currency misalignment from Mark Sobel.

For a recent assessment using price level data, see Cheung, Chinn and Xing (2017), referring to exchange rates in 2014.

Update, 7/16, 1:30am Pacific: For more econometric analysis of PPP reversion, etc., re: Big MacParity, see David Parsley and Shang-Jin Wei’s incredibly thorough piece on the subject in 2007 Economics Journal; ungated version: A Prism into the PPP Puzzles:

The Micro-foundations of Big Mac Real Exchange Rates.

“The Russian ruble is the most undervalued against the dollar, by 65%”

And we thought Trump and Putin were BFFs!

“a lighthearted way” – indeed!

“The Big Mac Index, released Wednesday, is rooted in the theory of purchasing power parity: Exchange rates reflect the value of goods a currency can buy. If currency X can buy an item at a lower price than currency Y, then currency X may be comparatively undervalued and currency Y could be overvalued.”

We are not talking about simple commodities. Yes a Big Mac is made up of bread, beef, etc. but the raw food component of what one pays for a Big Mac is only 35% of its price. A lot of the price represents non-tradeable goods such as the labor to put it in your hands and the location where you purchase this. PPP does not necessarily hold for non-tradeable goods.

“Trump should really be pursuing… Russia”

Well, that was a great idea, while it lasted. Did you want to tell donald trump to stop using that orange tanning spray while you’re at it??

Menzie, I commented to you before on an important shortcoming of the Big Mac index, but I’m going to repeat it here: The index tends to understate the purchasing-power-parity (PPP) value of the dollar against countries that have a substantial border-adjusted value added tax (VAT). In constructing the index, the Economist includes all taxes, including any VAT, in the price. But the VAT is rebated at the border and imposed on imports, so it should not be included in the price if the purpose is to get a PPP gauge.

For example, suppose the local VAT is 25% (roughly right, I think, for most EU members). Suppose further that the price of the Big Mac before any tax was $1 in the U.S. and 1 euro in members of the euro bloc, and that you buy the Big Mac in a U.S. state with a typical sales tax (about 5%). Then, Big Mac index would encourage you to believe that the PPP price of the dollar should be about 1.14 euros (= 1.20/1.05). But assuming the state sales tax and VAT are both border adjusted (e.g., not imposed on exports), and ignoring pesky details (like trade and transport margins and the fact that Big Macs are not internationally traded), the dollar and euro prices of exported Big Mac’s would be equal if the price of the dollar was just 1 euro. But at that exchange rate, the Big Mac index would find dollar undervalued. So if the index tells you the dollar is overvalued, the problem is worse than implied.

don: As I mentioned before, a major component of prices overall is labor, so VAT is not relevant in practice, even if it should be in principle. But if you are curious, in Parsley and Wei’s (Economic Journal, 2007) paper, they find accounting for VAT and local sales taxes do not have much of an impact. Ungated version here; this is the best econometrically rigorous piece on the subject I am aware of.

, labor cost, rent, etc.) in 34 countries during 1990-2002, which allows us to conduct a number of useful thought experiments. As a result of our focus on prices and real exchange rate levels we uncover a number of interesting findings. First, we find that the non-traded component of Big Mac prices is substantial, i.e., between 55% and 64%.”

Wow – sort of what I said but with a lot of empirical support!

https://www.youtube.com/watch?v=QzEtE_sbUUE

Two all beef patties, special sauce, lettuce, cheese, pickles, onions on a sesame seed bun.

My stupid computer truncated part of the passage from the article but I think most people get the gist.

It is Judy Shelton day over at Mark Thoma’s place. Three excellent links as to why she is not qualified to be on the FED.

Is your point that the incidence of the tax is primarily passed back to labor in the form of lower wages, rather than being passed forward to consumers in the form of higher prices? In any event, I guess the main question for our PPP comparisons is whether the VAT affects the domestic price level, and the evidence on that effect appears mixed.

The one nation I have never seen have a Big Mac less expensive than one in the US, although maybe it has been at some time or other and I just missed it, is Switzerland. This reflects the Swiss franc long being even more of a safe haven currency than the USD and why they have the world’s most negative interest rates, some of them now even below -0.6 percent, with the Swiss central bank trying to discourage foreigners from holding their currency so as to maintain at least some competitiveness for Swiss industries internationally. After all, they have a small, very open economy.

How does PPP do for master artwork?? Enquiring degenerates on break from “R” studies wanna know:

https://www.youtube.com/watch?v=ob_t3xPBZfo

Lot at stake here in forex markets

Time honored outcome

Intense extensive academic research

Yields a muddle

A weak tea muddle at that

Given the value of an over valued currency

For some systems versus the value of an undervalued currency to other systems

This seems a global trade peace inducing outcome

Worth a peace Nobel

Oh joy – more cryptic babble from the Paine. I do wish you would learn to write coherent sentences someday!

Menzie, do we have an issue here insofar as China suffers from an income distribution radically different from many of the other nations to which you are comparing it? There’s a very wealthy population of 300mm attached to a very poor population of a billion. Not clear that using an average-capita measure is appropriate in that context.: if the big macs are sold only among those 300mm, you can’t compare it to per capita income. There are what, 10x the number of McDonalds in the US as in China? The correlation of McDonalds locations to income in China would seem to REALLY matter here.

formereconomist: You think China is the only country with a skewed income distribution? Your critique could apply to a bunch of developing countries…

i think China’s income distribution is so skewed it’s not comparable to most of the other countries. you should as well. the broader point is that the skewness of the income distribution and the distribution of McD’s within a country matter, and that the Big Mac measure is kind of silly unless it addresses that.

I’m not sure you’re getting the gist of using “The Big Mac Index”. It could also be representative of many other consumer goods. Food is actually a larger percentage of poor and lower income families spending than it is for wealthy people. What % of their own income does the 300mm group put into Big Macs vs that lower billion as a ratio of their income?? If the price of Big Macs raises or lowers can we generally assume other food products prices are raising or lowering with it?? I would strongly argue the answer to that question is “Generally, YES”. So again, if we’re talking food goods, food consumables, however you wanna say it, it’s a pretty good gauge on how lower income are obtaining value from their own currency.

I don’t think Menzie is arguing “The Big Mac Index” is the optimal gauge. Neither is kicking the tires on your car to check air pressure the “most optimal” way to check the pressure on your tires before a long journey from East coast to West coast USA. But you know what?? Kicking the tires on your car to check the pressure still has some value, and it beats guessing what it is, with your children riding in the back seat.

The Big Mac index has a long history. As I understand it – Menzie is presenting reasons not to take this age old tale all that seriously. After all – labor is a large part of what one is paying for when one buys a Big Mac. And the idea that PPP applies to haircuts is absurd. Look one pays a fortune for a SuperCuts in Manhattan whereas they are great barbers in Brooklyn at reasonable prices. And yea we residents of Brooklyn think of Manhattan as a foreign nation!

The World Bank is a handy source for Gini coefficients across nations:

https://data.worldbank.org/indicator/SI.POV.GINI?view=map

It seems this measure of income inequality is actually higher for the US than it is for China.

“There are what, 10x the number of McDonalds in the US as in China?”

Your source for this is ???? BTW – even if Americans eat more Big Macs than the Chinese, how would that necessarily affect the price? I’m sure we use more gasoline per capita too. But that does not impact the price of oil here v. China. It would say the Chinese might have healthier diets than many Americans.

From the McDonald’s 10-K filing:

“The Company operates and franchises McDonald’s restaurants. Of the 37,855 restaurants in 120 countries at year-end 2018, 35,085 were franchised.”

Which means 2770 were company owned stores. These company owned stores generated $10 billion in sales last year of which about 25% were in the U.S. The franchised owned stores generate $86 billion in sales. The only indication of how the foreign based sales were allocated by nation:

“International Lead Markets – established markets including Australia, Canada, France, Germany, the U.K. and related markets.” (the big 5)

“High Growth Markets – markets that the Company believes have relatively higher restaurant expansion and franchising potential including China, Italy, Korea, the Netherlands, Poland, Russia, Spain, Switzerland and related markets.”

pgl: a few things.

1) the measurement of income in China is highly unsatisfactory, particularly vis the top of the distribution. Just think about the number of billionaires in China and the number of poor people in China. I don’t have a well-quantified comparison of the skewnesses, and based on the quality of data collection in China, anyone who does is a joke.

2) My source for the # of McD was just a quick google of “how many McDonalds are there in __” and comparing what google said for China vs. the US. Highly unscientific, and if you have a good number, I’m happy to accept it. My mental arithmetic was wrong and the ratio is closer to 6 — wasn’t devoting 100% of my brain capacity to this.

3) It makes absolutely no difference whether the restaurants are franchised or not. What matters is the price of the Big Mac sold, not whether the profits are remunerated to a local franchisee or the parent company.

4) Per capita consumption does not matter, but the correlation between local consumption and local incomes does matter in the presence of skewness. If the Big Macs exist only in high- or low-wage districts, comparing the average income to the average BM-price is going to give you a biased result.

“1) the measurement of income in China is highly unsatisfactory”.

So you are saying this CIA source has it wrong? Excuse me but I do not see you provided an alternative and more reliable comparison.

PGL, you’re not even wrong here. There is NO satisfactory measurement of the income distribution in China because their statistics methods are primitive at best and deceitful at worst. The CIA doesn’t even attempt to provide characteristics of the distribution beyond the first moment (which it does with a great deal of uncertainty given the problems in data collection over there..). I would except the money/credit data, which at their best are reasonably reliable. If you understood any part of my point (which Menzie didn’t even try to address but simply deflect to distributional differences in other countries too), it’s that the average alone doesn’t give you enough information.

i apologize to Menzie. re-reading his response to me, it seems he did accept my criticism of the Big Mac index more broadly.

noneconomist: Well, no, I didn’t accept it, didn’t reject it. I merely observed that many countries have a higher measured Gini coefficint than China…

“It makes absolutely no difference whether the restaurants are franchised or not. What matters is the price of the Big Mac sold, not whether the profits are remunerated to a local franchisee or the parent company.”

McDonald’s does treat its company owned stores and its third party stores similarly so yea. I just tossed that interesting information into the discussion because some people here think China is stealing our IP. They’re not in this case. Of course a lot of the know nothings here are never read a 10-K filing even if http://www.sec.gov makes it very easy to do so.

@ pgl

It might interest you to know there are blatant rip-offs of McDonald’s in China—that aren’t actually “franchises”. I ate at one regular during a short summer job I had in northeast China in a lower populated city (not because I liked it “that much”, but because my boss at the time had part ownership in it). I’m not really wanting to argue with you on this, because it’s not worthy of arguing about—but your example is pretty silly and trifling as it relates to IP theft, which, I’m going to dare say it, even Menzie would recognize and confirm as a very legit problem—and a problem worth addressing with good/pragmatic U.S. policy measures, which I’m assuming Menzie would take on in a more multilateral fashion. But I am walking towards the dangerous waters of putting words in Menzie’s mouth so I will stop there.

Now now, pgl, clearly you are just terribly naive. Those sneaky smart Chinese are right now not only stealing the tech of McDonald’s they use to make their famous french fries, but they are improving it, or at least figuring out how to make them more cheaply.

So beware. Soon we shall see Alihuaburgers start up with franchises in Tokyo and Paris and LA and New York undercutting McDonald’s on their glorious french fries. This IP theft will be another step into the inferno for the long run of the US economy.

Oh, and they will steal and improve the tech for Big Macs too. I have no idea what that will do to the Big Mac index, although probably it will make it even more useless and misleading for sure.

Kelly Anne Conway goes full racist:

https://talkingpointsmemo.com/news/kellyanne-conway-fox-news-trump

White House counselor Kellyanne Conway says that the President’s ire doesn’t stop with the four congresswomen he’s been incessantly tweeting about for days — but that he’s also “sick and tired of many people in this country. Forget these four,” she continued Tuesday on Fox News. “They represent a dark underbelly in this country of people who are not respecting our troops, are not giving them the resources and respect that they deserve.”

****

Sick and tired of blacks, Muslims, Asian, Hispanics! DARK underbelly – huh?!

****

https://talkingpointsmemo.com/news/conway-reporter-ethnicity-trump

Andrew Feinberg, White House correspondent for Breakfast Media, was trying to ask which countries President Donald Trump was suggesting that four congresswomen — all U.S. citizens — should “go back to” Tuesday afternoon when White House counselor Kellyanne Conway sharply turned the question back on him. “What’s your ethnicity?” she asked. Feinberg paused, seemingly taken aback. “Uh, why is that relevant” he asked. “No, no, because I’m asking you a question,” she said. “My ancestors are from Ireland and Italy.” “Kellyanne, my ethnicity is not relevant to the question I’m asking,” he responded.

****

Mr. Feinberg probably does not get that Conway disdains Jews!

Make America White Again!

Wow Kelly Anne’s husbands knows how to tell the truth about Trump being a racist:

https://www.usatoday.com/story/news/politics/2019/07/16/george-conway-trump-racist/1741855001/

I never condone men telling their wives to shut up but in this case I will make an exception!

Senator Turtle (McConnell) is a coward and a liar:

https://time.com/5627657/mcconnell-trump-racist-tweets/

Senate Majority Leader Mitch McConnell says President Donald Trump is “not a racist” after Trump tweeted over the weekend that four congresswomen of color should return to their native countries. All of the congresswomen are American citizens. McConnell said at a news conference Tuesday that political rhetoric has gotten “way, way overheated across the political spectrum.” He pointed to Democratic comments, saying “we’ve seen the far left throw accusations of racism at everyone.”

Hey – this turtle to married to someone named Elaine Chao. I hear one of the reporters tried to ask him if his wife should go back to China.

I don’t doubt that on a personal level, the bastard loves her. I will give the bastard that much. But it’s fascinating to note that McConnell, who lives in and pays homage to one of the most racist states in the 50 of the Union, the man name drops his wife as often as if he was a cousin to Hitler. I would argue, if the man loved her as much as a man should love his wife, he would do more work for her than just behind the scenes, and would speak proudly of her in public.

The reality is they are BOTH horrid human beings irregardlous, unrelated to, and unconnected to their races.

OK, your reply has me puzzled. Suppose labor is 100% of the price of the Big Mac. Then a tax rate of 25% for a credit-invoice VAT would raise its internal price by exactly 25% relative to the price of its exports (in the admittedly unlikely event that it was traded).

I have never found an empirical failure to find an effect very convincing. To me, such a finding means only that one cannot assert that the effect is significant, not that one can assert that it is not significant. The latter requires me to accept the premise that the empirical experiment truly anticipates all possibilities, something that I think should be demonstrated rather than assumed.

In theory, a VAT should affect relative prices, either through adjustment of the exchange rate, or through the adjustment of internal prices. It’s hard for me to see why that effect would not exist in a world where real exchange rates are strongly influenced by PPP, especially at levels of the VAT as high as 25%. if that effect does not, in fact, exist, then proving so empirically would be very hard indeed (as proving a negative usually is), but I would rather see a positive experiment showing the effect is small, or at least a compelling theoretical story as to why we shouldn’t expect the effect to exist, even in a world where PPP has strong influence.

There is an entire literature on why you have it all wrong here. A lot of this came up in the discussions of the Destination Based Cash Flow tax debate.

The classical paper by Martin Feldstein and Paul Krugman that debunks the view you are articulating:

https://www.nber.org/chapters/c7211.pdf

READ. IT. VERY. CAREFULLY!

It seems you have (understandably, perhaps) taken the wrong interpretation of my term “relative price.” I know that the VAT does not affect international competitiveness. For example, under the destination principle of border tax adjustments, the price of the county’s exports is not affected – the addition of a VAT adjusted increases the price to domestic consumers, but as the VAT on exports is rebated, so it leaves the export price unaffected. The price of imports rises by the amount of the VAT, but so does the price of the competing domestic good. With border tax adjustments under the origin principle, the tax would remain on the exports and not be imposed on the imports. In this case, the tax is still “trade competitiveness” neutral, but requires an adjustment of the exchange rate, or of the domestic prices. In either case, the VAT raises the price of domestic consumption relative to international (pre-tax) prices. That is why it needs to be accounted for in the purchasing power parity comparisons. One way to do this would be to measure the domestic prices without the VAT. But the Big Mac index uses uses the price inclusive of the the VAT, so the VAT distorts the PPP comparisons.

Let’s suppose we had high inflation for a year. The nominal exchange rate adjusts so as to keep all relative prices the same. You are noting that VAT does the same thing. Of course the point of something like the Big Mac index is to address the former effect so I’m not sure there is anything to add from your latter effect. Inflation neutrality / VAT neutrality. It also seems to be the same thing.

“Let’s suppose we had high inflation for a year. The nominal exchange rate adjusts so as to keep all relative prices the same.”

Exactly my point. Measuring the PPP exchange rate without taking account of the inflation would be like measuring the PPP exchange rate without taking account of the VAT. (But see my reply to Menzie’s comment above – there is a question of whether the VAT actually raises nominal prices.)

“Barkley Rosser

July 16, 2019 at 12:08 pm

Now now, pgl, clearly you are just terribly naive. Those sneaky smart Chinese are right now not only stealing the tech of McDonald’s they use to make their famous french fries, but they are improving it, or at least figuring out how to make them more cheaply.”

Barkley – thanks as this made me laugh. OK, McDonald’s makes decent French fries but they have already been outdone at least in Los Angeles. Fat Burger – best hamburger and fries EVER. Maybe they went to China Town to learn how.

https://www.youtube.com/watch?v=cQp9RC2sfT0

If you’re in the neighborhood, I promise you won’t regret it. Taylor’s in Marshalltown Iowa. Not far from either I-80 or I-35

https://www.maidrite.com/maid-rite_history.html

Taylor’s in Marshalltown is the best of all the Maid-rites franchises, and it’s not even close. Burgers and malts are the specialties (fries not so much).

Wow – that looks good. If I’m ever in the neighborhood – will have to try it out!

Have not had the pleasure of visiting a Fat Burger. But given a fast food parameter, I’ll stick with In-N-Out and the Double-Double with cheese. (Had one today in Sacramento) Fries are ok. but they have different texture because they’re cooked fresh, not pre (flash?) fried/frozen.

Surprisingly, the best burger I can remember was a juicy charbroiled dandy (there was a real char pit, as I recall) at a Carl’s Jr. in Orange County (in the corner of a Fullerton strip mall) when there were only a few such places long before the company went public, long before Carl got the boot, and few knew much about Carl and his extreme far right leanings.

In-N-Out rocks too. California has the best hamburgers. In NYC we have Shake Shack which is OK but these New Yorkers who think it is the best ever are clueless.