In these times? Among other reasons, it’s: (1) An indicator of household consumption behavior; (2) An indicator of conditions for business – including small/medium size enterprises. Hence, the recovery of retail sales has been much lauded. But if you thought the recovery was in brick-and-mortar retailers, you’d be somewhat misguided.

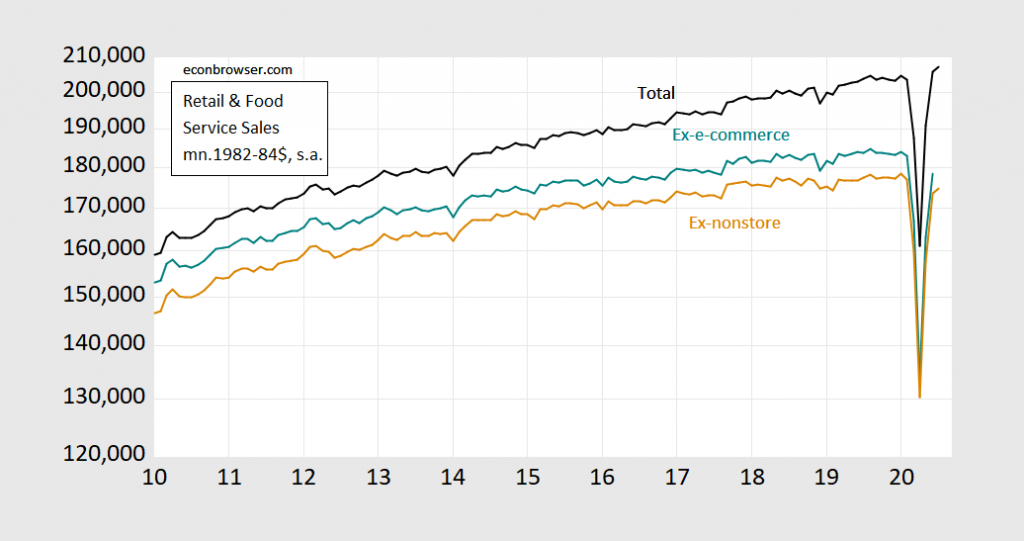

First, for retail sales and food services, sales are clearly up relative to trend, in real (CPI-deflated) terms. But then, interestingly, real sales were essentially flat at the end of last year, coming into this year.

Figure 1: Total retail and food service sales (black), excluding e-commerce sales (teal), excluding nonstore sales (brown), all in millions of 1982-84$, s.a., on log scale. E-commerce sales quarterly data converted to monthly by dividing by three. All deflated by CPI-all. Source: Census, BLS via FRED, and author’s calculations.

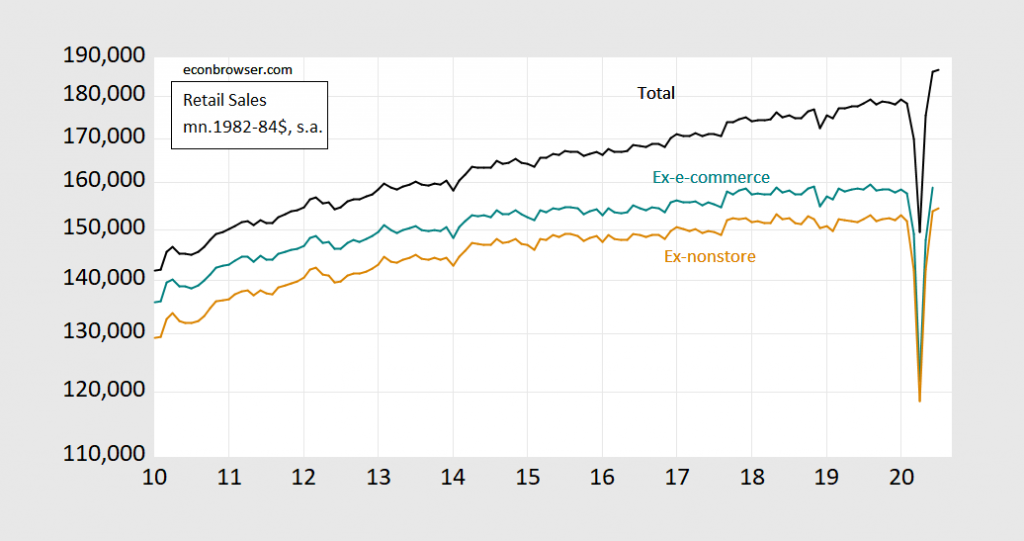

Second, there is a definite recovery of real retail sales (ex-food services), indeed jump above (flat) trend. However, the excess over pre-shock trend seems attributable to e-commerce.

Figure 2: Total retail sales (black), excluding e-commerce sales (teal), excluding nonstore sales (brown), all in millions of 1982-84$, s.a., on log scale. E-commerce sales quarterly data converted to monthly by dividing by three. All deflated by CPI-all. E-commerce sales quarterly data converted to monthly by dividing by three. Source: Census, BLS via FRED, and author’s calculations.

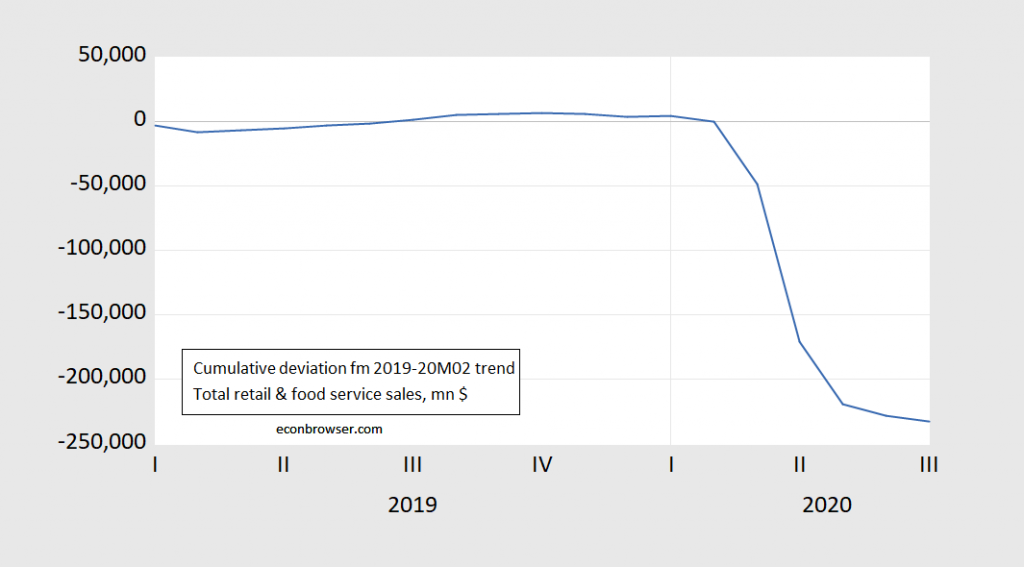

Third, even if real retail sales have recovered in levels, that still means that there was a loss of sales relative to what would have occurred otherwise. In other words, just because the flow is back to pre-shock levels doesn’t mean accumulated flows (sales) are. To show this, consider the cumulative deviation from trend of nominal retail and food service sales; it’s about $233 billion.

Figure 3: Cumulative deviation from trend of total retail and food service sales (black), in millions of dollars, s.a. Trend in sales calculated as time trend in logs, 2019-2020M02. Source: Census via FRED, and author’s calculations.

As the bite from the reduction in enhanced unemployment insurance benefits increases, I expect sales to dive in September (and may have stalled in August as public health restrictions increased in many states).

Just to clarify, Menzie, while retail sales include food services, they do not include services more generally, right? I am not sure about this. I note that when the BEA quarterlyi GDP numbers came out, the item showing the largest decline was services, which I noted at the time was an important point, although there has been essentially zero commentary on it.

You are correct.

Barkley Rosser: Others have answered, but for completeness, “yes”.

I believe sincerely in being kind to people. That being said, I give up.

I’ll go to the end of it, really, but when it turns into some kind of self-obsession…….

Barkley, et al; the Census released the Quarterly Services Survey at 10 this AM, which gives us an advance estimate of select services spending for the 2nd quarter…that should result in major revisions to Q2 GDP services: https://www.census.gov/services/index.html?utm_campaign=&utm_content=&utm_medium=email&utm_source=govdelivery

if you want to compare this report to the figures used in the advance estimate of GDP, go to the BEA’s GDP page and select “Key source data and assumptions”

https://www.bea.gov/data/gdp/gross-domestic-product

if i have time, i may work up a GDP revision estimate based on this report later this week…

Even if we can’t recoup the lost sales, that is a surprisingly good retail sales performance!

Have you ever watched a football game? Your comment is sort of like having your team trail 49 to 0 by the end of the 3rd quarter but then score 21 points in the last 15 minutes. I guess you would declare this a victory but your team still got slaughtered.

That’s a good analogy pgl.

We have a $22 trillion economy, which if adjusted for 1983 prices, would be around $8.5 billion in real terms. Retail sales are only $200 million, so this is a small subset of even consumer demand as I understand it. Actually one should be doing retail sales in terms of value-added as that is how GDP is calculated. Now if these are retail sales of goods made in America (Mike Lindell’s crappy pillows for example) – fine. But what if these represents apparel goods and sneakers made in China?

Retail sales are only $200 billion. Sorry for the typo. Trying to watch the playoffs.

I expect sales to dive in September (and may have stalled in August as public health restrictions increased in many states).

The Harvard University/Brown University tracktherecover.org shows consumer spending hit bottom on 31 March and then steadily rose, peaking on 22 June, at which point it was only 5% below the pre-pandemic January level. Since then it’s moved sideways and as of 2 August (most recent update) it was down about 3 percentage points from the 22 June level, or 8% relative to the pre-pandemic January level.

Interestingly, grocery sales are actually up 9.7% relative to January. More people making sourdough bread at home! Restaurant sales have increased from -66.5% in late March to only -29.4% relative to January. Entertainment & Recreation and Transportation are the two major sectors that have not seen any significant recovery since April.

I’ve been cooking at home for the entire duration. Then again – I like my own cooking.

I’ve also been cooking at home though we try to support a couple of our favorite local restaurants by ordering pick up. Each time I go to pick food up the restaurant is empty of patrons and I don’t know how much longer they can exist. I also am a baker and make a mean sourdough.

We do the same with our favorite neighborhood restaurant. They seem to be thriving on take-out. The difference may be that they always had a take-out clientele. It’s nothing new for them or for the neighborhood.

https://fred.stlouisfed.org/series/PCEC96

Real Personal Consumption Expenditures

Began the year at $13.4 billion. Fell to just under $11 billion. As of June, it was just over $12.5 billion. So other parts of consumer demand has not fully recovered. Not nearly.

In accordance with Barkley’s comment, above. Services have not recovered, similar to brick-and-mortar store sales.

I have retail sales falling 2%+ in August and another 3% in September.

https://talkingpointsmemo.com/news/mypillow-ceo-mike-lindell-cnn-interview-unproven-covid-19-treatment?fbclid=IwAR09oZT5MlDgkc23_CHzRzQ10kkMBT6-VKqZG_lwiRtf-liiPxYUSN5ztH4

Andersen Cooper rips into MyPillow’s Mike Lindell over that oleandrin scam. Trump’s supporters are true nut cases and slimy business people.

there actually is a clinical trial of oleander in Houston based on a preprint showing in vitro activity against SARS-CoV-2. Of course it must be remembered that many compounds have shown in vitro activity and never work in humans. I think this compound will follow the same route as there is not a plausible mechanism of action. the trial is only a feasibility one and not randomized so I don’t expect they will learn anything at all. It is also recruiting patients “by invitation” and that only leads to cherry picking patients to prove a concept. We have already been down that road with HCQ. Lots of junk science going on these days. If interested here is the NIH trial number: NCT04486144

Professor Chinn,

1. I am unclear on the calculation of the trend and the cumulative difference from trend.

Could you give a few more details to allow replication?

2. Why use nominal RSAFS instead of real RRSFS?

Thanks

AS: restrict sample to 2019m01-2020m02, run regression log(rsafs) c @trend, fit trend in levels (not logs) 2020m03-2020m07, subtract actual rsafs from trend, cumulate

Thanks!

I had done the regression correctly, but seemed to get confused about fitting trend. Also did not know if you were starting with trend at “1” or :0″. @ trend begins with “0”.

Professor Chinn,

I ended with a difference of -232.602 billion. Does that agree with the answer book?

AS: Yes, I think so; of course there are *many* answers. I could’ve done a stochastic trend instead of a deterministic, etc., but all should get to similar magnitude.

Off topic – Cuomo is getting readt to run in 2024.

I thought the same thing too for a while but here’s the funny thing – he may not even get the vote from his own state. Politics in NY is a rough and tumble thing.

The book is a dead give-away.

Cuomo is peddling a new book:

https://dailyvoice.com/new-york/nassau/politics/covid-19-cuomo-to-publish-book-on-pandemic-amid-blistering-attacks-on-trump-in-dnc-speech/792672/

While New York continues combating COVID-19, Gov. Andrew Cuomo has taken the time to write a book looking back at the state’s experience “climbing the mountain and coming down the other side” while dealing with the pandemic.

“American Crisis: Leadership Lessons From The COVID-19 Pandemic” is set to be released by Crown Publishing on Tuesday, Oct. 13, three weeks before Election Day.

The announcement of Cuomo’s book comes a day after he was a prominently featured speaker at the Democratic National Convention, harshly criticizing President Donald Trump, leading to a series of scathing tweets from Trump in response.

I’m not entirely sure about the publication date but rumor has it coming out in October – just before the election.

“set to be released by Crown Publishing on Tuesday, Oct. 13, three weeks before Election Day”

Duh – that’s where I heard that!

To the extent that food business such as restaurants have been bankrupted or marginalized by executive order restrictions, don’t expect to see much of a bounce back any time soon. If restaurants that are surviving now through outdoor seating must contend with continued restrictions into the late fall, expect many more failures in the northern states.

Fast food chains with drive-through service have been least affected. https://www.restaurantbusinessonline.com/financing/fast-food-restaurant-sales-return-normal

Bruce Hall: Or if their customers who dined in die off … as Dr. Fauci says, we may be in for a world of pain when flu and Covid season coincide.

… but, but, but we have vaccines for the flu. /s

https://www.cdc.gov/flu/vaccines-work/effectiveness-studies.htm

Well, maybe they can be just as effective for COVID-19.

Prediction: old, sick people gonna die.

We have vaccines for other diseases and you are stupid enough to think they will magically work on COVID-19? It is beyond amazing how gullible you are.

Oh my – CoRev and Bruce Hall diverge in their spin for the 1st time! Now if Brucie got out of his mother’s basement for the first time in months, he might know Brooklyn eating places are serving a lot of people outside. It seems we have figured out how to use our streets for social distance dining.

“Quick-service restaurants fared best. Their sales were down just 0.8%, thanks largely to the strong prevalence of takeout business, particularly the heavy use of the companies’ drive-thrus, which have proven to be a big winner during the pandemic.”

Great more Big Macs and less sushi, which is going to have adverse long-term health consequences. Oh wait in my city you can order online and have someone deliver it straight to your apartment. Of course Uber Eats is charging an obscene 20% deliver charge. But there is so much to American capitalism that Bruce Hall misses as hides in his mother’s basement.

Bruce Hall To the extent that food business such as restaurants have been bankrupted or marginalized by executive order restrictions, don’t expect to see much of a bounce back any time soon.

You’re confusing the fate of the restaurant sector with the fate of individual businesses. Restaurants come and go all the time. Restaurants have a very low Domar weight and mainly effect the macroeconomy via final demand pull and contribute almost nothing in the way of intermediate supply to other sectors. Cooks don’t forget how to cook. Wait staff don’t forget how to wait tables. Hosts don’t forget how to seat customers. Dishwashers don’t forget how to wash dishes. When customers feel that the virus is under control, then people will return to indoor dining. That probably won’t happen until we have something like vaccine based herd immunity. Do a thought experiment. Suppose the virus magically disappeared overnight. How long do you think it would be before restaurants came back? Probably not the same restaurants, but it wouldn’t take long. Every few weeks I used to go to the old Detroit Arsenal along Van Dyke in Warren, MI. You might be familiar with it. In the wake of the depths of the Great Recession you could literally go for miles along Van Dyke all the way up to Troy and see hundreds of shuttered restaurants. A year later there was very little evidence of the economic blight. Different restaurants, but still plenty of them. And generally better ones.

You should thank your governor. Her policies probably kept you alive despite your pigheadedness. COVID cases in Michigan were exploding until she implemented restrictions the last week of March. COVID cases fell from almost 1800/day and a positivity rate of 74% to less than 100/day. That’s pretty good for a state of 10 million. But then she caved into the “Liberate Michigan” nonsense and things started going in the wrong direction; however, she has managed to keep the Rt at or below 1.00.

“Prediction: old, sick people gonna die.” I suspect this is more than a prediction from Bruce Hall. It is almost he is cheering for people to die. MAGA!

@Bruce Hall – this has to be one of the dumbest posts I’ve read. It has nothing to do with executive orders at all. 1/3 of the population won’t go to a restaurant until there is a vaccine or treatment for COVID-19. The same goes for getting on an airplane. We had our trip to Italy cancelled this year. We don’t go to restaurants. Performing arts are shut down until the end of the year. We have nothing to spend money on right now. Read up on Occam’s Razor before you comment.

Referring to Occam just reminds me of why I like this blog, even though the technical analysis sails over my head.

“this has to be one of the dumbest posts I’ve read. ”

It is dumb but it does not even make Bruce’s top ten.

Menzie, i have a problem with that “real retail sales” metric as promoted by FRED and NBER…by deflating sales of goods with CPI, you’re using a price index that is mostly services (and 30% shelter), which means you are in effect deflating sales of TVs and clothing (which have generally been falling in price) with the price changes of housing, rent, and medical and educational services, prices for which are rising above trend…

the “real retail sales” that FRED graphs originated with the NBER’s Business Cycle Dating Committee; at the time, it was one of the four economic indicators they were using, in addition to GDP, to determine turning points in the economy for the purpose of making recession calls… FRED took the indicators listed by the NBER and turned them into a “tracking the economy” page which they have since taken down https://research.stlouisfed.org/economy/ but which are still tracked in 4 posts a month by doug short: https://www.advisorperspectives.com/dshort/updates/2020/08/14/the-big-four-economic-indicators-july-real-retail-sales ..

the definition FRED attaches to their real retail sales metric is as follows “This series is constructed as Retail and Food Services Sales deflated using the Consumer Price Index for All Urban Consumers” which as i’ve pointed out, means they’re deflating sales of items purchased at retail with price increases for services such as rent, doctor’s visits, and college tuition..

if the NBER is still using the same metric to determine economic turning points, then they may well get their recession calls wrong, too…

rjs: Good point about the appropriate deflator. NBER BCDC uses “real manufacturing and trade industries sales”, which I think mimics the series reported by Census.

Bea calculates a real retail sales estimate as they estimate real GDP and real PCE. It is released near the end of the month when personal income data is released. It does not have a separate release for the public but it can be downloaded directly from BEA Section, tables 5U, 6U and 7U. The three tables are nominal, real and the deflator. The tables are detailed by the major retail sales categories.

Generally the deflator for retail sales runs about two percentage points per year below the CPI. As of June the y/y cH: for the CPI is 0.7% while the retail deflator is minus ( – ) 2.7%, Using the BEA data gives a quite different view of real retail sales.

Over all this retail sales if far superior to the Census, FRED release. I have complained for years about th FRED data to no avail.

Lot of money sloshing around out there. DOW at near 28,000; WTI at $42. Which is the proper measure of the real economy?

There is no proper measure. Tech stocks are strong and driving the market. Real estate other than single family homes are in the tank along with a lot of retail, food service and hospitality. When do you think those will come back. Sysco, the biggest food service company, is off 30% and you don’t even see their ubiquitous trucks around our area these days. How soon will it be for airlines to become profitable? When will organizations start planning for in person large regional and national meetings? I don’t see any signs that this is going to turn around quickly.

Eh, maybe. Looks like money is being destroyed. Markets lay that feature.

Cramer: Stock Market v Economy

https://www.cnbc.com/2020/08/18/the-economy-is-in-precarious-shape-despite-new-sp-highs-cramer-says.html

James Cramer finally got something right? Stop the presses.

Neither. Another simple answer to a stupid question.

And the S&P has just hit a record. What strikes me is that while Trump is taking credit for this, all the polls show Biden, who was just this minute officially nominated by the US Democratic Party to be its candidate for President of the USA, is leading Trump by large margins, many of them by double digits, with all the polls also showing him well ahead in the swing states that will determine the electoral college outcome. Certainly Trump can still win, but the market is obviously looking at those polls and seems to be fine with a likely victory by Biden-Harris over Trump-Pence.

Good point but careful. If Trump sees your comment, he will fly off in another Twitter Tantrum.

https://ycharts.com/indicators/us_coronavirus_deaths_per_day

The news is talking about how 1324 people died of coronavirus yesterday. Of course we should be doing 7 day averages even though CoRev confuses this with 5-day averages for some odd reason. OK, over the past 7 days, the daily death rate averaged 1042.

For the first 7 days of July, this average was 578. The next 7 days? 795. The next 7 days? 826. The next 7 days? 1047. July saw an accelerating daily death rate when we do this as a 7-day average.

But CoRev assures us that this has been declining. Has it? The next 7 days? 1047. Yea the next 7 days saw an average daily death count of only 1006. Progress?! Well the last 7 days again was 1042.

Simply put the rate of increase of total deaths seems to be stuck at a figure over 1000 per days. But CoRev sees this as progress. Go figure!

Bruce Hall says they are old people who were going to die anyway. Or something like that.

With online sales up tremendously – 44% in the quarter – we seem to be seeing an acceleration of the erosion of retail business. Much of this, IMO, seems connected to offices being closed. I live in Boston. Most of downtown is closed: outside of Downtown Crossing, most stores and restaurants are closed. Back Bay is devoid of office workers well. I’ve taken photos of the hallway at the Prudential Center in front of the main entrance to the offices, with only 2 people in sight. There is very little retail traffic on Newbury Street.

There is some more retail traffic in the suburbs, but it seems concentrated in a few places. Costco is doing well. The parking structure for the nearly new Legacy Place

– a modern lifestyle center – is empty and the central surface lot seems to contain a lot of employee cars. The retail stores have little traffic. Most of the small business owners I know arent making enough to cover rent. (Shopping centers were my business for years.)

Shopping patterns seem to have changed because people arent going to an office. I’m hearing numerous companies planning to cut space, either by reducing or eliminating planned expansion or by giving up space. The remote work process has been accelerated because companies are having to figure out how to evaluate people, how to manage people, how to advance careers, how to attract and retain, without the former stigma associated with not being in the office all the time.

The shifts in office demand and in retail will have large displacement effects. That’s the motive for my post; if retail sales are up, the composition has changed away from stores to online, and that means very large job displacement, both in stores and in the companies that run stores. With offices, which has also been to a lesser degree my business, there could be some good effects in some markets. As in, SF rents are ridiculous so if companies reduce daily head count and control office time

to manage occupancy cost, that might make room for other companies. But most markets arent SF. The drop in business associated with long term office demand changes may have a huge effect on values, as well as on businesses dependent on office worker volumes. One side effect: much of this stuff is owned by insurers, so they’ll need to raise rates to make up the investment losses.

The lenders have been pulling back out of fear of what’s coming. Example: the restaurant business is dead in the water without rent relief, which depends on lenders.

I’m afraid the current wave of development, if it gets finished, will be followed by a long hiatus.

Your analysis is spot on! It is pretty much the same story down here in the Washington DC metro area. Very few offices are open right now and there is little rush hour traffic.

It would surprise me if the buildings under construction now get abandoned. I agree that there wont’ be much more development following it, at least for offices or stand alone retail. Downtown Seattle is a ghost town these days. The neighborhoods outside downtown are quiet, but clearly populated. Some small businesses are boarded up, but a surprising number are opening back up. It’s practical stuff, like hardware stores for the most part.

The side of construction and development that I cannot get a handle on is the future of apartment and townhouse construction. The path of development in this city has been medium size to large mixed-use buildings along the arterials and townhouse projects jammed onto previously single family lots on side streets. The kind of buildings that cram five condo/townhouse units onto a small single family lot are ugly and ungainly. Inside, the units are awkward. They usually have roof decks, which is a pleasant amenity, but they are otherwise both unremarkable and ungainly. With the shift to remote working, I wonder how demand for small apartments will hold up, and how demand for awkward two bedroom townhouses will hold up. There’s no reason to be near Amazon’s downtown campus if you aren’t working there. Same with any other business location. If houses are bigger and cheaper in other areas, but have the same connectivity, I can’t see how the price of single family houses will stay inflated, nor can I see how demand for increasingly bizarre townhouse projects will avoid collapse.

joanie If there’s an effective vaccine in the not too distant future, then there’s still hope for downtown offices. Working remotely is one of those things that sounds great at first, but eventually it takes a toll on productivity. So if working remotely becomes the norm, then businesses are going to have to balance the savings in rent against lost worker productivity. Satellite work arrangements probably mean lower wage growth for those workers.

The good news? HHS is finally sending rapid COVID-19 testing machines sent to nursing homes. The bad news? HHS did not include instructions how to use them:

https://talkingpointsmemo.com/muckraker/hhs-sent-rapid-testing-machines-to-nursing-homes-without-direction-resulting-in-mass-confusion

Last month, Dr. Michael Wasserman received a surprise at the nursing homes he operates. It came in the form of a delivery from the Department of Health and Human Services: three rapid COVID-19 testing machines sent to nursing homes that Wasserman, president of the California Association for Long Term Care Medicine, directs. Part of Wasserman’s surprise stemmed from the fact that he had no idea the machines were coming without instruction. Neither, for that matter, did the state government, which had regulations on the books that barred the use of the machines in California nursing homes….But the HHS program to distribute the machines has been met with mass confusion stemming from a lack of direction over what to do with the machines and how, or whether, to record and report the results. As a result, some nursing homes have been failing to report the results of tests to state health departments. The tests’ accuracy has also been reduced by operator error, clouding the true spread of COVID-19. “I have to say, I’m not impressed that they basically sent us machines without clear direction on how to use them, and without clear direction to state and county health departments,” Wasserman said. Wasserman is not alone in his concern.

The incompetence of this White House is beyond belief!

its not just the white house

https://www.kxan.com/news/texas/coding-errors-meant-504000-covid-19-test-results-were-not-previously-reported-to-the-state-dshs-says/

the state of texas could not properly report over 500,000 covid test results in late july and early august. clerical issues would not let them process more than 50,000 tests per day! then when the backlog was fixed, the data showed a surge in testing- nobody could explain because the backlog fix was not communicated. so texas went weeks during the summer with unreliable data, which was also unknown to policy makers. it is really difficult to respond to the trump virus when the state cannot produce accurate data in the spread of the virus. a state monitoring system that cannot process more than 50,000 cases in a day during the eighth month of a pandemic is criminal. somebody should be fired.