Deceleration continues, according to some key indicators noted by the NBER’s Business Cycle Dating Committee (BCDC).

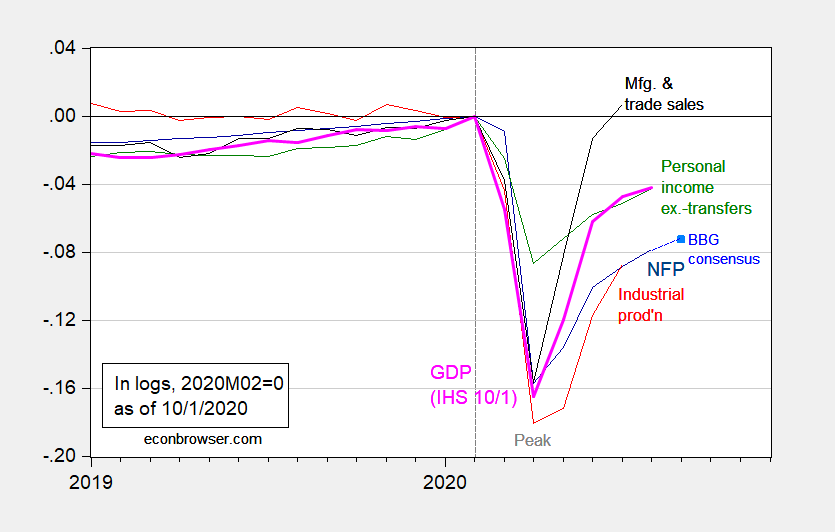

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus for September as of 10/1 (light blue square), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers (10/1 release), NBER, Bloomberg, and author’s calculations.

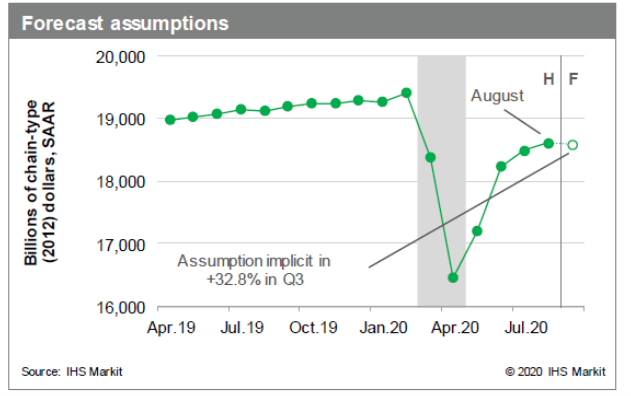

IHS/MarkIt provides a projection of the September GDP number consistent with their forecast for Q3: essentially 0% growth in September.

Source: IHS/MarkIt, October 1, 2020.

So, we are already decelerating rapidly along a number of dimensions, as passage of a pre-election package becomes ever more unlikely. Deutsche Bank’s conditional forecast is zero growth on Q4. With the political — and hence policy — uncertainty possible in the election’s wake, don’t rule out another leg downward in economic activity.

If you’re interested, lecture slides interpreting recession and output gap readings for my Econ 442 “Macro Policy” course, here.

Update, 4pm Pacific:

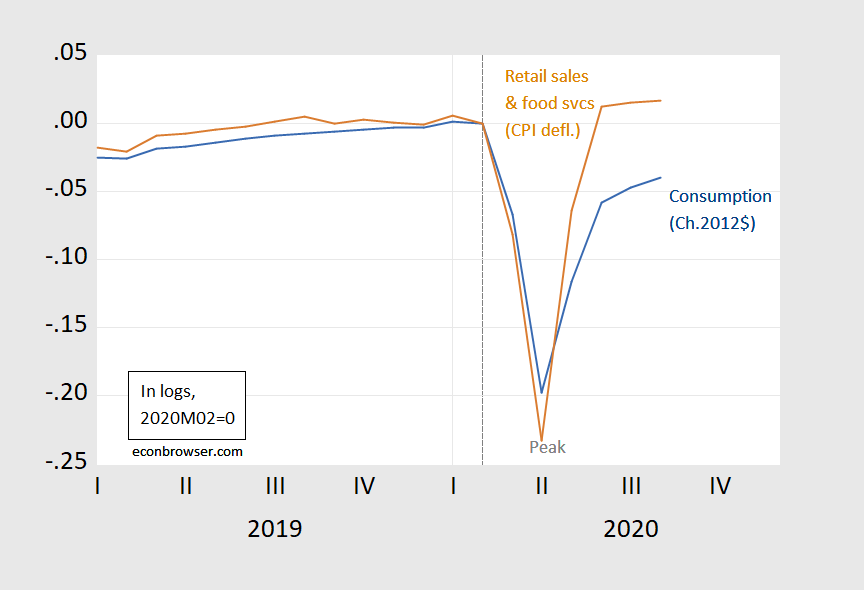

Reader rjs notes the rapid pace of consumption growth. This jump still leaves consumption 4% (log terms) below 2020M02 levels.

Figure 2: Consumption in Ch.2012$ (blue), and CPI-deflated retail and food service sales (brown), both in logs, 2020M02=0. Source: BEA, BLS via FRED, and author’s calculations.

today’s income and outlays report has the annualized chained 2012 dollar figures for July and August at 12,788.3 billion and 12,874.4 billion respectively; real PCE for the 2nd quarter was at 11,860.3 billion in chained 2012 dollars…

https://www.bea.gov/sites/default/files/2020-10/pi0820.pdf tables 7 & 8

hence, (((12,788.3 + 12,874.4)/ 2) / 11,860.3) ^ 4 = 1.369956, meaning real PCE has grown at a 37% annual rate over those two months…that’s a pace that would add 25.36 percentage points to the growth rate of the 3rd quarter, even if there is no improvement in September’s real PCE from that July & August average..

(Source: BEA and author’s calculations)

What we can’t do with these data is to sort out the lagged effects of events earlier in the year and more recent developments. There was a big overshoot to the downside early in the year which created conditions for a sharp partial recovery. Government assistance was a big help in sparking the rebound and a big help om its own. It is hard to estimate the self-sustaining upside from here, but we know government aid and the rebound from overshoot have less to offer now.

Pelosi and Mnuchin are talking, but this is not a promising time for legislation.

Professor Chinn,

1. Thanks for posting your lecture slides.

2. Is the BBG Consensus a subscription publication?

AS: 2. BBG might be a subscription, suspect it’s on the Bloomberg terminal. I just go to Bloomberg website, and look up the calendar:

https://www.bloomberg.com/markets/economic-calendar

Thanks, I recently found the Bloomberg Calendar, which seems to be the same as your link.

1% growth would not surprise me in the 4th quarter. The boom in 3rd quarter growth does not shock me, I predicted it. About a 4% decline in 2020, maybe less if there is another giddyup.

Professor Chinn,

Would it fit with your course to expand on Econbrowser a bit on the “unsustainable Policies” as described in your lecture #7 slides?

For those of us who lived through monetary expansion of the 1970s and the resultant inflation, I think we keep thinking that inflation will return when we least expect it. Right now it seems that the shutdown of the economy may have retarded inflation, but the increase of Y/Y M2 from about 6.7% as of Feb. 10, 2020 to about 24.4% Y/Y as of Sep. 21, 2020 seems to need perspective, that many of us may not have. I am not arguing against what seems necessary, but just trying to understand if inflation will be an issue once we get of the current mess.

I don’t think monetary expansion caused inflation. It was treasury printing dollars to keep budget deficits low in the 60’s coupled with high GDP to population right when wwii interest payments came due. Then BW’s collapsed killing the dollar. Then Oil exploded as a response. It just wasn’t one thing. Monetary expansion is irrelevant and weak in the period you talk about, as a response to other factors.

“I don’t think monetary expansion caused inflation. It was treasury printing dollars to keep budget deficits low in the 60’s coupled with high GDP to population right when wwii interest payments came due.”

Dude – your 2nd sentence IS monetary expansion. I know bots are only trained to babble gibberish so please pull your own plug.

The Treasury doesn’t print money. I taxes and issues debt in the amount necessary to offset spending. No change in money supply. The MMT guys would note that it is necessary to tax or issue debt to balance spending, but we do.

As a practical matter, the central bank’s absorption of debt and the banking system’s resultant lending account for grow (or shrinkage) in the !oney supply.

MMT would say it is NOT necessary to tax and borrow. Oops.

AS, i wouldn’t try to forecast the future because there’s too many things that haven’t happened yet that i’m not aware of….but the Fed doesn’t seem to be too worried about it, releasing a new inflation policy just over a month ago…

Fed Chairman Jerome Powell announced a major policy shift Thursday to “average inflation targeting.” That means the central bank will be more inclined to allow inflation to run higher than the standard 2% target before hiking interest rates.

https://www.cnbc.com/2020/08/27/powell-announces-new-fed-approach-to-inflation-that-could-keep-rates-lower-for-longer.html

But note that coney supply growth appears to be starting to turn down.

Yep. From the Fed’s perspective, a one-time jump in money supply is likely to induce a one-time jump in the price level. That would not constitute inflation in the Fed’s view. Given the Fed’s recent adoption of a new operational rule, as rjs notes, a one-time jump in the price level would be welcome. It would lead to an earlier return to tighter monetary conditions, but not in an effort to extinguish inflation.

AS, i don’t think you worry about inflation until it actually appears. we have had people harping about the recurrence of inflection for a decade now-since the financial crisis. it has NOT appeared. and yet we have still tried to develop policy around the fact that it exists. this has been a hinderance. we have far better tools to deal with inflation, if it does appear, than we have tools to handle this systemic slow growth that has existed for a decade. we need to fight the real problems, not the imagined ones.

Yep.

Tonight’s news interesting. I assume with smart phone alerts 98% of people awake knows. He’s probably going to recover in flying colors. But this brings two interesting questions to my mind aside from a 2% opening drop in the Dow. How does this look “optics wise” for a guy who insulted his competitor for wearing a mask?? And how long does he wait to recover and go back on the campaign trail~~~when I believe the usual prescribed recovery time is at least 2 weeks after getting a negative test result, which he is probably at least a week away from right now. It’s interesting to note, when he was yelling and screaming on the debate stage, it’s arguable he put Joe Biden at minimal risk, and no doubt put Mike Pence at risk. It’s tempting to make jokes here, but all human life is precious. I hope he recovers to “face the music” of his actions.

and now trump is off to walter reed medical center for a few days. my understanding is he is NOT taking hcq. he is taking an experimental cocktail drug that HAS shown some promise. so much for that miracle drug promoted by corev and bruce hall. they were conned once again.

the optics are a disaster that the president has become an invalid in the hospital. perhaps we should have a national policy to promote the wearing of masks, social distancing, and anything else which could suitably slow down the spread of the virus? that might be something the leader of the free world might pursue as he governs the nation going forward. wonder if potus still wants no changes to the debate format? or will he simply skip it? or perhaps his covid diagnosis is simply a lie, and an opportunity to withdraw from the election and save face from an embarrassing defeat? even drudge report has turned on potus. what a crazy world we live in.

The orange creature already claimed he took HCQ. So we have two scenarios here: 1) He took HCQ, and then not long after got Covid 19 respiratory virus. or 2) He never took HCQ (I never heard any of his doctors confirm/deny he took HCQ) even though he stated in public he took HCQ.

My bet is, the latter, he never took HCQ. Observers are free to make their own conclusions. I’d bet a lot he never took a single pill of HCQ.

First words out of Mark Meadows did not address the spread of COVID-19 in the White House but rather the drop in the unemployment rate from 8.4% to 7.9%. I guess Kudlow suckered him into thinking this was incredible news but check out the Household Survey data:

https://www.bls.gov/news.release/empsit.a.htm

The employment to population ratio barely inched up while the labor force participation rate fell. This was not a great employment report but of course the liars in the White House will tout it as such.

Meanwhile their orange idol is idled. I hope there’s Covid finger that prevents him from spewing tweets.

Wasn’t his entire debate performance a 90 minutes Twitter rant. Cannot wait for Saturday Night Live when they redo this debate!

All of it was very predictable~~~and WAS predicted. If the DNC didn’t have its head up it’s A-hole 24-7-365, they would have had the microphone rule in place on the very first debate. How do you have a “neutral” debate with a FOX host hosting and no mic rule on an orange being who has proven it thinks debates are a board meeting of some fraud multilevel marketing company he’s running??

I guess if some people on here like YOU ever got a clue that it’s mostly Hillary’s cronies running the $hit show that allows a FOX host to host and no rules on shutting off mics, we might actually get some place. But good luck getting rid if the Hillary fawns.

How about we have a DNC with a backbone and skip the SNL children’s rehash show??

Moses,

I am mostly trying to avoid getting into pointless arguments with you, and probably I should just ignore this, but this particular post by you is seriously out of it.

A basic problem is that somehow you think the DNC is able to dictate the details of prez debates. It is a negotiation. And they were negotiating as if past practices should determine things. Many of us could foresee that Trump would break the rules, but few could see how badly he would do so. Blaming the DNC for not only not foreseeing that but failing to overcome GOPsters in the process to change details based on this is, well, not all that reasonable.

On the two immediately substantial matters, well, shutting of a mic will not shut off Trump, assuming he is out of the hospital and functioning like he has in the past, he will just shout even after his mic is shut off.

On the matter of Wallace, well, I guess you do not pay attention to the Trump worshipping part of Fox News. Their view, and that of the Trump campaign, is that Wallace is just a Dem clone. Trump himself said ir was “2 against 1” with Wallace supposedly just a pawn of the Dems. Sorry, Moses, you are just completely out of it on this particular post.

for all the trump cronies. are we still calling the virus a fake? or have new working orders been sent out to restylize the argument? is trump faking sick?