I’m talking about inflation expectations in my macro course, so wanted to show what different measures predicted for the next year.

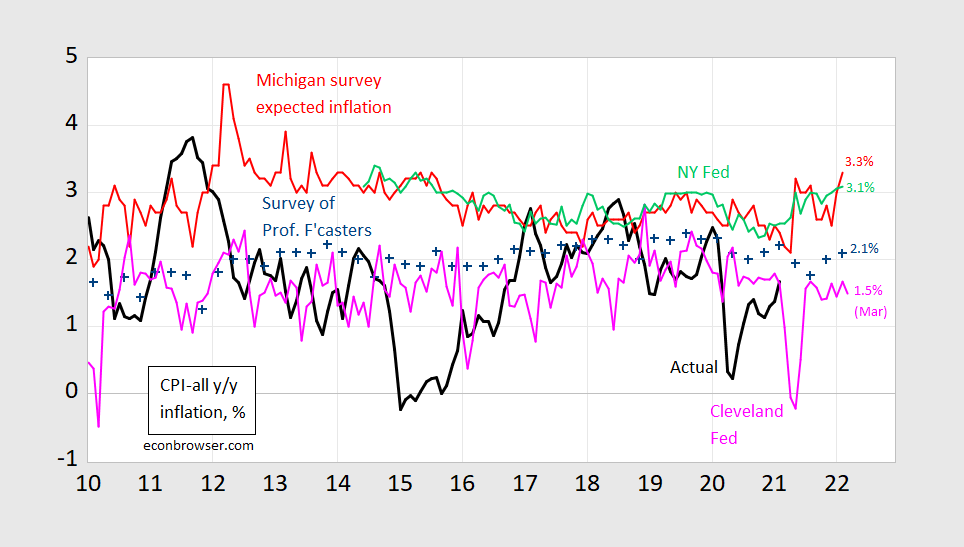

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink). Source: BLS, University of Michigan via FRED, Philadelphia Fed Survey of Professional Forecasters, Philadelphia Fed, NY Fed, and Cleveland Fed.

Interestingly, the two household based surveys (Michigan, NY Fed) are at the top, while the market/expectations based (Cleveland Fed) and economist survey based (SPF) are at the bottom. In some sense, the household survey results is not too surprising; the Michigan survey has historically been upward biased.

Keep in mind we’re doing price level catch-up over the next year.

“median from NY Fed Survey of Consumer Expectations (pink), forecast from Cleveland Fed (light green)”

Your labeling is this description seems to be at odds. Anyway – the pink one seems to do a pretty good job.

pgl: Yes, that’s a mistake. Labels *in* graph correct. I have fixed the text. Thanks for flagging that error.

Smoothed out, it does look like the Cleveland Fed has been most accurate. Happenstance, or better methodology?

SecondLook: there is a literature demonstrating averages are better in overall forecasting. So, this might be an example of that finding.

What If I don’t want ketchup?? I prefer Whuz aaaaaaawwp B.

I understand that the same level of granularity isn’t available, but it would be interesting to see how the FOMC’s PCE projections (median or ranges) have performed across time. Yes, each governor and each president provides projections based “under their individual assumptions of projected appropriate monetary policy”, but it would be interesting in a similar context as the graph above.

Allow me to be the rude person in the room, and openly wonder why the Michigan Survey and NY Fed is even bothered with when the Cleveland one obviously does it much better?? This seems as near asinine to me as the nightly quoting of the Dow Jones. What is the damned point exactly when it’s obvious the number is WAY off compared to other measures??

Moses Herzog: Well, to the extent that the Michigan survey more accurately reflects (biased) household expectations, they might also be better explanatory variables for explaining behavior. This is indeed the point in Coibion et al. Now, on the other hand, if my objective was forecasting, then I would probably use something like the Cleveland Fed measure.

Very good answer, something I hadn’t thought of. Appreciate it.

https://fred.stlouisfed.org/graph/?g=t7QR

January 15, 2018

Inflation Expectation and Inflation, 1978-2021

https://fred.stlouisfed.org/graph/?g=Cqk6

January 15, 2018

Inflation Expectation minus Inflation, 1978-2021

SPF looks like a Tetlock wet dream. Seems like a convergence around the belief that the committee will hit its 2% target. I wonder how a simple ARMA model would’ve performed?

I wonder how a simple ARMA model would’ve performed?

I think the answer is not well. An ARIMA (1 1 0) with constant model applied to year-over-year inflation rates from Jan 2010 thru Feb 2020 yields a pretty bad forecast over the Mar 2020 thru Feb 2021 horizon. MAPE of 191% and a MAE of 1.1 percentage points. Theil’s U of 3.78 with most of the weight in bias proportion. So pretty bad.

Apologies – my curiosity of an ARMA model’s performance was not so much in absolute terms but in relative terms.

Progress is getting the Ever Given back to floating and not blocking the Suez Canal and oil prices have already started declining:

https://www.msn.com/en-us/money/markets/oil-drops-after-ever-given-container-ship-blocking-the-suez-canal-is-refloated/ar-BB1f4zm9?ocid=uxbndlbing

Another Princeton Steven forecast ($100 a barrel) seems even sillier!

Oil prices are up this morning. Having said that, I am not sure that a Suez blockage would raise oil prices, or not across the globe. It could, for example, lead Persian Gulf prices to decline and WTI to increase. But that’s speculation. It would almost certainly, however, lead to higher refined product prices.

I have not changed my view of oil market dynamics. Underpinning all this, as I have said, is one’s view of the covid pandemic. We have yet another surge beginning even as vaccines are rolling out at a pretty good pace. Not clear which side wins in the short run. I have picked the optimistic view.

We’ll see.

“Oil prices are up this morning.”

Seriously? WTI is only $61.63 a barrel. Oh wait they fell last week and maybe had a small turnaround. Why do feel the need to lie to us this way? $61.63 =is a far cry from your $100 forecast.

The big debate on infrastructure investment will be on how to fund it. The Wall Street Journal and some of those other Communist newspapers note how the ultrarich are dodging taxes even more than we previously thought:

https://www.wsj.com/articles/high-income-tax-avoidance-far-larger-than-thought-new-paper-estimates-11616364001

Here’s a thought – enforce the already existing transfer pricing rules. Now I have to admit that I learned about this story from some self promoting twit on Linkedin who claims he is THE expert on partnership. So what is Mr. self promoting hoping? That Congress shuts down his favorite loophole or that some of the ultrarich hire him to better exploit his favorite loophole?

Honestly, I am not sure why we care very much about inflation. The global economy was not brought down in 2008 by inflation. It was brought down by a bubble in housing prices and a slate of dodgy alternative investment vehicles, CLOs, CMOs, CDOs and, yes, SPACs. And I believe that’s what we should care about now.

https://seekingalpha.com/article/4404673-is-this-the-biggest-financial-bubble-ever-hell-yes-it-is?lift_email_rec=false&mail_subject=is-this-the-biggest-financial-bubble-ever-hell-yes-it-is&utm_campaign=nl-morning-briefing&utm_content=link-1&utm_medium=email&utm_source=seeking_alpha

Lord this is beyond stupid. The right analogy is not 2008. Try 1966. Or do you know nothing about either macroeconomics or economic history?

you only worry about rising inflation then if wages are rising as well.

I cannot see that in your country or mine

“This one is a surprise because it was the epicenter of the last bubble, and very seldom does an asset class reinflate so quickly.”

Here we go again. Real rents are higher than they were back in 2005. Real interest rates are much lower. Now I know Princeton Steve flunked Finance 101 but this dude did too? Damn!

Of course he is convinced that interest rates must return to their average over the last 720 years. Leave it to you to cite such a clown as an authority.

@ “Princeton”Kopits

Any updates on when we’ll see your prediction of $4.00 gas at the pump?? I think the U.S. national average dropped 2 cents from a week ago. I hope you’re not too depressed about the EverGiven breaking free. Better luck next time Biffy.

He just claimed oil prices are up today. He forgot to tell us that it is up to $61.63 a barrel having dropped last week. Yes Princeton Stevie is doing what he excels at – lying.

They have already hit $4 in places in California. We have been flirting with $3 for regular in Mass.

But, but oil prices has still less than $62 a barrel. But keep lying to us and maybe your buddies on Fox and Friends will have you on to smear Latino kids.

I guess Princeton Stevie has never read anything James Hamilton has written on the role of oil prices and gasoline prices but permit me to provide the Oil Prices for Dummies version so our favorite hack consultant might get it.

First take the price of oil/barrel and divided by 40. Then add $1/gallon to cover taxes, cost of refining, and cost of distribution.

Since oil prices are just over $60/barrel, this tells us that gasoline prices are just over $2.50 a gallon. And in a lot of states, one can find gasoline for say $2.60 a gallon.

Now if Stevie decides to find the highest price in Los Angeles to be representative of the national average, he is both the dumbest motorist ever and one lying troll.

So much concern about inflation, so little concern about real wages and real median household income. I suspect that the obsession with inflation is driven by the same folks as those who track the S&P 500 closely—the investor class and the economists who cater to them.

The focus should be on real wages but I do hope you are not that stupid claim that Cameron’s reducing UK inflation led to higher real wages. Nope – UK real wages plummeted under Cameron. Please inform that other JohnH that he got it all wrong back then.

Not all economists cater to them, that’s an unfair blanket statement. Have you even skimmed Menzie’s book?? Doesn’t strike me as “catering” to the higher income groups. Menzie has been one of the truth-tellers on the Reagan years, which was one of the reasons I originally started following Menzie.

“the investor class and the economists who cater to them”.

Let’s be fair – Lawrence Kudlow caters to the investor class. He’s not an economist you say? Fair but he was Trump’s chief economic advisor. So per Econned’s dictionary, Kudlow is an eminent economist.

@ JohnH

I’ve supported your arguments here, and will continue to do so, because I sympathize with your thoughts in a general way, but you might want to hone your arguments a little better to make certain you’re striking the right targets. This is especially offensive if we think of guys like Alan Krueger, who I suspect may have had some of his darker moments because of his extreme empathy and sensitivity to the poor and the working class. Guys like Krueger don’t deserve unfair aspersions. He paid a price.

I never said that ALL economists cater to the investor class. But wouldn’t you agree that many, if not the vast majority , of those who focus on monetary policy almost by definition share many common interests with the investor class? After all, monetary policy is about money and banking…the financial industry.

Wouldn’t it be better for the general welfare if more attention were directed at real wages and real median household incomes? Where’s the balance?

Have you ever heard of James Tobin? Franco Modigliana? Paul Samuelson? Brad DeLong? Paul Krugman? None of them catered to the investor class. But according to St. JohnH know it all (even though you know nothing about economics) they got paid by someone somewhere. Your usual pathetic BS.

pgl,

Arguably Modigliani and Samuelson did at times with some of their work, but not in general.

Interesting that pgl failed to mention Alan Greenspan, Milton Friedman, and Larry Summers, the three economists judged most responsible for the Global Financial Crisis. Other prominent economists are also on the list.

https://rwer.wordpress.com/2010/02/22/greenspan-friedman-and-summers-win-dynamite-prize-in-economics/

I will reiterate that not ALL economists cater to Wall Street. But an obsession primarily with matters of deep concern to the investor class can only beg the question.

“the three economists judged most responsible for the Global Financial Crisis”

i am not sure it is fair to make them responsible for the irresponsible behavior of the titans of finance leading up to the financial crisis.

Princeton Steve has us trust some clown over at Seeking Alpha for expertise on macroeconomics? Even their little resume for John Rubino calls this reliance into question:

“John Rubino manages the financial website DollarCollapse.com. He is the co-author, with GoldMoney’s James Turk, of The Money Bubble (DollarCollapse Press, 2014) and The Collapse of the Dollar and How to Profit From It (Doubleday, 2007), and author of Clean Money: Picking Winners in the Green-Tech Boom (Wiley, 2008), How to Profit from the Coming Real Estate Bust (Rodale, 2003) and Main Street, Not Wall Street (Morrow, 1998). After earning a Finance MBA from New York University, he spent the 1980s on Wall Street, as a money market trader, equity analyst and junk bond analyst.”

Gee – I bet even Econned would call Rubino an eminent economist!

How stimulating is the stimulus?

https://lipperalpha.refinitiv.com/2021/03/covid-19-stimulus-payments-boost-savings-rather-than-spending/#

If this survey is right, this money will be used mostly as easy money has been used in the last year: to save, invest in stocks and pay down debt. eg, it will principally go to continuing to fuel the bubble in assets.

Like I said: https://apnews.com/article/business-b0ffd8047469e566ea24ba5609c6ed23

Hedge funds and margin calls are you explanation of how weak consumer demand will lead to an asset bubble? Damn Stevie – I am afraid the men in white coats need to come get you.

An increase in national savings matched by more investment is an asset bubble? Where did you learn your macroeconomics? Oh yea the University of One Flew Over the Cuckoo’s Nest!

https://www.nytimes.com/2021/03/20/opinion/sunday/unpaid-tax-evasion-IRS.html

March 20, 2021

How to Collect $1.4 Trillion in Unpaid Taxes

Wealthy Americans are concealing large amounts of income from the I.R.S. There is a straightforward corrective.

When the federal government started withholding income taxes from workers’ paychecks during World War II, the innovation was presented as a matter of fairness, a way to ensure that everyone paid. Irving Berlin wrote a song for the Treasury Department: “You see those bombers in the sky? Rockefeller helped to build them. So did I.”

The withholding system remains the cornerstone of income taxation, effectively preventing Americans from lying about wage income. Employers submit an annual W-2 report on the wages paid to each worker, making it hard to fudge the numbers.

But the burden of taxation is increasingly warped because the government has no comparable system for verifying income from businesses. The result is that most wage earners pay their fair share while many business owners engage in blatant fraud at public expense.

In a remarkable 2019 analysis, * the Internal Revenue Service estimated that Americans report on their taxes less than half of all income that is not subject to some form of third-party verification like a W-2. Billions of dollars in business profits, rent and royalties are hidden from the government each year. By contrast, more than 95 percent of wage income is reported….

* https://www.irs.gov/pub/irs-pdf/p1415.pdf

Yes – the NYTimes and the WSJ ran similar stories. Time to raise the corporate tax rate AND enforce the transfer pricing rules.

The problem is enforcement. It is easy to create an offshore investment vehicle in a banking secrecy jurisdiction. One funds that vehicle with money that is already ex-patriated. If one recruits enough people and operates the vehicle as an entity (mutual fund, private equity pool, etc), then there is no mandatory foreign situs account reporting. If the vehicle operates on a growth model (no dividends) then the investors have no income. With a little work, and a lot of fees, that vehicle can be listed on an exchange. One would then be able to buy and sell derivatives of that investment through licensed brokers throughout the world. One would be taxed only on the ADRs bought and sold. The foregoing is legal. It is a very simple avoidance strategy. Initial transaction costs are high. At some tax rate (unknown number) it is rational for the 1% to spend the money on lawyers, accountants, etc to avoid the tax bite. International money is extremely difficult to pin down. The Tax man relies on voluntary reporting with criminal penalties for lying. People who can afford to go to district court (as opposed to Tax Court) have the advantage that the IRS bears the burden of proof that the tax payer lied. This is why one rarely sees the IRS going after the truly wealthy (unless they did something really stupid). Since the IRS is not likely to catch the sophisticated avoider/fraud there is less deterrent effect for the truly wealthy. The trade pricing rules are also easy to manipulate. For every malum prohibitum law, there is a way around it. The problem is enforcement.

“At some tax rate (unknown number) it is rational for the 1% to spend the money on lawyers, accountants, etc to avoid the tax bite.”

Yep – and do the taxpayer’s representatives lie? Of course they do. Of course the IRS could hire competent lawyers and expert witnesses if Congress gave them a decent budget. But they don’t.

“This is why one rarely sees the IRS going after the truly wealthy (unless they did something really stupid). ”

Coca Cola paid a lot of money for incompetent transfer pricing advice aka stupid really stupid. And they got away with this until only recently. They lost a very expensive and time consuming litigation where the big shot expert witnesses for the taxpayer argued things that would embarrass even Stephen Moore. So they are appealing this loss on the grounds that the IRS transfer pricing enforcement is unConstitutional. I kid you not.

https://www.washingtonpost.com/business/2021/03/26/wealthy-tax-evasion/

March 26, 2021

The richest 1 percent dodge taxes on more than one-fifth of their income, study shows

Those at the very top of the income spectrum deny the U.S. government roughly $175 billion a year in revenue, researchers estimate

By Christopher Ingraham – Washington Post

The richest Americans are hiding more than 20 percent of their earnings from the Internal Revenue Service, according to a comprehensive new estimate of tax evasion, * with the top 1 percent of earners accounting for more than a third of all unpaid federal taxes.

That’s costing the federal government roughly $175 billion a year in revenue, according to the findings by a team of economists from academia and the IRS….

* http://gabriel-zucman.eu/files/GLRRZ2021.pdf

China Journal of Accounting Research

Volume 13, Issue 4, December 2020, Pages 327-338

China Journal of Accounting Research

A review of tax avoidance in China

Tanya Y.H.Tang

This paper synthesizes the major empirical findings of the burgeoning tax avoidance research in China from the accounting, finance, and economics literature over the last 13 years. It surveys the evidence in four main areas: (1) the mechanisms through which Chinese firms avoid income taxes; (2) the effects of government ownership and agency problem on tax avoidance; (3) tax avoidance and political connections; and (4) the roles of book-tax conformity, tax enforcement, and corporate governance. It also discusses the appropriateness of tax avoidance measures in the Chinese setting. Finally, it proposes important directions for future research.

https://www.sciencedirect.com/science/article/pii/S1755309120300381

Providing a link so I can more carefully read this later. A quick skim showed they discussed transfer pricing games. Macau, Hong Kong, Singapore – all known tax havens!

Fortunately this is not a large problem thanks to the Social Security COLA, but there is an old textbook case regarding how some people are hurt by any increase in inflation, even an increase that is expected. That is people on fixed nominal incomes. Again, this does not apply to wages, profits, or Social Security. But the classic old textbook case is old people who receive pensions that are nominally fixed, which many are, although not Social Security. I think this damage has been largely forgotten about in the US because inflation has been so much under control for such a long time.

But when people talk about how there is no particular problem with inflation running at something like 5-6% rather than the current near 2% are not thinking about this set of people and this part of their income. But at such rates the damage to those people will be a lot more noticeable. While JohnH can accurately point out that people in debt will gain from inflation who are mostly poorer than those who are their creditors, I also note that this only holds for unexpected increases in inflation, whereas this damage to people on fixed nominal incomes happens even for inflation that is accurately foreseen.

Of course this is not a reason to get worked about some fairly small temporary increase in the rate of inflation as at least the Fed is expecting us to see later this year.

https://econospeak.blogspot.com/2021/03/the-iran-china-deal.html

March 30, 2021

The Iran-China Deal

By Barkley Rosser

[ China has just affirmed a “right to development,” and this short essay is an important introduction. ]

“But when people talk about how there is no particular problem with inflation running at something like 5-6% rather than the current near 2% are not thinking about this set of people and this part of their income.”

i guess the point is there will always be a sacrificial lamb, depending upon the circumstances. from a cost benefit view, doing a small amount of damage over the last 10 years of ones life is probably better than hurting some 30 year old with many decades of work and life remaining. and as you say, current social security policy helps to blunt some of that damage to the retired. there is no formal instrument to blunt the damage to the younger workers, who are forming families and will contribute for decades to economic growth-or the lack thereof. we could certainly set up an improved safety net for the retired stuck in this situation, and would probably be cheaper than hurting the prospects of the younger generation.

https://fred.stlouisfed.org/graph/?g=Copd

August 4, 2014

Real per capita Gross Domestic Product for China and Iran, 1971-2019

(Percent change)

https://fred.stlouisfed.org/graph/?g=Copq

August 4, 2014

Real per capita Gross Domestic Product for China and Iran, 1971-2019

(Indexed to 1971)

Notice that in 60 years, real per capita GDP for Iran has declined by about 25%, while that of China has increased by more than 3,300%. China offers Iran the prospect of growth after all these years.

The indices are poor measures of the actual cost of buying restaurant meals, healthcare, …. .

https://fred.stlouisfed.org/graph/?g=CtSi

January 15, 2018

Consumer Price Index for food at home & food away from home and Consumer Price Index for all items, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=sXuU

January 15, 2018

Consumer Price Index for medical care and Consumer Price Index for all items, 2017-2021

(Percent change)

Thank you, Baffling:

https://www.sciencedirect.com/science/article/pii/S1755309120300381

December, 2020

A review of tax avoidance in China

By Tanya Y.H.Tang

Abstract

This paper synthesizes the major empirical findings of the burgeoning tax avoidance research in China from the accounting, finance, and economics literature over the last 13 years. It surveys the evidence in four main areas: (1) the mechanisms through which Chinese firms avoid income taxes; (2) the effects of government ownership and agency problem on tax avoidance; (3) tax avoidance and political connections; and (4) the roles of book-tax conformity, tax enforcement, and corporate governance. It also discusses the appropriateness of tax avoidance measures in the Chinese setting. Finally, it proposes important directions for future research.

Following up on that little debate between Moses and Princeton Steve on oil prices. Stevie informed us yesterday that oil prices were rising so gasoline prices exceeded $4 a gallon. OK the last part is blatantly false.

But let’s note how oil prices (WTI $/barrel) have faired in the last few weeks. $66.08 back on March 5. Now? Less than $60.50. Oil prices are soaring heading to $100 a barrel and I’m the best defensive player in the NBA!

The Derek Chauvin defense attorney seems intent on digging the grave for his client. Could it be Chauvin’s strategy is to lose and then appeal on the grounds of incompetent counsel?

https://www.cnn.com/us/live-news/derek-chauvin-trial-day-two-testimony/h_19648131d051943ca648e57b2eaf879f

“Alan Greenspan, Milton Friedman, and Larry Summers, the three economists judged most responsible for the Global Financial Crisis.”

How cute – there is a Dynamite Prize in Economics! Selected by 7500 people who commented on some blog????

Funny thing – Princeton Steve insists this was caused by a housing bubble that is about to repeat itself. And never mind the fact that much of the push for financial deregulation was so little guys might get a decent return on their deposits – something JohnH claims he supports (even if he as usual has no idea about the economics behind this issue).

I have said many times that a lack of attention to downside risk was the cause of this crisis which is criminal as it was a massive repeat of the mistakes made during the S&L crisis.

It also turns out that uber free marketer Greenspan had been advocating perhaps the best way of addressing this serious concern – that being requiring banks to have at least 20% of the market value of their assets financed by equity and not debt.

Of course the vast literature on these issues is way over the head of economic know nothing JohnH who spends his time not learning economics but searching for stupid polls such as the Dynamite Prize in Economics.

Someone at Grant Thornton wants us to believe that multinationals are trying to pay as much taxes in high tax jurisdictions as possible as all of those profits belong in tax havens like Singapore:

https://news.bloombergtax.com/daily-tax-report-international/transfer-pricing-and-tax-authorities-a-singapore-perspective?context=search&index=1

I found this discussion almost as amusing as a Bruce Hall rant for a variety of reasons including how he weaved everything including the kitchen sink into his discussion of transfer pricing games that he clearly got backwards. But did you know that the mean old US tax authority is called the Inland Revenue Service?

This is how Grant Thornton is promoting its “expertise”. Sort of like what I say about their competitor – “those who know – avoid BDO”!