The WSJ and IGM/FiveThirtyEight forecast surveys [1] [2] are out. Mean forecasts from the WSJ are up (in levels).

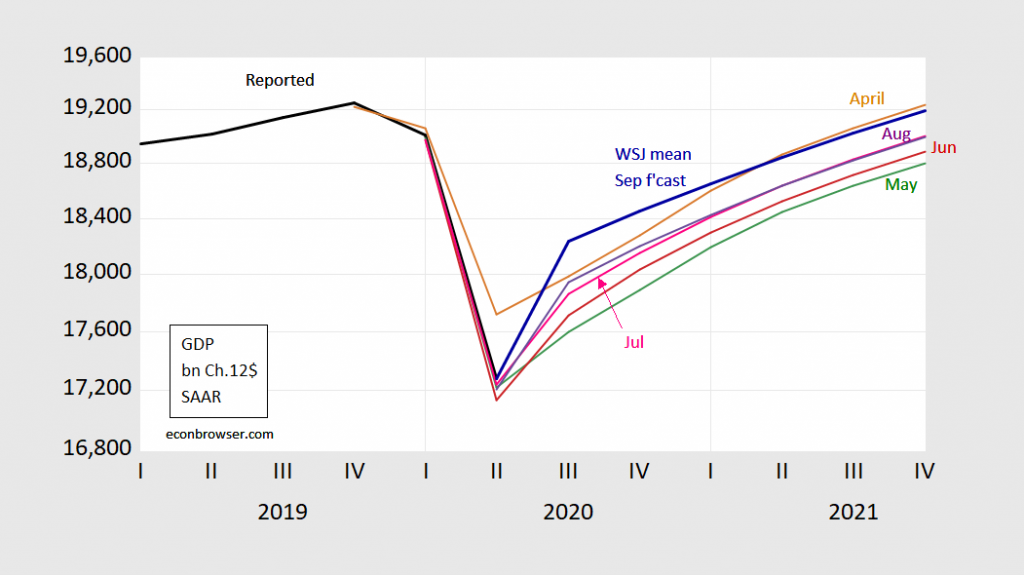

Here’s the most recent (mean) forecasts of levels, in the context of previous.

Figure 1: GDP as reported in 2020Q2 2nd release (black), WSJ April survey (tan), May survey (green), June survey (red), July survey (pink), August survey (purple), and September (bold dark blue) all in billions Ch.2012$, SAAR, all on log scale. Source: BEA, various vintages, WSJ survey, various vintages, author’s calculations.

The upward movement in the trajectory of GDP from August survey to September largely arises from an upward revision in 2020Q3 growth (18.3% to 23.9%) even as growth declines from 5.9% to 4.9% and 5.0% to 4.4% in Q4 and 2021Q1 respectively (all SAAR).

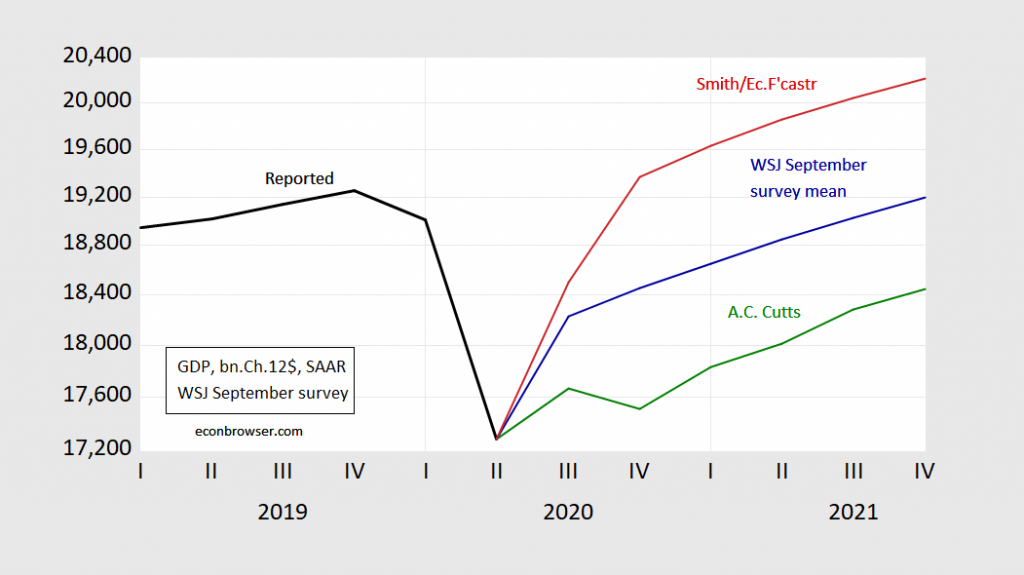

In terms of most optimistic and pessimistic (for the rest of 2020), James Smith of EconForecaster retains his crown, while Amy Crew Cutts supplants Daniel Bachman of Deloitte (although both predict a W recovery, with a drop in Q4).

Figure 2: GDP as reported in 2020Q2 2nd release (black), James Smith/Economic Forecaster LLC (red), Amy Crew Cutts/A.C. Cutts & assoc. (green), all in billions Ch.2012$, SAAR, on log scale. Source: BEA, 2020Q2 2nd release, August WSJ survey, and author’s calculations.

Personally, I would think that as it becomes more and more apparent no Phase 4 recovery package is forthcoming, Q4 forecasts will be further downshifted.

The IGM/FiveThirtyEight results are discussed in “Economists Don’t Think The Lower Unemployment Rate Signals A Clear Recovery” by Paine and Thomson-DeVieux:

After an August jobs report that yielded better-than-expected results for American workers, economists have a much sunnier outlook on unemployment through the end of the year. But that optimism isn’t trickling into the rest of their economic forecasts — in part because there’s still so much uncertainty about what the rest of the year will bring, and in part because the July 31 expiration of the $600-per-week payment for unemployed workers could already be leaving millions of Americans in dire economic straits.

…

“The surprisingly large drop in last month’s unemployment rate is seen by our survey as not being a temporary blip, but as reflecting a more permanent decline,” said Allan Timmermann, an economist at the University of California, San Diego who has been consulting with FiveThirtyEight on the survey.

The survey panel’s projected unemployment rate for December, for instance, is 2 percentage points lower now than it was when we asked just a month earlier. And our panel currently thinks there is a 63 percent chance that unemployment will drop below 8 percent at some point between now and the end of the year.

While the perceived unemployment picture has brightened (before the latest unemployment insurance claims came out today), perceptions of GDP growth going forward into Q4 have not changed appreciably:

Even while our survey’s forecasts for the December unemployment rate were being revised downward, the economists’ outlook for fourth-quarter real GDP growth (a much broader measure of the overall recovery) has hardly budged over the past two weeks. The panel now thinks real GDP will grow at an annualized rate of 6.3 percent (quarter-over-quarter) at year’s end, barely up from 5.8 percent on Aug. 24.

While that rate is higher than any of our survey’s median forecasts since we began asking the question on June 8, the economists still think there’s at least a 10 percent chance of negative real GDP growth in the fourth quarter — and their best-case3 forecasts have been stuck between 12 and 13 percent growth for a month now.

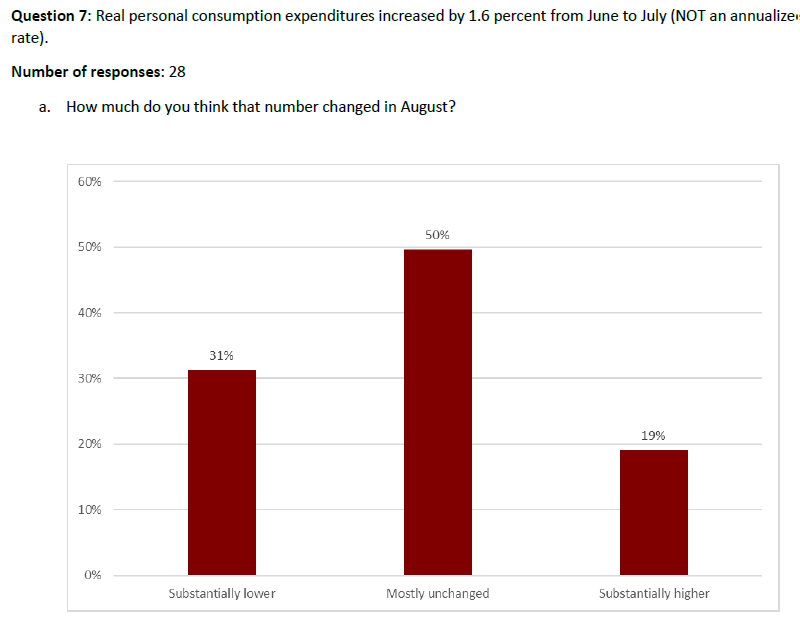

The detailed survey results are here, covering additional questions including differentials in labor outcomes by race, the impact on consumption of the cessation of extended UI benefits, among others. On the last question, the modal view is that consumption growth continues despite the lapse. However, roughly one-third of respondents (including me) think that there will be a reduction in consumption growth.

Source: IGM/FiveThirtyEight Covid-19 Economic Outlook Series Round 8.

roughly one-third of respondents (including me) think that there will be a reduction in consumption growth.

This website shows consumer spending has been more or less flat since July after rebounding sharply between mid-April thru June:

https://tracktherecovery.org/

maybe i’m missing something obvious, but i have a hard time seeing what part of our personal consumption was slowing in August…does anyone have any cites?

I get why our Usual Suspects bombard this comment with serial stupidity, dishonesty, and feign anger:

https://www.cnn.com/2020/09/10/politics/trump-woodward-tapes-michigan/index.html

‘I didn’t lie’: A subdued but defensive Trump denies he misled despite tape

I actually watched this stupid performance of his. He does nothing but lie about everything.

How could consumer spending do anything except decline if there is a high unemployment rate and no resumption of unemployment benefits? This will hurt.

Willie: Well, the rich are getting richer, and they account for most of the consumption (in dollar value). While the poor will get poorer on average, and hence reduce consumption, they account for a smaller proportion of total consumption. Hence, it’s possible (although to me not too likely) that overall consumption will rise.

I did not know that the rich were the bulk of consumption. I would have thought that people with less money, who have to spend all of it to stay alive, would be the ones who drove consumption. But, I base that on limited information. I still think that even if the rich up their spending, because they can, it’s highly unlikely that they will offset the reduced consumption by those whose incomes have evaporated. Meaning both the poor and the middle classes. That will have ripple effects as well.

Willie: From this post — admittedly a bit outdated, a quote from Ley (2005):

If consumption were equally distributed among household, you’d expect the household with budget shares equal to CPI to be about 50th, not 75th, percentile. At least, that’s how I think of it.

I had not thought of it that way. It makes logical sense in light of the fact that consumption is a far larger portion of the economy than investment. Meaning the rich must be spending since they have the money. My thinking has to get past basic marginal utility.

I don’t feel strongly enough about this to argue against Menzie’s view of it—or, I should rephrase, I feel strongly about the topic but don’t have enough tangible evidence to get into a 12 round blog comment boxing match. I would say there’s a large grey area here though. Off the top of my head, I’d be curious to know if we took out/ excluded the purchasing of housing as part of consumption, how would those numbers on total consumption delineated by different wealth brackets then compare?? It might not change the end “winner” of which income/wealth group consumes more, but I would still be curious to see the numbers if they exist.

Willie If you go to the Harvard/Brown “tracktherecovery” website https://tracktherecovery.org/ and then click on the “Explore the Data” button, then in the upper left select “Consumer Spending” you will find three radio buttons for high income, middle income and low income consumers. You’ll see that low income consumer spending is only 4% below it’s January level; however, high income spending is 10.7% below it’s January level. Middle income is 6.5% below January’s level.

That’s also an insight I didn’t have. Thanks.

An analogy:

A ship can cruise at 25 knots, but the captain decides that such speed is dangerous so he drops anchor. But then the Coast Guard cutter comes along and says that the captain must move the ship faster so they tether the ship to the cutter and begin pulling it. However, the ship simply cannot achieve enough speed to meet the Coast Guard cutter’s demand because the captain of the ship has kept the anchor dragging on the bottom. Everyone observing disagrees whether the problem lies with the Coast Guard cutter not pulling hard enough or the intransigence of the ship’s captain.

Clues:

Ship = economy

Coast Guard cutter = special government payments to individuals and corporations

Ship’s captain = state governors

Anchor = business activity crippled by executive orders

BTW, Nancy Pelosi’s hairdresser’s salon owner is receiving death threats.

Wow. Macroeconomics as a nautical analogy. Sounds like that MAGA hat might be a bit too tight around the head.

Tell us. Did you go to the no-socially-distance-and-maskless Trump rally in Michigan?

No no no, 2slug, Nancy Pelosi’s hair salon is going out of business. Clearly she is single handedly responsible for any failure of the ship of the economy to zoom forward rapidly enough! No wonder those good supporters of our president in Michigan were not wearing masks at his rally!

Never get on a ship if Brucie is the captain. I guarantee he would sink a ship if he ever was put in charge. Fortunately the boy is hunkered down in his basement fearful of this virus and has no clue how to get to Lake Michigan.

@ Barkley Junior

For the record, I had nothing to do with that threat against Pelosi. Aside from hoping you’ll take your car the full journey to Alcatraz to prove your deep knowledge on California’s most expeditious state and federal highways, I’d never even skirt around such viciousness. I’m hopeful you’ll “give it a go” though Junior. Make sure the Michelins have the proper air pressure before hitting the gas pedal off the coastline.

Your analogy is complete gibberish but hey you are Bruce no relationship to Robert Hall. And be careful as the FBI is monitoring those death threats you are sending to the Speaker. I trust you know going to prison increases your chances of getting COVID-19.

Maybe you should start tossing people who used to be just fine into the ocean and letting them sink. That would make it easier to pull the ship, now wouldn’t it. There’s an analogy that works for what you are suggesting.

Wait! Someone still believes that the economy can fully recover while the Virus is running amok?!?! Dream on, pal.

Economic recovery depends upon subduing the Virus first. All policies that exacerbate the spread of the Virus are the actual anchors in your metaphor. Of course, that means that governors can no longer be the dim-witted/venal ship’s captain. I wonder who is rightfully identified with the captain , hmm?

According to Trump – we have turned the corner on this virus. Never mind that Dr. Fauci said just the opposite an hour ago. What does Fauci know? Trump is Churchill after all.

Trump is more Chamberlain, capitulating to the virus.

dim-witted/venal ship’s captain

We need a picture of Bruce Hall to go along with this perfect caption!