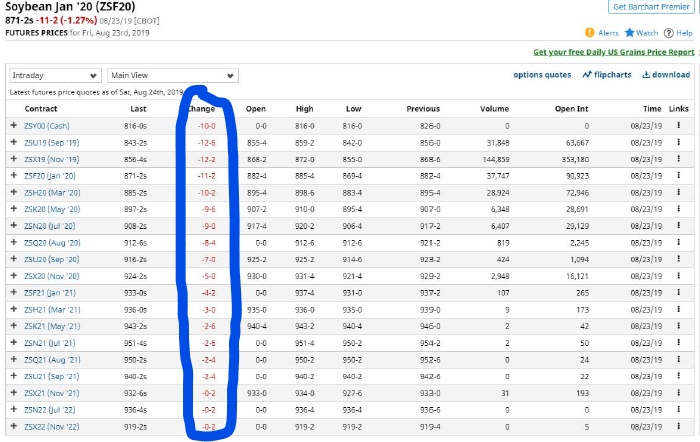

Going from August 22rd to 23rd, front month futures dropped 12-6; the August 2020 futures price (which are an unbiased predictor of one year ahead spot prices) was down 8-4. Hence, farmers should prepare for a long, tough, period of self-inflicted (by the administration) damage.

Source: Barchart.com, accessed 8/24/2019.

Given no real market moving agricultural news — aside from Mr. Trumps tweets tit-for-tat response to the Chinese tariff retaliation — we can ascribe about 2/3 of the current drop to long term impact on US soybean prices.

In other words, the market sees little prospect for a swift and positive resolution to the current US-China trade dispute.

The blip continues!

Trump is now threatening tariffs on French wine – while he is in France:

http://econospeak.blogspot.com/2019/08/digital-sales-tax-v-tariffs-on-french.html

The blip is now 16 months long and may continue for another 12 months? Gee I wonder what the latest will be from CoRev? Maybe he will blame low soybean prices by developments in Brazil such as the fires in the Amazon rain forest. Anything to deflect blame from his MASTER – Trump.

Trump has a history of bluster and threat followed by caving in once the consequences start to be detrimental to him personally. The problem he has here is that the Chinese cannot be bullied into submission, and they show little sign of letting him off the hook. He shot himself in the foot, and he should not expect any foreign cooperation when it comes to stopping the bleeding. Unfortunately, it is Americans who will do most of the bleeding, not Trump. Trump will be tarnished, of course, but he does not face the dire consequences that average people face.

A concern I have, and have now posted several times on Econspeak about, is that the Dems are not well positioned to come down hard on Trump on the trade issue. This is increasingly obviously going to be his weakest point economically, especially if his trade war actually does push us into a recession prior to the election, or even if we see a substantial slowdown in growth, which looks highly likely.

The problem is that for too long too many Dems have been playing the protectionist game, which now can be seen to be a disaster. Even US Steel is now laying off workers in Michigan, one of the most protected of all industries by Trump. But we have several candidates bragging that they are “tougher than Trump on trrade,” with even the NY Times posing the issue this way, “Can the Dems be tougher than Trump on trade,” when “being tough on trade” is clearly becoming a stupid and disastrous policy that needs to be attacked. The Dems will need a candidate who can do that, but quite a few are severely hobbled on this issue, but international economics simply does not come up in their idiotic debates.