DWD will release July numbers tomorrow. Here’s my guess for employment. First, what we know now.

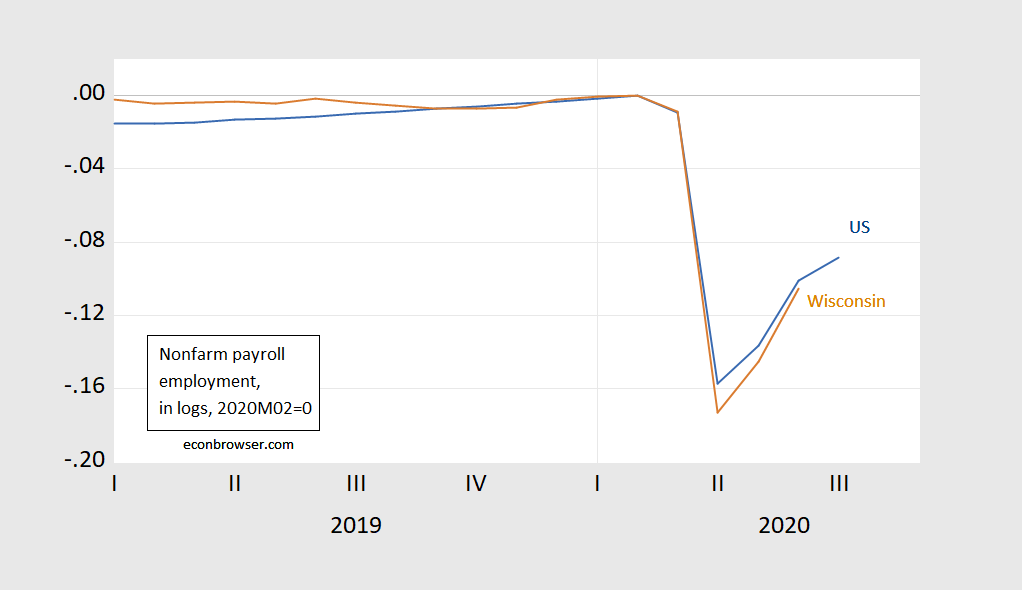

Figure 1: Nonfarm payroll employment in the US (blue), in Wisconsin (brown), in logs, 2020M02=0. Source: BLS, author’s calculations.

I can use the historical relationship between the national and Wisconsin series (2019-2020M06) in first differences to forecast July employment.

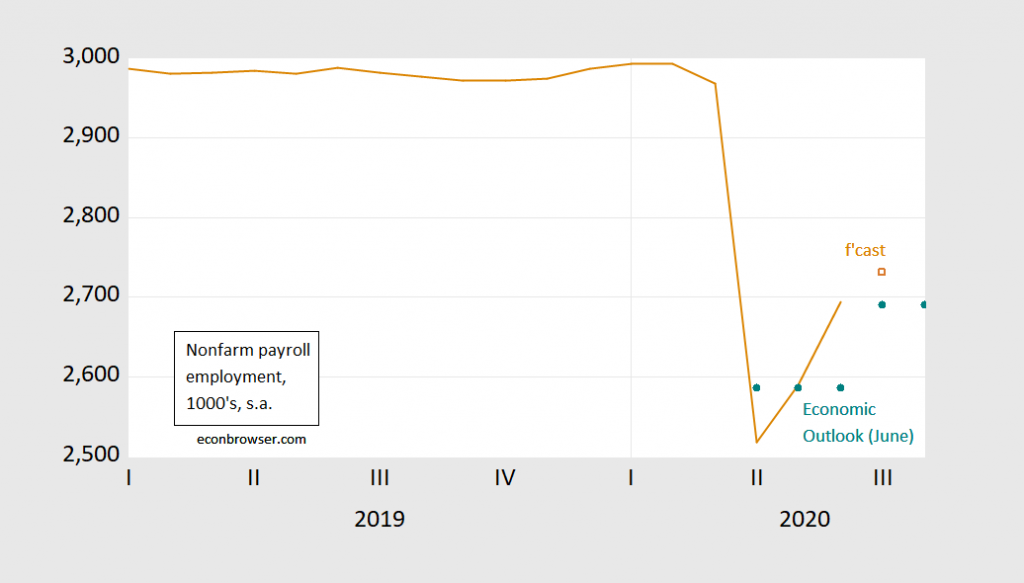

Figure 2: Nonfarm payroll employment in Wisconsin, 000’s, s.a. (brown), Economic Outlook forecast of June (teal), author’s forecast based on national employment (brown box). Source: BLS, Wisconsin Economic Outlook (June 2020), and author’s calculations.

This implies a 37 thousand increase, i.e., 1.4% (not annualized). Note that as of June, we are outpacing the June 2020 Economic Outlook forecast thus far.

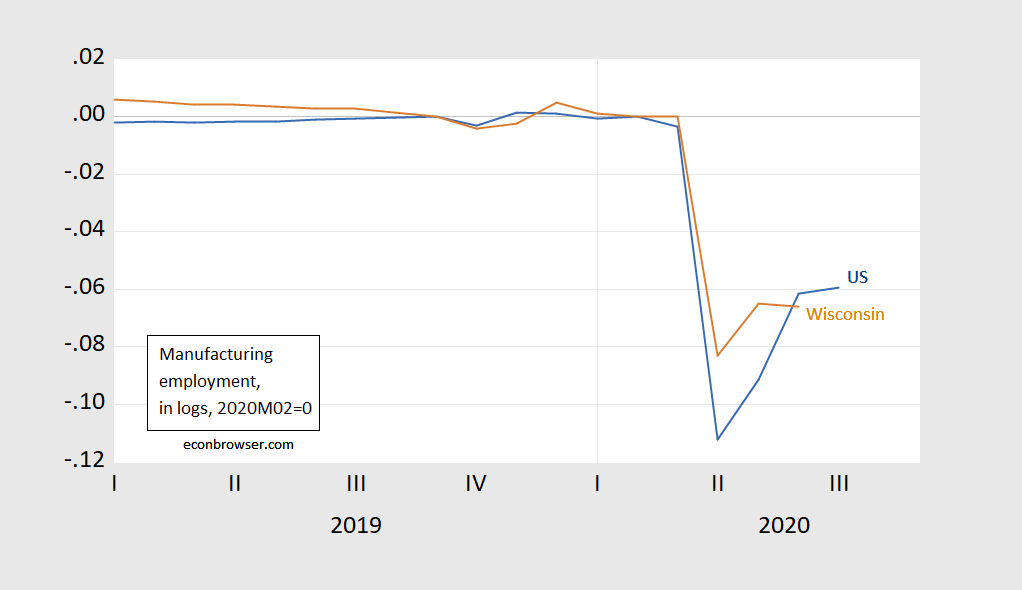

Wisconsin is somewhat more manufacturing-heavy relative to the nation overall. It’s interesting to note that Wisconsin’s manufacturing recovery tailed off earlier than the nation’s.

Figure 3: Manufacturing employment in the US (blue), in Wisconsin (brown), in logs, 2020M02=0. Source: BLS, author’s calculations.

Professor Chinn,

Any thoughts to share on what may cause the change in Wisconsin nonfarm employment, other than random variation, to vary from the mean forecast of 37,000?

Initial jobless claims last week hit 1.1 million.

But Apple’s market valuation is now $2 trillion. MAGA!

Which is an excellent argument for a high tax on excess profits. Apple’s value in normal times has to do with producing a sort of luxury item with planned obsolescence. Now, it is an act of god. The economy suffers no harm from high taxes in those situations.