I keep on hearing that economists are lousy at forecasting, citing the An, Jalles, and Loungani (2018) analysis. Recently, we heard Larry Kudlow claim that nobody was predicting a recession in December 2007, when he was dismissing the possibility. Without disputing the consensus is lousy at detecting turning points in real time, we can check if all economists are.

In particular, thanks to this thing called “the Internets”, we can verify. From the Wall Street Journal December 2007 survey (taken early that month), three economists (out of 52 respondents) predicted at least two quarters of negative growth (Richard Berner/David Greenlaw of Morgan Stanley, Ram Bhagavatula and Kathleen M. Camilli), and four others at least one quarter of negative growth (Paul Ashworth of Capital Economics, Kurt Karl/Arun Hara of Swiss Re, David Resler of Nomura, and Lawrence Yun of NAR).

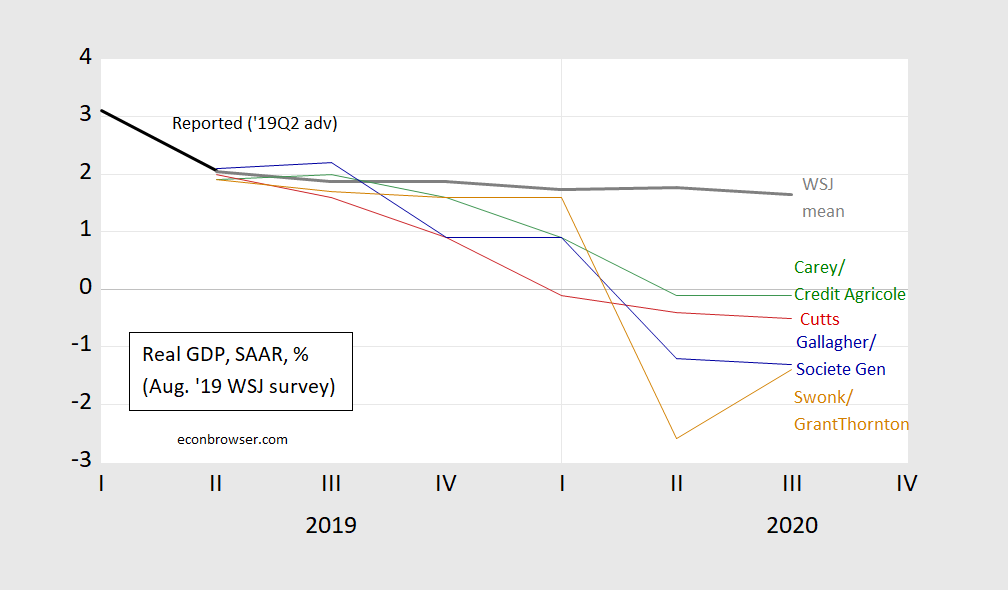

What about August 2019? A total of four forecasters predict at least two consecutive quarters of negative growth (with another two a single quarter), out of 55 respondents.

Figure 1: Real q/q GDP growth, SAAR (black), and mean forecast from Wall Street Journal August survey (gray), and Michael Carey/Credit Agricole (green), Amy Crews Cutts (red), Stephen Gallagher/Societe General (blue), and Diane Swonk/Grant Thornton (light brown). Source: BEA, 2019Q2 Advance Release and WSJ August 2019 survey.

In addition, Joel Naroff predicts -1.5% SAAR growth in 2020Q4; it’s possible he thinks there’ll be another quarter of negative growth in 2021Q1 for a technical recession, but we don’t know.

So, you can see there are some economists (11% of those polled and responded) who are willing to predict a recession by end-2020.

* “Technical” because recessions are officially defined by the National Bureau of Economic Research’s Business Cycle Dating Committee, relying upon a number of key indicators, including, but not primarily, real GDP. The two quarter definition is merely a rule of thumb, used for this post.

“we heard Larry Kudlow claim that nobody was predicting a recession in December 2007”. Really?

There were a lot of economists back then who were sounding alarm bells about what was happening in the real estate market and/or the financial sector. OK – Kudlow was too stupid to know what any of this meant but nobody was worried about a recession?

Kudlow’s December 2007 rant was published by the National Review. Go figure!

https://www.nationalreview.com/kudlows-money-politics/kudlow-101-there-aint-no-recession-larry-kudlow/

“Now I’m not smart enough to know what the jobs number is going to be tomorrow, but you could easily have a blockbuster 200,000 jobs report. I don’t know, it could be 150K”

FRED?

https://fred.stlouisfed.org/series/PAYEMS

Huh – it was only 110K. And the bottom fell out in 2008!

The reason the bottom fell out is that many of the banks were using much of the CDO as means of maintaining capital and investing in the real estate market however there were no liquidity in the system to guard against people who can not pay their mortgages (underwriting standards were nonexistent and rising real estate price with flipping).

It should be noted that Kevin Hassett knew the housing marketing was overheating however predicted that the recession would be brief because he argued that the more people are paying for their home because their income are higher and interest rate was low. He also expect rising interest rate would raise this cost and the housing price would decline proportionally saying “I don’t think a catastrophe is very likely.” This is from July 25, 2004 NYT.

I started getting worried when I realized Countrywide Financial was about to fold:

https://www.newyorker.com/magazine/2009/06/29/angelos-ashes

‘But, as 2007 progressed, subprime defaults escalated rapidly, and Wall Street bankers abandoned the mortgage-backed securities they had prized, and their supplier, too. In August, they cut off Countrywide’s short-term funding, a move that constricted its ability to operate, and a few months later Mozilo was forced to choose between bankruptcy or being acquired by Bank of America. (In January, 2008, Bank of America announced that it would buy the company for four billion dollars, a fraction of what Countrywide was worth at its peak.) Angelo Mozilo has reportedly been named a defendant in more than a hundred civil lawsuits and a target of a criminal investigation. On June 4th, the Securities and Exchange Commission, in a civil suit, charged Mozilo, David Sambol (a former president of Countrywide), and Eric Sieracki (its former chief financial officer) with securities fraud, alleging that they had hidden the high-risk nature of Countrywide’s loan products from investors. Mozilo was also charged with insider trading. E-mails quoted in the complaint showed Mozilo privately deploring the high-risk loans that had become Countrywide’s stock-in-trade while in public he was praising his company’s high standards. The complaint seemed to formalize a public indictment of Mozilo as an icon of corporate malfeasance and greed, the chief villain at the center of the economy’s collapse.’

Kudlow did not get what all of this mess meant to the general economy? I guess he was not talking to Ben Bernanke.

Back a bit before that I was debating with Dean Baker and Nouriel Roubini about the timing of the arrival of the recession. In late 2006 after the housing bubble peaked and residential construction began to decline both of them forecast a recession to start around beginning of 2007. I warned them that the US dollar was down and that would likely help prop up the US economy during 2007. Indeed that is basically what happened, housing construction fell throughout 2007 while exports rose. The latter stopped by the end of the year and the economy went into recession, although GDP did not actually decline until well into 2008, with the big fall happening after the crash in September, which I called two months earlier.

Given that many indicators point toward a slowdown or recession, how severe of a slowdown or recession should we expect? What is looming like the subprime and repurchase agreement markets as described by Professor Gorton in his analysis of the past great recession?

What concerns me are the worrisome signs in many of our trading partners. The EU is weak and Brexit won’t help. Boris Johnson is dumb as a fencepost. The Italian banks are fragile and made more fragile by their exposure to Turkish loans. Canadian growth looks to be positive but well below 2%. One of the least understood facts about the global Great Recession was how the central banks agreed to cooperate and backstop one another. Given Trump’s “American First” attitude that could be a harder sell if the next recession goes global, as I think is likely.

Lately I have looked at the New York Fed Center for Microeconomic Data for information on US consumers.

https://www.newyorkfed.org/microeconomics/hhdc/background.html

Some consumer data seem a bit riskier comparing 2019Q2 compared to 2007Q4, specifically auto loans and student loans as a percent of total consumer debt and delinquency rates.

Auto loan % total consumer debt 2019Q2 9.4%

Auto loan % total consumer debt 2007Q4 6.2%

Auto loan 90 day+ delinquency rate 2019Q2 4.6%

Auto loan 90 day+ delinquency rate 2007Q4 3.1%

Student debt % of consumer debt 2019Q2 10.7%

Student debt % of consumer debt 2007Q4 4.4%

Student debt 90 day+ delinquency rate 2019Q2 10.8%

Student debt 90 day+ delinquency rate 2007Q4 7.5%

Total household debt to GDP looks better, declining from 98.1% of GDP as of 2007Q4 to 76.3% of GDP as of 2019Q2.

https://fred.stlouisfed.org/series/HDTGPDUSQ163N

AS

As is per usual your habit on this blog, you have asked a great question. I think you would be looking towards mostly corporate bonds and “shadow banking” activity. Going to be harder for low-life scum like Peter J Wallison to blame it on the American working man this time—doesn’t mean he won’t try.

@ AS

If you want a super-good and detailed account of how these things tend to build up you can read about Allied Capital in David Einhorn’s book. I read all of it maybe about 5 years ago?? It’s a very dry read in some sections and you get to that 1/2 mark to 3/4 way through the book, you’ll think it’s a bearcat and wonder if you’re gonna make it. I believe it is worth it though. These things don’t happen on accident. Phil Gramm, his wife, and many other Republicans set out to castrate both the CFTC and the SEC—the same way donald trump has destroyed the EPA and Justice Department now.

http://foolingsomepeople.com

If you wanna go back farther than that you can read about “the Keating 5” that our great “war hero” and wife deserter John McCain was part of. William Black’s book is most likely the best one to read on that, though there were many books on it.

https://www.goodreads.com/book/show/1144371.The_Best_Way_to_Rob_a_Bank_Is_to_Own_One

@ AS

A chart for you to mull over brother:

https://www.zerohedge.com/s3/files/inline-images/Mauldin-Corporate-Debt-082219.png?itok=H4AmfqiG

Just use your browser to zoom in if it’s a little difficult to read the margins.

You have to give him this much, Xi Jinping *IS* a cute little Winnie the Pooh.

https://i.redd.it/8dwl1gdzs0i31.jpg

I am sick of hearing about a ‘technical’ recession. It was thought up in your land and not everyone agrees it is technical or correct. More Yankee imperialism at work me thinks.

I prefer the kraut definition of a yearly drop in GDP

I don’t much care what anybody calls it. Recession, depression, panic, slowdown. It is miserable when you are out of work and are surplus capacity nobody needs or wants. There are a number of steel workers in that position right now and China just slapped on some more tariffs, presumably to tweak Li’l Lord Trump-leroy’s nose. It won’t be the failure of a bank that tips the economy, it will be trade this time, and at this point, I don’t see it as recoverable right away. Steel tariffs rippled into auto making and other industries, which caused that to slow, depressing steel demand and so on. It’s basic enough that an outhouse economist like me can figure it out. My fearless, and perhaps too timid, prediction, is that there will be a noticeable slowdown by mid 2020. It may not be a recession in the German or technical sense, but it sure will be felt by the average person whose livelihood depends on working. The economic fear and loathing will leak out and depress demand. Which then depresses supply because supplying becomes unprofitable, never mind what wingnuttery says about supply side economies.

10 US recessions since 1950 last abt 3 quarters…so unconditional prob in any quarter is 30/276 = abt 10%. So prob no recession 90% . Pretending they are independent events, prob no recession thru Jan 2021 = .9^5 = 60%. But there all sorts of conditional things going on and instead of the censored regression first-pass regressions seen here, I’d like to see some quarterly GDP growth regressions with the residuals saved and then drawn out of sample to see – in maybe 1000 or so runs – the current-state conditional prob of recessions over various horizons. Nice undergrad macro topic.

Bob Flood: So boostrapping to evaluate the growth elasticity bounds. I tried some plain OLS to get the point estimate; one problem is that growth is trending downward over the past 50 odd years, so how to deal with that in a good-fitting but not overparameterized way. But agree it’s an interesting topic to assign.