Decisions regarding the trilemma, but also choices regarding macroprudential policies have an impact. From the revised version of Joshua Aizenman, Menzie Chinn and Hiro Ito, “Financial Spillovers and Macroprudential Policies” (forthcoming Open Economies Review):

In this paper, we empirically investigated whether and to what extent the financial link through policy interest rates between the CEs [Core Economies] (i.e., the U.S. the euro area, and Japan) and the PHs [Peripheral Economies] can be affected by a set of macroprudential policies implemented by the PHs.

We found that macroprudential policies negatively affect the interest rate connectivity between the CEs and the PHs when we focused on the time periods when the CEs implement expansionary monetary policy. This asymmetrical finding makes sense considering that CEs’ lax monetary policy causes massive capital to flow to the PHs while the latter countries try to attenuate any negative impact on the real economy of credit expansion caused by capital influx from the CEs.

When we disaggregated the index for macroprudential policies into the group of borrower-targeted macroprudential policy tools and that of lender-targeted tools, we found that the above negative impact of MPI is mainly driven by lender-targeted macroprudential policies. This finding is unique because recent studies show borrower-based macroprudential policies tend to be more effective than lender-based policies.

Furthermore, when we disaggregated the MPI into (broad-based) capital tools; asset-side (sectorial capital) tools; and liquidity-related tools, only liquidity-related tools turn out to be a significantly negative contributor to the correlation of policy interest rates between the CEs and the PHs.

The effectiveness of macroprudential policies can vary depending on the macroeconomic conditions or policies of the PH economies that implement them.

We found that PH countries’ policy interest rates could become more independent of CEs’ when macroprudential policies are implemented by the countries with current account deficit. In other words, macroprudential policies could work more effectively for countries that import capital from overseas.

When we compared high IR holding countries with low IR holding ones, the estimated coefficient of the variable for macroprudential policies was found to be significantly negative, i.e., weakening the policy interest rate link between the CEs and the PHs, only for low IR holders. This suggests that countries with low levels of IR holding may use macroprudential policies as a substitute to holding high levels of IR [international reserves].

We also detected the effect of macroprudential policies only among those with increasing net portfolio inflows, not among those with declining net portfolio inflows. We also compared the PH countries that are experiencing credit growth with those which are not and found that only those which are experiencing credit growth have a significantly effect on their macroprudential policies.

Thus, we have been able to show the effect of macroprudential policies as the “fourth” factor in the quadrilemma. It must be noted that macroprudential policies are not the same as conventional capital controls policies. What makes macroprudential policies different from conventional capital controls is that macroprudential policies are aimed at mitigating the balance sheet exposure associated with short term debt flows while typical capital controls are blunt instruments that focus more on affecting capital flows and less on mitigating the balance sheet exposures. That may explain our findings that the effect of macroprudential policies are detected only when the CEs implement expansionary policy and when the PHs’ domestic credit conditions are affected.

Clearly, it is better to use more nuanced or detailed cross-country data on macroprudential policies, rather than relying on crude dummy variables, so that we can identify which types of macroprudential policies are effective or ineffective under what kind of policy or macroeconomic conditions. However, such an exercise is outside the scope of this paper. We will tackle this issue as one of the future research agendas.

As the use of macroprudential policies increases both in advanced and developing countries, this issue has attained heightened importance.

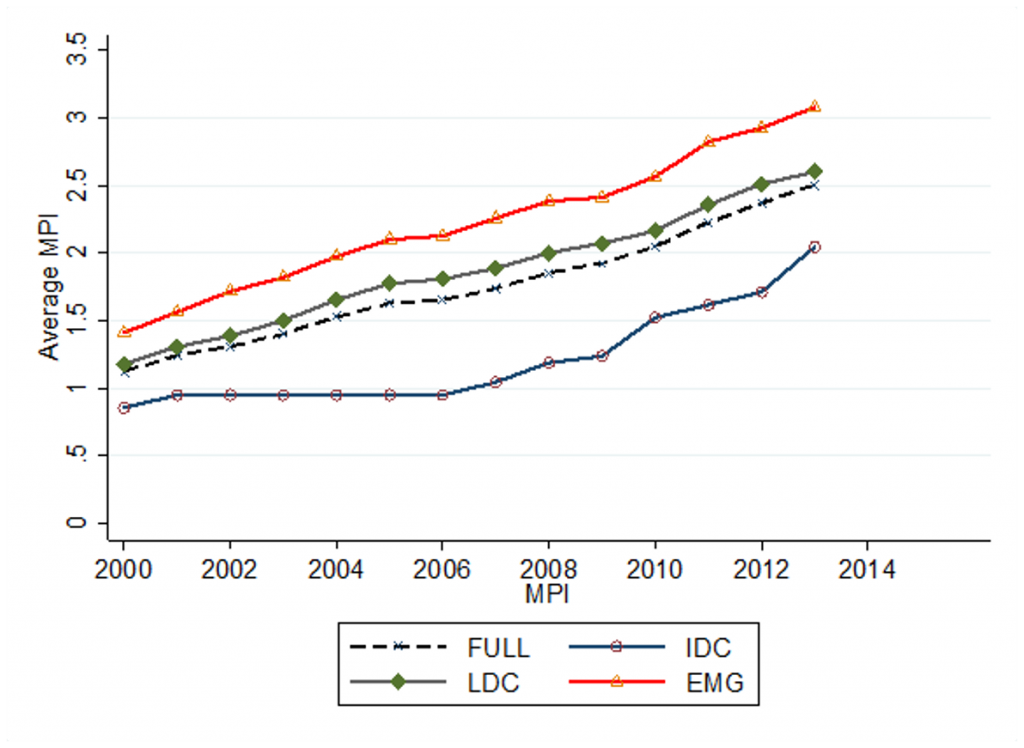

Figure 1: MPI by country grouping. MPI is simple average of dummy variables for 12 types of macroprudential regulations.

As core country monetary policy becomes more accommodative, these macroprudential policies might (depending on which ones are implemented) mitigate the global financial cycle.

A set of powerpoint slides is here.

Hope to say a couple semi-intelligent things in this thread eventually. This looks like a great one and is going to take my gray matter longer to digest and gestate. (Can you digest something and gestate it at the same time??)

So which policies are included in the set of “macroprudential” in this paper, Menzie? Foreign capital flow controls?

I thought it was very flattering of Menzie to name-drop us both by our comic book moniker in the first paragraph of his paper’s intro, didn’t you??

12 of them—as it says, from the Cerutti paper:

“MPI is the sum of the following 12 dummies variables: Loan-to-value ratio cap

(LTV_CAP); Debt to income ratio (DTI); Dynamic Loan-loss Provision (DP); Countercyclical

capital buffer/requirement (CTC); Leverage (LEV); Capital surcharges on Systematically

Important Financial Institutions (SIFI); Limits on interbank exposures (INTER); Concentration

limits (CONC); Limits on foreign currency loans (FC); FX and/or countercyclical reserve

requirements (RR_REV); Limits on domestic currency loans (CG); and Levy/tax on financial

institutions (TAX). ”

It conditionalizes what they are going for—as a quote from paper:

” We treat MPI as the measure for the extensity of macroprudential policy implementation Cerruti, et al. (2015) make it clear that each of the 12 dummies does not ‘capture the intensity of the measures and any changes in intensity over time.’ Although each dummy does not directly refer to the stringency of individual policy measures, MPI, as an aggregate of the 12 dummies, does reflect the extensity of the macroprudential measures.”

I wonder if there is a [direct] correlation between government corruption and the amount or extensivity of macroprudential policy used?? For example isn’t a lot of China’s international reserves hoarding and capital controls an attempt by the Central Committee or “the party” to keep control of economic levers?? Wouldn’t the higher MPI number for both LDC and IMG groups at least imply that is the case??

*should have typed EMG in above comment/question.