From Reuters:

“I think the economy is on a self-sustaining recovery and it’s a V-shaped recovery.”

Could happen. While some monthly indicators have not slowed much (manufacturing and trade industry sales), the more recent ones have…

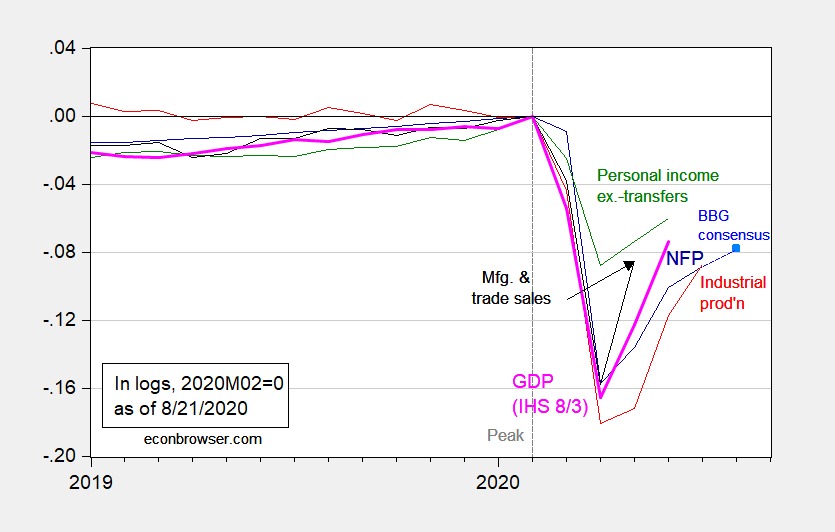

Figure 1: Nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), and Bloomberg consensus on nonfarm payroll employment as of 8/21 (light blue square), all log normalized to 2019M02=0. Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers (8/3 release), NBER, and author’s calculations.

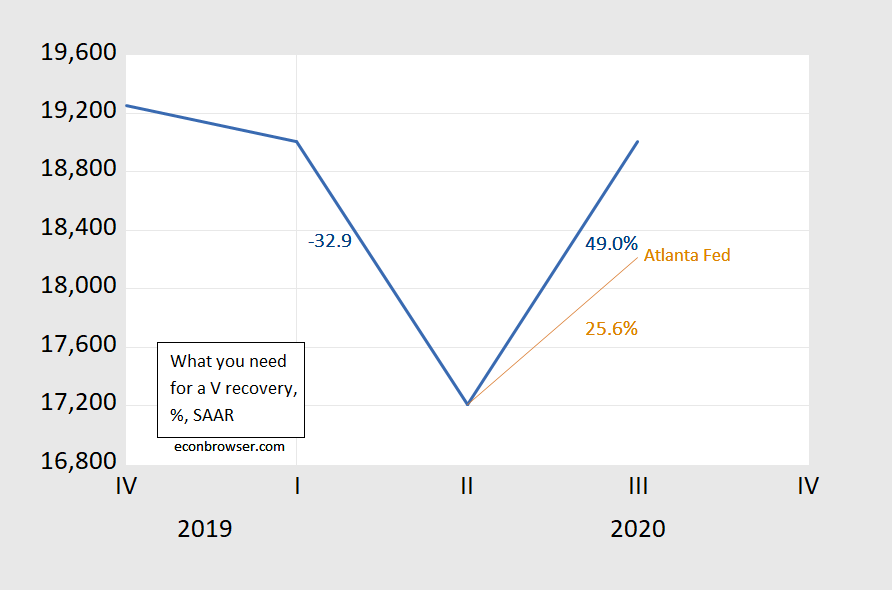

Nowcasts are for a big jump in 2020Q3, but nowhere near getting us back to where we were before. In fact, one would need a 49.0% jump in 2020Q3 GDP in order to re-attain 2020Q1 levels…

Figure 2: GDP as reported (black), Merrill Lynch (blue), IHS-Markit (purple), Atlanta Fed GDPNow (red), NY Fed nowcast (green), all in billions of Ch.2012$ SAAR. Source: BEA 2020Q2 advance, IHS Markit (8/21), Merrill Lynch, Atlanta and NY Fed via Calculated Risk and author’s calculations.

It’s conceivable that growth will keep pace next quarter so as to write out a “V” by 2020Q4, but that’s certainly not consensus.

Well, it was Kudlow that forecast it, so smart money will bet against it. Very hard to see his record changing now.

Anchors not aweigh… https://www.huschblackwell.com/state-by-state-covid-19-guidance

Every try getting that ship moving again with the anchor down?

@ Bruce Hall

Nay thou.

https://www.youtube.com/watch?v=cHAf9PDhfGA

Be nice to Bruce Hall as he has been put in charge of Trump’s Four Phases of recovering from this virus:

https://forums.talkingpointsmemo.com/uploads/default/original/4X/1/5/f/15f9fdebdd326a39050cd6d94ca330b94b9f63d9.jpeg

This right-wing rag is obviously wrong: https://www.washingtonpost.com/business/on-small-business/small-businesses-are-dying-by-the-thousands–and-no-one-is-tracking-the-carnage/2020/08/11/660f9f52-dbda-11ea-b4f1-25b762cdbbf4_story.html

Hey, boy, ah see ‘nother bus’ness tryin’ to stay open; shut ‘er down!

Bruce Hall: Well, people are paying attention – as noted on this blogpost from June. End-July analysis here.

Find a chalk board and write this down 100 times “test and trace”. Had the rest of the nation been developing testing abilities the way New York has, we could be reopening businesses safely.

Of course Trump is too stupid, lazy, and utterly incompetent to pull this off. And his chief cheerleader does not get it either. So start writing this over and over and maybe even someone as clueless might get it.

@ pgl

I hope to be the first to bring you the sad news about one of the members of the fairer sex and George T. Conway’s better side:

https://news.yahoo.com/longtime-trump-adviser-kellyanne-conway-025224688.html

“the sad news about one of the members of the fairer sex and George T. Conway’s better side”.

I cheered for the courage of their daughter. One – she is smart enough to hate Trump. But more importantly – she is rightfully sick of how her parents are bickering with each other. I’m sure George wants to be a good dad but this young woman needs a better mother than Kelly Anne even could be.

Reportedly Kellyanne Conway is leaving her White House position at the end of the month.

@ pgl

If you’re into MAD magazine/Al Feldstein type farcical humor, the best part of this story is the premise that Kellyanne is leaving MAGA cult for her children. That’s worth about a 3 minute belly laugh on the first hearing, and 10 seconds chuckle for every subsequent recall of the statement.

I don’t have ANY doubt the daughter is much sharper. The younger generation often outshines its older counterpart, and she has a low bar to hurdle there as relates to her mother.

That’s the point of the forecasts and of the post, isn’t it. If we hadn’t had such a disastrous policy response to the virus on the federal level and in (primarily) the Confederacy, we could have fewer health-based restrictions in effect. In addition, large numbers of people likely would not be self-restricting to avoid the virus, as rational people should be doing. It’s the pandemic, and the fact that we’re still hip deep in it with no clear end to it that is holding the economy back.

I guess if I wasn’t my usual lazy self, I would look at the individual components and hopefully be able to figure out why the difference. But it’s fascinating to me that NYFRB Nowcast was way more positive than Atlanta Fed in the prior quarter, and now these roles have reversed. Very weird, because wouldn’t one kinda “semi-assume” that the one that was more negative would tend to bend that way most of the time—unless the components of tabulation had changed?? Or is it just that one measure “lends itself” to more “extreme” or “diverging” forecasts??

Hey Moses,

You probably remember earlier discussions of the two. Atlanta is a “bottom up” now cast (adding up data, with assumptions to fill in missing data) while NY is “top down” (model driven rather than accounting). They don’t really have much bias in normal times (by design) so unless these abnormal times have lent one or the other some bias, neither one should err toward optimism or pessimism more often than the other. I say “should” because I haven’t actually compared. One thing to note is that if early data releases are deceptively strong, the Atlanta estimate will be high relative to the actual result – and presumably relative to NY. Same goes for the inputs to the NY model.

In good times, Atlanta’s forecast was often better than the median estimate of forecasters. Don’t know if that will prove true in plague times.

Once we have enough vaccine in 1Q21 we should be able to achieve herd immunity rather quickly given that 10-20% of the population has already been infected thanks to Trump’s bungling. At that point, the Fed’s massive monetary response should gain traction and Pres. Biden will enjoy a strong rebound. Presumably, this is what the stock market has been anticipating just as it correctly anticipated the Obama upturn in March, 2009.

The problem is, equity prices don’t match even that reality. Bubbles bubble. The Fed is part of the problem and need it’s gone buying ability reduced

Paul Mathis,

You’re assuming a quick rollout of the vaccine and that most consumers will change their behavior quickly after that. Yes, I know that a significant minority of consumers chose … poorly when governors started relaxing restrictions. However, we don’t know how long it will take for the rest of us to be assured that the significant minority cannot screw it up again.

Without an exogenous increase in the purchasing power of the bottom 60-80 percentiles of households (i.e., another round of disaster payments), a much higher level of consumer confidence is essential. The Fed can’t do it alone. This is a point that Krugman has hammered on in Every. Single. Downturn. Jerome Powell has been saying the same thing after the last what, 3, 4 FOMC meetings now?

Monetary policy alone is not sufficient. If fiscal policy does not provide the necessary impetus, we need the infamous ‘Step 2: A miracle occurs,” in this case where consumers do an about-face in their spending patterns.

While consumer demand is certainly always a key consideration, this recession seems similar to the 1946 recession (-11.6%) which was nearly as bad as the contraction in 1932. But unlike 1932, the 1946 contraction was mostly the result of supply shortages as opposed to the typical demand destruction. Until consumer demand for cars and houses could be met by re-organization of the economy from war production, the economy slumped.

Then, as now, there is significant pent up consumer demand to drive new investment once the war is over, i.e., the virus is controlled. Of course movie theaters and concert venues will take longer to recover, but the housing market is already strong and auto sales will rebound sharply once production resumes in full. Travel and restaurants will see booming business causing a vigorous rebound in 2021 for Pres. Biden. Poor Trump won’t be able to claim credit from his jail cell.

Auto sales have topped and housing is overrated debt scam. As the 2000’s showed, it doesn’t produce a bunch of growth.

You are assuming Trump’s impatience will not screw up the development of vaccines. You know – Trump can screw up just about everything important.

Navarro had aggressively confronted FDA officials, saying, “You are all Deep State and you need to get on Trump Time.”

This freakish nut of an economist is a monster. First he was pushing hydroxychloroquine and now he’s pushing the FDA to get a vaccine approved in time to support Trump’s election. He’s going to get people killed.

If this guy is ever accepted back into the halls of academic economists it just illustrates the bankruptcy of the profession. Perhaps he will quietly shuffle off to a sinecure at the Hoover Institution with the rest of the right-wing monsters.

if i were biden, navarro would be in my crosshairs for investigation of wrongdoings. set an example for future monsters. miller should also get in line. bannon has already fallen. they have crossed the lines of political partisans into the arena of cruel and unusual behavior to their fellow man. they will be found guilty, here or in the afterworld.

joseph,

No, I seriously doubt Hoover will take Navarro. He is really badly damaged goods. They have people like Obama’s Ambassador to Russia, Michael McFaul. They have a lot of conservative economists, but I cannot name a current one that is anywhere near as bad as Navarro.

Plosser, Sowell, Cochrane, Shultz, Lazear, Boskin, Henderson. Some are even crazier than Navarro who was a strong Clinton supporter before he became a Trumper.

Sorry, Paul, none of these remotely match Navarro in his current state.

You are right that once upon a time back in the 90s he was more or less reasonable. Heck he even coauthored a paper with our Menzie, and ran as a Dem for a local political office in Cal. That was also when he last published any academic papers that I am aware of. Then he turned into an anti-China gonzo nut case, which is what brought him to the attention of the Trump family and to his curent position.

As a simple matter, I do not think you would find any of the people you list as supposedly “even crazier than Navarro” doing anything as remotely crazy as arguing with top scientists on health matters. Can you name any of these that would be either that stupid or that crazy to do such a thing? This is a case of a once reasonable and sane economist just completely losing it.

@ Barkley Junior

Uh-oh, did someone dare to disagree with one of your proclamations “from on high” Junior?? You need to wave your arms around vociferously and tell them they are beyond the bounds of propriety. Mention how the FBI is out to get you and is taping/bugging your weekly phone conversations with Gopalan Balachandran. Or something worthy of framing yourself in badly need of attention. Can we get your house nurse to at least pat you on the head?? Put on a Hawaiian print shirt with a bright fluorescent orange theme and check how your butt looks in the mirror with those leather pants.

https://www.hoover.org/profiles/edward-paul-lazear

https://www.theguardian.com/books/2013/may/04/niall-ferguson-apologises-gay-keynes

Some economists we may be familiar with on this blog might also tell you Hoover provides you with an opulent environment, a large audience, paid travel to a cosmopolitan city “by the bay” and a feeling you are a very special person. Whether there are other places with more institutional integrity where one can promote their own academic papers is something they’ll have to work out on their own I guess.

Well, Moses, you have certainly not made the case that any of the people Paul Mathis suggested are crazier than Peter Mavarro actually is. You provided a link to something about Lazear, but offhand I saw nothing particularly insane. The people listed by Paul Mathis are all conservative and I am sure enjoying being at the Hoover Institution. You did link to Niall Fergusion, who is a major creep. But while he sort of pretends to be one, he is not really an economist and also not on Paul Mathis’s list.

As it is, there is one possible candidate for someone who has been at Hoover, although I think not there now, who might compete with Navarro for being crazy. That would be gold bug Judy Shelton, taken down effectively by Jeffrey Fraenkel above. However, she has at least arguably been consistent in her gold buggery, that is until she decided to play Trump toady recently, which has gotten her nominated to the Fed board. But I bet that if the Senate does get approved by the Senate for that position, I bet we shall not see her publicly denouncing FDA scientists as “deep state” as Navarro has done. She might be a rival to Navarro, but I doubt even she will outdo him for being insane.

https://www.calculatedriskblog.com/2020/08/the-failed-promises-of-2017-tax-cuts.html

i like calculated risk because it is data driven and avoids political controversy. for those hurrahing the trump agenda, here is a takedown of the results of the trump tax cuts. in simple terms, failure. we don’t need another four years of this folly.

Your latest update from Moses the Misogynist (so other people can feel self-righteous and saintly about themselves) on one of the sharper women in our great American society.

https://www.nytimes.com/2020/08/23/business/media/how-zeynep-tufekci-keeps-getting-the-big-things-right.html?action=click&module=Top%20Stories&pgtype=Homepage

Of course I was talking about Esther Duflo on this site before Barkley Junior said he got cheated out of his Nobel by Paul Krugman and was giving me Menzie’s, Professor Hamilton’s, and his own publication and citation count. No word yet on if Barkley Junior is now an Emeritus member of NOW’s board for updating us on the 3 men’s counts. Here’s the website if you’d like to check.

https://now.org

Gasoline supplied, a consumption proxy, has been flat at 10% below normal for eight weeks now. Refinery runs and total product supplied (a proxy for total oil consumption) have been 14-16% below normal for the last 5-7 weeks. This high frequency data suggests US oil demand recovery is stalling out.

You know I’ll admit the world or even U.S. domestic oil market is far from my bailiwick. And I know rig counts are important in determining where oil prices are going. But wouldn’t you just directly look at demand numbers?? BTW, I’m not sure I couldn’t randomly tag someone off the streets who had not gotten their high school degree or their GED who would disagree with your last sentence. I mean do you think your average junior high kid in a decent suburban public junior high would disagree that demand for gasoline would be low at this point?? Not a real rocket scientist observation there “Princeton”Kopits. Have I mentioned when you get up tomorrow, assuming the skies are not overcast in your area, most likely the skies will be blue at mid-day. Make a notation Steve, please. I’m calling FOX News now to see if they’ll let me discuss sky colors at 4:00am tomorrow, so don’t F**king hog my stagelight dude.

“This high frequency data suggests US oil demand recovery is stalling out.”

or you can simply pull into any costco to get gasoline, without waiting one second in a line, to realize demand is gone.