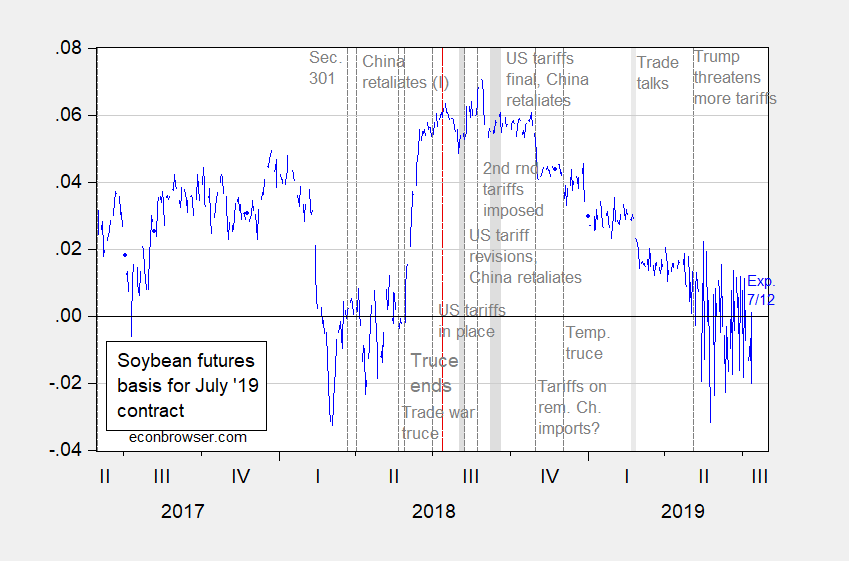

Or, hope died in August 2018…

Figure 1: (Log) July 2019 soybean futures contract price minus spot price (blue). Source: ino.com and macrotrends.com, and author’s calculations. Red dashed line at 7/12/2018, one year before expiration of July 2019 futures contract. Dates from Dezan Shira and Assoc.

Typically, the futures and spot should differ by cost of carry, but for soybean futures, but at the 3, 6 and 12 months horizons, the futures are an unbiased predictor of future spot rates (see Chinn and Coibion, 2014). Hence, the spread can (roughly) be interpreted as an estimate spot rate rising in the future, which is inversely proportional to the probability of a resolution of the US-China trade war (cost of carry is going to vary over the year, so the spread is only partly indicative).

For the course of the spot and July 2019 futures, see this post.

Professor Chinn,

Would you consider showing a numerical example of the following, to help understanding?

“…the spread can (roughly) be interpreted as an estimate spot rate rising in the future, which is inversely proportional to the probability of a resolution of the US-China trade war (cost of carry is going to vary over the year, so the spread is only partly indicative).”

Thanks

That might be useful. One might cull something out from all the rabblings ala CoRev’s incessant comments if one has infinite patience and time. But I won’t do that as reading all the weird comments from CoRev would give me a headache.

Now I bet Menzie comes up with a very coherent explanation on his own. But bet the ranch that CoRev will jump in with his usual stupid objections.

So be patient!

Have you read the adjoining paper with Colbion?? I wager it will answer some of those questions—even some of the math related.

Hi Moses,

The difference between the futures price and the spot price is defined as the “basis” on page 610 of Professor Chinn’s paper.

What I am curious about is the calculation of the inverse probability of resolution of the tariff fight as stated by Professor Chinn, “…the spread can (roughly) be interpreted as an estimate spot rate rising in the future, which is inversely proportional to the probability of a resolution of the US-China trade war (cost of carry is going to vary over the year, so the spread is only partly indicative).”

There’s a lot of things that go over my head AS and this may be one of those moments, but I am interpreting this to be more of an “ad hoc” calculation than something that could be represented by an exact equation. What you might do is look at the numbers when the market (in recent past moments, post-trump presidency where the market perceived a high chance of US-China trade resolution vs numbers when the market perceived the chance as low, mark those price points. You might mark those points and see if there’s a point it kind of revolves around.

Now my guess is Menzie will grimace and groan when he sees my effort here, but if you’re looking at logs, number negative 0.0175 kinda seems like the number when trade resolution chances are low, positive 0.045 seems to be the log number when trade resolution chances are high.

When I look at that phrase, “is inversely proportional to the probability of a resolution of the US-China trade war” I don’t know how you turn that into a math equation, but I’m not being sarcastic at all when I say I’m happy to be educated on the matter if someone knows a math equation for that.

“the spread can (roughly) be interpreted as an estimate spot rate rising in the future, which is inversely proportional to the probability of a resolution of the US-China trade war”.

An interesting interpretation which I bet will generate a lot more angry gibberish from CoRev. Which is a shame because in a way we can sort of thank him for this insight. After all – his “blip” prediction (which utterly failed) was exactly his belief that the trade war would be quickly resolved resulting in a restoration of soybean prices. Yes we could have had the CoRev Hypothesis had CoRev even calmed down, stopped defending Trump at all costs, and actually done something usual for him – THINK!

something UNusual for him – THINK!

My apologies for the initial typo.

If you wanna find the part where donald trump is acting as Epstein’s prostitute liaison jump to the 3:04 mark

https://www.youtube.com/watch?v=ad1ysX2iLmA

It doesn’t look like donald trump was familiar with pedophile Epstein at all does it?? Just Jeffrey Epstein’s hooker concierge, that’s all. Nothing more than that.

Some kind of ruckus over the audio in this tweet GIF??

https://twitter.com/passantino/status/1151639762085863424

Not sure what all the excitement is about?? I agree 100% with that crowd. This creature needs to go back to where it came from.

https://images.app.goo.gl/1o7qVRUFNKq3SLoN6

Dear Folks,

This is primarily addressed to Menzie, but others should feel free to jump in. In the Chinn and Coibion paper, you have, “The evidence for agricultural commodities, as was the case with energy commodities, is consistent with market efficiency: we cannot reject the joint hypothesis of “alpha” = 0 and “beta” = 1, nor can we reject the unbiasedness hypothesis for any agricultural commodity at any horizon. Furthermore, we can strongly reject the null that the basis is uninformative about future price changes (“beta” = 0) for all three agricultural commodities. However, there are again quantitative differences across commodities in the predictive content of futures prices: soybeans and corn futures account for a much larger fraction of subsequent price changes than wheat, especially at longer horizons.” [Here I have replaced the Greek letters, which did not come out, with their transliterations.]

There are three characteristics of this argument which make it an interesting general question. First, is the question of market efficiency. Chinn and Coibion conclude that the market is efficient for soybeans, which seems to have been the case, and may still be. Second, interest rates were relatively predictable, not stable, but not subject to erratic changes, as may be the case now. Third, and this goes back to the tariffs argument of last time – ignoring the specific values of the process for the second, what exactly is the process by which tariffs are determined? If we assume that the values of the tariffs are a random walk with drift, which can be estimated, what does this imply for market efficiency for soybeans in the future? In other words, suppose I guess the values of the future course of tariffs better than the markets (or more to the aggravation of others, CoRev does). Does this imply that the guesser, who is well-versed in the operations of the market (not me) would be able to make a significant profit, or will the market really have deciphered the process of the future tariffs up to a random error? These ideas of understanding interest rates and disentangling future expectations of tariffs would seem to be interesting things to look at.

Julian

Julian,

I see absolutely no reason to assume that tariffs should be expected to be a “random walk with drift.” That sort of thing holds for things determined by markets. Tariffs are determined by politics and policy and diplomacy and tend to change only once in a while by by large amounts, in contrast to prices. Indeed, if there is a trade deal, they may go to zero or very low at some point, with this more likely than them going way up and staying up, although that could happen.None of this looks like a random walk with drift.