In a 2015 Cato Institute session, Fed Board Nominee Judy Shelton discusses whether to trust or not official GDP and inflation statistics (she says no — see 1:07:07) (h/t Sam Bell).

This makes me wonder (1) what is the basis for her beliefs, and (2) what would she use that is different.

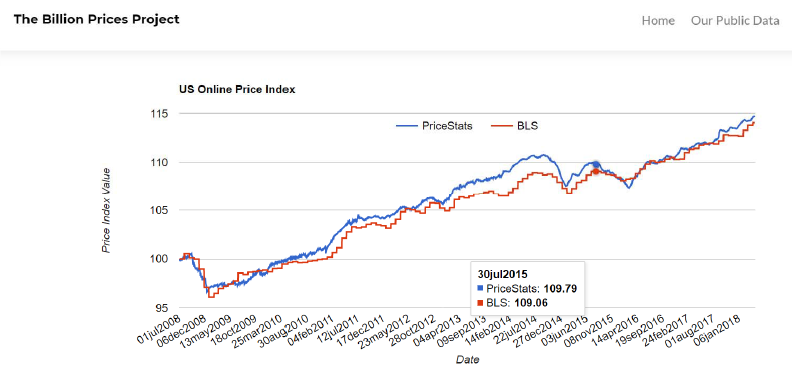

Let’s consider inflation, presumably CPI inflation. One recent innovation is the Billion Prices Project’s price value indicator (see Jim’s post on this subject). For the US, the comparison against the official CPI series is depicted below.

Source: Billion Prices Project, accessed 7/19/2019.

With both series rescaled to July 2008, the price levels are virtually the same at July 30, 2015, the day of Dr. Shelton’s speech. It might be that Dr. Shelton is consulting Shadow Government Statistics; if so, I hope she will immediately cease and desist (per discussion by Jim Hamilton, and subsequent “debate” with ShadowStats’ John Williams).

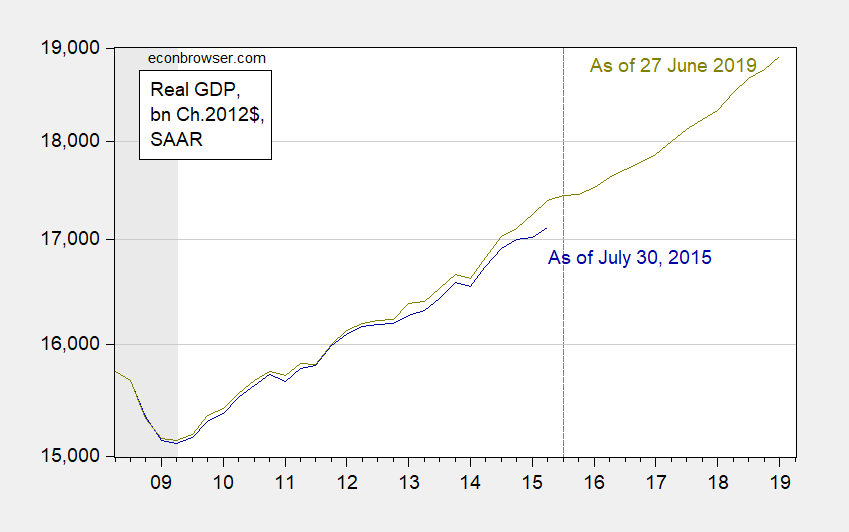

What about GDP? Well, here she might be on slightly firmer footing, although it leaves open the question of what would be a better indicator of total economic activity. In point of fact, with revisions based upon more detailed data, GDP was actually 1.6% higher than estimated in 2015Q2 (she had access to an advance estimate of GDP as of 30 July 2015). I suspect her view at the time was that reported GDP was lower than actual economic activity…

Figure 1: Reported GDP as of July 30, 2015 (dark blue), and as of June 11, 2019 (chartreuse), both in billions of Ch.2012$, SAAR. July 2015 vintage series rescaled from Ch.2009$ to Ch.2012$ using ratio of implicit GDP deflator in 2009 vs. 2012 (0.95004). NBER defined recession dates shaded gray. Dashed line at 2015Q3, encompassing Shelton’s statement. Source: BEA via FRED, and ALFRED, and author’s calculations.

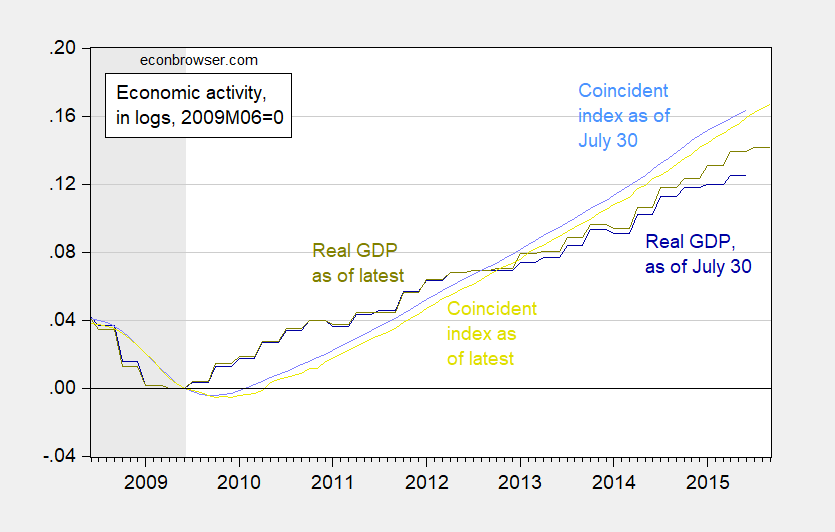

How about alternative indicators to GDP. Well, there are numerous, but they usually aim at detecting cyclical fluctuations in advance (CFNAI, monthly GDP from Macroeconomic Advisers, etc.). [As an aside, an interesting high frequency measure recently developed is described here, and compared to Aruba-Diebold-Scotti.] I suspect that Shelton is uninterested in this high-frequency/cyclical aspects, and more in the trend. Here, I compare the July 2015 and latest vintage of GDP measures, plotted against the Philadelphia Fed coincident indices of comparable vintages.

Figure 2: Reported GDP as of July 30, 2015 (dark blue), and as of June 11, 2019 (chartreuse), SAAR, and Philadelphia Fed coincident indices as of July 30, 2015 (light blue), and as of June 28, 2019 (light chartreuse), all series rescaled to log 2009M06=0. NBER defined recession dates shaded gray. Dashed line at 2015Q3, encompassing Shelton’s statement. Source: BEA, Philadelphia Fed via FRED, and ALFRED, and author’s calculations.

Note that the advance GDP release available to Shelton in 2015 understated real GDP as we understand it in 2019. The coincident indices also suggest that economic activity is higher than indicated by GDP, although given the normalization on end-of-recession (June 2009), the gap is only 2% in log terms, using the latest vintages.

So, we are left with wondering exactly what Dr. Shelton believes those key price and activity variables that the Fed follows (technically, it’s PCE deflator rather than the CPI, but you get the idea). Of course, if as indicated elsewhere, she wants the price of gold as a nominal anchor, this discussion is moot — and she’s just a data-conspiracy crank like so many others.

I will also say that if she plans to implement retaliation for currency manipulation by other countries, she had better figure out what variables to look at, and whether they are measured correctly (here I think there is room for debate, although I think she would say if another country pegs its exchange rate, its prima facie evidence of manipulation).

I’m quite certain that Judy Shelton would disagree with me, but I’ve always believed we should be more concerned with a properly measured Net Domestic Product (NDP) rather than Gross Domestic Product (GDP). Why? Because NDP tells us how much we can consume today without reducing how much we can consume tomorrow. High GDP growth that includes a high depreciation component is a better measure of waste than it is a measure of economic well-being. But we also need to improve the way we compute depreciation of natural resources. I’ve always been impressed by this paper:

https://www.sciencedirect.com/science/article/pii/004727279090002Y

So if the official numbers do not support Shelton’s right wing spin, they have to be fake numbers. When other credible estimates move further away from the right wing spin – they must be Communist lies or something like that. Judy Shelton sounds a lot like CoRev in this regard. Time to consult Dr. Kelly Anne Conway for her “alternative facts”!

Judy Shelton sounds a lot like CoRev in this regard.

Apparently CoRev would want BEA to only publish “raw” economic data so that he can employ his deep knowledge and expert data cleansing skills on the “raw” data.

John Cochrane puts his two cents on the gold standard:

https://johnhcochrane.blogspot.com/2019/07/all-that-glitters-is-not-gold.html

Menzie – your thoughts on what he has offered?

Send her back!

Judy Shelton is obviously a crank, but Christopher Waller does seem to have the proper background. Just what are Christopher Waller’s economic beliefs?

Richard A.: Suggest punching his name into Google Scholar. I think that will give you some idea, especially with respect to ideas of discretion vs. rules based approach to monetary policy.

I am surprised but not displeased that Waller has been nominated. He seems quite reasonable.

The main thing I have seen said about him is that he is very close to his superior at the St. Louis Fed, its president, James Bullard, whom I know quite well. I saw somebody complaining that this would be a bad thing because he would just replicate Bullard’s views. But Bullard is one of the smartest and most knowledgeable people on the FOMC. I do not know if it is still true, but during much of the Bernanke and Yellen periods, Bullard was viewed as the key swing vote (when he had a vote) and when not a key influencer of the vote. If he spoke about a change in policy, it was very likely to come about in the near future.

For a number of years he was the only FOMC member to be a coeditor of a major economics journal, in his case the Journal of Economic Dynamics and Control (JEDC). As it was it became too much and there were complaints he was not putting in enough time on it, so he stepped down unsurprisingly.But he was Director of Research at St. Louis before becoming president, which I think is Waller’s position. Bullard has done vey sophisticated and high-powered work. Menzie and Jim can attest that JEDC is a high-powered journal, and Bullard has also published in the Journal of Economic Theory, which is about as mathy high powered as it gets.

So, if Waller is a Bullard follower, well, bring him on, please.

BTW, Menzie certainly knows what is involved in coeditiing a major journal as apparently he is doing that for the Journal of International Money and Finance, which is basically the top journal in international macro and exchange rate modeling, which means he gets to see what is really going on in the cutting edge research on these matters.

Everyday Menzie shares with “the common man” on this blog is gold. Whether they ever realize that fact or not. A free resource from one of the best in his field in the world.

https://www.youtube.com/watch?v=jjaqrPpdQYc&t=0m12s

https://www.youtube.com/watch?v=0KxMc_tyQBo

I never thought James Kwak would hang his blog up—it’s good to keep in mind while consuming these posts.

l have just checked on Chistropher Waller specifically, and he has published papers in leading journals such as Journal of Monetary Economics and Journal of Economic Theory, with some highly respected coauthors, including David Andolfatto, a leader of the New Monetarist School of thought, and also with Randall Wright, one of the most important current monetary theorists, who happens to be at UW-Madison with Menzie. He is a sharp contrast with the wacko and hypocritical Shelton.

Dear Readers,

Reading various posts by Professor Chinn and Professor Hamilton, and from other sources, I am not a fan of the gold standard. Paraphrasing Professor Hamilton from one of his posts, I think he said that exceptional economic progress in the 19th century was perhaps correlation with the gold standard and not causation. With that said, is there any value in having Judy Sheldon on the Fed Board as perhaps someone who would express an opinion different from the other members? Again, this is said as a question, not an endorsement.

AS: Different informed views, yes. Different uninformed views, no.

exactly menzie. would you see any value in having somebody like corev serving on any board? obviously no. i would add another angle to your comment menzie. you also do not want somebody who is informed, but intentionally dishonest and opaque in their assessments. on this board, i would use rick stryker as an example. while dick is knowledgable, he is also intentionally dishonest in his assessments. you not want dishonest views on a board either. they are more dangerous than stoooopidity like corev.

“would you see any value in having somebody like corev serving on any board? obviously no.”

This gives me a chilly moment. Bear with me. When Herman Cain withdrew – we got Stephen Moore. When he withdrew we got Judy Shelton. If we can muster enough protests to get her to withdraw – who’s next? I would not put it past Trump to nominate CoRev.

I’m sad to say CoRev is all booked up for the next 2 months. He’s selling tickets for a road show version of Letterman’s “Stupid Human Tricks” in which he performs multiple feats of trickery such as doing a special rendition of Lee Greenwood’s “God Bless the USA” by making fart noises between his lips and hands.

Thanks for the comment.

Menzie, I have to say, you have given a lot of great answers in your time. That one has to rank in the top 20 somewhere. Succinct and you NAILED it.

People can have differing views. That doesn’t mean we go down the street avenue labeled “Celebration of Ignorance”.

You remind me of James Kwak sometimes in the days Professor Kwak was an active blogger Menzie, you take something that could be seen as “self-apparent” that no one else is “calling out” and you call it out and you nail the matter right on the head.

I see you mob spending whole time on soybean as being “intentionally dishonest”.

We got it that when back being a civilian, Trump may stand a trial. But the jury is still out who’ll be the next President.

Wow, Zi Zi, one of the stupidest posts I have seen here for awhile. This thread is about Shelton, a candidate for being a Fed governor. But you make stupid snarky remarks about soybeans. And then you note the totally obvious: we have no idea who will be president on Jan. 20, 2021. Duuuuuuuuh.

more evidence that zizi is a bot from a troll farm. incoherent statements with a spattering of clickbait phrases. it actually results in a slightly more elevated level of discourse than what comes from corev. i guess it is evidence that AI is capable of exceeding some levels of human capability, today.

I should tell you to make sure you turn the sound on, on the video GIF after you make the two link jumps:

https://twitter.com/ndrew_lawrence/status/1152048480594137090

https://twitter.com/bad_takes/status/1152050412377260032

Well, I don’t know about you kids, but all my questions have been answered. I’m ready to declare DershBag 100% innocent. “Perfect”. “Case closed”.

I haven’t felt this convinced of something since CoRev told us U.S. market soybean prices were headed to the sky.

https://www.theatlantic.com/ideas/archive/2019/07/evangelical-christians-face-deepening-crisis/593353/

By the time Reagan had taken office my father had already become cynical about many things in America, and before he died, let’s say roughly the 2008–2012 time period, my father became convinced that democracy wouldn’t survive in America. I have said before on this blog that I silently (in my head) chuckled the latter thought from my Dad off. Now, day by day, I am believing more and more in my father’s thoughts on the limited lifespan of American democracy, and I am genuinely thankful that my Dad never got to see America as it currently subsists.

My Dad voted for Carter, Jesse Jackson (before the “Hymie-town” incident), Mondale, Clinton, and his last presidential vote was for Obama (which he was enthusiastic about before President Obama’s first term). It may shock some here, that my Dad detested both Pelosi and Hillary—for what I believe to be obvious reasons. For the record, there were many female politicians my father liked. Ann Richards is one who immediately comes to mind:

https://en.wikipedia.org/wiki/Ann_Richards

https://en.wikipedia.org/wiki/Ann_Richards#/media/File:Texas_Governor_Ann_Richards,_His_Excellency_Nelson_Mandela,_Dominique_de_Menil,_Texas_State_Senator_Rodney_Ellis.jpg

A great lady. They aren’t making anymore of her model it seems……. Not in the south USA anyway……

What I meant by spending whole time on soybean is that very few Trump hater is commodity expert per se. If your intention is to report about soybean — fine. If you have another agenda in writing about it, actually it’s a waste of time for you and readers, and eventually tax payers’ money stacked on you.

You cannot be an agriculture expert today, then a health care expert the next, just saying.

Barkley, continue barking.

Zi Zi: I’m the guy writing about soybeans. It’s on my time I’m doing this (it’s even summer break!). How does this impact the average American taxpayer. And what do you care about the taxpayer, when you are writing in from the UK?

Ah Zi Zi – the issue in case you missed it was something to do with the Trump trade wars. Now if you wish to defend mercantilism – be our guest.

“You cannot be an agriculture expert today, then a health care expert the next, just saying.”

Ever heard of Ken Arrow? He wrote the seminal article on health care economics. And I bet he knew a lot about agricultural economics. Just because you know absolutely nothing about economics does not mean someone else can apply economics to two different sectors.

Of course it has been Menzie writing about soybean prices, indeed in regard to the impact on them of the Trump tariffs, although he drew on his own published work on the matter.

Funny you should make a claim that I cannot be an expert in more than one area of economics, Zi Zi. As it is, although it did not end up in any refereed econ journal articles, I did work on modeling ag prices at one point, and I have also written about health economics in my best selling book. Indeed, it turns out that I have published in a wide variety of sub-fields of economics, something easily checked by googling my name and “Google Scholar citations,” which, curiously, does not even list my two most cited publications. As it is, I have also published in refereed academic journals of disciplines outside of economics, including physics, mathematics, biology, computer science, philosophy, psychology, sociology, finance, and management, among others. Also, the late Kenneth Arrow provided an approving blurb for one of my books. I am no Ken Arrow, but like he could, I can walk and chew gum at the same time at least some of the time.

So, Zi Zi, you really picked on the wrong person to make your idiotic remark about.

Zi Zi You have the denizens on this site pegged perfectly. They are amongst those whose heads exploded on the eve of November 8th 2016. This site’s not been the same since. Jim Hamilton posts rarely at all anymore. It’s become a full-out attack on President Donald Trump. Schoolyard bully ridicule about the color of his hair. Trump Derangement Syndrome run rampant. You cannot have a rational discussion anymore. Trump sends Judy Shelton’s name to the Senate for confirmation. In a flash she’s attacked and besmirched mercilessly. No substantive discussion about her views is brooked. Menzie Chinn often no longer addresses the main issue, but slides off comments. Sound money is simply a third rail to these people. Their minds, as I’ve said before, are hermetically sealed. Corev gets pelted with soybeans. Hundred-long comment posts that are not really at all about soybeans. Just as the slurs slung at the president are not about the color of his hair. They are about bashing and attacking whomever does not fall in line with the Marxist view here. This has become the Antifa of economic blogs. It is a microcosm of the cultural decline of America.

JBH: I think there are several posts wherein both Jim Hamilton and I have concluded that resumption of the gold standard would be a recipe for disaster. Weren’t those substantive discussions of her views?

I would welcome your explication of why what I have written about soybeans, futures, and forecasting, has been in error.

Since you have come to the point of calling my views “Marxist” (gee, when did I appeal to the labor theory of value, or dialectical materialism?) and called this the “Antifa of economics blogs”, then you will not mind being banned.

Did you just accuse the eminent James Hamilton of being a COMMUNIST?!

Wow, pgl, I must say that you and JBH have his the nail on the head. I must now reveal the secret past of apparently mild-mannered and apolitical James Hamilton.

When I first visited him decades ago in Rouss Hall in Charlottesville, I was a follower of the Schachtmanite tendency that split in 1940 from the Trotskyist Fourth International Socialist Workers’ Party. But as we discussed and debated oil prices and time-series econometrics, I came to learn that not only was he a Marxist, with all three volumes of Das Kapital in the original German along with the three volumes of Theories of Surplus Value, hiding on his bookshelf behind a bunch of books on probability theory, but he was also a fire-breathing Maoist who kept the Little Red Book of Mao quotations in his desk drawer. We agreed that oil companies should be nationalized and put under the control of command central planners and that there should be communist revolutions in OPEC nations to deal with oil prices. We also agreed that the famines in USSR and China were necessary for helping to eliimnate class enemies in the countryside. But we really had it out over time-series econometrics.

I was defending the reactionary capitalist Box-Jenkins ARIMA approach, while he was pushing his new regime-switching method. Most may think that is all about looking for changes in trends in such things as foreign exchange rates or GDP growth, but the real motivation for it was to encourage revolutionary regime changes, with his inspiration coming from his study of class warfare and dialectical materialism as promulgated by Mao. The crucial moment when he won me over was when he pulled out the Little Red Book and began shouting “Serve the People! Serve the People!” How could I resist?

He may give talks at the conservative and traditionally anti-communist Hoover Institution, but make no mistake, he still keeps that Little Red Book of Mao quotations under his pillow at night. This obviously explains why he would invite a screaming Marxist with the last name of “Chinn” to be his co-blogger here.

Thank you, JBH, for bringing this deep truth to our attention.

“Schoolyard bully ridicule about the color of his hair. Trump Derangement Syndrome run rampant. You cannot have a rational discussion anymore. Trump sends Judy Shelton’s name to the Senate for confirmation. In a flash she’s attacked and besmirched mercilessly.”

Hey I get why Shelton should be on the FED! Trump’s hair looks like gold so if we adopt a gold standard, he profits from that too! Everything to make Trump richer at the expense of the rest of us! MAGA!

What we espy in this post is a paucity of imagination. Frogs are not capable of imaging what birds do see. This post ribbits to all the frogs in this frog pond which Econbrowser is. Sheldon bad, ricochets the skipping pebble. Gold bad.

Judy Sheldon is of course furthest from frog. She is a bird. The distinction is as early as Goethe. As such she is able to see what frogs cannot, and she thinks in ways frogs do not. Not lost in all manner of pedantic detail as are frogs (reread this post for what it really is), what she sees from her angle of vision is that the juggernaut Federal Reserve needs reigning in. It needs a governor in both senses of the word. It has, over its 106 years of existence, finally driven this once vibrant economy deep into a box canyon walled high with debt. Made debt slaves out of the population.

It is far past time that someone with a finer perception than frogs takes a place on the inside to stop this foolishness. Gold, of course, is utterly beside the point. It is merely one of many possible governors of the great travesty of fiat money made out of nothing.

JBH: so you agree w Dr Shelton, don’t trust govt GDP and CPI statistics? What is your alternative? *That* was the point of the post, not who had the grand unified theory of the universe.

Menzie: You misdirect. This is about sound money. Period.

JBH: For you, it’s about sound money. For the rest of us away from la-la-land, it’s about what she believes about the data she would receive as a FRB governor.

Maybe we should ask JBH for what on earth he means by “sound money”. I guess the nitwits who use this term mean zero inflation forever. Of course if one is a gold bug or the Stephen Moore variation – one distrusts the usual measures of inflation. In Moore’s case, the commodity boom meant prices for everything were making America = Venezuela. So we need tight money during Obama’s first term!

Sound money? The clarion call from people whose mind is not sound!

Someone has spent WAY too much time bird watching.

I LIKE bein’ the Econbrowser regular reader froggy shade of green. Turn it up nice and loud so you can hear the flute.

https://www.youtube.com/watch?v=gLJocgU8xAs

JBH You’re taking the wrong lesson from Goethe. Are you familiar with the old German wives tale of “a pike in a carp pond”? Back in Goethe’s day pike was considered a garbage fish and carp was considered a delicacy. People believed that putting a pike in a carp pond would keep the carp active and therefore tastier. In Goethe’s “Faust” the Mephistopheles character plays the role of the pike and urges Faust to constant restlessness. I can see where having Shelton on the FED could rouse otherwise sensible conservative economists from their slumber and silence concerning Trump’s policies.

Also, her last name is “Shelton” rather than “Sheldon.”

jbh, you sound like the typical conspiracy theorist. if you want to promote such ideologies, you need to provide explicit proof. not vague accusations and innuendo. as for sheldon, her own track record does not indicate she is somebody who looks at all of the available data and lets that lead her to a rational conclusion. it appears she has already made a conclusion, and sifts through the data to find what supports her view. not a very good quality in a fed governor.

baffling,

We already know that JBH is a conspiracy theorist. Although he has gone quiet about it recently, a while ago he was spouting how huge numbers of people have been indicted by the DOJ, and at any moment it will swoop down on them and ship all of them off to Gitmo or wherever. We are stil holding our collective breaths on that one to transpire.

Maybe Trump will mess up the negotiations to raise the debt ceiling and the US will default, which might be just the trigger for the DOJ to implement its massive sweep.

Barkley Rosser: Yeah, when *are* those thousands of sealed indictments goin’ to be unsealed.

Roughly the same time “Princeton”Kopits told us the Chinese peasants are going to invade Zhongnanhai and throw Xi Jinping off of the nearest high balcony.

https://www.youtube.com/watch?v=N9hIpjiGDq4&t=08h08m08s

He is not a conspiracy whiner, but a Dr Rothschild supporter like the Trump organization. You will get it some day hopefully…

Judy ShelDon must be delighted to know she’s not one of the 92,000 destined for trial at Guantanamo. Judy Shelton, OTOH, May have to sweat mistaken identity. Those middle of the night rousters will need directions on who’s who.

You know I’ve always liked Nouriel Roubini. I don’t put him up there say as high as an Alan Blinder, Paul, Krugman etc, but he is in my upper tier group, I bought two of his books, intermittently read his columns. But this Taipei fiasco/soap opera is not coming out very clean in the wash. Roubini has always had a little bit of a “road show” quality to him. A little too eager to sign up for events where he’s being paid or being put up on some kind of a guru pedestal. I’m left wondering why engage in a debate with people you don’t even ethically respect. Aren’t “you” afraid to get some of the “ick” and “goo” on yourself by associating with them?? Let’s be honest here, what did Brad DeLong get out of debating Stephen Moore, other than the opportunity for an ego trip, which I think DeLong failed in achieving (not saying Delong lost the debate, I’m saying I don’t think there was much achieved in the process, other than giving Stephen Moore more credence by having another check-off on the resume “debated mainstream credentialed economist”) I think for the most part, DeLong looked a little silly sitting next to Stephen Moore, and the theatrical stage moment I think DeLong was fantasizing about, never happened (how dramatic is it when Andre the Giant does a body slam on a midget wrestler?? May I posit—not very).

So why didn’t Roubini insist on contractual legalese that BitMEX/Hayes release ALL of the video “no later than calendar date X” after the debate?? Is the relatively sophisticated and world-wise Roubini claiming “he couldn’t foresee” a cryptocurrency outfit pulling such a stunt as hiding video detrimental to their marketing/cause??? Could it be Roubini was being paid a lot of money?? And that the scene of the debate is actually something Roubini is not enthusiastic about being paraded about either?? I think all of these are legit questions (coming from someone who has largely respected Roubini up until the current events).

https://ftalphaville.ft.com/2019/07/18/1563458202000/Nouriel-vs-the–scammers-/

I think other mainstream/credentialed economists might think about such things when they are drawing out the legal contractual wording of public debates and agreeing to engage in circus freak show events for “a quick buck”. That large bank deposit might feel something like an orgasm with a hot looking stranger. But you may not respect yourself come the next morning.

i will admit, i fell for the roubini scam at first. he came out on the media with guns blazing during the financial crisis, claiming he called the collapse yadayadayada. but now you really see he is nothing but a permabear, and played the game just right when his bearish views finally occurred. in reality, he has not offered much in the way of legitimate solutions to the many problems he says we have. once again, i wanted to like him once upon a time, but have come to typically ignore him in the media these days. others provide much deeper arguments for their positions. not saying the guy is wrong, just not convinced of his arguments anymore.

I love it when right wing trolls toss out meaningless terms like “sound money”. As a courtesy – I pulled the Merriam Webster definition:

https://www.merriam-webster.com/dictionary/sound%20money

“money not liable to sudden appreciation or depreciation in value : stable money specifically : a currency based on or redeemable in gold”.

Of course anyone with a brain knows the relative price of gold is highly volatile so this notion we could not have a sudden appreciation or depreciation in value is beyond idiotic. Now if one looks at the U.S. CPI over the past 35 years, one would likely conclude we have had the avoidance of a sudden appreciation or depreciation in value.

Those who own the gold……oh you know what I mean. They are just serving their masters, who likely don’t want to bow to king dollar.

There’s some pretty strong vulgarity in this, so if Menzie decided to pull it, I get it, because the vulgarity is really not necessary. The point can be made without the vulgarity. On the other hand, when we consider they’ve been doing this to Bernie since at least 2015, and doing what they can to put him in the Joe Biden “I’m a washed up closet sexist who actually isn’t for women’s choice and was a racist when it was still ‘cool’ ” camp—for us who know Bernie is the real deal, it makes us pretty angry, so…..

https://www.youtube.com/watch?v=8GFXuVrWyYU

https://www.youtube.com/watch?v=1OQxejaSHBU

Here is another version, Cleaner, so some of the sharper observers KNOW what is going on here. Robert Costa is a joke—he’s a another version of NYT’s David Brooks—he likes to play the pretend role of “objective moderator” for Democrats, so then he can turn around and manipulate their thoughts. Costa—we see you, we know WHAT you are, you showed it in this interview. Go back to Bank of America and see if the CEO needs a fluffer.

Well spoken candidate:

https://www.youtube.com/watch?v=ZTMsXbKvUfo

WOW, I’m getting addicted to this show. I mean you can say all Jimmy Dore is doing is being a smart aleck, but it is funny, I mean where does NYT find these people?? If this girl keeps going, she’s gonna make David Brooks look like he actually could find his nether-regions with a roadmap. Brooks might actually start to look good if this girl keeps talking:

https://www.youtube.com/watch?v=jS-sxJFn6O0

Does anyone know which northeast girl’s prep school NYT is hiring their columnists from??

I’m angry at Barkley Junior he never told me about this show “Jimmy Dore”. I’m being dead serious here, some of these shows about have me dying on the floor laughing. I wish they would take it easier on the vulgarity, but can you show me anywhere in here where they aren’t telling the God’s honest truth?!?!?! I mean cable TV is supposed to be where the smart people hang out, right??—I mean vs “antenna TV’, it’s the lowest of the low watching “Antenna TV” right?? But people PAY to watch this stuff. And yeah I admit I watch a decent amount of Maddow—but really remember when she said she had donald trump’s tax forms, and she had like one of trump’s McDonald’s receipts from 1965. I mean do these people have any idea what a laugh riot they are becoming?? Remember when they fired Phil Donahue, because he had the unmitigated gall to mention the fact people were dying in wars. Why is this Jimmy Dore one of the few calling them all out??—NBC really is near as bad as FOX—NBC tells the same lies as FOX, they just don’t make the lies as extreme—so somehow we think NBC is “better”. NBC is like the Pelosi of TV networks. We have the Barkley idiots telling us Pelosi “is our friend”. REALLY!?!?!?! Pelosi just handed BILLIONS over to trump for his ICE cages and added in the footnotes “Oh by the way, we Dems don’t give a F— about how the children are treated in the cages, you do it how you want”. This woman cares about ANYONE?!?!?! Who other than Barkley Junior believes that?? Show of hands please?? Or just go ahead and tell me you’re an idiot and save me the time.

https://www.youtube.com/watch?v=xi5YYZ9eocU

Moses,

You are angry at me that I did not tell you of this guy? Sorry, but I knew nothing of him until you brought him up here off-topic as usual with you. Now that I have looked at two of your links, he does not impress me at all, sort of a stupid ignorant jerk, frankly. No wonder you like him.

So on the Costa link he did score a lot, although mostly it was Bernie scoring on Costa very capably. Dore’s additions were not worth much, with in fact Bezos leaving WaPo as it was, so its center left-not challenging-aspects-of-capitalism stance was already there under the previous owners. They give lots of people a hard time, as in 2016 with Hillary, with many blaming WaPo and NYT for over-hyping the dumb stories about her emails while downplaying all sorts of bad stuff about Trump. I may be biased as I know many who write for WaPo, including my niece, Erica Werner, who covers Congress and is currently providing the best reporting there is on the debt ceiling issue, which I drew on for a post on Econospeak three days ago about it. NYT has better international coverage, but WaPo remains tops for covering inside DC stuff. As it is, these papers are under sever financial strain and in danger of going under. Dore’s squalid commentary really is not helpful, although he is right about Costa, and did show Bernie nailing him.

The other I saw was much worse, the slam on Rachel Maddow. Excuse me, but it was pretty obvious she was making a joke with remark about Russia shutting off power to the Dakotas. But Dore went off on an almost insane rant with massive cursing, backed up by some almost worse jerk guest he had on. This was simply shameful and disgusting. If this is what you think is great, Moses, it is pathetic. Stupid, ignorant, and a jerk. That is what he is. Is that what you are?

BTW, Moses, you still owe me an apology. You making a bunch of jerk demands after this was requested did not get you off the hook on that one.

@ Barkley Junior

I’m so sad to inform you, your window of opportunity on that closed. All you had to do was type the number “6” or “six” and your sincere apology from me would have been on this blog for all posterity. What a sad missed opportunity for you.

Whether inside of that window you deserved that apology is for regular readers to decide.

Sorry, boy, but you do not get to “close the window” based on a unacceptable demands by you when you own an apology. It is still owed, and your refusal to do so shows that you are as creepy as this Jimmy Dore jerk you are so enamored of.

@ Barkley Junior

The point of getting you to admit the number was six, was so you yourself would admit you had quoted a poorly designed survey. Of course I knew you would never do this, as you would have to admit as a person supposedly steeped in mathematics and stats his entire life (apparently learning through osmosis rather than real study) you couldn’t even do the extra “footwork” (i.e. keyboard taps) to find out whether the survey/poll you were quoting was worth a crap. This was an easy way of evading an apology you didn’t in fact deserve, because it involved doing something Barkley Junior could never do—admit he was wrong.

Thanks for consistently being a d*ck and thereby giving me an easy “out”/ Your BFF—Moses

Look, boy, you are in no position to make amny demandsa or any speeched. The more you make snarky remarks without apologizing, the more you prove that you are just a worthless jerk. Do you see anybody (other than CoRev once) supporting you on any of this idiotic and unacceptable ranting you have been indulging on on this nonsense?

On the survey, so what if it was “poorly constructed” (which your number does not establish, btw, you idiot). It was whether it existed at all, which you firmly denied and called me a liar for saying that it did when you could easily have found it by simple googling. Not only a jerk, but stupid and ignorant to boot.

@ Barkley Junior

Why don’t you poll ALL the people in your domestic abode if they like Kamala Harris over Joe Biden?? Get one of those things with the string running from tin can to tin can routed to your main bathroom and “phone up” one of your relatives currently using the crapper if they like Kamala Harris better than Joe Biden—that’ll tip your sample size just above the poll you were quoting. Your Dad will look down from heaven in pride at your statistical sampling standards. This is gonna be sweeeeeeeet!!!!!! Let us know the results.

I thought I posted previously that I was not going to reply further to posts from “Moses Herzog.” Anyway, in the future I may comment on exceptionally idiotic comments he makes here about broader issues, but I shall not waste time responding to his personal attacks on me. That would be just a waste of everybody’s time, given how worthless he is.

There are three axioms that underlay a good economy: Sound money is one. Judy Shelton is a proponent of sound money. If you don’t know what sound money is, as numerous of you leftist frogs in the Econbrowser pond evidently do not, then read Judy Shelton.

We asked you before to define sound money. You haven’t. So comments like this are beyond dishonest. Define your terms or do not use them.

“If you don’t know what sound money is, as numerous of you leftist frogs in the Econbrowser pond evidently do not, then read Judy Shelton.”

You do not know what “sound money”. So you are a Communist toad. BTW – we have read the gibberish from Shelton which is what Menzie has devastated. Learn to read this blog. DUH!

“There are three axioms”.

I presume that the other are: (1) tax cuts for the rich pay for themselves; and (2) praising the Gospel of King Donald Trump is the pathway to Heaven!

Yea – I’m sure you have a couple of more that are even more bat$hit insane.

Is quantitative easing sound money? What have the unintended consequences of QE been? Why are there virtually no papers by mainstream economists on this? What is the profession trying to bury? Lurkers, pay attention!

JBH: “Why are there virtually no papers by mainstream economists on [the unintended consequences of QE]?” Are you serious? Punch in “quantitative easing” or “unconventional monetary policy” into Google Scholar, and you’ll get literally thousands of citations…

If he did – he would not understand a single one of these papers. No – JBH is just your standard die hard know nothing fan of all things that sound like “sound money”. I bet this clown even thinks Milton Friedman was an advocate of Shelton’s “sound money”!

Menzie: No dispute about the need for QE1. It’s this last decade of ZIPR, QE2, QE3, and now QT that needs examination and explaining. The stellar paper is by William White. I read it when it first came out. As for Google Scholar. With unintended consequences in the title, the paper by Di Maggio and Kacperczyk is thin gruel indeed addressing nothing but MMFs. The paper by Putnam has in the title. But concludes QE lowered the yield curve, which Jim Hamilton’s conference video seemed to controvert. Thin gruel here as well. The 2015 paper by Gern et. al has only broad conclusions and zero empirical work. In fact, there’s very little meat in any of the first 30 or papers that come up on Google Scholar with as part of the search string.

Wallopingly important questions have simply not been addressed: how much of QE spilled over to emerging markets and what are the consequences of a potential blow-back; what was the overall net effect including that of the ongoing QT period; how did the QEs distort the price system and what consequences are we living with; what does all this imply for the next round of QEs if global recession strikes and threatens to take the system down once again; and so on and on. I could easily compile a list of 20 or more unintended consequences. Where in the economics literature is such a list? Specifically where? The American people deserve better than from the highpriests of the economy.

JBH: Impact on EMEs? I remember right off the bat an early paper by Fratzscher. There are tons on the topic. (Gee I think I did one, for a BIS conference.) Reading a bunch on how macroprudential policies partly insulated some EME’s even as I type this. (I am a discussant). So…there are plenty, and I can’t keep up with ’em.

@ Menzie One of the very few times you hear conservatives discuss EMEs is when they do their infomercial-like spiel on inflation. This is one of their check mark talking points to sell inflation when they’ve been peddling inflation fears à la ZeroHedge blog, à la John H. Cochrane for the last 11+ years and they can’t hardly get 1% out of the USA numbers.

These are the type rants you can figure out after about 1/2 second what JBH’s regular reading sources are.

“Is quantitative easing sound money?”

Did we get hyperinflation? Nope. We have had very modest inflation for over a decade. So by the standard definition of sound money – QE WAS sound money. Of course the troll known as JBH has yet to articulate what he means by “sound money”. Until you do – you are babbling gibberish. Sort of like those rants by Shelton.

Investopedia has a sort of luke warm definition of “fiat money” which the gold bug “sound money” loony tunes think is the root of all evil:

https://www.investopedia.com/terms/f/fiatmoney.asp

There is one passage in this description that I find odd at best:

“The mortgage crisis of 2007 and subsequent financial meltdown, however, tempered the belief that central banks could necessarily prevent depressions or serious recessions by regulating the money supply. A currency tied to gold, for example, is generally more stable than fiat money because of the limited supply of gold. There are more opportunities for the creation of bubbles with a fiat money due to its unlimited supply.”

The Great Recession was not caused by some fiat money created “bubble”. I realize that John B. Taylor started complaining about excessive monetary growth in 2010 when we were in the middle of the Great Recession because he stopped being an economist and joined Team Republican. Yes Taylor started saying Greenspan back in 2003 was keeping interest rates too low for too long but he never said that at the time as he was on the Team Republican crowd in the Bush43 White House. Besides the FED was keeping interest rate low precisely because we did not return to full employment until Bush43’s second term. So Taylor was wrong to criticize that.

BTW a commodity standard during Obama’s first term would have dictated tight money during a period when we needed expansionary monetary policy.

I raise this in light of the “sound money” stupidity from JBH. JBH is spinning dishonesty but he is not alone.