Today we are fortunate to present a guest contribution written by By Laurent Ferrara (SKEMA Business School, Paris, and Director of International Institute of Forecasters), Luca Metelli (Banca d’Italia), Filippo Natoli (Banca d’Italia) and Daniele Siena (Banque de France). The views presented represent those of the authors, and not necessarily those of the institutions the authors are affilliated with.

Few months after its arrival, at the end of 2017, the Trump administration launched a large fiscal stimulus composed of both tax cuts and government expenditures of roughly 1.4% of GDP (Tax Cuts and Jobs Act and Bipartisan Budget Act – although the exact impact on output is difficult to assess, there is a consensus on some positive effects on GDP growth of this pro-cyclical fiscal boost).

At the same time, the Trump administration decided to fight external imbalances (i.e. reduce US trade deficit) by increasing tariffs and by starting a trade war with China (the escalation in trade tensions was only recently put on hold by the signature of the “Phase 1 trade deal” with China in January 2020).

Yet, it turns out that getting additional growth through government expenditures and reducing trade deficit through stronger protection are contradictory policies. In fact, in a recent working paper (Ferrara, Metelli, Natoli, Siena, 2020) focusing on the effects of government spending on the US economy, we show that an increase in government spending induces a trade deficit. Therefore, while the tariff war aimed at decreasing the trade deficit, the fiscal package was pushing down net exports.

More generally, our work joins an open debate in the academic literature on the impact of fiscal shocks on macroeconomic variables, like the exchange rate, inflation rate, consumption and net exports. There are two reasons why this debate has generated so much academic work. First, it is difficult to identify exogenous movements in government spending to assess their causal effect and, second, theoretical intuitions are not aligned with the empirical evidence, generating economic puzzles. According to standard theoretical frameworks, whether Real Business Cycle or old and new-Keynesian theories, consumption and the trade balance should fall, inflation increase and the real exchange rate appreciate in response to an increase in government spending. This is because, in theory, an increase in government spending works as an aggregate demand shock. On the one hand, higher demand pushes domestic prices up, increasing inflation and appreciating the real exchange rate. On the other hand the fall in consumption is explained by an expected increase in future taxes, which decreases household wealth who is incentivized to save more. The reduction in consumption, the appreciation of the exchange rate and the home bias in government spending make the trade balance fall.

However, when dealing with data, the empirical literature finds mixed results. For example, on inflation, while Caldara and Kamps (2017) find that a government spending shock is inflationary, Fatás and Mihov (2001b) show that the same shock decreases prices/inflation. On the real exchange rate, while Kim and Roubini (2008) find that fiscal expansions depreciate the real exchange rate, Auerbach and Gorodnichenko (2016) show that unanticipated shocks to announced military spending appreciate the U.S. dollar (for interested readers, an extensive review of the literature is available in our working paper).

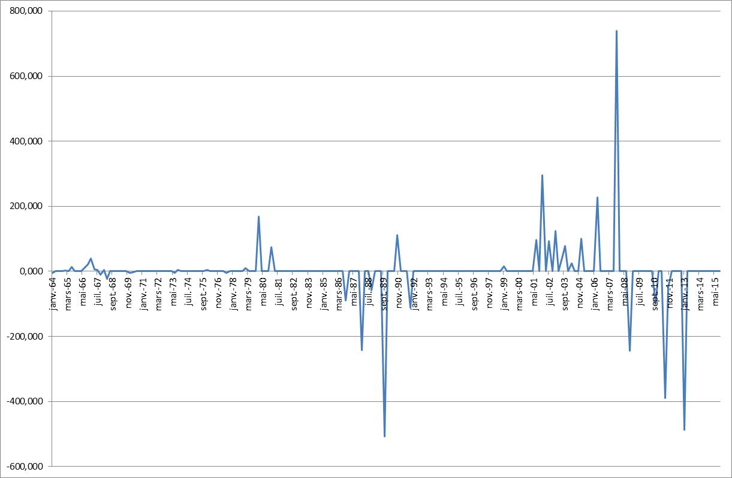

In Ferrara, Metelli, Natoli and Siena (2020), we re-examine the question on the effects of fiscal spending shocks, merging the closed and open economy debate. The main novelty with respect to the existing literature is that we employ a different identification scheme. The military narrative series constructed by Ramey (2011) (and updated in Ramey (2016), see Figure below) is used into a Vector Auto-Regression model, employing the proxy-SVAR methodology developed by Mertens and Ravn (2013) and Stock and Watson (2008).

Figure 1. Military spending news shock as computed by V. Ramey (2016), from 1964 to 2015

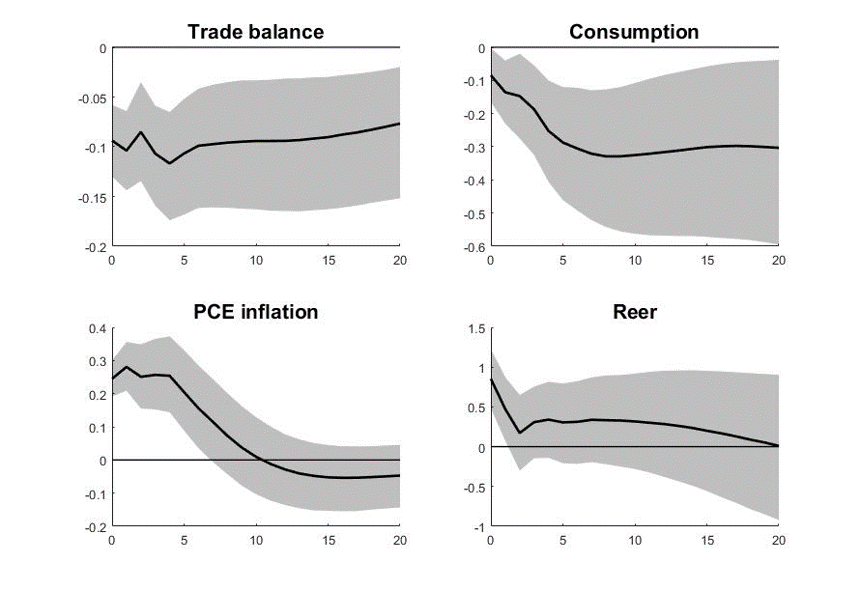

By employing this identification technique, most puzzling results dissolve: government spending shocks are inflationary, appreciate the real exchange rate, worsen the trade balance and decrease private consumption (see the Impulse Response Functions in the figure below).

Few technical details are needed. The proxy-SVAR model is estimated on quarterly U.S. data using a Bayesian approach over the 1964Q1-2015Q4 period. Two important aspects should be emphasized at the very outset. First, even though Ramey (2016) has constructed the narrative series to instrument both contemporaneous and anticipated government spending, we use it here to instrument only unanticipated shocks. We show that this series is indeed a valid and good instrument for contemporaneous government spending in the 1964-2015 period, satisfying both the relevance and the exclusion restrictions. Second, given the importance of the time-frame for fiscal estimates, we pick as a baseline the longest possible sample, 1964Q1-2015Q4, allowing the use of the official real effective exchange rate data from the Bank of International Settlement (BIS). However, multiple robustness checks of these two aspects are also performed.

Figure 2: Impulse response functions from a one standard deviation shock on U.S. government spending on trade balance, consumption, inflation and real exchange rate, estimated using a proxy-SVAR approach (Source: Ferrara, Metelli, Natoli, Siena, 2020)

In fact, our findings restore the link between theoretical and empirical results. We show this previous point by setting up a standard two-good RBC small open economy model and estimating it to match the empirical impulse-responses to a government spending shock. Empirical dynamics are aligned with standard theoretical predictions and the responses of an estimated real business cycle small open economy model match extremely well empirical impulse-responses (see Figure below).

We conclude by saying that we can see our results as a reconciliation of empirical estimates with standard theories or, more simply, as a spur to further research on the joint response of domestic and international prices to fiscal shocks.

This post written by Laurent Ferrara, Luca Metelli, Filippo Natoli, and Daniele Siena.

One thing I will say about the current administration’s policies is this: there’s plenty of uncontrolled experimenting going on. It’s accidental so far as I can tell, but it will make for plenty to study and try to understand over the next few decades or centuries.

Too much Toynbee reading is making me a little concerned about the future of Western Civilization. Oh, well. Time to play loud music and not worry about things outside my control.

Over the past 4 years, Core PCE Inflation has been flat. https://fred.stlouisfed.org/series/DPCCRV1Q225SBEA#0

Real Personal Consumption increases have been steady. https://fred.stlouisfed.org/series/DPCERO1Q156NBEA#0

The Trade Weighted Exchange Rate of the Dollar has increased. https://fred.stlouisfed.org/series/TWEXB#0

Real Median Weekly Wages have increased. https://fred.stlouisfed.org/series/LES1252881600Q#0

Trade Deficit has increased. https://fred.stlouisfed.org/series/BOPGSTB#0

Even Keynes cannot explain these results: “It is often pointed out that, when loan-expenditure was on a larger scale as a result of official encouragement, this did not prevent an increase of unemployment. But at that time it was offsetting incompletely an even more rapid deterioration in our foreign balance. The effects of an increase or decrease of £100,000,000 in our loan-expenditure are, broadly speaking, equal to the effects of an increase or decrease of £100,000,000 in our foreign balance. Formerly we had no visible benefit from our loan-expenditure, because it was being offset by a deterioration in our foreign balance. Recently we have had no visible benefit from the improvement in our foreign balance, because it has been offset by the reduction in our loan-expenditure. To-day for the first time it is open to us, if we choose, to have both factors favourable at once.” The Means to Prosperity, p. 16.

“The Trade Weighted Exchange Rate of the Dollar has increased.” Followed by how the trade deficit has increased.

“Even Keynes cannot explain these results”. Wait – Keynes certainly got the idea that an appreciation of one’s currency tends to lower net exports.

Now no one in the Trump team of “economists” get this but most real economics do.

GDP is still growing and employment is rising, albeit the trade deficit is worse and the dollar has increased in forex markets as the budget deficit increases along with Fed’s balance sheet.

These are paradoxical times — Quantum Econ?

Actually, US trade deficit declined last year for the first time in six years. You are not up to date, Paul.

Very strange. My GDP table shows net trade higher in 2018 and 2019 (OK, preliminary data are $4 billion lower last year, but let’s see how that pans out over the next few revisions). Indeed, the largest net trade deficit since 2008.

Net trade “deficit” was higher …

“David O’RearFebruary 14, 2020 at 3:23 am

Very strange. My GDP table shows net trade higher in 2018 and 2019”

Not sure what you are saying here but let’s check here.

https://www.bea.gov/data/intl-trade-investment/international-trade-goods-and-services

This source shows our service surplus fell by about $10 billion from 2018 to 2019 but the goods deficit fell by about $20 billion over the same period. As such, the overall trade deficit fell by a mere $10 billion.

Annualized the trade deficit is worse over the past 4 years, although 2019 is slightly better than 2018, according to FRED.

Your quote from Keynes makes the basic point that if one increases domestic demand by X (£100 million) but net export demand falls by X, the net impact on overall aggregate demand is zero. Again – a simple idea that eludes the court jesters who make up Trump’s economic team.

Your “Median usual weekly real earnings” shows something interesting. During the last 3 years of the Obama period, real wages rose by a paltry $15 per week, which Trump has declared a disaster. Now during his 3 years in office they have risen by a staggering $13 per week. MAGA! Best economy EVER.

Of course every MAGA hat wearing genius knows that 13 is so much greater than 15! If you doubt this – it has been explained over and over on Fox & Friends!

It has been a mantra of the Republican Party that privately managed schools/education is more efficient and “less wasteful” than public education. How does the mantra “The sky is red!!!” “The sky is red!!!!” “The sky is red!!!!!” play out in reality?? Is the sky actually red just because a Republican repeated it 500 times??

https://www.readfrontier.org/stories/epics-financial-web-includes-related-companies-organizations/

https://www.readfrontier.org/stories/epic-charter-school-penalized-530k-for-excessive-administrative-costs/

Well, there’s still/always Ray Kinsella’s and Terence Mann’s favorite slogan for state budget management: “If you build it, they will come”:

https://www.readfrontier.org/stories/oklahoma-paid-more-than-250000-for-its-new-brand/

The end results appears to be that Trump has had little or no economic impact and the moderate trend growth established in Obama’s second term is not changed.

In other words, there’s been no yuuuuuge change from the trajectory Obama established. But, the tax cuts were a minimal boost in spite of their cost. The trade wars were a source of pointless chaos. There have been other gyrations that the economy has absorbed. So, it appears that Obama left the economy in pretty good shape. Who knows how many more crazy gyrations it can absorb before it falls apart.

My take is still that there will be a noticeable downturn this summer. It’s the train that takes a while to slow, but the drop in job openings, the decline in manufacturing, and the other scattered declines mean that personal consumption will be undermined and will eventually cave in. I’m open to correction on that view.

You have been non-corrected, Sir:

https://tradingeconomics.com/united-states/industrial-production-mom

That is manufacturing for the most part. It is a fairly small part of the economy. A recession in that sector is not an overall downturn or recession, although it could be the harbinger of one. That is not a given.

“Paul MathisFebruary 14, 2020 at 11:35 am

Annualized the trade deficit is worse over the past 4 years, although 2019 is slightly better than 2018, according to FRED.”

Yes – we are correct here. Going to the NIPA accounts from BEA:

https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2#reqid=19&step=2&isuri=1&1921=survey

Table 1.1.5. Gross Domestic Product

Line 15 Net exports of goods and services

For 2015 and 2016, this was negative $519 billion per year. By 2018 it became negative $638 billion – a very significant deepening of the trade deficit. OK, it was only negative $632 billion for 2019. A somewhat meaningless improvement.

Paul used FRED:

https://fred.stlouisfed.org/series/NETEXP

Net Exports of Goods and Services (NETEXP)

This shows the BEA figures on a quarterly basis.

I think this is what Paul has been referring to. Memo to Paul – a link would help you make your point!

Menzie, you might remember as I told you my Twitter acct was suspended, so I only check your twitter feed about once very 3 weeks. You asked how many could say “I told ya’ so” related to FOXCONN in our grand colloquial English you (as I also have affection for) like to use sometimes. I know one guy who said “I told ya so” who I have a great deal of respect for. And that same guy who I respect and read is often falsely accused of being overly “pro-China”. I know that guy is too classy to have my bad attitude, but if I was that guy I would want to be semi-violent with those who falsely accused me off being too “pro-China” or not patriotic enough to their home country—when they have been fiercely loyal in every sense. I don’t know how that guy contains his anger on those libels of character. Again, he is a better man than me,

Menzie, while I am on a hot Valentine’s Day date tonight with this overly small bottle of wine, and apt to get babyishly and infantilishly (??) grumpy when my eyes view the bottom of this bottle (the coldness of this bottle is so warm, see what Idid there??), you asked on Twitter what a group of MAGA folks had in common. My first slightly buzzed thought is “shallowness of character”. That being said you know Mnuchin is by far the most clever of the group of individuals you mentioned in that tweet. UNfortununately he has enough shallowness to cover up the intelligence God gave him. And that genuinely is a sad state of affairs, for Mnuchin and all of us.

I could make a comparison here, to something I fantasize I share with Colonel Kurts in my personal life, and we’ll skip that today. What I think Colonel Kurtz is saying in a broader sense that relates to the here and now, is if Republicans are willing to deal “in the dark art” then Democrats have to partake to “deal in the dark arts” or at least and at bare minimum, match them in rhetorical terms. That means not in a Nancy Pelosi half-senile way. But in an effective way.

https://www.youtube.com/watch?v=xNRBajLM8_4

https://youtu.be/0VZmlFbfWrg?t=248

https://www.youtube.com/watch?v=XdfZtVlOIdA

“You know by that I mean , uh, seconds late” “I been mistreated babe, I believe, I’m gonna shake uhm on down……..aaaaaaaaaahuuuuuuhhhhhh…………

https://www.youtube.com/watch?v=-rrnLJ1U7qw