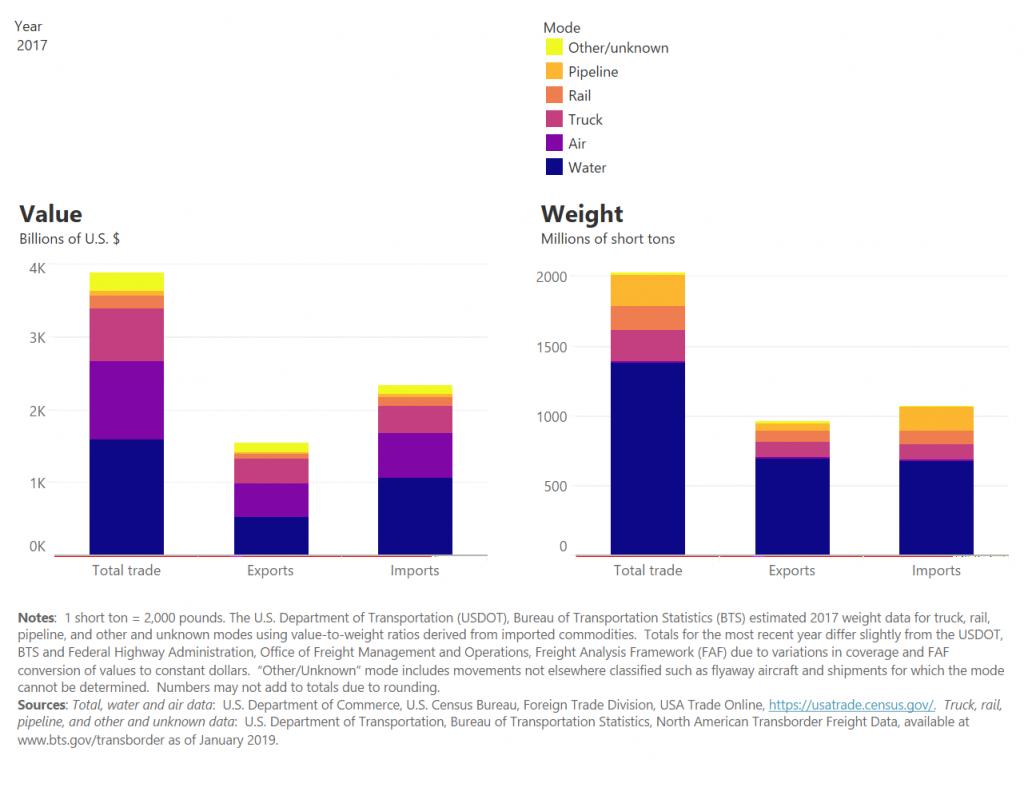

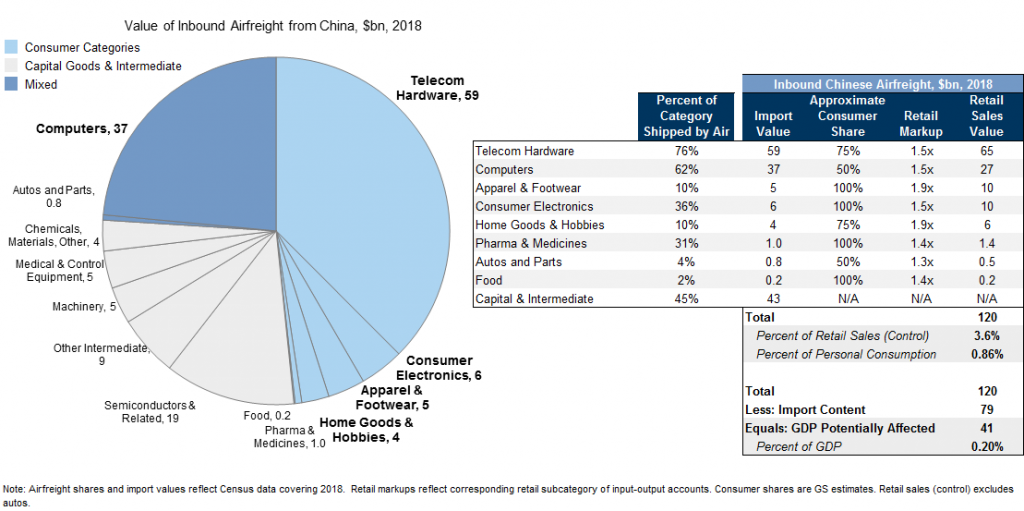

Some pictures to envision the impact of covid-19: (1) lots of US int’l trade goes by air, (2) and US sensitivity to disruption to air freight from China, by sector.

Source: Bureau of Transportation Statistics.

Goldman-Sachs attempts to discern the impact from air freight disruption to supply chains.

Source: Goldman Sachs, “US Daily: Chinese Factory Shutdowns and the US Consumer (Hill),” 14 February 2020.

So if I’m reading this right, G-S is saying that instead of (say) a 2% growth rate next quarter, we should expect a 1.8% growth rate. That’s not catastrophic, but I suspect it understates the total effect of Covid-19. We should expect China’s other trading partners to feel similar effects, and those effects should impact the US economy. For example, if Sino-Japanese or Sino-Korean trade in manufacturing components used in US production also dries up, then I would expect a second order supply shock to the US economy. I wonder if whatever story G-S is telling its customers matches what G-S executives are saying internally.

GS also says apparent oil demand down is down 4 mbpd in China.

Lowe’s and Home Depot in Princeton sold out of masks this afternoon .

Steve, You can get yours here: https://twitter.com/djbaskin/status/1228798382598000640?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1228798382598000640&ref_url=https%3A%2F%2Fmuddyeconomist.com%2F2020%2F02%2F16%2Ffannie-and-freddie-reo-inventory-declined-in-q4-down-17-year-over-year%2F

Great post and interesting numbers.