Headline CPI inflation is up. But the level matters.

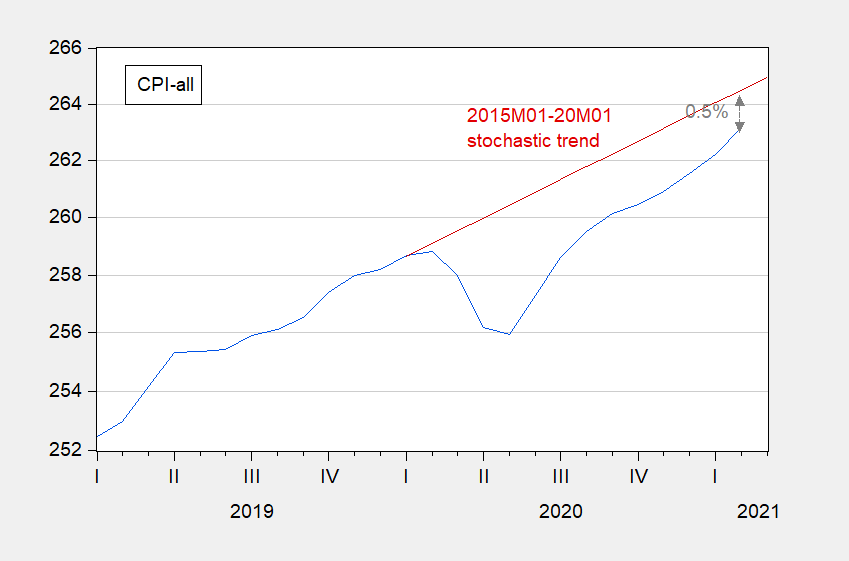

Figure 1: CPI-all (blue), and CPI if growing at constant rate over 2015M01-2020M01 (red). Gray arrow indicates the difference between February level and trend. Source: BLS, author’s calculation.

Notice that even with the acceleration in headline inflation (CPI-all) to 4.7% 4.3% month-on-month annualized (or 1.7% year-on-year), the CPI is still below where it would have been had CPI trended upwards at the rate it did over the five years preceding the pandemic (1.8%).

Professor Chinn,

Am I reading FRED data incorrectly?

CPIAUCSL January 2021 index value =262.231

CPIAUCSL February 2021 index value = 263.161

((263.161/262.231) ^12-1) *100 = 4.34% annualized

AS: apologies, you are right. I put in Jan numbers. Will fix.

Where can I get a WDN pin for my sport jacket? That stand for “Whip Disinflation Now” in case you had to ask.

The constant stream of stories about inflation risks over the next several years–even in the Economist–is tiresome. If the Fed AIT protocol actually results in three consecutive quarters of inflation above 2% in 2022 I’ll be impressed, and we’ll all be very lucky. It’s amazing how baselines of perception have shifted over the decades. I was wearing diapers in the late 70’s so my only frame of reference is the 90’s–when bank CD’s paid 5%. Fed policies aren’t geared towards a return to that anytime soon. Our best hope is that the unemployment rate gets driven down to “normal” by mid 2022.

A throw back to the Ford Administration! If you still have one of those WIN buttons, Trump sharpie could be used to alter the I to D!

You bashers of Pres. Ford don’t know the facts.

In October, 1974, as inflation hit a peak of 12% in the 4th quarter, Ford announced WIN in a speech to Congress.

From that first full quarter of the Ford administration to the last full quarter in 1976, inflation fell 57% to 5.2%.

Thereafter, during the Carter administration, inflation rose steadily to 14.4% in the 2Q1980 which was the highest since WWII and ended in the worst recession since the Depression. Carter was defeated after one term by more than 8 million votes with Reagan carrying 44 states and winning 489 EC votes.

Pres. Ford lost, not because of WIN, but because he pardoned Nixon (albeit acceptance of a pardon is legally an admission of guilt). If Ford had won, moderates would have continued to control the GOP and the Reagan-Bush-Trump nightmare might never have happened.

Did Peggy Noonan type your comment for you? That spin was almost as slick as Morning in America (1984 commercial).

‘Paul Mathis

March 16, 2021 at 4:45 pm

The numbers don’t lie:

Real GDP peaked in 2Q1978 and then collapsed to -8% in 2Q1980 (a “mild” recession??). It rebounded to -0.5% in 3Q1980, then was positive for the next 2 quarters before sinking again to -2.9% in 2Q1981.’

I thought for a moment that this peaking in 1978Q2 meant growth rates peaked (after all your writing SUCKS) but FRED tells me that you do not even have the history of growth rates correct:

https://fred.stlouisfed.org/graph/?g=8eiT

Real GDP had strong growth even through 1979 so how in hell could even a lying moron like you claim that real GDP peaked then?

Yes troll – I can handle the truth but it is really pathetic that a utter dumba$$ like you goes on and on without even checking the damn data.

“Thereafter, during the Carter administration, inflation rose steadily to 14.4% in the 2Q1980 which was the highest since WWII and ended in the worst recession since the Depression.”

Paul I would hate to call you a liar but this sentence is a blatant lie. We had a mild recession in 1980 but once Volcker thought he had inflation under control, he eased up and the economy grew by 4.2% from mid 1980 to mid 1981. But then Saint Reagan spooked the FED with that incredibly irresponsible fiscal stimulus. And in 1981 Volcker overreacted to the fiscal stimulus giving us the deep 1982 recession.

This has all be thoroughly noted so if you do not know the facts you should not be commenting on economics. Now I admit Morning America blamed the 1982 recession on Carter. But it was all a lie. Which is what your comment seems to be.

The numbers don’t lie:

Real GDP peaked in 2Q1978 and then collapsed to -8% in 2Q1980 (a “mild” recession??). It rebounded to -0.5% in 3Q1980, then was positive for the next 2 quarters before sinking again to -2.9% in 2Q1981. It finally bottomed out in 1Q1982 at -6.1%. So after 2Q1978, Carter had one good quarter: 4Q1980. While technically two consecutive quarters of growth ends a recession, Carter’s re-election campaign wipeout proved that Americans did not believe the malaise recession was over in 1980.

Your timing on the Fed Funds Rate also is way off: the Fed reduced rates for 2 quarters in 1980 then raised them sharply in 4Q1980 to 15.85% before Reagan took office. The Fed kept on raising to 17.8% in 2Q1981, then cut the rate sharply in 4Q1981 to 13.6% exactly when the first phase of the 1981 Reagan tax cut (signed in August) took effect.

“Morning America blamed the 1982 recession on Carter. But it was all a lie.” The American voters believed it was the truth — Reagan carried 49 states with 525 EC votes and beat Carter’s 1980 running mate by ~17 million votes.

” if you do not know the facts you should not be commenting on economics.” Facts are not your friend.

The voters believe Morning in America? My apologies to Peggy Noonan as Paul is more akin to Kelly Anne Conway. You know – you spin numbers the way Lawrence Kudlow does.

pgl (if that’s your real name)

You can’t handle the truth.

Paul MathisMarch 16, 2021 at 4:45 pm

The numbers don’t lie:

Real GDP peaked in 2Q1978 and then collapsed to -8% in 2Q1980 (a “mild” recession??).

https://fred.stlouisfed.org/series/GDPC1

The numbers may not lie but Paul Mathis certainly did. Maybe he should have checked FRED before writing this utter BS.

Of course we are talking about real GDP as in what is going on with the level but maybe Paul Mathis does not get that levels and growth rates are two different things.

But enough with this loud mouth lying troll.

Your memory of what really happened during the 1973-1976 period is a bit incomplete but this NBER paper might help:

https://www.nber.org/system/files/chapters/c9101/c9101.pdf

Note in particular how they note the recession under Ford was rather severe in comparison to preceding recessions. The tight monetary policy did a number on investment demand and the recovery was slow. But we did see all sorts of talk about tax cuts and other forms of fiscal stimulus during 1975. Alas Ford was ill served by his very confused chief economist (Alan Greenspan) who actually argued cutting government spending to pay for a tax cut was somehow stimulus. Balanced budget multiplier – hello?

Greenspan is very overrated, but he did contribute one idea to economics:

“The U.S. can pay any debt it has because we can always print money to do that. So there is zero probability of default.”

Not quite as good as Keynes’ quote: “In truth, the gold standard is already a barbarous relic.”

@ Mathis

Do you think Richard Nixon ever recovered from the severe admonishment of “admission of guilt”?? Like in post-Presidency years when Racist Richard was by personal choice isolated in his own home taking back liquor shots convinced that Ralph Nader was just outside his front door with a knife, this obviously was worse than sitting in a federal prison, right?? I mean aside from the crowd chants of “lock him up!!!!” from “family value” “conservative” Republicans, right??

Obviously Ford’s harsh treatment of Nixon sure did put the fear of God into donald trump. The orange abomination now cites the Southern District of New York and Manhattan DA as now overtaking groin rash as his biggest fear in life.

Unlike Trump who is still a political force, Nixon never reclaimed the political stage. After 30 years in the limelight, we finally did not have Nixon to kick around any more. Getting rid of Nixon was what Ford did with the pardon. We are not yet rid of Trump.

Look – no one hated Tricky Dick more than I did. But it was Ford’s total economic incompetence that led to his 1976 downfall. Don’t encourage Paul’s revisionist economic history. Those WIN buttons were both stupid and led to bad monetary policy.

@ Paul Mathis

The U.S. Congress got rid of Nixon, not Gerald Ford. Gerald Ford handled the enabling part. Seems you also have a selective memory problem, which is a common affliction in the comments section of this blog.

Reagan said. “Yeah,” Nixon interjected. Reagan forged ahead with his complaint: “To see those, those monkeys from those African countries—damn them, they’re still uncomfortable wearing shoes!” Nixon gave a huge laugh.

https://www.theatlantic.com/ideas/archive/2019/07/ronald-reagans-racist-conversation-richard-nixon/595102/

Saint Reagan, you may remember, is the guy Peggy Noonan uses her reverential tones she normally only ever saves for “white” Jesus. Noonan’s Stepford wives club for those addicted to prescription pills is very proud of her. They think that “chickenhawk” Ronny was a hell of a guy for lounging stateside and convincing young boys to sign up for their deaths in the “1st Motion Picture Unit,”. There was a large influx of German Nazis overtaking Burbank California in a blitzkrieg at the time, but damn it!!!~~Reagan’s courage knew no bounds.

Welcome back to the Obama economy. Any indication of economic growth will drive-up commodity prices and cost of living uncertainty increases savings and capital investment must be cancelled. Where monetary easing causes disinflation instead of inflation.

Depends on how one defines “monetary easing”.

Funny.

Aaron did mention commodity prices, which brings up the specter of Judy Shelton and Stephen Moore and their commodity price rule, which of course we all know is beyond stupid monetary policy.

Commodity prices have gone up for their own reasons and to follow their policy would have meant tight money in the middle of weak economies.

That is a weird chain of logic. Now if you have been reading Princeton Steve’s blog, a little advice. Stop reading it as that type of activity kills brain cells.

Did monetary easing “cause” disinflation, or were the impulses toward disinflation too strong for monetary policy alone to prevent it? Apparently opinions differ.

Or was monetary policy not properly accommodating? Apparently opinions differ.

Did you miss the “alone” in my comment? ISTR many periodic discussions not just here but in several (many?) forums, not to mention public comments from three Fed chairs that I can think of off the top of my head, regarding the diminishing returns of monetary policy. IST also R a consensus around the necessity of a complementary fiscal policy when the economy is near the ZLB. Do you have some heterodox ‘one neat trick’ that would have made monetary policy more effective?

No, I caught that. My implying monetary may not have been sufficient doesn’t presuppose fiscal policy is needed. There are economists who feel the committee could be more accommodating. I suppose “one neat trick” proposed by economists specializing in monetary theory & policy includes a regime change towards a nominal income target. See, e.g., Scott Sumner, Christina Romer, David Beckworth, and Michael Woodford among others who have, at various points, voiced support for such a policy.

How would monetary easing cause disinflation?

That’s an odd sort of economics you’re offering. Not only are you focusing on secondary effects while ignoring first-round effects. You’ve also decided that the magnitude of secondary effects are very large – without putting a number to those effects for the rest of us to consider and without evidence.

So hows ’bout it? Got evidence? Model? Anything?

Not to mention that the Obama expansion was quite long and generated lots of employment. So whatever you may beleave about some features of the Obama years, they were good ones on balance.

The orange abomination should send President Obama a thank you note. The same type of “administration transition” economic expansion McConnell is falsely laying claim to happening now, the orange creature got on a silver platter from President Obama. Of course, the orange creature fumbled that gift.

Barkley has been making some informed comments about the price of platinum ore which is a key component of catalytic converters. In the meantime, Bruce Hall has been making some of his strange recommendations to Tesla as he frets over the semiconductor sector. Now if one talks to Elon Musk, his more worried about soaring nickle ore prices which are a key component in the production of lithium batteries.

Now it seems a lot of nickle comes from Indonesia who is taking advantage of all of this to boost its manufacturing sector. And not just in manufacturing of batteries but perhaps the entire Electric Vehicle:

https://www.reuters.com/article/us-indonesia-electric/indonesia-plans-incentives-to-boost-electric-vehicle-industry-idUSKCN1UR4FE

All of this global industrial policy went straight over Trump’s incompetent economic team but the rest of the world marches on. Hopefully someone is the Biden Administration has a strong grasp of this than their former MAGA hat wearing predecessors.

We need this vaccination roll out as fast as possible and TPM is noting that things would be going much more slowly than they are now had Trump remained President:

https://talkingpointsmemo.com/muckraker/we-werent-going-to-get-the-covid-vaccine-until-fall-what-changed

I know – a wee bit off topic but an important story – even if Manfred continues to object.

McConnell once again wants to block any legislative agenda from a Democratic White House. Facing the end of the precious filibuster, he has the temerity to say this?

https://news.yahoo.com/mcconnell-warns-scorched-earth-dems-183229625.html

A scorched earth Senate Senator McConnell? You have been creating a scorched earth Senate since 2009. Go back into your stupid shell.

Oh, no! McConnell is going to try to completely obstruct all Democratic initiatives, and then allow zero Democratic input to any legislation or executive appointments when Republicans hold the Senate majority again? What happened to the public service oriented McConnell who for 12 years offered constructive amendments to Democratic legislation and welcomed Democratic input to … wait, I’ll come in again.

@ Menzie

I was reading one of your favorite publications (one of my least because they tried to charge me once for a trial subscription), and it raised a question in my mind. As America’s economy recovers and therefor our demand for goods rises, and the world economy recovers, but at a pace slower than America’s recovery and therefor a slower increase in demand, could America’s more speedy recovery actually in some kind of weird way increase America’s trade deficit??

@ Menzie

I was checking your twitter feed, which I only do like maybe once every 3 weeks and saw your OMFIF link, this basically answers my question. Believe it or not I didn’t see you had tweeted that until hours after I asked the question sometime this morning. So, I guess this is self-apparent at this point. I wonder what our right-wing folks will blame as their reason the U.S. trade deficit is increasing. No doubt something “sinister”.

Moses,

The ceteris paribus answer is yes. But there this is not c.p. and the fly in the ointment is that the USD has been falling in value. To the extent the extra US growth includes a sufficient expansion of exports due to the US lower dollar, then we might see a reduction of the trade deficit. From the eyes of the rest of the world, that would be the US following Joan Robinson’s old “Beggar Your Neighbor” policy.

Not related to the CPI but a disturbing set of events in my birth town (Atlanta). A series of deadly attack on Asian establishments in the city that is supposed to be too busy to hate.

https://www.msn.com/en-us/news/crime/robert-aaron-long-what-we-know-about-the-atlanta-massage-parlor-shootings-and-the-suspect/ar-BB1eEVAh?ocid=uxbndlbing

Crazy story out of Atlanta last night. It appears they have caught the perpetrator of the horrific crime. He didn’t look like a real “winner” in the photo the local police released (not a booking photo either). If it was racially motivated it won’t take long for them to find stuff in his background I don’t think. It’s possible it could be a religious extremist, but then the obvious question is why not hit other types of massage parlors or brothels?? So then you have to bend towards the race element.

He seems to be addicted to sex and porn and now he blames the ladies that enabled his habit. Thank God they caught this creep before his killing spree got worse.

He’s obviously emotionally and psychologically mixed up. Probably the dogma at his “church” wasn’t helping much either. I think your theory may have some thread of truth in it, but oversimplifies things. It is worth noting he wasn’t “just” shooting Chinese. But like when Antifa defends Blacks from violence what happens?? So, I think it’s way too early to draw a conclusion. Why would someone attend an oddball church?? I think Joaquin Phoenix could tell us a lot about that. The crux probably gets back to his family. It’s always easy for people who come from well-adjusted nuclear families to point the finger and go “this guy is a loser”. Yes, in some facets he probably fits that description, but these things never happen in a vacuum.

This kid is from North Georgia which is a very scary enclave of the KKK and other zany cults. Look – you would love the city of Atlanta but please do not venture too far north on I-75 unless you drive by this area very quickly.

I’ve probably delivered and picked up freight in those areas and eaten there. But that was a long time ago. My experience has been (and I’m speaking in general terms here obviously) places near the interstate aren’t that bad, it’s when you get off into those old U.S. highways or small state routes where you will pick up those weird feelings like certain towns are little universes “unto themselves”. My mind is pretty hazy on town names, but I have delivered and picked up around the Dalton area. Certainly at that time Dalton struck me as pretty quiet, but I’m not black, so who knows. The darkest feelings I ever got as far as “auras” of places and geography, it was almost always down south where you would get those eerie feelings like you wanted to get out of town as soon as you could. Detroit also gave you a queasy kind of rush like you wanted to start the motor up and get out of town, and least in certain areas, If any of those massage parlors are near the interstate or the bypass there’s a good chance I’ve been near there. Certainly you can’t drive semi “over the road” and not have been in Atlanta several times, which I was.

My mother is from western North Carolina, which isn’t too different from north Georgia. Just a fact that probably has no relevance but that I found amusing in context.

@ Willie

You may or may not have picked up on the fact I am pretty harsh on the south (I feel in a general sense the region has”earned” my scorn). Keep in mind I have spent most of my life in the South (though in my heart consider myself a Midwesterner). However there have been some precious gems of people who hail from the South. Of which I have no doubt your Mom is one of those gems, judging from your civility and smarts you have exhibited on the blog. Heck, there’s even some clever people “of the Tribe” from there:

https://youtu.be/e0zY8o0laZY?t=98 (I’m gonna push my luck one more time on these YT links).

Biden is going to eventually make proposals how to alter how we tax corporate profits. The UK government has its own proposals that are sort of making my head spin:

https://www.gov.uk/government/news/finance-bill-2021-published

Raising the corporate profits tax from 19% to 25% strikes me as a good idea. I think Biden wants to raise our 21% rate to 28%.

But then there is the UK superdeduction for investments in new fixed assets which allows for a deduction = 130% of the cost of capital. Yea this might encourage more investment but why not just have the government buy the machines for the corporations? This is an idea that only Mitch McConnell could love.

Multinationals used to shifting profits to tax havens are really going to hate Sec. Janet Yellen for pushing for a global minimum tax:

https://www.washingtonpost.com/us-policy/2021/03/15/yellen-pushes-global-minimum-tax-white-house-eyes-new-spending-plan/

Some 60 years ago Peggy Musgrave (yes the wife of Richard) convinced the US to establish a tax system that embodied “capital export neutrality” which was enforced with something akin to this. But over time with deferrals and inversions and all sorts of other games, this became Swiss cheese. Republicans only made this worse with the hair brain ideas behind that 2017 tax farce.

Maybe back to the future is the way to go as Peggy Musgrave was 60 years ahead of her time. The OECD thinks they invented this with their Pillar Two. Humor them as it is a good idea.

While I’m on this topic, can I say that the latest from Japan is depressing:

https://mainichi.jp/english/articles/20210316/p2g/00m/0bu/033000c

This METI idea is akin to the FDII idea in the Trump tax cut for the rich (2017). We know hi tech companies love to shift profits into tax havens and the not so brilliant idea of METI and FDII is basically “if you can’t beat them join them”. FDII taxes any intangible profits at only 13.125% if that income is sourced here. METI strikes me as a similar idea. Yes hi tech companies make huge profits and have managed to trick governments into allowing them to get really low tax rates.

https://fred.stlouisfed.org/graph/?g=C6pb

January 15, 2018

Consumer Price Index and Consumer Price Index for energy, 1968-1988

(Percent change)

[ Energy accounted for a relatively large portion of spending in the 1970s, and energy price increases spurred inflation. Simply moving to conservation measures strikes me as much of the protection needed. That the Federal Reserve tightened so dramatically strikes me as having been too conservative an action, but possibly expectations had to be severely changed. ]

I have wondered if an argument could be soundly made that the Federal Reserve actions in the wake of the energy price shocks of the 1970s began the breaking of the national labor movement that was continued with Republican presidents in the 1980s. Why should the Fed have caused recessions that were so severe in the wake of energy price shocks? Was inflation in the 1970s, labor cost produced? In any event, the labor movement was seriously weakened through the 1980s.

https://fred.stlouisfed.org/graph/?g=ns5D

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 1980-2018

(Indexed to 1980)

Decline in labor share of income:

92.0 – 100 = – 8.0%

Increase in real profits:

404.4 – 100 = 304.4%

Given the Fed’s difficulty in sustaining its 2% inflation target since at least the Great Recession, arguably the jumping off point in your graph should be about 2008Q1 rather than 2019Q1.

Brian: See https://econbrowser.com/archives/2021/03/the-price-level-shortfall