The stock market booms while GDP staggers along. Why?

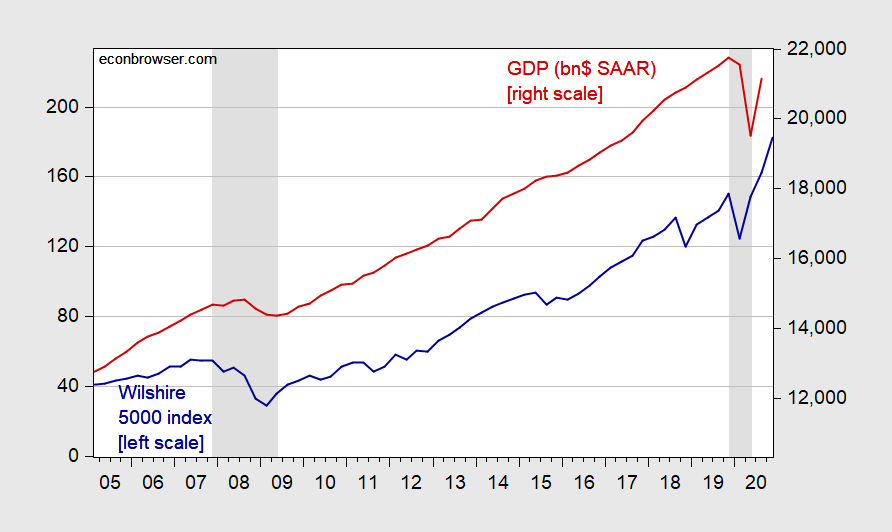

For the moment, let’s dispense with the Dow Jones, which has a big multinational component, and inspect a broader market capitalization — the Wilshire 5000 — and nominal GDP.

Figure 1: Wilshire 5000 index, end of quarter month (left scale), and nominal GDP in billions$ SAAR (right scale). NBER defined recession dates shaded gray. Latest recession assumed to start at NBER peak, end 2020Q2. Wilshire index for 2020Q4 is December through 18th. Source: Wilshire, BEA via FRED, NBER.

Notice the divergences in the 2000’s, as well as in 2020. Why might this occur, even if the stock market index only covered companies with US revenues?

First, GDP is a flow of current goods and services expenditures within a given period. The stock market valuation is the present discounted value of the expected stream of future dividends from now to the infinite future, for corporations that issue stock (assuming no bubbles). It doesn’t include the revenues for noncorporates.

At the end of 2019, corporations accounted for $14812.1 billion of a total $18960.8 billion nonresidential fixed capital stock (and accounted for $253.1 billion of $23557.1 billion of residential). In other words, only 78.1% of the nonresidential capital stock is represented by the stock market, and only 35.4% of the total (nonresidential and residential) capital stock [source: BEA].

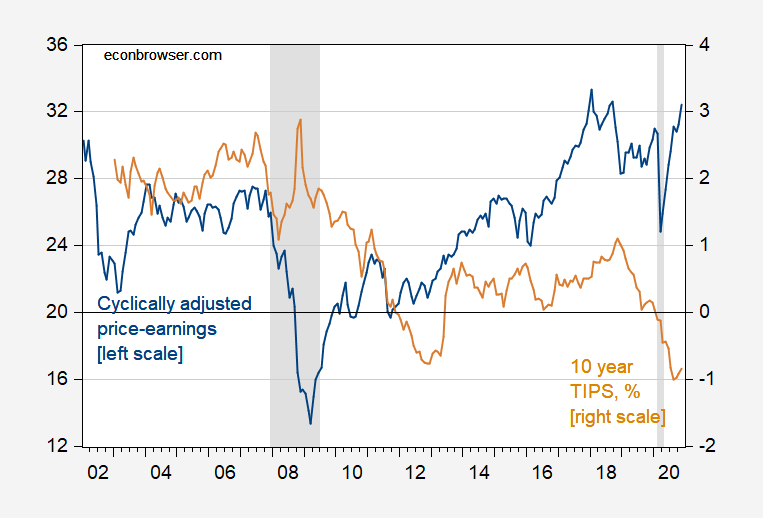

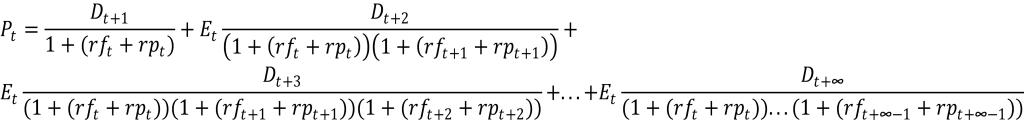

The biggest issue is the following – the stock price is a present discounted value:

Where P is the stock price, D is the dividend, rf is the risk free rate, and rp is the equity risk premium. Et is the expectations operator (here using the mathematical, but in general could be the subjective). The above assumes no bubbles.

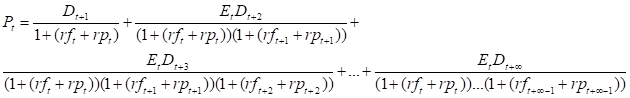

Notice that everything is time-indexed, so the stock price can change as expectations are revised, as the risk free rate changes, and perhaps most importantly the equity premium varies (variations of which are sometimes called changes in “risk appetite”). This means that stock prices can fluctuate drastically even if currently observable variables don’t change. The current surge could be because of low risk free rate and/or decline in risk premium and/or upward revisions in expected earnings.

Figure 2: Cyclically adjusted price earnings (CAPE) for S&P500 (blue, left scale), and TIPS 10 year (brown, right scale). NBER defined recession dates shaded gray. Latest recession assumed to start at NBER peak, end 2020M02. Wilshire index for December is through 18th. Source: Shiller, NBER.

This doesn’t mean that the variations in stock prices are rational, in the sense of full-information rational expectations. As I mentioned, Et in the notation I use above could pertain to subjective expectations. But it would be hard to show definitively irrationality, given market expectations of future outcomes are unobservable. Only actual outcomes are observable (see Shiller; Summers show how much data is necessary to discern efficient markets from big fads).

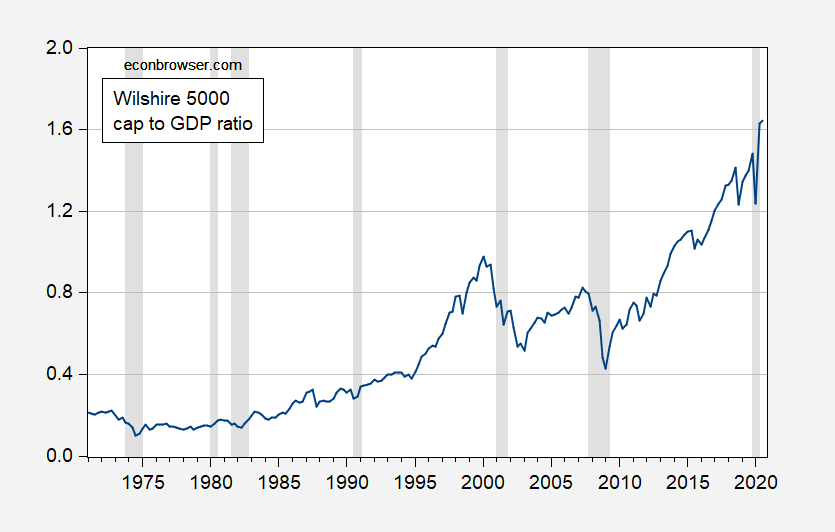

So, to reiterate – the stock market doesn’t necessarily move in tandem with the economy’s fortunes. Good to remember when looking at this picture.

Figure 3: Wilshire 5000 index, end of quarter month divided by nominal GDP (left scale). NBER defined recession dates shaded gray. Latest recession assumed to start at NBER peak, end 2020Q2. Wilshire index for 2020Q4 is December through 18th. Source: Wilshire, BEA via FRED, NBER.

Update, 12/22 6pm Pacific: Willem Thorbecke points out that the “stock market valuation is the expected present discounted value of the stream of future dividends. The discount factor is stochastic also.” He is absolutely right; here is what I should’ve written:

Professor Chinn,

Would you expand an explanation of the mathematical expectations operator that you are using and perhaps compute an example valuation?

Thanks

“The above assumes no bubbles”. Well, so much for constructive intellectual pursuits. Got any wood to whittle on??

As both Bob Flood and Jim Hamilton have written on extensively when trying to figure out whether a particular asset price series exhibits a bubble or not involves the problem of the so-called “misspecified fundamental.” One does not know what the rationally expected future stream of net income is in general, so even though one might see a rising price/earnings ratio for a stock or stock index, this may reflect rationally expected rising dividends. That those expectations may prove to be unfulfilled with the stock price (or prices) falling sharply later does not mean that the original expectation was necessarily irrational, and one is still unable to definitely say that the price runup was due to speculators buying on the expectation of a capital gain rather than the expectation of a rising dividend or income flow.

There are a few assets that are exceptions to this, with one being closed end funds where the fundamental is simply the value of the assets in the fund minus some transactions and tax costs, which implies that in general one should expect closed end funds to trade at something like a single digit percent discount, which most do most of the time. But if one sees such a fund’s price soaring to twice the value of the underlying assets, well, that is almost certainly a speculative bubble, unless there are restrictions on being able to buy and sell the underlying assets.

It’s hard to do financial economics without relying on an assumption of rationality. Which means it’s hard to draw strong conclusions from financial economic analysis. We can posit that some rational explanation exists for the divergence of stock prices and economic performance, but identifying the actual driver of the divergence is tricky. Could just be a bubble. Fifteen years ago, a lot of big names didn’t allow for the possibility of a bubble.

Peter Hammond has argued that rationality often means little more than consistency in economics. We rely on rationality, but we can’t really depend on rationality.

@ AS

Maybe these couple links will be helpful??

https://www.ssc.wisc.edu/~mchinn/Summers_JoF_1986.pdf

https://www.arnoldkling.com/apstats/expect.html

Of course the truly terrible thing about this post is that Menzie has gone and done it again, posting a figure of GDP that makes what has happened in 2020 look like a darned V. And here you have repeatedly explained to everybody here that the only people who think there has been anything resembling a V should probably be labeled with the forbidden s word. So, shame on Menzie for so viciously misrepresenting reality, when you have made the accurate, if still secret, description of what the pattern resembles. But I hope you will forgive Menzie for this fall from grace, Moses. I know it means so much to him.

It’s not a V-shaped recovery, it has never been a V-shaped recovery. And no one here other than you has asserted that. In fact, Menzie has definitively stated, I believe at least twice, that it is not. Now, if I was a child I guess, or permanently limestone embedded at the same age 12 maturity level going into my septuagenerian years, I could link those or refer to the posts and do a jig, and if you insist on it, I will, but I trust the readers (certainly the regulars), as actively thinking adults, to piece that out on their own.

Just how blind are, Moses? Just look at it. Indeed, the V has continued longer than I thought it would. It has just been announced that the GDP growth rate for third quarter was at 33% SAAR, an almost perfect replica of the decline in the previous quarter, a decline you have gone on at length about here. Much more like a V than even I was expecting or forecasting. Deal with it, Moses.

Sorry, Moses, but Menzie has never said it was not a V-shaped recovery. I think he has not weighed in precisely on this debate over patterns, which, of course, cannot be tested for econometrically. It is all a matter of eye-balling and judgment.

As near as I can tell there has been exactly one person here who has agreed with you that it is not (or has not been) a V-shape. That would be our friend from Down Under, Not Trampis. His argument was not about the shape, with him never disputing that the recovery looks to have been about as fast as the decline. It had to do with the endpoints, with the top of the V-shaped recovery not getting back up as high as the GDP level when the decline at the beginning of the V shape started, with him citing dictionaries on this. This is a fair point, if a bit picky. But this does not seem to be what you claim, that there is not remotely any resemblance to a V and I should be removed from my job by the taxpayers of Virginia for having the temerity to have ever suggested such an atrocity.

Otherwise, Moses, and no, I am not going to go dredging through past threads here like you like to waste your time doing, but quite some time ago, many months ago, quite a few people here, at least a half dozen, if not more, agreed that it looked like a V, with several simply referring to it as a V-shaped recovery with no mention of the fact that you were running around like a chicken with your head cut off denying it. That discussion has largely stopped, over and done with, as it is that most people here accept that it looked like a V for at least awhile with almost no disagreement, except for you, of course, NT getting into all this much more recently than that period of clear consensus (aside from you)..

I also remind that I said it would flatten, which more recent evidence suggests it has, with it possibly going into a double dip, with Menzie posting several times on this possibility, although the flattening did not happen as of third quarter, which, as I already noted, had GDP growing at almost the exact same SAAR rate that it declined by in second quarter, almost a prefect V for at least those two quarters.

And, of course, the only shape you ever mentioned here was the massively wrong L, although you have since claimed that was not your forecast, keeping your actual forecast a continuing secret, even though you have been repeatedly challenged to “put up or shut up:” on that, which you keep ignoring by coming on and making ever more outrageously stupid and flamingly wrong comments as this one you just did here.

BTW, it was reasonably pleasant for the few days you took off from here, looking like maybe you would go along with the “shut up,” but, no, we have to put up with your worthless nonsense yet some more.

Barkley Rosser: To be precise, my definition of V is return of GDP to 2019Q4 peak. I don’t require everybody agree with my definition. Bec et al. 2011 provide a more stringent definition of V.

Thanks, Menzie.

What you do not clarify is if that bounceback to the “original level” must be at the same rate all the way as the decline to qualify for being a V rather than a U or the “deep” nonlinear effect, which seems to involve some delays for the bounceback (and they also allow for a W, which you have posted about the possibility of).

Indeed it looks like the recovery has slowed down, or “flattened” as I have called it, even though the quarterly data for US so far looks like a V in progress. Needless to say, insisting on the same rate of growth in recovery as going down until the previous peak fits with Not Trampis’s argument as to why what we are seeing is not a true V: it has sort of looked a lot like a V, but the slowing down too soon means it is not really. But that sudden bounceback means that it is not any of the other patterns discussed in your link, the U or the “deep” nonlinear pattern these authors seem to favor for some of the series.

So is what we are seeing not properly described by any letter pattern, aside possibly from a “W” if indeed the dreaded double dip appears?

Barkley Rosser: Like a Rorschach test, to each their own (within limits). In absence of a downturn in Q4 (could still occur in Q1), I’d say “reverse radical” is my preferred symbol.

Menzie,

Well, with the flattening appearing but no downturn, it probably looks more like a “reverse radical,” although that is not one of the shapes in the link you provided that supposedly provides the categories for these patterns.

Of course a major part of the problem here is that this particular fluctuation we are still in involved a sharper and deeper plunge than anything we have ever seen, even rivaling the Great Depression in the sharpness of the decline. And the bounceback also involved something we have not seen, as your agreeing that we saw an all time high rate of increase in consumption back in May. So this particular pattern does not fit what has been studied before.

Given the depth of the plunge it takes a much larger amount of bounceback to get back to where it all started. Looking at the V patterns in your link, they involve very small and not very rapid declines, with the symmetric bounceback not all that rapid but easily reaching the starting level where it started. In this case the amount of return has been, well, unprecedented. The funny thing is that compared to the V patterns in your link, which are very flat Vs, this one looks a whole lot more like a V than them, except for not making it all the way back up before the flattening happened that is making it more into this unprecedented “reverse radical.”

BTW, thinking back to March and April, a lot of us around here, including I think both you and me, Menzie, were forecasting what your link describes as the “deep” nonlinear pattern. That one does not bounce back rapidly but initially starts back up more slowly than the decline that preceded it, but then takes off into a more rapid increase. I at least thought that the initial bouceback would be slow due to consumers being fearful and lacking wealth. But then it turned out that for whatever reasons we got that record increase in consumption, so now we have this reverse radical or whatever that looked like a V for awhile.

Moses,

Thanks. I am familiar with expected value, but was uncertain about the specific expectations operator that was mentioned.

Here is a link to a recent SP 500 valuation done by Aswath Damodaran. Looks like a good job. He also provides an Excel spreadsheet to make additional valuations.

http://aswathdamodaran.blogspot.com/2020/11/a-viral-market-update-xiv-wrap-on-covid.html

BTW, some people will think I am saying this tongue in cheek, or as some kind of veiled “dig”, but I am being very earnest here. You know one of the reasons I still deeply love this blog?? Similar to the same reasons I loved Sirs Kwak’s and Johnson’s blog before they became “less prolific” in their blog posts. The addendum to the post shows Menzie is a man of integrity, and never unwilling to admit error. This is one of the reasons I like him so much even though I have never met the man personally, and I want to compliment and pay kudos to 母親欽, (hope Google translate got that right), she did a damned fine job in rearing the cerebral lad.

“I had a friend in New York City, he never called me by my name, just “Hillbilly” I’d love to spit some beech nut in that dude’s eye, and shoot him with my old ’45,…… cuz country folk’s can survive”……

“the stock price can change as expectations are revised, as the risk free rate changes, and perhaps most importantly the equity premium varies (variations of which are sometimes called changes in “risk appetite”). This means that stock prices can fluctuate drastically even if currently observable variables don’t change. The current surge could be because of low risk free rate and/or decline in risk premium and/or upward revisions in expected earnings.”

Let’s go back 20 years and ask why was the DOW at 12000 and not 36000? After all Glassman and Hassett wanted us to believe two things: (1) the equity premium = 0; and (2) dividends = earnings. Never mind the fact that a part of earnings would have to be committed to investing in new capital to support growth. Some silly assumptions and simpleton arithmetic gets you a book deal. And snickers for the rest of time.

“A New Congressional Budget Office Study Shows That Medicare for All Would Save Hundreds of Billions of Dollars Annually”

https://www.jacobinmag.com/2020/12/medicare-for-all-singler-payer-health-insurance-cbo?mc_cid=fa34ea5383&mc_eid=c03ba522b1

Apart from a few progressive news outlets, the reaction was a silence was deafening. After several Google searches I found no corporate media outlets that found the story fit to print. And no Democrats hailed the report.

What’s up? Polls reveal that 70% of Americans support Medicare for All. It can save $billions at a time when budgets are stressed. And the pandemic highlights the need for it and provides a unique opportunity to make it reality.

If the Democratic leadership can’t seize the moment, they will have proven themselves beyond a shadow of a doubt to be utterly corrupt and craven.

JohnH: It’s a working paper, not an official representation of CBO’s assessment. It is *not* an official cost estimate.

It may not be official, but considering the source, it has to be a lot more serious and impartial than the nonsense that politicians often seize on to promote the causes of their big donors—think horse and sparrow economics.

But it’s hard to convince a politician of something if he’s being paid by his big donors not to believe it.

https://www.commondreams.org/news/2020/11/06/centrist-house-democrats-attack-medicare-all-fox-news-poll-shows-72-voters-want

“Democrats in Washington seem intent on placating the health insurance industry and then losing the Georgia Senate races.“

“Polls reveal that 70% of Americans support Medicare for All.“

This is misleading. Support is only that high if u offer medicare or the ability to keep your own insurance. Support for a national plan is not as great. The support is for all americans to have affordable access to medical care.

Once again, you are trying to back democrats up into a corner. This is a typical talking point given by conservative trolls. Why are you promoting such nonsense?

We have been through this many times. The goal is an efficient health care system that fairly gives all Americans good health care. Now ask JohnH to weigh the different means of achieving this goal. What you will get from this tiresome troll is deafening silence. In this age of Coronaviruses – one would think we need a lot more serious research with respect to ideas that were floating 4 years ago. But don’t ask JohnH as he is the most clueless person since Bruce Hall.

“Apart from a few progressive news outlets, the reaction was a silence was deafening. After several Google searches I found no corporate media outlets that found the story fit to print. And no Democrats hailed the report.”

Your Google must be broken. My had 14 million its. Yes – some of them were progressive outlets but golly gee one went to the NY Times. Oh wait – Trump has you believing the NY Times is a communist rag.

Macroduck: link to Yves Smith’s “horrors of Medicare?”

pgl’s search: 14 million hits!!! MoreBS. He must have used the search term “Medicare”, which generates a lot of hits. Searching specifically for the CBO Dec. 10 report comes back with nothing but a handful of progressive outlets…no prominent Democrats, no corporate media. A blackout!

pgl wants to discuss “rational policy!!!” This is just the usual analysis paralysis of the past 50 years, intended to give the appearance of making an effort without ever accomplishing anything…an art that corrupt and craven corporate Democrats have long perfected…even at the cost of losing elections.

You can always count on pgl to defend whatever Democrats do to protect the status quo.

You are one whiney little moron. First of all Medicare alone generates 108 million Google hits. But then you are incompetent of finding anything on the internet.

And you accusing of paralysis by analysis is such a stupid comment that your mother should slap you silly for insulting her family. But I guess you would have Congress pass just anything that suited your dumb slogans. But that is exactly what Trump does when it comes to policy. Now being as dumb as Trump is a real accomplishment but you do that every time.

Hey Johnny boy – try growing up before you embarrass your family again with your pathetic rants.

So, pgl, put up or shut up: I typed in the search term: “ nytimes medicare cbo” limited to the past month to bring the Dec 10 report to the fore.

Google response: “ It looks like there aren’t many great matches for your search.” In fact, my comment here appeared before any NYTimes report, something which I could not find!”

So where did pgl find 14 million hits on the Dec 10 CBO report???? And where is his alleged link to the NYTimes report on the Dec 10 CBO report???

pgl apparently thinks that the economists at the CBO wasted their time reporting on a Medicare for All plan that was nothing more than “a slogan.”

Question is, why are the corporate media and the Democratic leadership silent about their findings? If they truly support universal coverage, why not hail the report and ask for an official one to be made so as to bludgeon Republicans when they the oppose it.

Answer: Democrats would rather placate the health insurance industry than pass a very popular program.

https://www.nakedcapitalism.com/2020/12/medicare-blues.html

My wife and I have been on Medicare for years and found it to be as good as and cheaper than the excellent employer coverage we had while we were working. I am not a heavy user of the the healthcare system but my wife is. No one I know has complained about Medicare.

Access to providers, the main complaint of the article, has not been a problem at all.

We do not use home health care services, so that could well be an area where an already excellent plan could be strengthened.

IMO everyone deserves health insurance coverage equivalent to Medicare, not the extortionate premiums, co-pays, and deductibles foisted onto people by the insurance industry and by Obamacare.

I would even venture to say that most people on Medicare wonder why it’s even debatable why everyone shouldn’t have a plan of the caliber of Medicare…it’s the industry and their stooges in Congress who want to convince people otherwise.

Yves Smith recently posted a glorious rant about the monstrosity that is Medicare today. Yet it is our national dream that all be allowed access to something like Medicare. Yes, Medicare for all.

Also, Medicare, right or wrong. If right, to be kept right; if wrong, to be set right. There is a lot to set right. Advantage and Part D need to die, to be replaced by broad access to medical treatment without corporate goalies.

Valid but do remember this. JohnH is nothing but slogans. He gets all angry when he is asked to actually THINK. You see – those of us who actually want to discuss actual policy and economics must have gotten paid.

JohnH,

All other high income nations have universal health care coverage and have it at much lower cost than US does and generally also with superior health outcomes for many things, if not all. However, only a few of those have either a single payer system like Canada’s that is the one in your study, or a full-blown socialized medicine one such as in the UK. The vast majority are mixed public-private systems, although with much larger public than private components.

Yes, there are different of systems…but only in the United States have political elites been too craven and corrupt to devise any universal healthcare system at all. Now we have a study by CBO economists that suggests that Medicare for All would save money. But the corporate media and the political leadership of the Democratic party, the folks who supposedly supports universal coverage, refuse to even acknowledge the study…even though they lack any serious proposal of their own.

Meanwhile, 63% of voters in Georgia are in favor of “changing the healthcare system so that any American can buy into a government-run healthcare plan if they want to.” https://www.commondreams.org/news/2020/11/06/centrist-house-democrats-attack-medicare-all-fox-news-poll-shows-72-voters-want

But rather than ride voters’ clear preference to victory, Democratic Senate candidates would rather placate corporate donors…and lose, depriving themselves control of the Senate.

Why? An industry front group run by a former Hillary Clinton aide has amassed millions to block a public health insurance option.

https://www.dailyposter.com/p/the-next-war-against-a-public-option

I am frankly puzzled why any universal healthcare supporter would consider Medicare for All to be a greater threat than the healthcare industry. After All criticizing Medicare for All is exactly is part of the industry’s game, embraced by most centrist Democrats who have nothing to offer but criticism.

JohnH,

Here on the verge of Christmas you got it, even though you lost it later. Yes, 63% of Americans want a public option. Last I heard, Biden supports that, although it probably will not be able to pass the Senate, even if Dems win GA runoff. As it is, this was probably Obama’s biggest blunder in his push for ACA: he let one of the GOP senators, I think Grassley but maybe another, talk him out of having the public option in the bill with the promise that this senator would support ACA. Needless to say, not one GOP member of Congress in either House supported in the end, a screw job.

But public option, which I sure as heck support, is not the same as single payer, although it might be described as “Medicare Avaiiable for All,” rather than “Medicare for All,” which implies Medicare is the only option. BTW, neither Canada nor UK (and certainly not US) has the highest rated health system in the world. The top several are all mixed public-private, with much more public, although varying considerably amongst each other in details. As it is, the US system is also mixed, but about half and half, with the private part the money wasting part with all those people in insurance companies trying to not pay for people making claims.

Merry Christmas, you all.

The statement that supporting Medicare for All precludes other options is a myth perpetrated by centrist Democrats who take their talking points for the industry.

While M4A is somewhat aspirational, it is a damn good proposal that is easily understood and quantifiable, as shown by the CBOeconomists’ report. Even if M4A is not perfect, let’s not let the perfect be the enemy of the very good.

JohnH,

Actually those pushing M4A, such as Bernie Sanders, have been very clear that it is single payer, that all private health insurance is to be eliminated, although some of it advocates suggest a transition period for that to happen. After all, the most significant cost savings from M4a come from getting rid of those indeed annoying admin costs associated with private insurance, and if is kept around, that part of the cost savings disappears.

So, sorry, M4A by its hardcore supporters is not just a public option added to the existing system. It is a single payer system that kills all private insurance, and indeed lots of polls show that is highly unpopular, which is exactly why Kamala Harris backed off her initial support of it, hurting her in the primary campaign, and was never supported by Biden and several other candidates.

“The statement that supporting Medicare for All precludes other options is a myth perpetrated by centrist Democrats who take their talking points for the industry.”

no. it is a myth perpetrated by conservatives, so that they can continue to call supporters socialists. and it is a winning game plan right now. this allows republicans to continue to attack centrists, and use the “socialist” dog whistle on them. because conservatives know and understand, if the public were well informed about a government or private option system, they would support it overwhelmingly. but they are conditions to believe medicare for all is socialism. don’t blame centrist democrats. blame the conservative talk shows.

“in the United States have political elites been too craven and corrupt to devise any universal healthcare system at all.”

Yes – we have devised plans. The problem is getting them passed Mitch McConnell. That was Barkley’s point – which of course a troll like you cannot accept.

The problem is politicians who claim to support universal healthcare during elections but immediately forget about it afterwards. This has been the story of Democrats for for the past 70 years, only to be shaken out of their torpor and hypocrisy by LBJ and to a minor extent by Obama.

Until Biden takes definitive action in response to popular pressure, lower costs of M4A, and the obvious opportunity provided by the disaster (pandemic,) I have to believe that he will revert to the corrupt and craven Democratic norm, putting health insurers profits over people’s needs.

In any case Biden needs to hear people complaining, lest he repeat the rightward drift of Obama over his two terms. Nothing good will come just passively trusting in politicians’ better instincts.

JohnH,

Since you claim to be on Medicare, probably you are aware that it does not itself cover lots of things, although you claim you have never had a problem with it not covering something. But it is my understanding that the vast majority of people on Medicare supplement it with some private insurance to help cover those things it does not cover. Are you among those people, JohnH, and if not how lucky are you that you or your wife have not had one of these health problems?

I am old enough to be on Medicare, but continue with my employer-supplied health coverage that comes from Anthem (formerly Blue Cross/Blue Shield), with my wife requesting this as she is retired and could be on Medicare but considers my health care coverage to be much superior to Medicare.

Oh, and indeed most of the proposals for universal single payer coverage that have been made by various politicians have in fact added coverage for many of those things Medicare does not cover, so even though these proposals have ben advertised as “Medicare for all,” they are not really that as their proposals involve something better than Medicare. In any case, I hope Biden follows through on trying to get a public option available added to our system, although as already noted it will be very difficult to get it passed in the Senate even if Dems win GA runoffs given that GOPs there will still be able filbuster it, and one GOP member of either House of Congress voted for ACA when it went through Congress. Indeed, although they seem to be getting quieter about it now that it is clear that a majority of piopulation now likes ACA, they have long sought to simply repeal ACA, which indeed there is a lawsuit at the SCOTUS backed by the Trump admin that would do exactly that. But then, hey, you are a Third Party supporter apparently seeing no diffeerence worth bothering with between the Dems and the GOP.

Interesting discussion on total US deaths in 2020 that Menzie might use in an update of his Excess Death measures:

https://talkingpointsmemo.com/news/us-deaths-in-2020-top-3-million-far-exceeding-most-ever-counted

Expected total deaths this year around 3.2 million up 15% from last year. Yea population tends to rise over time but 15%? Of course Bruce Hall will try to tell us that this is insignificant because I guess old people dying is a virtue in his MAGA world.

I am not an economics professional; I am not even a talented amateur. I am just a pedestrian who walks past with an interest to glean tidbits on how Wisconsin is faring. This is my apology, up front, for offending anyone with stupidity.

A question arises in my head from the phrasing: “the expected present discounted value of future dividends.” A long generation ago I had the idea that dividends were important to the price of stocks. Not so much today. The tax code has disparate treatment of dividends and stock appreciation. My memory is that when Microsoft initiated its dividend with a large initial payment, Bill Gates particularly transferred rights to his dividends to his tax exempt charity in advance so that money never touched his personal hands. Amazon lost money for years, while increasing in market value. And if I understand reporting on public radio, the valuations of Facebook and Google are hugely related to advertising spending, which has the ability to make drastic changes in very short periods of time. I make no study to support my perceptions, but it does appear that technology changes so quickly, that estimations of dividend streams for an indefinite future are not reasonable estimates. In place of an expectation of productive value from the corporate activity, we have a system where people can bet on the movement in market value.

If that makes any sense, I return to the question at the head of the diary: why the disparate performance in GDP and stock values? It seems that the two have little to do with each other. The total value of stocks is not a random walk, but it does appear to have big forces affecting it that the GDP does not.

Dividends in my mind is a short hand. The real issue is free cash flows. But then I’m an old fashion Modigliani and Miller type.

The idea that today’s asset price reflects expectations of future payments does not require any particular level of confidence in those expectations. A high level of uncertainty about future earnings amounts to greater risk, which shows up as a risk premium. The issue you have raised is that high uncertainty about future earnings should lead to a lower price/earnings ratio (reflecting a higher risk premium), but the market P/E is quite high.

Careful there. Uncertainty in the form of diversifiable risk does not show up as a high risk premium. Then again I’m an Arbitrage Pricing Model kind of dude.

Calling a price path a ‘bubble’ is shorthand for ‘I don’t know what’s going on.’

Bob Flood: You’re the expert (literally) — correct me if I’m wrong but without seeing the market’s information set, stochastic bubbles are indistinguishable from regime switching.

From August 2002 on, Paul Krugman and Dean Baker were calling the housing market a bubble. By August 2005, Krugman was referring to the “hissing sound” from the bubble. By August 2006, Krugman was writing of the bursting of the bubble and referring to a related recession by December 2007. Baker and Krugman evidently knew what was going on and described it.

http://www.nytimes.com/2002/08/16/opinion/mind-the-gap.html

August 16, 2002

Mind the Gap

By PAUL KRUGMAN

http://www.nytimes.com/2006/08/25/opinion/25krugman.html

http://www.nytimes.com/2005/08/08/opinion/that-hissing-sound.html

August 8, 2005

That Hissing Sound

August 25, 2006

Housing Gets Ugly

http://krugman.blogs.nytimes.com/2006/08/25/the-bubble-bursts/

August 25, 2006

The Bubble Bursts

But only one prediction came boldly enough to matter:

https://michael-hudson.com/wp-content/uploads/2010/03/RoadToSerfdom.pdf

And you could have mentioned Barkley along with Krugman and Baker, and others for that matter.

Thanks for noting that indeed I called the housing bubble early and also called early that it would lead to a bad recession and why, and indeed was more accurate than either Dean Baker or Nouriel Roubini on the timing of that, which indeed Dean has since agreed publicly was the case. That I was among the small number who very accurately called the whole mess was noted by Jamie Galbraith in a New York Times article at one point, although do not remember date on that.

As it was indeed, back then I debated with Jim Hamilton on whether or not there was a housing bubble going on at the time, with him being a long holdout on that it was not necessarily, with his argument about misspecfied fundamentals a part of that discussion, the point that was also long advocated by Bob Flood with other cosuthors, although I do not remember Bob getting involved in the internet debates at the time over whether or not the housing bubble was a bubble or not, much less what the implications of that would be.

I do note that the first person at the Fed to notice and make a fuss about it was Janet Yellen, in 2005 the president of the San Fran Fed.

Time to call Hamilton in off the bench.

md,

It is possible that Jim H. is staying on the bench given that he was rather slow to get on board with that housing bubble during 1998-2006 being a bubble. But he just does not post on here as much as he did back in those days, so maybe not.

Should bubbles be distinguishable from regime switching? The notion that sometimes volatility is persistently high, sometimes persistently low, doesn’t seem inconsistent with the notion that asset prices can become inflated relative to fundamentals.

md,

A refinement on how to use regime switching to look for bubbles is to use some sort of VAR to estimate a possible path for a fundamental based on likely variables and then to look at the residuals off that VAR model. Applying regime switching to these residuals is definitely a candidate for looking for possible bubbles as are some other methods, such as looking at Hurst persistence coefficients on those residuals.

However, for most assets this approach is subject to the “misspecified fundamentals” problem that both Jim Hamilton and Bob Flood (the latter with several different coauthors) have identified. This basically boils down to saying that for most assets one cannot be sure one has picked the right set of detemining bubbles, much less the right time series formulation, of the VAR type model one uses to estimate the hypothetical fundamental. I can provide some references to papers where this sort of approach has been used.

“right set of determining variables” not “right set of determining bubbles.” One is looking for the bubbles by trying to get the right set of underlying fundamental determining variables and modeling them. Persistent behavior one way or another of the residuals off that then become possible candidates for bubbles, if usually subject to the m..f problem.

I figured “right set of variables ” but “right set of bubbles ” is a heck of a lot more fun.

Oh, and if one is dealing with an asset where one can reasonably identify the fundamental, such as closed-end funds, well, one can do the Hamilton regime switching tests or the Hurst persistence tests directly on the logs of the price series itself without messing with cooking up some hypthetical fundamental standin using some VAR or whatever.

So, Bob, do you dismiss the argument that one can specify the fundamental pretty well for closed end funds and thus be able to distinguish probably true bubbles from non-bubble paths for that particular type of assets, even if your and Jim H.’s “misspecified fundamentals” argument applies to most assets.

Bob,

So I find it interesting that you do not comment on this point about how certain assets like closed end funds that one can freely buy and sell the underlying assets from may not be subject to the misspecified fundamentals problem. I note that there have been a number of people who have pointed out this matter of such closed end funds not being subject to this problem, including several people in finance and also Brad DeLong in economics with several coauthors. I have a story about your sometime coauthor on these issues, Peter Garber.

So there is a paper published in 1997 in JEBO (with 53 GS citations, order of magnitude below your top ones on this matter) entitled “Complex bubble persistence in closed-end country funds” by four authors. This paper was presented at several conferences. At one of them Garber was invited to discuss this paper, but he withdrew at the last minute from doing so without providing any explanation. To this day I have not seen either him or you comment on this matter. I am curious why that is.

Well, it appears that Bob is not going to reply to my simple request and either acknowledge or dispute my widely accepted claim that closed-end funds whose underlying assets can be freely bought and sold themselves are candidates for having a well-specified fundamental for analyzing whether their price movements constitute bubbles or not.

As hinted, but I shall now say more explicitly, I have also never seen any of Bob’s coauthors on papers about bubbles comment on this either, with Peter Garber going out of his way to avoid doing so publicly at least once. I do not know why this has been the case, but I see two possible explanations.

One is that they are simply embarrassed at having not noticed or commented on it, given how strong the statements were about the near universality of the misspecified fundamental problem were.

The other is that they recognize it but consider it to be so obvious as not to be worth commenting on. Indeed, it is so widely known that more than one economic forecasting firm uses the size of the discount or premium on closed-end funds as an input to estimates regarding “market sentiment.” But I guess we dhall never learn which of these explanations (or possibly any other) is why no comment on this has been forthcoming from any of them.

I know I am going on too much about this, but I shall note a more sophisticated reply Bob or somebody else could make on this matter. It is that one cannot make a precise estimate of the fundamental for closed-end funds. That is because the amount of tax effects and transactions costs related to holding a closed-end fund, and thus determining how large a discount from net asset value constitutes the precise fundamental value, varies from fund to fund also across the agents buying and selling a fun (this for the size of the related tax effects). These simply cannot be precisely estimated, although as I noted previously, if one sees a premium emerging that then rises noticeably, with none of those elements varies much, one is almost certainly looking at a bubble.

The other matter is one I have effectively recognized, that agents need to be able to buy and sell the underlying assets. That does hold for most closed-end funds, but not for all such funds and agents. Thus when a lot of closed-end country funds exhibited rising premia in late 1989 and early 1990, up to 100% for some, that is about double the net asset value, one of those nations was South Korea. At the time that nation did not allow foreigners buy their stocks, which meant that if foreigners wanted to participate in the South Korean market they needed to do it by buying a Korea closed-end fund. But clearly there were limits on people buying and selling the underlying assets.

Very simple, the increased money supply has been flowing into asset prices, while prices of goods & services remain low.

PeakTrader is back. And he seems to be rehashing Princeton Stevie Boy’s nonsense. Come on Peaky – you can do better!

Yes, indeed, and this guy has a graph that looks just like the stock market and housing price bubble.

https://econbrowser.com/wp-content/uploads/2020/12/qtytheory.png

And the housing bubble:

https://1.bp.blogspot.com/-GhVFWwyGtTc/X71Cb3pR5jI/AAAAAAAA3KE/cmY_WhMvYgMpnQ0HTJTK_Kmm4Hq7c1qxgCLcBGAsYHQ/s1021/RealSept2020.PNG

Thus, it would seem: MV = P(goods and services) * V(goods and services) + P(financial and real assets)*Volume(financial and real assets)

The question would then appear to be how easy money is allocated between flows of goods and stocks of assets.

And let me add there are many ways to discern bubbles.

There are many ratios which characterize financial and real relationships in the economy.

For example, the median wage should be able to purchase the median dwelling. The price of an asset cannot forever deviate from its replacement cost. Prices cannot forever rise with increasing inventories.

There are maybe a hundred of these ratios in the economy. They are commonly used for financial analysis in industry.

I have stated — perhaps a decade ago now — that a nice PhD thesis might be to collect these ratios and their standard deviations into A Book of Economic and Financial Ratios, which would then be used to underpin DSGE models. As the model progresses, it would show stress, and the greater the stress from the norms, the greater the risk of and need for a correction.

But perhaps someone has already done this, in which case the talk about bubbles above would be moot.

Steven,

I think you need to be careful about your statement that “the median wage should be able to purchase the median dwelling.” This ignores renting, the percentage of which can vary from locale to locale. Indeed, Shiller and others have long argued that one does not expect to see bubbles in rents as those tend to reflect very current supply and demand conditions for housing as rents cannot vary with peoples’ expectations about future rents. There is no chance for a capital gain in rents themselves. Capital gains can only happen for ownership of the housing that earns the rents, and so it is real estate prices that can experience bubbles based on expectations of capital gains, not rents.

This makes the price/rent ratio to be the obvious focus for considering possible bubbles in housing, not rents themselves. But this then does highlight the matter of expectations, and indeed we expect to see higher price/rent ratios in locales where we rationally expect future rents to rise due to supply and demand conditions. Expectations about future incomes in a locale are the main driver of future demand, but future supply also become important, with a large literature out there by people like Glaeser on how metro areas with lots of land use controls tend to have higher price/rent ratios tjhan ones with fewer land use controls, given similar expectations about future incomes and economic activity, this being why we see much higher price rent ratios in metro areas in California than in Texas.

Shiller’s case for what went on in much of the US housing market between 1998 and 2006 focused on the behavior of the price/rent ratio, which rose sharply throughout that period in many locales, although not all, with it then falling after 2006. That many are worrying that we may be seeing bubbles again in some local US housing markets is precisely due to noticeable increases in this ratio in a several major locales this year especially. Indeed, in some places like New York and the Bay Area, we have seen rents declining with the drop in demand as people move out of central city areas, even as prices have risen in some of those same markets.

Yes, of course, Barkley, you are correct. The point I was trying to make was that as an economic matter we cannot have a substantial portion of the population unable to afford a home while an unusual number of homes sit vacant. Back in 2006, you needed a top 10% income in NJ to buy the median home in Princeton. The vast majority of the people who lived in these homes would not have been able to purchase them on the open market. As such, it was apparent that the situation would end badly.

I’d note that I did not appreciate how badly it would end, that a sustained collapse in housing prices will constitute the very essence of a depression, as it necessitates a protracted period of negative equity withdrawals as home owners rebuild their net equity positions, and therefore implying ‘a lack of aggregate demand’. I think I did not fully appreciate the situation until I watched The Big Short, where Brad Pitt’s character makes some comment about the default on bundled mortgages being a catastrophe for the economy and society. (In this respect, I would consider Biden to be our first post-depression president and Trump to be the last depression-era president; the depression ending in August 2017 by my math.)

In any event, if we conducted a little group exercise, we could probably quickly come up with perhaps 30-40 such ratios, including rent-to-price. All these ratios have known, average values and historically observable standard deviations. Thus, if these were incorporated into DSGE models, they would act as a kind of elastic, a sort of web. If one started to violate these, then they would tend to show up as stresses, as on a fault line. In that sense, they could help remedy a historical weakness of DSGE models, that is, their relative inability to predict recessions and, often, the nature of the correction.

I’d also add that I have not tracked developments in DSGE modeling. Perhaps someone has already incorporated these.

Via inflation expectations.

Disagree. You are suggesting the effect of increases in prices between goods/services and financial/real assets comes down to public mood, ie, inflation expectations. Therefore, a mere change in sentiment could send inflation shooting higher or stock prices crashing. I disagree with this view. I believe the split is driven essentially by real conditions on the ground, not the public mood.

…increases in M2…

https://ourworldindata.org/excess-mortality-covid

December 22, 2020

Excess mortality during the Coronavirus pandemic (COVID-19)

By Charlie Giattino, Hannah Ritchie, Max Roser, Esteban Ortiz-Ospina and Joe Hasell

December 22, 2020

Coronavirus

US

Cases ( 18,684,628)

Deaths ( 330,824)

India

Cases ( 10,099,308)

Deaths ( 146,476)

France

Cases ( 2,490,946)

Deaths ( 61,702)

UK

Cases ( 2,110,314)

Deaths ( 68,307)

Germany

Cases ( 1,556,611)

Deaths ( 28,241)

Mexico

Cases ( 1,325,915)

Deaths ( 118,598)

Canada

Cases ( 521,509)

Deaths ( 14,425)

China

Cases ( 86,867)

Deaths ( 4,634)

December 22, 2020

Coronavirus (Deaths per million)

UK ( 1,004)

US ( 997)

France ( 944)

Mexico ( 915)

Canada ( 381)

Germany ( 337)

India ( 106)

China ( 3)

Notice the ratios of deaths to coronavirus cases are 8.9%, 3.2% and 2.5% for Mexico, the United Kingdom and France respectively.

December 22, 2020

Coronavirus

Massachusetts

Cases ( 331,174)

Deaths ( 11,804)

Deaths per million ( 1,713)

————————————

December 22, 2020

Coronavirus

New York

Cases ( 906,834)

Deaths ( 36,735)

Deaths per million ( 1,888)

And who are you protecting by taking the tired, centrist Democratic position of the past fifty years, a position that denies healthcare to millions? I call this the “no, we can’t!” thinking” so beloved by the healthcare industry and echoed by the octogenarians running the Democratic Party.

My goodness – the same Russian bot that has been posting gibberish under The Rage has taken over your computer. Boring and pointless as ever.

Latin American countries have recorded 4 of the 13 highest and 6 of the 24 highest number of coronavirus cases among all countries. Brazil, Argentina, Colombia, Mexico, Peru and Chile. Mexico, with more than 1 million cases recorded, has the 4th highest number of cases among Latin American countries and the 13th highest number of cases among all countries. Mexico is now the 4th among all countries to have recorded more than 100,000 coronavirus deaths.

December 22, 2020

Coronavirus (Deaths per million)

US ( 997) *

Brazil ( 883)

Argentina ( 931)

Colombia ( 800)

Mexico ( 915)

Peru ( 1,121)

Chile ( 845)

Ecuador ( 785)

Bolivia ( 770)

* Descending number of cases

The larger question may be is monetary policy appropriate. The Fed prevented deflation successfully and inflation remains below 2%. A fiscal expansion is needed, but the national debt is too high. When a stronger expansion is underway, interest rates will rise and interest payments on the national debt will explode crowding out government spending, which is contractionary, and may slap the economy down to stagnation or long lasting slow growth.

PT,

Interest rates might or might not rise with a resumption of economic growth, or might rise only a fairly small amount. A seriously noticeable long run trend has been a downward trend of interest rates globally, at least among higher income nations. There remains considerable debate regarding why this is, although I note that Steven Kopits here has argued strongly for demographic factors being important, notably the slowdown and even reversal of population growth, with Japan the poster boy for these possibly related trends.

I’m impressed that anyone call follow the rants of Steven Kopits. I gave up months ago.

He is better on some issues than others.

Interest rates may also begin to rise substantially, from historically low levels, as inflation begins to accelerate. I doubt the Fed wants 1970s style stagflation.

Interest payments on the national debt is $400 billion a year, although the Fed remits $100 billion to Treasury. So, it’s $300 billion net. It looks like trillion dollar a year budget deficits will continue, adding to the mountain of federal debt.

PeakTrader If servicing the debt gets to be a significant problem, then maybe we could increase taxes on the rich. Just a thought. After all, the rich got the lion’s share of Trump’s tax cut, which is the structural component of the annual deficit, so it’s only fair that they be asked to surrender some of their ill-gotten gains.

The rich will always find ways to avoid or minimize taxes, and sometimes in ways that harm the economy, e.g. less private investment. The burden will fall on the middle class.

PeakTrader If that were true the rich wouldn’t squeal so much at the prospect of higher taxes. But the rich are not indifferent to higher taxes, so this suggests that avoiding taxes isn’t quite as easy as the rich want you to believe. As to the effect of private investment, the results of the Trump tax cuts doesn’t exactly support the view that lower taxes on the rich increases private investment.

Actually, 2slug, PT is having it both ways, incoherent as usual. On the one hand the rich don’t give a Christmas fig about high taxes because they can avoid them. But, uh oh, if their taxes are not low, it will really impact them so that they will hurt the middle class by not engaging in “private investment.” But then, I think you got this.

Interest rates will rise? Crowding out? I guess you have not seen a historical chart of government bond rates in over 40 years.

we need m4a . the US has the most expensive healthcare system in the world in terms of absolute terms and per capita terms and what we get in return. A continuing shortage of ppe ; 326000 deaths as of this writing , which in turn to some media outlets will have drop of 3 years in life expectancy.

there is too much waste which includes grossly overpaid doctors; medicines, and insurance execs.

“there is too much waste which includes grossly overpaid doctors; medicines, and insurance execs.”

Granted but Medicare for All is not going to accomplish all three of your cost cutting goals here. Yes it would take out those obscene health insurance company profits and may lower administrative costs. That an insurance company is getting a 20% gross margin on what we pay into covering health costs is obscene.

But if you want doctors not to receive such huge salaries, we need more doctors. Dean Baker and Greg Mankiw may not agree on much but they agree that we should let well trained doctors abroad to move here.

Now Big Pharma is a problem because we give them too much patent protection. Dean Baker has written a lot on how to address this issue.

But of course the Medicare for All fanboys like JohnH will not accuse me of paralysis by analysis. Yes – he is really THAT stupid.

Yes, of course, but where would things be if the the corporate Democrats, with their ‘Third Way’ schemes, had not devised a healthcare plan which channels ex nihilo funding to the health care industry? It is after all a major contributor to GDP. Which is why Obamacare advocates have never applied much effort to policies that would curtail waste, or, improve good health via a better food supply, and etc. Bad health has simply become a necessary contributor to the economy. Consequently, their scheme includes integral support of the unhealthy citizens by the healthier citizens, and thereby there is little or no incentive to be healthy. Then too, not to be out done by these sneaky Democrats… the corporate Republicans have done well to make mitigation efforts on the virus far less than effective, and, this has of course allowed the pandemic to be yet another way for the Fed and the Treasury to subsidize at will. And, naturally, as explained in earlier comments, only fools believe in bubbles.

Of course if GOP wins GA Senate runoff races all these discussions about some ideal health care system or substantial reforms of it will just be completely moot and essentially pointless. Heck, even with a 60 person majority in the Senate in 2009-10, Obama could barely get even the modest improvement that ACA has been through, with it getting down to dying Sen. Robert Byrd, he once of the KKK, getting brought in in a wheelchair to provide the crucial vote on cloture to pass it, with GOP commentators openly hoping he would die before he could do that.

Even if Dems win GA, they will not have anywhere near enough votes to invoke cloture, so anything really dramatic is simply not going to happen in the near future.

Raymond Love sounds a lot like JohnH – except a little more eloquent with the prose. The truth be told health economists can devise an excellent system of health care but they are alas clueless how to get rid of Mitch McConnell. Until we do – lots of luck fellows.

You know you have something useful to add but as soon as you write “corporate Democrats” you have become the moron we call JohnH. Yea Obama tried to find someway to get bipartisan support for health care reform but the Republicans were dead set against anything. When and if we get the Republicans out of the way – whining about Democrats is rather pointless.

A quick check reminds me that there are a lot of lists out there ranking nations on their health care systems, and given the many different variables involved in those systems it is not surprising that there is a lot of variety in their rankings, even as certain countries regularly seem to be near the top. I found one list that had single payer Canada on top and another that had socialized medicine UK on top. But on most lists neither is at al near the top, and, of course the US is not remotely in the competition, always way down among high income nations.

Four that seem to be almost always in the competition near the top are France, Sweden, Switzerland, and Japan, with France on top on the World Health Organization list. All of these are mixed public-private systems, although with considerable differences between them.

Obama was under the illusion that had he pushed RomneyCare – Republicans would work with him. They didn’t. No more illusions. Biden should push for stronger health care reform.

The rich complain, because they have to spend more on tax accountants and make adjustments from the higher tax rates – bigger adjustments than the middle class. More taxes on the rich for government spending means less money for private investment – little or no effect on their consumption.

‘More taxes on the rich for government spending means less money for private investment – little or no effect on their consumption.’

We lowered taxes on the rich big time in 1981. Rich people consumed those tax cuts and investment fell. That is simply historical facts that run completely contrary to your usual BS here. Come on Peaky – I thought Donald Luskin had wrapped up the Most Stupidest Man Alive award but it seems you are trying really hard to dethrone him.

That may or may not be true, but reducing taxes not the same as raising taxes. Here’s what Elon Musk says:

He is your classic, cash-poor billionaire. All his money is invested in the businesses he owns.

“My proceeds from the PayPal acquisition were $180 million. I put $100 million in SpaceX, $70m in Tesla, and $10m in Solar City. I had to borrow money for rent.” @elonmusk

The post notes the role of the cost of capital, which includes the risk-free rate and the equity risk premium. If one ever had to endure what goes on with “business economists” in terms of utter junk science on this topic, one might scream. I certainly screamed when I got this in my Inbox:

https://www.duffandphelps.com/insights/publications/cost-of-capital

Duff & Phelps charges a lot for their publication so I’m wondering if others have any experience with this crew. Maybe I’m being unfair but their stuff does not strike me as the best and the brightest. I did find it odd that they are now claiming the risk-free rate is 2.5% and the risk premium is 6%. Maybe on the other extreme from DOW 36000.