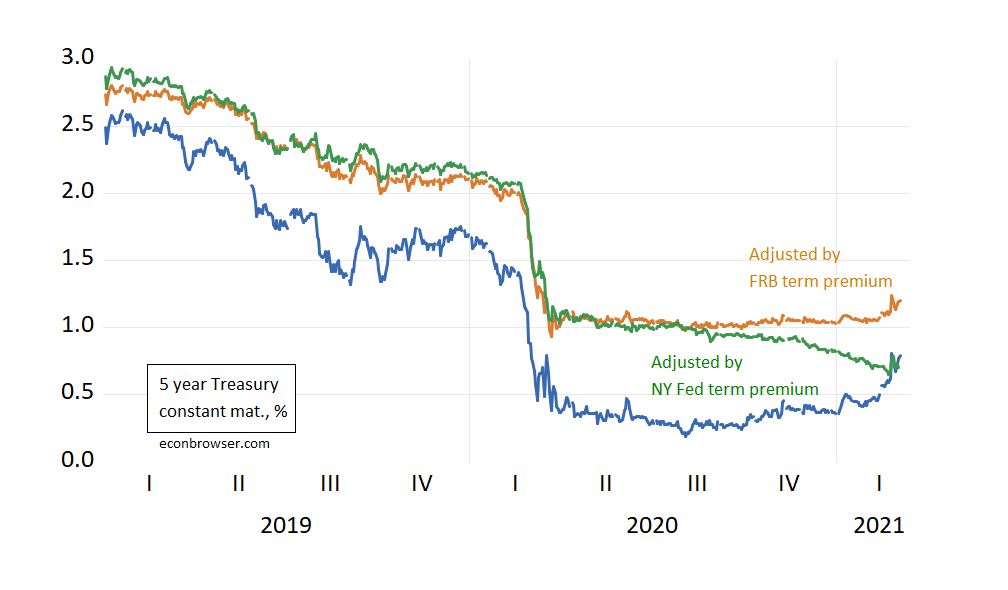

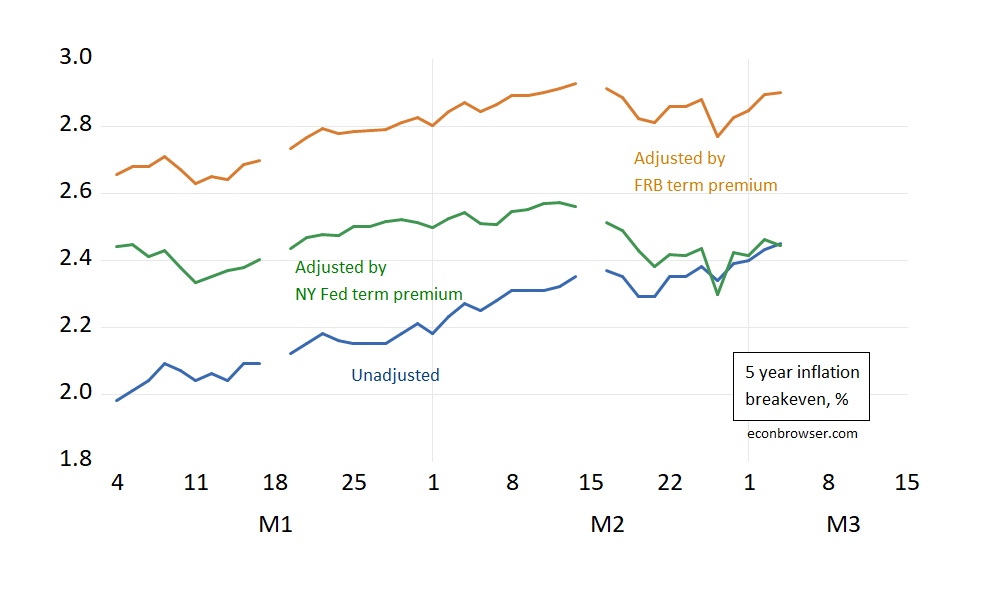

The five year constant maturity Treasury yield has risen; but after accounting for the estimated term premium, the increase is much more modest, if not negative. Moreover, expected 5 year inflation has not on net moved much over 2021.

Figure 1. Five year constant maturity Treasury yield (blue), five year yield adjusted by Kim-Wright term premium (brown), and adjusted by Adrian-Crump-Moench term premium (green), all in %. Source: FRB via FRED, NY Fed, and author’s calculations.

As noted in this post, the unadjusted 5 year Treasury-TIPS spread is:

Where tp is the term premium on the Treasury yield, and the lp is the liquidity premium on the TIPS yield. Using estimates of the term premium (but not of the liquidity premium), one obtains the following estimates of expected inflation.

Figure 2. Five year inflation breakeven calculated at five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by Kim-Wright term premium (brown), and adjusted by Adrian-Crump-Moench term premium (green), all in %. Source: FRB via FRED, NY Fed, and author’s calculations.

Kevin Drum is not really an economist but he does not shy away from commenting on economics. Here he notes core inflation is still quite low:

https://jabberwocking.com/inflation-remains-low-low-low/

Of course this is sort of an open invitation for anyone to comment on what Kevin cooked up here!

The ECB has announced an increase in asset purchases and has reportedly decided on a market rate target, though the ECB has not confirmed that decision. The decision is in response to the risk of rising borrowing rates, while the ECB has acknowledged a somewhat improved outlook.

The rise in term premium, rather than in inflation expectations, is a pretty good fit with the ECB’s explanation of it’s policy position.

https://fred.stlouisfed.org/series/IRLTLT01DEM156N

The 10-year German government bond rate for January average negative 0.58%. I just checked the latest from Bloomberg and this rate has soared to negative 0.34%. Yes negative nominal interest rates!

Indeed, for all the talk of rising short term inflation, which I have contributed to, has so far not really appeared. Today’s WaPo repotteed year to year CPI increase from February to February being only a 1.3% rate, which is still not even getting to the famous target of 2%, much less rates above that many are now expecting for later in the year. While there are many commodities that have gone up, and gasoline prices have gone up, with refinery shutdowns in Texas exacerbating the increasing crude oil prices. But quite a few other goods have actually fallen in prices, such as used cars and clothing, with those getting fewer headlines.

In terms of commodities the most dramatically rising of all is rhodium, used in catalytic converters in cars. It was at about $1700 per troy ounce, but it has recently hit about $37,000 per troy ounce and is currently rapidly rising. This reflects an odd complementary commodities case. 80% of rhodium comes from platinum mines in South Africa. Platinum ore is on average 60% platinum, 30% palladium (which is also used in converters), and less than 10% rhodium. What has happened is that due to the pandemic an excess supply of platinum appeared, which led to its price falling with the large inventories. This then triggered a reduction of platinum mining in South Africa. This led to the shortage of rhodium, which is also facing rising demand as it is especially important for reducing pollution in cars.

Stealing catalytic converters has become a real epidemic. The local news had video of two guys cutting off and stealing catalytic converters in a community college parking lot. Amazing how fast they worked…probably less than 30 seconds and they were gone. There have been dozens of such thefts even in people’s garages and driveways.

They tried to get the catalytic converter off my daughter’s care in Oakland two months ago. It was parked at her apartment building. They were deterred by something as it was late night. Insurance paid for the repair. She tole me that the Toyota Prius is the most at risk car along with SUVs that sit high off the ground (she has a Honda CR-V). There is work going on to make the less theft resistant by putting steel around the joints which is hard to cut through.

The South African transfer pricing litigation I briefly noted involved the production of catalytic converters. Their government won on a really odd argument in my view. First of all – the customers were third parties so the prices received by the manufacturing affiliate had to be market (arm’s length). The issue was the price of the Precious Metals which are a key component of production. As Barkley noted – these prices have skyrocketed. Now maybe the prices of the converters also rose but it is entirely possible that a firm facing such market conditions would end up with a poor return on assets even under market pricing.

The case made by the South African Revenue Service was simply put that if a local affiliate does not make a great return to assets, it must have paid too much for its inputs. You have to wonder who represented the multinational here.

Of course in the US, sharks representing multinationals shifting profits to tax havens can beat the government lawyers every time with even dumber arguments. Tax evasion is easy if the government hires lawyers and economists even dumber than Lawrence Kudlow.

https://finance.yahoo.com/news/thefts-catalytic-converters-way-heres-200000022.html

Even yahoo finance is covering these thefts!

Kardashians have been quiet lately.

I wonder what TV host Chris Harrison is doing for humanitarian causes today?? Possibly negotiating with Oprah for a public image reboot?? Click on this link to see how Oprah’s weight changes are going. And the next link on the right side of Yahoo is for to find out how much uglier 30 “has been” TV stars have become. Wait, why doesn’t Menzie have this stuff on his site margins?? I suddenly feel deprived. Nobody told the truly cool web sites have stuff on the margins. I need to touchback with James Kwak and Simon Johnson about this damage on my development as a person.

Something else off-topic but closer to this blog is I have just seen a thread on the awful ejmr about “Who are ten greatest living time-series econometricians?” The OP’s list had our Jim Hamilton as Number Three behind Yale’s P.C. Phillips and Nobel Prize winner Lars Hansen. I did not see any commenters disputing this placement for him.

So, congratulations to Jim. Rumor has it you are Number Three!

Speaking of commodities, copper prices are booming. $4.14 per pound as of yesterday:

https://www.macrotrends.net/1476/copper-prices-historical-chart-data

After a well publicized battle between Glencore and the Zambian government over the intercompany price received by the Mopani copper mines, it seems Glencore has sold its shares in these mines to the government.

Now I guess this is great timing for the Zambian government but the terms of this acquisition leave me wondering if Glencore has figured out yet some other way of cheating the citizens of Zambia.

Of course Greg Mankiw will likely write another one of his yawns about getting rid of the copper penny.

https://tradingeconomics.com/commodity/rhodium

Not sure if trading economics is the best source for rhodium prices but this chart suggests these prices have risen by over 26X since 2014. Just wow!

Where is the precious metal mined?

pgl,

As I explained above, rhodiusm gets mined with platinum, a mnor constitutent of platinum ore, with 80% of it mined in South Africa.

Which explains what so many catalytic converters are manufactured in South Africa. Now Bruce Hall thinks American automobile manufacturers should vertically integrate and buy only American. I guess he has never got understand all the things that go into a car!

Can we talk gold prices?

https://fred.stlouisfed.org/series/GOLDAMGBD228NLBM

Rudy Giuliani apparently has been since early August of last year when he decided to start his “common sense” podcasts, which of course represent Trump stop the steal and utter right wing nonsense. But he also includes advertisements trying to convince his MAGA hat wearing fools to buy gold. So let’s see if one of these fools bought 50 ounces at $2000 an ounce back then sinking $100,000 he could cash out today at $1700 an ounce or $85,000.

Rudy is as much of a drifter as our own Princeton Steve!

“This reflects an odd complementary commodities case. 80% of rhodium comes from platinum mines in South Africa. Platinum ore is on average 60% platinum, 30% palladium (which is also used in converters), and less than 10% rhodium.”

Also known as the Precious Metals Group. Their pricing is a hot topic in terms of South African transfer pricing with respect to the production of converters.

Very interesting, thanks

Ps the fed publishes tips premia estimates in the csv file on this page, albeit with some delay – https://www.federalreserve.gov/econres/notes/feds-notes/tips-from-tips-update-and-discussions-20190521.htm

Bob: Many thanks! I didn’t see the link to the data (or assumed it was not updated).